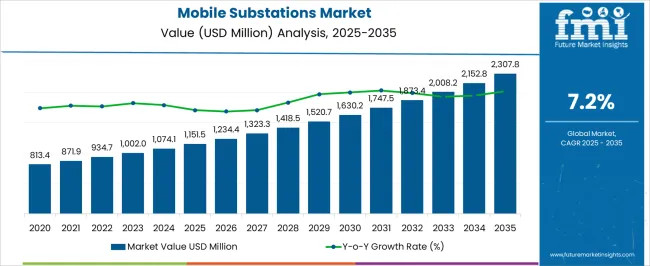

The Mobile Substations Market is estimated to be valued at USD 1151.5 million in 2025 and is projected to reach USD 2307.8 million by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Mobile Substations Market Estimated Value in (2025 E) | USD 1151.5 million |

| Mobile Substations Market Forecast Value in (2035 F) | USD 2307.8 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

The mobile substations market is undergoing accelerated growth, driven by grid modernization efforts, increasing frequency of natural disasters, and demand for rapid deployment of power infrastructure. Utilities and industrial operators are increasingly adopting mobile substations to ensure uninterrupted power supply during planned maintenance, emergencies, and capacity expansions.

This trend is being reinforced by the growing complexity of distributed energy systems, aging grid infrastructure, and the rising integration of renewables. Governments and utility providers are investing in agile, resilient, and scalable transmission solutions to strengthen network reliability, particularly in underserved and remote regions.

Additionally, strategic defense operations, construction projects, and mining sites are adopting mobile substations for their modularity and short commissioning times. With a global shift toward smart grids and infrastructure redundancy, the market is expected to expand steadily, driven by technological innovation and regulatory focus on energy continuity.

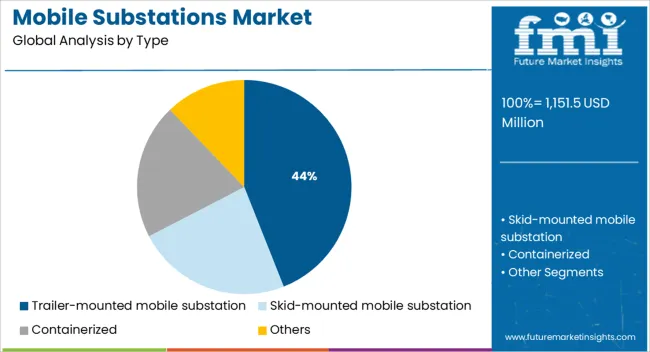

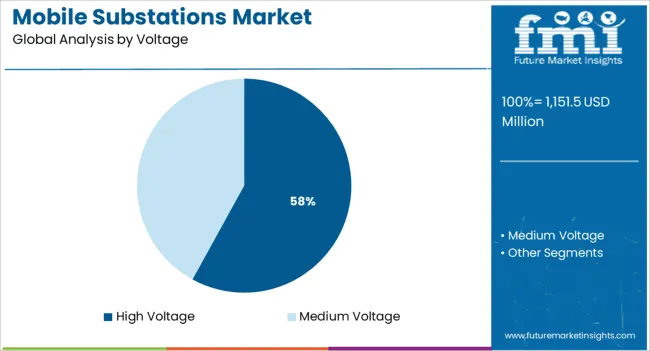

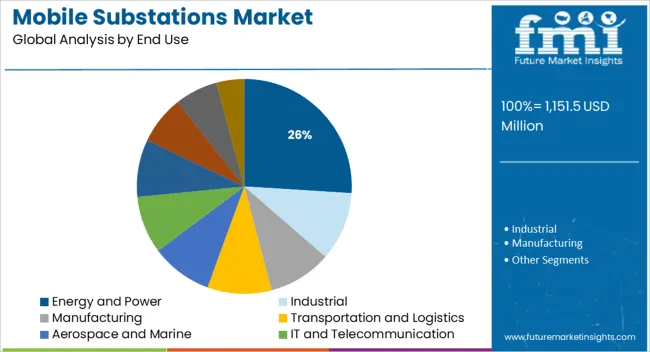

The market is segmented by Type, Voltage, and End Use and region. By Type, the market is divided into Trailer-mounted mobile substation, Skid-mounted mobile substation, Containerized, and Others. In terms of Voltage, the market is classified into High Voltage and Medium Voltage. Based on End Use, the market is segmented into Energy and Power, Industrial, Manufacturing, Transportation and Logistics, Aerospace and Marine, IT and Telecommunication, Oil and Gas, Mining, Military, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Trailer-mounted mobile substations are anticipated to capture 44.0% of the total market revenue in 2025, making them the leading product type. Their prominence is being driven by the need for rapid mobility and ease of deployment in grid failure scenarios, emergency restorations, and remote location servicing.

The ability to transport the unit without disassembly, combined with minimal civil infrastructure requirements, enhances operational responsiveness for utility operators and disaster recovery agencies. Trailer-mounted units offer flexibility for both temporary and semi-permanent installations, making them ideal for infrastructure projects, event-based energy demands, and interim power needs.

Advancements in compact equipment design and multi-voltage capability have further reinforced their position as the preferred choice for fast-track energy provisioning.

High voltage mobile substations are projected to command 58.0% of the market share in 2025, positioning them as the dominant voltage category. This leadership is being supported by the rising demand for high-capacity, long-distance power transmission in industrial, mining, and utility-grade applications.

High voltage configurations are essential for stabilizing load fluctuations during grid upgrades and regional energy redistribution. Their usage is also expanding due to the surge in renewable energy projects that require efficient transmission solutions with minimal downtime.

Regulatory mandates on energy resilience and peak-load balancing have led to increased procurement of high voltage mobile substations across national transmission networks. The segment’s scalability and ability to support large-area coverage make it indispensable in modern power distribution strategies.

The energy and power sector is expected to contribute 26.0% of the mobile substations market revenue in 2025, establishing it as the leading end-use industry. This segment’s growth is attributed to the need for temporary substations during scheduled maintenance, capacity expansion, and grid failure recovery.

As utility providers upgrade aging infrastructure and extend electrification to underserved regions, mobile units are being deployed to maintain continuity and reduce downtime. The sector’s increasing reliance on mobile substations is further driven by decentralization trends, integration of renewables, and demands for flexible load management.

These units are also being leveraged to support critical power restoration during natural disasters or geopolitical disruptions. With grid resilience emerging as a strategic priority, the energy and power industry remains a key growth engine for the mobile substations market.

Clean Energy Projects

The demand for mobile substations is rising due to the need for smooth renewable energy integration into the electric grid, which is necessitated by an increase in the number of clean energy projects.

Moreover, having the capacity to bounce back as soon as possible from significant weather events and natural disasters benefits local businesses and communities regarding the economy, public health, and safety.

Management Strategy

A new efficient and effective transition management strategy that fully utilizes mobile substations is required due to the increase in electricity demand, as well as the ongoing and expanded growth of the share of renewable energy in centralized and decentralized grids. These factors are likely to increase demand for the mobile substations market during the forecast period.

Lack of Awareness

The development of mobile substations is said to be hampered in some nations by the general lack of knowledge about them. As a result, this is anticipated to be the main factor restricting the global mobile substations' market share.

North America is the leading region in the mobile substation market, with a share of 26.3% during the forecast period.

As a result of a well-established industrial sector, there has been an increase in the need for power. Nevertheless, the country's frequent power outages caused by natural disasters and other events challenge this high demand. This particular factor has been a significant market driver in the USA alone.

The USA Department of Energy (DOE) reported that inclement weather is the main reason for power outages in the nation. The need for mobile substations is also increasing due to aging grid infrastructure and expensive upgrades to these facilities.

Due to the expanding population and quick industrial automation sector growth, the demand for mobile substations in the Asia Pacific has noticed a noticeable increase. China continues to have one of these regional marketplaces with the strongest growth rates.

The mobile substation market is expected to register considerable growth in sales during the projected period from the area due to growing concerns and knowledge about adequate transmission and distribution to guarantee uninterrupted power supply.

New firms are entering great prospects in the mobile substation market due to renewable power demand and multiple industrial applications. Startups in mobile substations are offering customized solutions to fulfill the end-user demand.

For instance: Mobile substations from Elgin Power Solutions are fully functional, standalone equipment. They offer units that are created and constructed to suit state and federal highway regulations and customer specifications.

Besides this, sustainability is a crucial factor to consider in the overall market. For instance: Iberdrola is searching for novel materials, designs, manufacturing processes, and construction techniques for electric substations and very high-voltage lines that improve the sustainability of the processes through its startup program PERSEO

Mobile substations can minimize or even eliminate the requirement for prolonged power interruptions during planned maintenance. Manufacturers are concentrating on finding solutions to the energy issue and opening up new markets for mobile substations.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.2% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, Voltage, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; The Asia Pacific excluding Japan; Japan; The Middle East and Africa |

| Key Countries Profiled | The USA, Canada, Brazil, Argentina, Germany, The United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC Countries, South Africa |

| Key Companies Profiled | Tait Communications; Motorola Solutions, Inc; JVCKENWOOD Corporation; Icom America Inc; Hytera Communications; Sepura plc; Yaesu USA; Entel; Uniden; Kirisun Communications Co.; Quansheng |

| Customization | Available Upon Request |

The global mobile substations market is estimated to be valued at USD 1,151.5 million in 2025.

The market size for the mobile substations market is projected to reach USD 2,307.8 million by 2035.

The mobile substations market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in mobile substations market are trailer-mounted mobile substation, skid-mounted mobile substation, containerized and others.

In terms of voltage, high voltage segment to command 58.0% share in the mobile substations market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA