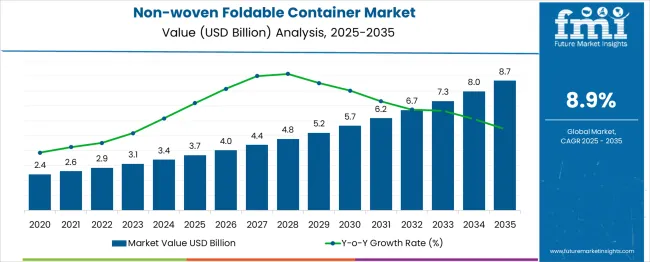

The non-woven foldable container market is projected to rise from USD 3.7 billion in 2025 to USD 8.9 billion by 2035, delivering a CAGR of 8.9%. Year-on-year growth scales consistently, from USD 0.33 billion in 2026 to over USD 0.72 billion in 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.7 billion |

| Industry Value (2035F) | USD 8.9 billion |

| CAGR (2025 to 2035) | 8.9% |

This steady expansion is attributed to increased demand for collapsible packaging in logistics, warehousing, and last-mile distribution. Lightweight design, durability, and cost efficiency make non-woven containers preferable for e-commerce and food delivery segments. Manufacturers benefit from rising automation in packaging and an emphasis on reusable solutions.

By 2030, adoption accelerates as circular economy policies and import-export compliance favor foldable formats. Asian and Latin American industries are expected to lead volume growth due to trade-driven containerization.

On April 30, 2025, Tony Smurfit, CEO of Smurfit WestRock, stated, “Smurfit Kappa Group has delivered a very strong first quarter. These results reflect the continuing benefits of our multi-year capital plans and the dedication and commitment of our people, providing the most sustainable and innovative packaging solutions for our customers… our combination with WestRock creates a global leader in innovative and sustainable packaging with a very exciting future for all stakeholders.”

Non-woven foldable container market holds a relatively small yet growing share across its parent markets. Within the foldable and collapsible container segment, they represent approximately 10-15%, as plastic and metal variants continue to dominate.

In the reusable storage and organization market, which includes fabric bins and storage cubes, non-woven foldables account for about 10-12% based on material usage. They contribute nearly 15% to the reusable shopping and carry bag segment, driven by eco-conscious retail practices. In the industrial and logistics storage category, non-woven variants hold around 8-10%, with adoption rising in lightweight packaging. For the home and consumer organization market, their share is more significant, reaching 15-20% due to increasing demand for compact, collapsible storage solutions in residential spaces.

The industry has been segmented by material type, structure, distribution channel, end-use industry, and region. Material types include polypropylene (PP), polyethylene terephthalate (PET), and high-density polyethylene (HDPE). Structures are categorized into rigid, foldable, and semi-flexible formats.

Distribution is dominated by direct sales (B2B) and supported by third-party channels. Key end-use industries include food and beverage, pharmaceuticals, electronics, agriculture, and textiles. Regional analysis spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, where demand is shaped by industrial automation levels, regulatory packaging norms, and investment in returnable logistics infrastructure.

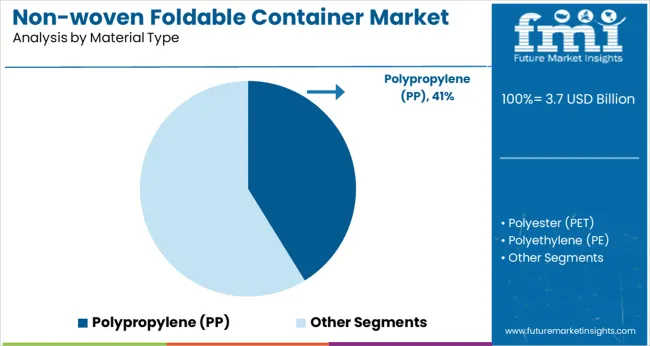

Polypropylene (PP) accounted for 41.2% share of the industry in 2025 due to its lightweight profile, durability, and cost-efficiency in high-volume logistics. Between 2025 and 2027, large-scale deployment of PP containers was noted across food packaging units and warehouse storage systems.

From 2028 to 2030, demand accelerated in India and China due to reusable transit packaging mandates in the FMCG sectors. By 2035, recyclability incentives in Europe and export packaging regulations in the Middle East will further solidify PP’s lead. PP remains preferred for returnable packaging across automotive and retail logistics due to ease of folding, rigidity retention, and water resistance.

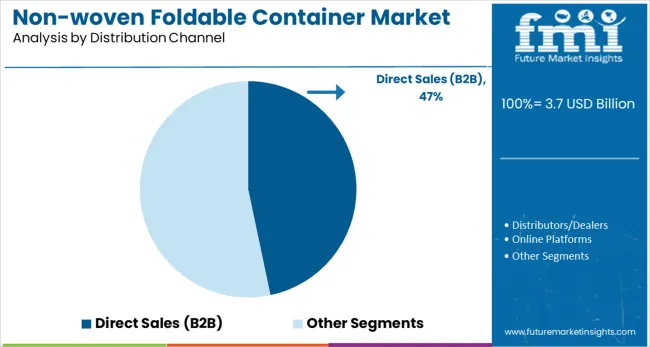

Direct sales (B2B) represented 46.7% of the distribution channel in 2025, with manufacturers and enterprises favoring bulk procurement. From 2025 to 2027, contract-based supply chains across automotive and electronics hubs in South Korea and Germany relied heavily on direct engagement with container producers.

Between 2028 and 2032, USA food processing firms adopted direct sourcing to standardize pallet sizes and reduce downtime. In India, organized retailers formed consortia to negotiate container supply directly from vendors. This channel remains essential for large-scale industries seeking volume pricing, customization, and long-term supplier partnerships.

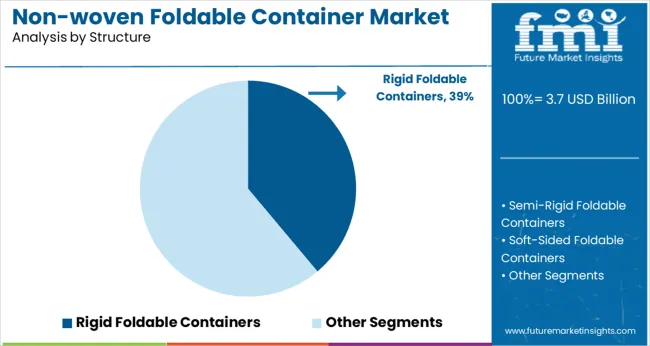

Rigid foldable containers held a 38.9% share in 2025, valued for balancing durability with space-saving capability. From 2025 to 2027, German automotive OEMs and Japanese appliance exporters standardized rigid units for return logistics. Between 2028 and 2031, adoption increased across Latin American cold chains for perishables.

Use cases expanded into e-commerce warehouse automation systems by 2032, particularly in South Korea and the UK These containers continue to outperform soft-sided variants in terms of load-bearing strength and compatibility with automated storage and retrieval systems (ASRS).

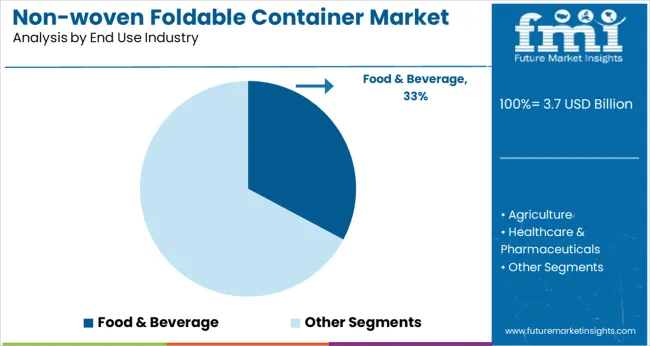

The food and beverage industry held 32.8% of industry share in 2025, driven by a rising focus on hygienic and reusable secondary packaging. Between 2025 and 2027, USA and Canadian producers adopted foldable crates for fresh produce to meet retailer shelf-life targets.

From 2028 to 2031, dairy firms in the Middle East and confectionery exporters in Europe transitioned to non-woven containers to improve return logistics. By 2035, Southeast Asian beverage companies will utilize rigid containers for inter-facility transit under controlled environments. Food-grade compliance, easy sanitation, and reduced breakage supported continued use in packaged and fresh food logistics.

The industry is being shaped by increased demand for space-efficient, reusable packaging across retail, logistics, and industrial sectors. While the format supports supply chain agility and cost control, high setup costs and integration limitations pose notable constraints.

Rising Demand for Space-Saving and Reusable Formats

Non-woven foldable containers are increasingly adopted in sectors like automotive, e-commerce, and food distribution, where storage optimization and return logistics efficiency are critical. Studies show that collapsible formats can reduce reverse logistics volume by 70-80%, directly lowering backhaul costs.

Their lightweight non-woven design-typically 30-50% lighter than rigid plastic bins-enhances ergonomic handling and reduces workplace injuries. Reuse rates average 35-50 cycles per unit, significantly extending lifecycle value versus single-use corrugated alternatives, especially in high-frequency fulfillment operations.

Adoption Barriers Linked to Cost and Compatibility

Initial capital expenditure for non-woven foldable containers averages USD 6-9 per unit, compared to USD 1.5-3 for traditional corrugated options, limiting access for mid-sized players. Less than 25% of warehouses globally have automated systems fully compatible with foldable designs, creating bottlenecks in digital tracking and movement. In Asia and Latin America, regulatory variations delay market entry certification lead times range from 3 to 9 months depending on the destination. These factors combined have slowed adoption outside top-tier retail and logistics networks.

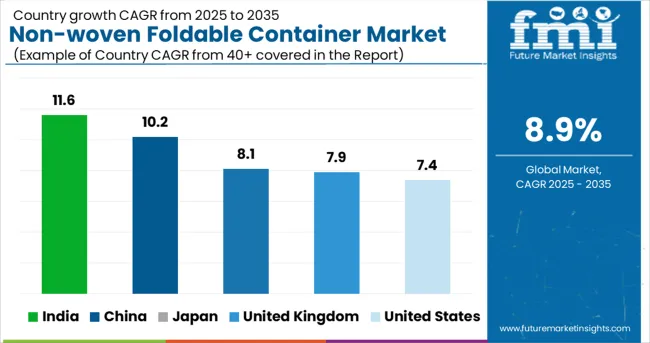

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.4% |

| United Kingdom | 7.9% |

| India | 11.6% |

| China | 10.2% |

| Japan | 8.1% |

The global CAGR for non-woven foldable containers is projected at 8.9% from 2025 to 2035, with performance varying significantly across key economies. India leads at 11.6%, exceeding the global trend by over 30%, followed by China at 10.2%.

These BRICS nations are scaling output rapidly due to rising demand from e-commerce, agriculture logistics, and informal retail. The United Kingdom and Japan post moderate growth at 7.9% and 8.1% respectively, while the United States trails at 7.4%, impacted by higher input costs and slower warehouse automation cycles.

India is expanding local manufacturing zones with reusable container clusters near agri-mandis and FMCG hubs. China’s demand is tied to intra-city distribution for fresh produce and parcel services. USA demand remains steady but fragmented, while the UK and Japan see niche adoption across grocery, apparel, and pharmaceutical channels. These countries form part of a broader 40+ nation study.

Between 2025 and 2035, the non-woven foldable container market in the United States is projected to grow at a CAGR of 7.4%. Growth is expected to be supported by adoption in last-mile delivery, retail warehousing, and omnichannel fulfillment strategies.

Logistics partners are integrating collapsible formats into automated picking systems to optimize space and cost. From 2020 to 2024, market penetration was driven by mandates and early trials in e-commerce warehouses, with moderate scale-up across national retailers.

A CAGR of 7.9% is projected for the non-woven foldable container market in the United Kingdom from 2025 to 2035. Retailers and fulfillment centers are incorporating these units in seasonal warehousing and Q-commerce delivery infrastructure.

Expansion is expected through food, apparel, and home goods verticals. From 2020 to 2024, adoption was limited but supported by circular packaging pilots and commitments within regional supply chains, especially in Greater London.

Demand for non-woven foldable containersin India is projected to expand at a CAGR of 11.6% between 2025 and 2035. Growth is anticipated across garment exports, organized retail, and fast-growing warehouse networks in tier-1 and tier-2 cities.

Widespread adoption is being supported by infrastructure expansion in e-commerce and FMCG logistics. From 2020 to 2024, penetration was primarily concentrated in industrial belts and startup-driven supply chain solutions, with increased awareness emerging post-2022.

The non-woven foldable container market in China is expected to grow at a CAGR of 10.2% from 2025 to 2035. Regional logistics zones and industrial parks are increasingly deploying these systems in warehouse automation and component transit lines. Policy incentives targeting packaging recyclability are strengthening municipal demand.

From 2020 to 2024, domestic OEMs expanded production to support pilot procurement from SOEs and regional logistics hubs, with usage diversifying into sectors like automotive, electronics, and medical supplies.

The sale of non-woven foldable containers in Japan is forecast to grow at a CAGR of 8.1% from 2025 to 2035. Retail logistics, convenience store networks, and pharma distribution systems are expected to drive consistent demand. Growth is underpinned by a shift toward compact logistics formats and returnable container systems in high-density cities.

From 2020 to 2024, deployment remained limited but gained momentum post-pandemic as part of supply chain risk mitigation and resource optimization strategies.

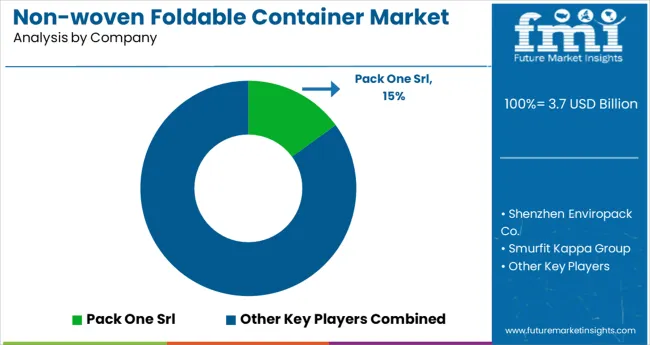

The non-woven foldable container industry features a diverse group of companies focused on lightweight, space-efficient, and reusable packaging formats. Pack One Srl (Italy) specializes in industrial foldable containers using non-woven and hybrid fabrics suited for the mechanical and transport sectors.

Shenzhen Enviropack Co. is a prominent exporter offering non-woven storage and tote solutions across global retail and utility channels. Smurfit Kappa incorporates non-woven elements into its foldable bulk packaging systems to improve transport efficiency and reduce handling effort.

Supreme Industries Ltd. manufactures polymer-based foldable crates used widely in agriculture and storage infrastructure. Sonoco Products Company is enhancing its presence by integrating non-woven composites into its reusable container lineup, reflecting its commitment to scalable, multi-use packaging solutions.

Leading Company - Pack One SrlIndustry Share - 15%

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 3.7 billion |

| Projected Industry Size (2035) | USD 8.9 billion |

| CAGR (2025 to 2035) | 8.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Material Types Analyzed (Segment 1) | Polypropylene (PP), Polyester (PET), Polyethylene (PE), Biodegradable Non-wovens (PLA, Starch-Based), Others (Composite Blends) |

| Distribution Channels Analyzed (Segment 2) | Direct Sales (B2B), Distributors/Wholesalers, Online Platforms, Contract Packaging Services |

| Structures Analyzed (Segment 3) | Rigid Foldable Containers, Semi-Rigid Foldable Containers, Soft-Sided Foldable Containers |

| End Use Industries Analyzed (Segment 4) | Food & Beverage, Agriculture, Healthcare & Pharmaceuticals, Consumer Goods & Retail, Industrial Packaging |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Pack One Srl, Shenzhen Enviropack Co., Smurfit Kappa Group, Supreme Industries Ltd., Sonoco Products Company, SILTEX, EPP-Packaging Solutions |

| Additional Attributes | Dollar sales, share by structure and material type, growing demand from food and pharma logistics, expansion of eco-friendly and lightweight container systems, regional material substitution patterns |

The segment is categorized into Polypropylene (PP), Polyester (PET), Polyethylene (PE), Biodegradable Non-wovens (such as PLA and starch-based materials), and Others, including composite blends.

The industry is segmented into Direct Sales (B2B), Distributors/Wholesalers, Online Platforms, and Contract Packaging Services.

The category includes Rigid Foldable Containers, Semi-Rigid Foldable Containers, and Soft-Sided Foldable Containers.

This segment covers Food & Beverage, Agriculture, Healthcare & Pharmaceuticals, Consumer Goods & Retail, and Industrial Packaging.

Regional analysis includes North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is projected to reach USD 3.7 billion in 2025.

The industry is expected to grow at a CAGR of 8.9% from 2025 to 2035.

Polypropylene is expected to capture 41.2% of the market in 2025.

The Asia Pacific region, particularly India, is projected to register a CAGR of 11.6% from 2025 to 2035.

The industry is projected to reach USD 8.9 billion by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foldable/Compressible Beverage Carton Market Size and Share Forecast Outlook 2025 to 2035

Foldable Inflatable Boats Market Size and Share Forecast Outlook 2025 to 2035

Foldable Display Market Size and Share Forecast Outlook 2025 to 2035

Foldable And Collapsible Pallets Market Size and Share Forecast Outlook 2025 to 2035

Foldable Phone Market Analysis by Product Type, Display Technology, Sales Channel, End-User and Region from 2025 to 2035

Key Companies & Market Share in Foldable Mailer Box Sector

Examining Market Share Trends in Foldable Plastic Pallet Boxes

Foldable Mailer Box Market Analysis – Trends & Demand 2025 to 2035

Foldable Plastic Pallet Boxes Market Trends & Forecast through 2035

Foldable Bottles Market

Foldable Container Market Trends & Forecast 2024-2034

Foldable Steel Containers Market Insights & Growth 2025 to 2035

ESD Foldable Container Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA