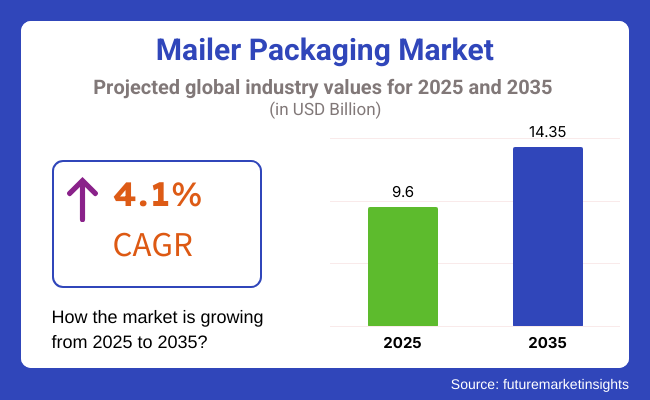

The market size of the mailer packaging industry is estimated to reach USD 9.6 billion in 2025 and is likely to reach a value of USD 14.35 billion, billion by 2035. Sales are expected to increase at a CAGR of 4.1% during the forecast period of 2025 to 2035. Revenue from mailer packaging in 2024 was USD 9.2 billion.

Mailer packaging is gaining rapid traction in e-commerce and retail sectors due to its lightweight, durable, and protective nature. The market is expected to capture over 58.3% of the e-commerce packaging market share by 2035, driven by increasing demand for secure and sustainable shipping solutions.

Mailer Packaging Industry Forecast

Among material types, paper-based mailers are expected to dominate with a market share of more than 62%. Paper mailers, including Kraft and padded mailers, are widely preferred due to their recyclability, lightweight nature, and cost efficiency. Poly mailers and bubble mailers are also witnessing significant adoption due to their enhanced protective features. The mailer packaging market is projected to offer an incremental opportunity of USD 2.1 billion, growing 1.2 times its existing value by 2035.

The table below presents the expected CAGR for the mailer packaging market over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 5.3% (2024 to 2034) |

| H2 | 4.9% (2024 to 2034) |

| H1 | 3.7% (2025 to 2035) |

| H2 | 4.5% (2025 to 2035) |

The first half (H1) of the decade from 2024 to 2034 is projected to record market growth at a rate of 5.3%, while growth during the second half (H2) of the same 10 years will be at a lower compound annual growth rate (CAGR) of 4.9% This trend continues into the following period: H1 2025 to H2 2035, where the CAGR falls slightly to 3.7% in the first half before swelling to 4.5% in the second half. The H1 showed a decrease of 60 BPS, while the H2 indicated a gain of 80 BPS.

Market Drivers: Increasing Demand for E-Commerce Packaging

Furthermore, the growth of online retail and direct-to-customer brands has increased demand for mailer packaging as secure in addition to budget-friendly delivery alternatives. This market is additionally propelled by the shifts towards Omni channel retailing.

Increasing Demand for Eco-Friendly and Recyclable Mailers

In response to growing environmental issues, mailers manufactured from paper-based and compostable materials have become recommended by consumers and businesses. The top brands are innovating in recyclable mailers designs to align with new regulations and sustainability objectives.

Material Costs and Performance Durability Challenges

The mailer packaging landscape is challenged owing to volatility in raw material costs, and the paper-based along with polymer-based materials. Also, manufacturers are still focused on balancing lightweight design with rigidity. These issues are expected break through with new protective coatings and reinforced paper mailers.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Advanced Sustainable Materials | To develop biodegradable, compostable, and recycled mailers to meet eco-conscious consumer demand. |

| Automation & AI in Mailer Production | To enhance efficiency, reduce costs, and scale up production to meet e-commerce growth. |

| Protective & Lightweight Packaging | To optimize material use for better protection while keeping shipping costs low. |

| Circular Economy & Recyclability | To create fully recyclable mailer packaging solutions and comply with global regulations. |

| Government Collaboration & Compliance | To meet evolving sustainability laws and gain faster approvals for new packaging solutions. |

The global mailer packaging market recorded a CAGR of 3.2% between 2020 and 2024, growing from USD 7.9 billion in 2020 to USD 9.2 billion in 2024. The increase was largely driven by e-commerce expansion, rising demand for lightweight and protective packaging, and the shift towards sustainable alternatives. The demand for recyclable and compostable mailers grew significantly during this period, with brands prioritizing eco-friendly packaging solutions to align with consumer expectations and government regulations.

Consumer Priorities vs. Manufacturer Priorities (2020 to 2024 vs. 2025 to 2035)

The mailer packaging segment witnessed a relatively steady growth (~3.2% CAGR) from the e-commerce boom (2019 to 2024). There was more focus on recyclable mailers and biodegradables, but polyethylene, paper-based mailers, and mixed-material designs were still strongholds. From manual production and printing of mailers to automated mailers the industry slowly transitioned.

Speaking of product innovation, they use simple mailers that are recyclable and padded. Low-cost methods of achieving sustainability developed, with applicable models for e-commerce, retail and postal. Design and branding capabilities were limited, while new laws around plastic use in packaging forced demand toward lighter, more cost-efficient mailers. Such efforts towards recyclability and reusability of the early programs were on the way to the circular economy.

From 2025 to 2035 strong growth (~4.1% CAGR) is expected due to sustainability mandates and material innovations. The results: In the long term, webmasters will take the lead in producing bio-based, reusable, and water-soluble products. Innovations on the product side will include tamper-evident, compostable and durable smart mailers.

Electronics, pharmaceuticals and luxury goods packaging will see larger adoption as digital printing will allow for high-quality, customized mailers on demand. Pay-to-play and true-cost accounting and post-consumer content will push recyclable or compostable mailers into default mode, forcing e-commerce to turn to biodegradable and reusable solutions. Closable mailer + packaging system to support the circular economy through integration into logistics networks.

Consumer priorities were based on affordability, basic sustainability, and functionality from 2020 to 2024. Consumers expressed a preference for recyclable mailers, but were cost-sensitive, and manufacturers made initial investments in eco-friendly materials. Price-driven buyers selected economical mailers, while manufacturers balanced cost with compliance.

Performance issues focused around package integrity and protection, which resulted in the creation of padded and water-resistant mailers by manufacturers. Aesthetics were less important than functionality to consumers, and manufacturers provided basic branding opportunities. Plastic-based mailers were all the talk, and tracking features were reduced to basic solutions. Reusability remained at a slow crawl generally focusing on single-use recyclable mailers.

One clear theme from 2025 to 2035: Sustainability and Innovation. The move toward 100% sustainable production will also see consumers demanding fully compostable or reusable mailers, which will force manufacturers to make the switch. Consumers are now often willing to pay a premium for eco-friendly mailers, while large-scale setups and automation can lower the costs of sustainable packaging. Durability requirements increase, demanding solutions that are weather proof as well as lightweight.

It necessitates investments in on demand digital printing, personalized and aesthetically pleasing mailers become essential. Consumers will not only expect compostable and recycled mailers as the norm, but manufacturers will be expanding eco-friendly systems in the production of large-scale mailers. Smart tracking capabilities (QR codes, RFID authentication) become critical, and circular economy solutions spur the development of returnable and reusable mailers.

The global mailer packaging market is consolidated at the top end; this is because there are many Tier 1 companies that are leading the global mailer packaging market with high shares. These companies have high production capacity and a wide range of products. With a significant commitment to global networks and industry experience, they have come to be known as a leader in the production of multiple mailer packaging products, including padded, bubble, and paper mailers.

These companies spend on the latest technology, sustainable materials and compliant operations to deliver high-quality products. Sealed Air Corporation, Pregis LLC, Intertape Polymer Group, 3M Company, and Sonoco Products Company are the most significant companies in tier 1.

Tier 2 companies- the middle-sized players with a large regional and market presence. Tier 2 companies generally have good technical capabilities and comply well with regulations but lack the sophisticated technology and extensive global network that tier 1 players have. They run for specialty applications and bespoke mailer packaging solutions. Tier 2 competitors consist of market-leading brands such as Storopack, ProAmpac, Polyair, Uline, and VP Group.

Tier 3 is small businesses operating locally answering regional needs. These players largely work to meet local market demand and are unorganised as compared to tier 1 and tier 2 companies which are operating in a structured manner.

Mailer Packaging Trends in North America (2020 to 2024) Asia Pacific (APAC) saw a steady growth, which was attributed to strong e-commerce activities in China and India favouring lightweight and economical mailers. In Europe, aggressive EU packaging waste rules had outlets turning to paper-based and environmentally-friendly mailers from the likes of the biggest brands.

North America (especially USA and Canada) led the way in sustainable mailer innovations, retailers switching to plastic-free alternatives. Latin America experienced modest expansion, underpinned by burgeoning cross-border e-commerce in Brazil and Mexico. Conversely, Middle East & Africa (MEA) experienced slow adoption due to not offering robust e-commerce infrastructure and South Asia had low adoption as a result of cost constraints, although interest on recyclable mailers did start to bubble up.

Between 2025 and 2035, sustainability regulation will leverage major transitions. Demand for recyclable and biodegradable mailers will rise resulting in strong growth in the APAC with local manufacturers enlarging capabilities. The new fibre-based mailers with advanced recyclable coatings reflect Europe’s sustainability mandates pushing the transition. There will be increased adoption of paper-based and compostable mailers in North America, thanks to stricter waste reduction legislation.

Latin America will experience significant growth as governments enact packaging waste reduction programs and strengthen local production capacity. The emerging demand for sustainable mailers across MEA will be accelerated by the expansion of e-commerce and sustainability goals set by governments.

With e-commerce dominating the retail landscape globally, India, Bangladesh, and Sri Lanka raising their plastic bans will put South Asia into a new landscape as eco-friendly mailers catch fire in line with their e-commerce revolution. Brands will continue to adopt sustainable and lightweight mailers, with an increase in compostable and reusable options, globally.

The section below covers future projections for the mailer packaging market in key countries across different regions. The United States is expected to remain a major market, with a CAGR of 6.1% through 2035. India is projected to lead South Asia with a CAGR of 7.8%.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.1% |

| India | 5.8% |

| Germany | 2.9% |

| China | 5.5% |

| Brazil | 3.9% |

| United Kingdom | 2.6% |

| Canada | 3.0% |

The USA eco-friendly mailer packaging market is expected to gain traction as consumers in the USA extend their demands for sustainable solution and with regulatory pressures on plastic. So brands and retailers are embracing recyclable and compostable mailers to meet sustainability targets and consumer demand. Paper and padded mailers with biodegradable linings are gaining traction.

This Part Two of our latest Sustainable Packaging Series highlights Leaders in sustainable mailer packaging in Germany, under the weight of both EU waste reduction regulations, and increased online shopping, Germany is leading the pack. Manufacturers are investing in recyclable, compostable and reusable mailers to meet regulations and appeal to environmentally conscious consumers. The future of the market is moulded by the move toward lightweight yet durable mailers.

Here in this segment, know about the top most segments in the industry When analysed on the basis of material type. Applications based on the prediction, Paper-based Mailers are expected to account for a share of 61.3% by 2035. E- Commerce is expected to remain on the top and capture 48.9% market share at the end of 2035.

| Material Type | Market Share (2025) |

|---|---|

| Paper-Based Mailers | 61.3% |

Paper-based mailers, including Kraft mailers, padded paper mailers, and recyclable paper envelopes, have gained prominence due to increasing environmental regulations and growing consumer demand for sustainable packaging. Many brands and retailers are shifting from plastic mailers to compostable and FSC-certified paper mailers, especially with government bans on single-use plastics in regions like the EU and North America.

Paper mailers offer lightweight, cost-effective, and protective solutions, making them a preferred choice for clothing, books, and non-fragile consumer goods.

| Application | Market Share (2025) |

|---|---|

| E-commerce | 48.9% |

Mailer packaging for e-commerce is still the No. 1 application, as DTC (direct to consumer) brands and online marketplaces need cost-effective, durable, and lightweight protective packaging.

As retailers like Amazon, Shopify brands and third-party logistics (3PL) providers are also opting for customized, branded mailers, growth will only accelerate. Other options for electronics, apparel, and accessories include bubble-lined rigid mailers and waterproof poly mailers. The shift toward returnable and reusable mailers is also being driven by the growing demand for sustainable last-mile delivery solutions.

Recent developments in mailer packaging market include: Key players in the mailer packaging market are investing in sustainable materials along with enhancing protective properties and expanding e-commerce-focused packaging solutions.

Key Developments in the Mailer Packaging Market

The mailer packaging market has witnessed significant developments, with companies focusing on sustainability, innovation, and strategic expansion. Sealed Air Corporation introduced a new line of curb side recyclable padded mailers, enhancing sustainable e-commerce packaging. Pregis partnered with Amazon to supply sustainable paper mailers for its fulfilment centres, aiming to reduce plastic waste.

In terms of acquisitions, Mondi Group acquired Hoffmann Verpackung to strengthen its position in protective mailer packaging solutions across Europe, while Store Enso completed the acquisition of De Jong Packaging Group, expanding its presence in sustainable corrugated mailer packaging.

Additionally, Smurfit Kappa achieved FSC® certification for its entire range of paper-based mailers, reinforcing its commitment to sustainability. Ransack introduced thermal-insulated paper mailers, catering to temperature-sensitive deliveries in the food and pharmaceutical industries. These strategic developments reflect the industry's growing emphasis on eco-friendly materials, advanced packaging solutions, and responsible sourcing.

Latest Developments

The mailer packaging market has been growing rapidly owing to the rising need for packaging solutions in various industries; key players in the market are focusing on introducing sustainable, new, and innovative products while expanding their market reach.

Sealed Air Corporation reinforced their position by introducing sustainable, curb side recyclable padded mailers, whereas Pregis acquired market share by securing partnerships with established e-commerce retailers for sustainable mailer solutions. Mondi Group enriched its offering through an acquisition of the protective mailer segment and Smurfit Kappa boosted its sustainability credentials with the launch of FSC®-certified paper mailers.

Stora Enso turns increasingly innovative through acquisition and innovations of paper-based mailers alongside RSQR, primarily insulated and eco-friendly mailer solutions targeted at e-commerce and food delivery.

On the other hand, 3M Company continued to dominate the market with its tamper-evident mailers and high-performance, and Berry Global Group expanded its range of recyclable and lightweight poly mailers for logistics. Intertape Polymer Group, for instance, ramped up investments in compostable and bio-based mailer solutions, while Uline was able to maintain market share by offering a diversified assortment of padded and poly mailers.

In addition, ProAmpac expanded its market presence with lightweight poly mailers, and Huhtamaki leveraged fibre-based, compostable mailers to advance sustainable packaging efforts.

The mailer packaging market is set for robust growth, driven by the surge in e-commerce and increasing sustainability concerns. To capitalize on these trends, industry stakeholders should focus on:

By adopting these strategies, stakeholders can drive market growth and establish leadership in the evolving mailer packaging industry.

The market is projected to witness a CAGR of 4.1% between 2025 and 2035.

The global market stood at USD 9.2 billion in 2024.

The market is anticipated to reach USD 14.35 billion by 2035.

South Asia & Pacific is expected to record the highest CAGR, driven by e-commerce expansion.

Leading players include Sealed Air Corporation, Pregis, Mondi Group, and Smurfit Kappa.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Insulation, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Insulation, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Insulation, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Insulation, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Insulation, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Material, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Insulation, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Insulation, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Material, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Insulation, 2023 to 2033

Figure 29: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Insulation, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Material, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Insulation, 2023 to 2033

Figure 59: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Insulation, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Insulation, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Insulation, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 116: Europe Market Attractiveness by Material, 2023 to 2033

Figure 117: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Insulation, 2023 to 2033

Figure 119: Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Insulation, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Material, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Insulation, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Insulation, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 176: MEA Market Attractiveness by Material, 2023 to 2033

Figure 177: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Insulation, 2023 to 2033

Figure 179: MEA Market Attractiveness by End-Use, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mailer Boxes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mailers Market Trends - Growth & Forecast 2024 to 2034

Lab Mailers Market Size and Share Forecast Outlook 2025 to 2035

Padded Mailers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Padded Mailers Providers

Polybag Mailers Market Size and Share Forecast Outlook 2025 to 2035

Shipping Mailers Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in Foldable Mailer Box Sector

Competitive Breakdown of Shipping Mailers Manufacturers

Foldable Mailer Box Market Analysis – Trends & Demand 2025 to 2035

Cushioned Mailer Market Growth – Demand & Forecast 2025-2035

Foam Tube Mailer Market

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Paperboard Mailer Market Growth - Demand & Forecast 2025 to 2035

Compostable Mailer Market Growth & Trends Forecast 2024-2034

Kraft Paper Mailer Market

Polyethylene Mailers Market Insights - Growth & Trends Forecast 2025 to 2035

Kraft Bubble Mailer Market from 2024 to 2034

Non-cushioned Mailer Market by Material Type, End Use, and Region 2025 to 2035

Thermal Insulated Mailers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA