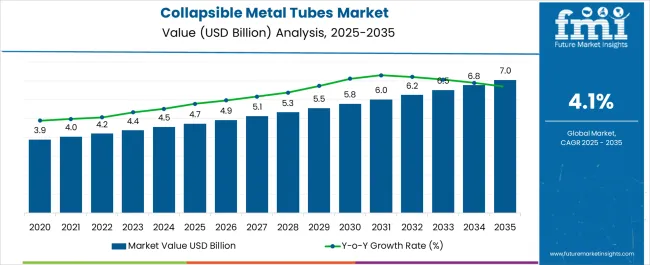

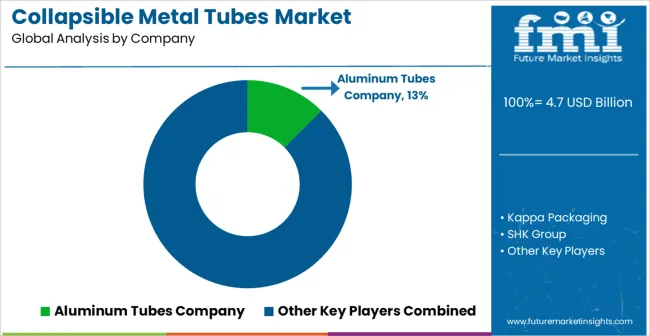

The Collapsible Metal Tubes Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 7.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Collapsible Metal Tubes Market Estimated Value in (2025 E) | USD 4.7 billion |

| Collapsible Metal Tubes Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The Collapsible Metal Tubes market is experiencing steady growth, driven by the increasing demand for packaging solutions that combine product protection, convenience, and sustainability. Rising consumer preference for portable and easy-to-use packaging in personal care, pharmaceuticals, and specialty chemicals is fueling adoption. Collapsible metal tubes provide durability, barrier protection against light, air, and moisture, and the ability to preserve product integrity over extended periods.

Growing awareness of environmentally friendly and recyclable packaging materials is further supporting market expansion, as these tubes are largely recyclable and reduce plastic usage. Technological advancements in tube manufacturing, including precision filling, high-quality sealing, and customized printing, are enhancing product appeal for brands seeking premium and differentiated packaging.

The increasing popularity of smaller volume formats and travel-size products is also shaping market demand As manufacturers focus on efficiency, product shelf life, and consumer convenience, the Collapsible Metal Tubes market is poised for sustained growth, driven by ongoing innovation, regulatory compliance, and rising global consumption in personal care and healthcare segments.

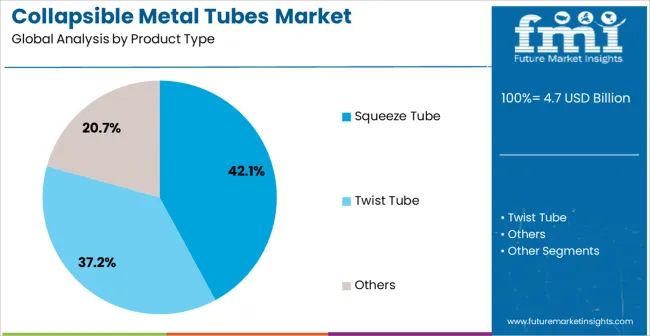

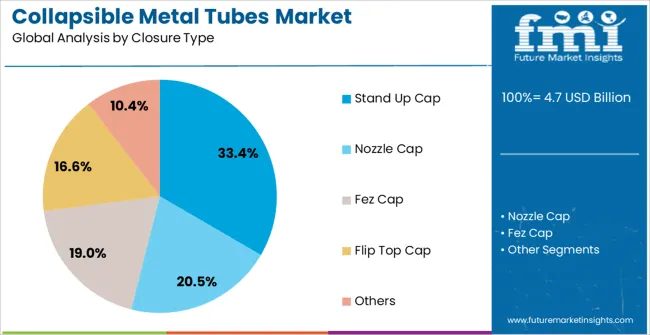

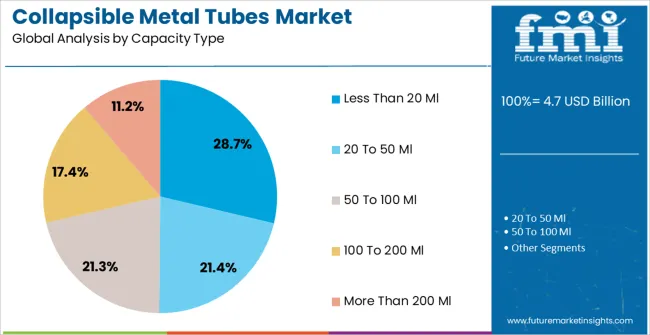

The collapsible metal tubes market is segmented by product type, closure type, capacity type, end use, and geographic regions. By product type, collapsible metal tubes market is divided into Squeeze Tube, Twist Tube, and Others. In terms of closure type, collapsible metal tubes market is classified into Stand Up Cap, Nozzle Cap, Fez Cap, Flip Top Cap, and Others. Based on capacity type, collapsible metal tubes market is segmented into Less Than 20 Ml, 20 To 50 Ml, 50 To 100 Ml, 100 To 200 Ml, and More Than 200 Ml. By end use, collapsible metal tubes market is segmented into Cosmetics, Home Care & Personal Care, Industrial, Pharmaceutical, Food, and Others. Regionally, the collapsible metal tubes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The squeeze tube product type segment is projected to hold 42.1% of the market revenue in 2025, establishing it as the leading product type. Its dominance is being driven by ease of use, precise product dispensing, and widespread adoption in personal care, pharmaceutical, and specialty chemical applications. Squeeze tubes provide convenience for consumers by allowing controlled application of viscous products while minimizing waste.

The lightweight and portable nature of these tubes enhances usability for travel and on-the-go consumption. Compatibility with a variety of closure types and capacities allows manufacturers to customize packaging according to product requirements. Additionally, technological improvements in tube materials, including multi-layer aluminum and composite constructions, have strengthened durability, barrier performance, and print quality.

These features have increased preference among brands seeking premium packaging options As demand for efficient, user-friendly, and sustainable packaging solutions rises, squeeze tubes are expected to maintain their leadership, supported by innovation and growing end-user adoption across diverse sectors.

The stand up cap closure type segment is anticipated to account for 33.4% of the market revenue in 2025, making it the leading closure type. Growth is being driven by its ability to provide stability, ease of storage, and consumer-friendly dispensing. Stand up caps allow tubes to remain upright, enhancing shelf visibility, convenience, and controlled product flow.

This closure type reduces spillage and improves hygiene, which is particularly critical for personal care and pharmaceutical products. Manufacturing advancements, including precision molding and high-quality sealing, have enhanced durability and functional reliability.

Brands increasingly prefer stand up caps for their premium appearance, convenience, and compatibility with various tube designs and sizes As consumer expectations for functionality, portability, and product aesthetics rise, the stand up cap segment is expected to maintain a strong position in the market, supported by continued innovation in closure design, material quality, and compatibility with emerging tube types.

The less than 20 ml capacity type segment is projected to hold 28.7% of the market revenue in 2025, making it the leading capacity category. Growth is being driven by rising demand for travel-size, sample, and single-use products across personal care, cosmetics, pharmaceuticals, and specialty chemicals. Smaller capacity tubes provide convenience for consumers, portability, and precise dosing, particularly for high-value or concentrated formulations.

They also reduce waste and improve product shelf life by minimizing exposure to air and contaminants. Manufacturers benefit from the ability to produce cost-effective small-volume packaging without compromising quality or barrier performance. Rising adoption of e-commerce, subscription-based product delivery, and on-the-go consumption patterns is further accelerating demand.

Technological advancements in filling, sealing, and printing for small-capacity tubes have enhanced usability and aesthetic appeal As consumer preference for compact, portable, and functional packaging grows, the less than 20 ml capacity segment is expected to continue leading the market, driven by convenience, efficiency, and sustainability considerations.

With rapid growth for tubes with lightweight and special properties such as anti-corrosive, easy molding, and so on, the demand for collapsible metal tubes is widening. Collapsible tubes are flexible composite containers being used for stashing and dispensing crumbly product formulations.

According to our analyses, because aluminum is less expensive to manufacture than alternative metals such as tin, aluminum collapsible metal tubes are more prominent. Also, the evolution of shifting from rigid metal packaging to flexible metal tubes seems to be more economically efficient for the transportation and waste disposal of collapsible metal tubes.

Increases or reductions in the cost of producing metal tubes have a decisive influence on the production of the global collapsible metal tubes industry.

FMI's research indicates collapsible metal tube market shows great potential for a wide range of reasons. One of the major factors driving the expansion of collapsible metal tubes is the emerging trend for cosmetic and personal care products, which is predicted to propel the market over the coming years.

According to our research results, organizations must also overcome a variety of obstacles. During the COVID-19 pandemic, this market was in decline. This is attributable to a drastic drop in the renovation, automotive, and industrial sectors.

The global collapsible metal tube market is expanding into North America, Latin America, Europe, Asia-Pacific (APAC), and the Middle East and Africa (MEA). Over the forecast period of 2025-2035, the global collapsible metal tube market is anticipated to expand slowly. Besides that, due to the growing consumption of personal care and beauty products, North America is predicted to be the biggest collapsible metal tube market.

Aside from that, the comprehensive evolution of the retail sector in evolving economies such as India and China is anticipated to increase sales of collapsible metal tubes in the Asia Pacific by the end of the forecast period of 2025-2035. Over the forthcoming years, Latin America, the Middle East, and Africa are likely to expand slowly.

Moreover, collapsible metal tube manufacturers in China and India are hoping to seize the majority of the revenue opportunities offered by the global tube market.

FMI recently completed a comprehensive analysis of key market players and their recent developments. Albea S.A., Essel Propack Ltd., Adelphi Healthcare Packaging, Linhardt GmbH & Co, Montebello Packaging, Alltub Group, Andpak Inc., Jiujiang Deshun Adhesive Industry Co., Ltd, Construct Packaging, Perfect Containers Pvt. Ltd, Hubei Xinji Pharmaceutical Packaging Co., Ltd, and others are among the major players identified globally in the collapsible metal tubes market.

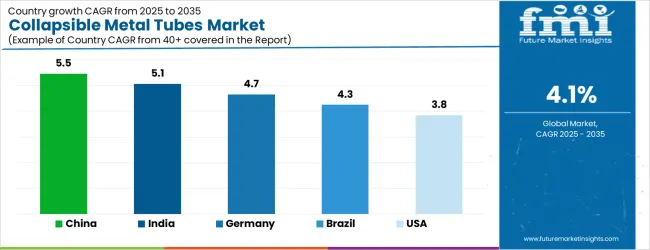

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| Brazil | 4.3% |

| USA | 3.8% |

| UK | 3.4% |

| Japan | 3.0% |

The Collapsible Metal Tubes Market is expected to register a CAGR of 4.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.5%, followed by India at 5.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.0%, yet still underscores a broadly positive trajectory for the global Collapsible Metal Tubes Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.7%. The USA Collapsible Metal Tubes Market is estimated to be valued at USD 1.7 billion in 2025 and is anticipated to reach a valuation of USD 1.7 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 245.5 million and USD 142.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Product Type | Squeeze Tube, Twist Tube, and Others |

| Closure Type | Stand Up Cap, Nozzle Cap, Fez Cap, Flip Top Cap, and Others |

| Capacity Type | Less Than 20 Ml, 20 To 50 Ml, 50 To 100 Ml, 100 To 200 Ml, and More Than 200 Ml |

| End Use | Cosmetics, Home Care & Personal Care, Industrial, Pharmaceutical, Food, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aluminum Tubes Company, Kappa Packaging, SHK Group, Somerset Aluminum Tube, TUBEX GmbH, Essentra Packaging, Mason Packaging, Allied Tube and Conduit Corporation, A W Chesterton Company, MettlerToledo International, BWAY Corporation, ArcelorMittal, Apex Tubes, Precision Tube, and Kraft Industries |

The global collapsible metal tubes market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the collapsible metal tubes market is projected to reach USD 7.0 billion by 2035.

The collapsible metal tubes market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in collapsible metal tubes market are squeeze tube, twist tube and others.

In terms of closure type, stand up cap segment to command 33.4% share in the collapsible metal tubes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metallurgical Lighting Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Collapsible Rigid Containers Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA