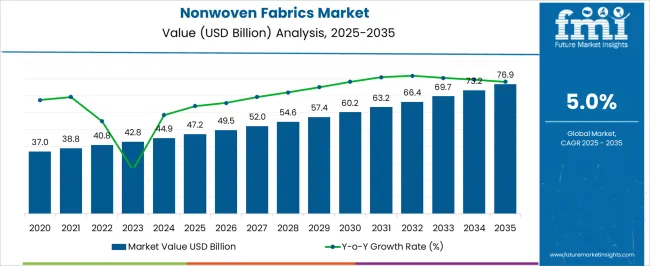

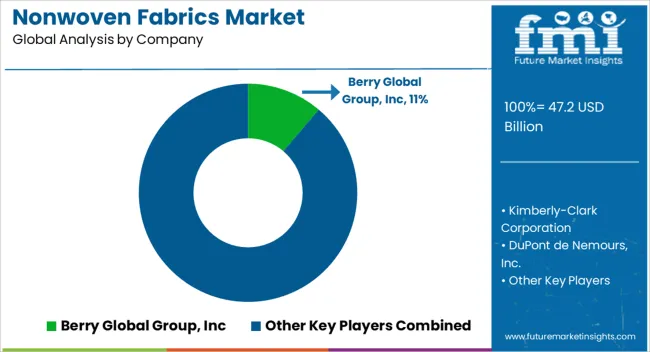

The nonwoven fabrics market is estimated to be valued at USD 47.2 billion in 2025 and is projected to reach USD 76.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The primary cost elements in this market are raw fibers, including polypropylene, polyester, and viscose, which collectively account for a substantial portion of total production costs. Fiber selection impacts both material expenses and the performance characteristics of the final nonwoven products, influencing application-specific pricing in sectors such as hygiene, filtration, automotive, and construction.

Manufacturing costs form another significant component of the value chain, encompassing processes such as spunbond, meltblown, needle-punching, and hydroentanglement. Energy consumption, labor, machinery maintenance, and process efficiency determine production expenditures, with higher automation and advanced machinery driving moderate cost reductions while enabling consistent product quality. Post-production operations, including finishing, cutting, and packaging, further contribute to total costs and affect supply chain efficiency.

Distribution and logistics represent the final cost layer, where transportation, storage, and inventory management influence margins, particularly for global supply chains serving multiple industries. Over the forecast period, the market value trajectory reflects incremental cost efficiencies achieved through process optimization, technological upgrades, and strategic sourcing of raw materials. The value-chain analysis underscores that cost management across fibers, manufacturing technologies, and distribution networks is pivotal to sustaining profitability and competitiveness in the nonwoven fabrics sector while supporting gradual market expansion from USD 47.2 billion to USD 76.9 billion.

| Metric | Value |

|---|---|

| Nonwoven Fabrics Market Estimated Value in (2025 E) | USD 47.2 billion |

| Nonwoven Fabrics Market Forecast Value in (2035 F) | USD 76.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The nonwoven fabrics market represents a specialized segment within the global textiles and technical fabrics industry, emphasizing lightweight construction, durability, and versatility. Within the broader textile sector, it accounts for about 5.2%, driven by demand in hygiene, medical, filtration, automotive, and construction applications. In the technical textiles segment, its share is approximately 6.1%, reflecting adoption for geotextiles, protective clothing, and industrial uses. Across the medical and hygiene products market, it holds around 4.8%, supporting surgical gowns, masks, wipes, and absorbent products. Within the filtration and environmental protection category, it represents 3.9%, highlighting use in air, water, and liquid filtration systems.

In the overall industrial and consumer materials ecosystem, the market contributes about 4.4%, emphasizing functional performance, cost efficiency, and adaptability for diverse end-use applications. Recent developments in the nonwoven fabrics market have focused on material innovation, production efficiency, and eco-conscious manufacturing. Groundbreaking trends include the use of biodegradable polymers, spunbond-meltblown-spunbond (SMS) structures, and advanced laminating techniques to improve strength, softness, and filtration efficiency. Key players are collaborating with the healthcare, automotive, and construction industries to develop high-performance, lightweight, and sustainable nonwoven solutions.

Adoption of automation, digital monitoring, and energy-efficient production lines is gaining traction to optimize output and reduce costs. Research on multifunctional fabrics with antimicrobial, flame-retardant, and water-repellent properties is driving product innovation. These trends demonstrate how versatility, performance, and sustainability are defining the market.

The nonwoven fabrics market is expanding steadily, driven by their rising use across hygiene, medical, automotive, and construction industries. The unique combination of lightweight properties, breathability, durability, and cost-effectiveness makes nonwovens highly suitable for both disposable and long-term applications.

A surge in demand for hygiene and personal care products, especially in emerging markets, has fueled consumption of nonwoven materials, while ongoing advancements in production technologies are enabling greater customization and sustainability. The push for biodegradable and recyclable nonwovens, coupled with regulations favoring eco-friendly products, is influencing innovation in fiber selection and processing techniques.

The market is expected to benefit from increasing investments in automation, green technologies, and the growing healthcare sector, making nonwoven fabrics a critical input material for a wide array of industrial and consumer applications

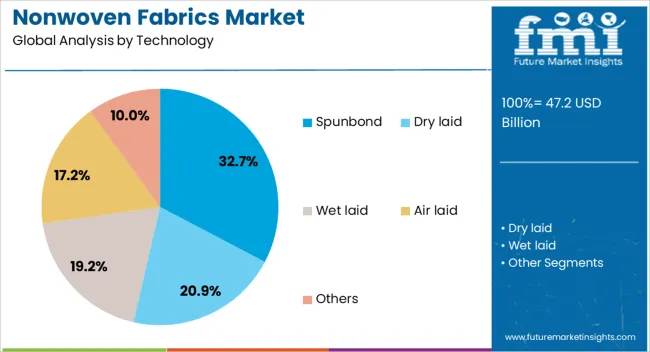

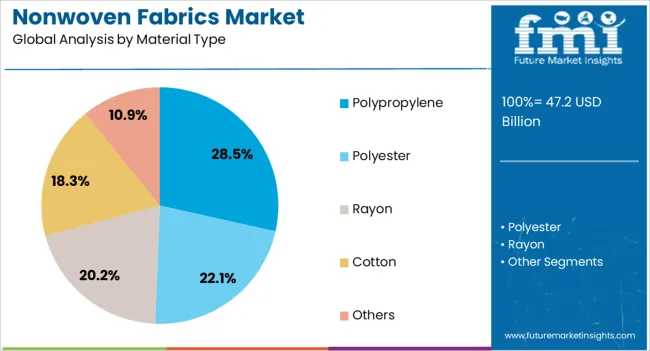

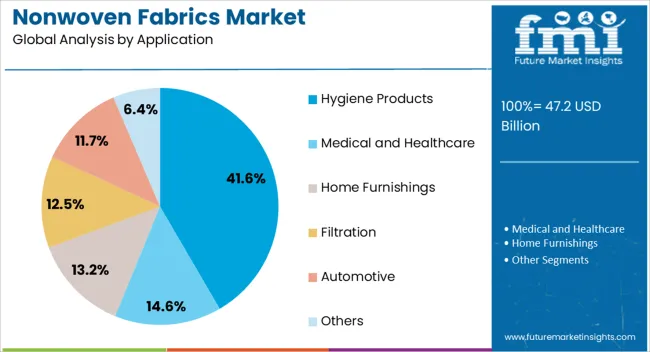

The nonwoven fabrics market is segmented by technology, material type, application, and geographic regions. By technology, nonwoven fabrics market is divided into Spunbond, Dry laid, Wet laid, Air laid, and Others. In terms of material type, nonwoven fabrics market is classified into Polypropylene, Polyester, Rayon, Cotton, and Others. Based on application, nonwoven fabrics market is segmented into Hygiene Products, Medical and Healthcare, Home Furnishings, Filtration, Automotive, and Others. Regionally, the nonwoven fabrics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The spunbond segment accounts for 32.7% of the nonwoven fabrics market by technology, owing to its ability to deliver high tensile strength, uniformity, and process efficiency. This technology is widely preferred for producing continuous filament fibers that are thermally bonded, resulting in fabrics with excellent durability and cost-performance balance.

Its compatibility with high-speed production lines and suitability for a broad range of applications such as hygiene products, medical drapes, and agricultural coverings contribute to its strong market position. The low production cost and versatility of spunbond nonwovens are encouraging manufacturers to expand their capacities and integrate with downstream product lines.

As the demand for disposable and lightweight materials continues to grow globally, the spunbond segment is expected to remain at the forefront, supported by technological innovations and its ability to meet functional and regulatory requirements across multiple end uses

Polypropylene holds a 28.5% share in the material type category, maintaining its dominance due to its lightweight nature, chemical resistance, and ease of processing in nonwoven applications. This thermoplastic polymer is extensively used for hygiene, medical, and filtration products where softness, barrier properties, and affordability are essential.

Its low melt viscosity and compatibility with major nonwoven technologies, including spunbond and meltblown, have cemented its role as a primary raw material. The recyclability of polypropylene further aligns with increasing environmental regulations and corporate sustainability goals, encouraging its continued adoption.

In response to global hygiene demands and pandemic-related shifts, polypropylene-based nonwovens have seen elevated usage in face masks and protective apparel. As manufacturers continue to invest in material innovation and circular economy strategies, polypropylene is expected to retain its leading status in the nonwoven fabrics market

Hygiene products represent the largest application segment with a commanding 41.6% market share, driven by sustained demand for baby diapers, feminine care products, adult incontinence items, and wet wipes. Nonwoven fabrics are indispensable in this category due to their softness, absorbency, breathability, and hypoallergenic characteristics, which are critical for consumer comfort and product efficacy.

Growth in this segment is fueled by rising awareness of personal hygiene, expanding urban populations, and increased spending on health and wellness, particularly in developing economies. Manufacturers are responding with advanced nonwovens that offer odor control, fluid management, and skin-friendliness, while also pursuing bio-based and compostable materials in response to environmental concerns.

As private label brands and premium hygiene products proliferate globally, demand for high-performance nonwoven materials is expected to grow steadily, reinforcing the dominance of hygiene applications in the overall market landscape

The market has expanded due to their versatility, cost-effectiveness, and wide industrial applications. Nonwoven fabrics are produced through bonding fibers mechanically, chemically, or thermally, providing customizable properties such as strength, absorbency, and filtration efficiency. They are used extensively in hygiene products, medical textiles, filtration media, automotive interiors, geotextiles, and construction materials. Rising demand from healthcare, personal care, and industrial sectors has propelled market growth. Manufacturers are investing in advanced production technologies and sustainable raw materials, including recycled fibers and bio-based polymers.

Nonwoven fabrics are widely adopted in healthcare and hygiene products due to their sterility, breathability, and absorbency. Surgical gowns, face masks, wound dressings, diapers, feminine hygiene products, and wipes rely heavily on nonwoven materials for performance and safety. The global emphasis on healthcare infrastructure, rising hospitalizations, and stringent hygiene regulations have accelerated demand. Innovations in fiber bonding and surface treatments enhance fluid resistance, softness, and strength, catering to high-performance applications. The integration of nonwovens in disposable and reusable medical products ensures infection control, user comfort, and environmental efficiency. Market growth is further supported by increasing consumer awareness and adoption of hygienic and protective solutions in both developed and emerging economies.

Nonwoven fabrics are extensively used in industrial filtration, automotive, construction, and packaging applications. Filtration media, insulation mats, geotextiles, protective covers, and automotive interiors utilize nonwoven materials for durability, thermal stability, and chemical resistance. Advanced manufacturing processes enable customization of fiber composition, thickness, porosity, and mechanical strength to suit diverse operational needs. Rapid industrialization, growing automotive production, and increased air and water quality monitoring initiatives have boosted demand for high-performance nonwovens. Manufacturers focus on producing sustainable, fire-retardant, and mechanically robust fabrics to meet industrial standards. Nonwoven fabrics provide cost-effective, lightweight, and high-efficiency solutions, reinforcing their role as critical components in modern industrial processes.

Technological innovations in spunbond, meltblown, needle-punched, and hydroentangled nonwovens have improved product performance and application versatility. Advanced bonding techniques and surface modifications enhance strength, permeability, softness, and barrier properties. Sustainability initiatives, including recycled fibers, biodegradable polymers, and low-energy production processes, have become central to market development. Companies are investing in R&D to produce eco-friendly nonwovens for hygiene, filtration, and packaging applications. Digital process monitoring and automated production lines improve efficiency, reduce defects, and enable scalable production. These innovations have made nonwoven fabrics more competitive compared to traditional textiles, supporting broader adoption in industrial, healthcare, and consumer applications worldwide.

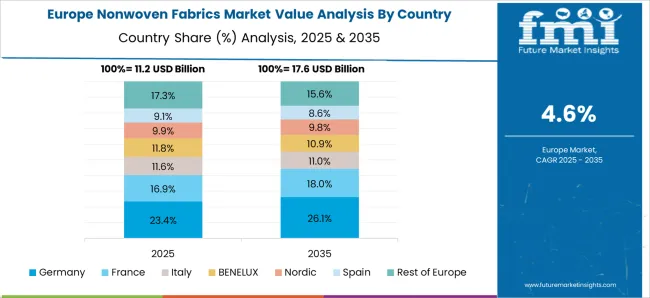

North America and Europe dominate the nonwoven fabrics market due to mature manufacturing infrastructure, stringent regulatory compliance, and high consumption in healthcare and hygiene sectors. Asia Pacific is emerging as a high-growth region, driven by rapid industrialization, expanding hygiene product markets, and rising construction activities. Market participants focus on product innovation, sustainable material sourcing, and strategic partnerships to strengthen their competitive position. Growth is also influenced by government initiatives supporting eco-friendly materials, investments in healthcare, and industrial modernization. The combination of advanced technologies, expanding end-use applications, and increasing demand for high-performance nonwoven fabrics is expected to sustain long-term market growth globally.

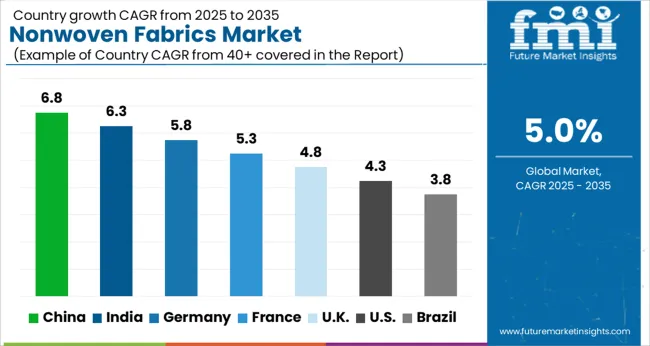

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The market is anticipated to expand at a CAGR of 5.0% between 2025 and 2035, reflecting growing applications across healthcare, hygiene, and industrial sectors. China registers 6.8%, leading due to large-scale manufacturing and rising demand for medical and hygiene products. India follows at 6.3%, supported by expanding domestic consumption and industrial applications. Germany records 5.8%, driven by high-quality production standards and technical innovations. The UK stands at 4.8%, fueled by sustainable and specialized nonwoven fabric adoption, while the USA reaches 4.3%, reflecting steady demand across healthcare and construction applications. These countries highlight the ongoing scaling and technological advancement in the nonwoven fabrics sector. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is registering a CAGR of 6.8%, supported by large-scale consumption in hygiene, medical, and industrial applications. The country has emerged as the global hub for nonwoven production due to its integrated supply chain, cost competitiveness, and rapid technology adoption. Spunbond and meltblown fabrics remain key product categories, especially after the surge in demand for medical and protective equipment. Beyond healthcare, construction, agriculture, and automotive sectors increasingly use nonwovens for insulation, filtration, and reinforcement. Continuous investment in advanced manufacturing units with automation and sustainability features strengthens China’s position as a dominant supplier to both domestic and export markets.

India is expanding at a CAGR of 6.3%, driven by rising demand across personal hygiene, healthcare, agriculture, and industrial uses. Growth is underpinned by increasing adoption of disposable nonwovens in diapers, sanitary products, and medical consumables. Government initiatives supporting healthcare infrastructure and the packaging sector further drive demand. Local manufacturers are investing in spunbond, thermal bond, and needle-punched fabrics to reduce reliance on imports. Export opportunities are increasing, particularly to Middle Eastern and African markets, where demand for cost-effective hygiene products is rising. The market is also witnessing early-stage innovation in biodegradable and recycled fiber-based nonwovens to meet sustainability goals.

Germany is witnessing growth at a CAGR of 5.8%, supported by strong industrial and medical demand. The country’s focus on quality, innovation, and compliance with EU sustainability regulations has positioned it as a key supplier of high-performance nonwovens. Applications include filtration media, protective apparel, wound dressings, automotive interiors, and geotextiles. Investment in recyclable and bio-based fibers is gaining momentum, aligning with Europe’s green transition targets. Germany also serves as a technology hub, exporting advanced nonwoven machinery and solutions to other regions. The balance between innovation, regulatory compliance, and high-quality production sustains its role in the global market.

The United Kingdom is advancing at a CAGR of 4.8%, supported by demand in hygiene, medical, and specialty industrial applications. The UK industry emphasizes quality-driven solutions with growing focus on specialty nonwovens for protective equipment, filtration, and advanced packaging. Manufacturers are increasingly adopting sustainable raw materials and recycling processes in response to regulatory pressures. Export potential is also notable, particularly in Europe, where high-quality nonwovens are in demand for healthcare and industrial use. Despite smaller production volumes compared to China or India, the UK market leverages innovation and niche applications to maintain competitiveness.

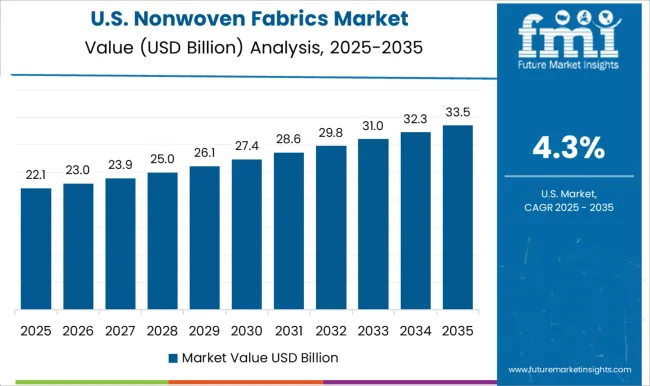

The United States is growing at a CAGR of 4.3%, with demand supported by healthcare, hygiene, automotive, and filtration industries. The pandemic accelerated investment in meltblown and spunbond lines, which now continue to serve broader applications such as masks, wipes, and medical gowns. Beyond healthcare, nonwovens are being integrated into geotextiles, insulation, and automotive interiors. Sustainability is a growing driver, with manufacturers investing in biodegradable and recyclable nonwovens. The US market is characterized by large multinational players, advanced R&D, and strong alignment with safety and environmental standards. Export activities are also significant, with shipments of medical-grade nonwovens to Latin America and Europe.

The market is characterized by strong competition among global and regional players, driven by diverse applications in hygiene, medical, filtration, automotive, and construction sectors. Leading multinational corporations such as Berry Global Group, Inc, Kimberly-Clark Corporation, and DuPont de Nemours, Inc. hold significant market share owing to their robust R&D capabilities, wide product portfolios, and strong distribution networks across multiple geographies. Their focus on sustainable and high-performance nonwoven materials strengthens brand positioning and fosters long-term customer loyalty. European and Asian specialists such as Ahlstrom-Munksjo Oyj, Freudenberg Group, Fibertex Nonwovens A/S, Avgol Nonwovens, and Toray Industries, Inc. compete by offering innovative solutions such as biodegradable, spunbond, and meltblown fabrics. Their agility in addressing regional standards and evolving consumer demands enhances their market presence. Niche players, including SWM International, Suominen Corporation, Johns Manville, TWE Group, PFNonwovens Group, and Glatfelter Corporation, focus on product differentiation through specialty applications, lightweight materials, and environmentally friendly processes. Market growth is largely influenced by increasing healthcare awareness, hygiene product demand, and industrial applications, making technological innovation, sustainability, and supply chain efficiency critical competitive factors for market leadership.

| Item | Value |

|---|---|

| Quantitative Units | USD 47.2 Billion |

| Technology | Spunbond, Dry laid, Wet laid, Air laid, and Others |

| Material Type | Polypropylene, Polyester, Rayon, Cotton, and Others |

| Application | Hygiene Products, Medical and Healthcare, Home Furnishings, Filtration, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Berry Global Group, Inc, Kimberly-Clark Corporation, DuPont de Nemours, Inc., Ahlstrom-Munksjo Oyj, Freudenberg Group, Fibertex Nonwovens A/S, Avgol Nonwovens, Toray Industries, Inc, SWM International, Suominen Corporation, Johns Manville, TWE Group, PFNonwovens Group, and Glatfelter Corporation |

| Additional Attributes | Dollar sales by fabric type and application, demand dynamics across medical, hygiene, automotive, and industrial sectors, regional trends in nonwoven adoption, innovation in fiber technology, durability, and functional finishes, environmental impact of production and disposal, and emerging use cases in disposable hygiene products, filtration media, and sustainable packaging solutions. |

The global nonwoven fabrics market is estimated to be valued at USD 47.2 billion in 2025.

The market size for the nonwoven fabrics market is projected to reach USD 76.9 billion by 2035.

The nonwoven fabrics market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in nonwoven fabrics market are spunbond, dry laid, wet laid, air laid and others.

In terms of material type, polypropylene segment to command 28.5% share in the nonwoven fabrics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA