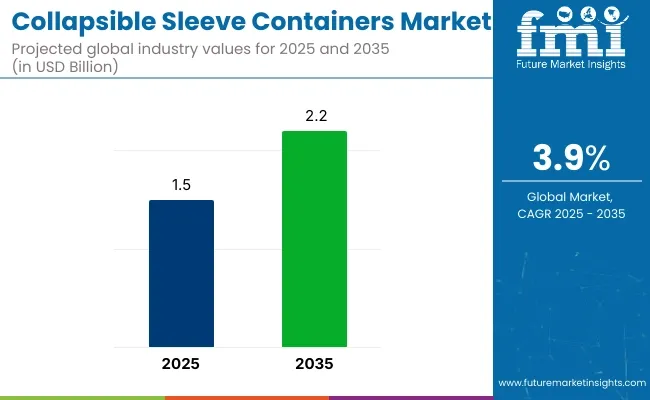

The collapsible sleeve containers market is projected to grow from USD 1.5 billion in 2025 to USD 2.2 billion by 2035, registering a CAGR of 3.9% during the forecast period. Sales in 2024 reached USD 1.3 billion, reflecting a steady increase in demand across various industries.

This growth has been attributed to the rising need for efficient, reusable, and space-saving packaging solutions that enhance supply chain operations and reduce environmental impact. The adoption of collapsible sleeve containers has been reinforced by their ability to optimize storage and transportation, leading to cost savings and improved logistics efficiency.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.5 billion |

| Projected Market Size in 2035 | USD 2.2 billion |

| CAGR (2025 to 2035) | 3.9% |

Greif, Inc. a global leader in industrial packaging products and services, announced today that it has completed its previously announced acquisition of Ipackchem Group SAS. Ipackchem has become an international leader in the design and manufacturing of innovative, high-performance rigid plastic barrier packaging products (containers, bottles, jerry cans) with uncompromising quality and service. Ipackchem takes pride in providing sustainable, secure & safe UN-certified packaging solutions technology for the transport of life enhancing chemicals.

"We are thrilled to welcome an exceptional 1,400 Ipackchem colleagues to Greif," said Ole Rosgaard, President and Chief Executive Officer of Greif. "Adding Ipackchem to the Greif portfolio is another key step forward in executing our Build to last strategy and helps unlock significant new capabilities and market opportunities to further grow as a world leader in high-performance small plastic containers and jerry cans.

Our teams have been planning our integration strategy over the past several months, which we will begin implementing immediately post-closing to drive incremental benefits, support future growth, and capture our targeted USD 7 million of synergies. I would like to extend my deep gratitude to every member of the Greif and Ipackchem team for their unparalleled dedication and excellent collaboration in planning post acquisition integration.”

The shift towards sustainable and environmentally friendly packaging solutions has significantly influenced the collapsible sleeve containers market. Manufacturers have been focusing on developing containers that are recyclable, lightweight, and made from renewable resources. Innovations include the integration of RFID tracking systems, modular designs, and the use of recycled materials to reduce environmental impact. These advancements align with global sustainability goals and regulatory requirements, making collapsible sleeve containers an attractive option for environmentally conscious industries.

The collapsible sleeve containers market is poised for significant growth, driven by increasing demand in logistics, automotive, and food & beverage industries. Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge. As global supply chains expand and environmental regulations become more stringent, the adoption of collapsible sleeve containers is anticipated to rise, offering cost-effective and eco-friendly packaging solutions.

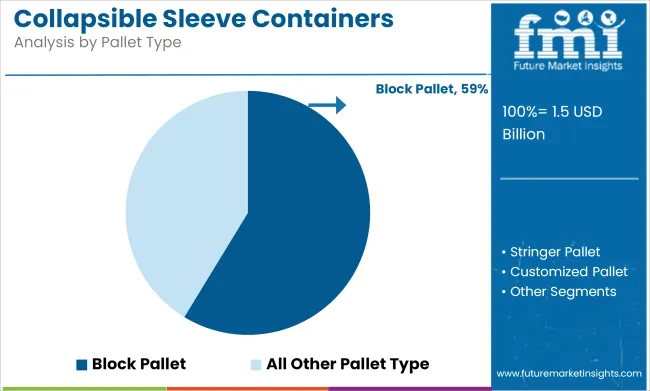

The plastic segment is projected to account for approximately 58.7% of the global collapsible sleeve containers market by 2025, as plastic-based containers have been widely adopted for their superior durability, weather resistance, and reusability. High-density polyethylene (HDPE) and polypropylene (PP) have been the most commonly utilized polymers, offering an ideal balance between strength and weight.

Plastic sleeves have been engineered to withstand repeated folding and unfolding cycles without material fatigue, making them suitable for long-term use in closed-loop logistics and industrial shipping operations. Their resistance to moisture, chemicals, and extreme temperatures has enabled reliable protection of goods in varied storage and transit conditions.

Compatibility with automation systems and ease of sanitation have also contributed to their increasing use in sectors such as automotive, electronics, food processing, and pharmaceuticals. Additionally, plastic components have been increasingly manufactured with recycled content and end-of-life recyclability in mind, supporting broader sustainability goals.

As operational efficiency, regulatory compliance, and packaging reuse targets continue to shape industrial logistics, plastic-based collapsible sleeve containers are expected to retain market dominance due to their performance consistency and lifecycle cost advantages.

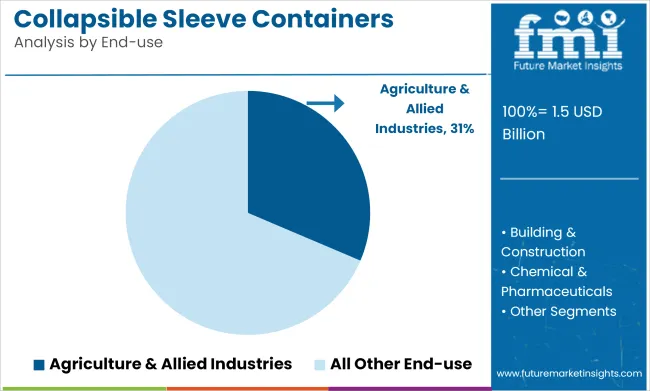

The agriculture & allied industries segment is projected to account for nearly 31.4% of the global collapsible sleeve container market by 2025, positioning it as one of the most dominant end-use segments. These industries increasingly rely on collapsible sleeve containers for bulk transport and temporary storage of perishable produce, seeds, fertilizers, agrochemicals, and equipment components.

Collapsible sleeve containers provide a cost-effective and reusable solution for supply chains that span across rural production zones and urban consumption hubs. Their foldable nature enables significant savings in return logistics up to 65% in backhaul volume making them highly practical for seasonal agricultural cycles and multi-point distribution.

Additionally, containers made from high-density polyethylene (HDPE) and polypropylene offer durability, moisture resistance, and weather tolerance, which are essential for handling agricultural goods exposed to fluctuating environmental conditions.

Stackability and compatibility with forklifts and pallet systems also support easy handling and storage during harvest or transit. With rising global exports of agri-commodities, increasing mechanization of farm logistics, and greater emphasis on minimizing packaging waste, collapsible sleeve containers are being widely adopted across the agri-value chain-from farm gates to processing centers. This trend is expected to accelerate as sustainability and operational efficiency become core priorities in agricultural logistics.

High Initial Investment and Logistics Constraints

High initial investments required for producing long-lasting and fully reusable sleeve containers is a major hindrance to the growth of collapsible sleeve containers market. Moreover, the lack of awareness and reverse logistics infrastructure in developing regions restricts widespread uptake. Heavy and bulky rigid plastic sleeve containers are also more expensive to transport, taking a toll on cost-effectiveness for long-haul supply chains.

Growth in Sustainable Packaging and Supply Chain Optimization

As the demand for environmentally friendly and cost-efficient packaging solutions rises, collapsible sleeve containers become a popular choice for single-use plastic crates and cardboard packaging. Durable, reusable, and space-saving packaging solutions are being adopted by industries including automotive, retail, e-commerce, agriculture, and pharmaceuticals. Moreover, innovations in lightweight materials, RFID tracking for inventory management and foldable container automation are making logistics more efficient and enabling lower carbon footprints.

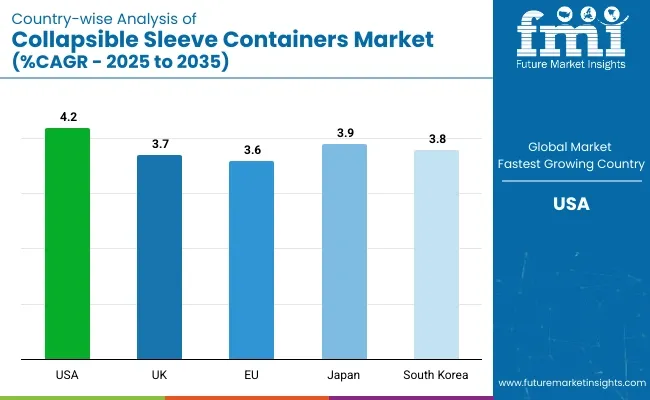

The market for United States collapsible sleeve containers is growing steadily, with the increasing need for efficient and cost-effective bulk packaging solutions across a variety of sectors such as logistics, automotive, and retail industry. The growing emphasis on supply chain optimization and reusable packaging solutions is driving the market growth.

The significant presence of leading e-commerce companies and strict sustainability regulations promoting packaging waste reduction and operational efficiency are driving businesses to adopt collapsible sleeve containers. Moreover, introduction of lightweight and durable materials are expected to support adoption of these containers in the USA

Moreover, the growing automotive industry that uses returnable packaging for transporting car parts is further instrumental to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The USA collapsible sleeve containers market is projected to grow in reaction to the growing sustainable and cost effective packaging solutions. Environmental regulations lead logistics and retail industries to take up reusable bulk containers.

Growing emphasis on efficient warehouse management, coupled with the rise of e-commerce, continues to positively influence the uptake of collapsible sleeve containers. In addition, circular economy initiatives and government-driven sustainability programs are driving companies to adopt returnable and reusable packaging solutions.

The growing food and beverage industry, which demands anaerobic clones type bulk packing that is space-and-hygiene friendly, is also driving the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The reported market in Europe also benefits from new EU sustainability regulations, including packaging recycling targets and new disposable bans, as the EU collapsible sleeve containers market is continuing to grow steadily as demand for more reusable alternatives increases and cross-border trade continues to grow within Europe. The EU’s push to reduce single-use plastics is prompting companies to adopt collapsible sleeve containers as an environmentally friendly option.

Sustainable bulk packaging solutions are mainly being adopted in the automotive, pharmaceutical, and industrial sectors in leading economies such as Germany, France, and Italy. Increasing penetration of third-party logistics (3PL) service providers adopting returnable transit packaging is also driving market growth.

The use of new lightweight and recyclable materials for sleeve containers is making them easier and more cost-efficient to use while making them more durable towards the rigors of supply chain operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.6% |

Implementation of automation coupled with optimized space requirement and sustainable packaging demands are boosting the market for collapsible sleeve containers in the country. Market demand is driven by the increasing adoption of returnable packaging solutions, especially in the automotive and electronics industries.

The demand of efficient and eco-friendly material handling in Japan which has strong logistics infrastructure and stringent waste management policies is expected to propel the Japan collapsible sleeve container market growth. Furthermore, the rising need for space-efficient and retractable storage systems in urban distribution centers is boosting the market growth.

In addition, the increasing use of collapsible packaging for warehouse and in-transit storage applications is being driven by the expansion of Japan’s retail and e-commerce industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The market for collapsible sleeve containers in South Korea is expected to grow at a lucrative rate owing to the growth of segment of the manufacturing, automotive and logistics industries. Demand for collapsible bulk containers is being driven by the country’s move toward sustainable packaging solutions and the growing uptake of smart logistics practices.

Government regulations mandating waste minimization and circular economy practices are prompting companies to lean towards reusable and returnable packaging options. Moreover, the growing e-commerce sector in South Korea, in addition to the growing demand for space-efficient warehouse management systems, is contributing to the market growth.

The increasing demand for hygienic and light-weight packaging solutions from food and pharmaceutical industry will also aid in the adoption of collapsible sleeve containers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

The collapsible sleeve containers market is positively influenced by the increasing demand for device-efficient, economical, and re-usable bulk packaging solutions across industries such as automotive, food & beverage, pharmaceuticals, retail, and logistics. The reason for this is that these containers provide durability, ease of storage, and lower shipping costs, making them the all-time preferred types of supply chain optimizations and sustainable packaging initiatives. Growing implementation of returnable packaging solutions to reduce waste and carbon footprint is also favoring the market growth.

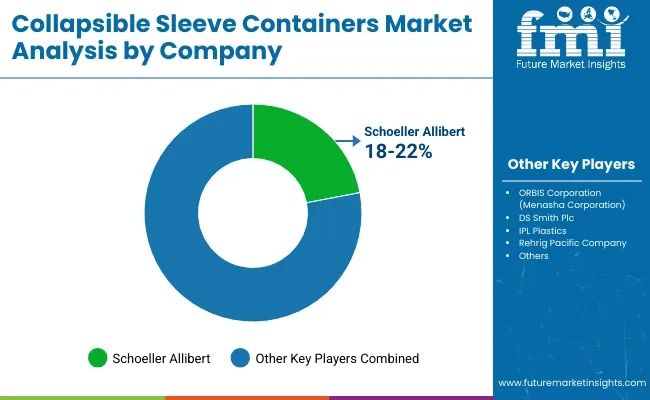

Schoeller Allibert (18-22%)

Schoeller Allibert leads the market with heavy-duty, reusable collapsible sleeve containers designed for efficient storage and transport. The company focuses on automotive, industrial, and agricultural applications, integrating high-strength materials for long-term use.

ORBIS Corporation (Menasha Corporation) (14-18%)

ORBIS is a key player in returnable and reusable packaging solutions, providing lightweight, easy-to-handle collapsible sleeve containers. The company targets retail, food & beverage, and warehouse automation industries.

DS Smith Plc (12-16%)

DS Smith specializes in fiber-based and plastic collapsible sleeve containers, offering sustainable and recyclable solutions for e-commerce, logistics, and FMCG (fast-moving consumer goods) sectors.

IPL Plastics (10-14%)

IPL Plastics manufactures customized, collapsible bulk containers tailored to specific industrial, retail, and food supply chain needs. The company is investing in innovative designs for enhanced stack ability and cost reduction.

Rehrig Pacific Company (8-12%)

Rehrig Pacific provides high-durability collapsible sleeve containers for distribution and logistics applications, with a focus on warehouse automation and material handling.

Other Key Players (26-32% Combined)

The overall market size for collapsible sleeve containers market was USD 1.5 billion in 2025.

The collapsible sleeve containers market is expected to reach USD 2.2 billion in 2035.

The growth of the collapsible sleeve containers market will be driven by increasing demand for space-efficient and reusable packaging solutions, advancements in lightweight and durable materials, and rising adoption in logistics and retail industries for cost-effective storage and transportation.

The top 5 countries which drives the development of collapsible sleeve containers market are USA, European Union, Japan, South Korea and UK.

48x40x34 collapsible sleeve containers to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Collapsible Metal Tubes Market Size and Share Forecast Outlook 2025 to 2035

Collapsible Gates Market Size and Share Forecast Outlook 2025 to 2035

Collapsible Water Bottle Market Size and Share Forecast Outlook 2025 to 2035

Collapsible Fuel Tank Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Collapsible Wardrobe Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Collapsible Water Bottle Companies

Collapsible Jerry Can Market Growth - Size & Forecast 2024 to 2034

Collapsible Aluminium Tube Market

Collapsible Rigid Containers Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Collapsible Rigid Containers Providers

Collapsible Food Packaging Containers Market

Foldable And Collapsible Pallets Market Size and Share Forecast Outlook 2025 to 2035

Sleeve Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Sleeve Wrapping Machine Market

Cup Sleeves Market Growth - Demand, Trends & Forecast 2025 to 2035

Can Sleeves Market Growth & Packaging Innovations

Rigid Sleeve Boxes Market Size and Share Forecast Outlook 2025 to 2035

Paper Sleeve Market Trends – Growth & Demand Forecast 2024-2034

Shrink Sleeve Label Applicator Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Labeling Machine Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA