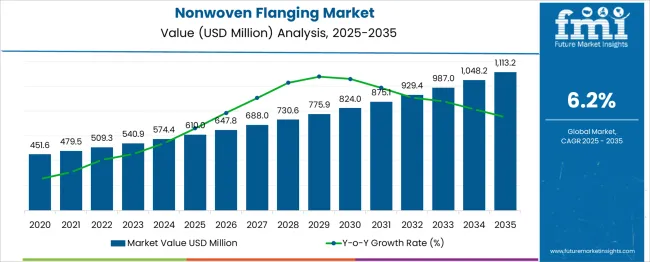

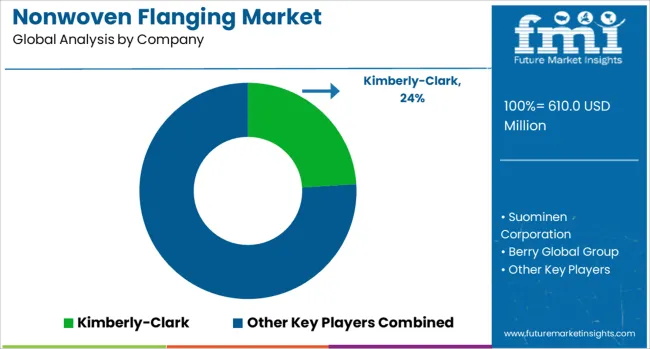

The Nonwoven Flanging Market is estimated to be valued at USD 610.0 million in 2025 and is projected to reach USD 1113.2 million by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. Evaluating the market’s year-by-year trajectory reveals a stable upward trend driven by the expanding use of nonwoven materials in high-precision applications. From 2025 to 2030, the market is projected to grow from USD 610.0 million to USD 775.9 million, generating an incremental gain of USD 165.9 million, representing roughly 33% of the entire decade’s expansion. Annual growth during this period averages between USD 30–40 million, signaling sustained demand and gradual adoption across industrial sectors. From 2031 to 2035, the pace of growth strengthens, with the market expanding from USD 824.0 million in 2031 to USD 1,113.2 million in 2035. The latter half contributes approximately USD 289.2 million, nearly 57% to the total growth, indicating an accelerating value contribution and underscoring the importance of long-term capacity building. The Growth Contribution Index (GCI) emphasizes that while early-stage growth establishes market viability, it is the later years that yield the highest marginal returns. Players with forward-looking strategies and investment in advanced processing are likely to gain the most competitive advantage.

| Metric | Value |

|---|---|

| Nonwoven Flanging Market Estimated Value in (2025 E) | USD 610.0 million |

| Nonwoven Flanging Market Forecast Value in (2035 F) | USD 1113.2 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The nonwoven flanging market is experiencing a steady upward trajectory as industries increasingly prioritize lightweight, durable, and cost-efficient materials to meet evolving performance and regulatory demands. The adoption of nonwoven solutions is being reinforced by their versatility, recyclability, and superior mechanical properties compared to conventional alternatives.

Advancements in manufacturing techniques and material engineering are enabling higher precision and customization, which is encouraging wider adoption across diverse end-use sectors. Future growth is expected to be supported by increasing investments in sustainable production, integration of advanced fibers, and the rising demand for high-efficiency filtration and automotive components.

The market is being shaped by tightening emission norms, consumer preferences for eco-friendly solutions, and manufacturers’ focus on operational efficiency, all of which are paving the path for robust expansion and broader market penetration.

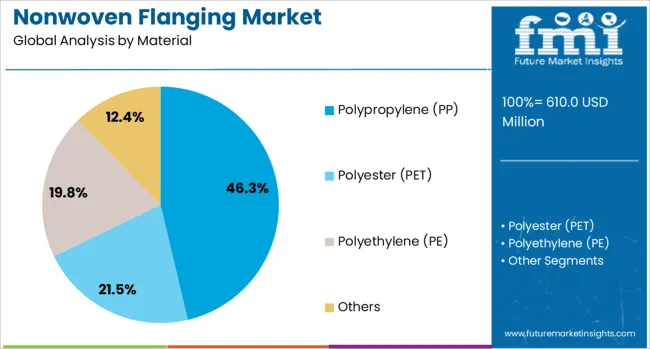

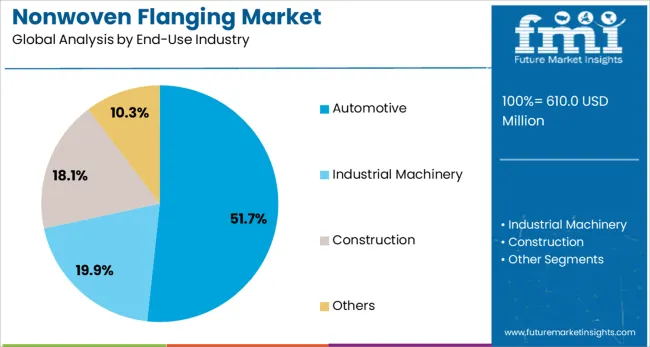

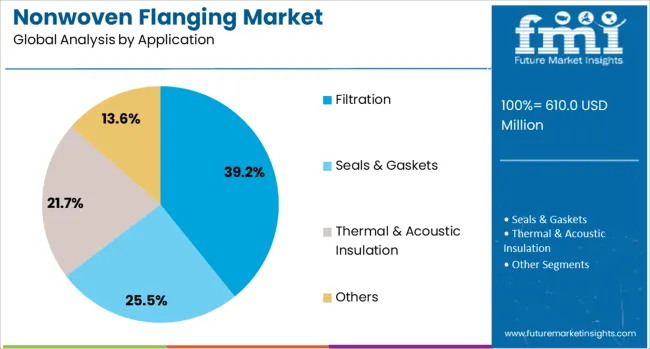

The nonwoven flanging market is segmented by material, end-use industry, application, and geographic regions. The material of the nonwoven flanging market is divided into Polypropylene (PP), Polyester (PET), Polyethylene (PE), and Others. In terms of end-use industry, the nonwoven flanging market is classified into Automotive, Industrial Machinery, Construction, and Others. The nonwoven flanging market is segmented into Filtration, Seals & Gaskets, Thermal & Acoustic Insulation, and Others. Regionally, the nonwoven flanging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material, polypropylene PP is expected to hold 46.3% of the total market revenue in 2025, positioning it as the leading material segment. This dominance has been driven by the material’s favorable balance of lightweight characteristics, mechanical strength, and cost-effectiveness, which have made it a preferred choice for high-volume production.

The ease of processing and compatibility with advanced manufacturing techniques have further contributed to its widespread adoption. Its inherent resistance to moisture, chemicals, and wear has enabled consistent performance in demanding environments, particularly where durability and cleanliness are critical.

Enhanced recyclability and the ability to incorporate functional additives have reinforced its appeal, ensuring its continued leadership in applications requiring reliable and sustainable nonwoven solutions.

Segmenting by end use industry shows that automotive is projected to account for 51.7% of the market revenue in 2025, securing its position as the leading industry segment. This leadership has been supported by the sector’s growing reliance on lightweight, durable materials to meet stringent fuel efficiency and emission standards.

The integration of nonwoven flanging components in interior, filtration, and insulation systems has been increasingly observed as automakers aim to reduce vehicle weight while maintaining performance and comfort. The material’s versatility and ability to conform to complex geometries have enabled innovative design possibilities, while also reducing production costs.

Automotive manufacturers have capitalized on the operational efficiency and sustainability of nonwoven flanging, reinforcing its dominance within the sector and aligning with long-term industry transformation trends.

When segmented by application, filtration is expected to hold 39.2% of the market revenue in 2025, making it the leading application segment. The increasing demand for high-performance filtration solutions in industrial, automotive, and environmental contexts has driven this prominence.

The superior particle capture efficiency, durability, and adaptability of nonwoven flanging materials have positioned them as the preferred choice in both liquid and air filtration systems. The ability to engineer specific porosity and structural integrity has allowed manufacturers to meet stringent regulatory and operational requirements across various sectors.

Rising awareness of air quality, occupational safety, and environmental protection has further bolstered the segment’s growth, ensuring that filtration remains at the forefront of application areas within the market.

The Nonwoven Flanging Market is experiencing increasing relevance in automotive, HVAC, and industrial manufacturing sectors where edge reinforcement, sealing, and vibration control are critical. Nonwoven flanging materials are applied to component perimeters to provide formability, acoustic dampening, and thermal insulation without adding excessive weight. Their ability to conform to complex geometries, bond with various substrates, and maintain integrity under stress makes them valuable in both static and dynamic assembly applications. As demand grows for lightweight and noise-reducing assemblies, manufacturers are incorporating flanged nonwoven components into design and production lines.

Nonwoven flanging has become a preferred solution in automotive manufacturing due to its combination of flexibility, sound dampening, and heat resistance. Components such as interior panels, HVAC ducts, and trunk liners use nonwoven flanged edges to prevent abrasion, improve fit, and reduce vibration. Automakers are increasingly specifying flanged materials that conform to irregular shapes while maintaining adhesive compatibility with plastic or metal substrates. In electric vehicles, where noise and thermal management are priorities, these materials support passenger comfort without contributing to vehicle mass. As production platforms prioritize modular assemblies and tighter tolerances, flanged nonwovens offer precision along with functional reinforcement. OEMs are collaborating with materials suppliers to customize the density, compressibility, and surface finish of flanged edges to meet exacting interior and safety standards. This level of material integration is contributing to the broader shift toward multi-functional components in automotive design.

HVAC systems and white goods manufacturers are increasingly using nonwoven flanging to enhance product performance and production efficiency. In appliances such as washing machines, dishwashers, and air handlers, flanged nonwoven edges help seal panel joints, reduce vibration, and prevent dust or moisture ingress. These applications demand materials that are easy to process, offer shape retention, and resist deterioration under thermal cycling or mechanical loading. Nonwoven flanging supports streamlined assembly by reducing the need for separate gaskets or adhesives in many configurations. As appliance designs move toward slimmer profiles and quieter operation, nonwoven components contribute to both structural rigidity and acoustic control. Manufacturers are working with suppliers to co-develop flanged materials that withstand cleaning agents, heat, and repeated flexing. The demand for reliable, scalable solutions in appliance and HVAC manufacturing is boosting market share for flanged nonwovens across global production hubs.

Innovation in nonwoven flanging is centered on improving bonding characteristics, long-term durability, and compatibility with automated processing systems. New developments involve thermally bonded or resin-enhanced nonwoven materials that offer superior edge retention, reduce fiber shedding, and integrate more efficiently with injection-molded parts. Manufacturers are exploring blends of polyester, polypropylene, and recycled fibers to meet both performance and cost objectives. Adhesion improvements allow flanged materials to remain fixed during mechanical fastening or exposure to thermal cycling, common in automotive and industrial environments. Additionally, the ability to laser-cut or die-punch complex patterns into flanged components supports broader automation. Suppliers offering consistent roll stock and pre-flanged formats are responding to customer needs for throughput efficiency. These advancements reduce waste, shorten production times, and improve part fitment across a variety of end-use sectors, making material innovation a key pillar in the competitiveness of the nonwoven flanging market.

Although nonwoven flanging offers operational and performance advantages, adoption remains uneven due to cost considerations and limited awareness among smaller manufacturers. Some industrial users continue to favor traditional rubber or plastic edge trims, perceiving them as more durable or cost-effective in bulk orders. In markets where low labor costs dominate, manual installation of generic seals still prevails over purpose-engineered nonwoven solutions. Additionally, designers and engineers unfamiliar with nonwoven properties may overlook their benefits during material selection stages. Lack of clear technical standards or testing benchmarks further complicates specification. To address this, suppliers are offering prototyping support, educational resources, and case studies to demonstrate how nonwoven flanging improves component lifespan, assembly efficiency, and product appearance. Expanding technical sales outreach and integrating product data into CAD libraries are helping bridge the knowledge gap, but broader adoption depends on clearer cost-benefit communication and exposure within engineering networks.

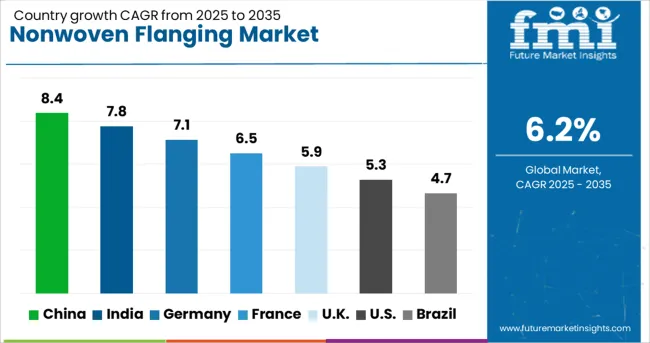

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The global nonwoven flanging market is projected to grow at a CAGR of 6.2% through 2035, supported by its increasing use in automotive gaskets, insulation systems, and industrial sealing components. Among BRICS nations, China leads with 8.4% growth, driven by strong output in auto parts manufacturing and component assembly. India follows at 7.8%, where adoption has been supported by domestic production of engine systems and thermal barriers. In the OECD region, Germany reports 7.1% growth, aided by consistent demand in precision manufacturing and OEM supply chains. France, growing at 6.5%, has maintained procurement across aerospace, HVAC, and mechanical systems. The United Kingdom, at 5.9%, reflects stable demand from industrial machinery producers and construction suppliers. Market development has been influenced by flammability ratings, mechanical performance standards, and approved application specifications. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China has advanced in the nonwoven flanging market at a CAGR of 8.4%, fueled by application in filtration units, automotive insulation systems, and industrial ventilation assemblies. HVAC manufacturers have utilized flanged nonwoven components for stable edge sealing and media layering. Custom die-cut lines have been developed to handle high-speed trimming of flanged inserts for panel filters. Automobile cabin air systems have integrated flanged nonwovens to improve perimeter retention and reduce air leakage. Factory operators have relied on composite roll-fed machines to produce multi-layered media with heat-formed flange edges. Equipment suppliers have delivered ultrasonic welding tools tailored for precision bonding in flanging lines. Packaging firms have used flanged wraps to secure lightweight parts during shipping. Industrial parks have reported increased demand for flanged parts in high-dust manufacturing zones.

India has shown notable progress in the nonwoven flanging market, growing at a CAGR of 7.8%, driven by increased use in HVAC filters, household appliances, and transport air modules. Regional air purifier brands have incorporated flanged edges in their cartridge-style filters for better sealing during operation. Domestic filter converters have adapted rotary die-cut stations to produce round and oval formats with flanged linings. Train ventilation systems and bus cabin filters have deployed nonwoven flanges to ensure leak-free airflow. Contract manufacturers have modified heat sealing lines for faster flange reinforcement on spunbond and meltblown substrates. Consumer appliance brands have moved toward modular filter units using precision-cut flanged nonwovens for easy installation. Roll suppliers have introduced custom-width materials for localized trimming and bonding.

The nonwoven flanging market in Germany has been expanding at a CAGR of 7.1%, supported by usage across industrial cleanrooms, precision ventilation units, and laboratory filtration systems. Engineering teams have selected flanged nonwoven interfaces for maintaining controlled air pressure zones within sealed equipment. Material converters have installed semi-automated flanging modules in media assembly lines to improve uniformity and edge strength. Hospitals and cleanroom suppliers have requested custom flanged filter panels for high-efficiency particulate control. Automotive cabin filtration providers have adopted high-tensile nonwovens with thermoformed flanges for tight-fit housings. Scientific device manufacturers have specified ultrathin flanged formats for compact filter placements. Warehouse automation lines have integrated flanged filter media into airflow regulation modules for temperature-sensitive product zones.

France has demonstrated steady activity in the nonwoven flanging market with a CAGR of 6.5%, as demand grows in food-grade filters, commercial HVAC units, and factory dust collectors. Flanged nonwoven elements have been applied in ventilation ducts to achieve a secure mechanical seal with minimal leakage. Kitchen extractor systems and air purification modules have incorporated flanged designs to ease filter replacement. Nonwoven fabricators have introduced edge-strengthened variants for higher air pressure applications. Equipment installers have favored pre-flanged inserts in rooftop units and underground metro air control panels. Adhesive bonding lines have shifted to flange-capable media to reduce downtime during edge forming. Food packaging plants have deployed flanged filter trays in clean process areas to trap airborne particles.

The United Kingdom has experienced a CAGR of 5.9% in the nonwoven flanging market, supported by application in localized air purification units, portable filtration modules, and small-batch medical filters. Regional air quality solution providers have adopted flanged filters for compact housing in schools, offices, and transit shelters. Nonwoven converters have built tooling systems to create uniform flange edges on low-GSM media. Medical suppliers have incorporated flanged components in isolation room filters and sterilization units. Portable air systems sold via retail outlets have introduced clip-on filter cartridges with integrated flanged seals for ease of replacement. Light industrial workshops have sourced flange-based dust extractors tailored for bench-mounted tools. Flanged packaging wraps have also entered circulation for clean storage of delicate machine parts.

The nonwoven flanging market is supported by major players specializing in engineered fabrics used in hygiene products, medical textiles, and industrial applications where edge reinforcement and structural support are essential. Kimberly‑Clark leads the market with its extensive experience in nonwoven materials tailored for high-speed manufacturing lines and advanced flanging processes, particularly in personal care and disposable hygiene products. Suominen Corporation and Berry Global Group are key suppliers known for producing high-performance spunlace and spunbond fabrics designed to offer strength, flexibility, and compatibility with thermal or ultrasonic flanging methods.

DuPont, with its proprietary nonwoven technologies like Tyvek®, offers specialty materials that maintain integrity during flanging, especially in medical packaging and protective apparel. FiberWeb and Freudenberg Group are also prominent contributors, offering customized solutions for filtration, healthcare, and automotive sectors where edge-sealing and flanging precision are critical. Cygnus Group and Toray Industries provide innovative, lightweight nonwovens with excellent dimensional stability and adaptability to various flanging equipment. Emerging manufacturers such as Synwin Non Wovens, Sunshine Nonwoven Fabric Co., Ltd., and TWE Group are gaining market share by offering cost-effective, scalable nonwoven options that meet growing regional demands, particularly in Asia-Pacific. These suppliers support both OEM and private label needs with materials that enable strong, clean flange formation during high-speed converting. As product complexity increases in hygiene, medical, and industrial applications, demand for consistent, high-strength nonwoven flanging materials continues to drive supplier innovation and market growth.

Dilo Systems GmbH and Turkey’s Kansan Group announced a strategic partnership in May 2025 to deliver customized nonwoven production lines. The collaboration integrates fiber preparation, wetlaid, hydroentanglement, and end-of-line technologies for hygiene, medical, and technical applications, with Dilo serving as the main engineering contractor for turnkey solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 610.0 Million |

| Material | Polypropylene (PP), Polyester (PET), Polyethylene (PE), and Others |

| End-Use Industry | Automotive, Industrial Machinery, Construction, and Others |

| Application | Filtration, Seals & Gaskets, Thermal & Acoustic Insulation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kimberly‑Clark, Suominen Corporation, Berry Global Group, DuPont, FiberWeb, Freudenberg Group, Cygnus Group, Toray Industries, Synwin Non Wovens, Sunshine Nonwoven Fabric Co., Ltd., and TWE Group |

| Additional Attributes | Dollar sales by nonwoven flanging type including polyester-based, polypropylene-based, cellulose-based, nylon-based, and other fiber materials, by application in automotive components, medical textiles, personal care packaging, and industrial filtration, and by geographic region including North America, Europe, and Asia-Pacific; demand driven by lightweight materials adoption, hygiene product consumption, and automotive production; innovation in biodegradable fibers, nanofiber layering, and automated edge finishing; costs influenced by fiber sourcing, production technology, and regulatory compliance; and emerging use cases in advanced medical disposables, vehicle acoustic linings, and sustainable packaging solutions. |

The global nonwoven flanging market is estimated to be valued at USD 610.0 million in 2025.

The market size for the nonwoven flanging market is projected to reach USD 1,113.2 million by 2035.

The nonwoven flanging market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in nonwoven flanging market are polypropylene (pp), polyester (pet), polyethylene (pe) and others.

In terms of end-use industry, automotive segment to command 51.7% share in the nonwoven flanging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Staples PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA