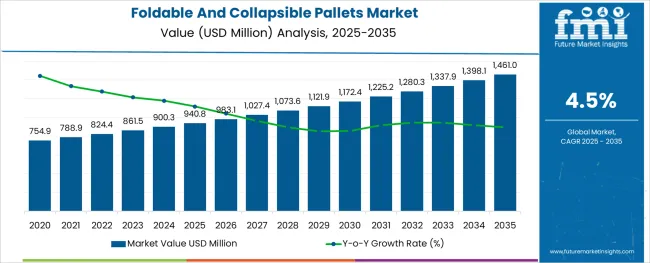

The Foldable And Collapsible Pallets Market is estimated to be valued at USD 940.8 million in 2025 and is projected to reach USD 1,461.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The foldable and collapsible pallets market is undergoing significant transformation as industries seek to optimize storage, reduce transportation costs, and meet sustainability objectives. Increasing demand for space-saving logistics solutions and the need to minimize return shipping volume are key drivers influencing adoption. Industries including automotive, pharmaceuticals, and food and beverage are integrating foldable pallet systems to enhance warehouse efficiency and improve supply chain agility.

Innovations in structural design and integration of RFID and IoT-enabled traceability are further enhancing their utility. Moreover, the global emphasis on reducing carbon footprints and improving material recyclability aligns well with the market’s value proposition.

Regulatory movements encouraging reusable transit packaging and the rising cost of wood are also shifting demand toward foldable alternatives. Looking ahead, the market is poised for steady growth, supported by strong interest in modular packaging formats that deliver on both performance and environmental goals.

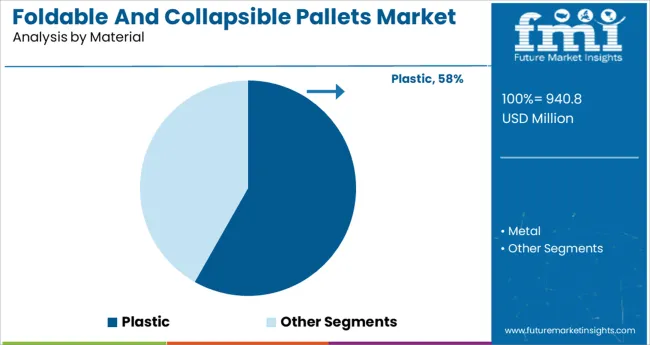

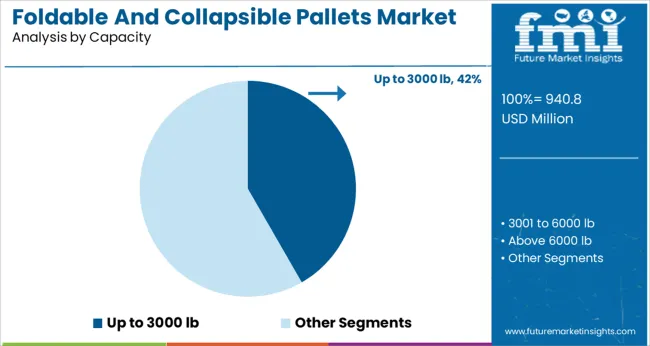

The market is segmented by Material, Capacity, and End Use and region. By Material, the market is divided into Plastic and Metal. In terms of Capacity, the market is classified into Up to 3000 lb, 3001 to 6000 lb, and Above 6000 lb. Based on End Use, the market is segmented into Food & Beverage, Pharmaceutical, Shipping & Logistics, Cosmetics & Personal Care, Building & Construction, and Other Consumer Goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment is projected to account for 58.20 percent of the total market revenue by 2025, positioning it as the leading material type. This dominance is attributed to its superior durability, resistance to moisture and chemicals, and overall longevity in repeated-use cycles. Plastic pallets offer consistent dimensional accuracy, which is critical in automated handling systems and closed-loop logistics environments.

Their lighter weight also supports improved fuel efficiency in transport compared to wooden or metal alternatives. Hygiene compliance in sectors like food processing and pharmaceuticals has further encouraged plastic pallet adoption due to easy sanitization and non-porous properties.

Moreover, plastic variants are increasingly being manufactured from recycled resins, aligning with corporate sustainability commitments. The combination of operational, environmental, and regulatory advantages has reinforced the leadership of plastic as the material of choice in foldable and collapsible pallet solutions.

The up to 3000 lb segment is expected to capture 41.70 percent of total revenue by 2025 within the capacity category, making it the most prominent subsegment. This capacity range effectively balances load-bearing performance with ease of handling and storage flexibility.

It is well-suited for a wide range of applications including mid-weight industrial goods, automotive parts, and FMCG distribution, where bulk shipments must be optimized without over-engineering the solution. The design versatility and structural reliability of pallets in this range contribute to reduced product damage and more efficient stacking.

Furthermore, their compatibility with standard racking and transport systems makes them highly scalable across supply chains. As companies look to streamline packaging without sacrificing safety or strength, the up to 3000 lb capacity segment has emerged as the preferred specification in the foldable and collapsible pallets market.

The global foldable and collapsible pallets market witnessed steady growth at a CAGR of 4.1% over the historic period of 2020 to 2024. The foldable and collapsible pallets market reached around USD 900.3 Million by the end of 2024.

The problem for shipment and heavy cost incurred in shipment can be a big problem in the packaging industry which is been solved by the foldable and collapsible market, space-saving easy transportation with less cost can be one of the big drivers for the market, nowadays every industry is forwarding to smart and innovative packaging, pallets that are foldable and collapsible are frequently used in the consumer goods sector to package and store goods. These pallets can be found in a variety of sizes and forms, making them perfect for a range of uses.

In the food and beverage business, foldable and collapsible pallets are frequently used to store, transport, and package a variety of food items according to consumer choice. Compared to conventional wooden or metal pallets, these pallets have a number of advantages, including being lighter in weight, simpler to clean, and more affordable.

Additionally, they are simple to fold and store away when not in use, saving valuable storage space. Farmers and agricultural businesses are investing in packaging options that enhance the handling, storage, and shipping of fresh fruit. Additionally, it is anticipated that demand in the bakery, dairy, beverage, meat, and other food processing industries would rise, driving the market during the projection period.

According to a recent global survey by Future Market Insights, manufacturers of foldable and collapsible pallets around the world prefer plastic because of its versatility, ease of availability, and affordability. The cost of raw materials incurred in the production of foldable and collapsible plastic pallets is cheaper than that of other materials like metal.

The use of plastic gives products flexibility and barrier protection, which need protection against external atmospheric effects. Between 2025 and 2035, it is predicted that sales of plastic foldable and collapsible pallets would increase by 1.6X globally. 35% of the pallet market is made up of rackable plastic pallets.

Shipping pallets are necessary to efficiently transfer huge amounts of merchandise between hubs in the shipping and logistics sector, which generates lucrative demand for the market for collapsible and foldable products. For handling and delivering products, pallets are safer. Foldable pallets offer considerable space and fuel savings, especially during return trips.

They collapse when not in use. Pallets can withstand changing temperatures. Foldable plastic pallets are 20–30 kg lighter than regular pallets, which lowers the overall weight-related transportation costs.

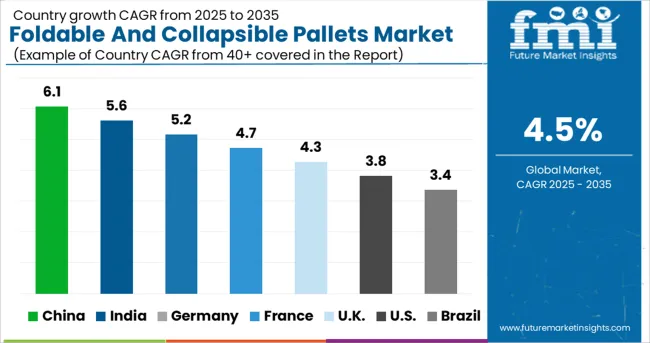

In the years to come, demand in the Indian market will also be boosted by advances in supply chain management and a rise in the use of technologically advanced packaging techniques. Due to the development of active tracking technology like RFID tagging and GPS, pallet tracking during transit has significantly increased in efficiency.

The Pallet demand in the pharmaceutical sector is predicted to increase, making the nation a desirable market in the approaching years. This is also a result of the increased incidence of lifestyle diseases like obesity and diabetes in the nation.

The usage of pallets in the pharmaceutical sector lowers the risk of product contamination. Pallets are a common tool used by makers of pharmaceuticals and dietary supplements to reduce contamination risk and product waste.

The increased popularity of foldable and collapsible pallets across the pharmaceutical industry has forced many players to use it as a cost-saving and protective packaging solution to gain a competitive edge over others.

Collapsible and foldable pallets are an appealing and sustainable solution for the customer and producer due to their excellent performance, long lifespan, and flexible configurations, which will help to meet the growing need for pharmaceutical packaging in the Europe region.

An key market factor boosting pallet usage in the Indian market is the country's substantial manufacturing sector growth. Due to government programmes like "Make in India" and the implementation of the GST tax structure in the upcoming years, the manufacturing sector in India is ready to take off and demonstrate a sustainable rise. Such reforms are probably going to have a good effect on India's manufacturing industry.

The expansion of the warehouse business is probably going to get a large boost thanks to the boost the manufacturing sector has received, and as a direct result, the pallets industry in India is probably going to grow greatly.

Pallet use in the Indian market is also projected to increase because to the rising demand for safe transportation of commodities and other materials. Over the course of the projection period, all of these factors are projected to support the market for pallets in India.

The expansion of the India pallets market, however, is anticipated to be constrained by the fall in global trade and the labour-intensive nature of the Indian economy. Additionally, the development of the India pallets market is probably going to be constrained by a lack of adequate warehousing infrastructure.

With the presence of various local and regional competitors in the market, the global foldable and collapsible pallets market is highly competitive. Key players are focusing on various different strategies to increase their revenue and market share in the global market such as capacity expansion, mergers & acquisitions, expansions, collaborations, and partnerships. Some of the recent developments in the market are as follows-

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, Volume in Units and CAGR from 2025-2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segment Covered | Material, Capacity, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa (MEA) |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Russia, China, Japan, India, GCC Countries, Australia |

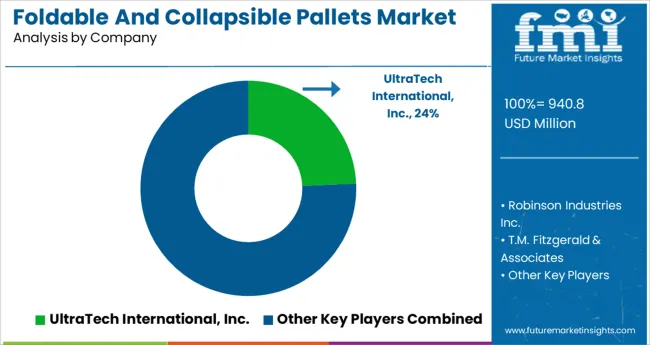

| Key Companies Profiled | UltraTech International, Inc.; Robinson Industries Inc.; T.M. Fitzgerald & Associates; Jonesco (Preston) Ltd; Qingdao Huading Imp. And Exp. Co., Ltd.; Tranpak, Wanzi; Ergen Plastic Industries; Schoeller Allibert; 1Logistics Zuralski; Swift Technoplast Private Limited; Time Technoplast Limited; CABKA Group; Olitec Packaging Solutions; Schoeller Allibert; Rowlinsons Packaging Ltd.; Palette L.C.N inc; GEOPALL L.L.C.; Orbis Corporation |

| Customization | Available Upon Request |

The global foldable and collapsible pallets market is estimated to be valued at USD 940.8 million in 2025.

It is projected to reach USD 1,461.0 million by 2035.

The market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types are plastic and metal.

up to 3000 lb segment is expected to dominate with a 41.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foldable/Compressible Beverage Carton Market Size and Share Forecast Outlook 2025 to 2035

Foldable Inflatable Boats Market Size and Share Forecast Outlook 2025 to 2035

Foldable Display Market Size and Share Forecast Outlook 2025 to 2035

Foldable Phone Market Analysis by Product Type, Display Technology, Sales Channel, End-User and Region from 2025 to 2035

Foldable Steel Containers Market Insights & Growth 2025 to 2035

Key Companies & Market Share in Foldable Mailer Box Sector

Examining Market Share Trends in Foldable Plastic Pallet Boxes

Foldable Mailer Box Market Analysis – Trends & Demand 2025 to 2035

Foldable Plastic Pallet Boxes Market Trends & Forecast through 2035

Foldable Container Market Trends & Forecast 2024-2034

Foldable Bottles Market

ESD Foldable Container Market Size and Share Forecast Outlook 2025 to 2035

Non-woven Foldable Container Market Analysis - Size, Share, and Forecast Outlook 2025-2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA