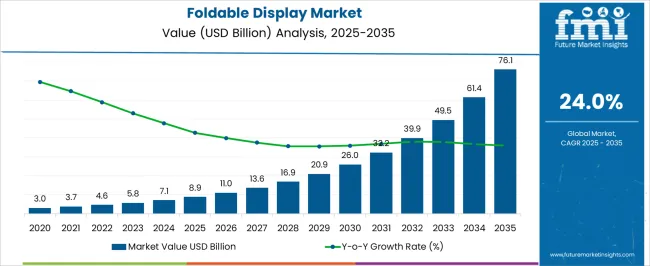

The foldable display market is forecasted to surge from USD 8.9 billion in 2025 to USD 76.1 billion by 2035, advancing at a CAGR of 24.0% over the decade. In 2025, the market value reaches USD 8.9 billion, a considerable jump from USD 7.1 billion in 2024. Growth continues in 2026 as the market rises to USD 11.0 billion, followed by USD 13.6 billion in 2027.

By 2035, the industry will achieve USD 76.1 billion, creating an absolute increase of USD 67.2 billion compared to 2025. This robust trajectory is reinforced through consistent YoY gains, as values progress from USD 20.9 billion in 2029 to USD 61.4 billion in 2034. Annual increases of USD 5–12 billion in the latter half of the forecast underscore momentum, with widespread integration of foldable formats into consumer electronics and enterprise solutions.

| Metric | Value |

|---|---|

| Foldable Display Market Estimated Value in (2025 E) | USD 8.9 billion |

| Foldable Display Market Forecast Value in (2035 F) | USD 76.1 billion |

| Forecast CAGR (2025 to 2035) | 24.0% |

The foldable display segment is a key part of the broader display technologies market, which includes OLED, LCD, and microLED panels. In 2025, foldable displays account for USD 8.9 billion, representing roughly 5–6% of the overall display market. By 2035, the segment is projected to reach USD 76.1 billion, increasing its share to approximately 10–11% as adoption accelerates across smartphones, tablets, and emerging consumer electronics. This sharp rise in market share demonstrates the growing influence of foldable displays within the parent market, highlighting their role in driving innovation, differentiation, and revenue expansion for display manufacturers.

The foldable display segment grows at a CAGR of 24.0% from 2025 to 2035, significantly outpacing the growth of the broader display technologies market. Its increasing contribution, from 5–6% to around 10–11%, underscores the rapid adoption and market penetration of foldable panels. This expanding share provides manufacturers, component suppliers, and investors with clear opportunities to capture high-margin revenue streams.

Innovations in flexible substrates, protective polymers, and thin-film encapsulation technologies are enabling high-performance displays that can be bent, rolled, or folded without compromising resolution or durability.

Strong investment from smartphone manufacturers, along with advancements in user interface design and materials science, is reshaping product development cycles. Consumer preference for large-screen experiences within pocket-sized form factors is fueling adoption. As durability improves and production costs decline, foldable displays are expected to transition from niche to mainstream across applications.

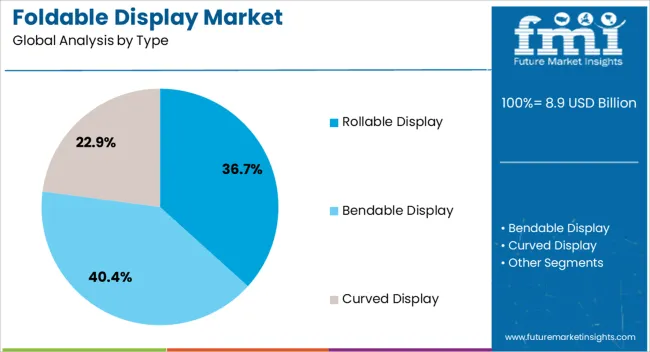

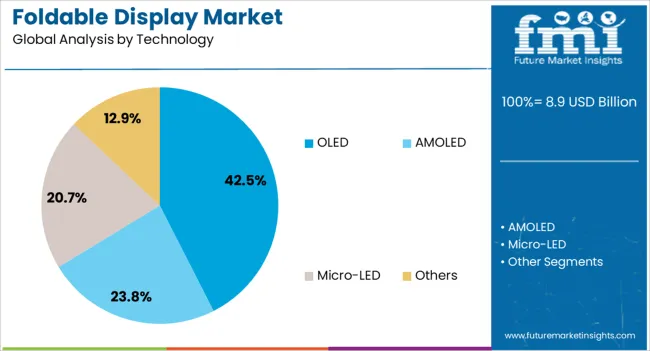

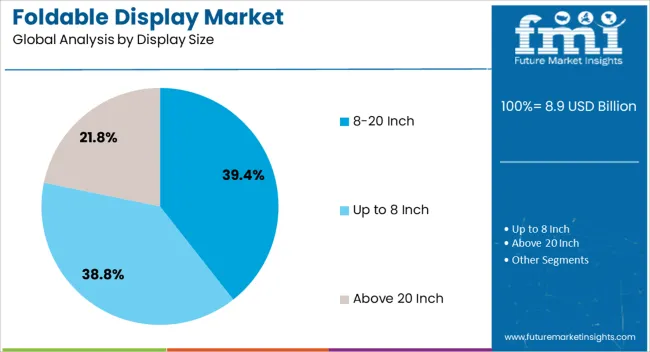

The foldable display market is segmented by type, technology, display size, application, end-use industry, and geographic regions. By type, foldable display market is divided into Rollable Display, Bendable Display, and Curved Display. In terms of technology, foldable display market is classified into OLED, AMOLED, Micro-LED, and Others. Based on display size, foldable display market is segmented into 8-20 Inch, Up to 8 Inch, and Above 20 Inch.

By application, the foldable display market is segmented into Smartphones, Laptops and Tablets, Televisions, Digital Signage, Automotive Display, and Others. By end-use industry, the foldable display market is segmented into Consumer Electronics, Automotive, Healthcare, Industrial, Aerospace & Defense, Retail, Media & Entertainment, and Others. Regionally, the foldable display industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Rollable displays are projected to lead the market by type, capturing 36.70% of the market share in 2025. This dominance is driven by their unique ability to extend or retract based on user interaction, offering superior portability and screen real estate management.

Rollable displays address key limitations of conventional foldable formats, including crease visibility and mechanical fatigue. Tech giants are investing heavily in this form factor for next-gen smartphones, laptops, and televisions.

The lightweight and compact nature of rollable designs also aligns with consumer preferences for adaptable, futuristic devices. With ongoing R&D around flexible OLED and polymer technologies, rollable displays are positioned for strong commercial traction.

OLED technology is expected to account for 42.50% of the market by 2025, making it the leading technology in foldable displays. OLED’s self-emissive nature allows for ultra-thin, lightweight, and highly flexible screen construction, which is crucial for devices that require bending or folding.

Its superior contrast ratios, color vibrancy, and lower power consumption give it a significant advantage over traditional LCDs. The absence of backlighting and use of organic layers also facilitates seamless integration into curved and foldable surfaces.

As OLED production scales and costs fall, its role as the foundation for flexible display innovation will continue to expand across industries.

Displays in the 8–20 inch range are anticipated to dominate the market by display size, contributing 39.40% of the share in 2025. This size category serves as a sweet spot for hybrid devices like foldable tablets, large-screen smartphones, and flexible monitors.

It offers the ideal balance between portability and user experience, enabling immersive multimedia consumption, multitasking, and productivity. The segment’s strength is also linked to enterprise use cases, such as field operations and design workflows, where larger foldable screens offer enhanced functionality without the bulk.

As consumer and business users increasingly seek adaptable hardware, this display size range will likely remain the preferred form factor.

Foldable displays, leveraging OLED and flexible substrate technologies, enable smartphones, tablets, and laptops to combine large screen sizes with compact designs. Demand is driven by premium device adoption, user preference for multitasking capabilities, and the desire for advanced form factors in entertainment and productivity applications.

Manufacturers are competing on durability, seamless folding mechanisms, and energy-efficient displays. Partnerships with material suppliers and component manufacturers are accelerating commercialization. As foldable displays gain mainstream acceptance, companies that can balance affordability, reliability, and cutting-edge performance will secure strong growth opportunities in both consumer electronics and professional device markets.

The foldable display market faces challenges in durability, production yield, and cost management. Repeated folding stresses display layers, adhesives, and protective coatings, raising concerns about longevity and reliability. Achieving consistent manufacturing yield for flexible OLED and plastic substrates is complex and costly, leading to higher product prices compared to conventional displays. The supply chain for advanced cover glass, ultra-thin substrates, and hinge systems is still maturing, creating bottlenecks. Consumers remain cautious due to limited durability data and premium price points, slowing mass adoption. Overcoming these issues requires advancements in protective materials, more efficient fabrication techniques, and scale-driven cost reductions. Until these challenges are addressed, foldable displays may remain concentrated in the premium device segment rather than achieving widespread affordability.

The foldable display market is trending toward flexible OLED adoption, hybrid form factors, and advanced material innovations. Flexible OLED panels offer thinner profiles, energy efficiency, and superior image quality, making them the standard for foldable devices. Hybrid form factors such as rollable and slide-out screens are emerging, providing new consumer experiences and design possibilities. Material innovations, including ultra-thin flexible glass, improved hinge technology, and self-healing protective coatings, are addressing durability challenges. Integration of 5G connectivity, AI-driven features, and multitasking interfaces further enhances the appeal of foldable devices. These trends highlight the industry’s focus on delivering innovative, high-performance displays while pushing the boundaries of design and usability in consumer electronics.

Foldable displays present significant opportunities in consumer electronics, enterprise use, and next-generation wearables. Smartphones and tablets remain the largest market, but laptops and dual-screen devices are gaining traction as productivity tools. Enterprise adoption is increasing as businesses look for devices that combine portability with large-screen efficiency for remote work, design, and content creation. Wearables, including foldable smartwatches and fitness devices, represent a growing niche with strong potential for innovation. Expansion into automotive infotainment systems, retail signage, and gaming further broadens market applications. Companies that innovate across multiple use cases and deliver affordable solutions stand to capture long-term value in the evolving foldable display landscape.

Supply chain limitations, lack of standardization, and cautious consumer perception restrain market growth. Production of foldable displays requires specialized materials, such as flexible glass and advanced hinges, which are concentrated among a few suppliers. This creates dependency and supply risks. Industry-wide standards for durability testing, fold cycles, and user safety are still evolving, leading to uncertainty. High product prices and skepticism about longevity reduce consumer willingness to adopt foldable devices widely. Repair and replacement costs also present barriers to ownership. Until supply chains mature, standardized testing protocols emerge, and pricing declines, foldable displays will primarily appeal to early adopters and premium buyers rather than the broader mass market.

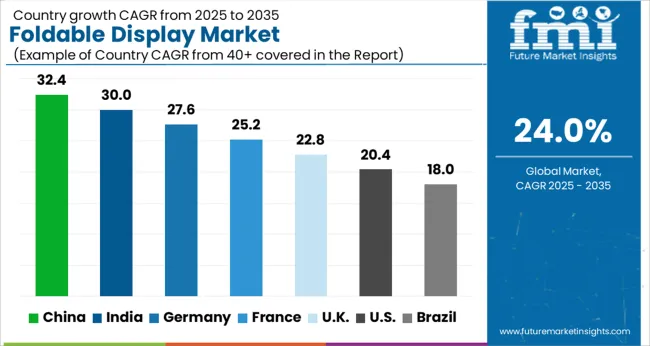

| Country | CAGR |

|---|---|

| China | 32.4% |

| India | 30.0% |

| Germany | 27.6% |

| France | 25.2% |

| UK | 22.8% |

| USA | 20.4% |

| Brazil | 18.0% |

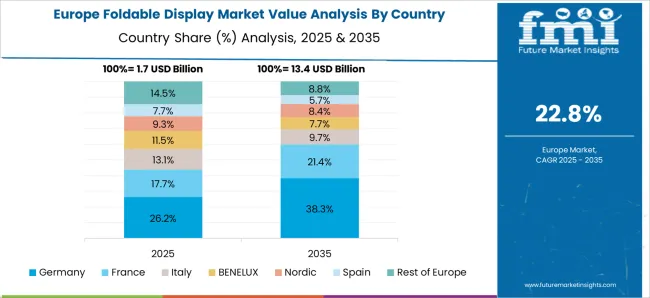

The global foldable display market is projected to grow at a CAGR of 24.0% through 2035, supported by increasing demand across consumer electronics, smartphones, and wearable devices. Among BRICS nations, China has been recorded with 32.4% growth, driven by large-scale production and deployment in smartphones and high-end consumer gadgets, while India has been observed at 30.0%, supported by rising adoption in premium mobile devices and flexible electronic applications. In the OECD region, Germany has been measured at 27.6%, where production and utilization in industrial displays, automotive, and consumer electronics have been steadily expanded. The United Kingdom has been noted at 22.8%, reflecting growing use in high-end electronic devices and niche industrial applications, while the USA has been recorded at 20.4%, with production and utilization across consumer electronics, wearable devices, and flexible display research being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is rapidly leading the global foldable display market, achieving a CAGR of 32.4% due to strong domestic smartphone manufacturing, consumer demand for innovative devices, and robust R&D investment. Manufacturers are focusing on high-resolution, flexible OLED and AMOLED panels for smartphones, tablets, and wearable devices. Government support for advanced electronics production, smart device innovation, and technology incubation is accelerating market growth. Pilot launches in major smartphone brands demonstrate operational benefits such as enhanced device portability, user engagement, and premium product differentiation. Collaborations between panel suppliers, electronics OEMs, and research institutes are enhancing material durability, hinge mechanisms, and foldable screen performance. Rising consumer interest in multi-functional and compact devices continues to fuel China’s foldable display market.

Foldable display market in India is growing at a CAGR of 30.0%, driven by rising smartphone penetration, tech-savvy consumers, and increasing demand for premium devices. Manufacturers are investing in flexible OLED panels and foldable display technologies for mid-range and high-end smartphones. Government initiatives promoting domestic electronics manufacturing, technology R&D, and smart device adoption are strengthening market expansion. Pilot product launches in urban centers demonstrate operational benefits such as improved portability, multitasking capabilities, and enhanced consumer experience. Collaborations between international display technology providers and domestic smartphone brands are improving panel longevity, hinge durability, and device integration. With expanding online retail and mobile device adoption, India’s foldable display market is poised for rapid growth.

Germany’s foldable display market is recording a CAGR of 27.6%, supported by advanced consumer electronics adoption, premium smartphone demand, and industrial innovation in display technology. Manufacturers are focusing on flexible OLED panels for smartphones, tablets, and laptops. Government programs promoting high-tech electronics, R&D funding, and sustainable manufacturing practices are encouraging market adoption. Pilot deployments in premium consumer devices highlight benefits such as portability, multitasking efficiency, and enhanced user experience. Collaborations between display suppliers, device manufacturers, and research institutes are advancing foldable screen durability, energy efficiency, and hinge design. Germany’s emphasis on high-quality, innovative electronics continues to fuel growth in foldable display adoption.

The United Kingdom is experiencing a CAGR of 22.8% in its foldable display market, driven by growing consumer preference for compact, multitasking devices and rising adoption of high-end smartphones and tablets. Manufacturers are investing in flexible OLED and AMOLED displays with robust hinges and high durability. Government initiatives promoting electronics innovation, R&D, and technology incubation support market growth. Pilot launches of foldable smartphones and tablets highlight operational benefits including portability, improved multitasking, and enhanced user interaction. Partnerships between device manufacturers, international display technology providers, and R&D institutes are advancing panel longevity, hinge design, and device integration. Rising demand for premium, innovative consumer devices continues to drive adoption in the UK.

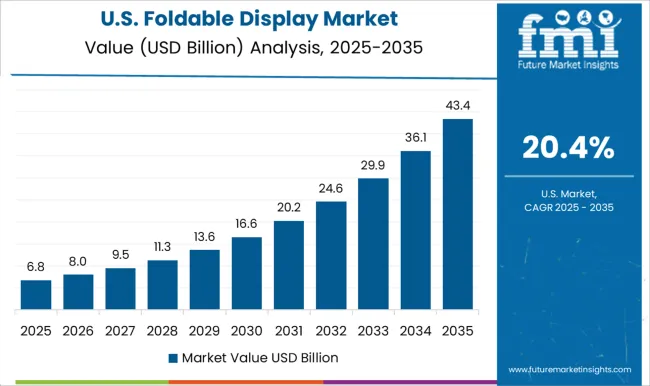

The United States foldable display market is growing at a CAGR of 20.4%, fueled by increasing consumer demand for compact, high-performance devices and adoption of next-generation smartphones and tablets. Manufacturers are focusing on flexible OLED panels with advanced hinge mechanisms and durability enhancements. Government programs promoting electronics R&D, innovation incentives, and advanced manufacturing technologies are supporting adoption. Pilot product launches demonstrate operational benefits such as portability, multitasking efficiency, and premium user experience. Collaborations between device manufacturers, display suppliers, and research institutes are improving material performance, hinge design, and integration of foldable screens into consumer electronics. Rising consumer awareness and premium device adoption are expected to sustain strong growth in the USA foldable display market.

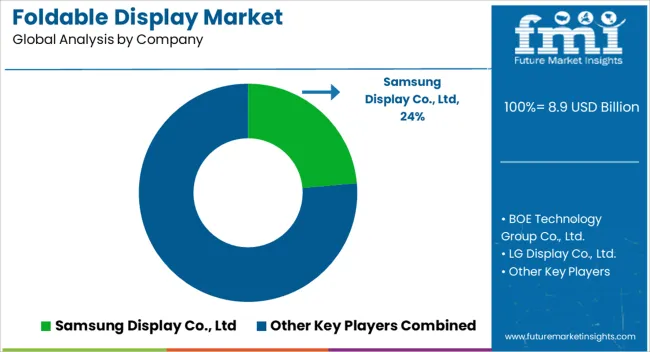

Samsung Display Co., Ltd is positioned as a market leader, with brochures emphasizing ultra-thin glass layers, hinge reliability, and high-resolution AMOLED panels suitable for smartphones and tablets. BOE Technology Group Co., Ltd competes with OLED and flexible panel solutions, with technical literature highlighting color accuracy, bend radius specifications, and energy efficiency metrics. LG Display Co., Ltd offers foldable panels with wide viewing angles and adaptive touch sensitivity, with brochures detailing substrate materials, stress testing results, and display lifetime. AUO Corporation and Innolux Corporation provide mid- to large-format foldable displays, with brochures presenting folding durability cycles, brightness levels, and response times. Visionox Technology, Inc. emphasizes smartphone-grade panels with flexible encapsulation, while TCL China Star Optoelectronics Technology Co., Ltd highlights both consumer and automotive applications, with literature detailing bending angles, contrast ratios, and substrate options.

Other emerging suppliers compete by offering lower-cost panels, rapid prototyping capabilities, and specialized customizations for niche devices. Development strategies are focused on mechanical resilience, panel uniformity, and integration with device electronics. Investments are directed toward substrate materials, hinge engineering, and protective coatings to reduce stress during folding. Partnerships with OEMs and device assemblers are leveraged to ensure compatibility, reduce integration complexity, and accelerate adoption. Observed industry patterns suggest emphasis on minimizing crease formation, improving touch sensitivity at fold regions, and optimizing layer adhesion. Product roadmaps frequently include expansion of display sizes, enhancement of color gamut, and reduction of optical distortion under repeated folding cycles. Differentiation is achieved through the combination of visual performance, tactile response, and structural durability across consumer and industrial use cases. Brochures and datasheets are used to communicate technical specifications, durability testing results, and integration guidelines.

Samsung Display literature emphasizes fold radius, display thickness, and pixel density. BOE and LG brochures highlight lifetime cycles, mechanical stress testing, and substrate composition. AUO, Innolux, and Visionox materials provide bending tolerances, luminance metrics, and touch responsiveness data. TCL China Star documentation details fold mechanics, color stability, and material layers. Clear tables, diagrams, and cross-sectional schematics are used consistently to allow engineers and procurement teams to evaluate suitability quickly. Market success is determined not only by display performance but also by the clarity and completeness of brochures, making technical literature essential for adoption and competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 Billion |

| Type | Rollable Display, Bendable Display, and Curved Display |

| Technology | OLED, AMOLED, Micro-LED, and Others |

| Display Size | 8-20 Inch, Up to 8 Inch, and Above 20 Inch |

| Application | Smartphones, Laptops and Tablets, Televisions, Digital Signage, Automotive Display, and Others |

| End-use Industry | Consumer Electronics, Automotive, Healthcare, Industrial, Aerospace & Defense, Retail, Media & Entertainment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung Display Co., Ltd, BOE Technology Group Co., Ltd., LG Display Co., Ltd., AUO Corporation, Innolux Corporation, Visionox Technology, Inc., and TCL China Star Optoelectronics Technology Co., Ltd. |

| Additional Attributes | Dollar sales vary by display type, including OLED, AMOLED, and flexible LCD; by application, such as smartphones, tablets, laptops, and wearables; by end-use industry, spanning consumer electronics, automotive, and retail; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by demand for innovative consumer devices, advancements in flexible materials, and increasing adoption of premium electronics. |

The global foldable display market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the foldable display market is projected to reach USD 76.1 billion by 2035.

The foldable display market is expected to grow at a 24.0% CAGR between 2025 and 2035.

The key product types in foldable display market are rollable display, bendable display and curved display.

In terms of technology, OLED segment is expected to command 42.5% share in the foldable display market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foldable/Compressible Beverage Carton Market Size and Share Forecast Outlook 2025 to 2035

Foldable Inflatable Boats Market Size and Share Forecast Outlook 2025 to 2035

Foldable And Collapsible Pallets Market Size and Share Forecast Outlook 2025 to 2035

Foldable Phone Market Analysis by Product Type, Display Technology, Sales Channel, End-User and Region from 2025 to 2035

Foldable Steel Containers Market Insights & Growth 2025 to 2035

Key Companies & Market Share in Foldable Mailer Box Sector

Examining Market Share Trends in Foldable Plastic Pallet Boxes

Foldable Mailer Box Market Analysis – Trends & Demand 2025 to 2035

Foldable Plastic Pallet Boxes Market Trends & Forecast through 2035

Foldable Container Market Trends & Forecast 2024-2034

Foldable Bottles Market

ESD Foldable Container Market Size and Share Forecast Outlook 2025 to 2035

Non-woven Foldable Container Market Analysis - Size, Share, and Forecast Outlook 2025-2035

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Display Drivers Market Growth – Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA