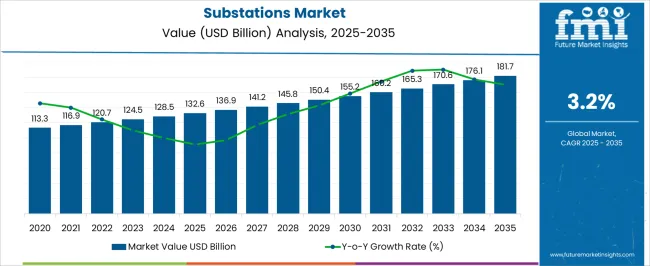

The substations market, valued at USD 132.6 billion in 2025 and projected to reach USD 181.7 billion by 2035 at a CAGR of 3.2%, demonstrates the characteristics of a mature infrastructure-driven sector. The relatively modest growth trajectory indicates that adoption is progressing steadily but without disruptive acceleration, as demand is tied to grid modernization, renewable energy integration, and replacement of aging assets rather than new large-scale deployment. The market is entering a late growth to early maturity phase within the adoption lifecycle, where incremental upgrades and digitalization are prioritized over rapid expansion.

The maturity curve highlights a progression where early adoption occurred during industrial and urban electrification, while current adoption is driven by advanced technologies such as digital substations, automation, and condition monitoring systems. With growth slowing compared to emerging energy technologies, the market shows signs of saturation in developed economies, where most substations are already deployed. In contrast, incremental adoption continues in developing regions, but the pace reflects capital-intensive nature and long lifespans of these assets.

From USD 132.6 billion in 2025 to USD 181.7 billion in 2035, the market demonstrates stable yet limited growth. The adoption lifecycle suggests that substations will remain indispensable, but future expansion will be driven primarily by modernization, efficiency upgrades, and integration of renewable generation rather than fresh deployment.

| Metric | Value |

|---|---|

| Substations Market Estimated Value in (2025 E) | USD 132.6 billion |

| Substations Market Forecast Value in (2035 F) | USD 181.7 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The substations market forms a critical part of the global power infrastructure industry, reflecting its essential role in electricity transmission and distribution networks. Within the broader power equipment and grid solutions sector, substations account for nearly 8.5%, highlighting their importance in maintaining grid stability and energy reliability. In the electrical utility infrastructure domain, their share is around 7.3%, supported by ongoing grid modernization and expansion projects. Across the renewable energy integration and smart grid ecosystem, the market holds about 6.2%, underlining its role in managing variable generation. Within the high voltage equipment and power system automation space, substations represent approximately 5.5%, demonstrating their link to digital control technologies. In the overall electrical infrastructure investment segment, substations secure about 4.9%, indicating their contribution to capital-intensive power system development. Recent developments in the market emphasize automation, digitalization, and sustainable design.

Gas-insulated substations are gaining wider adoption due to space-saving layouts and enhanced safety in urban and industrial areas. Hybrid substations that integrate digital monitoring, communication protocols, and predictive maintenance tools are emerging as a standard. The deployment of digital substations with IoT-enabled sensors and cloud-based supervisory systems is transforming operational efficiency. Manufacturers are focusing on alternatives to SF6 gas to reduce environmental impact, aligning with global emission reduction initiatives. Investment in renewable-focused substations is rising, with advanced configurations designed for solar and wind integration. The modular and prefabricated substations are being introduced to accelerate deployment timelines.

The substations market is experiencing steady expansion due to the growing global emphasis on upgrading aging electrical infrastructure and integrating decentralized power sources. Increasing demand for uninterrupted electricity supply, coupled with rising investments in renewable energy integration, is stimulating the deployment of modern substations across transmission and distribution networks. Governments and utilities are prioritizing infrastructure that enables real-time monitoring, grid flexibility, and energy efficiency, which is contributing to the adoption of advanced substation technologies.

The transition toward smart grid frameworks is further boosting demand for substations capable of handling complex data, variable loads, and distributed generation. Strong policy support for reducing transmission losses and improving grid stability is leading to substantial investment in both new substation construction and the digitalization of existing ones.

Furthermore, rising urbanization and industrial expansion across emerging markets are accelerating the need for reliable electricity delivery systems As energy demand grows and power systems become more dynamic, the substations market is positioned for long-term growth driven by modernization, automation, and digital connectivity.

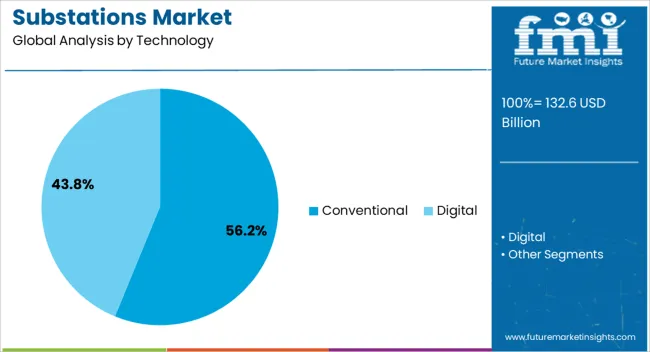

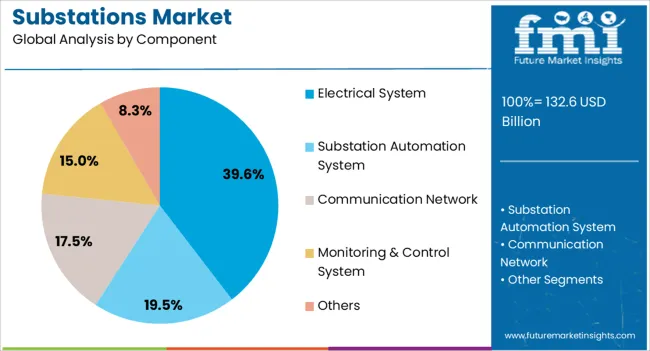

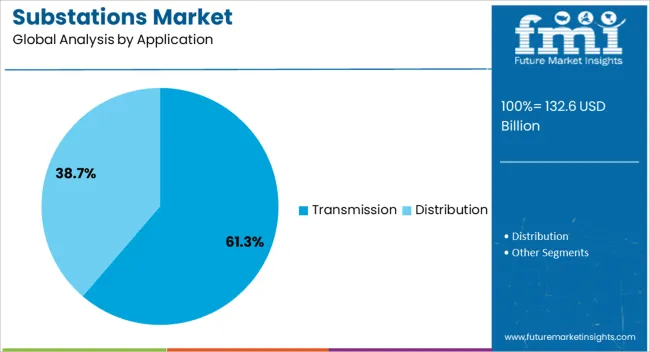

The substations market is segmented by technology, component, application, connectivity, voltage level, end use, category, and geographic regions. By technology, substations market is divided into Conventional and Digital. In terms of component, substations market is classified into Electrical System, Substation Automation System, Communication Network, Monitoring & Control System, and Others. Based on application, substations market is segmented into Transmission and Distribution. By connectivity, substations market is segmented into > 110 kV to ≤ 220 kV, ≤ 33 kV, > 33 kV to ≤ 110 kV, > 220 kV to ≤ 550 kV, and > 550 kV. By voltage level, substations market is segmented into High, Medium, and Low. By end use, substations market is segmented into Utility and Industrial. By category, substations market is segmented into New and Refurbished. Regionally, the substations industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional technology segment is projected to hold 56.2% of the substations market revenue share in 2025, positioning it as the leading technology type. This dominance is being supported by the widespread presence of legacy infrastructure across global power grids, where upgrades and maintenance continue to rely on established conventional systems. Conventional substations are known for their reliability, cost-effectiveness, and simplicity of operation, which makes them a preferred choice in regions where smart grid implementation is still in its early stages.

The segment benefits from long-standing technical familiarity among utilities and service providers, allowing for easier deployment and maintenance in both urban and rural networks. Additionally, the continued expansion of traditional power generation assets, particularly in developing countries, reinforces the demand for conventional substations.

While digital technologies are gaining ground, the robust performance, proven standards, and compatibility of conventional systems with existing grid architecture continue to support their significant market share. As energy infrastructure expands, this segment is expected to remain relevant for foundational grid support and dependable power delivery.

The electrical system component segment is anticipated to account for 39.6% of the substations market revenue share in 2025, making it the leading component category. This segment’s growth is being driven by the central role of transformers, switchgear, circuit breakers, and other core electrical components in ensuring efficient and safe power flow within substations. As substations serve as critical nodes in power transmission and distribution, the demand for reliable and high-performing electrical systems is growing significantly.

Ongoing upgrades to existing infrastructure and the addition of new transmission lines are further boosting requirements for advanced electrical components that can manage higher voltages and improved load handling. The evolution of substation designs to include automation, digital monitoring, and condition-based maintenance is enhancing the complexity and importance of electrical systems. Utilities and industrial users are increasingly investing in quality components to reduce system losses, extend equipment life, and comply with performance standards.

The transmission segment is expected to contribute 61.3% of the substations market revenue share in 2025, making it the leading application area. This leadership is being driven by the global focus on expanding and modernizing transmission infrastructure to support growing energy demand and integrate large-scale renewable energy sources. Substations in transmission networks play a critical role in stepping up or stepping down voltages and ensuring stable, long-distance power delivery.

The rise of interregional transmission projects, along with the need to connect remote wind and solar farms to the main grid, is reinforcing demand for high-capacity transmission substations. Increasing adoption of ultra-high voltage and high-voltage direct current technologies is also contributing to the segment’s growth.

Governments and utilities are prioritizing investments in transmission to reduce congestion, improve reliability, and enhance cross-border electricity trade. As the backbone of the power grid, transmission substations are positioned to remain a critical area of infrastructure development, supporting energy transition and future grid resilience across global markets.

The market plays a critical role in global power transmission and distribution infrastructure, enabling electricity to be stepped up or stepped down efficiently for reliable grid operations. Substations integrate switchgear, transformers, circuit breakers, and protective relays to ensure continuous power flow while managing load variations and preventing outages. Rising electricity consumption, grid modernization initiatives, renewable energy integration, and the expansion of smart grids are driving demand.

Technological advancements such as digital substations, advanced monitoring systems, and automation are reshaping market dynamics. Investment flows from both governments and private utilities are supporting upgrades and greenfield projects.

The market is being influenced strongly by the expansion of transmission and distribution networks worldwide. Growing electricity consumption, particularly in industrial and urban centers, has necessitated upgrades in existing substations as well as the construction of new facilities. Demand for high voltage substations has increased due to the need for efficient long-distance transmission. Distribution substations are also being widely deployed in fast-growing residential and commercial zones. Investments by utilities in strengthening grid resilience and ensuring stable supply have created opportunities for advanced equipment integration. Regional interconnection projects and cross-border electricity trade further increase the requirement for reliable substations. This expansion trend highlights the role of substations as critical nodes in ensuring uninterrupted energy delivery.

With renewable energy capacity being scaled globally, substations are playing a pivotal role in grid integration. Solar and wind farms require substations equipped with modern switchgear and advanced monitoring systems to manage variable generation and ensure stable transmission. High voltage substations are increasingly being designed for renewable integration with flexible configurations and digital controls. Hybrid substations are also being deployed where renewable sources are combined with conventional power. Grid operators are investing in smart substations that provide real-time data analytics for balancing supply and demand fluctuations caused by renewables. This integration trend has not only increased demand for new substations but also accelerated modernization of aging infrastructure to meet decarbonization targets.

The shift toward digital substations have emerged as a transformative market driver. Digital substations utilize intelligent electronic devices, sensors, and communication protocols for automation and real-time monitoring. They enable predictive maintenance, enhance fault detection, and optimize grid efficiency. Utilities are replacing traditional substations with digital solutions to reduce operational costs and improve reliability. Cybersecurity solutions are also being incorporated to protect digital assets. This adoption has been accelerated by the need for smart grid development and integration of distributed energy resources. Advanced digital substations support adaptive grid operations, enabling flexible load management and demand response. This trend emphasizes technology-driven growth and a long-term transformation of the global substation landscape.

Despite strong growth prospects, the market faces challenges related to high capital requirements and cybersecurity concerns. The construction and upgrading of substations involve significant investment in land acquisition, equipment, and skilled labor. Smaller utilities and developing regions face difficulties in securing adequate funding, slowing adoption of advanced solutions. With increasing digitization, substations have become vulnerable to cyberattacks that threaten grid stability. Cyber intrusions can disrupt protective systems, leading to large-scale outages. Compliance with regulatory frameworks and investment in cybersecurity infrastructure are necessary to mitigate these risks. These challenges highlight the importance of financial planning, robust governance, and technological safeguards in securing long-term market growth.

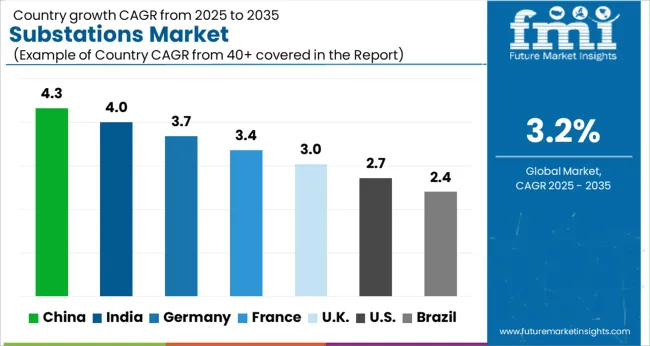

| Country | CAGR |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| France | 3.4% |

| UK | 3.0% |

| USA | 2.7% |

| Brazil | 2.4% |

The market is projected to grow at a CAGR of 3.2% from 2025 to 2035, influenced by rising electricity demand and grid modernization programs. India registered 4.0%, supported by investments in transmission and distribution upgrades. Germany accounted for 3.7%, with progress linked to renewable energy integration and advanced grid technologies. China led with 4.3%, highlighting its large-scale power infrastructure projects. The United Kingdom stood at 3.0%, reflecting replacement demand for aging substations. The United States followed at 2.7%, driven by modernization and resilience-focused projects. Together, these countries represent the leading centers advancing, producing, and innovating in substation development and deployment. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to advance at a CAGR of 4.3%, supported by large scale grid modernization and high voltage transmission projects. Significant investments in smart grid infrastructure and rural electrification programs are reinforcing demand. Digital substations equipped with intelligent control systems and IoT sensors are increasingly adopted to enhance reliability. Domestic manufacturers are focusing on high capacity transformers and modular substations to meet rising electricity requirements from industrial and urban clusters.

India is expected to grow at a CAGR of 4.0%, driven by expansion of renewable energy integration and demand for reliable distribution networks. Government initiatives such as Green Energy Corridors and transmission upgrades have boosted installation of new substations. Adoption of GIS technology is increasing due to land constraints and operational efficiency needs. Domestic and international players are supplying compact and automated substations that cater to both rural electrification and industrial requirements.

Germany is forecast to expand at a CAGR of 3.7%, reinforced by the energy transition and integration of offshore and onshore wind capacity. The focus has shifted toward digital substations with advanced monitoring and control systems to balance distributed energy resources. Investments in high voltage direct current substations have been prioritized to support cross border power flows within Europe. Domestic manufacturers emphasize efficiency and compliance with strict EU energy regulations.

The United Kingdom is projected to record a CAGR of 3.0%, supported by offshore wind integration and modernization of aging distribution networks. Emphasis is placed on compact and automated GIS substations to reduce land footprint and improve operational safety. Financing support from government programs accelerates upgrades of legacy substations across the country. Utility companies are working with global technology providers to introduce predictive maintenance and digital twin solutions.

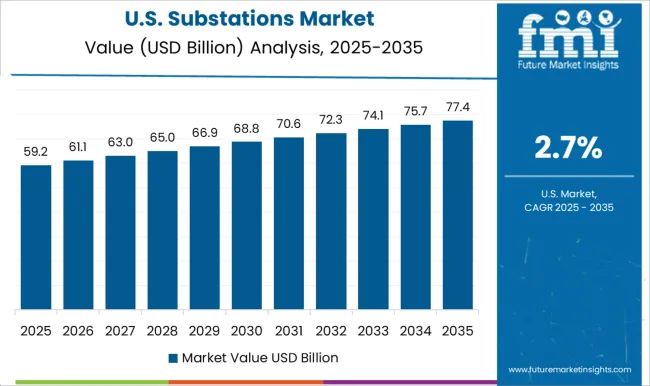

The United States is projected to expand at a CAGR of 2.7%, influenced by grid reliability concerns and modernization of transmission networks. Significant demand comes from replacement of aging infrastructure and integration of solar and wind generation. Utility operators are increasingly adopting smart substations with advanced communication and automation features. Federal funding initiatives and public private partnerships are stimulating regional investments in substation upgrades.

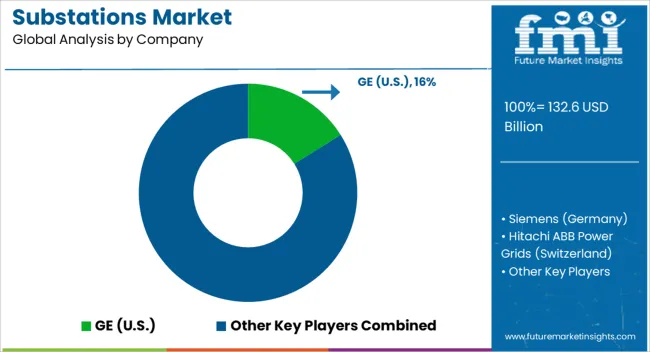

The market is characterized by a strong presence of global electrical equipment manufacturers, automation specialists, and regional power solution providers. Multinational leaders such as GE, Siemens, Hitachi ABB Power Grids, and Schneider Electric dominate through comprehensive portfolios covering high, medium, and low-voltage substations with advanced digital monitoring and automation technologies. Eaton, Rockwell Automation, and Emerson strengthen the market with expertise in intelligent control systems, energy management, and smart grid integration.

Regional players such as L&T Electrical & Automation in India, Efacec in Portugal, and NR Electric in China focus on scalable substation projects tailored to emerging economies, supporting grid reliability and modernization efforts. Technology enablers like Belden and Texas Instruments Incorporated provide critical components such as communication infrastructure, sensors, and semiconductors that enable digital substations and predictive maintenance. Competition is increasingly defined by the transition to digital substations, integration of renewable energy, and grid automation. Companies are prioritizing cybersecurity solutions, IoT-enabled monitoring, and modular substation designs. Strategic partnerships, R&D in energy storage integration, and emphasis on decarbonization-driven grid upgrades are shaping the long-term competitive dynamics of this market.

| Item | Value |

|---|---|

| Quantitative Units | USD 132.6 Billion |

| Technology | Conventional and Digital |

| Component | Electrical System, Substation Automation System, Communication Network, Monitoring & Control System, and Others |

| Application | Transmission and Distribution |

| Connectivity | > 110 kV to ≤ 220 kV, ≤ 33 kV, > 33 kV to ≤ 110 kV, > 220 kV to ≤ 550 kV, and > 550 kV |

| Voltage Level | High, Medium, and Low |

| End Use | Utility and Industrial |

| Category | New and Refurbished |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GE (USA), Siemens (Germany), Hitachi ABB Power Grids (Switzerland), Schneider Electric (France), NR Electric Co., Ltd. (China), Eaton (Ireland), Rockwell Automation (USA), L&T Electrical & Automation (India), Efacec (Portugal), Emerson (USA), Belden (USA), and Texas Instruments Incorporated (USA) |

| Additional Attributes | Dollar sales by substation type and application, demand dynamics across power transmission, distribution, and industrial sectors, regional trends in grid modernization and electrification, innovation in digital monitoring, automation, and modular design, environmental impact of land use, equipment disposal, and energy efficiency, and emerging use cases in renewable integration, smart grids, and microgrid deployment. |

The global substations market is estimated to be valued at USD 132.6 billion in 2025.

The market size for the substations market is projected to reach USD 181.7 billion by 2035.

The substations market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in substations market are conventional and digital.

In terms of component, electrical system segment to command 39.6% share in the substations market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Substations Market Size and Share Forecast Outlook 2025 to 2035

Digital Substations Market - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA