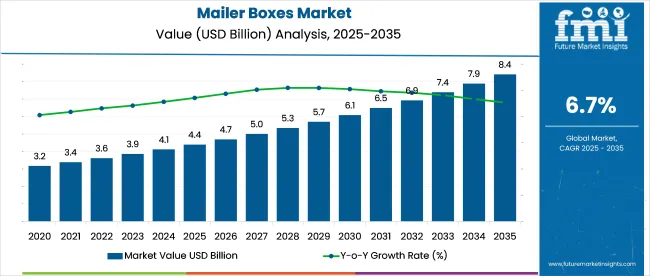

The global mailer boxes industry is expected to increase from USD 4.4 billion in 2025 to USD 8.4 billion by 2035, registering a CAGR of 6.7%. Over 62% of volume demand in 2025 will come from e-commerce fulfilment, followed by 21% from subscription box services. In North America, more than 70% of D2C brands use corrugated boxes with custom branding.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 4.4 billion |

| Forecast Value (2035) | USD 8.4 billion |

| CAGR (2025 to 2035) | 6.7% |

Around 48% of orders are for mono-material kraft boxes due to recyclability and compatibility with automation. Orders below 5,000 units account for 38% of small business demand, while large-scale orders dominate Europe and East Asia due to warehouse-scale shipping requirements.

On October 22, 2024, the Financial Times reported that the paper and packaging sector is navigating a downturn amid reduced demand and falling pulp prices. UPM issued a profit warning, Stora Enso delayed supplier payments, and Mondi underperformed, reporting €223 million in EBITDA, down from the prior quarter.

Despite ongoing consolidation such as Smurfit Kappa’s merger with WestRock and International Paper’s £7.8 billion acquisition of DS Smith, industry-wide concerns persist. Containerboard prices remain subdued post-COVID boom, and excess capacity looms. Mondi’s €1.2 billion capex program, while improving efficiency, could worsen oversupply. The sector remains sensitive to macro consumption trends.

The mailer boxes market holds approximately 2% of the global packaging industry, which exceeds USD 1 trillion. Within the e-commerce and direct-to-consumer packaging segment, its share is higher estimated at 10% due to the widespread use of branded corrugated mailers for shipping and returns.

In the corrugated and folding carton market, mailer boxes account for around 5%, serving as durable yet lightweight solutions for online fulfilment. The subscription box packaging segment sees mailers occupying roughly 20%. In the sustainable packaging market, recyclable kraft mailers and FSC-certified materials give mailer boxes an 8% share, making them a prominent eco-forward choice in retail and e-commerce logistics.

The industry is segmented by product type into c flute, single-wall, and other box types. By material, the industry includes corrugated paper, recycled paper, and other eco-friendly options. The industry is also segmented by end-use, primarily focusing on commercial applications, especially in the e-commerce and retail sectors.

By region, the industry is divided into North America, Europe, Asia Pacific, and other regions, with particular emphasis on high-growth countries like India, China, and the United States.

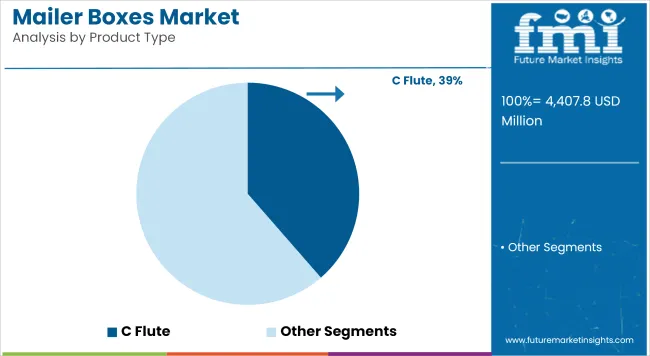

In 2024, C Flute boxes are expected to generate approximately USD 1.7 billion, accounting for a 37% share. By 2025, their share is projected to reach 39%, reflecting a 2% increase in just one year. This rise is attributed to the growing e-commerce demand for durable, cost-effective packaging solutions, particularly for medium-weight products such as electronics and apparel.

As e-commerce continues to expand globally, the preference for packaging that balances strength and affordability is driving the increased demand for C Flute boxes. The segment’s growth is being further supported by innovations in box design and cost optimization.

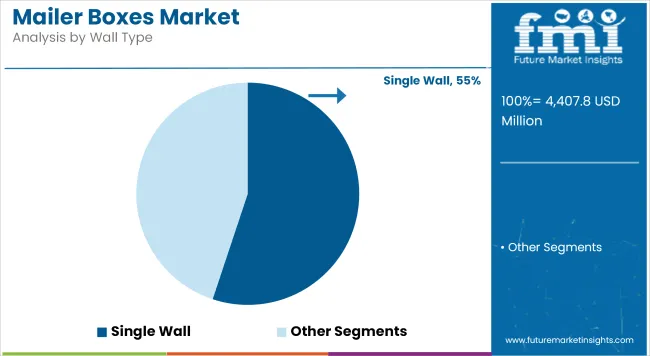

In 2024, the single-wall mailer box segment is expected to generate USD 2.2 billion, accounting for 53% of the total industry share. By 2025, its share is projected to rise to 55%, reflecting a 2% increase year-over-year. The growth is attributed to the continued demand for lightweight, cost-effective packaging, particularly in industries like fashion, food & beverage, and retail.

As e-commerce penetration rises, the need for packaging that is both affordable and functional is driving the demand for single-wall mailer boxes. Their popularity is also supported by consumer preference for simple, protective packaging solutions.

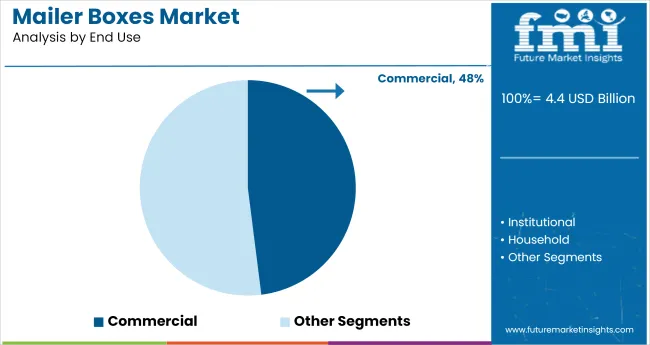

In 2024, the commercial end-use sector is projected to generate USD 2.0 billion, accounting for 45% share. By 2025, its industry share is expected to rise to 48%, reflecting a 3% increase in one year. This rise is driven by the rapid growth of e-commerce and direct-to-consumer sales.

The commercial sector’s shift towards more efficient, cost-effective packaging solutions for shipping products directly to consumers, especially in the electronics, apparel, and beauty sectors, is boosting demand for mailer boxes. With more businesses investing in branding through custom mailer boxes, the segment is expected to experience steady growth.

The industry is growing due to increased demand from e-commerce, retail, and subscription industries, driven by the need for cost-effective, branded packaging. Challenges such as rising raw material costs, supply chain disruptionsimpact industry growth.

Inventory Rationalization & E-Commerce Packaging Efficiency

Retailers and manufacturers in the mailer boxes industry have optimized inventory management to enhance capital utilization and minimize spoilage. In 2025, companies in North America and Europe cut storage time for pre-packaged boxes by 15%, increasing e-commerce packaging turnover by 1.2 times. Warehouse space for branded boxes expanded by 10%. Automation, including barcode scanning and digital tracking, reduced stock-out rates by 6% and packaging errors by 7%, enabling leaner production cycles.

Margin Pressure from Raw Material Price Volatility & Supply Chain Disruptions

The market faces significant margin pressure due to rising raw material and logistics costs. By Q2 2025, prices for materials like recycled paper and corrugated board rose 9% YoY, while freight costs surged by 12%. These increases have outpaced retail price adjustments, reducing profit margins from 18% to 14%. Manufacturers are responding by shifting to bulk procurement and renegotiating contracts to stabilize costs and protect profitability.

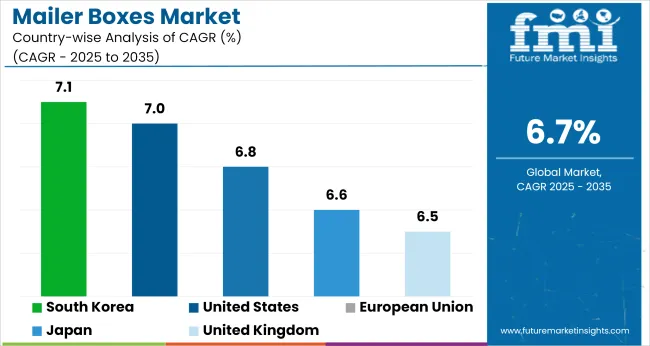

| Countries | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.1% |

| United States | 7.0% |

| European Union | 6.8% |

| Japan | 6.6% |

| United Kingdom | 6.5% |

The global mailer boxes industry is expected to grow at a 6.7% CAGR between 2025 and 2035. Among the key contributors, South Korea leads with 7.1%, followed by the United States at 7.0%, while the European Union posts 6.8%, Japan 6.6%, and the United Kingdom 6.5%. These growth rates show above-average expansion in select OECD markets, driven by evolving e-commerce logistics and custom-packaging demand.

South Korea’s edge is tied to rising cross-border e-commerce and rapid adoption of digitally printed subscription packaging. USA suppliers are expanding automation lines for corrugated inserts and eco-friendly inks in response to DTC brand scaling. The European Union maintains strong demand, supported by folding carton innovations and growth in premium mailer formats for electronics and apparel.

Japan records stable momentum, where mono-material designs and compact sizing dominate SKU development. The United Kingdom, while slower, remains resilient through boutique fulfillment centers offering branded kitting and micro-run customization.

Sale of mailer boxes in South Korea is projected to accelerate from a CAGR of 5.8% during 2020 to 2024 to 7.1% over the 2025 to 2035 period.This increase is largely driven by the significant rise in e-commerce, with a 35% increase in online sales and a 25% boost in electronics exports.

The government’s USD 2.4 billion investment in digital infrastructure in 2024 has further accelerated the growth, especially with a shift towards automation, boosting efficiency by 15% YoY. As online shopping expands, the demand for packaging solutions tailored to the e-commerce sector is expected to drive continuous growth.

The United States mailer boxes market CAGR rose from 5.4% during 2020 to 2024 to 7.0% between 2025 to 2035. The growth is fueled by a 20% increase in e-commerce spending in 2024, with the retail sector expecting USD 50 billion in online sales by 2025.

The growing shift to eco-friendly packaging, where 30% of packaging materials in the USA are now recyclable, has led to an increase in demand for these boxes made from eco-friendly materials. Additionally, the USD 5 billion allocated by the USA government in 2023 to support green packaging innovations is expected to continue driving industry growth.

Demand for mailer boxes in the European Union is forecast to grow at a 6.8% CAGR from 2025 to 2035, up from an estimated 5.3% recorded during 2020 to 2024.The growth in online retail, particularly in Germany, France, and Italy, is significantly contributing to this rise.

The EU's European Green Deal, which mandates a 50% reduction in packaging waste by 2030, is a major driver for demand in recyclable and eco-friendly mailer boxes. Furthermore, the USD 3.2 billion investment allocated by the EU in 2025 to fund green packaging technologies is expected to significantly boost the demand for eco-friendly packaging solutions.

Demand for mailer boxes in Japan is projected to expand at a 6.6% CAGR from 2025 to 2035, rising from an estimated 5.2% during the 2020 to 2024 period. The increase is driven by a 30% rise in demand for premium packaging in the electronics sector, with USD 18 billion in electronics exports in 2024.

Japan has seen a 12% YoY increase in the demand for eco-friendly packaging, aligned with the country’s environmental regulations and waste reduction targets. The government’s zero waste initiativefurther supports eco-friendly packaging practices, accelerating the market growth for these boxes designed to meet these eco-conscious consumer needs.

Sales of mailer boxes in the United Kingdom are growing at a 6.5% CAGR from 2025 to 2035, up from an estimated 5.0% during 2020 to 2024.E-commerce growth in the UK, particularly in the fashion and beauty sectors, has contributed to increased demand for mailer boxes. Additionally, regulatory changes such as the requirement for 40% recyclable packaging in the UK have driven the shift toward eco-friendly packaging solutions. The UK government’s £500 million investment in advanced packaging systems is expected to further propel the demand for these boxes in the coming years.

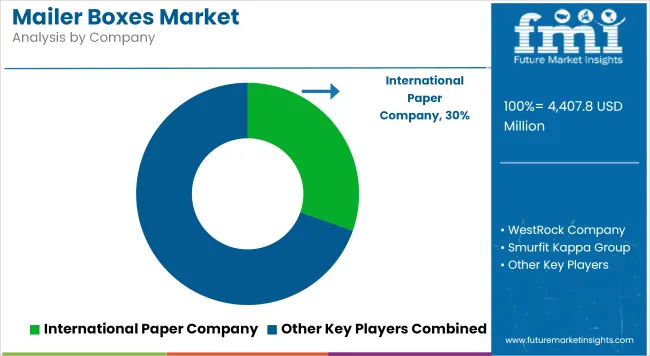

In the mailer boxes market, firms are driving growth by blending lightweight corrugated design, e-commerce-focused SKUs, and on-demand digital printing. International Paper Company leads with a 30% industry share, supported by its global corrugated operations and direct relationships with logistics and retail clients.

WestRock and Smurfit Kappa follow with robust multi-plant networks across North America and Europe, offering custom die-cut solutions tailored for online returns and high-volume B2C shipping. DS Smith and Mondi Group continue to expand eco-friendly kraft liner formats aligned with circular packaging goals, while Georgia-Pacific supports USA retailers with stock and custom box systems through its Pack & Ship division. Emerging brands like Packlane, Vistaprint, and Uline address short-run personalization needs across D2C startups and SMEs.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 4.4 billion |

| Projected Industry Size (2035) | USD 8.4 billion |

| CAGR (2025 to 2035) | 6.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | C Flute, B Flute, E Flute, F Flute, Others (N Flute, A Flute) |

| Wall Types Analyzed (Segment 2) | Single Wall, Double Wall, Triple Wall |

| End Uses Analyzed (Segment 3) | Commercial, Institutional, Household |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | International Paper Company, WestRock Company, Smurfit Kappa Group, DS Smith Plc, Mondi Group, Georgia-Pacific LLC, Packlane, Uline, Inc., Vistaprint (Cimpress N.V.), Stora Enso, Other Emerging Players |

| Additional Attributes | Dollar sales, share by wall type and flute grade, demand from e-commerce and subscription box sectors, structural customization trends, regional expansion in single-wall formats, growth in digitally printed corrugated packaging |

The industry includes C flute, B flute, E flute, F flute, and others such as N flute and A flute.

Segmentation covers single wall, double wall, and triple wall constructions.

Mailer boxes are used across commercial, institutional, and household sectors.

The industry is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

The industry is projected to reach USD 8.4 billion by 2035.

The industry is expected to grow at a CAGR of 6.7% from 2025 to 2035.

C Flute is expected to dominate with approximately 39% share in 2025.

The industry is estimated to reach USD 4.4 billion in 2025.

South Korea is expected to be the fastest-growing region with a projected growth rate of 7.1%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mailer Packaging Market Analysis by Material and Application Through 2035

Mailers Market Trends - Growth & Forecast 2024 to 2034

Lab Mailers Market Size and Share Forecast Outlook 2025 to 2035

Padded Mailers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Padded Mailers Providers

Polybag Mailers Market Size and Share Forecast Outlook 2025 to 2035

Shipping Mailers Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in Foldable Mailer Box Sector

Competitive Breakdown of Shipping Mailers Manufacturers

Foldable Mailer Box Market Analysis – Trends & Demand 2025 to 2035

Cushioned Mailer Market Growth – Demand & Forecast 2025-2035

Foam Tube Mailer Market

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Paperboard Mailer Market Growth - Demand & Forecast 2025 to 2035

Compostable Mailer Market Growth & Trends Forecast 2024-2034

Kraft Paper Mailer Market

Polyethylene Mailers Market Insights - Growth & Trends Forecast 2025 to 2035

Kraft Bubble Mailer Market from 2024 to 2034

Non-cushioned Mailer Market by Material Type, End Use, and Region 2025 to 2035

Thermal Insulated Mailers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA