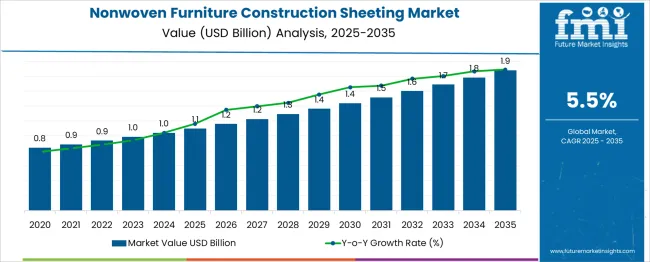

The Nonwoven Furniture Construction Sheeting Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

Supported by a steady CAGR of 5.5%, this growth is driven by the increasing demand for cost-effective, durable, and lightweight materials in the furniture industry. In the first five years (2025–2030), the market is expected to rise from USD 1.1 billion to USD 1.4 billion, adding USD 0.3 billion, or 37.5% of the total incremental growth, with a 5-year multiplier of 1.27x. The second phase (2030–2035) contributes USD 0.5 billion, representing 62.5% of incremental growth, signaling steady demand driven by rising adoption of nonwoven materials in upholstery, insulation, and packaging applications in furniture manufacturing. Annual increments will increase from USD 0.06 billion in early years to USD 0.1 billion by 2035, indicating stronger growth. Manufacturers focusing on the eco-friendly, cost-effective, and versatile nature of nonwoven materials will capture the largest share of this USD 0.8 billion opportunity, particularly as sustainability trends in furniture production continue to rise.

| Metric | Value |

|---|---|

| Nonwoven Furniture Construction Sheeting Market Estimated Value in (2025 E) | USD 1.1 billion |

| Nonwoven Furniture Construction Sheeting Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The nonwoven furniture construction sheeting market is experiencing notable growth, driven by increasing demand for cost-effective, durable, and sustainable materials in furniture manufacturing. Rising awareness of environmental impact and regulatory push towards recyclable and reusable materials have positioned nonwoven sheets as a preferred alternative to conventional textiles.

Manufacturers are innovating with advanced nonwoven technologies to meet performance, aesthetic, and sustainability requirements, supporting widespread adoption across residential and commercial furniture segments. Future growth is anticipated to be supported by expansion of organized furniture retail, evolving interior design trends emphasizing lightweight and versatile materials, and greater integration of eco-friendly supply chains.

Enhanced production efficiency and reduced material wastage are paving the way for deeper penetration into emerging markets and broader acceptance among small and medium-sized furniture makers.

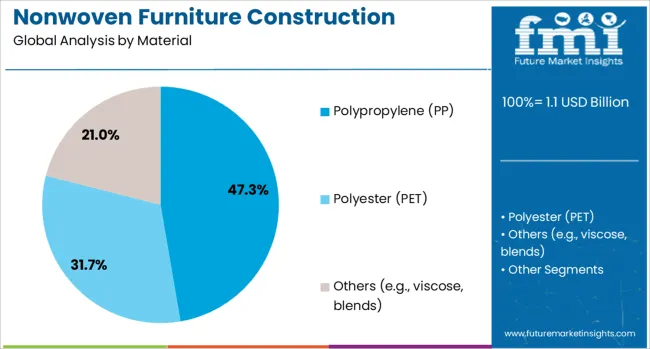

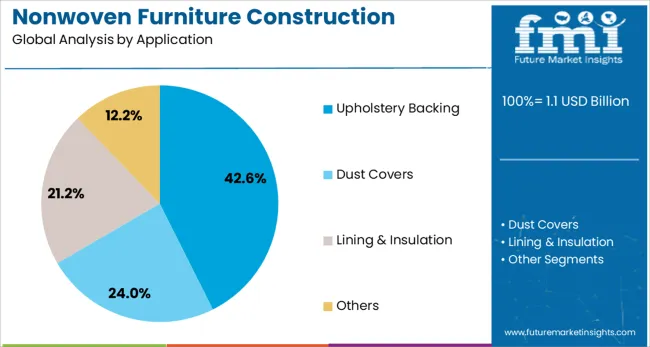

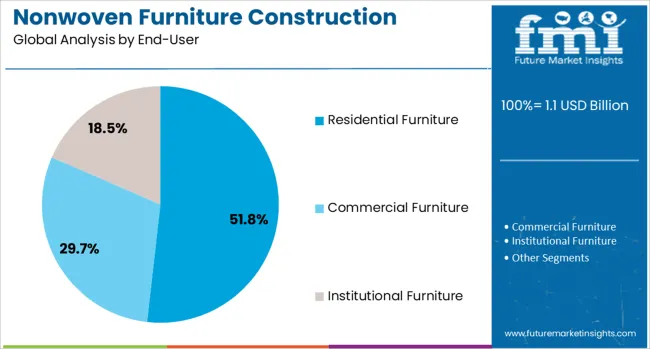

The nonwoven furniture construction sheeting market is segmented by material, applicationend-user, and geographic regions. By material of the nonwoven furniture construction sheeting market is divided into Polypropylene (PP), Polyester (PET)Others (e.g., viscose, blends). In terms of application of the nonwoven furniture construction sheeting market is classified into Upholstery Backing, Dust Covers, Lining & Insulation, Others. Based on end-user of the nonwoven furniture construction sheeting market is segmented into Residential Furniture, Commercial FurnitureInstitutional Furniture. Regionally, the nonwoven furniture construction sheeting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material, polypropylene PP is expected to account for 47.30% of the total market revenue in 2025, establishing itself as the leading material segment. This dominance has been supported by the inherent advantages of PP such as high tensile strength, resistance to moisture and chemicals, and low production costs, which have aligned well with the functional requirements of furniture construction.

The lightweight nature of PP coupled with its recyclability has encouraged its widespread use, particularly as environmental standards in manufacturing have tightened. Improvements in fiber processing technology have further enhanced the visual and tactile appeal of PP-based sheets, making them suitable for a variety of applications while maintaining affordability.

Insights into the Upholstery Backing Application Segment

In terms of application, upholstery backing is projected to hold 42.6% of the market revenue share in 2025, positioning it as the top application segment. This prominence has been driven by the critical role of nonwoven sheets in providing structural integrity, durability, and aesthetic finish to upholstered furniture.

The ability of nonwoven backing materials to distribute stress evenly, resist sagging, and maintain shape over prolonged use has contributed to their preference among manufacturers. Enhanced processing methods have also enabled upholstery backings to be produced in a range of weights and textures, catering to diverse design requirements.

Their easy handling during manufacturing, cost efficiency, and contribution to the overall quality of finished furniture have further solidified this segment’s leading position.

When segmented by end user, residential furniture is expected to capture 51.8% of the market revenue in 2025, making it the foremost end user segment. This leadership has been driven by growing consumer spending on home improvement and the rising preference for affordable yet stylish furniture solutions.

The versatility and cost-effectiveness of nonwoven sheets have enabled furniture makers to meet the demands of mass-market residential customers without compromising on quality. The increasing trend of compact and modular furniture in urban homes has also amplified the use of lightweight and durable nonwoven materials.

Furthermore, heightened consumer awareness of sustainable materials in household products has encouraged furniture brands to integrate environmentally friendly options, thereby strengthening the dominance of the residential segment in the market.

The nonwoven furniture construction sheeting market is growing due to increased demand for affordable, durable materials in furniture production. Expanding opportunities in customization and cost-reduction are driving market potential, while automation trends are improving manufacturing efficiency. However, challenges like rising raw material costs and supply chain disruptions pose significant constraints. As the market continues to evolve, innovations in material performance and manufacturing processes will be key to overcoming these obstacles, with steady growth expected by 2025.

The nonwoven furniture construction sheeting market is gaining momentum, primarily due to the rising demand for durable and lightweight materials. Nonwoven fabrics offer an ideal solution in furniture manufacturing, providing superior performance at a lower cost compared to traditional materials. The growing furniture industry, along with consumer preferences for cost-efficient, yet durable options, drives the market forward. By 2025, the trend toward practical, affordable solutions is expected to continue, boosting demand for nonwoven sheeting in furniture applications.

Opportunities in the nonwoven furniture construction sheeting market are expanding as manufacturers increasingly focus on reducing production costs while enhancing product quality. Nonwoven materials offer flexibility in design, making them an attractive option for custom furniture applications. The ongoing focus on improving material performance, including resistance to moisture and wear, presents significant growth prospects. By 2025, the market will likely benefit from increasing demand for versatile and customizable furniture solutions that utilize nonwoven sheeting materials.

Emerging trends in the nonwoven furniture construction sheeting market point toward the increased adoption of automation and integration in manufacturing processes. Automation is driving operational efficiency and enhancing production consistency, which is beneficial for manufacturers seeking to reduce costs. The integration of nonwoven sheeting into customized, consumer-specific furniture designs is becoming more prevalent, reflecting the shift toward personalized products. This trend is expected to shape the market, with automation further improving production speed and reducing costs in the coming years.

The nonwoven furniture construction sheeting market faces significant challenges, primarily stemming from rising raw material costs. The price volatility of synthetic fibers used in nonwoven fabrics presents a barrier to maintaining stable production costs. In addition, ongoing supply chain disruptions, particularly in raw material procurement, add to the complexity of meeting market demands. These issues are expected to hinder growth, particularly in regions heavily reliant on imports. Addressing these challenges through efficient supply chain management and cost-control measures will be critical by 2025.

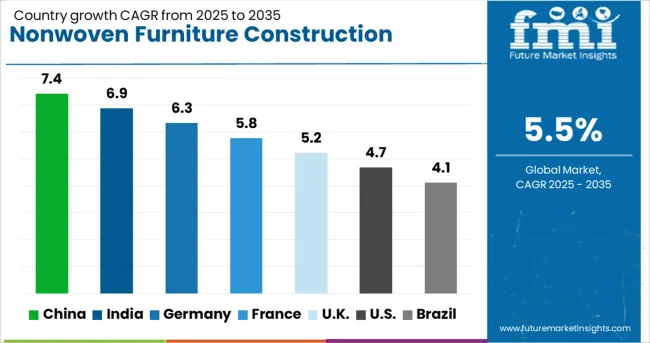

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global nonwoven furniture construction sheeting market is projected to grow at a 5.5% CAGR from 2025 to 2035. China leads with a growth rate of 7.4%, followed by India at 6.9%, and Germany at 6.3%.

The United Kingdom records a growth rate of 5.2%, while the United States shows the slowest growth at 4.7%. These variations in growth rates are driven by factors such as the increasing demand for nonwoven materials in the furniture and construction industries, rising disposable incomes, and the ongoing shift toward more durable and eco-friendly alternatives.

While China and India are witnessing higher growth due to rapid industrialization and increasing consumer spending, mature markets like the USA and the UK show steady growth driven by ongoing demand for nonwoven materials in furniture production.

The nonwoven furniture construction sheeting market in China is growing at a strong pace, with a projected CAGR of 7.4%. China’s expanding furniture industry, coupled with the country’s ongoing industrialization and urbanization, is driving the demand for nonwoven materials. As consumer preferences shift towards eco-friendly and durable alternatives, nonwoven sheeting is becoming increasingly popular in the production of furniture, upholstery, and other household applications. Moreover, China’s growing focus on sustainable manufacturing processes, combined with rising disposable incomes, further fuels the demand for nonwoven materials in the furniture and construction sectors.

The nonwoven furniture construction sheeting market in India is projected to grow at a CAGR of 6.9%. India’s growing middle class and increasing demand for affordable and durable furniture are driving the market for nonwoven sheeting materials. The demand for lightweight, cost-effective, and eco-friendly alternatives in furniture production is further contributing to market growth. Additionally, the expansion of the construction industry and increasing investments in housing and infrastructure are boosting the use of nonwoven materials in both furniture and construction applications. As India continues to urbanize, demand for nonwoven materials in furniture production and construction applications is expected to rise significantly.

The nonwoven furniture construction sheeting market in Germany is projected to grow at a CAGR of 6.3%. Germany’s well-established furniture industry, coupled with its strong manufacturing base, is a key driver behind the adoption of nonwoven materials in furniture production. As German consumers increasingly seek sustainable and durable furniture solutions, nonwoven sheeting is becoming a preferred material. The country’s focus on eco-friendly and energy-efficient manufacturing processes, along with the growing emphasis on sustainability, is driving the demand for nonwoven materials. Additionally, the increasing trend of customized and high-quality furniture is fueling the market for innovative nonwoven sheeting materials.

The nonwoven furniture construction sheeting market in the United Kingdom is projected to grow at a CAGR of 5.2%. In the UK, increasing consumer demand for lightweight, durable, and eco-friendly furniture materials is driving the market for nonwoven sheeting. The country’s growing focus on sustainability and reducing carbon footprints in manufacturing processes is further contributing to the adoption of nonwoven materials in furniture production. Additionally, the rise in disposable incomes, coupled with increasing demand for high-quality and affordable furniture, supports market growth. Although the market is more mature, these factors ensure steady demand for nonwoven materials.

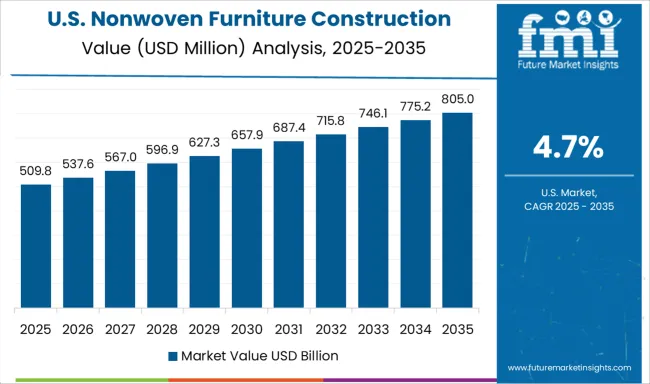

The nonwoven furniture construction sheeting market in the United States is expected to grow at a CAGR of 4.7%. The USA market is mature but continues to see steady growth driven by demand for high-quality, durable, and eco-friendly furniture. The ongoing trend toward sustainable manufacturing practices in the furniture and construction industries is accelerating the use of nonwoven materials. Additionally, the USA is witnessing a growing interest in custom-made and modular furniture solutions, which further drives demand for nonwoven sheeting materials. While growth is slower compared to emerging markets, continued consumer interest in sustainable products ensures long-term demand for nonwoven materials.

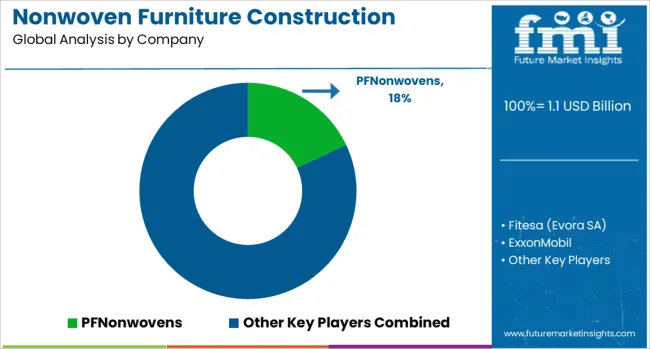

The nonwoven furniture construction sheeting market is dominated by PF Nonwovens, which leads with its high-quality nonwoven fabric solutions tailored for use in furniture manufacturing, automotive, and other industrial applications. PF Nonwovens' dominance is supported by its advanced production processes, strong customer base, and focus on providing durable, cost-effective nonwoven sheeting for diverse applications. Key players such as ExxonMobil, SABIC (Saudi Aramco), Toray, and Fitesa (Evora SA) maintain significant market shares by offering innovative nonwoven fabrics with superior strength, flexibility, and resistance, making them ideal for furniture construction and upholstery.

These companies focus on meeting the growing demand for sustainable, environmentally friendly materials while ensuring high performance in their products. Emerging players like First Quality, Fibtex, Kimberly-Clark, and Mitsui Group are expanding their market presence by providing specialized nonwoven fabrics for niche applications, such as biodegradable and fire-resistant furniture sheeting. Their strategies focus on improving material properties, offering customized solutions, and expanding their reach in emerging markets.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Material | Polypropylene (PP), Polyester (PET), and Others (e.g., viscose, blends) |

| Application | Upholstery Backing, Dust Covers, Lining & Insulation, and Others |

| End-User | Residential Furniture, Commercial Furniture, and Institutional Furniture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PFNonwovens; Freudenberg Performance Materials; Fibertex Nonwovens A/S; Fitesa S.A.; Toray Industries, Inc.; Ahlstrom; Johns Manville; Kimberly-Clark Corporation; Avgol Nonwovens (Indorama Ventures) |

| Additional Attributes | Dollar sales by material type and application, demand dynamics across furniture, automotive, and construction sectors, regional trends in nonwoven sheeting adoption, innovation in eco-friendly and durable materials, impact of regulatory standards on product safety and environmental concerns, and emerging use cases in sustainable furniture manufacturing and interior design. |

The global nonwoven furniture construction sheeting market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the nonwoven furniture construction sheeting market is projected to reach USD 1.9 billion by 2035.

The nonwoven furniture construction sheeting market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in nonwoven furniture construction sheeting market are polypropylene (pp), polyester (pet) and others (e.g., viscose, blends).

In terms of application, upholstery backing segment to command 42.6% share in the nonwoven furniture construction sheeting market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Staples PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA