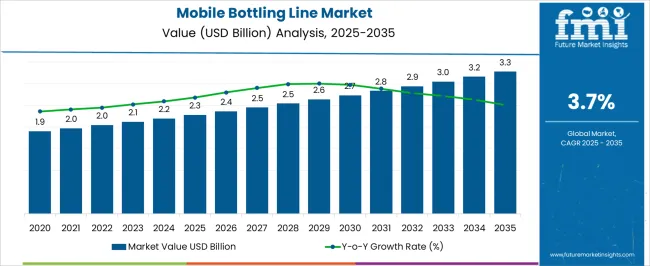

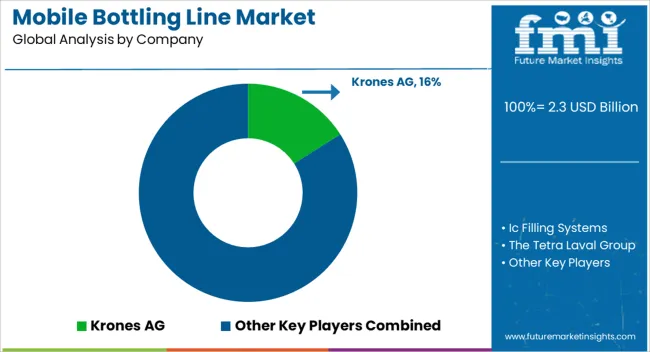

The Mobile Bottling Line Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Mobile Bottling Line Market Estimated Value in (2025 E) | USD 2.3 billion |

| Mobile Bottling Line Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The Mobile Bottling Line market is experiencing notable momentum as beverage producers increasingly adopt flexible and efficient bottling solutions to meet dynamic production demands. The current market landscape reflects a shift toward mobile operations that reduce logistical constraints and capital expenditure associated with fixed bottling facilities. Industry press releases and manufacturing news sources have highlighted the growing preference for mobile bottling as it offers cost-effective, on-site solutions for seasonal and small-scale producers.

The outlook remains positive, supported by advancements in automation, modular system design, and the rising number of craft beverage producers. Investor updates from equipment manufacturers have also indicated increased deployment in emerging markets where mobility and compactness are critical factors.

Sustainability goals are further influencing adoption, as mobile lines help reduce transportation emissions and material waste With the integration of smart controls and automated cleaning systems, mobile bottling units are aligning with modern production standards, ensuring that the market continues to expand across both established and developing regions.

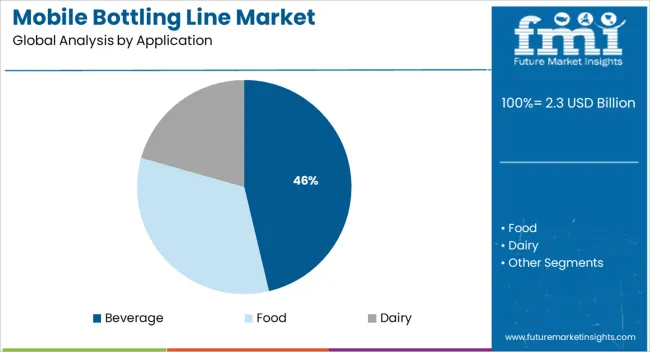

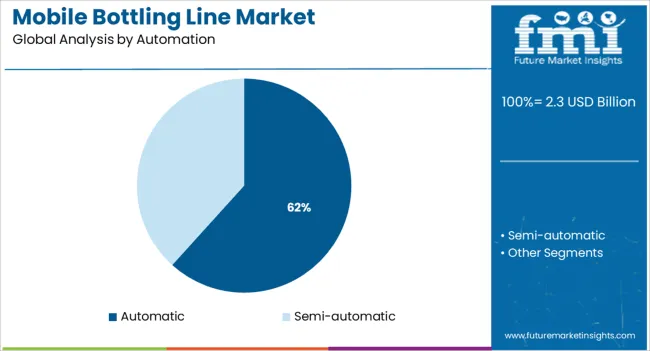

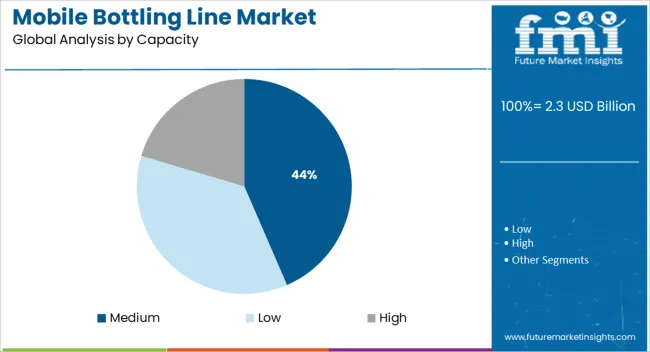

The market is segmented by Application, Automation, and Capacity and region. By Application, the market is divided into Beverage, Food, and Dairy. In terms of Automation, the market is classified into Automatic and Semi-automatic. Based on Capacity, the market is segmented into Medium, Low, and High. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The beverage application segment is projected to hold 46.3% of the Mobile Bottling Line market revenue share in 2025, positioning it as the leading application area. This dominance is being attributed to the segment’s extensive use across wine, craft beer, spirits, and non-alcoholic drinks production, as identified in manufacturing industry reports and production facility insights.

The increasing popularity of regional and artisanal beverages has driven demand for on-site bottling, enabling producers to maintain product integrity and reduce transportation risks. Equipment manufacturers have emphasized the value of maintaining freshness and minimizing oxidation, especially in wine and beer, which has led to increased adoption of mobile solutions in this category.

Press releases from leading vendors have also highlighted that beverage producers are choosing mobile lines to streamline operations during peak seasons or limited batch runs These operational advantages have reinforced the segment’s lead in the market by delivering both economic efficiency and improved product control.

The automatic automation segment is anticipated to account for 61.7% of the Mobile Bottling Line market revenue share in 2025, making it the most dominant automation type. The high share is being driven by strong demand for faster throughput, labor optimization, and consistent quality across large-scale and mid-size bottling operations.

Technical publications and automation supplier updates have outlined that automatic systems are preferred due to their precision, integrated cleaning mechanisms, and ability to meet food safety standards with minimal human intervention. As noted in recent facility upgrades and press briefings, producers are increasingly shifting toward automation to ensure scalability, maintain hygiene, and comply with evolving regulatory protocols.

The segment’s leadership has also been supported by cost-saving opportunities from reduced downtime and maintenance, which have been highlighted in operations and logistics whitepapers These capabilities are enabling manufacturers to meet volume targets efficiently while supporting traceability and product standardization, reinforcing the segment’s commanding position.

The medium capacity segment is expected to contribute 43.5% of the Mobile Bottling Line market revenue share in 2025, making it the leading capacity class. This position has been strengthened by its suitability for small and medium-sized producers who require balanced output with manageable operational complexity. Equipment catalogs and company presentations have emphasized that medium-capacity mobile units offer optimal speed, efficiency, and flexibility without the footprint and cost burden of high-capacity systems.

These systems are being increasingly adopted by contract bottling services and regional beverage producers seeking to scale production with minimal infrastructure. Product announcements from mobile equipment suppliers have shown consistent demand in rural and semi-urban locations, where access to large fixed-line infrastructure is limited.

The segment’s growth has also been driven by its ability to support multiple product types and packaging formats, which is crucial for producers with diverse portfolios These advantages continue to make medium capacity systems the preferred choice for dynamic bottling environments.

The global market for mobile bottling lines increased from USD 1,702.1 million in 2020 to USD 2,045.4 Million in 2025. The market exhibited considerable growth at a CAGR of 4.7% during the historical period from 2020 to 2025.

The historical outlook of the mobile bottling line industry has been positive, but future projections are even more optimistic. With the increasing demand for mobile bottling lines, the market is growing rapidly.

In the next ten years, the mobile bottling line industry is expected to grow significantly. This growth is expected to be driven by factors such as the increasing popularity of bottled beverages and the need for more efficient & convenient packaging solutions. These factors would further help provide growth opportunities to new and existing players in the market to capitalize on.

Various factors are responsible for propelling growth in the mobile bottling line industry. Lead analysts at Future Market Insights have conducted extensive research work to find out upcoming trends, threats, growth opportunities, driving factors, obstacles, and recent developments that can affect the market in the given time frame.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

USA-based Mobile Bottling and Canning Line Companies to Engage in Mergers & Acquisitions

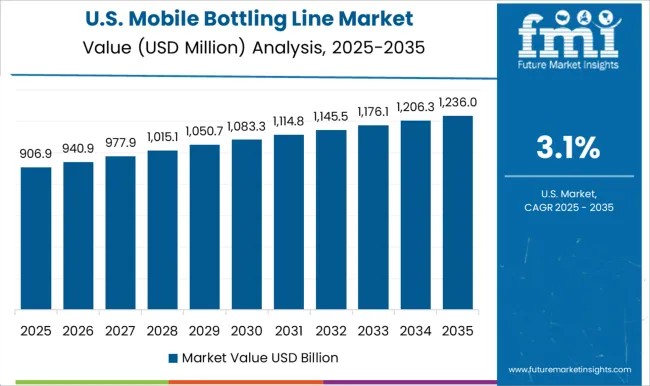

The US is set to account for 38.6% of the North American market share and is projected to surpass a valuation of USD 2.3 Million in 2025. In recent years, the US mobile bottling line market has seen significant changes.

The most notable change has been a consolidation of the industry. There have been several large mergers and acquisitions among mobile bottling line manufacturers across the country. This consolidation has led to a smaller number of suppliers in the market and has further allowed remaining suppliers to increase their market shares.

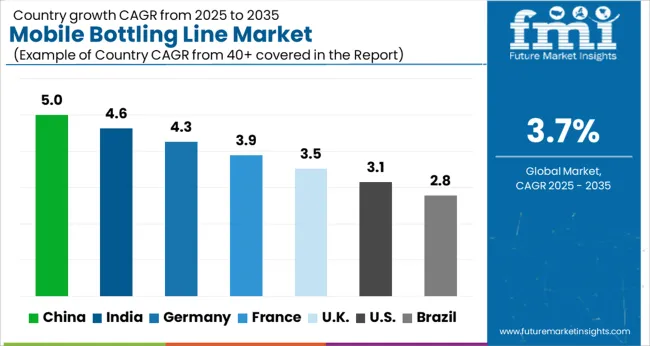

Manufacturing Facility Expansions by Bottling Line Process Firms to Push Sales in the UK

The UK mobile bottling line industry is anticipated to grow at 5.8% CAGR between 2025 and 2035. The country has a long tradition of manufacturing and exporting such products. In recent years, there has been an increasing demand for these products due to the growth of the craft beer industry.

Various UK-based companies have responded to this surging demand by investing in new manufacturing facilities and expanding the existing ones. This has allowed the UK to become one of the leading suppliers of mobile bottling lines in the world.

High Demand for Bottled Water in India to Propel Sales of Bottling Plant Equipment

The India mobile bottling line industry is anticipated to grow at 5.8% CAGR between 2025 and 2035. The mobile bottling line sector in India is expected to continue to grow at a steady pace in the next ten years. This is because the demand for bottled water and other beverages is expected to increase across the country. Mobile bottling lines are an ideal way to bottle large quantities of beverages quickly and efficiently.

Government Support to Chinese Bottling Line Machine Manufacturers Would Aid Growth

The China mobile bottling line industry is likely to exhibit growth at 6.5% CAGR between 2025 and 2035. China has a strong position in the mobile bottling line sector due to a large number of reasons.

Firstly, China has a large population which provides a ready market for mobile bottling lines. Secondly, Chinese manufacturers are able to produce mobile bottling lines at relatively lower prices compared to their foreign counterparts. This makes them attractive to cost-conscious buyers.

Thirdly, China has a well-developed infrastructure which makes it easy for manufacturers to transport mobile bottling lines around the country. Lastly, the Chinese government is supportive of businesses and provides various incentives for companies to set up their facilities in the country.

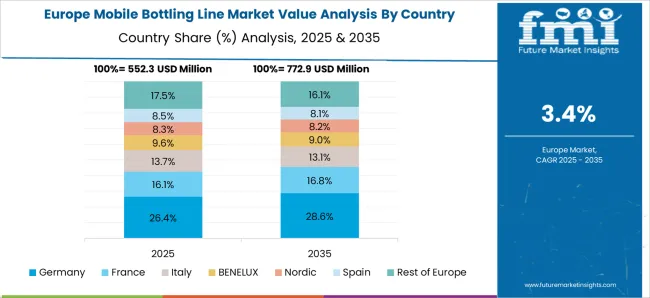

Constant Innovations by German Bottling Line Manufacturers to Bode Well by 2035

Germany is anticipated to hold a 22.6% share of the global mobile bottling line market by 2025 and hold a value of USD 479.4 Million. In the mobile bottling line market, Germany is known for its innovative and efficient production processes.

The country has a long history of successful product development and implementation. In the mobile bottling line market, Germany's innovation is in its ability to produce large quantities of high-quality products in a short amount of time. The country has a reputation for being able to meet the unmet needs of customers quickly and efficiently.

Demand for Automatic Bottling Plant Equipment to Skyrocket across the Globe

Based on automation, the market for mobile bottling lines is divided into semi-automatic and automatic. Out of these, the automatic segment is projected to remain at the forefront throughout the speculated time frame. This type of mobile bottling line is operated with minimal human intervention. Thus, their demand would skyrocket among beverage manufacturing companies that produce commodities in bulk.

Majority of the Companies to Prefer Medium Capacity Bottling and Canning Lines

Based on capacity, the global market is segmented into low capacity, medium capacity, and high capacity. Low-capacity mobile bottling lines are suitable for companies with lower production output. These machines have a compact design and are easy to install & operate. They occupy less floor space and less manpower, as compared to the other two types.

Medium-capacity mobile bottling lines are designed for companies with higher production output. These machines have high speed and can handle more products at a time. They occupy more floor space and require more manpower, as compared to low-capacity machines. Demand for these machines is likely to grow at a fast pace among bottled water manufacturing firms.

Bottling Machine Lines Are to be Extensively Utilized by Beverage Manufacturing Companies

There are many industries that have a use for mobile bottling lines. The beverage industry is one that has a major use for this type of equipment. There are various benefits of using a mobile bottling line in the beverage industry.

One of the benefits of the beverage industry is that it can help to speed up the production process. This is because mobile bottling lines can be used to bottle products quickly and efficiently. This can also help to save time and money in the production process.

Another benefit of using a mobile bottling line in the beverage industry is that it can help to improve the quality of products that are being manufactured. This is because mobile bottling lines can be used to ensure that products are bottled correctly and securely. This can also help to prevent numerous problems associated with products being contaminated or leakage during transport.

Competition in the mobile bottling line market is intense as renowned companies are trying to gain a larger share of the overall industry. In today's business world, mobile bottling lines are becoming more and more popular. With advancements in technology, these bottling lines are able to be set up faster and easier than ever before. There are different companies that offer mobile bottling lines and beverage bottles with advanced features.

For instance:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 2.3 billion |

| Projected Market Valuation (2035) | USD 3.3 billion |

| Value-based CAGR (2025 to 2035) | 3.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD Million) |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania |

| Key Countries Covered | The USA, Canada, Mexico, Germany, The UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Application, Automation, Capacity, Region |

| Key Companies Profiled | Krones AG; Ic Filling Systems; the Tetra Laval Group; Promach; Barry-Wehmiller Group, Inc.; Coesia S.P.A.; Optima Packaging Group GmbH; Zhangjiagang King Machine Co. Ltd; Hiemens Bottling Machines; PallayPack Inc.; MULTIVAC Sepp Haggenmuller SE and Co. KG; ATS Automation Tooling Systems Inc.; Sacmi Imola S.C. |

| Report Coverage | Company Share Analysis, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives, Market Forecast, Competitive Landscape |

The global mobile bottling line market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the mobile bottling line market is projected to reach USD 3.3 billion by 2035.

The mobile bottling line market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in mobile bottling line market are beverage, food and dairy.

In terms of automation, automatic segment to command 61.7% share in the mobile bottling line market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA