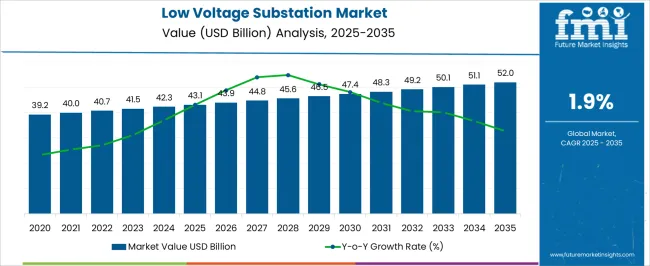

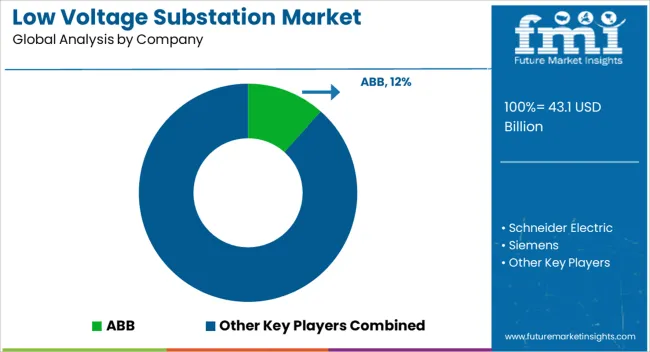

The low voltage substation market is estimated to be valued at USD 43.1 billion in 2025 and is projected to reach USD 52.0 billion by 2035, registering a compound annual growth rate (CAGR) of 1.9% over the forecast period. Conventional air-insulated switchgear (AIS) technologies continue to represent a significant portion of market value due to their established reliability, cost-effectiveness, and wide deployment across residential, commercial, and industrial applications. Their incremental growth, however, is constrained by limited scalability and rising competition from compact solutions.

Gas-insulated switchgear (GIS) and hybrid technologies demonstrate stronger incremental contributions, driven by demand for space-efficient, low-maintenance, and safer configurations. These technologies are increasingly adopted in urban centers and constrained sites where land availability and operational continuity are critical. The value contribution of GIS and hybrid substations is reflected in the steady annual market increments from USD 43.1 billion in 2025 to USD 52.0 billion in 2035, indicating a gradual but consistent shift toward advanced solutions.

Emerging smart substation technologies, incorporating digital monitoring, automated fault detection, and remote control capabilities, are beginning to influence the contribution landscape. Their integration enhances operational efficiency and reliability, allowing utilities to optimize energy distribution and predictive maintenance. The technology contributions are characterized by the sustained dominance of conventional systems, complemented by the rising share of GIS, hybrid, and smart solutions. The cumulative effect of these contributions underpins the moderate but steady market expansion, reflecting both technological evolution and adoption patterns across diverse end-use segments.

| Metric | Value |

|---|---|

| Low Voltage Substation Market Estimated Value in (2025 E) | USD 43.1 billion |

| Low Voltage Substation Market Forecast Value in (2035 F) | USD 52.0 billion |

| Forecast CAGR (2025 to 2035) | 1.9% |

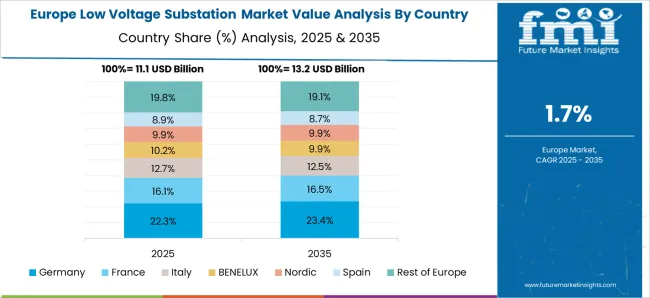

The low voltage substation market represents a critical segment within the global electrical infrastructure and power distribution industry, emphasizing safe, efficient, and reliable delivery of electricity to end-users. Within the broader power equipment and grid solutions sector, it accounts for about 6.4%, driven by urban and industrial demand for stable low voltage supply. In the electrical utility infrastructure segment, its share is approximately 5.8%, reflecting adoption in residential, commercial, and light industrial applications. Across the renewable energy integration and smart grid ecosystem, it holds around 5.0%, supporting distributed generation and microgrid projects.

Within the low voltage switchgear and distribution equipment space, it represents 4.3%, highlighting use in modular and prefabricated solutions. In the overall electrical infrastructure investment segment, the market secures about 3.7%, emphasizing its contribution to safety, automation, and energy management at the consumer level. Recent developments in the market have focused on digitalization, compact designs, and energy-efficient solutions. Integration of IoT-enabled monitoring systems, automated protection relays, and smart metering is gaining traction to improve reliability and reduce downtime.

Prefabricated low voltage substations with plug-and-play installation capabilities are being introduced to accelerate deployment in urban and industrial zones. Manufacturers are increasingly adopting eco-friendly insulation materials and low-loss transformers to reduce operational energy consumption. Modular architectures are being developed to enable scalable capacity upgrades and rapid integration with renewable energy sources. The remote monitoring, predictive maintenance, and advanced fault detection technologies are being deployed to enhance performance, reliability, and safety. These trends illustrate how innovation, efficiency, and digital integration are shaping the market.

The low voltage substation market is witnessing significant expansion, driven by increasing investments in decentralized power distribution systems and the rising demand for reliable electricity infrastructure across urban and industrial developments. Modernization of aging electrical infrastructure and growing adoption of renewable energy sources are prompting utility providers and industrial players to enhance substation performance and efficiency. The integration of digital technologies, intelligent monitoring systems, and real-time control capabilities is transforming conventional substations into responsive and data-driven nodes within the power grid.

As urbanization accelerates and smart city projects scale globally, the need for compact, modular, and automation-enabled substations is growing steadily. The adoption of advanced safety systems, remote operation, and predictive maintenance strategies is further contributing to the appeal of next-generation low voltage substations.

With supportive government policies, regulatory reforms, and a heightened focus on energy efficiency, the market is positioned for continued growth. Stakeholders are increasingly prioritizing systems that offer scalability, grid stability, and enhanced power quality across both new installations and retrofitted infrastructure.

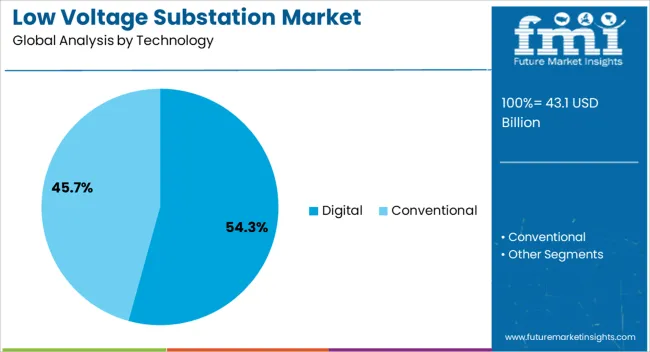

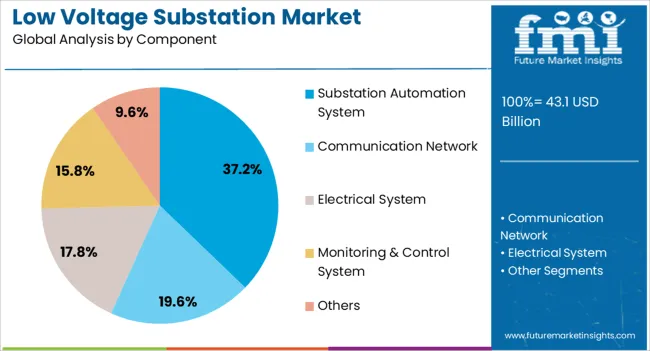

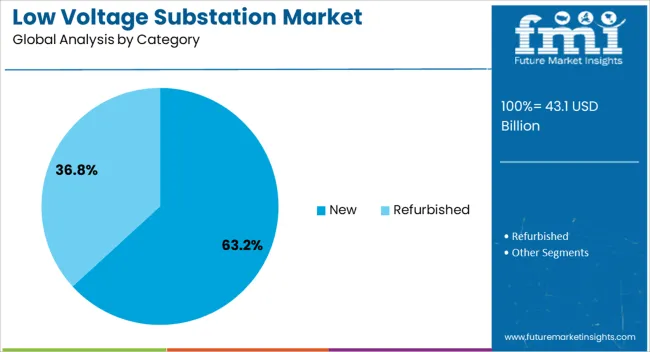

The low voltage substation market is segmented by technology, component, category, and geographic regions. By technology, low voltage substation market is divided into Digital and Conventional. In terms of component, low voltage substation market is classified into Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others. Based on category, low voltage substation market is segmented into New and Refurbished. Regionally, the low voltage substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The digital technology segment is projected to account for 54.3% of the low voltage substation market revenue share in 2025, establishing it as the leading technological approach. This leadership is being driven by the transition from legacy electrical systems to intelligent, communication-enabled substations capable of remote monitoring and real-time control. Digital substations enhance operational reliability by enabling faster fault detection, automated diagnostics, and seamless integration with SCADA and IoT platforms.

Utilities and industries are increasingly deploying digital systems to improve grid resilience and reduce operational costs through predictive maintenance and condition-based asset management. The flexibility to upgrade system functionalities via software without extensive hardware changes is contributing to the segment’s widespread adoption.

Enhanced data analytics capabilities and cybersecurity features also support compliance with emerging grid standards and regulatory requirements. As the global power sector evolves toward smarter, decentralized networks, digital substations are expected to remain the preferred choice, offering scalable and future-ready solutions for complex distribution environments.

The substation automation system component segment is expected to represent 37.2% of the low voltage substation market revenue share in 2025, making it the most significant component category. The segment’s prominence is being supported by the critical role it plays in enabling real-time control, data acquisition, and protection within the substation environment. Automation systems facilitate seamless communication between field devices and control centers, thereby improving system reliability and response times.

The growing need to enhance grid efficiency, minimize human intervention, and reduce downtime is accelerating the deployment of these systems across utility and industrial substations. Rising investments in smart grid infrastructure, combined with the need for integrating renewable energy sources and distributed generation, are driving the implementation of intelligent automation frameworks.

The ability to support advanced functions such as remote switching, load forecasting, and fault isolation further reinforces the value proposition of this component. As operators seek greater visibility and control over power distribution assets, substation automation systems are expected to continue playing a central role in digital substation architecture.

The new category segment is projected to capture 63.2% of the low voltage substation market revenue share in 2025, making it the leading deployment category. Its dominance is being driven by the increasing demand for new substation installations across expanding urban centers, greenfield industrial projects, and renewable energy developments. New substations are being equipped with the latest digital and automation technologies from inception, allowing for improved grid integration, lower maintenance needs, and optimized operational control.

Governments and utilities in emerging economies are accelerating investments in new power infrastructure to meet growing electricity demand and to reduce technical losses. The ease of incorporating modular, factory-assembled units in new construction is further streamlining deployment timelines and reducing site labor costs.

As electrification trends continue to rise across sectors such as transportation, manufacturing, and commercial construction, the need for new low-voltage substations is set to grow rapidly. This trend is expected to maintain the segment’s leadership as stakeholders prioritize efficient, scalable, and digitally equipped solutions from the ground up.

The market is a critical component of modern power distribution systems, enabling safe and efficient delivery of electricity to residential, commercial, and industrial consumers. These substations step down high-voltage electricity to usable low-voltage levels, ensuring stability and protection across the distribution network. Increasing electricity demand, urban infrastructure expansion, and integration of distributed energy resources are driving investments in low voltage substations. Technological advancements such as digital monitoring, smart grid integration, and modular designs are enhancing operational efficiency and reliability. While the market is growing rapidly, challenges, including high installation costs, regulatory compliance, and maintenance complexities, continue to influence strategic decisions among utilities and private investors.

The modernization of existing electrical distribution networks is a key factor influencing low voltage substation deployment. Aging infrastructure in many regions is being upgraded to support increasing electricity loads and improve system reliability. Utilities are replacing conventional substations with compact, modular units that are easier to maintain and integrate with advanced monitoring systems. Smart grid initiatives have increased demand for substations with digital communication capabilities, enabling real-time data collection, remote operation, and predictive maintenance. These improvements reduce outage times, optimize load management, and enhance energy efficiency. Modernization efforts are particularly significant in fast-growing urban centers and industrial zones, where demand for resilient and flexible power distribution is highest.

The integration of renewable energy sources and distributed generation systems has become a major driver for low voltage substations. Solar rooftop installations, small-scale wind turbines, and energy storage units require substations capable of handling bidirectional power flow and maintaining voltage stability. Advanced low voltage substations with intelligent controllers and protection mechanisms ensure seamless integration of these variable energy sources. Utilities are increasingly adopting solutions that allow remote monitoring and adaptive load management to balance renewable input with consumer demand. The growing emphasis on decarbonization and grid modernization further enhances the deployment of low voltage substations capable of supporting sustainable energy initiatives across residential and commercial networks.

Technological advancements are transforming low voltage substation operations, focusing on efficiency, safety, and reliability. Intelligent electronic devices, automated switchgear, and digital protective relays enable precise monitoring of voltage, current, and load conditions. Remote diagnostics and predictive maintenance capabilities reduce downtime and maintenance costs. Modular designs allow for quick installation and scalability, accommodating varying load demands. Integration with smart meters and energy management systems enhances data-driven decision-making for utilities. These innovations not only improve operational performance but also ensure compliance with regulatory standards for safety and environmental impact. The adoption of advanced technologies is creating opportunities for utility modernization while reducing operational risks in distribution networks.

Despite strong demand, the low voltage substation market faces challenges related to high capital expenditure, regulatory compliance, and technical complexity. Installation costs, including land, equipment, and labor, can be significant, particularly in urban areas with space constraints. Regulatory frameworks vary by region, influencing design specifications, safety standards, and environmental compliance requirements. Maintenance of advanced digital substations requires skilled personnel and periodic software updates, adding to operational expenses. Utilities must carefully plan investments and adopt modular, cost-effective solutions to mitigate financial and technical risks. These constraints emphasize the need for strategic project planning and robust management practices to ensure sustainable growth in the market.

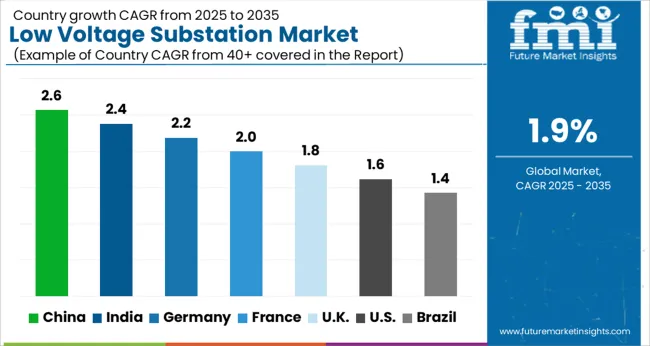

| Country | CAGR |

|---|---|

| China | 2.6% |

| India | 2.4% |

| Germany | 2.2% |

| France | 2.0% |

| UK | 1.8% |

| USA | 1.6% |

| Brazil | 1.4% |

The market is expected to expand at a CAGR of 1.9% between 2025 and 2035. Germany reached 2.2% as modernization of power infrastructure and grid upgrades contributed to steady growth. India followed with 2.4%, supported by rural electrification and industrial demand. China led at 2.6% due to large-scale deployment projects and strong manufacturing capabilities. The United Kingdom recorded 1.8%, reflecting gradual infrastructure improvements, while the United States reached 1.6% as replacement and upgrade activities maintained market movement. These nations represent key regions driving production, scaling, and technological innovation in the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 2.6%, supported by increasing industrialization, commercial development, and expansion of residential complexes. Adoption is reinforced by modernization of existing networks and rising demand for compact, modular, and safe low voltage substations capable of handling growing electricity loads. Integration of smart metering, IoT enabled monitoring, and automated control systems enhances operational efficiency. Manufacturers are investing in high reliability, scalable solutions for industrial zones, commercial facilities, and urban residential complexes. Furthermore, rising deployment of renewable energy sources requires flexible LV substations to connect distributed generation to the grid.

India is expected to grow at a CAGR of 2.4%, driven by government programs to improve electricity distribution and rural electrification. Demand is reinforced by the need for compact, pre-engineered substations that support residential, industrial, and commercial loads. Smart LV substations with remote monitoring, energy management, and protection systems are being adopted to reduce downtime and enhance grid reliability. Collaborations between domestic manufacturers and global technology providers improve design, efficiency, and installation speed. Expansion of urban industrial hubs further strengthens market potential.

Germany is forecast to expand at a CAGR of 2.2%, supported by industrial automation, integration of distributed renewable energy, and energy storage requirements. Adoption is reinforced by advanced LV substations that allow grid monitoring, load balancing, and fault detection in industrial and commercial setups. Manufacturers focus on high efficiency, compliance with EU environmental standards, and modular designs to reduce installation time and costs. Replacement of aging substations and upgrades to smart grids sustain consistent growth.

The United Kingdom is projected to grow at a CAGR of 1.8%, driven by adoption in urban infrastructure, commercial facilities, and industrial power distribution. Imports dominate advanced LV substation supply, while domestic production focuses on standard capacity units. Adoption is reinforced by the modernization of legacy networks, integration with renewable energy systems, and automation of electricity distribution. Predictive maintenance and remote monitoring systems are being increasingly adopted to reduce downtime and improve efficiency.

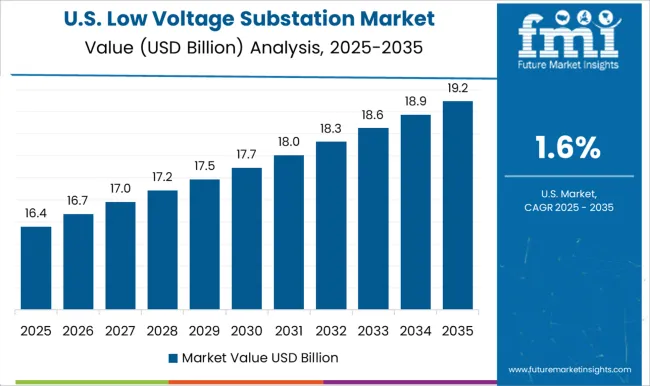

The United States is projected to grow at a CAGR of 1.6%, influenced by industrial, commercial, and residential distribution requirements. Adoption is reinforced by replacement of aging substations and integration with advanced metering and smart grid infrastructure. Manufacturers emphasize modular, scalable, and energy efficient designs to optimize installation and operational efficiency. Federal and state funding for grid modernization drives incremental investments. Deployment of microgrids and renewable energy integration further supports adoption of flexible LV substations.

The market is highly competitive, combining offerings from global industrial giants and specialized regional players. Key leaders such as ABB, Schneider Electric, and Siemens dominate through advanced automation, digital twin technology, predictive maintenance, and integrated energy management solutions, providing reliability and efficiency for industrial, commercial, and utility applications. General Electric, Eaton, and Hitachi Energy focus on modular, scalable, and environmentally compliant systems while enhancing grid resilience and operational safety. Mitsubishi Electric, L&T Electrical and Automation, and Alstom compete with turnkey installations, smart monitoring, and energy optimization, targeting regional industrial and urban infrastructure projects.

Cisco Systems, Rockwell Automation, and Texas Instruments integrate IoT, AI-driven analytics, and remote connectivity to enable real-time monitoring, fault detection, and energy performance optimization, strengthening their digital substation solutions portfolio. Mid-tier and niche players including Efacec, Open System International, Netcontrol Group, Belden, SIFANG, Grid to Great, Tesco Automation, and smaller regional providers differentiate through cost-effective, flexible, and customized solutions, focusing on rapid deployment, ease of integration, and retrofit projects. Continuous innovation in smart grid integration, cybersecurity, predictive maintenance, and green energy compliance drives market rivalry, creating opportunities for collaborations, technology partnerships, and regional expansions across Asia-Pacific, Europe, and North America.

| Item | Value |

|---|---|

| Quantitative Units | USD 43.1 Billion |

| Technology | Digital and Conventional |

| Component | Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others |

| Category | New and Refurbished |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Schneider Electric, Siemens, General Electric, Eaton, Hitachi Energy, Mitsubishi Electric, L&T Electrical and Automation, Cisco Systems, Toshiba, Rockwell Automation, Texas Instruments Incorporated, Alstom, Efacec, Open System International, Netcontrol Group, Belden, SIFANG, Grid to Great, and Tesco Automation |

| Additional Attributes | Dollar sales by substation type and application, demand dynamics across residential, commercial, and industrial distribution networks, regional trends in decentralized power adoption, innovation in compact design, automation, and safety systems, environmental impact of material use and energy efficiency, and emerging use cases in smart grids, renewable integration, and micro-distribution networks. |

The global low voltage substation market is estimated to be valued at USD 43.1 billion in 2025.

The market size for the low voltage substation market is projected to reach USD 52.0 billion by 2035.

The low voltage substation market is expected to grow at a 1.9% CAGR between 2025 and 2035.

The key product types in low voltage substation market are digital and conventional.

In terms of component, substation automation system segment to command 37.2% share in the low voltage substation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Low Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA