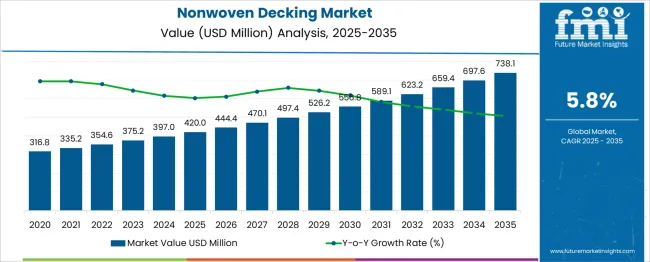

The Nonwoven Decking Market is estimated to be valued at USD 420.0 million in 2025 and is projected to reach USD 738.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. Analyzing the Growth Contribution Index (GCI) across the ten-year period reveals a progressively increasing impact of each successive year on total market expansion. From 2026 to 2030, the market grows from USD 444.4 million to USD 556.8 million, delivering an incremental growth of USD 136.8 million and contributing roughly 43% to the total decade-long growth. The earlier half of the period sees consistent year-on-year growth of USD 24.4 million to USD 30.6 million, indicating moderate adoption momentum. The period from 2031 to 2035 exhibits a stronger influence, with annual gains ranging from USD 32.3 million in 2031 to USD 40.5 million in 2035. This second half contributes over 56% to the decade’s total growth, signifying a structural shift in demand acceleration likely driven by project scalability and broader end-use adoption.

The GCI underlines that the market’s later years hold higher weight in value creation, a key insight for long-term strategic investments, procurement planning, and capacity alignment within the nonwoven decking ecosystem.

| Metric | Value |

|---|---|

| Nonwoven Decking Market Estimated Value in (2025 E) | USD 420.0 million |

| Nonwoven Decking Market Forecast Value in (2035 F) | USD 738.1 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The nonwoven decking market is experiencing steady growth as sustainability considerations, material innovation, and functional advantages of nonwoven structures reshape decking solutions. Growing demand for lightweight, durable, and low-maintenance outdoor materials has encouraged manufacturers to incorporate nonwoven technologies in decking applications.

Rising awareness among builders and homeowners about the benefits of nonwoven materials, including improved water resistance, slip resistance, and aesthetic versatility, is supporting broader adoption. Regulatory pressures for environmentally conscious construction materials and the rising trend of outdoor living spaces are also contributing to market expansion.

Future opportunities are expected to emerge from advanced material formulations, integration of recycled content, and technological improvements in manufacturing processes, paving the way for wider acceptance across diverse geographies and applications.

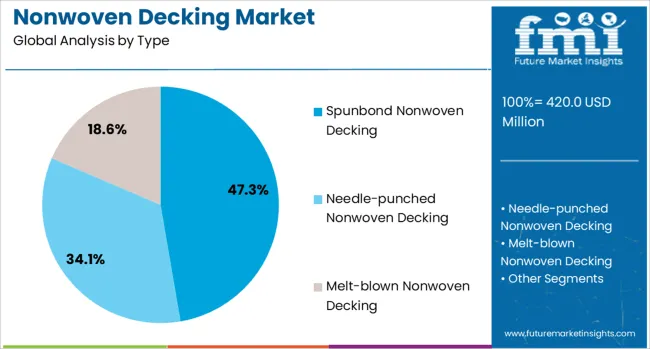

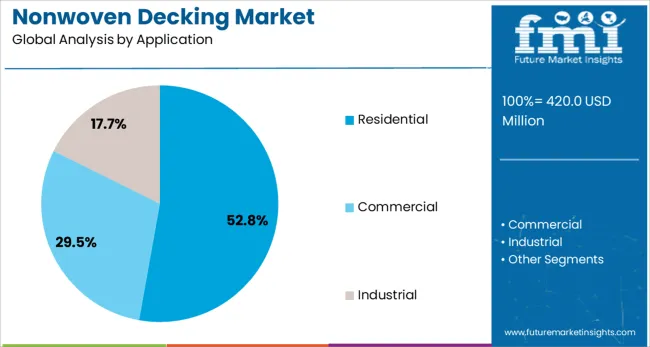

The nonwoven decking market is segmented by type, application, material, and geographic regions. The nonwoven decking market is divided into Spunbond Nonwoven Decking, Needle-punched Nonwoven Decking, and Melt-blown Nonwoven Decking. In terms of application, the nonwoven decking market is classified into Residential, Commercial, and Industrial.

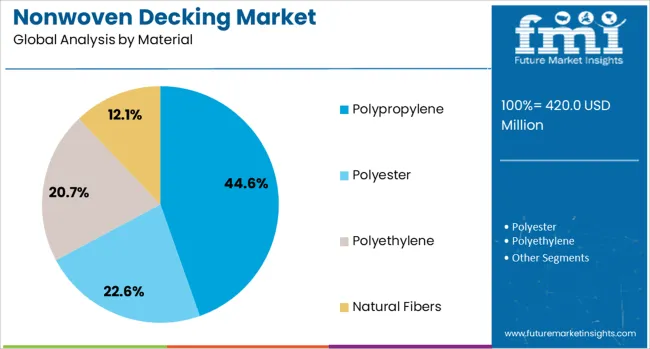

The nonwoven decking market is segmented into Polypropylene, Polyester, Polyethylene, and Natural Fibers. Regionally, the nonwoven decking industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, spunbond nonwoven decking is projected to hold 47.3% of the total market revenue in 2025, making it the leading type segment. This leadership is attributed to the inherent properties of spunbond technology, which delivers superior strength, uniformity, and durability compared to other nonwoven types.

Its ability to provide high resistance to tearing and environmental degradation has enhanced its suitability for outdoor decking exposed to varying weather conditions. Manufacturers have favored spunbond materials for their cost-effectiveness and scalability, enabling consistent quality and performance in high-volume production.

Furthermore, the adaptability of spunbond fabrics to various surface finishes and textures has supported their use in both premium and standard decking products, reinforcing their dominance in the market.

In terms of application, residential use is expected to account for 52.8% of the market revenue in 2025, positioning it as the top application segment. This prominence is driven by growing consumer preference for enhanced outdoor living spaces and the increasing prevalence of single-family homes with private decks.

Residential buyers have shown strong demand for nonwoven decking materials due to their low maintenance requirements, aesthetic appeal, and environmental benefits. Developers and homeowners are opting for these solutions as part of broader efforts to improve property value and meet green building standards.

The ability of nonwoven decking to offer comfort, safety, and longevity has made it a preferred choice in the residential sector, further solidifying its market leadership.

When segmented by material, polypropylene is projected to capture 44.6% of the market revenue in 2025, securing its position as the leading material segment. This leadership stems from polypropylene’s advantageous balance of strength, flexibility, and resistance to moisture and UV radiation, all of which are critical for outdoor decking applications.

Its relatively low cost and ease of processing have made it attractive for manufacturers aiming to deliver competitive products without compromising performance. Polypropylene’s compatibility with various nonwoven technologies and its recyclability have also supported its adoption in sustainable construction initiatives.

These combined attributes have ensured polypropylene’s continued dominance as the material of choice within the nonwoven decking market.

The nonwoven decking market is emerging as a niche yet promising segment within the construction materials industry. These composite materials integrate nonwoven fabrics with plastic or resin bases to offer enhanced dimensional stability, moisture resistance, and surface strength. Unlike conventional wood-based decking, nonwoven variants are lightweight, splinter-free, and exhibit superior traction even in wet environments. Demand is accelerating in both residential and commercial outdoor applications where low maintenance and long service life are prioritized. Manufacturers are targeting architectural, hospitality, and modular infrastructure sectors with tailored nonwoven decking solutions.

The home improvement segment continues to fuel adoption of nonwoven decking systems. Property owners are seeking durable, low-maintenance alternatives to natural wood for patios, balconies, and outdoor flooring. Nonwoven decking offers high resistance to rot, termites, and seasonal weather fluctuations, eliminating the need for frequent sealing or painting. These products are also easier to handle and install, reducing labor costs during DIY or contractor-led renovation projects. Homeowners increasingly value slip-resistant, fade-proof surfaces, especially for poolside decks and children’s play areas. As residential remodeling activities grow in urban and suburban zones, suppliers are responding with broader color palettes, textured surfaces, and modular assembly options to suit varied architectural styles. Distribution through home improvement retail chains and e-commerce platforms ensures accessibility across price ranges. This segment remains a cornerstone for volume sales, particularly in regions where real estate turnover and seasonal renovations remain consistently high.

Hospitality projects and commercial developments such as hotels, rooftop lounges, and outdoor cafés are adopting nonwoven decking to meet aesthetic and safety requirements. These venues prioritize materials that maintain their appearance despite high foot traffic, beverage spills, or harsh sunlight exposure. Nonwoven composite decking provides a premium look similar to hardwood without the upkeep, offering stain resistance, mildew control, and color stability. Designers also value its consistent finish and clean-line installation for seamless transitions between indoor and outdoor areas. Many products can incorporate flame-retardant or anti-slip properties to comply with commercial safety codes. In coastal or humid locations, commercial property managers increasingly specify nonwoven options due to their resistance to warping and delamination. With hospitality projects rebounding globally, architects and developers are investing in upgraded outdoor environments to attract clientele. Nonwoven decking manufacturers who cater to bespoke design and regulatory standards are well-positioned in this high-margin segment.

Advancements in nonwoven composite engineering are helping decking products offer improved tensile strength, UV protection, and dimensional stability. Manufacturers are combining nonwoven polyester or glass fiber mats with recycled plastic or wood-plastic composites to deliver hybrid boards that withstand harsh outdoor conditions. The integration of co-extruded layers or textured coatings improves grip, reduces heat absorption, and simulates natural wood grain aesthetics. These innovations address key user demands around comfort, durability, and visual appeal. Engineering efforts are also focused on reducing expansion and contraction rates during thermal cycling, a common issue in traditional decking materials. Furthermore, acoustic dampening and fire resistance features are being explored to broaden applications into public infrastructure or transport hubs. As property owners seek longer-lasting materials that require less intensive maintenance, engineered nonwoven decking offers strong competitive differentiation. Suppliers investing in R&D and proprietary fabrication methods are leading innovation in this emerging material category.

Despite their technical advantages, nonwoven decking products face slow uptake due to pricing sensitivity and limited market awareness. Many consumers and contractors remain unfamiliar with the category and default to traditional wood or first-generation composites based on price and accessibility. In cost-sensitive markets, the premium pricing of nonwoven variants can be a barrier, especially for large-scale installations like apartment balconies or public walkways. Moreover, installers may lack training or guidance on correct handling and fastening techniques for nonwoven-based materials. Retail visibility remains relatively low outside of specialty distributors or design catalogs, limiting impulse or replacement purchases. The absence of universal grading standards also complicates product comparison, creating hesitation among builders and procurement professionals. To overcome these challenges, suppliers must invest in marketing campaigns, demonstration projects, and distribution partnerships that communicate the long-term cost benefits and performance advantages of nonwoven decking over legacy materials.

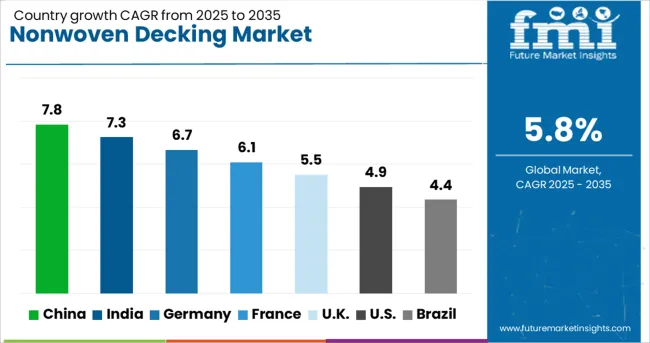

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global nonwoven decking market is expected to grow at a CAGR of 5.8% through 2035, supported by increased usage in moisture-resistant flooring, exterior platforms, and modular construction. Among BRICS nations, China leads with 7.8% growth, driven by large-scale residential developments and export-focused production. India follows at 7.3%, where demand has been supported by public infrastructure works and commercial installations. In the OECD region, Germany reports 6.7% growth, backed by standardized material testing and broad application in engineered structures. France, growing at 6.1%, has maintained steady output for use in prefabricated components and recreational areas. The United Kingdom, at 5.5%, reflects consistent demand through architectural landscaping, marine decking, and light commercial projects. Market dynamics have been shaped by durability standards, structural codes, and supplier qualification requirements. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Growth in the nonwoven decking market across China has been advancing at a CAGR of 7.8%, fueled by demand from modular infrastructure, prefabricated balcony systems, and eco-efficient building materials. Nonwoven mats have been layered beneath synthetic wood composites to enhance moisture resistance and impact absorption. Residential developers have adopted these materials in mass housing schemes involving rapid floor installations. Contractors have sourced composite panels backed by spunbond layers for improved deck durability in high-humidity zones. Production units have scaled output of custom-width rolls for integration into decking modules used in outdoor cafes and public seating zones. Demand has also been supported by civil bodies requiring nonwoven-backed solutions for temporary pedestrian structures. Material formulators have adjusted bonding properties to meet outdoor lifespan expectations.

India has recorded consistent growth in the nonwoven decking market, registering a CAGR of 7.3%, driven by application in commercial walkways, hospitality spaces, and apartment terraces. Project contractors have favored roll-based nonwoven supports beneath polymer decking tiles to reduce vibration and absorb minor structural shifts. Coastal resorts have installed moisture-resistant decking boards lined with nonwoven layers to minimize salt exposure effects. Urban planners have supported modular decking in recreational zones using spunlace materials for underlayer padding. Budget housing developers have procured composite decks reinforced with thermally bonded nonwovens for long-term strength. Manufacturing lines have adapted roll slitters to cater to small-scale production needs in tier-two cities. Local suppliers have maintained inventory for walkways, rooftop cafés, and semi-outdoor lounges.

Germany has seen strong adoption in the nonwoven decking market, reflecting a CAGR of 6.7%, with deployment across residential patios, rooftop terraces, and modular park flooring. Structural engineers have specified nonwoven inserts beneath recycled composite boards to provide insulation and dampening. Installers of high-traffic pedestrian decking have utilized thermally bonded underlayers to extend surface integrity. Parks and municipal walkways have adopted perforated decking panels stabilized with supportive nonwoven membranes. Lightweight, breathable variants have been chosen to minimize moisture buildup in rooftop applications. Prefabrication firms have incorporated dual-layer backing sheets into decking panels used for rental installations and exhibitions. Manufacturers have also aligned thickness and density specifications with standard outdoor decking profiles popular in urban environments.

France has progressed in the nonwoven decking market at a CAGR of 6.1%, supported by demand from outdoor dining areas, public square refurbishments, and temporary event flooring. Decking system suppliers have integrated spunbond nonwovens beneath interlocking panels to provide cushioning on stone or concrete bases. Public gardens have used modular units incorporating stitched backing to control ground moisture seepage. Event organizers have opted for quick-deploy decking lined with bonded nonwoven pads to meet safety norms for uneven ground setups. Prefab housing projects have introduced pre-backed deck modules with color-matched nonwoven inserts to improve aesthetic finish and stability. Nonwoven manufacturers have collaborated with flooring brands to design moisture-buffer layers matching regional weather variability.

The nonwoven decking market across the United Kingdom has expanded steadily at a CAGR of 5.5%, bolstered by usage in patios, garden decking kits, and light commercial entryways. Builders have adopted nonwoven-lined deck boards to offset minor base irregularities and ensure smoother installation on aging structures. Retailers have distributed modular decking kits featuring underlay pads made from thermally bonded fabrics. Senior living residences and schools have procured anti-slip decking with integrated nonwoven dampening layers for user safety. Project firms have sourced decking bundles pre-assembled with fabric insulation to meet thermal bridging concerns in rooftop structures. Garden supply outlets have promoted do-it-yourself kits containing nonwoven layers, screws, and alignment frames. Moisture-resistant formats have supported usage in shaded, moss-prone environments.

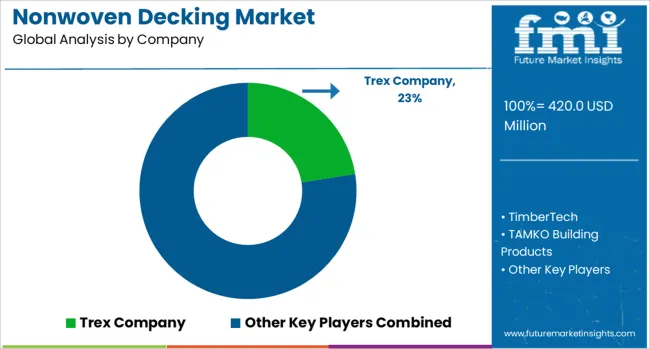

The nonwoven decking market is led by manufacturers offering composite decking solutions that incorporate nonwoven materials or fiber-reinforced technologies to enhance durability, moisture resistance, and structural stability. Trex Company stands as the dominant supplier, known for its high-performance composite decking made from recycled materials, including nonwoven fibers, offering long-lasting, low-maintenance alternatives to traditional wood. TimberTech and Azek Building Products are also key players, delivering advanced capped polymer and composite decking products with improved resistance to fading, staining, and weathering. TAMKO Building Products and Fiberon LLC are widely recognized for their integration of nonwoven reinforcement layers within composite boards, improving load-bearing strength and reducing expansion or contraction.

UPM Biocomposites, with its focus on wood-plastic composites reinforced with natural fibers, offers sustainable decking solutions with strong environmental appeal. Green Bay Decking LLC emphasizes the use of rice hulls and other nonwoven agricultural by-products in its formulations, targeting eco-conscious consumers. Duralife Decking and Railing Systems and Cardinal Building Products round out the competitive landscape, offering durable and aesthetically appealing options tailored for residential and commercial decking applications. As the market shifts toward more eco-efficient, low-maintenance outdoor building materials, these suppliers continue to innovate in composite formulations, surface technologies, and installation systems. The combination of nonwoven reinforcements with advanced polymer systems plays a crucial role in meeting performance expectations in high-moisture and high-traffic environments.

On June 20, 2023, AstenJohnson officially opened its AJ Nonwovens plant in Waco, Texas, featuring state-of-the-art needle‑punch technology to scale production of high-performance nonwoven materials suitable for decking substrates, filtration, automotive, and industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 420.0 Million |

| Type | Spunbond Nonwoven Decking, Needle-punched Nonwoven Decking, and Melt-blown Nonwoven Decking |

| Application | Residential, Commercial, and Industrial |

| Material | Polypropylene, Polyester, Polyethylene, and Natural Fibers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Trex Company, TimberTech, TAMKO Building Products, UPM Biocomposites, Green Bay Decking LLC, Duralife Decking and Railing Systems, Cardinal Building Products, Fiberon LLC, and Azek Building Products |

| Additional Attributes | Dollar sales by nonwoven decking type including sheets, rolls, and tiles made from polypropylene, polyethylene, and cellulose-based materials, by application in residential, commercial, marine, and recreational decking, and by geographic region including North America, Europe, and Asia-Pacific; demand driven by urbanization, sustainable construction, and outdoor living trends; innovation in recycled composites, biopolymer blends, and textured finishes; costs influenced by polymer prices, manufacturing complexity, and environmental regulations; and emerging use cases in sensor-enabled smart decks, weather-adaptive surfaces, and circular-economy construction solutions. |

The global nonwoven decking market is estimated to be valued at USD 420.0 million in 2025.

The market size for the nonwoven decking market is projected to reach USD 738.1 million by 2035.

The nonwoven decking market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in nonwoven decking market are spunbond nonwoven decking, needle-punched nonwoven decking and melt-blown nonwoven decking.

In terms of application, residential segment to command 52.8% share in the nonwoven decking market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Staples PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA