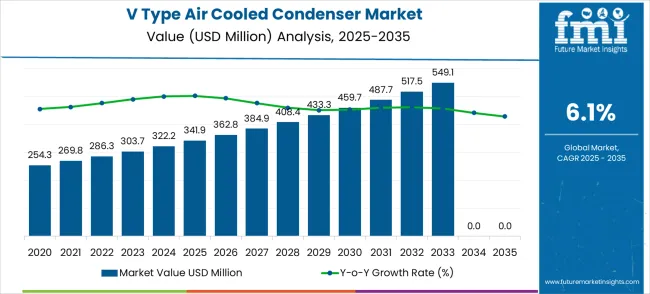

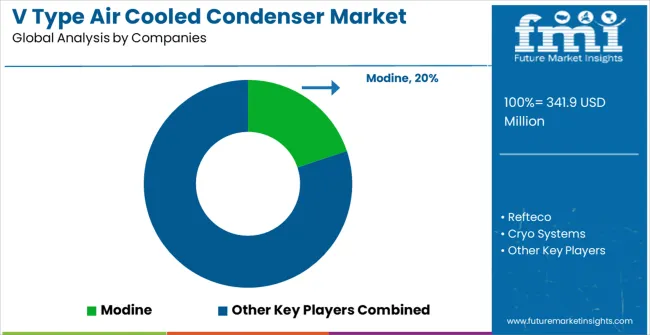

The V type air cooled condenser market is valued at USD 341.9 million in 2025 and is anticipated to reach USD 618.1 million by 2035, with a forecast CAGR of 6.1%. This steady growth reflects rising adoption of efficient cooling technologies in industrial, commercial, and power generation sectors, driven by increasing demand for sustainable energy systems and strict environmental regulations. The CAGR of 6.1% indicates consistent annual expansion, supported by rising industrialization, urban development, and advancements in condenser efficiency.

Over the decade, the market is set to grow by USD 276.2 million, representing a significant expansion of 80.7% over 2025 levels.

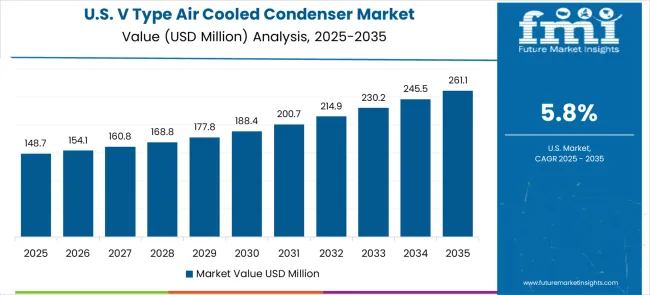

A year-on-year (YoY) analysis reveals steady growth throughout the forecast period. Between 2025 and 2026, the market grows from USD 341.9 million to USD 362.8 million, a 6.07% increase. The following years show consistent expansion, with annual growth rates generally ranging between 5.9% and 6.3%. The highest YoY growth occurs between 2027 and 2028, with a 6.3% increase, moving from USD 384.9 million to USD 408.4 million. This spike can be attributed to intensified investments in energy-efficient infrastructure and upgrades in cooling systems, particularly in developing economies.

| V Type Air Cooled Condenser Market | Value |

|---|---|

| Market Value (2025) | USD 341.9 million |

| Market Forecast Value (2035) | USD 618.1 million |

| Market Forecast CAGR | 6.1% |

Growth volatility is minimal in this market, indicating a stable demand pattern. Slight decelerations are seen between certain years, such as between 2030 and 2031, where growth slows marginally to 5.8%. This could result from temporary delays in large-scale industrial projects or fluctuations in raw material prices affecting manufacturing costs. Nevertheless, the variations remain minor, suggesting a resilient market supported by long-term industrial and regulatory drivers rather than short-term fluctuations.

The average YoY growth rate across the decade stands close to 6.1%, aligning closely with the projected CAGR. This reflects a balanced growth curve with limited volatility and constant market expansion. By 2035, the market reaches USD 618.1 million, marking a robust increase driven by ongoing technological innovations in condenser design, rising energy efficiency standards, and demand from sectors such as power generation, petrochemical, and heavy industries. The market demonstrates consistent growth with low volatility, driven by stable industry demand and efficiency-driven upgrades.

Market expansion is being supported by the rapid increase in industrial facility construction worldwide and the corresponding need for efficient cooling equipment that provides superior heat transfer performance and operational reliability for industrial refrigeration systems. Modern industrial facilities rely on consistent cooling performance and energy efficiency to ensure optimal production conditions including manufacturing plants, processing facilities, and power generation installations. Even minor cooling inefficiencies can require comprehensive system adjustments to maintain optimal operational standards and energy performance.

The growing complexity of industrial cooling requirements and increasing demand for energy-efficient cooling solutions are driving demand for V type air cooled condenser equipment from certified manufacturers with appropriate performance capabilities and technical expertise. Industrial facility operators are increasingly requiring documented energy efficiency and equipment reliability to maintain operational quality and cost effectiveness. Industry specifications and performance standards are establishing standardized cooling procedures that require specialized condenser technologies and trained technical personnel.

The V Type Air Cooled Condenser market is entering a new phase of growth, driven by demand for energy-efficient cooling, industrial facility expansion, and evolving environmental and energy standards. By 2035, these pathways together can unlock USD 120-150 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Standard Configuration Leadership (FN Type Condensers) The FN Type segment already holds the largest share due to its balance of capacity and efficiency. Expanding product innovation, energy optimization, and technical support can consolidate leadership. Opportunity pool: USD 35-45 million.

Pathway B -- High-Demand Industrial Applications (Refrigeration Systems & Processing) Refrigeration systems account for the majority of demand. Growing industrial infrastructure, especially in emerging economies, will drive higher adoption of V type air cooled condensers for cooling management. Opportunity pool: USD 25-35 million.

Pathway C -- Energy Efficiency & Environmental Compliance Industrial operators are expanding focus on energy efficiency and environmental standards. Condensers optimized for energy performance and regulatory compliance can capture significant growth. Opportunity pool: USD 15-20 million.

Pathway D -- Emerging Market Expansion Asia-Pacific, Middle East, and Latin America present growing demand due to rising industrial infrastructure. Targeting distribution networks and competitive product lines will accelerate adoption. Opportunity pool: USD 12-18 million.

Pathway E -- Smart Control & IoT Integration With increasing digitalization, there is an opportunity to promote smart control systems and IoT-enabled monitoring innovations for operational optimization. Opportunity pool: USD 8-12 million.

Pathway F -- Premium Efficiency Features Condensers with variable speed controls, advanced fin designs, and enhanced heat transfer systems offer premium positioning for specialized industrial facilities and energy-critical applications. Opportunity pool: USD 6-10 million.

Pathway G -- Service, Maintenance & Lifecycle Value Recurring revenue from maintenance services, replacement parts, and performance optimization contracts creates a long-term revenue stream. Opportunity pool: USD 5-8 million.

Pathway H -- Digital Monitoring & Predictive Analytics Digital performance monitoring, predictive maintenance alerts, and operational analytics can elevate V type condensers into "smart industrial" equipment while strengthening facility management. Opportunity pool: USD 3-5 million.

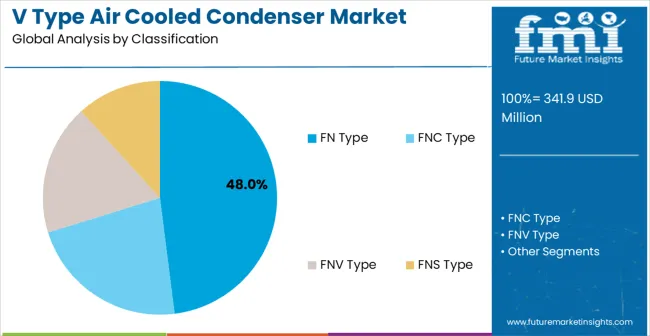

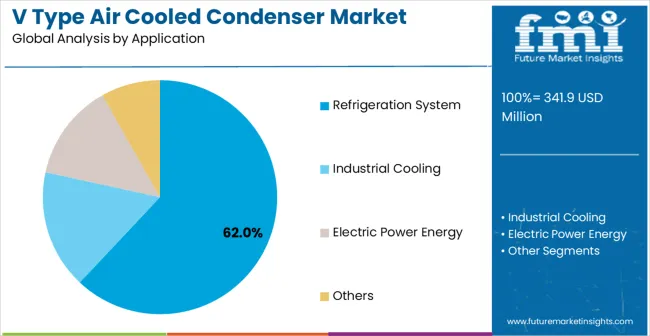

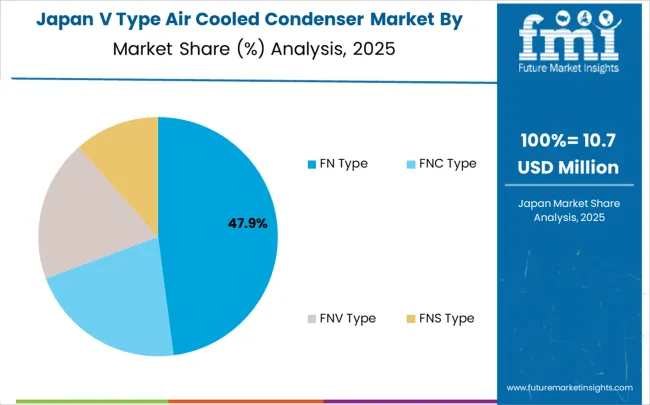

The market is segmented by product type, application, and region. By product type, the market is divided into FN Type, FNC Type, FNV Type, and FNS Type. Based on application, the market is categorized into refrigeration system, industrial cooling, electric power energy, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

In 2025, the FN Type V type air cooled condenser segment is projected to capture around 48% of the total market share, making it the leading product category. This dominance is largely driven by the widespread adoption of standard configuration condensers that provide optimal balance between cooling capacity and operational efficiency, catering to a wide variety of industrial applications. The FN Type condenser is particularly favored for its ability to deliver effective heat transfer performance in both standard and demanding operational environments, ensuring cooling reliability. Manufacturing plants, processing facilities, refrigeration installations, and industrial complexes increasingly prefer this type, as it meets operational cooling needs without imposing excessive energy consumption or maintenance requirements. The availability of well-established product lines, along with comprehensive technical support options and aftersales service from leading manufacturers, further reinforces the segment's market position. This product category benefits from consistent demand across regions, as it is considered a practical and reliable solution for facilities of varying cooling loads and operational requirements. The combination of efficiency, performance, and versatility makes FN Type V air cooled condensers a dependable choice, ensuring their continued popularity in the industrial cooling equipment market.

The refrigeration system segment is expected to represent 62% of V type air cooled condenser demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the unique operational needs of industrial refrigeration environments, where consistent cooling performance and energy efficiency are critical to process quality and operational costs. Refrigeration systems often feature continuous operation requirements that demand reliable and efficient cooling equipment throughout extended operational periods, requiring robust and dependable condenser solutions. V type air cooled condensers are particularly well-suited to these environments due to their ability to provide consistent heat rejection capacity and energy-efficient operation, even during high ambient temperature conditions. As industrial refrigeration systems expand globally and emphasize improved energy efficiency standards, the demand for V type air cooled condensers continues to rise. The segment also benefits from heightened environmental compliance requirements within the industrial sector, where operators are increasingly prioritizing energy efficiency and environmental sustainability as essential operational measures. With refrigeration systems investing in advanced cooling technologies and efficiency standards, V type air cooled condensers provide an essential solution to maintain high-performance industrial cooling. The growth of specialized industrial networks, coupled with increased focus on energy management standards, ensures that refrigeration systems will remain the largest and most stable demand driver for V type air cooled condensers in the forecast period.

The market is advancing steadily due to increasing industrial facility development and growing recognition of air cooled condenser advantages over water cooled alternatives in water-scarce regions. The market faces challenges including higher space requirements compared to compact cooling solutions, need for adequate ventilation clearances in installation environments, and varying ambient temperature limitations across different geographic regions. Energy efficiency optimization efforts and technology advancement programs continue to influence equipment development and market adoption patterns.

The growing development of advanced heat exchanger designs is enabling higher cooling efficiency with improved energy performance and reduced operational costs. Enhanced fin technologies and optimized airflow patterns provide superior heat transfer capabilities while maintaining environmental compliance requirements. These technologies are particularly valuable for large industrial operators who require reliable cooling performance that can support extensive operational processes with consistent efficiency results.

Modern V type air cooled condenser manufacturers are incorporating advanced control systems and monitoring capabilities that enhance operational efficiency and equipment effectiveness. Integration of variable speed fan controls and intelligent temperature management enables superior cooling optimization and comprehensive energy management capabilities. Advanced control features support operation in diverse industrial environments while meeting various efficiency requirements and operational specifications.

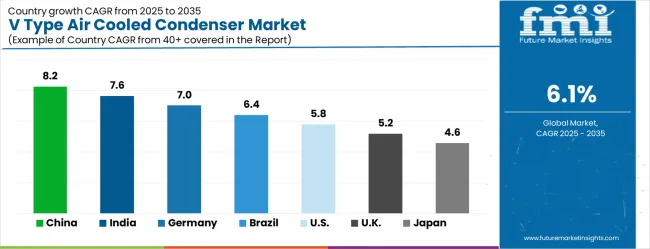

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| Brazil | 6.4% |

| United States | 5.8% |

| United Kingdom | 5.2% |

| Japan | 4.6% |

The market is growing rapidly, with China leading at an 8.2% CAGR through 2035, driven by strong industrial facility development and increasing adoption of energy-efficient cooling equipment. India follows at 7.6%, supported by rising manufacturing infrastructure development and growing awareness of advanced cooling solutions. Germany grows steadily at 7.0%, integrating efficient cooling technology into its established industrial infrastructure. Brazil records 6.4%, focusing industrial facility modernization and equipment upgrade initiatives. The United States shows solid growth at 5.8%, focusing on energy efficiency enhancement and operational optimization. The United Kingdom demonstrates steady progress at 5.2%, maintaining established industrial cooling applications. Japan records 4.6% growth, concentrating on technology advancement and efficiency optimization.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to grow at a CAGR of 8.2% between 2025 and 2035, driven by industrial expansion, modernization of power generation, and a growing focus on energy efficiency. V type air cooled condensers are increasingly deployed in large-scale power plants, petrochemical facilities, and heavy manufacturing units for efficient heat rejection without excessive water use. The demand is strengthened by rising electricity demand and the expansion of thermal and combined cycle power generation. Chinese manufacturers are focusing on optimizing condenser design to improve heat transfer efficiency while reducing footprint and operational costs. Government investments in energy infrastructure, coupled with incentives for green technology adoption, further support market growth. Rising exports and domestic adoption ensure China remains a leader in the V type air cooled condenser market.

India is forecasted to grow at a CAGR of 7.6% from 2025 to 2035, driven by rapid expansion in power generation, refining, and chemical process industries. V type air cooled condensers are preferred for their ability to deliver high heat rejection efficiency with reduced water consumption. The growing demand for compact industrial cooling solutions is encouraging manufacturers to innovate condenser designs for higher performance and reduced energy usage. Government incentives for power plant expansions, renewable energy, and industrial modernization further strengthen the market. Domestic manufacturers are investing heavily in R&D to deliver cost-efficient and reliable condensers, while international collaborations are enhancing technical capabilities. Increasing focus on environmental regulations also boosts adoption. The Indian market is poised for significant growth in unattended condenser applications.

Germany is expected to expand at a CAGR of 7.0% between 2025 and 2035, supported by strong demand in industrial cooling, petrochemical plants, and energy production facilities. V type air cooled condensers are valued for their energy efficiency and ability to operate with minimal water consumption, aligning with strict environmental policies. German manufacturers are investing in innovations in heat exchange materials, corrosion resistance, and compact design to meet industry requirements. Expansion in energy-intensive sectors, including chemicals, steel, and power generation, steady market demand. Germany’s export strength in engineering equipment and advanced manufacturing solutions supports its global presence in the condenser market. Continuous R&D and government support for energy efficiency further boost growth.

Brazil is projected to grow at a CAGR of 6.4% from 2025 to 2035, supported by increasing investments in power generation and industrial cooling solutions. V type air cooled condensers are becoming essential in tropical climates for their low water consumption and high heat rejection efficiency. Growth in the energy sector, including thermal power and renewable energy plants, drives market demand. Local manufacturers are investing in developing cost-efficient condensers tailored to Brazil’s environmental conditions. International partnerships and technology transfers enhance manufacturing capabilities. Expansion of infrastructure projects, including new power plants and industrial facilities, increases demand. Government incentives for energy efficiency solutions further encourage adoption. Brazil is expected to show steady growth in condenser deployment during the forecast period.

The United States is projected to grow at a CAGR of 5.8% from 2025 to 2035, supported by upgrades in aging infrastructure, expansion of power generation capacity, and demand for efficient cooling solutions. V type air cooled condensers are increasingly used in thermal power plants, chemical processing facilities, and large-scale manufacturing systems to improve operational efficiency and reduce water usage. Demand is further supported by the trend toward renewable energy projects and the retrofitting of older plants with advanced condensers. USA manufacturers are investing in cutting-edge manufacturing techniques to deliver condensers with enhanced durability, efficiency, and reduced footprint. Government initiatives promoting advanced manufacturing and energy efficiency bolster adoption.

The United Kingdom is forecasted to grow at a CAGR of 5.2% between 2025 and 2035, driven by demand in industrial cooling, power generation, and process industries. V type air cooled condensers are valued for their ability to deliver high heat rejection efficiency with low water usage, aligning with environmental regulations. UK manufacturers are investing in developing condensers that combine performance with compact designs suited to modern industrial environments. Expansion of industrial modernization projects and investments in low-carbon infrastructure support adoption. Export demand for high-quality condensers further strengthens the UK market. The integration of advanced materials and corrosion-resistant technologies positions the UK as a steady growth market for V type air cooled condensers.

Japan is expected to grow at a CAGR of 4.6% from 2025 to 2035, supported by rising demand for high-efficiency cooling solutions in power generation and industrial sectors. V type air cooled condensers are increasingly adopted for their durability, compact size, and water conservation benefits. Japan’s advanced manufacturing sector invests heavily in precision engineering to produce condensers with enhanced heat transfer efficiency and corrosion resistance. Demand is driven by upgrades in thermal power plants, industrial automation, and electronics manufacturing facilities. Government support for energy efficiency and technology innovation strengthens adoption. Japan continues to be a competitive market for technologically advanced condenser solutions, supported by high standards for quality and performance.

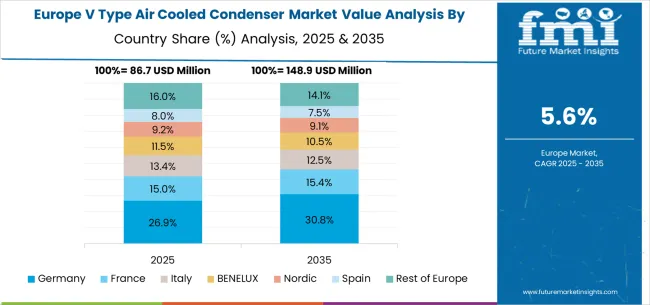

The V type air cooled condenser market in Europe is forecast to expand from USD 89.2 million in 2025 to USD 158.4 million by 2035, registering a CAGR of 5.9%. Germany will remain the largest market, holding 28.5% share in 2025, easing to 27.8% by 2035, supported by strong industrial infrastructure and advanced manufacturing standards. The United Kingdom follows, rising from 18.5% in 2025 to 19.2% by 2035, driven by industrial facility modernization and energy efficiency initiatives. France is expected to maintain stability from 15.8% to 15.5%, reflecting consistent industrial sector investments. Italy holds around 13.5% throughout the forecast period, supported by manufacturing facility upgrades and cooling system modernization programs. Spain grows from 11.2% to 11.8% with expanding industrial infrastructure and increased focus on energy-efficient cooling solutions. BENELUX markets maintain 6.8% to 6.5%, while the remainder of Europe hovers near 5.7%--5.9%, balancing emerging Eastern European industrial development against mature Nordic markets with established cooling technology adoption patterns.

The market is defined by competition among specialized cooling equipment manufacturers, industrial system companies, and heat exchanger solution providers. Companies are investing in advanced heat transfer technology development, energy efficiency optimization, control system improvements, and comprehensive service capabilities to deliver reliable, efficient, and cost-effective cooling solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and market presence.

Modine offers comprehensive V type air cooled condenser solutions with established manufacturing expertise and professional-grade cooling equipment capabilities. Refteco provides specialized cooling system products with focus on efficiency reliability and operational performance. Cryo Systems delivers advanced cooling solutions with focus on energy efficiency and industrial-friendly operation. EVAPCO specializes in heat transfer equipment with advanced cooling technology integration.

Kelvion offers professional-grade cooling equipment with comprehensive technical support capabilities. FRITERM A.S. delivers established industrial cooling solutions with advanced condenser technologies. Babcock & Wilcox provides specialized industrial equipment with focus on performance optimization. Far East Group, Square Technology Group, Jiangsu Linble Cold Chain Technology, Nanjing Canatal Data-Centre Environmental Tech, Shandong Ourfuture Energy Technology, Beifeng Refrigeration Equipment, Henan Kaiteng Refrigeration Equipment, and Heyan Tech offer specialized manufacturing expertise, product reliability, and comprehensive development across global and regional market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 341.9 million |

| Product Type | FN Type, FNC Type, FNV Type, FNS Type |

| Application | Refrigeration System, Industrial Cooling, Electric Power Energy, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Modine, Refteco, Cryo Systems, EVAPCO, Kelvion, FRITERM A.S., Babcock & Wilcox, Far East Group, Square Technology Group, Jiangsu Linble Cold Chain Technology, Nanjing Canatal Data-Centre Environmental Tech, Shandong Ourfuture Energy Technology, Beifeng Refrigeration Equipment, Henan Kaiteng Refrigeration Equipment, Heyan Tech |

| Additional Attributes | Dollar sales by product type and application segment, regional demand trends across major markets, competitive landscape with established cooling equipment manufacturers and emerging technology providers, customer preferences for different condenser configurations and efficiency options, integration with industrial facility management systems and cooling protocols, innovations in heat exchange efficiency and energy optimization technologies, and adoption of smart control design features with enhanced performance capabilities for improved operational workflows. |

The global v type air cooled condenser market is estimated to be valued at USD 341.9 million in 2025.

The market size for the v type air cooled condenser market is projected to reach USD 618.1 million by 2035.

The v type air cooled condenser market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in v type air cooled condenser market are fn type, fnc type, fnv type and fns type.

In terms of application, refrigeration system segment to command 62.0% share in the v type air cooled condenser market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Heat Shrink Film Market Size and Share Forecast Outlook 2025 to 2035

Valerian Root Powder Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Frame Casement Window Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Sliding Window Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Virtual Land NFT Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Windows and Doors Market Size and Share Forecast Outlook 2025 to 2035

Vibration Screening Machine Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-Mounted Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Voltage Monitoring Integrated Circuit Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Very Narrow Aisle Turret Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vascular Sheath Group Market Size and Share Forecast Outlook 2025 to 2035

Vertical Induction Hardening System Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Video on Demand (VoD) Service Market Size and Share Forecast Outlook 2025 to 2035

Vertical Furnace Tube Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA