The market for container stacking machines is expanding rapidly with the rise in world trade, logistics automation, and the need for effective container handling. Shipping lines, ports, and intermodal terminals rely more and more on advanced stacking solutions to optimize space utilization, reduce turnaround time, and optimize operational efficiency. The companies focus on sustainability, AI-based automation, and high-load capacity equipment to be competitive.

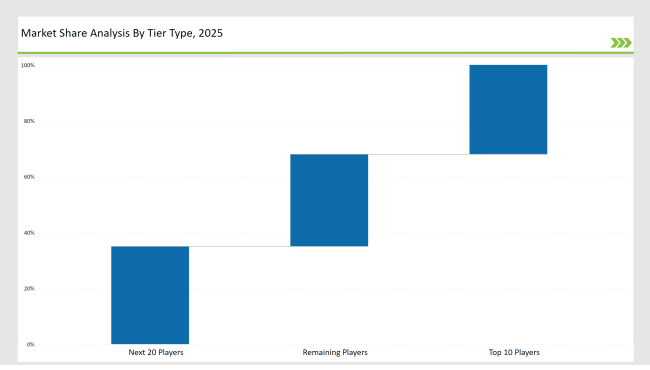

Market leaders such as Tier 1 Konecranes, Kalmar, and Hyster-Yale account for 32% of the market.Their market is because of global distribution channels, intelligent automation, and high-efficiency stackers. These companies keep innovating continuously with AI-based technologies and green technologies to stay competitive.

The tier-2 companies such as Toyota Material Handling, Liebherr, and SANY hold 35% of the market with cost-effective and custom solutions. They focus on creating hybrid and electric-powered machines to cope with evolving environmental regulations.

Regional manufacturers and niche players account for the remaining tier 3 33%, specializing in tailored equipment for specific port and intermodal needs. These companies prioritize adaptability and cost-effective solutions to cater to specialized demands.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Konecranes, Kalmar, Hyster-Yale) | 15% |

| Rest of Top 5 (Toyota Material Handling, Liebherr) | 10% |

| Next 5 of Top 10 (SANY, CVS Ferrari, ZPMC, etc.) | 7% |

The container stacking machine market caters to multiple industries that require advanced automation, high load capacity, and durable equipment. Key trends include electrification, AI-based control systems, and modular stacking solutions.

Manufacturers innovate by incorporating AI, sustainability, and modular designs into container stacking machines. They are integrating predictive maintenance features, smart load-balancing systems, and eco-friendly materials to enhance efficiency. These advancements aim to reduce operational costs, improve machine longevity, and support green logistics initiatives.

Industry players focus on automation, efficiency, and sustainability, revolutionizing container stacking machine technology. Companies invest heavily in AI-powered solutions, electric and hybrid technologies, and modular designs to ensure peak operating efficiency. Their quest for reducing carbon footprints and maximizing intelligent logistics solutions remains at the industry forefront.

Year-on-Year Leaders

Suppliers should focus on automation, sustainability, and performance improvement to be in the market-leading position. Organizations should also create AI-based control systems for enhancing operational efficiency. Strategic partnerships with technology firms also accelerate innovation in stacking solutions.

Invest in hybrid and electric-powered machines to meet environmental regulations.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Konecranes, Kalmar, Hyster-Yale |

| Tier 2 | Toyota Material Handling, Liebherr |

| Tier 3 | SANY, CVS Ferrari, ZPMC, Taylor |

Manufacturers focus on sustainability, automation, and efficiency to drive industry transformation.

| Manufacturer | Latest Developments |

|---|---|

| Konecranes | March 2024: Launched AI-powered automated cranes. |

| Kalmar | June 2024: Unveiled fully electric reach stackers. |

| Hyster-Yale | January 2024: Introduced hydrogen-powered stackers. |

| Toyota Material Handling | May 2024: Upgraded fleet telematics for efficiency. |

| Liebherr | April 2024: Developed hybrid-powered stacking machines. |

The container stacking machine market is rapidly evolving, with major players focusing on automation and sustainability.

Automation, sustainability, and smart tracking systems will characterize the future of the industry. AI-driven systems will improve accuracy and efficiency, and growing demand for zero-emission machinery will force manufacturers to convert entirely to electric. Modular and flexible stacking systems will facilitate scalability and versatility for future logistics operation expansion.

Leading players include Konecranes, Kalmar, Hyster-Yale, Toyota Material Handling, and Liebherr.

The top 3 players collectively control 15% of the global market.

The market is moderately concentrated, with top players holding 32%.

Key drivers include automation, sustainability, AI-driven efficiency, and regulatory compliance.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Container-based Firewall Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Container As A Service (CaaS) Market Size and Share Forecast Outlook 2025 to 2035

Container Washing System Market Size and Share Forecast Outlook 2025 to 2035

Containerboard Market Size and Share Forecast Outlook 2025 to 2035

Containerized Substation Market Size and Share Forecast Outlook 2025 to 2035

Container Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Container Weighing Systems Market Growth - Trends & Forecast 2025 to 2035

Container Security Market

Container Coating Market

Container Mouth Inner Seal Market

Analyzing Container Liner Market Share & Industry Leaders

Container Stacking Machine Market by Automation & System Type Through 2035

PS Containers Market Size and Share Forecast Outlook 2025 to 2035

PP Container Liner Market

Tin Container Market Forecast and Outlook 2025 to 2035

PET Containers Market Growth, Demand and Forecast from 2025 to 2035

ISO Container Market Growth – Trends & Forecast 2025 to 2035

EPS Container Market Trends & Growth Forecast 2024-2034

PVC Container Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA