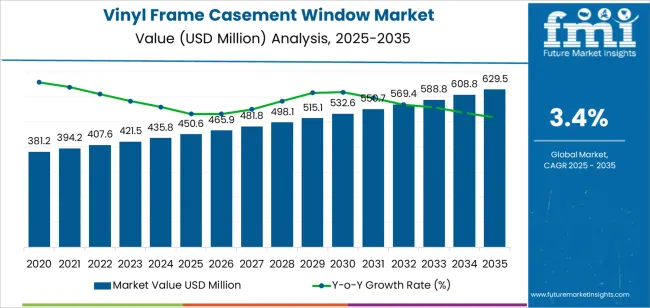

The vinyl frame casement window market is forecast to grow from USD 450.6 million in 2025 to USD 629.5 million by 2035, expanding at a CAGR of 3.4% and adding USD 178.9 million over the period. Growth is supported by rising demand for energy-efficient, low-maintenance, and durable window solutions used in residential and commercial construction. Casement windows provide strong ventilation, unobstructed views, and tight seals that enhance thermal performance, making them attractive for new builds and renovation projects. Vinyl frames do not rot or corrode and maintain color stability over time, helping homeowners and builders reduce long-term maintenance costs. From 2025 to 2030, the market increases to USD 540.2 million, adding USD 89.6 million, and from 2030 to 2035 it rises to USD 629.5 million, adding another USD 89.3 million, indicating balanced growth across both halves of the decade.

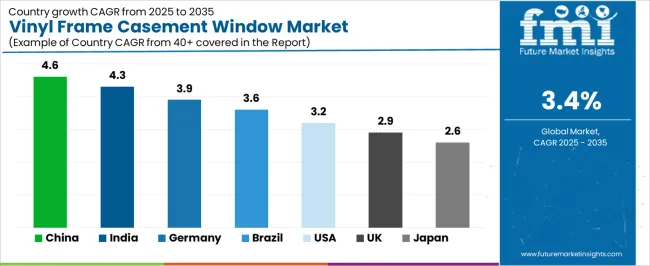

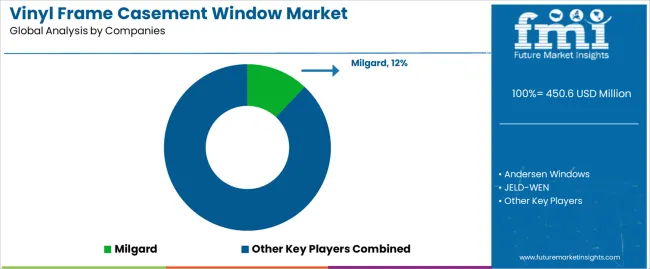

Crank-operated types lead with a 65% share due to ease of use and strong sealing capability, while residential applications account for 70% of demand as homeowners prioritize comfort, insulation performance, and energy savings. Country-level growth is led by China at 4.6%, followed by India at 4.3% and Germany at 3.9%, with Brazil at 3.6%, the USA at 3.2%, the UK at 2.9%, and Japan at 2.6% driven by renovation cycles and energy-efficiency regulations. Competition is shaped by Milgard with a 12% share, along with Andersen Windows, JELD-WEN, Pella, Harvey Windows & Doors, Centra Windows, Stanek, Sun Windows, PGT, Simonton, MI Windows, Ply Gem, Sierra Pacific, and Paradigm Windows, supported by continued innovation in glazing, structural vinyl profiles, and color-stable finishes.

As energy efficiency remains a priority for homeowners and building managers, vinyl-frame casement windows are increasingly preferred. These windows also require minimal maintenance due to their resistance to weathering, corrosion, and fading. The growing focus on energy-efficient building solutions, especially in the residential sector, is driving demand for vinyl-frame casement windows. Vinyl’s cost-effectiveness and long lifespan make it an attractive option for both budget-conscious homeowners and commercial builders.

The market for vinyl-frame casement windows is also supported by innovations in window technology. Advancements in glazing, including double- and triple-glazing options, are enhancing the energy efficiency of these windows and making them even more attractive to consumers. As environmental concerns continue to drive demand for energy-efficient building materials, vinyl frame windows are becoming an integral part of green building designs.

Between 2025 and 2030, the vinyl frame casement window market is projected to grow from USD 450.6 million to approximately USD 540.2 million, adding USD 89.6 million, which accounts for about 50.2% of the total forecasted growth for the decade. This period will see growing adoption in both residential and commercial sectors, driven by the increasing focus on energy-efficient solutions.

From 2030 to 2035, the market is expected to expand from approximately USD 540.2 million to USD 629.5 million, adding USD 89.3 million, which constitutes about 49.8% of the overall growth. This phase will see sustained demand for vinyl frame casement windows, particularly in rapidly developing regions and in new construction projects, supported by ongoing advancements in window technologies and the continued emphasis on energy savings and durability.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 450.6 million |

| Market Forecast Value (2035) | USD 629.5 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

The vinyl frame casement window market is growing as demand rises for energy-efficient, low-maintenance, and visually appealing window solutions. Casement windows, which open outward from the side, offer excellent ventilation and a tight seal when closed, making them ideal for both residential and commercial applications. The growing popularity of these windows is attributed to their superior performance in terms of airflow, natural light, and energy conservation.

The continued growth in residential construction, alongside the increasing demand for home renovations, is a major driver for the vinyl frame casement window market. Vinyl windows, which are resistant to rotting, warping, and fading, provide a low-maintenance alternative to traditional wood and metal windows. This durability, coupled with improved insulation properties, makes vinyl frame casement windows an attractive choice for homeowners and builders alike.

Technological advancements in vinyl window manufacturing, such as multi-chamber frames and high-performance glazing, have enhanced the overall energy efficiency and durability of casement windows. The growing emphasis on sustainable building practices and energy-efficient solutions has further contributed to the demand for vinyl frame windows. Despite challenges such as price sensitivity in certain regions, the market is expected to continue growing as the demand for high-performance windows in both new builds and retrofits increases.

The market is segmented by type, application, and region. By type, the market is divided into crank-operated type and push-out type, with crank-operated type leading the market. Based on application, the market is categorized into residential and commercial, with residential representing the largest segment in terms of market share. Regionally, the market is divided into North America, Europe, Asia Pacific, and other key regions.

The crank-operated type segment leads the vinyl frame casement window market, holding 65% of the total market share. This segment’s growth is driven by the ease of use and reliability of crank-operated windows. The crank mechanism allows users to open and close the window with minimal effort, which is especially beneficial for hard-to-reach or larger windows typically found in residential and commercial buildings. The ability to provide excellent ventilation and secure sealing when closed makes the crank-operated type highly desirable.

As demand for energy-efficient and durable window solutions increases, the crank-operated casement window remains the preferred option due to its strong sealing capabilities and ease of operation. The versatility of crank-operated windows in both residential and commercial buildings ensures that this segment continues to dominate the market, meeting the needs for enhanced ventilation and long-term performance.

The residential application dominates the vinyl frame casement window market, accounting for 70% of the total market share. This growth is driven by the increasing demand for high-performance windows that offer energy efficiency, improved insulation, and ease of use in residential buildings. Vinyl frame casement windows, particularly the crank-operated type, are ideal for homes as they provide optimal airflow while offering a tight seal when closed, contributing to lower energy consumption.

Homeowners are increasingly seeking window solutions that balance functionality, aesthetics, and energy efficiency, making vinyl frame casement windows a popular choice for new construction and home renovation projects. As the focus on energy-efficient housing grows, especially in markets with fluctuating climates, the demand for high-quality windows that provide long-term value remains strong. This trend ensures that the residential sector continues to be the primary driver of growth in the vinyl frame casement window market.

The market is expanding as vinyl‑framed casement windows gain traction in both residential and commercial buildings. These windows offer features such as tight seals when closed, improved ventilation when open, energy‑efficient vinyl frames, and compatibility with modern glazing systems. Key drivers include rising demand for low‑maintenance, energy‑efficient fenestration solutions and growth in housing construction and renovation activity. Restraints stem from aesthetic perceptions comparing vinyl to wood or aluminum, upfront cost premiums for premium vinyl systems, and weaker regional awareness in certain markets that favour traditional materials.

Why are Vinyl Frame Casement Windows Gaining Popularity in Building Projects?

Vinyl frame casement windows are gaining popularity because they combine the benefits of casement design such as unobstructed views, efficient operation via crank or lever, and superior ventilation with the advantages of vinyl frames: low maintenance, moisture resistance and effective thermal performance. As building codes tighten around energy efficiency and as homeowners and builders seek simplified upkeep, these vinyl‑casement combinations become attractive. In renovation markets especially, replacing older windows with sleek vinyl casement units enables improved comfort and lower heating/cooling costs. The versatility of vinyl frames available in multiple colors, finishes and styles also supports broader adoption across new builds and remodeling works.

How are Technological and Material Innovations Driving Growth in This Segment?

Technological and material innovations are fueling growth in the vinyl frame casement window segment by enhancing frame strength, durability and energy performance. Advanced interior‑chamber vinyl profiles improve insulation and allow for larger casement sashes without compromising structural integrity. Enhanced sealing systems, low‑E glazing compatibility and automation (motorised operation) further boost appeal, particularly in high‑end renovations and commercial builds. Colour‑matching, wood‑look finishes and reinforced vinyl blends address aesthetic concerns, widening market reach. These innovations help product manufacturers align with stringent building‑performance standards and consumer expectations, accelerating market uptake of vinyl casements.

What are the Key Challenges Limiting Adoption of Vinyl Frame Casement Windows?

Despite strong growth potential, adoption of vinyl frame casement windows faces notable challenges. One major barrier is the perception barrier in regions valuing wood or aluminum frames for premium finish, vinyl may be viewed as lower grade. Design restrictions and size limitations of vinyl frames in very large fenestration openings can also restrict use in luxury or architectural builds. Installation complexity (due to outward‑opening sashes and the need for adequate clearance) and regional climate suitability (extreme heat or ultra‑cold zones) may lead some specifiers to prefer alternatives. Cost sensitivity in lower‑end markets and lack of regulatory awareness of vinyl’s performance benefits can slow uptake in certain geographies.

| Country | CAGR (%) |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| Brazil | 3.6% |

| USA | 3.2% |

| UK | 2.9% |

| Japan | 2.6% |

The vinyl frame casement window market is expanding across key countries, with China leading at a 4.6% CAGR. This growth is driven by urbanization, the growing demand for energy-efficient building solutions, and rising home improvement trends. India follows closely at 4.3%, fueled by rapid urban development and increasing adoption of vinyl windows in both residential and commercial sectors. Germany is growing at 3.9%, supported by the demand for durable, energy-efficient windows and strong construction sector activity. Brazil shows a 3.6% CAGR, driven by growth in the residential construction market. The USA, UK, and Japan are experiencing moderate growth at 3.2%, 2.9%, and 2.6%, respectively, due to home renovations and increasing demand for energy-efficient window solutions.

China leads the vinyl frame casement window market with a 4.6% CAGR. The country’s urbanization and construction boom are key drivers of this growth. As more people move to urban areas, there is an increasing demand for energy-efficient windows that improve indoor comfort while reducing energy consumption. Vinyl frame casement windows are becoming a popular choice due to their durability, low maintenance, and energy-efficient properties. These windows are ideal for residential and commercial buildings, offering excellent thermal insulation and protection from the elements.

The growing interest in sustainable and green building materials has also contributed to the popularity of vinyl windows in China. As the country invests in green infrastructure and energy-efficient construction, vinyl frame casement windows are being increasingly incorporated into new buildings and home renovation projects. The demand for affordable yet high-quality windows, along with favorable government policies promoting energy-efficient buildings, ensures continued growth in the vinyl window market in China.

India is experiencing strong growth in the vinyl frame casement window market with a 4.3% CAGR. The country's rapid urbanization and expansion of the residential and commercial sectors are driving demand for durable and energy-efficient windows. Vinyl frame casement windows are becoming a preferred choice due to their long lifespan, low maintenance, and energy-saving features. With increasing awareness about energy conservation and building insulation, Indian consumers are increasingly opting for energy-efficient solutions, making vinyl windows an attractive option.

India’s construction sector is booming, with many new residential complexes and commercial buildings being built in urban areas. This surge in construction is driving the demand for vinyl frame windows, particularly in homes and offices looking for affordable yet high-quality solutions. The growing middle class and rising disposable incomes in India have also contributed to the increased demand for home improvement products, including vinyl windows. As the trend for modern, energy-efficient homes continues to grow, the vinyl frame casement window market in India is expected to experience steady growth.

Germany is experiencing steady growth in the vinyl frame casement window market, with a 3.9% CAGR. The country’s strong emphasis on energy efficiency and sustainable building practices has led to a growing demand for vinyl frame windows. These windows, known for their excellent thermal insulation properties and low maintenance, are being increasingly adopted in residential and commercial buildings. Germany’s focus on reducing carbon emissions and energy consumption in the construction sector is contributing to the growing popularity of energy-efficient windows.

The demand for vinyl frame casement windows is driven by Germany’s robust construction industry, which continues to modernize existing buildings and develop new housing projects. As more homeowners and builders seek cost-effective and durable window solutions that improve energy efficiency, the demand for vinyl windows is on the rise. With a strong commitment to sustainable construction and green technologies, Germany’s vinyl frame casement window market is expected to maintain steady growth in the coming years.

Brazil is witnessing moderate growth in the vinyl frame casement window market, with a 3.6% CAGR. The country’s growing residential construction market is a significant factor contributing to this growth. As Brazil’s urban areas continue to expand, the demand for durable, energy-efficient windows is increasing. Vinyl frame casement windows are popular due to their energy-saving properties, low maintenance, and ability to withstand various weather conditions. These benefits make vinyl windows an attractive option for both new construction and home renovation projects.

The Brazilian government’s focus on promoting energy-efficient and environmentally friendly building materials has also played a role in the growth of the vinyl window market. As consumers and developers look for cost-effective solutions that improve energy efficiency, the demand for vinyl frame casement windows continues to rise. With Brazil’s expanding middle class and increased focus on modern building practices, the vinyl window market is set to continue its steady growth in the coming years.

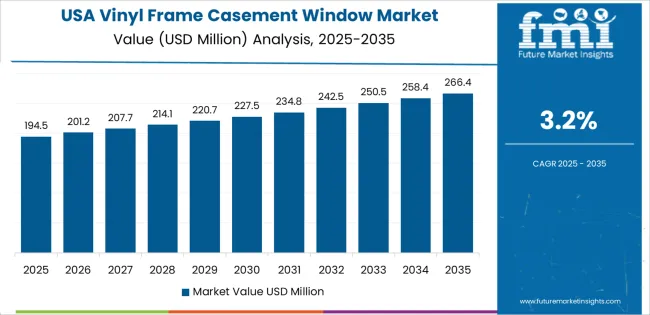

The USA is experiencing moderate growth in the vinyl frame casement window market, with a 3.2% CAGR. The market growth is driven by the increasing demand for energy-efficient window solutions in both residential and commercial sectors. Homeowners and builders in the USA are increasingly opting for vinyl frame casement windows due to their energy-saving features, low maintenance, and long-lasting durability. These windows offer excellent thermal insulation, helping to reduce heating and cooling costs, making them an attractive option for energy-conscious consumers.

The growing trend of home renovations in the USA is another significant driver of the vinyl window market. As homeowners look to improve the energy efficiency of older buildings, they are turning to vinyl frame windows as a cost-effective solution. The ongoing push for energy-efficient construction in both new and existing buildings, along with rising awareness of climate change, is further fueling the demand for vinyl windows in the USA. With a continued focus on energy efficiency, the vinyl frame casement window market in the USA is expected to experience steady growth.

The UK is witnessing steady growth in the vinyl frame casement window market with a 2.9% CAGR. This growth is largely driven by the increasing demand for energy-efficient building solutions and home improvement products. Vinyl frame windows are popular in the UK due to their low maintenance requirements, energy efficiency, and ability to withstand the country's variable weather conditions. These windows provide excellent thermal insulation, helping to reduce energy consumption and heating costs, making them particularly appealing for homeowners looking to improve energy efficiency.

The UK government’s push for greener buildings and more energy-efficient construction is also contributing to the growth of the vinyl window market. As homeowners, businesses, and builders increasingly prioritize energy conservation, the demand for vinyl windows that offer both durability and energy savings continues to rise. With an increasing number of renovation projects focused on improving building energy performance, the market for vinyl frame casement windows is set to continue growing steadily in the UK.

Japan’s vinyl frame casement window market is experiencing steady growth, with a 2.6% CAGR. This growth is driven by the increasing demand for energy-efficient windows in both residential and commercial buildings. As Japan faces fluctuating weather conditions, vinyl frame windows have gained popularity due to their ability to provide excellent insulation while offering durability and low maintenance. The increasing focus on energy efficiency in construction and home renovation projects is further fueling the demand for vinyl frame casement windows.

In addition to energy efficiency, the growing trend of home renovations in Japan is contributing to the market's growth. As homeowners seek cost-effective and sustainable solutions to improve the comfort and performance of their homes, vinyl frame windows are becoming a preferred choice. The government’s focus on energy-efficient building practices and environmental sustainability is also playing a role in driving the demand for vinyl frame casement windows. With the increasing adoption of green construction practices, Japan’s market for vinyl frame windows is expected to continue expanding steadily.

The vinyl frame casement window market is growing as homeowners and builders increasingly seek energy-efficient, durable, and low-maintenance window solutions. Milgard leads the market with a 12% share, known for its high-quality vinyl windows and strong focus on energy efficiency. Milgard’s innovative designs and reputation for craftsmanship make it a dominant player in the market, offering a variety of customizable options for residential and commercial projects.

Other major competitors include Andersen Windows, JELD-WEN, and Pella, which offer a wide range of vinyl frame casement windows tailored to meet various functional and aesthetic needs. Andersen Windows is renowned for its energy-efficient products and superior customer service, while JELD-WEN offers a comprehensive portfolio of vinyl window solutions with a focus on durability and performance. Pella also competes strongly in the market with its high-performance vinyl frame casement windows, emphasizing thermal efficiency and customizable options.

Regional players such as Harvey Windows & Doors, Centra Windows, and Stanek further strengthen the market by offering vinyl frame casement windows that cater to specific regional preferences and building codes. Sun Windows, PGT, and Simonton provide durable and energy-efficient window solutions designed for both new construction and replacement applications.

Other key players like MI Windows, Ply Gem, Sierra Pacific, and Paradigm Windows contribute to the market with their own vinyl window solutions, offering competitive pricing, high-quality materials, and a variety of styles. The competition in the market is driven by factors such as product quality, energy efficiency, customization options, and the growing demand for low-maintenance, cost-effective solutions in both residential and commercial building projects.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Crank-operated Type, Push-out Type |

| Application | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Milgard, Andersen Windows, JELD-WEN, Pella, Harvey Windows & Doors, Centra Windows, Stanek, Sun Windows, PGT, Simonton, MI Windows, Ply Gem, Sierra Pacific, Paradigm Windows |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in vinyl frame casement window technologies, integration with residential and commercial construction projects. |

The global vinyl frame casement window market is estimated to be valued at USD 450.6 million in 2025.

The market size for the vinyl frame casement window market is projected to reach USD 629.5 million by 2035.

The vinyl frame casement window market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in vinyl frame casement window market are crank-operated type and push-out type.

In terms of application, residential segment to command 70.0% share in the vinyl frame casement window market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vinyl Ester Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Acetate Homopolymer Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Electrical Tapes Market Size, Share & Forecast 2025 to 2035

Vinyl Flooring Market Growth - Trends & Forecast 2025 to 2035

Vinyl Extrusion Equipment Market Insights - Growth & Forecast 2025 to 2035

Market Positioning & Share in the Vinyl Cyclohexane Industry

Vinyl Films Market

Vinyl Windows and Doors Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Sliding Window Market Size and Share Forecast Outlook 2025 to 2035

Polyvinyl Chloride (PVC) Packaging Film Market Forecast and Outlook 2025 to 2035

Polyvinyl Butyral PVB Market Size and Share Forecast Outlook 2025 to 2035

Polyvinyl Alcohol (PVA) Films Market Size and Share Forecast Outlook 2025 to 2035

Polyvinylidene Fluoride (PVDF) Market Growth - Trends & Forecast 2025 to 2035

Polyvinyl Chloride Market Growth – Trends & Forecast 2024-2034

Polyvinyl Butyral Market Growth – Trends & Forecast 2024-2034

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Ethylene-vinyl Alcohol Copolymer (EVOH) Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Butylene-divinyl Fraction Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA