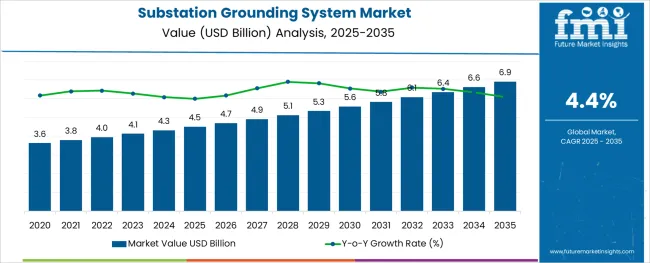

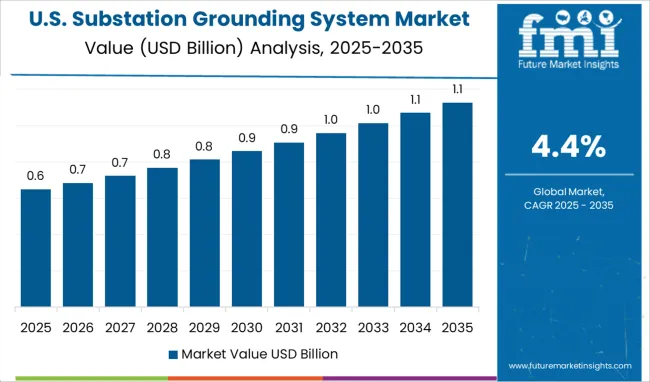

The Substation Grounding System Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 6.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The substation grounding system market is expanding steadily as the demand for reliable electrical infrastructure continues to rise. Ensuring safe and efficient dissipation of fault currents is becoming increasingly critical with the growth of power transmission networks. Engineering publications and infrastructure reports highlight the increasing focus on substation safety and regulatory compliance, which has driven investments in grounding solutions.

Advanced grounding hardware and components are being adopted to improve system reliability and reduce risks related to electrical faults. The growing modernization of substations and integration of smart grid technologies are also influencing market growth.

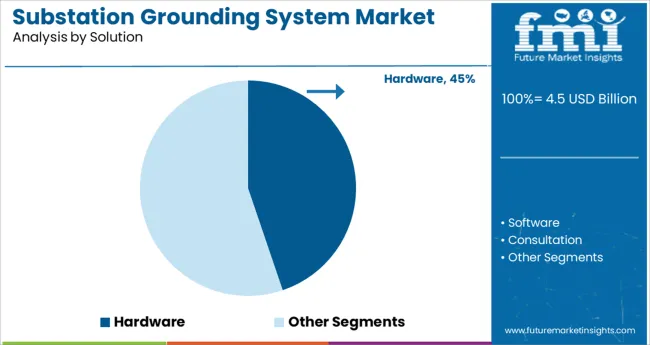

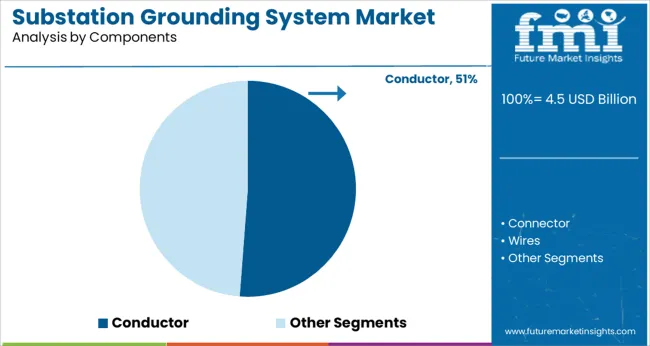

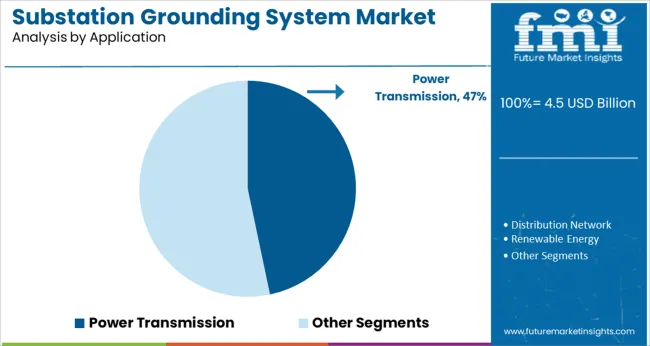

The expansion of renewable energy projects and urban electrification efforts has led to increased deployment of grounding systems. Going forward, the market is expected to grow with ongoing infrastructure upgrades and stricter safety standards. Segmental growth is projected to be led by Hardware as the preferred solution, Conductors as the key component, and Power Transmission as the primary application.

The market is segmented by Solution, Components, and Application and region. By Solution, the market is divided into Hardware, Software, Consultation, Testing, Installation, and Maintenance. In terms of Components, the market is classified into Conductor, Connector, Wires, and Others.

Based on Application, the market is segmented into Power Transmission, Distribution Network, Renewable Energy, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Hardware segment is expected to represent 44.8% of the substation grounding system market revenue in 2025, maintaining its dominant position. Growth in this segment is driven by the essential role hardware plays in establishing effective grounding connections that ensure electrical safety and system stability. Components such as clamps, rods, connectors, and grounding mats are critical in creating a secure electrical path to dissipate fault currents.

Technological improvements have enhanced the durability and corrosion resistance of grounding hardware, extending equipment lifespans and reducing maintenance costs. Additionally, the rise in smart substations has increased demand for reliable grounding hardware capable of supporting advanced monitoring and protection systems.

The segment’s importance is reinforced by stringent safety regulations that require robust hardware installations. The Hardware segment is expected to continue leading the market as a foundation for grounding system performance.

The Conductor segment is projected to account for 51.2% of the market revenue in 2025, making it the largest component category. Conductors serve as the main pathway for fault current dissipation in grounding systems and thus are critical for system effectiveness. The segment’s growth is supported by demand for high-quality copper and aluminum conductors that offer excellent electrical conductivity and mechanical strength.

Increasing infrastructure projects require conductors that can withstand environmental stressors such as corrosion and thermal expansion. Manufacturers have focused on producing conductors with enhanced flexibility and longevity to meet these demands.

The growing adoption of underground and compact substations has also influenced conductor specifications, necessitating optimized sizes and configurations. As power grids continue to modernize and expand, the Conductor segment is expected to remain a key driver of the grounding system market.

The Power Transmission segment is forecasted to hold 46.7% of the substation grounding system market revenue in 2025, retaining its position as the leading application. The segment’s expansion has been fueled by the ongoing development and upgrade of high-voltage transmission networks that require reliable grounding to ensure operational safety and prevent electrical hazards.

The increasing demand for uninterrupted power supply and grid stability has heightened the focus on grounding systems within transmission substations. Moreover, the push toward integrating renewable energy sources into transmission grids has created complex grounding requirements, prompting investments in advanced grounding solutions.

Infrastructure resilience and compliance with evolving electrical safety standards have made grounding systems indispensable in power transmission applications. As transmission networks grow in scale and sophistication, this segment is expected to sustain its market dominance.

As the trend of electrification and industrial process automation continues to create deeper inroads across diverse sectors, the demand for energy and electrical safety systems is registering robust growth across the world. According to a report by the International Energy Agency (IEA), the demand for electricity worldwide is projected to surge at 2.1% per year to 2040, which is twice the rate of overall primary energy demand.

Hence, governments in several countries are planning to make huge investments and are focusing on the development of smart grids and the replacement of old power transmission & distribution infrastructure to decline the cost of distribution and reduce electricity loss.

For instance, according to the India Smart Grid Forum, the Government of India announced allocating nearly USD 129.9 Million with additional budgetary support of around USD 44.8 Million under the National Smart Grid Mission (NSGM) for transforming the nation’s power infrastructure by constructing smart grids across smart cities in India.

Substation grounding systems are extensively used electrical infrastructures for providing neutrals to capacitors, transformers, generations, & reactors and a connection to the ground for earthing. Hence, such developments are anticipated to accelerate the sales of substation grounding systems in the global market.

Due to the complexities of these substation grounding systems, the cost involved in the installation and maintenance of these systems is relatively high, which is in turn, hindering the adoption of these technologies by utility engineers and industries players.

In addition to this, lengthy regulatory approval processes and fragmentation of electrical systems in remote regions are anticipated to hamper the growth in the substation grounding systems market.

Future Market Insights states that the Asia Pacific excluding Japan is projected to emerge as the highly lucrative market for substation grounding systems between 2025 and 2035.

Growing concerns pertaining to environmental sustainability and rising fuel prices have resulted in increasing the adoption of electrical-powered products such as automotive vehicles, industrial automated machineries, and others.

This, in addition to increasing inclination towards production of green energy using renewable sources such as solar, governments in numerous countries are undertaking several initiatives to increase renewable energy production.

For instance, according to a report by the India Brand Equity Foundation, the Indian Government announced allocating around USD 616.76 Million to the Indian Renewable Energy Development Agency Ltd. for the development of solar energy production units under the Production Linked Incentive (PLI) scheme. A multiplicity of such developments are estimated to accelerate the sales in the Asia Pacific excluding Japan market.

As per FMI, North America is projected to account for a significant share in the global substation grounding system market over the forecast period 2025 to 2035.

Governments in the countries such as the USA and Canada are increasingly emphasizing on increasing the production of renewable energy to address the surging demand for electricity. For instance, the USA has announced investing USD 6.9 Billion in the development of solar projects in Nevada by 2035.

As substation grounding systems play a crucial role in the overall safety of the electricity generation, transmission, and distribution infrastructure, increasing number of renewable energy generation plants are expected to bolster the demand in the North America market.

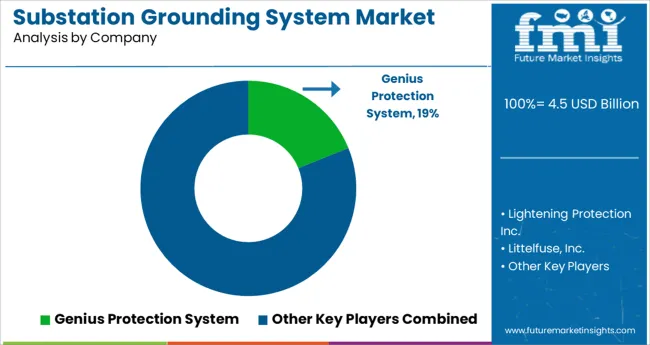

Some of the leading players in the global substation grounding system market are Genius Protection System, Lightening Protection Inc., Littelfuse, Inc., Southwire Company, LLC., Hubbell Power Systems, ABB Group, Power Technology, Burndy LLC., Onrion LLC, Siemens, and others.

Attributed to the presence of such high number of participants and increasing high performance product launches, the market is highly competitive.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.4% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, Volume in Kilotons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Solution, Components, Application, Region |

| Regions Covered | North America; Latin America; Eastern Europe; Western Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Genius Protection System; Lightening Protection Inc.; Littelfuse, Inc.; Southwire Company, LLC.; Hubbell Power Systems; ABB Group; Power Technology; Burndy LLC.; Onrion LLC; Siemens |

| Customization | Available Upon Request |

The global substation grounding system market is estimated to be valued at USD 4.5 billion in 2025.

It is projected to reach USD 6.9 billion by 2035.

The market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types are hardware, software, consultation, testing, installation and maintenance.

conductor segment is expected to dominate with a 51.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Substation Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Substations Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Substation Automation and Integration Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

Substation Automation Market Growth - Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Substation Testing Equipment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

DWDM System Market Analysis by Services, Product, Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA