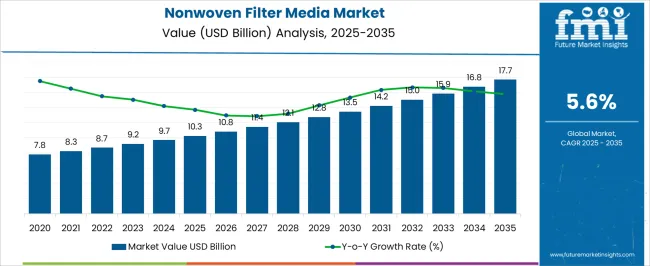

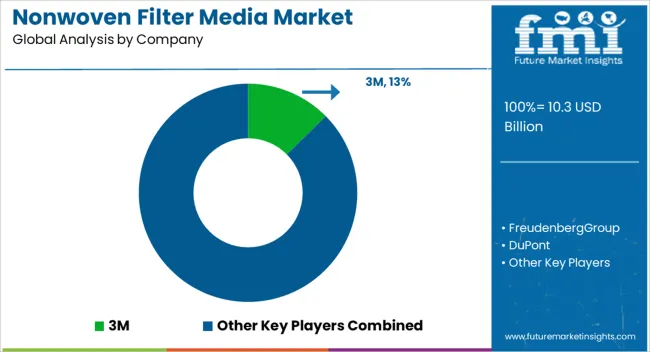

The nonwoven filter media market is projected to grow steadily, with industry size reaching USD 10.3 billion in 2025 and expanding to USD 17.7 billion by 2035, reflecting a CAGR of 5.6%. Growth is driven by rising demand for high-performance filtration in industries such as automotive, healthcare, water treatment, and HVAC systems. Increasing concerns about air and water quality, coupled with stricter environmental and safety regulations, are fueling adoption. Advancements in nanofiber technology and sustainable nonwoven materials further enhance performance, efficiency, and cost-effectiveness.

| Metric | Value |

|---|---|

| Nonwoven Filter Media Market Estimated Value in (2025 E) | USD 10.3 billion |

| Nonwoven Filter Media Market Forecast Value in (2035 F) | USD 17.7 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The nonwoven filter media market is experiencing substantial growth due to heightened environmental regulations, industrial hygiene standards, and expanding applications in air and liquid filtration. Industries across manufacturing, healthcare, and automotive sectors are increasingly adopting nonwoven filter media owing to their customizable porosity, lightweight structure, and superior particulate retention capabilities. The integration of advanced fiber technologies and composite layering techniques has enhanced the performance of nonwoven media in both air and fluid filtration systems.

Innovations in meltblown and spunbond production methods have allowed scalability while maintaining uniformity and efficiency across large-scale deployments. As global attention turns toward indoor air quality, emission control, and workplace safety, the demand for high-efficiency filtration materials is being reinforced by policy frameworks and public health directives.

Additionally, the nonwoven format enables greater design flexibility and supports sustainable production practices, aligning with circular economy goals. The market is expected to remain resilient as industries continue to prioritize filtration performance, sustainability, and cost-effectiveness.

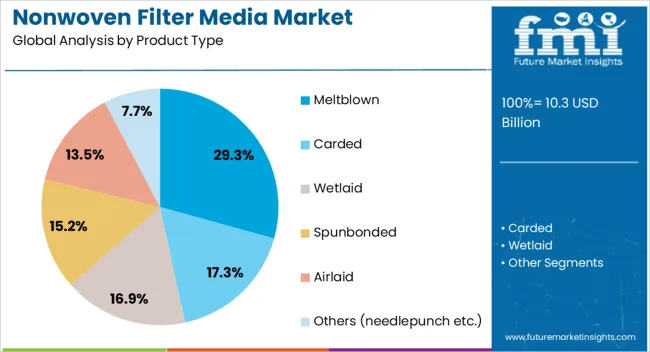

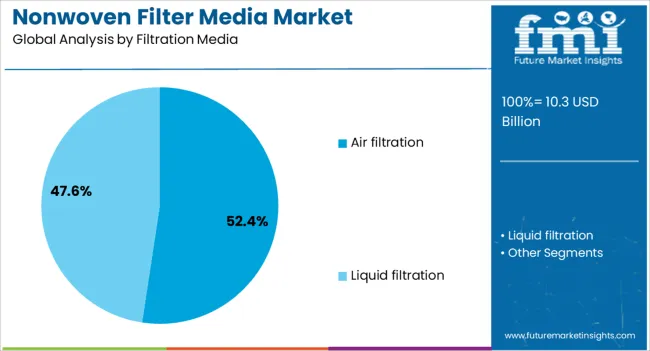

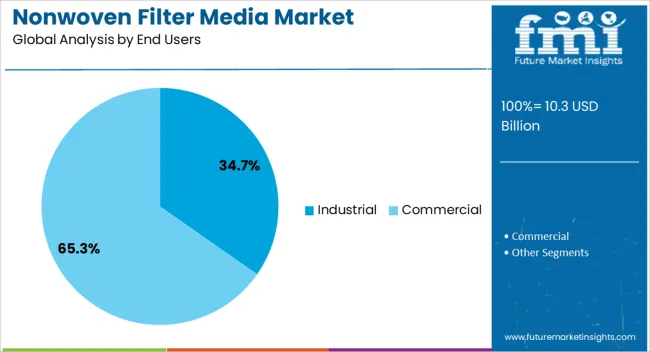

The nonwoven filter media market is segmented by product type, filtration media, end users, distribution channel, and geographic regions. By product type, nonwoven filter media market is divided into Meltblown, Carded, Wetlaid, Spunbonded, Airlaid, and Others (needlepunch etc.). In terms of filtration media, nonwoven filter media market is classified into Air filtration and Liquid filtration. Based on end users, nonwoven filter media market is segmented into Industrial and Commercial. By distribution channel, nonwoven filter media market is segmented into Direct sales and Indirect sales. Regionally, the nonwoven filter media industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The meltblown product type segment is expected to account for 29.3% of the nonwoven filter media market revenue share in 2025. This leadership is being driven by the unique microstructure of meltblown fibers, which offer exceptionally fine filtration capabilities. The high surface area and small fiber diameter of meltblown nonwovens enable effective capture of submicron particles, making them critical in applications such as respiratory masks, HVAC systems, and cleanroom environments.

The segment’s dominance is further supported by its suitability for electrostatic charging, which enhances particle retention without significantly increasing air resistance. Demand for meltblown materials surged during the global health crisis and continues to remain strong across pharmaceutical, environmental, and industrial sectors due to their efficiency and adaptability.

The ability to customize fiber configurations and integrate antimicrobial treatments has positioned meltblown media as a versatile solution in advanced filtration technologies. Ongoing investments in production infrastructure and material science innovation are expected to further strengthen this segment's relevance in high-performance filtration systems.

The air filtration segment is projected to represent 52.4% of the total revenue share in the nonwoven filter media market by 2025, underscoring its critical role in modern filtration applications. Rising concerns around air quality in both residential and industrial environments have prompted an increased focus on efficient airborne contaminant removal. Nonwoven filter media have been adopted extensively in air purification systems due to their high dust holding capacity, breathability, and ability to support layered composite configurations.

The market is being shaped by government initiatives mandating improved air quality standards in workplaces, manufacturing facilities, and public infrastructure. Nonwovens used in air filtration provide advantages in energy efficiency, pressure drop performance, and durability, which have become essential criteria in HVAC and cleanroom applications.

The flexibility in design and the potential for integrating antimicrobial or carbon-based treatments have further reinforced the segment’s position. As awareness around airborne pathogens and fine particulate matter continues to grow, air filtration using nonwoven media is poised to remain a dominant application area.

The industrial end user segment is anticipated to hold 34.7% of the nonwoven filter media market revenue share in 2025. This dominance is being driven by the critical role filtration plays in ensuring regulatory compliance, product quality, and equipment longevity across manufacturing and processing sectors.

Nonwoven filter media are being increasingly deployed in chemical plants, food processing units, electronics manufacturing, and heavy machinery operations due to their ability to handle high flow rates, withstand harsh operating environments, and offer consistent filtration efficiency. The adaptability of nonwoven configurations allows for tailored solutions that meet specific industry demands, such as chemical compatibility, thermal resistance, and particulate filtration precision.

The shift toward automated and closed-loop production systems has further emphasized the need for reliable and maintenance-efficient filtration media. Moreover, as industries aim to reduce downtime, energy consumption, and operational risk, the demand for advanced nonwoven filter media in dust collection, liquid purification, and air handling units is expected to remain strong across global industrial landscapes.

The nonwoven filter media market is experiencing robust growth, driven by increasing demand for efficient filtration solutions in industries such as automotive, healthcare, and industrial applications. Nonwoven filter media offer advantages like enhanced filtration efficiency, cost-effectiveness, and the ability to capture fine particles from air and liquids. As regulatory requirements become stricter, there is a growing focus on improving filtration technologies. The market is expanding due to advancements in materials, such as bio-based nonwoven media, which are becoming more popular for applications requiring better performance. Technological innovations and the need for cost-effective solutions in various sectors are expected to further drive market growth.

The rise in air and water pollution, along with stricter environmental regulations, is driving industries to adopt more efficient filtration solutions. Nonwoven filter media are capable of meeting these stringent standards and delivering high performance in both air and liquid filtration systems. Industries like automotive, pharmaceuticals, and HVAC rely on these materials for improved air quality and filtration effectiveness. As urbanization and industrialization continue to rise, especially in emerging economies, the demand for efficient filtration systems is growing. Increasing consumer awareness of air and water quality is pushing more industries to adopt nonwoven filter media to ensure cleaner and healthier environments, further boosting market growth across various applications and sectors.

One of the key hurdles is the volatility in the prices of raw materials such as polypropylene and polyester, which impacts production costs and pricing strategies, especially for manufacturers with budget constraints. Continuous innovation is required to meet evolving regulatory standards and consumer expectations for better filtration efficiency, which increases R&D expenses. The competition from alternative filtration materials poses a challenge to market dominance. Environmental concerns related to the disposal and biodegradability of nonwoven filter media are also growing, forcing manufacturers to adopt better production practices and sustainable solutions to meet consumer and regulatory demands, thus adding complexity to the development process.

The development of bio-based nonwoven materials to meet the growing demand for high-performance filtration solutions is gaining momentum. Integration of smart technologies like IoT-enabled sensors in filtration systems can significantly enhance real-time monitoring, improve efficiency, and offer more precise control over operations. Emerging industries, including semiconductor manufacturing, electric vehicles, and cleanroom environments, offer new applications that are driving the demand for advanced nonwoven filter media solutions. Collaborations between manufacturers, research institutions, and regulatory bodies are also creating opportunities for developing high-quality, industry-specific nonwoven filter products. As industries look for better performance and enhanced adaptability in their filtration processes, the market is poised for growth, fostering innovation and expanding applications across sectors.

A notable trend is the increasing focus on recyclable materials, which is driving the development of nonwoven media that are easier to dispose of and cause less environmental harm. Advances in manufacturing technologies, including meltblown and spunbond processes, are improving the efficiency and performance of nonwoven filter media. The integration of artificial intelligence (AI) and machine learning (ML) into filtration systems is enabling predictive maintenance, optimization of operations, and reduced downtime. Furthermore, customization of nonwoven filter media is becoming increasingly important, as industries seek tailored solutions to meet specific filtration requirements. These trends point to a dynamic and evolving market with continuous advancements driving the adoption of innovative nonwoven filter media technologies in various industries.

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

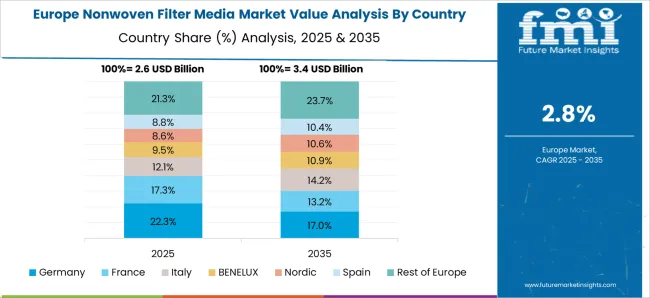

The global nonwoven filter media market is projected to grow at a CAGR of 5.6% from 2025 to 2035. Among the key markets, China leads with a growth rate of 7.6%, followed by India at 7.0%, and France at 5.9%. The United Kingdom and the United States show more moderate growth rates of 5.3% and 4.8%, respectively. This growth is driven by the increasing demand for filtration solutions across various industries such as automotive, manufacturing, and environmental protection. Emerging markets like China and India are expanding rapidly, while developed markets focus on innovation in industrial filtration technologies. The analysis includes over 40+ countries, with the leading markets detailed below.

China is expected to lead the global nonwoven filter media market, growing at a projected CAGR of 7.6% from 2025 to 2035. The country’s rapidly expanding industrial and manufacturing sectors, particularly in automotive, HVAC, and environmental industries, are key drivers of demand. As China continues to invest in infrastructure and environmental protection, the demand for efficient filtration solutions is increasing. The country’s growing focus on air and water pollution control, along with the rise of industrialization, is further boosting the need for high-performance nonwoven filter media. China’s large-scale production of consumer goods and automobiles continues to drive the adoption of nonwoven filter materials.

The nonwoven filter media market in India is projected to grow at a CAGR of 7.0% from 2025 to 2035. The country’s increasing industrialization, along with rising demand for air and water filtration solutions, is driving the demand for nonwoven filter media. India’s expanding automotive, manufacturing, and energy sectors are major contributors to market growth. The government’s growing focus on environmental regulations and pollution control is further pushing the adoption of advanced filtration technologies. As India’s middle class expands and the demand for clean air and water rises, the nonwoven filter media market is set to experience strong growth.

The nonwoven filter media market in Germany is expected to grow at a steady pace, with a projected CAGR of 5.9% from 2025 to 2035. The country’s strong automotive, aerospace, and industrial sectors continue to drive demand for filtration solutions. France’s increased focus on environmental protection and sustainable energy is contributing to the growing need for advanced filtration materials. The adoption of nonwoven filter media in HVAC, air purifiers, and industrial filtration systems is also rising as industries prioritize efficiency and environmental responsibility. With France’s emphasis on clean technologies, the demand for high-performance filter media will continue to rise.

The nonwoven filter media market in the United Kingdom is projected to grow at a CAGR of 5.3% from 2025 to 2035. The UK’s demand for nonwoven filter media is driven by its growing industrial and environmental needs, particularly in water and air filtration systems. The country’s investments in air pollution control and water treatment technologies are contributing to the increased use of nonwoven filter materials. As the UK continues to innovate in industrial filtration solutions and environmental protection, the market for nonwoven filter media is expected to experience steady growth, offering new opportunities for manufacturers.

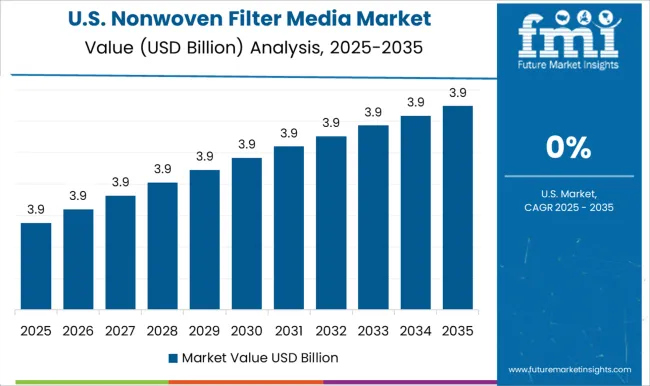

The nonwoven filter media market in the United States is projected to grow at a CAGR of 4.8% from 2025 to 2035. The USA market is driven by increasing demand for filtration solutions across industries such as automotive, manufacturing, and environmental protection. As the country continues to focus on improving air and water quality, the demand for high-efficiency filtration materials, including nonwoven filter media, is rising. The growth of consumer goods production and the need for industrial filtration solutions are contributing to the market’s expansion. As the USA adopts more advanced filtration technologies, the market for nonwoven filter media is set to experience steady growth.

The nonwoven filter media market is experiencing significant growth, driven by increasing demand for efficient filtration solutions across various industries. Leading players in this market include 3M, Freudenberg Group, DuPont, Donaldson, Kimberly-Clark, Mann+Hummel, Ahlstrom, Glatfelter, Johns Manville, Camfil Group, Sandler Group, Avintiv, Gessener, Mogul, and Americo. These companies are at the forefront of innovation, offering a wide range of nonwoven filter media products designed for applications such as air and liquid filtration, automotive, healthcare, and industrial processes.

3M is renowned for its high-performance filtration materials, while DuPont offers a variety of nonwoven fabrics specifically used in filtration applications. Freudenberg Group provides advanced nonwoven filter media solutions, enhancing the efficiency and effectiveness of filtration systems. Donaldson specializes in filtration systems and replacement parts, serving industries like automotive, industrial, and transportation. Kimberly-Clark offers a range of nonwoven products, some of which are used in filtration systems. Mann+Hummel is well-known for its filtration solutions in automotive and industrial sectors.

The competitive landscape is characterized by continuous innovation, with companies expanding their product portfolios and improving the performance of their filtration solutions to meet the growing demand for high-quality filtration systems across various industries. These companies also differentiate themselves through technological advancements, providing more efficient and reliable products tailored to meet the evolving needs of the market.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.3 Billion |

| Product Type | Meltblown, Carded, Wetlaid, Spunbonded, Airlaid, and Others (needlepunch etc.) |

| Filtration Media | Air filtration and Liquid filtration |

| End Users | Industrial and Commercial |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, FreudenbergGroup, DuPont, Donaldson, Kimberly-Clark, Mann+Hummel, Ahlstrom, Glatfelter, JohnsManville, CamfilGroup, SandlerGroup, Avintiv, Gessener, Mogul, and Americo |

| Additional Attributes | Dollar sales by product type (polyester, polypropylene, glass fiber, cellulose) and end-use segments (automotive, HVAC, healthcare, industrial, air/water filtration). Demand dynamics are driven by increasing environmental concerns, stricter air and water quality regulations, and the growing need for efficient filtration solutions. Regional trends indicate strong growth in Asia-Pacific, North America, and Europe, fueled by industrial expansion and heightened awareness of environmental issues. |

The global nonwoven filter media market is estimated to be valued at USD 10.3 billion in 2025.

The market size for the nonwoven filter media market is projected to reach USD 17.7 billion by 2035.

The nonwoven filter media market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in nonwoven filter media market are meltblown, carded, wetlaid, spunbonded, airlaid and others (needlepunch etc.).

In terms of filtration media, air filtration segment to command 52.4% share in the nonwoven filter media market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Staples PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA