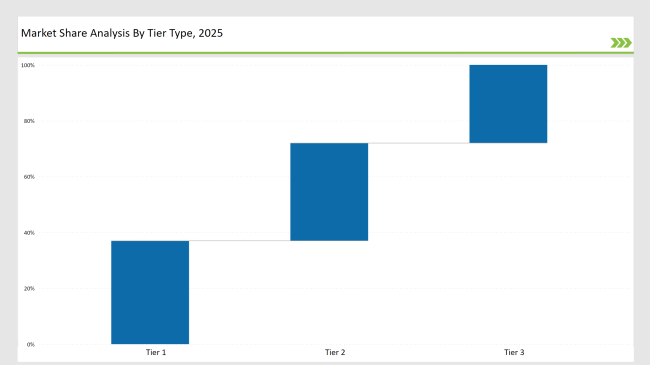

The global foldable mailer box market remains highly competitive, with companies strategically positioned across Tier 1, Tier 2, and Tier 3 based on market influence and execution strategies. Leading companies, International Paper, Smurfit Kappa, and WestRock, collectively hold over 37% of the market, leveraging economies of scale, automation, and sustainability-driven innovations to maintain dominance.

Tier 2 players, including Mondi, DS Smith, and Packaging Corporation of America, account for 35% of the market. These companies differentiate themselves by offering cost-effective, highly customizable, and sustainable foldable mailer box solutions tailored to mid-sized enterprises seeking reliable e-commerce and retail packaging options.

Tier 3 players, consisting of regional manufacturers, private labels, and emerging startups, contribute 28% of the market share. These companies focus on agility and innovation, producing eco-friendly, reusable, and high-performance foldable mailer boxes to address niche consumer demands and market gaps with specialized offerings.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (International Paper, Smurfit Kappa, WestRock) | 28% |

| Rest of Top 5 (Mondi, DS Smith) | 10% |

| Next 5 of Top 10 (Packaging Corporation of America, Pratt Industries, Uline, Packlane, Vistaprint) | 9% |

The Foldable Mailer Box Market serves multiple industries, including

Companies provide a variety of solutions tailored to industry needs

These industry giants helped to drive the **Foldable Mailer Box Market** in the course of the year with sustainable solution launch, technological investments, and extended market penetration. International Paper, Smurfit Kappa, WestRock, Mondi, and DS Smith played an important role with innovations in recyclable materials, AI-driven manufacturing, and efficiency improvement in their operations. Industry trend towards automation and green packaging contributed to more powerful global supply chains and furthering the practice of sustainability standards.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | International Paper, Smurfit Kappa, WestRock |

| Tier 2 | Mondi, DS Smith, Packaging Corporation of America |

| Tier 3 | Pratt Industries, Uline, Packlane, Vistaprint |

| Manufacturer | Latest Developments |

|---|---|

| International Paper | Launched recycled-content foldable mailer boxes (March 2024). |

| Smurfit Kappa | Introduced lightweight, durable mailer boxes for e-commerce (April 2024). |

| WestRock | Invested in AI-driven automation to improve manufacturing efficiency (May 2024). |

| Mondi | Expanded 100% recyclable packaging solutions (July 2024). |

| DS Smith | Developed temperature-controlled mailer boxes for sensitive goods (August 2024). |

| Packaging Corporation of America | Launched moisture-resistant mailer boxes for food shipments (September 2024). |

| Pratt Industries | Enhanced custom-printing capabilities for branding-focused businesses (October 2024). |

| Uline | Introduced bulk-order eco-friendly mailer box solutions (November 2024). |

The Foldable Mailer Box Market is moving towards eco-friendly materials, smart packaging solutions, and AI-enhanced automation. Innovations such as recyclable plastics, RFID-enabled packaging, and AI-powered manufacturing will redefine the industry. Companies will need to balance sustainability with cost efficiency to remain competitive.

Major manufacturers include International Paper, Smurfit Kappa, WestRock, Mondi, DS Smith, and Packaging Corporation of America.

The top 10 players hold approximately 37% of the global market, with Tier 1 companies leading with over 50%.

Market concentration remains medium, with top players holding 30% to 60% of total market share.

Tier-3 companies hold 28% of the market, focusing on niche, eco-friendly, and regional solutions

AI-driven automation, digital printing technology, and biodegradable packaging solutions are key innovation drivers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foldable/Compressible Beverage Carton Market Size and Share Forecast Outlook 2025 to 2035

Foldable Inflatable Boats Market Size and Share Forecast Outlook 2025 to 2035

Foldable Display Market Size and Share Forecast Outlook 2025 to 2035

Foldable And Collapsible Pallets Market Size and Share Forecast Outlook 2025 to 2035

Foldable Phone Market Analysis by Product Type, Display Technology, Sales Channel, End-User and Region from 2025 to 2035

Foldable Steel Containers Market Insights & Growth 2025 to 2035

Foldable Container Market Trends & Forecast 2024-2034

Foldable Bottles Market

Foldable Plastic Pallet Boxes Market Trends & Forecast through 2035

Examining Market Share Trends in Foldable Plastic Pallet Boxes

Foldable Mailer Box Market Analysis – Trends & Demand 2025 to 2035

ESD Foldable Container Market Size and Share Forecast Outlook 2025 to 2035

Non-woven Foldable Container Market Analysis - Size, Share, and Forecast Outlook 2025-2035

Mailer Packaging Market Analysis by Material and Application Through 2035

Mailers Market Trends - Growth & Forecast 2024 to 2034

Mailer Boxes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lab Mailers Market Size and Share Forecast Outlook 2025 to 2035

Padded Mailers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Padded Mailers Providers

Polybag Mailers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA