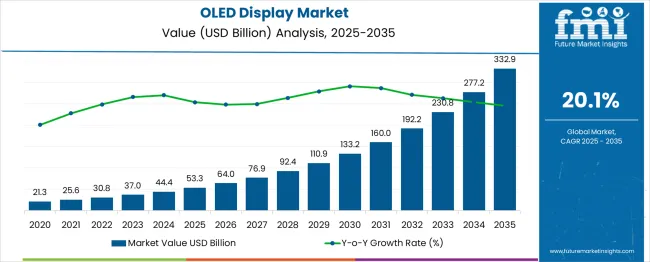

The OLED display market is expected to increase from USD 25.6 billion in 2025 to USD 332.9 billion in 2035, achieving a compound annual growth rate (CAGR) of 20% over the period. Market value is anticipated to rise steadily, reaching USD 30.8 billion in 2026, USD 44.4 billion in 2028, and USD 76.9 billion by 2031. Accelerated expansion is expected in the later years, with the market estimated at USD 160.0 billion in 2033 and USD 230.8 billion in 2034 before reaching USD 332.9 billion in 2035. Growth is supported by increasing adoption in smartphones, televisions, and wearable devices, along with advancements in flexible panels, energy efficiency, color accuracy, and integration of OLED technology across consumer electronics.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 53.3 billion |

| Forecast Value in (2035F) | USD 332.9 billion |

| Forecast CAGR (2025 to 2035) | 20% |

The OLED display market faces several risks that could impact growth trajectories over the 2025–2035 period. Supply chain disruptions, particularly in the availability of rare materials like indium tin oxide and organic compounds, may constrain production and delay product launches. Volatility in raw material prices can increase manufacturing costs, affecting profit margins. Competition from alternative display technologies such as microLED and quantum dot LCDs could slow adoption in key segments like televisions and wearables. Regulatory and environmental compliance requirements, especially related to e-waste disposal and chemical handling, may necessitate additional investment in sustainable manufacturing processes, increasing operational complexity and capital expenditure.

Market sensitivity is particularly high to shifts in consumer demand and technological adoption rates. Slower-than-expected uptake in smartphones, televisions, or wearable devices could reduce incremental revenue, while delays in flexible panel innovations or efficiency improvements could diminish the competitive edge of OLED solutions. Currency fluctuations in key manufacturing and consumption regions, as well as trade tensions affecting import-export dynamics, can alter cost structures and regional market shares. Investment cycles for capacity expansion are also sensitive to demand forecasts, making careful scenario planning essential to mitigate financial and operational risks.

Market expansion is being supported by the increasing consumer demand for superior display quality and the corresponding preference for devices with enhanced visual performance. Modern consumers are increasingly focused on display technologies that can deliver exceptional color accuracy, deep blacks, and energy efficiency. OLED technology's proven advantages in contrast ratio, response time, and form factor flexibility make it a preferred choice in premium consumer electronics and emerging applications.

The growing emphasis on flexible and foldable display technologies is driving demand for OLED solutions that can support innovative device designs and form factors. Consumer preference for thinner, lighter devices with superior visual performance is creating opportunities for advanced OLED implementations. The rising influence of gaming and entertainment content consumption is also contributing to increased adoption of high-performance OLED displays across different device categories and price segments.

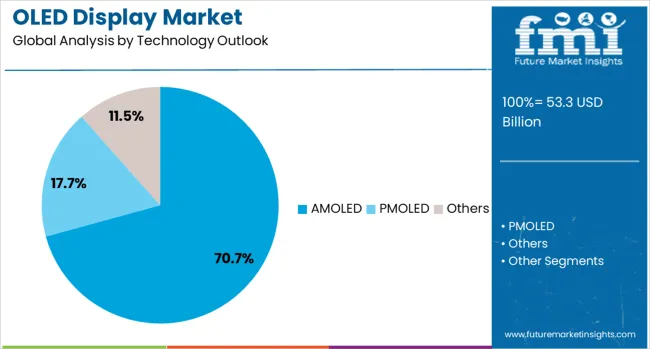

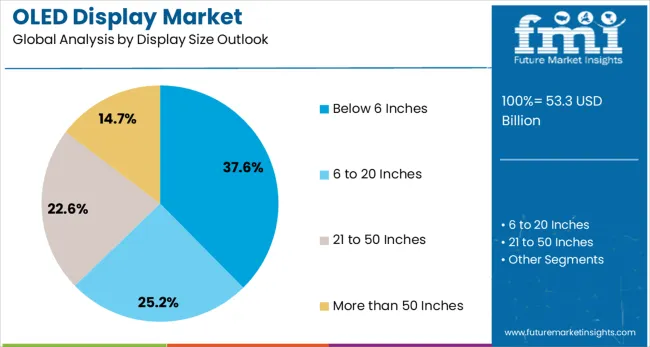

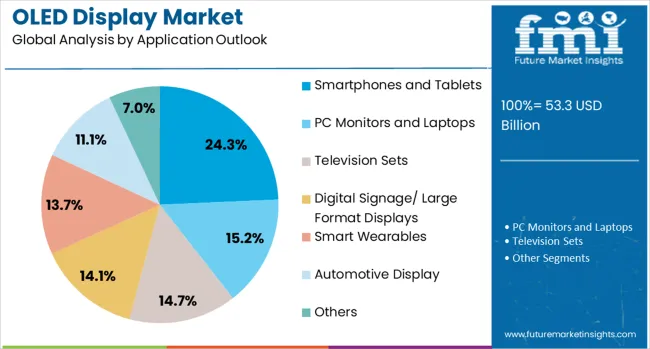

The market is segmented by technology, display size, application, and region. By technology, the market is divided into AMOLED, PMOLED, and other display technologies. Based on display size, the market is categorized into the following categories: below 6 inches, 6 to 20 inches, 21 to 50 inches, and more than 50 inches. In terms of application, the market is segmented into smartphones and tablets, PC monitors and laptops, television sets, digital signage/large format displays, smart wearables, and automotive displays. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

AMOLED technology is projected to hold 70.7% of the OLED display market in 2025, maintaining its dominance as the preferred display type. Consumers increasingly choose AMOLED for its individual pixel control, high energy efficiency, and superior color accuracy. The technology delivers deep blacks, high contrast ratios, and vibrant visuals, meeting the growing demand for premium viewing experiences in smartphones, tablets, and high-end televisions. Manufacturers continue to invest in AMOLED production capacity and refine manufacturing processes to enhance performance and reduce costs. AMOLED remains central to premium device positioning, enabling brands to differentiate products through exceptional visual quality, longer battery life, and cutting-edge display innovation.

Displays smaller than 6 inches are expected to account for 37.6% of OLED demand in 2025, reflecting their critical role in smartphones and other handheld devices. These compact OLED displays offer portability, high touch responsiveness, and excellent outdoor visibility while maintaining energy efficiency, making them ideal for battery-powered mobile devices. Their use extends beyond smartphones to smartwatches, fitness trackers, and other wearables, further broadening the market. As mobile users prioritize display quality alongside device form factor and power efficiency, sub-6-inch OLED panels remain essential for mid-range and premium devices, driving volume adoption while supporting consumer expectations for high-performance, portable visual experiences.

Smartphones and tablets are expected to represent 24.3% of OLED display demand in 2025, highlighting their pivotal role in driving market growth. Consumers increasingly demand vivid colors, deep contrast, and energy-efficient displays in mobile devices, favoring OLED technology over conventional LCDs. Continuous upgrade cycles and frequent device replacement in the mobile sector further reinforce adoption. OLED displays enhance the user experience for gaming, media consumption, and productivity applications, meeting rising expectations for premium visual performance. The segment serves as a key driver for both volume and revenue, as smartphone and tablet manufacturers continue to invest in high-quality OLED panels to differentiate devices and maintain competitiveness.

The OLED display market is strongly influenced by surging demand for smartphones, tablets, laptops, and wearables. Consumers prefer devices with vibrant visuals, slim profiles, and energy-efficient screens, all of which OLED technology delivers. Premium smartphone brands have already integrated OLED panels widely, while mid-range devices are rapidly adopting them to meet consumer expectations. Beyond phones, laptops and tablets featuring OLED displays are gaining popularity among professionals and gamers due to superior color accuracy and visual performance. The wearable segment, including smartwatches and fitness trackers, has also contributed to growth as OLED’s flexibility and brightness fit smaller screen designs. This rising adoption across electronics is a central driver for market expansion.

Automotive manufacturers are increasingly integrating OLED displays into dashboards, infotainment systems, and rear-seat entertainment units. The technology’s thin design, high brightness, and ability to support curved and flexible layouts make it ideal for modern car interiors. Drivers benefit from clearer visibility, sharper graphics, and improved safety features through advanced display integration. Luxury vehicle brands have already adopted OLED panels, and mass-market automakers are gradually introducing them to meet rising consumer expectations. The shift toward electric and connected vehicles is creating more opportunities for advanced displays, as these vehicles rely heavily on interactive digital interfaces. The automotive industry’s embrace of OLED displays is shaping a strong new growth avenue.

The OLED display market is highly competitive, with major players pursuing strategies to strengthen their positions. Manufacturers are investing in large-scale production facilities to meet growing global demand while aiming to reduce costs. Partnerships between display makers and consumer electronics companies help secure long-term supply agreements, ensuring steady growth. Regional expansion, especially in Asia-Pacific markets, has become a key strategy due to strong consumer electronics manufacturing hubs. Competition also centers around panel sizes, with companies diversifying offerings from small wearable screens to large television displays. By focusing on efficiency, cost reduction, and global outreach, industry leaders are driving market momentum while maintaining a competitive edge.

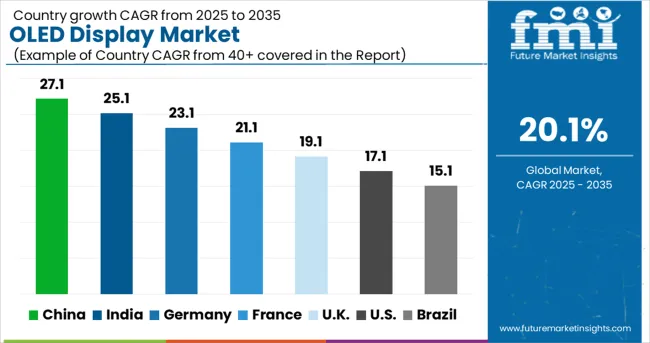

| Country | CAGR (2025-2035) |

|---|---|

| China | 27.1% |

| India | 25.1% |

| Germany | 23.1% |

| France | 21.1% |

| UK | 19.1% |

| USA | 17.1% |

| Brazil | 15.1% |

The OLED display market is experiencing exceptional growth globally, with China leading at a 27.1% CAGR through 2035, driven by massive manufacturing capacity, strong consumer electronics demand, and significant investments in display technology development. India follows closely at 25.1%, supported by rapidly growing smartphone adoption, increasing consumer purchasing power, and an expanding electronics manufacturing ecosystem. Germany shows strong growth at 23.1%, emphasizing automotive applications and industrial display solutions. France records 21.1%, focusing on premium consumer electronics and technology innovation. The UK shows 19.1% growth, prioritizing high-end consumer devices and display quality preferences.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

OLED displays in China are projected to grow at a CAGR of 27.1% through 2035, driven by large-scale domestic manufacturing, growing consumer demand for premium electronics, and the country’s position as a global electronics hub. Competition is intense among domestic and international manufacturers, with differentiation achieved through advanced production facilities and integrated supply chains. Adoption is accelerated compared with India and Brazil due to stronger industrial capacity and government-backed incentives. Investments in automated production, research capabilities, and distribution infrastructure have strengthened market positioning and reinforced China’s leadership in high-end consumer electronics and export markets.

OLED displays in India are expected to grow at a CAGR of 25.1%, supported by increasing smartphone penetration, rising middle-class purchasing power, and expansion of the consumer electronics sector. Competition involves both domestic and international brands establishing distribution networks to serve growing urban and semi-urban demand. Compared with China, scale and infrastructure are smaller, yet adoption is rapidly increasing due to strong demographic trends and exposure to premium technology products. Investments in retail channels, marketing, and device education are improving consumer awareness. Market differentiation arises from targeting younger consumers and leveraging social media and technology review platforms to promote premium display features.

OLED displays in Germany are projected to grow at a CAGR of 23.1%, supported by integration into the automotive sector and strong demand for premium consumer electronics. Competition emphasizes product reliability, advanced functionality, and integration in automotive dashboards, infotainment, and industrial applications. Adoption is more regulated and quality-driven compared with China or India. Investments in smart display solutions, precision manufacturing, and industrial automation are enhancing market differentiation. Germany represents a mature, technologically sophisticated market where operational reliability and high visual performance are critical. OEM partnerships and specialized industrial applications continue to drive OLED adoption across the country.

OLED displays in France are expected to grow at a CAGR of 21.1%, driven by premium consumer electronics demand, advanced technology adoption, and focus on superior display experiences. Competition centers on innovation, design excellence, and integration of next-generation OLED technologies. Compared with Germany and China, adoption is more focused on high-end niche products rather than large-scale industrial production. Investments in R&D, collaboration between technology companies and research institutions, and consumer-focused innovation programs are reinforcing market differentiation. France’s market emphasizes blending visual performance with design aesthetics, catering to consumers seeking advanced functionality, design, and immersive display experiences in both consumer electronics and professional applications.

OLED displays in the UK are projected to grow at a CAGR of 19.1%, supported by consumer preference for high-quality displays and premium electronics. Competition focuses on technological innovation, brand positioning, and product performance. Compared with China and India, adoption is moderate, yet the UK market emphasizes quality and niche applications such as gaming and entertainment devices. Investments in retail channels, e-commerce platforms, and technology education have enhanced consumer awareness. Market differentiation is achieved through integration of high-performance displays into professional and consumer devices, catering to users seeking superior visual experiences while balancing price and accessibility across multiple segments.

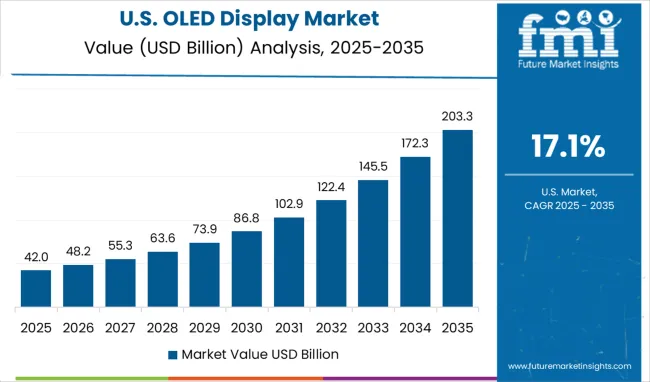

OLED displays in the United States are projected to grow at a CAGR of 17.1%, supported by advanced technology adoption, strong consumer electronics demand, and preference for premium displays. Competition is driven by manufacturers emphasizing innovation, brand recognition, and integration into high-end smartphones, televisions, and emerging applications. Compared with China and India, adoption is moderate due to market maturity, but technological sophistication differentiates offerings. Investments in retail networks, e-commerce, and consumer education strengthen market positioning. Differentiation arises from advanced display performance, integration with smart devices, and premium channel distribution, reinforcing the country’s role as a critical hub for innovation and consumer electronics excellence.

OLED displays in Brazil are expected to grow at a CAGR of 15.1%, driven by increasing smartphone penetration, rising disposable incomes, and growing demand for premium display experiences. Competition is emerging between local and international suppliers, with differentiation achieved through distribution networks and affordability strategies. Compared with China and Germany, adoption is slower due to infrastructure limitations and cost sensitivity, yet urban centers show rapid uptake. Investments in manufacturing incentives, consumer education, and digital entertainment adoption are supporting market expansion. Brazil represents a developing market where brand positioning, accessibility, and visual performance define competitive advantage.

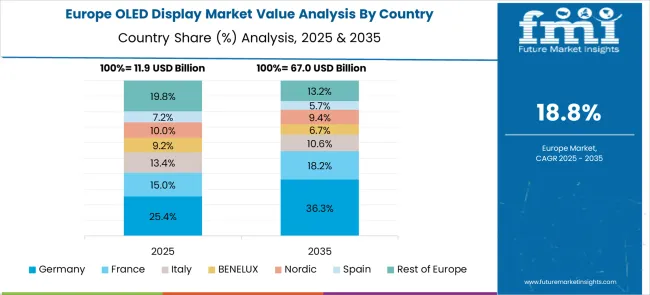

The OLED display market in Europe demonstrates strong development across major economies, with Germany showing a robust presence through its automotive industry integration and consumer appreciation for premium display technologies, supported by manufacturers leveraging engineering expertise to develop high-performance OLED solutions for automotive displays and industrial applications that emphasize reliability and advanced functionality.

France represents a significant market driven by its technology sector development and sophisticated understanding of display applications, with companies focusing on premium OLED implementations that combine French innovation with advanced display technologies for enhanced visual performance and energy efficiency benefits in consumer electronics and professional applications.

The UK exhibits considerable growth through its embrace of premium consumer electronics and display technology innovation, with strong adoption of OLED displays in high-end smartphones, televisions, and emerging applications. Germany and France show expanding interest in automotive OLED applications, particularly in premium vehicle dashboard displays and infotainment systems. BENELUX countries contribute through their focus on technology adoption and premium device preferences. At the same time, Eastern Europe and Nordic regions display growing potential driven by increasing consumer electronics penetration and expanding access to OLED-enabled devices across diverse retail channels.

Companies are investing in advanced manufacturing processes, research and development, production capacity expansion, and strategic partnerships to deliver high-performance, reliable, and cost-effective OLED display solutions. Technology innovation, manufacturing efficiency, and market positioning are central to strengthening product portfolios and competitive advantages.

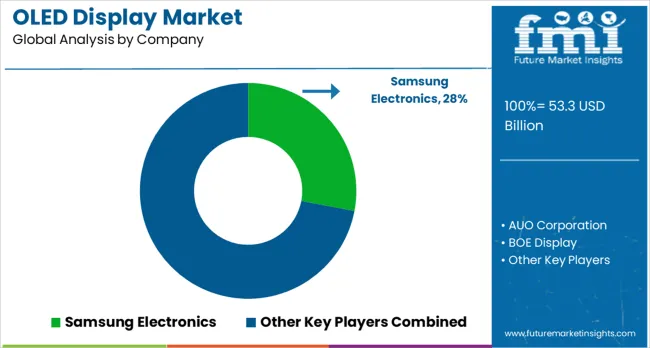

Samsung Electronics leads the market with significant global market share, offering comprehensive OLED display solutions with a focus on smartphones, tablets, and television applications. AUO Corporation provides advanced display technologies with emphasis on manufacturing excellence and product quality. BOE Display delivers cost-effective OLED solutions with a focus on volume production and market accessibility. eMagin Corporation specializes in microdisplay applications with emphasis on high-resolution and specialized use cases.

IPG Automotive focuses on automotive display applications with emphasis on reliability and performance under challenging conditions. LG Electronics provides comprehensive OLED solutions across consumer electronics and television segments. RitDisplay Co., Ltd. offers specialized display solutions with a focus on industrial and professional applications. Sony Corporation delivers premium OLED displays with emphasis on visual quality and brand positioning. Universal Display Corporation provides OLED materials and technology licensing. Visionox offers comprehensive display manufacturing with a focus on flexible and innovative form factors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 53.3 billion |

| Technology | AMOLED, PMOLED, Others |

| Display Size | Below 6 Inches, 6 to 20 Inches, 21 to 50 Inches, More than 50 Inches |

| Application | Smartphones and Tablets, PC Monitors and Laptops, Television Sets, Digital Signage/Large Format Displays, Smart Wearables, Automotive Display |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Samsung Electronics, AUO Corporation, BOE Display, eMagin Corporation, IPG Automotive, LG Electronics, RitDisplay Co., Ltd., Sony Corporation, Universal Display Corporation, and Visionox |

| Additional Attributes | Dollar sales by display technology and size category, regional demand trends, competitive landscape, buyer preferences for flexible versus rigid displays, integration with automotive and wearable applications, innovations in manufacturing processes, material science advancement, and emerging application development |

The global OLED display market is estimated to be valued at USD 53.3 billion in 2025.

The market size for the OLED display market is projected to reach USD 332.9 billion by 2035.

The OLED display market is expected to grow at a 20.1% CAGR between 2025 and 2035.

The key product types in the OLED display market are AMOLED, PMOLED and others.

In terms of display size outlook, the below 6 inches segment is expected to command a 37.6% share in the OLED display market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LED and OLED lighting Products and Display Market Size and Share Forecast Outlook 2025 to 2035

Africa LED & OLED Market Report – Growth & Forecast 2016-2026

OLED-on-Silicon (OLEDoS) Market Size and Share Forecast Outlook 2025 to 2035

OLED Market Size and Share Forecast Outlook 2025 to 2035

OLED Lightening Panels Market

MicroLED Photoluminescence Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Uncooled Thermal Imaging Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air-Cooled Cube Ice Machines Market – Efficient Cooling & Industry Trends 2025-2035

Self Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Cube Ice Machines Market - Growth Forecast & Industry Demand 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

V Type Air Cooled Condenser Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA