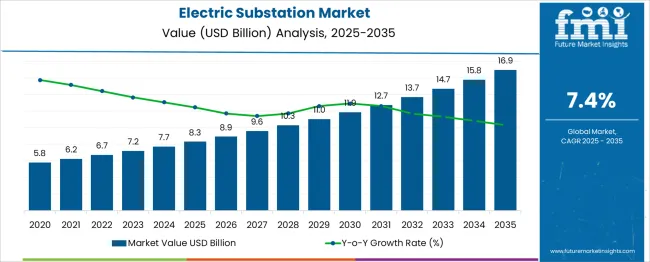

The Electric Substation Market is estimated to be valued at USD 8.3 billion in 2025 and is projected to reach USD 16.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period. Market growth is supported by a steady CAGR of 7.4%, driven by rising global demand for electricity infrastructure, grid modernization, and the integration of renewable energy sources. In the first five-year phase (2025–2030), the market is expected to grow from USD 8.3 billion to USD 11.4 billion, adding USD 3.1 billion, which accounts for 36% of the total incremental growth, fueled by government and private sector investments in sustainable grid solutions.

The second phase (2030–2035) is expected to contribute USD 5.5 billion, representing 64% of the incremental growth, reflecting continued momentum driven by the need for more efficient, secure, and intelligent substations to handle increasing energy demand and the integration of renewable energy sources. Annual increments rise from USD 0.6 billion in the early years to USD 1.1 billion by 2035, indicating stronger growth. Manufacturers focusing on automation, high-voltage solutions, and digital control systems will capture significant value in this USD 8.6 billion opportunity, particularly in regions focusing on energy transition and smart grid development.

| Metric | Value |

|---|---|

| Electric Substation Market Estimated Value in (2025 E) | USD 8.3 billion |

| Electric Substation Market Forecast Value in (2035 F) | USD 16.9 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The electric substation market is witnessing robust development, supported by the accelerated expansion of high-capacity transmission infrastructure and the increasing complexity of energy networks. A growing emphasis on grid stability, interconnection of large-scale renewables, and digital monitoring has shifted utility investments toward next-generation substations capable of handling dynamic voltage and power demands.

Governments and utilities are focusing on improving power reliability and resilience, particularly as electric vehicle integration, distributed energy resources, and smart metering increase the load volatility on existing infrastructure. Regulatory mandates for reducing transmission losses and ensuring energy efficiency are promoting automation and digital substation architectures.

Strategic collaborations between OEMs, EPC contractors, and utilities are fostering turnkey solutions and modular substations that reduce commissioning times. Over the forecast period, the market is expected to benefit from sustained capital expenditure in grid upgrades, especially in Asia Pacific, North America, and the Middle East, where demand for reliable long-distance power evacuation and smart grid initiatives are intensifying the deployment of advanced substations.

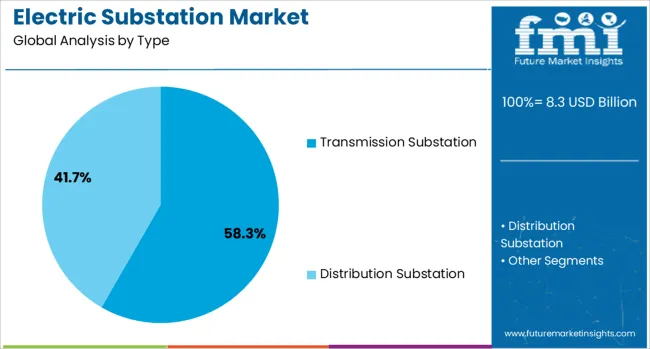

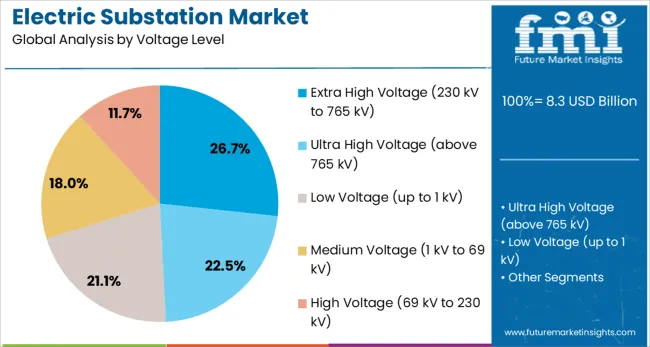

The electric substation market is segmented by type, voltage level, installation type, component, end use, and geographic regions. By type, the electric substation market is divided into Transmission Substation and Distribution Substation. In terms of voltage level, the electric substation market is classified into Extra High Voltage (230 kV to 765 kV), Ultra High Voltage (above 765 kV), Low Voltage (up to 1 kV), Medium Voltage (1 kV to 69 kV), and High Voltage (69 kV to 230 kV).

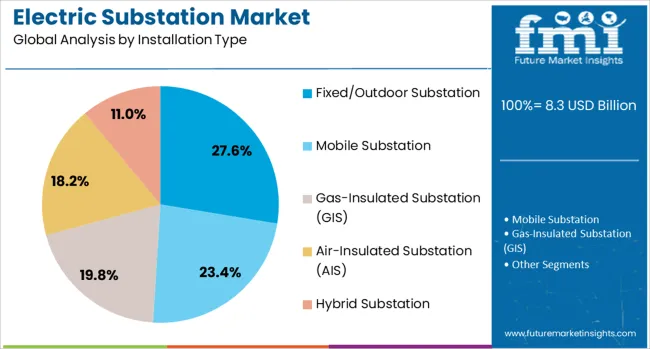

Based on the installation type, the electric substation market is segmented into Fixed/Outdoor Substation, Mobile Substation, Gas-Insulated Substation (GIS), Air-Insulated Substation (AIS), and Hybrid Substation. By component, the electric substation market is segmented into Transformers, Circuit Breakers, Protective Relays, Busbars, Control Panels, Battery Systems, and others. The end use of the electric substation market is segmented into Utilities, Industrial, Commercial, Infrastructure (airports, railways, metro, etc.), Data Centers, Oil & Gas, Renewable Energy Plants (solar, wind), and Others. Regionally, the electric substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Transmission substations are projected to contribute 58.3% of the revenue share in the electric substation market in 2025, emerging as the leading subsegment by type. This dominance is attributed to their essential role in stepping up voltages for long-distance power transmission and maintaining stability across regional and interregional grid networks. With rising electricity demand from urban and industrial growth centers, the need for efficient high-voltage transmission has intensified.

Transmission substations have been widely deployed to interconnect generation plants with load centers, ensuring minimal transmission losses and voltage regulation. The increasing development of ultra-high voltage lines and cross-border interconnections has further solidified the relevance of these substations in grid expansion plans.

Modernization programs aimed at upgrading aging infrastructure and integrating renewable energy sources have accelerated the refurbishment and installation of transmission substations. Their compatibility with digital monitoring systems and remote diagnostics also supports their deployment in future-ready grid ecosystems.

The extra-high voltage segment, ranging from 230 kV to 765 kV, is expected to account for 26.7% of the revenue share in the electric substation market by 2025. This segment's prominence is driven by the increasing requirement for bulk power transmission across vast distances with minimal energy loss.

The demand for EHV substations has increased significantly as utilities strive to expand their transmission networks, which are capable of supporting large-scale renewable energy projects and industrial hubs. Governments are investing in transmission corridors that rely on higher voltage capacities to optimize load balancing across regions.

EHV substations have proven instrumental in grid reinforcement strategies, particularly in countries modernizing their power networks or expanding to accommodate new sources of generation. Their operational efficiency, ability to handle large voltage swings, and adaptability to smart grid integration have positioned this voltage level as a critical component in future power infrastructure.

Fixed or outdoor substations are anticipated to hold 27.6% of the total revenue share in the electric substation market in 2025. This segment's leadership stems from its cost-effective structure, durability, and suitability for high-capacity installations in open environments. Fixed substations have traditionally been deployed for both transmission and distribution purposes, especially in remote or high-demand areas where space constraints are minimal.

The outdoor design enables efficient heat dissipation and easier maintenance, contributing to lower operational costs over the lifecycle. Their simplicity in layout and construction has made them favorable for utility-scale deployment, particularly in expanding suburban and industrial zones.

In addition, regulatory pushes for rural electrification and decentralized grid development have increased the use of fixed substations in regional grid networks. The segment continues to benefit from technological enhancements in insulation, fault monitoring, and arc protection systems, making it reliable for mission-critical operations.

The electric substation market is driven by the growing demand for power distribution across industries and urban expansion. The integration of renewable energy sources, such as wind and solar power, is contributing to market expansion. Key opportunities lie in smart grid implementation and energy storage systems. Emerging trends include automation and digitalization for better grid management. However, challenges such as high infrastructure costs and regulatory hurdles may hinder growth prospects. The market is expected to evolve as demand for reliable and efficient power distribution systems rises.

The major growth driver in the electric substation market is the increasing demand for efficient and reliable power distribution systems. In 2024, the surge in industrial activities and urbanization results in higher electricity consumption. This demand encourages the construction of more substations to ensure uninterrupted power supply. By 2025, the global push towards electrification in emerging economies and developed regions is expected to continue, accelerating market growth as new substations are required to support growing infrastructure needs.

The electric substation market presents ample opportunities through smart grid adoption and energy storage solutions. In 2024 and beyond, the integration of renewable energy sources like wind and solar, which require robust power distribution networks, paves the way for innovative grid management systems. The development of energy storage technologies, such as batteries integrated with substations, offers enhanced flexibility, which is expected to be increasingly demanded in the coming years, especially with the expansion of clean energy infrastructures.

Emerging trends in the electric substation market include the growing automation and digitalization of substation operations. As of 2025, more substations will be equipped with intelligent devices for monitoring and controlling power distribution, ensuring better grid reliability. Automation of systems for load balancing, fault detection, and self-healing capabilities will further optimize performance. Digital twins and real-time data analytics will improve operational efficiency and enhance decision-making processes, allowing utilities to manage complex power networks more effectively.

One significant market restraint in the electric substation sector is the high initial capital required for infrastructure development. In 2024, the construction and maintenance of substations, particularly in regions with aging infrastructure or remote areas, will involve substantial financial investment. This challenge is exacerbated by the regulatory complexities involved in securing permits and meeting local standards. Furthermore, the high operational costs of integrating renewable energy systems and modernizing existing substations may slow down the pace of growth in certain regions.

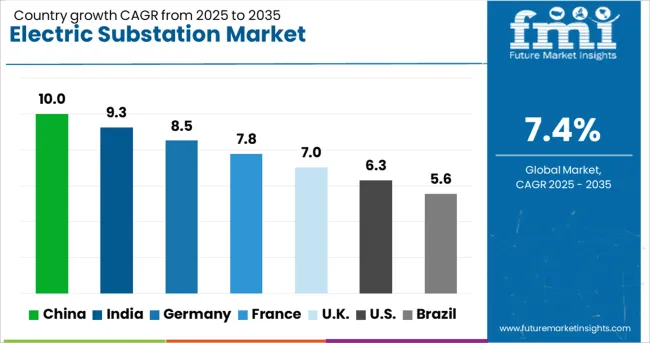

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| U.K. | 7.0% |

| U.S. | 6.3% |

| Brazil | 5.6% |

The global electric substation market is projected to grow at a 7.4% CAGR from 2025 to 2035. China leads with a growth rate of 10.0%, followed by India at 9.3%, and France at 7.8%. The United Kingdom records a growth rate of 7.0%, while the United States shows the slowest growth at 6.3%. These variations in growth rates are driven by increasing demand for electricity, industrial development, and the modernization of electrical infrastructure. Emerging markets like China and India are witnessing rapid growth due to their expanding energy needs and infrastructure development, while more mature markets like the U.S. and the U.K. experience steadier growth due to established power systems and grid expansion efforts. This report includes insights on 40+ countries; the top markets are shown here for reference.

The electric substation market in China is growing at an impressive CAGR of 10.0%. The country’s rapid urbanization, industrialization, and massive investments in energy infrastructure are driving this growth. China is focused on modernizing its power grids to meet increasing electricity demand from its expanding industrial, residential, and commercial sectors. The adoption of smart grid technologies, renewable energy integration, and government initiatives to enhance energy efficiency further accelerate the need for advanced electric substations. As China continues to lead in renewable energy projects, the demand for substations to support these initiatives remains high.

The electric substation market in India is projected to grow at a CAGR of 9.3%. India’s rapidly expanding energy sector, driven by population growth, industrial development, and urbanization, is propelling the demand for electric substations. The Indian government’s focus on electrifying rural areas, upgrading aging infrastructure, and increasing renewable energy capacity is fueling the market. Additionally, the country’s ambitious smart city initiatives and industrial growth further drive the need for efficient and reliable power distribution systems, contributing to the demand for advanced electric substations.

The electric substation market in France is projected to grow at a CAGR of 7.8%. France is making considerable efforts to modernize its electrical infrastructure to integrate renewable energy and improve grid stability. The country’s focus on increasing energy efficiency and reducing carbon emissions is driving the demand for more reliable and smart substations. France’s investments in offshore wind energy and solar power require enhanced substation infrastructure to accommodate these renewable energy sources. Moreover, the French government’s continued support for infrastructure development ensures sustained demand for electric substations.

The electric substation market in the United Kingdom is projected to grow at a CAGR of 7.0%. The U.K. is focusing on upgrading its electricity grid to enhance capacity, improve distribution efficiency, and integrate renewable energy sources. The shift toward a low-carbon economy, along with an increase in electric vehicle adoption, is driving the demand for modern electric substations. Additionally, the U.K.’s push for energy security and resilience against extreme weather conditions further contributes to the market’s growth. However, growth is relatively slower than emerging markets due to the country’s already advanced infrastructure.

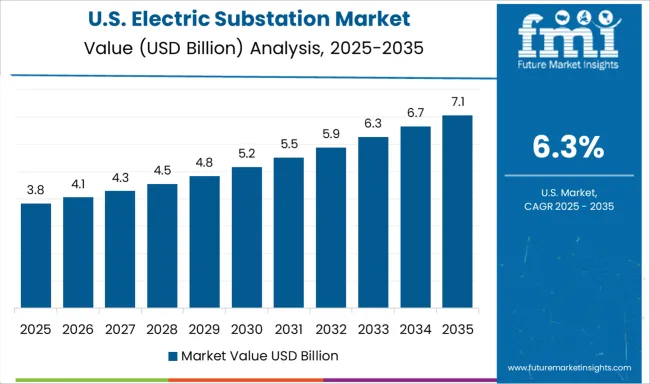

The electric substation market in the United States is expected to grow at a CAGR of 6.3%. The U.S. is investing heavily in modernizing its aging power grid to improve reliability, accommodate renewable energy, and reduce transmission losses. While the market is mature, the adoption of advanced digital substations, smart grid technologies, and energy storage solutions ensures continued demand for electric substations. Furthermore, the growing need for infrastructure upgrades to support electric vehicle charging networks and distributed energy systems is driving the market. However, the growth rate is slower compared to emerging markets due to the maturity of the U.S. market.

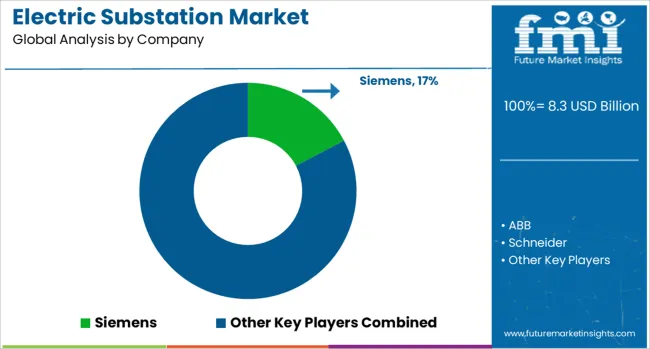

The electric substation market is evolving beyond conventional EPC-led projects into a complex ecosystem where technology, data, and service innovation define competitive advantage. Siemens Energy, ABB, and General Electric continue to dominate through turnkey high-voltage projects and global delivery networks, yet their edge now comes from digital integration, such as real-time monitoring, predictive maintenance, and condition-based service contracts. Schneider Electric and Hitachi Energy emphasize grid intelligence, deploying SCADA systems, digital twins, and analytics platforms that optimize energy flow and reduce operational downtime. Emerging regional players like Hyosung Heavy Industries, TBEA Co., and Bharat Heavy Electricals capture demand through cost-efficient engineering, local supply chains, and turnkey solutions adapted for grid modernization in Asia, Africa, and Latin America.

Niche vendors focus on modular and compact substations, microgrid integration, and advanced insulation technologies, supporting urban, industrial, and off-grid applications. Historically, competition revolved around pricing, equipment reliability, and EPC execution capacity. Moving forward, companies are leveraging renewable integration, IoT-enabled monitoring, and lifecycle service agreements as strategic differentiators. Integration with distributed energy resources, EV charging infrastructure, and energy storage systems is increasingly a growth driver, while modular, prefabricated, and transportable substation designs reduce deployment time and site complexity. Strategic alliances with utilities, tech providers, and renewable developers create embedded ecosystems that lock in long-term revenue streams and enable rapid adaptation to evolving grid requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.3 Billion |

| Type | Transmission Substation and Distribution Substation |

| Voltage Level | Extra High Voltage (230 kV to 765 kV), Ultra High Voltage (above 765 kV), Low Voltage (up to 1 kV), Medium Voltage (1 kV to 69 kV), and High Voltage (69 kV to 230 kV) |

| Installation Type | Fixed/Outdoor Substation, Mobile Substation, Gas-Insulated Substation (GIS), Air-Insulated Substation (AIS), and Hybrid Substation |

| Component | Transformer, Circuit Breaker, Protective Relay, Busbars, Control Panels, Battery Systems, and Others |

| End Use | Utilities, Industrial, Commercial, Infrastructure (airports, railways, metro, etc.), Data Centers, Oil & Gas, Renewable Energy Plants (solar, wind), and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, Schneider, GeneralElectric, Eaton, Mitsubishi, CG, and Caverion |

| Additional Attributes | Dollar sales by substation type and application, demand dynamics across utility, industrial, and commercial sectors, regional trends in electric substation installations, innovation in smart grid integration and automation technologies, impact of regulatory standards on safety and energy efficiency, and emerging use cases in renewable energy integration and electric vehicle infrastructure. |

The global electric substation market is estimated to be valued at USD 8.3 billion in 2025.

The market size for the electric substation market is projected to reach USD 16.9 billion by 2035.

The electric substation market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in electric substation market are transmission substation and distribution substation.

In terms of voltage level, extra high voltage (230 kv to 765 kv) segment to command 26.7% share in the electric substation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Substation Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA