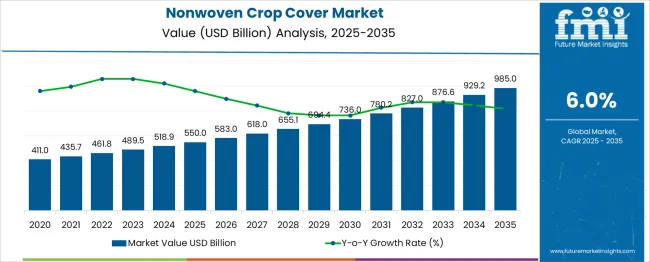

The Nonwoven Crop Cover Market is estimated to be valued at USD 550.0 billion in 2025 and is projected to reach USD 985.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. In 2020, the market size stood at USD 411.0 billion, progressively expanding to USD 435.7 billion in 2021 and USD 461.8 billion in 2022. The incremental annual growth translates into an increasing absolute dollar opportunity, with the market adding USD 24.7 billion in 2021, USD 26.1 billion in 2022, and continuing to rise steadily year-over-year.

By 2025, with a value of USD 550.0 billion, the sector captures an accumulated absolute dollar opportunity of nearly USD 139 billion from 2020, highlighting the market’s resilience and growing adoption across agricultural applications. Between 2025 and 2035, the market demonstrates even stronger dollar potential, as the value reaches USD 985.0 billion by 2035.

The annual absolute dollar increments range from USD 33 billion in 2026 to over USD 55 billion in 2035, reflecting the compounding impact of steady 6.0% growth. Over this decade, the cumulative absolute dollar opportunity exceeds USD 435 billion, driven by rising demand for crop protection, yield enhancement, and climate-resilient agriculture. The market’s steady expansion underlines the importance of technological innovation in nonwoven materials and increasing adoption in emerging economies, positioning the sector for robust long-term growth.

| Metric | Value |

|---|---|

| Nonwoven Crop Cover Market Estimated Value in (2025E) | USD 550.0 billion |

| Nonwoven Crop Cover Market Forecast Value in (2035F) | USD 985.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The nonwoven crop cover market is undergoing strong growth as sustainability imperatives, climate variability, and the need for improved agricultural productivity converge to reshape farming practices. Adoption is being influenced by the ability of nonwoven materials to provide superior protection against frost, pests, and excessive sunlight, while promoting moisture retention and reducing chemical usage.

Fabric innovations offering lightweight yet durable solutions have strengthened their appeal across diverse climatic conditions and crop types. Future growth is expected to benefit from increasing investments in modern farming techniques, heightened awareness of sustainable cultivation practices, and expansion of organized retail agriculture.

Strategic collaborations between material producers and agricultural enterprises are paving the way for new product introductions and enhanced penetration, particularly in high-value horticultural and export-oriented crop segments. Regulatory encouragement of eco-friendly farming inputs and the rising premium placed on yield optimization are anticipated to sustain market momentum over the coming years.

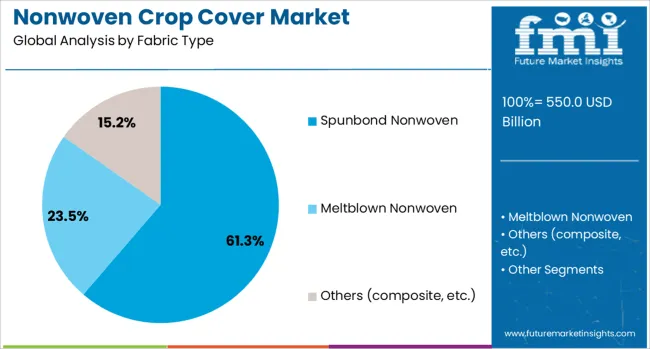

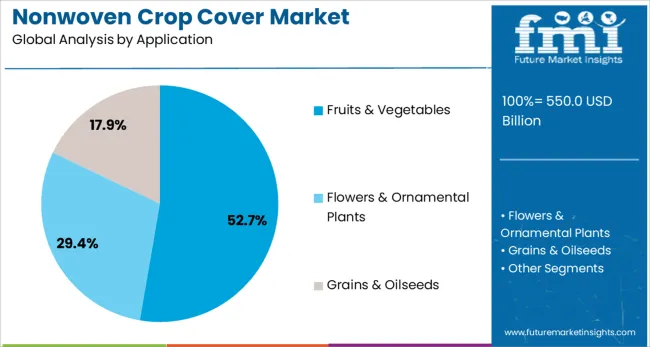

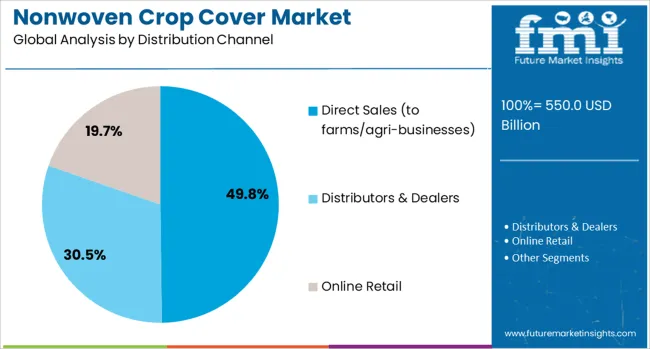

The nonwoven crop cover market is segmented by fabric type, application, distribution channel, and geographic regions. By fabric type, the nonwoven crop cover market is divided into Spunbond Nonwoven, Meltblown Nonwoven, and Others (composite, etc.). In terms of application, the nonwoven crop cover market is classified into Fruits & Vegetables, Flowers & Ornamental Plants, and Grains & Oilseeds. Based on distribution channel, the nonwoven crop cover market is segmented into Direct Sales (to farms/agri-businesses), distributors/dealers, and Online Retail. Regionally, the nonwoven crop cover industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by fabric type, spunbond nonwoven is projected to hold 61.3% of the total market revenue in 2025, making it the leading fabric type segment. This dominance is being driven by the superior tensile strength, uniformity, and cost-efficiency of spunbond materials, which have made them well-suited for extensive field applications.

The inherent durability of spunbond fabrics has enabled repeated use and reliable protection against environmental stressors, enhancing their attractiveness to both smallholders and large-scale farms. Advances in manufacturing processes have allowed for the production of lightweight and customizable spunbond sheets, meeting diverse crop and regional needs while keeping production costs competitive.

The combination of mechanical resilience, breathability, and scalability in production has solidified the position of spunbond nonwoven as the preferred choice among growers seeking dependable and economical crop protection solutions.

In terms of application, fruits and vegetables are expected to account for 52.7% of the market revenue in 2025, establishing this as the top application segment. This leadership is being sustained by the high economic value and vulnerability of fruits and vegetables, which necessitate effective protection throughout their growth cycle.

The widespread adoption of nonwoven covers in this segment has been enabled by their ability to shield delicate produce from frost, insects, and mechanical damage while maintaining proper ventilation and light transmission. Growers have increasingly favored these covers to reduce pesticide usage, enhance product quality, and extend harvest periods, which has further reinforced demand.

The perishable nature and export dependency of many fruits and vegetables have also encouraged the adoption of reliable protection systems to minimize post-harvest losses and meet stringent quality standards in international markets, strengthening this segment’s prominence.

When segmented by distribution channel, direct sales to farms and agribusinesses are forecast to hold 49.8% of the market revenue in 2025, maintaining their leadership position. This share is being upheld by the preference among large-scale growers and commercial farming operations to procure materials directly from manufacturers or authorized distributors, ensuring consistent quality and tailored service.

Direct engagement has facilitated better technical support, customization, and bulk pricing advantages, which have been critical for professional operations managing extensive acreage. The ability of suppliers to build strong relationships with farm managers and agribusinesses through consultative selling and reliable logistics has enhanced loyalty and repeat purchases in this channel.

Moreover, direct sales have allowed producers to gather feedback and co-develop solutions with end users, further reinforcing this segment as the most impactful route for delivering nonwoven crop covers in the competitive agricultural landscape.

The nonwoven crop cover market is growing as farmers and agricultural businesses seek solutions to enhance crop protection, yield, and quality. These lightweight fabrics are used to protect crops from pests, frost, wind, and excessive sunlight while supporting water conservation and soil health. Increasing adoption of sustainable farming practices, government support for advanced agricultural technologies, and rising demand for high-value crops are fueling market expansion. North America and Europe lead due to established agricultural infrastructure and regulatory support, while Asia-Pacific shows high growth potential with expanding farming operations. Innovations in lightweight, UV-resistant, and biodegradable nonwoven materials, along with multifunctional crop covers, are improving efficiency and usability. Rising awareness of crop protection benefits, coupled with cost-effective solutions, continues to drive adoption globally.

Nonwoven crop covers are widely used in horticulture, vegetable farming, and high-value cash crops to enhance productivity and protect plants from environmental stresses. They create a microclimate that regulates temperature and moisture, reducing reliance on chemical pesticides and irrigation. Farmers increasingly rely on these fabrics for frost protection, weed control, and early crop emergence. Growing consumer demand for fresh, high-quality produce encourages the adoption of protective coverings that maintain crop appearance and shelf life. Manufacturers are developing multifunctional nonwoven fabrics with improved permeability, tear resistance, and UV protection to enhance crop performance. Regional growth is supported by increasing awareness among farmers, agricultural extension programs, and government incentives promoting advanced farming practices. The broad applicability across different crop types ensures sustained market demand.

Advancements in nonwoven material technology are shaping market growth. Manufacturers focus on producing lightweight, durable, UV-stabilized, and biodegradable fabrics to meet diverse crop protection needs. Techniques such as spunbond, meltblown, and composite laminates improve strength, permeability, and weather resistance. Enhancing the fabric’s performance reduces labor costs, improves ease of installation, and increases crop protection efficiency. Research on environmentally friendly fibers, including natural and recycled polymers, supports eco-conscious farming practices. Customized solutions for specific crops, climates, and growing conditions further differentiate products in the market. Quality control, consistent thickness, and uniform coverage are critical for achieving desired agricultural outcomes. Continuous innovation in material composition and performance ensures adoption among large-scale and small-scale farmers alike.

Nonwoven crop covers offer operational and commercial benefits to suppliers and farmers. Lightweight and easy-to-handle fabrics reduce transportation and labor costs, enabling efficient large-scale deployment. Manufacturers benefit from recurring demand as crop covers are often replaced each season. Vertical integration, regional production, and optimized logistics improve supply reliability and reduce seasonal shortages. Suppliers providing standardized, high-performance fabrics strengthen brand credibility and maintain long-term client relationships. The versatility of nonwoven crop covers allows adoption across multiple crops and climates, enhancing market resilience. Product differentiation through enhanced durability, UV protection, and biodegradable options helps companies capture premium pricing. Reliable supply chains and effective distribution channels remain critical to supporting global market growth.

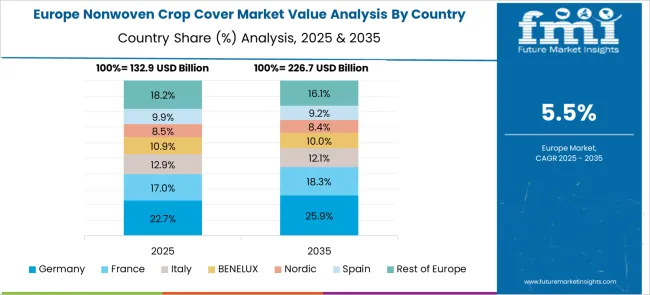

North America and Europe dominate the nonwoven crop cover market due to high-value agriculture, modern farming techniques, and supportive government policies. Asia-Pacific is rapidly expanding, driven by growing farm sizes, adoption of commercial agriculture, and rising awareness of crop protection methods. Latin America and Africa are emerging regions, with pilot programs and government initiatives promoting advanced farming solutions. Companies are focusing on region-specific product offerings, customized fabric weights, and targeted marketing to enhance adoption. Local production and partnerships with agricultural cooperatives strengthen distribution networks and reduce costs. Regional market dynamics, including climate, crop types, and farmer awareness, influence product development and penetration, ensuring sustained global growth for nonwoven crop covers.

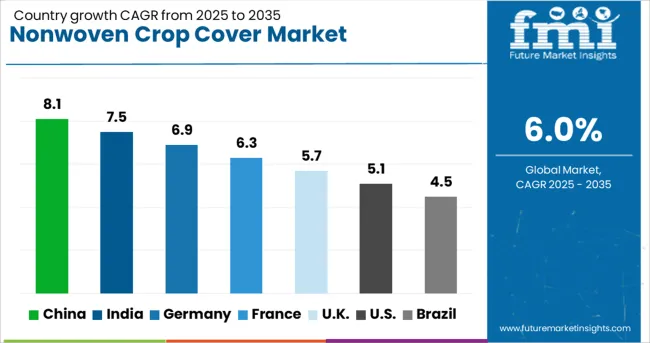

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The nonwoven crop cover market is projected to grow at a CAGR of 6.0%, driven by the increasing demand for crop protection and yield improvement. China leads with 8.1% growth, supported by large-scale agricultural production and adoption of advanced crop protection materials. India follows at 7.5%, as farmers increasingly use nonwoven covers to enhance productivity and reduce pest damage. Germany records 6.9% growth, reflecting a focus on high-quality, durable crop protection materials under strict regulatory standards. The UK grows at 5.7%, driven by horticultural applications and greenhouse farming. The USA shows 5.1% growth, supported by innovations in lightweight and reusable crop covers. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the nonwoven crop cover market with 8.1% growth. The expanding agricultural sector and focus on sustainable farming practices drive market adoption. Compared to India, China benefits from advanced textile manufacturing capabilities and government incentives promoting modern farming techniques. Nonwoven crop covers protect crops from pests, temperature fluctuations, and UV damage, improving yield and quality. The rise in high-value crops, such as fruits and vegetables, increases demand for protective coverings. Investments in research and development enhance product durability and environmental performance. Export opportunities to neighboring Asian countries further support market growth. Manufacturers adopt innovative nonwoven materials to reduce water loss and improve plant health. Overall, China combines industrial capability, supportive policies, and technological advancement to lead the global nonwoven crop cover market.

Nonwoven crop cover market grows at 7.5%, driven by rising awareness of crop protection and sustainable agriculture. Compared to Germany, India focuses on cost-effective production and accessibility for smallholder farmers. Farmers increasingly adopt nonwoven covers to prevent pest infestations and reduce crop damage from weather variations. The horticulture sector, especially vegetable and fruit cultivation, significantly drives demand. Government programs promoting modern farming techniques encourage wider adoption. Research into biodegradable and reusable nonwoven materials supports environmentally friendly practices. Expansion of distribution networks in rural areas increases market penetration. Overall, India combines affordability, government support, and growing agricultural awareness to strengthen its position in the global nonwoven crop cover market.

Germany shows steady growth at 6.9% in the nonwoven crop cover market. High standards for agricultural productivity and sustainability drive demand. Compared to the United Kingdom, Germany emphasizes environmentally friendly and recyclable materials. Farmers utilize nonwoven crop covers to protect high-value crops such as fruits, vegetables, and flowers. Research and development efforts focus on improving material strength, UV resistance, and water permeability. Government programs encourage sustainable agricultural practices, promoting adoption among commercial farms. Exports to neighboring European countries further enhance market stability. Overall, Germany combines strict quality standards, sustainability focus, and technological advancements to maintain a resilient nonwoven crop cover market.

The United Kingdom nonwoven crop cover market grows at 5.7%, driven by horticultural and agricultural demand. Compared to the United States, the UK emphasizes sustainable materials and regulatory compliance. Farmers increasingly adopt covers to reduce pest damage and enhance crop yield. The vegetable and fruit cultivation sector contributes significantly to market growth. Research in biodegradable nonwoven fabrics promotes environmentally responsible farming practices. Expansion of distribution channels ensures product availability across rural regions. Overall, the UK focuses on sustainability, regulatory adherence, and crop protection efficiency to strengthen the nonwoven crop cover market.

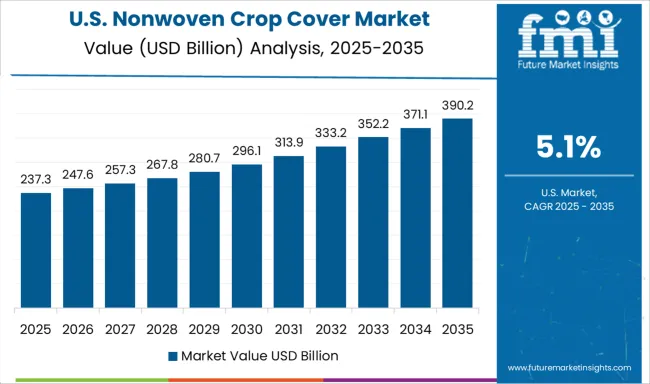

The United States advances at 5.1% in the nonwoven crop cover market. Agricultural innovation and adoption of modern farming techniques drive growth. Compared to China, the US emphasizes high-quality materials and product durability. Farmers use nonwoven covers to protect crops from pests, frost, and UV exposure. Expansion in horticulture and specialty crops increases demand. Research focuses on biodegradable and reusable nonwoven materials to minimize environmental impact. Distribution through agricultural supply chains enhances market reach. Overall, the United States combines innovation, sustainability, and product reliability to maintain steady growth in the nonwoven crop cover market.

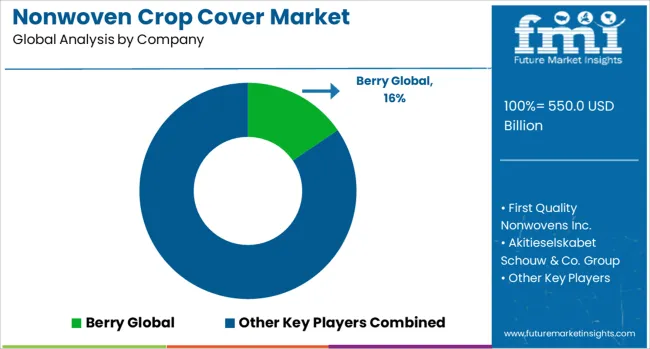

Historically, companies such as DuPont, Berry Global Group, and Freudenberg Nonwovens focused on advanced fabric technologies, high-performance manufacturing, and extensive distribution networks in North America and Europe, providing durable, UV-resistant, and breathable crop protection solutions. Regional players, particularly in Asia and Latin America, concentrated on cost-effective, locally adapted products tailored to smallholder and commercial farms.

Forecast strategies indicate expansion into bio-based, lightweight, and reusable nonwoven fabrics, along with enhanced water and pest protection, addressing evolving agricultural needs and climate variability. Differentiation levers include material innovation, fabric density optimization, UV and thermal resistance, and ease of deployment for diverse crop types. Growth opportunities are significant in emerging markets where mechanized farming, government subsidies, and climate-adaptive agriculture drive adoption. Strategic collaborations with agricultural technology providers, partnerships with seed and fertilizer companies, and development of localized production facilities are expected to improve market penetration. The matrix highlights how technological differentiation, regional expansion, and supply-chain robustness will define market leadership, providing actionable insights for C-level executives seeking investment, partnership, or acquisition opportunities in the nonwoven crop cover market.

| Item | Value |

|---|---|

| Quantitative Units | USD 550.0 Billion |

| Fabric Type | Spunbond Nonwoven, Meltblown Nonwoven, and Others (composite, etc.) |

| Application | Fruits & Vegetables, Flowers & Ornamental Plants, and Grains & Oilseeds |

| Distribution Channel | Direct Sales (to farms/agri-businesses), Distributors & Dealers, and Online Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Berry Global, First Quality Nonwovens Inc., Akitieselskabet Schouw & Co. Group, Mitsui Chemicals, and Kimberly Clark Corp |

| Additional Attributes | Dollar sales in the nonwoven crop cover market vary by material type including polypropylene, polyester, and polyethylene, application across frost protection, pest control, and weed management, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising adoption of sustainable farming practices, crop yield optimization, and increasing demand for protective agricultural solutions. |

The global nonwoven crop cover market is estimated to be valued at USD 550.0 billion in 2025.

The market size for the nonwoven crop cover market is projected to reach USD 985.0 billion by 2035.

The nonwoven crop cover market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in nonwoven crop cover market are spunbond nonwoven, meltblown nonwoven and others (composite, etc.).

In terms of application, fruits & vegetables segment to command 52.7% share in the nonwoven crop cover market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cover Crop Seed Mixes Market Size and Share Forecast Outlook 2025 to 2035

Cover Crop Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Cover Caps Market Size and Share Forecast Outlook 2025 to 2035

Crop Bactericides Market Size and Share Forecast Outlook 2025 to 2035

Crop Micronutrient Market Insights - Precision Farming & Yield Optimization 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA