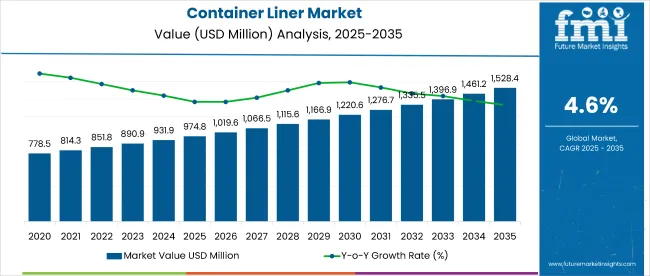

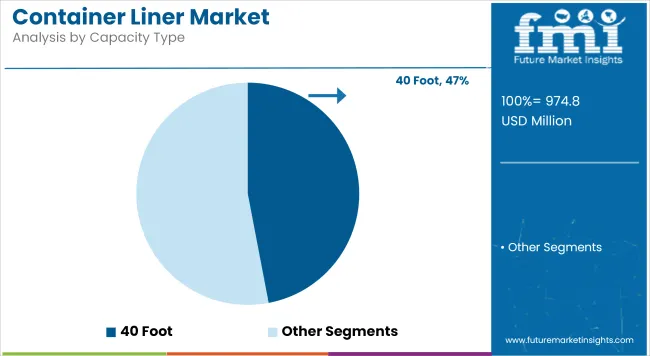

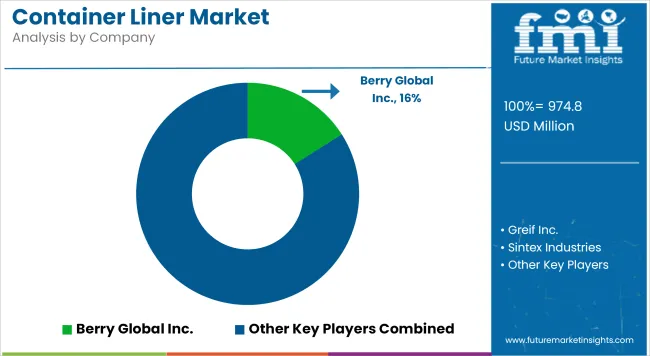

The global Container Liner Market is estimated at USD 974.8 million in 2025 and is projected to reach USD 1,528.4 million by 2035, growing at a CAGR of 4.6%. Nearly half of the market is dominated by 40 Foot capacity liners, which hold a 47% share.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 974.8 million |

| Market Size (2035) | USD 1,528.4 million |

| CAGR (2025 to 2035) | 4.6% |

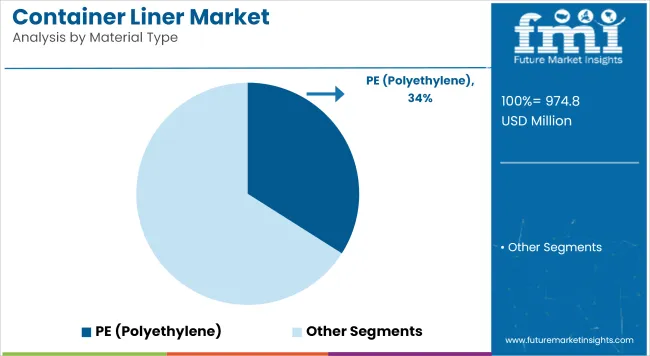

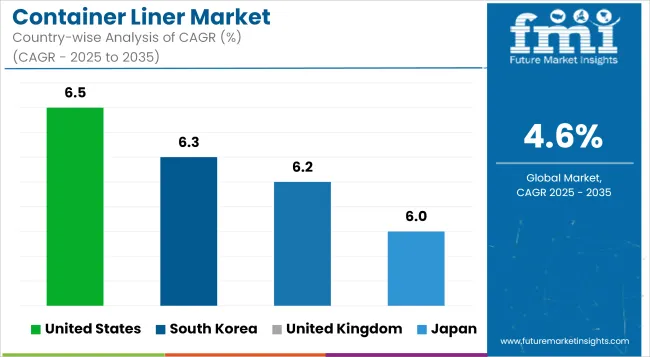

Polyethylene (PE) is the leading material type, accounting for 34% of the market. Top Fill products represent 29% of sales. Among regions, the United States leads with the highest CAGR of 6.5%, followed by South Korea at 6.3%, the United Kingdom at 6.2%, and Japan at 6.0%.

Growth in the Container Liner Market is driven by rising global containerized shipping and increasing demand for secure bulk cargo transportation. The preference for 40 Foot liners is supported by their compatibility with standard container fleets, while polyethylene remains favored due to its durability and cost efficiency.

Regional growth in the USA and Asia-Pacific reflects expanding industrial and e-commerce activities, though market expansion faces logistical challenges including supply chain constraints and raw material price volatility. Overall, companies investing in innovative liner designs and sustainable materials are positioned to gain competitive advantage through the forecast period.

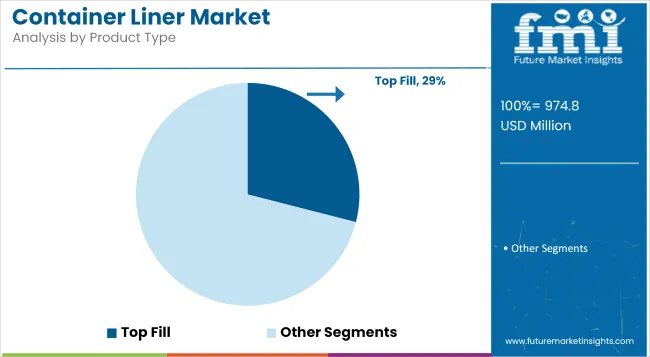

The Container Liner Market is segmented by Capacity Type into 20 Foot, 30 Foot, and 40 Foot liners, with 40 Foot liners dominating in 2025. By Material Type, the market is divided into Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Metallized Films, and other materials such as Polystyrene. Product Type segmentation includes End Fill, Open Top, Top Fill, and Wide Access liners.

End-use segments cover Agriculture, Chemical, Building & Construction, Mining, Food & Beverage, Pharmaceutical, and Others. Geographically, the market is analyzed across North America, Latin America, Western and Eastern Europe, East Asia, South Asia & Pacific, Middle East, and Africa. Country-level analyses include major markets such as the United States, Canada, Mexico, Brazil, Germany, Italy, France, the UK, China, Japan, South Korea, India, Australia & New Zealand, ASEAN countries, GCC nations, and South Africa.

In 2025, the 40 Foot capacity segment leads the Container Liner Market with a 47% share, reflecting its widespread compatibility with standard global shipping container fleets. This dominance is supported by growing demand for efficient bulk cargo transport solutions that optimize container volume utilization.

The 20 Foot and 30 Foot capacity segments together constitute the remaining 53% of the market, driven primarily by niche applications and regional container specifications. Growth in the 40 Foot segment is propelled by increasing containerized trade volumes and rising investments in logistics infrastructure. However, challenges such as fluctuating raw material costs and supply chain disruptions may moderate growth. Innovations in liner design aimed at enhancing durability and ease of installation are expected to further strengthen the 40 Foot segment’s position over the forecast period.

Polyethylene (PE) dominates the Container Liner Market in 2025 with a 34% share, favored for its durability, chemical resistance, and cost-effectiveness. PE liners are widely used across various end-use industries due to their ability to protect bulk cargo from contamination and moisture.

Other materials such as Polypropylene (PP), Polyvinyl Chloride (PVC), Metallized Films, and specialty polymers make up the remaining 66%, each offering specific performance benefits for different applications. Growth in the PE segment is supported by its versatility and increasing demand in industries like agriculture, chemicals, and food & beverage. However, environmental regulations and evolving sustainability requirements could drive innovation and gradual adoption of alternative, eco-friendly materials during the forecast period. The material segment’s expansion will hinge on balancing performance, cost, and compliance with regulatory standards globally.

Top Fill liners hold the largest share in the Container Liner Market in 2025, accounting for 29% of total revenue. These liners are preferred for their ease of filling from the top, making them suitable for bulk materials that require secure containment during transport. Other product types include End Fill, Open Top, and Wide Access liners, which collectively represent 71% of the market. Each product type caters to specific cargo handling needs and container designs, influencing their adoption across various industries.

Growth in the Top Fill segment is driven by increasing demand in sectors such as agriculture and chemicals, where efficient loading and unloading are critical. Despite logistical challenges and competition from alternative packaging solutions, ongoing product innovation aimed at improving liner strength and compatibility is expected to sustain growth throughout the forecast period.

The Container Liner Market is segmented by end use into Agriculture, Chemical, Building & Construction, Mining, Food & Beverage, Pharmaceutical, and Others. Agriculture and Chemical industries are among the primary consumers, driven by the need for secure and contamination-free transport of bulk raw materials and products.

The Food & Beverage segment is gaining traction due to stringent hygiene requirements and growing demand for bulk food ingredient shipments. Mining and Building & Construction sectors contribute significantly as well, leveraging liners to protect bulk minerals and construction materials during transit. The Pharmaceutical segment, while smaller in volume, is growing steadily, supported by increasing global trade of active pharmaceutical ingredients. Each end-use segment faces unique regulatory and operational challenges, but overall, demand is propelled.

The United States Container Liner Market is expected to grow at a CAGR of 6.5% from 2025 to 2035, driven by expanding industrial and e-commerce activities that increase demand for secure, efficient bulk cargo transport. In 2025, the USA market size anchors regional growth as the largest container liner market in North America, supported by advanced logistics infrastructure and growing import-export volumes.

Regulatory standards for safe transportation and contamination prevention in food, chemicals, and pharmaceuticals reinforce liner demand. Increased focus on supply chain optimization and the shift towards just-in-time inventory management further stimulate market expansion.

However, challenges including raw material price volatility and supply chain disruptions may temper growth. Public surveys reflect rising awareness among shippers about the benefits of durable liners to reduce cargo damage. Investment in innovative materials and sustainable liner solutions is anticipated to enhance the USA market’s competitiveness, positioning domestic manufacturers and global suppliers for continued growth over the forecast period.

South Korea’s Container Liner Market is forecast to grow at a CAGR of 6.3% during 2025-2035, fueled by the country’s strong export-oriented economy and advanced manufacturing sectors. The 2025 market size is anchored by key industries such as chemicals, automotive, and electronics that require reliable bulk packaging for overseas shipping.

South Korea’s focus on supply chain efficiency and container utilization optimization supports demand for high-quality liners, especially 40 Foot capacity types. Environmental regulations and sustainability initiatives are encouraging adoption of recyclable and eco-friendly liner materials, reflecting evolving market dynamics.

Despite potential headwinds from raw material cost fluctuations, government incentives for technological innovation in packaging materials help mitigate risks. Industry surveys indicate that shippers are increasingly prioritizing liner durability and compatibility with container handling systems. The market outlook points to steady growth as South Korea continues to strengthen its logistics infrastructure and expands international trade partnerships.

The United Kingdom Container Liner Market is projected to expand at a CAGR of 6.2% from 2025 to 2035. The UK’s market growth is propelled by post-Brexit trade realignments and increased demand for efficient containerized transport solutions.

Food & beverage, chemical, and pharmaceutical sectors contribute significantly to liner consumption, driven by stringent regulatory standards for product safety during shipment. The 40 Foot container liners remain dominant due to compatibility with UK and European logistics networks.

Investment in sustainable materials and enhanced liner designs is rising, as UK businesses align with environmental regulations and consumer expectations for responsible packaging. Challenges such as supply chain uncertainties and rising raw material prices pose risks, yet market participants are focused on innovation and supplier diversification to ensure resilience. Public sentiment increasingly favors durable liners that reduce product loss and contamination, supporting the market’s long-term expansion.

Japan’s Container Liner Market is expected to grow at a CAGR of 6.0% from 2025 to 2035, anchored by the country’s advanced manufacturing base and export-oriented economy. The 2025 market size reflects steady demand in sectors such as chemicals, food processing, and electronics, where container liners are essential for safe bulk transport. Japan’s stringent quality standards and emphasis on contamination prevention bolster liner adoption, especially polyethylene-based products.

The market benefits from Japan’s focus on logistics optimization and automation, which enhance container handling efficiency. However, supply chain constraints and raw material cost volatility represent ongoing challenges.

Survey data suggest increasing interest among shippers in liners offering both durability and environmental benefits. The development of innovative, sustainable liner materials is a key trend supporting Japan’s market growth, positioning it among the top Asia-Pacific markets for container liners over the forecast period.

The players in the Container Liner Market are focusing on product innovation, material diversification, and strategic partnerships to strengthen their market positions. Leading companies like Berry Global Inc. leverage advanced polyethylene formulations to enhance liner durability and chemical resistance, addressing diverse end-use requirements.

Concurrently, firms such as Greif Inc. and Sintex Industries invest in expanding production capacities and geographic reach to meet growing global demand, particularly in North America and Asia-Pacific. Sustainability initiatives have become central, with key players developing recyclable and bio-based liner materials in response to tightening environmental regulations. Supply chain resilience is being improved through localized manufacturing and diversified supplier networks to mitigate raw material price volatility and logistics disruptions.

Smaller and emerging companies focus on niche applications and customization to differentiate offerings. Technology adoption in manufacturing processes and quality control further intensifies competition. Overall, market leadership will be determined by firms’ ability to balance innovation, cost efficiency, and sustainability, positioning them to capture expanding opportunities amid evolving customer preferences and regulatory landscapes. Late movers face challenges in scaling quickly and establishing trusted supply chains.

| Metric | Details |

|---|---|

| Market Covered | Global Container Liner Market |

| Historical Period | 2020 to 2024 |

| Base Year | 2024 |

| Forecast Period | 2025 to 2035 |

| Market Size Units | USD Million; Volume in Metric Tons |

| Segmentation | Capacity Type (20 Foot, 30 Foot, 40 Foot); Material Type (PE, PP, PVC, Metallized Film, Others); Product Type (End Fill, Open Top, Top Fill, Wide Access); End Use (Agriculture, Chemical, Building & Construction, Mining, Food & Beverage, Pharmaceutical, Others); Region and Country-level analysis |

| Regional Coverage | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Key Countries | United States, Canada, Mexico, Brazil, Germany, Italy, France, UK, China, Japan, South Korea, India, Australia & New Zealand, ASEAN, GCC, South Africa |

| Key Players Covered | Berry Global Inc., Greif Inc., Sintex Industries, Thrace Group, Nier Systems Inc., Caretex, LC Packaging, Eceplast S.p.A, Bulk-Pack Inc., Powertex |

| Market Dynamics Covered | Drivers, Restraints, Opportunities, Trends |

| Additional Analysis | Technology Roadmap, Supply Chain, Pricing Analysis, Investment Feasibility, Competitive Landscape |

The market is expected to grow at a CAGR of 4.6% during this period.

40 Foot liners dominate, holding 47% of the market share in 2025.

What is the leading material used in container liners?

Top Fill liners lead with a 29% share of the market.

The United States leads with a CAGR of 6.5%, followed by South Korea (6.3%), the United Kingdom (6.2%), and Japan (6.0%).

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Container Liner Market Share & Industry Leaders

PP Container Liner Market

Container-based Firewall Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Container As A Service (CaaS) Market Size and Share Forecast Outlook 2025 to 2035

Container Washing System Market Size and Share Forecast Outlook 2025 to 2035

Containerboard Market Size and Share Forecast Outlook 2025 to 2035

Containerized Substation Market Size and Share Forecast Outlook 2025 to 2035

Container Stacking Machine Market by Automation & System Type Through 2035

Container Weighing Systems Market Growth - Trends & Forecast 2025 to 2035

Market Leaders & Share in the Container Stacking Machine Industry

Container Security Market

Container Coating Market

Container Mouth Inner Seal Market

PS Containers Market Size and Share Forecast Outlook 2025 to 2035

Tin Container Market Forecast and Outlook 2025 to 2035

PET Containers Market Growth, Demand and Forecast from 2025 to 2035

ISO Container Market Growth – Trends & Forecast 2025 to 2035

EPS Container Market Trends & Growth Forecast 2024-2034

PVC Container Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA