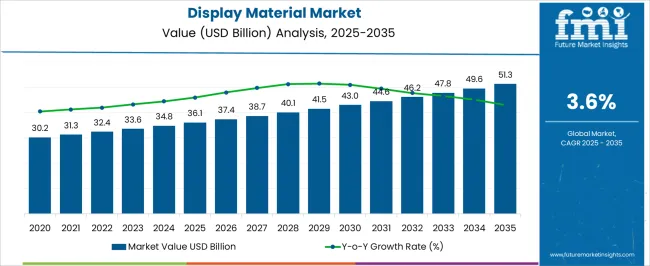

The Display Material Market, estimated at USD 36.1 billion in 2025 and forecast to reach USD 51.3 billion by 2035 at a CAGR of 3.6%, exhibits measured growth underpinned by the evolution of display technologies and incremental adoption across consumer electronics, automotive displays, and signage applications. The contribution by technology within this market is diversified, with liquid crystal displays (LCDs), organic light-emitting diodes (OLEDs), and emerging quantum dot (QD) and microLED materials representing distinct shares of total market value. LCD materials maintain a stable contribution due to established manufacturing processes, high reliability, and widespread integration in monitors and televisions.

OLED materials are gaining share through higher contrast, flexible form factors, and reduced power consumption, with technological improvements in emitter layers and encapsulation driving adoption. Quantum dot and microLED materials, though currently representing a smaller portion of the market, are contributing to incremental value through enhanced color performance, energy efficiency, and premium display segments. The contribution of each technology is further influenced by the integration of advanced coatings, substrates, and thin-film encapsulation materials, which enhance performance, lifespan, and visual quality. Supply chain alignment, process efficiencies, and R&D investments also play a critical role in technology-specific contributions. Over the forecast period, LCDs are expected to maintain the largest share, OLEDs are projected to expand steadily, and quantum dot and microLED materials are likely to grow at higher rates, reflecting a technology-driven segmentation where material selection, performance advantages, and cost efficiency collectively shape the overall market composition.

| Metric | Value |

|---|---|

| Display Material Market Estimated Value in (2025 E) | USD 36.1 billion |

| Display Material Market Forecast Value in (2035 F) | USD 51.3 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The display material market represents a specialized segment within the global electronics and optoelectronics industry, emphasizing image clarity, durability, and energy efficiency. Within the broader electronic components sector, it accounts for about 5.6%, driven by rising demand from consumer electronics, smartphones, televisions, and digital signage. In the display panel manufacturing segment, its share is approximately 6.1%, reflecting the use of advanced materials such as liquid crystals, organic light-emitting diodes, and quantum dots. Across the flat-panel and flexible display market, it holds around 4.9%, supporting innovations in high-resolution, foldable, and touch-sensitive devices. Within the semiconductor and optoelectronic materials category, it represents 4.4%, highlighting the integration of conductive films, polarizers, and encapsulation layers. In the overall visual technology and electronic materials ecosystem, the market contributes about 3.8%, emphasizing technological advancement, durability, and energy-efficient solutions for modern display applications. Recent developments in the display material market have focused on next-generation technologies, energy efficiency, and performance optimization. Innovations include quantum dot films, OLED and micro-LED materials, and anti-reflective coatings to enhance brightness, color accuracy, and viewing angles. Key players are collaborating with display panel manufacturers, consumer electronics brands, and research institutions to improve material performance, flexibility, and production scalability. Adoption of ultra-thin, bendable, and transparent materials is gaining traction for smartphones, wearables, and automotive displays. The eco-friendly and low-energy-consuming materials are being developed to meet regulatory standards and reduce environmental impact. These trends demonstrate how technological innovation, performance enhancement, and sustainability are shaping the market.

The display material market is undergoing significant transformation, driven by rapid technological advancements and increasing demand for high-performance, energy-efficient, and visually immersive display solutions. Widespread adoption of advanced display panels in smartphones, televisions, laptops, and automotive systems is propelling demand for high-quality materials that offer enhanced brightness, contrast, and longevity. Materials such as liquid crystals, organic compounds, and semiconductor substrates are playing a pivotal role in enabling next-generation display technologies, including OLED, QLED, and MicroLED.

Increasing investments by manufacturers in flexible and foldable displays, coupled with the growing popularity of high-definition and ultra-HD content, are shaping product development strategies. The need for lightweight, durable, and power-efficient display materials is also rising across emerging applications such as augmented reality, wearable devices, and medical displays.

As consumer preferences shift toward more immersive and responsive interfaces, the display material market is expected to experience sustained growth This is further supported by continued R&D efforts aimed at improving material quality, reducing manufacturing costs, and achieving better integration with evolving display technologies.

The display material market is segmented by material, application, technology, and geographic regions. By material, display material market is divided into Liquid crystals (LC), Polarizers, Glass substrates, Color filters, and Backlighting units (BLU). In terms of application, display material market is classified into Consumer electronics, Automotive, Healthcare, Retail, Industrial and enterprise, and Others. Based on technology, display material market is segmented into Organic light emitting diode (OLED), Liquid crystal display (LCD), Quantum dot display, Micro LED display, and E-paper display (EPD). Regionally, the display material industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid crystals material segment is projected to account for 26.9% of the display material market revenue share in 2025, establishing it as a key contributor among material types. This segment’s continued relevance is being supported by its widespread application in LCD technology, which remains dominant across multiple consumer and industrial devices. Liquid crystals are favored for their stability, low power consumption, and cost-effectiveness, making them an essential component in mid-range and large-volume display production.

Although newer technologies such as OLED are gaining prominence, the long-standing production ecosystem around liquid crystal displays ensures consistent demand for these materials. Advancements in alignment techniques and backlight systems have further enhanced the visual quality and efficiency of LC-based displays.

The segment is also benefiting from sustained adoption in automotive displays, monitors, and budget consumer electronics, where performance-to-cost ratio remains a critical factor As manufacturers continue to innovate within the LCD space to offer thinner, brighter, and more responsive panels, liquid crystals are expected to maintain their relevance and contribute significantly to overall market revenues.

The consumer electronics application segment is expected to hold 31.9% of the display material market revenue share in 2025, making it the largest application area. This segment’s dominance is being driven by the continuous demand for advanced display technologies in smartphones, televisions, laptops, tablets, and wearable devices. The rapid pace of product upgrades, coupled with high consumer expectations for screen resolution, color accuracy, and energy efficiency, is pushing display manufacturers to invest in premium materials.

The segment is further supported by the increasing integration of displays into home appliances, gaming consoles, and personal healthcare devices, expanding the volume of units produced annually. High production volumes and short product lifecycles in the consumer electronics industry have led to accelerated innovation in display material formulations, focusing on both performance and cost-efficiency.

With technology companies investing heavily in foldable, edge-to-edge, and ultra-thin screens, the demand for durable and adaptable materials is expected to grow significantly As consumer electronics remain the largest driver of display technology adoption, this application segment is likely to retain its leadership position over the forecast period.

The organic light emitting diode technology segment is projected to capture 39.8% of the display material market revenue share in 2025, positioning it as the leading technology segment. This dominance is being driven by the superior visual performance offered by OLED panels, including deeper blacks, higher contrast ratios, and flexible form factors. OLED technology enables ultra-thin, lightweight, and power-efficient displays, which are increasingly preferred in premium smartphones, smartwatches, televisions, and automotive infotainment systems.

Manufacturers are transitioning to OLED production lines to meet growing consumer expectations for high-end visual experiences. The segment is also benefiting from advancements in materials such as phosphorescent emitters, encapsulation layers, and organic semiconductors that extend product lifespan and reduce burn-in effects.

With ongoing investments in flexible and rollable display innovations, OLED is becoming central to next-generation design trends in both consumer and industrial applications As production scales improve and costs begin to decline, OLED technology is expected to further consolidate its position as the preferred choice among display manufacturers, driving continued growth in material demand.

The market has witnessed robust expansion due to the growing demand for high-resolution screens, flexible displays, and energy-efficient panels in consumer electronics, automotive, and industrial applications. Materials such as OLED, LCD, quantum dot films, and glass substrates are used to achieve brighter images, wider color gamuts, and lower power consumption. Rapid adoption of smartphones, televisions, laptops, wearable devices, and automotive infotainment systems has fueled the need for advanced display materials. Additionally, emerging technologies like foldable, rollable, and transparent displays are creating new opportunities for innovation.

Innovations in OLED, QLED, LCD, and polymer-based materials have improved the performance, durability, and efficiency of modern display panels. Materials are engineered to provide higher contrast ratios, faster response times, and enhanced brightness while consuming less energy. Flexible polymers and thin glass substrates enable foldable, rollable, and ultra-thin screens. Quantum dot and color conversion films are integrated to expand color reproduction and improve visual clarity. Advanced coatings, anti-glare layers, and barrier films increase durability and resistance to environmental stress. These innovations are essential to meet consumer expectations for vivid visuals, enhanced touch responsiveness, and lightweight designs, ensuring widespread adoption in consumer electronics, automotive, and industrial displays.

Energy-efficient display materials are increasingly prioritized in response to rising electricity costs and environmental regulations. Materials with low power consumption, improved thermal management, and recyclable components are widely adopted. Manufacturers are developing materials that maintain high performance while reducing resource usage, supporting sustainability goals. Eco-friendly production techniques and reusable substrates further enhance the environmental profile of displays. Consumer preference for energy-efficient and durable devices is motivating OEMs to integrate advanced materials in televisions, monitors, mobile devices, and automotive dashboards. Regulatory frameworks emphasizing environmental responsibility in electronics manufacturing reinforce this trend, ensuring that display materials contribute to sustainable and cost-effective product development.

The expansion of consumer electronics, smart appliances, and automotive infotainment systems has created sustained demand for high-performance display materials. Large-screen televisions, laptops, smartphones, tablets, and smart wearables require high-resolution panels that incorporate advanced polymers, glass, and conductive layers. Automotive displays, including instrument clusters, head-up displays, and touchscreens, demand materials capable of withstanding high temperatures, vibration, and sunlight exposure. Industrial applications such as medical monitors, digital signage, and control panels also require robust, precise, and reliable display materials. This diversification of end-use sectors ensures that display materials remain essential for performance, safety, and aesthetic quality across multiple industries.

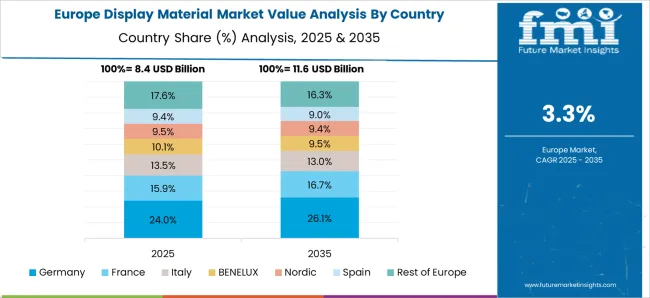

Asia Pacific dominates production and consumption of display materials due to its strong electronics manufacturing base, technological expertise, and cost advantages. North America and Europe emphasize high-end, energy-efficient, and sustainable materials for advanced displays. Leading manufacturers focus on R&D to improve material properties, thin-film technologies, flexible displays, and quantum dot integration. Strategic collaborations with electronics OEMs and automotive companies enhance product adoption. Regional differences in regulatory compliance, consumer demand, and infrastructure influence investment patterns. Continuous innovation, combined with rising demand for immersive, durable, and energy-efficient displays, positions the market for steady growth across global regions.

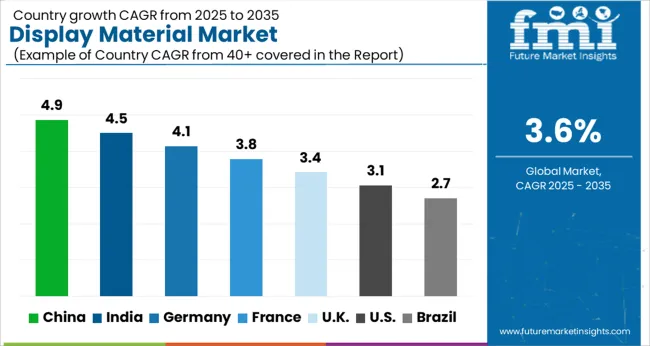

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| U.K. | 3.4% |

| U.S. | 3.1% |

| Brazil | 2.7% |

The market is expected to register a CAGR of 3.6% from 2025 to 2035. Expansion in China reached 4.9%, driven by large-scale display manufacturing and technological upgrades. India accounted for 4.5%, supported by increasing investments in electronics and digital signage sectors. Germany contributed 4.1%, reflecting adoption of high-performance display materials in industrial and consumer electronics. The United Kingdom reached 3.4%, focusing on innovation in flexible and advanced displays. The United States stood at 3.1%, emphasizing enhancements in OLED and LCD material applications. These countries are scaling, advancing, and innovating in display materials to support the evolving requirements of electronics and visual technology sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 4.9%, driven by rising demand for consumer electronics, smartphones, tablets, and television panels. Domestic manufacturers focus on high-quality liquid crystal displays (LCDs), organic light-emitting diodes (OLEDs), and flexible display materials. The country benefits from strong government support for electronics manufacturing and investments in research and development to enhance display performance. Increasing exports to international markets further fuel demand.

India is expected to grow at a CAGR of 4.5%, supported by expansion of the consumer electronics market and government initiatives promoting local manufacturing. Rising smartphone penetration and increased television adoption drive demand for LCD and OLED materials. Domestic and international suppliers are introducing energy-efficient, durable, and high-brightness display materials to cater to residential and commercial applications.

Germany, with a CAGR of 4.1%, demonstrates steady adoption due to the presence of premium consumer electronics, automotive display panels, and industrial applications. Manufacturers prioritize high-precision, energy-efficient, and sustainable materials for both standard and specialized displays. Integration with touch sensors and advanced display modules supports market growth.

The United Kingdom is forecast to grow at a CAGR of 3.4%, influenced by demand from consumer electronics, signage, and industrial displays. Adoption is driven by high-quality material requirements, long lifespan, and energy efficiency. Imports dominate the supply of advanced display materials, while domestic companies focus on customization and integration with digital devices.

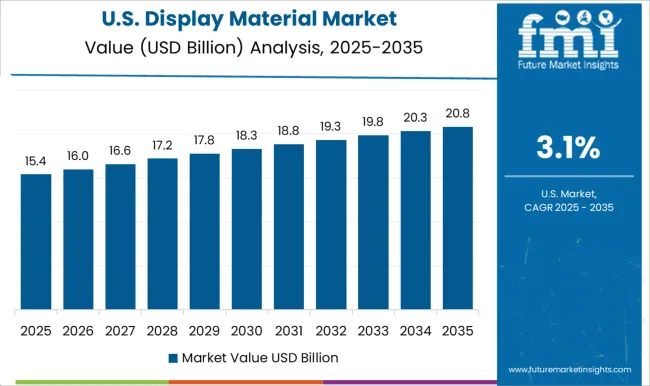

The United States, growing at a CAGR of 3.1%, sees moderate growth due to mature consumer electronics and industrial display markets. Focus is on advanced OLED, LED, and flexible display materials. Adoption is driven by demand in smartphones, automotive infotainment, and medical imaging displays. Manufacturers prioritize high-brightness, energy-efficient, and durable materials.

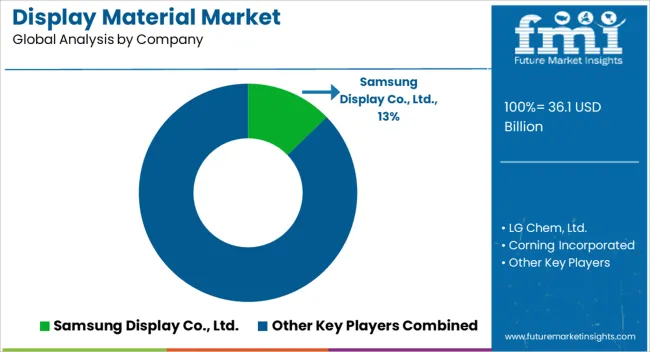

The market is dominated by a mix of large chemical conglomerates, specialized display material providers, and innovative technology developers catering to LCD, OLED, microLED, and emerging display technologies. Samsung Display, LG Chem, Corning, Merck KGaA, and DowDuPont lead the market with strong portfolios of substrates, polarizers, glass, and functional coatings, supported by global manufacturing capabilities and extensive R&D investments. These companies focus on delivering high-performance, durable, and energy-efficient materials for smartphones, TVs, monitors, and flexible displays. Specialized players including Sumitomo Chemical, Hitachi Chemical, Nitto Denko, DIC, Idemitsu Kosan, Japan Display, Innolux, JNC, Lumileds, Kyulux, and Nanoco Technologies compete by offering niche solutions such as quantum dots, color filters, phosphorescent emitters, and nanomaterials. Their competitive advantage stems from technological differentiation, patent-protected materials, and collaborations with OEMs to enable next-generation display performance. The market is highly dynamic, driven by increasing adoption of high-resolution displays, flexible and foldable panels, and energy-efficient technologies. Companies prioritize innovation, strategic partnerships, and supply chain integration to meet stringent quality standards, enhance display efficiency, and maintain leadership in a rapidly evolving landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 36.1 Billion |

| Material | Liquid crystals (LC), Polarizers, Glass substrates, Color filters, and Backlighting units (BLU) |

| Application | Consumer electronics, Automotive, Healthcare, Retail, Industrial and enterprise, and Others |

| Technology | Organic light emitting diode (OLED), Liquid crystal display (LCD), Quantum dot display, Micro LED display, and E-paper display (EPD) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung Display Co., Ltd., LG Chem, Ltd., Corning Incorporated, Merck KGaA, DowDuPont Inc., Sumitomo Chemical Co., Ltd., Hitachi Chemical Co., Ltd., Nitto Denko Corporation, DIC Corporation, Idemitsu Kosan Co., Ltd., Japan Display Inc., Innolux Corporation, JNC Corporation, Lumileds Holding B.V., Kyulux, Inc., and Nanoco Technologies Limited |

| Additional Attributes | Dollar sales by material type and application, demand dynamics across consumer electronics, automotive, and industrial display sectors, regional trends in advanced display adoption, innovation in transparency, flexibility, and durability, environmental impact of material production and disposal, and emerging use cases in foldable screens, augmented reality devices, and high-performance digital signage. |

The global display material market is estimated to be valued at USD 36.1 billion in 2025.

The market size for the display material market is projected to reach USD 51.3 billion by 2035.

The display material market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in display material market are liquid crystals (lc), polarizers, glass substrates, color filters and backlighting units (blu).

In terms of application, consumer electronics segment to command 31.9% share in the display material market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Display Drivers Market Growth – Size, Demand & Forecast 2025 to 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Display Paper Box Market

Display Cabinets Market

3D Display Market Size and Share Forecast Outlook 2025 to 2035

4K Display Resolution Market Size and Share Forecast Outlook 2025 to 2035

3D Display Module Market

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

OLED Display Market Size and Share Forecast Outlook 2025 to 2035

Microdisplay Market Size and Share Forecast Outlook 2025 to 2035

IGZO Display Market Size and Share Forecast Outlook 2025 to 2035

Food Display Counter Market Size and Share Forecast Outlook 2025 to 2035

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

Shelf Display Trays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Micro Display Market Analysis by Technology, Application and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA