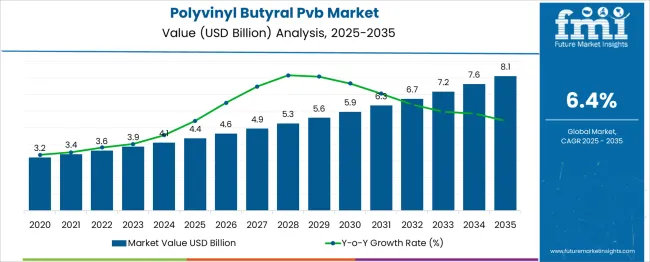

The Polyvinyl Butyral PVB Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 8.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. This represents a total absolute growth of USD 3.7 billion over the ten-year period. The steady growth trajectory reflects expanding demand across automotive, construction, and safety glass applications where PVB is critical for its adhesive and protective properties. The year-on-year increase is gradual and consistent, indicating stable market expansion.

Starting at USD 4.4 billion in 2025, the market is projected to reach USD 4.9 billion by 2027, crossing the USD 6 billion mark by 2030, and ultimately achieving USD 8.1 billion in 2035. This steady climb aligns with increasing industrial usage, regulatory standards mandating safety glass, and advancements in material technology that enhance product performance. This absolute dollar opportunity underscores the market’s potential for generating substantial revenue growth, appealing to manufacturers, suppliers, and end users. The cumulative increase of USD 3.7 billion signals robust market health and an attractive environment for investment and innovation. The PVB Market’s growth will be driven by rising consumer safety awareness and expansion in infrastructure development, making it a strategically valuable segment in polymer materials. The absolute dollar opportunity reflects a promising outlook fueled by steady demand and diversified applications.

| Metric | Value |

|---|---|

| Polyvinyl Butyral PVB Market Estimated Value in (2025 E) | USD 4.4 billion |

| Polyvinyl Butyral PVB Market Forecast Value in (2035 F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The polyvinyl butyral (PVB) market is undergoing consistent expansion, driven by the growing emphasis on energy-efficient infrastructure, increasing vehicle production with laminated safety glass, and rising demand for high-performance interlayers in glazing applications. Environmental mandates and building codes mandating enhanced impact resistance and UV protection in glazing systems have encouraged the widespread use of PVB films.

Concurrently, urbanization and infrastructure renewal programs across both developed and emerging markets have accelerated adoption, particularly in the construction and automotive sectors. Technological advancements in resin formulation and extrusion capabilities are enabling broader application in photovoltaic modules and soundproofing laminates.

Forward-looking growth is likely to be supported by investments in sustainable manufacturing practices, especially as end-users align with circular economy goals and low-VOC product usage.

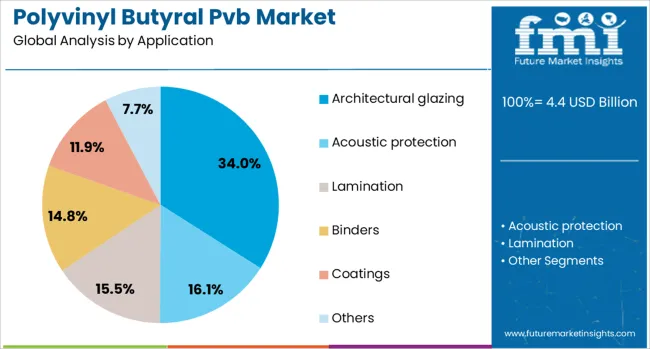

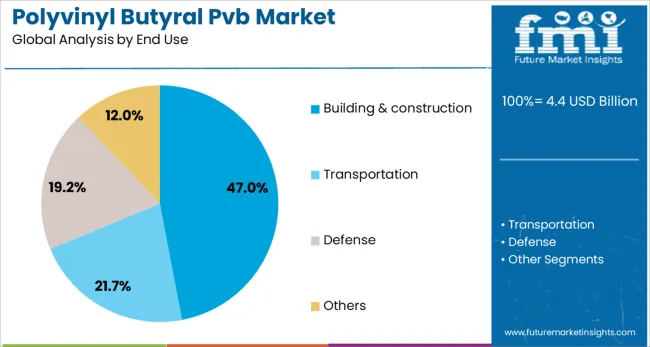

The polyvinyl butyral PVB market is segmented by application, end use, and geographic regions. By application, the polyvinyl butyral PVB market is divided into Architectural glazing, Acoustic protection, Lamination, Binders, Coatings, and Others. In terms of end use, the polyvinyl butyral PVB market is classified into Building & construction, Transportation, Defense, and others. Regionally, the polyvinyl butyral PVB industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Architectural glazing is anticipated to account for 34.0% of the overall market revenue in 2025, making it the leading application segment. The segment’s growth is being supported by the increasing specification of laminated glass in residential and commercial construction projects, especially those prioritizing blast resistance, acoustic control, and hurricane impact compliance.

Enhanced safety standards, coupled with architectural trends favoring large glass façades, have further solidified demand. PVB’s excellent adhesion, clarity, and weatherability make it the preferred interlayer material for insulating and safety glazing.

Moreover, its compatibility with solar control coatings and noise-reduction technologies continues to support growth in urban infrastructure and high-performance buildings.

The building and construction sector is projected to dominate the end-use landscape with a 47.0% revenue share in 2025. This leadership is being driven by the widespread use of laminated safety glass in both new developments and retrofitting projects across the globe.

Stricter safety norms, particularly in high-rise buildings and public infrastructure, are prompting increased deployment of PVB interlayers. As cities become denser and architectural designs more transparent, PVB’s ability to provide structural integrity, sound insulation, and UV filtering has made it a foundational material in modern construction.

Regulatory trends aimed at improving building safety and energy performance are expected to sustain demand for PVB products in this segment.

The PVB market has been growing steadily due to its critical role in laminated safety glass used in automotive, construction, and solar industries. PVB films provide excellent adhesion, transparency, and impact resistance, making them indispensable in windshields, architectural glass, and photovoltaic panels. Increasing demand for enhanced safety features and energy-efficient building materials has contributed to market expansion. Furthermore, the rise in automobile production and infrastructure development globally has driven PVB consumption. Innovations in PVB formulations targeting improved optical clarity and environmental resistance have further supported growth.

The automotive sector has been a predominant consumer of PVB due to its superior adhesion and cushioning properties in laminated windshields. Enhanced safety regulations globally have mandated the use of laminated glass to protect passengers from impact and reduce injuries. Additionally, rising vehicle production volumes and the shift toward electric and autonomous vehicles have increased demand for advanced laminated glass solutions. In the architectural segment, PVB has been employed to improve building safety, sound insulation, and solar control in facades and windows. Urban infrastructure development and modernization projects have contributed to increasing laminated glass installation. The versatility of PVB in accommodating various glass thicknesses and configurations has facilitated its widespread adoption in these sectors.

Advancements in PVB technology have focused on improving optical clarity, durability, and environmental resistance to meet evolving application needs. Modified PVB formulations with enhanced UV resistance and weatherability have been developed to extend service life, especially in harsh outdoor environments. Innovations in production processes have enabled thinner films without compromising mechanical strength, contributing to lightweight and energy-efficient glazing solutions. Incorporation of additives has improved flexibility and adhesion to diverse substrates, expanding potential applications. Automation and process optimization in PVB film manufacturing have increased consistency and reduced costs. These technological improvements have enabled manufacturers to address stringent industry standards and cater to specialized demands in automotive and construction applications.

Environmental considerations and regulatory frameworks have significantly impacted the PVB market dynamics. Increasing emphasis on energy efficiency and green building certifications has promoted the use of laminated glass incorporating PVB for thermal insulation and solar control. Regulations targeting volatile organic compound (VOC) emissions during PVB manufacturing have driven the adoption of cleaner production technologies. Efforts to develop recyclable and eco-friendly PVB formulations are underway to reduce environmental footprint and support circular economy initiatives. The automotive industry’s focus on lightweight materials to improve fuel efficiency aligns with PVB’s ability to enable thinner, lighter laminated glass. Compliance with international safety and environmental standards continues to shape product development and market strategies in the PVB sector.

The market has witnessed growth due to increasing applications beyond traditional automotive and architectural glass. Emerging uses in solar photovoltaic panels, electronic displays, and safety films have created new demand avenues. The rise of renewable energy projects incorporating laminated solar glass has been a significant growth driver. Additionally, demand from developing regions experiencing rapid urbanization and industrialization has contributed to market expansion. Investments in manufacturing capacity and supply chain localization have facilitated market penetration in Asia-Pacific, Latin America, and Middle East regions. Strategic partnerships and collaborations between raw material suppliers and glass manufacturers have enhanced product availability and customization. The diversification of end-use industries and geographic markets is expected to sustain growth momentum for PVB in the coming years.

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

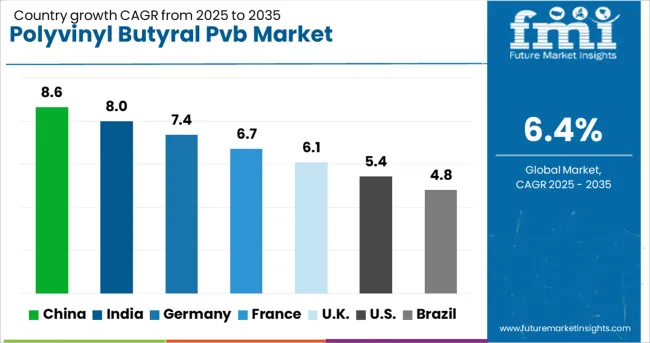

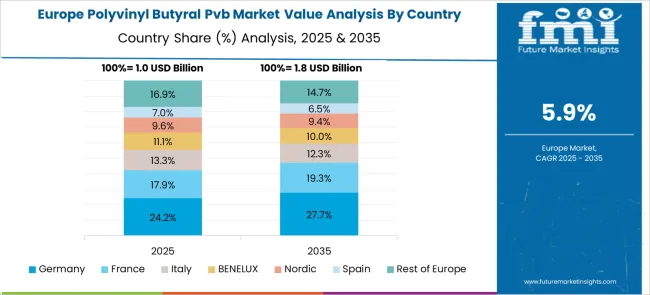

The PVB market is expected to grow at a CAGR of 6.4% between 2025 and 2035, driven by demand in automotive safety glass, architectural applications, and laminated glass products. China leads with an 8.6% CAGR, propelled by rapid construction growth and increasing automobile production. India follows at 8.0%, supported by infrastructure development and rising automotive manufacturing. Germany, at 7.4%, benefits from strong automotive industry demand and technological advancements in glass lamination. The UK, growing at 6.1%, is driven by refurbishment projects and safety regulations. The USA, with a 5.4% CAGR, experiences steady growth due to increasing safety standards and renovation activities. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 8.6% between 2025 and 2035, propelled by expansion in the automotive and construction glass sectors. Key domestic producers like Chang Chun Group and Wanhua Chemical have advanced product formulations to improve adhesion and durability. Increasing investments in safety glass applications for vehicles and buildings support market growth. Government incentives promoting energy-efficient building materials have stimulated demand. The industry is characterized by integration of sustainable production processes and partnerships with glass manufacturers to enhance supply chain efficiency.

The market in India is expected to grow at a CAGR of 8.0% from 2025 to 2035, driven by rising demand for laminated glass in automotive and construction applications. Local chemical companies are investing in production capacity and process improvements to meet quality standards. Demand from the increasing number of vehicle manufacturing plants supports sales growth. Expansion of the real estate sector with a focus on safety glass applications further propels market development. Import substitution strategies are encouraging domestic manufacturing and reducing dependency on imports.

Germany’s polyvinyl butyral demand is forecasted to increase at a CAGR of 7.4% over the next decade, driven by high standards in automotive safety and green building regulations. Leading players like Covestro and Evonik focus on innovative product blends that enhance mechanical properties and environmental compliance. Growing adoption of laminated glass in electric vehicles and smart buildings supports the market. Partnerships between chemical suppliers and automotive manufacturers help advance customization. Emphasis on reducing carbon footprint in manufacturing aligns with industrial policies.

The industry in the United Kingdom is anticipated to grow at a CAGR of 6.1% through 2035, supported by requirements in automotive glass and architectural applications. Focus on lightweight and safety-enhanced laminated glass products drives demand. Industry participants invest in R&D to improve product clarity and impact resistance. Regulations on building safety and glass standards further encourage adoption. Partnerships with glass fabricators and construction companies help expand market reach.

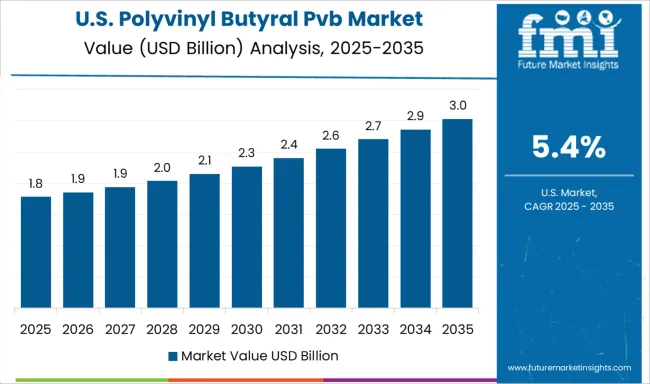

In the United States, polyvinyl butyral sales are projected to grow at a CAGR of 5.4% during 2025 to 2035, supported by growth in automotive and commercial glazing. Demand is driven by stricter safety regulations and increased use of laminated glass for noise reduction and impact protection. Companies such as Eastman Chemical and Sekisui Specialty Chemicals invest in advanced resin formulations. Market expansion is aided by collaborations with glass manufacturers and automotive suppliers to develop customized solutions.

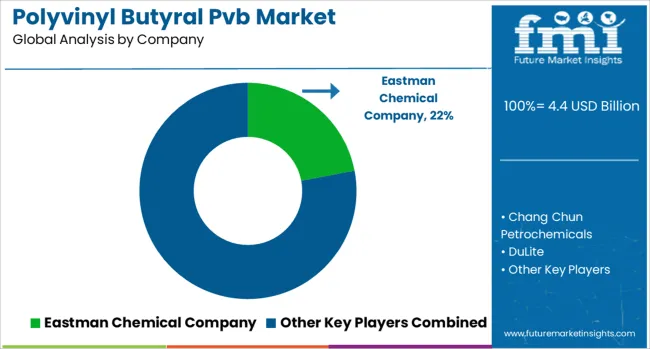

The PVB market features a blend of established chemical companies and specialized manufacturers offering resin solutions primarily used in laminated safety glass for automotive and architectural applications. Eastman Chemical Company is a dominant player, leveraging its extensive production capabilities and global distribution network to serve diverse end-use sectors. The company focuses on consistent product quality and innovation to meet evolving safety and environmental regulations. Chang Chun Petrochemicals is another key participant, emphasizing research and development to enhance resin properties, ensuring high durability and adhesion. DuLite and DuPont, with their strong chemical expertise, supply PVB resins tailored for various industrial needs, focusing on performance and cost efficiency. Kuraray leads with proprietary technologies and sustainable manufacturing practices, expanding its portfolio to include advanced PVB grades with improved clarity and flexibility.

SEKISUI CHEMICAL and Kingboard Chemical Holdings offer competitive products targeting regional markets with strategic partnerships and localized production. Other manufacturers like Huakai Plastic, Tiantai Kanglai Industrial, and Zhejiang Pulijin Plastic contribute through specialized formulations and capacity expansions. Entry barriers in the PVB market include high capital investment for production facilities, stringent quality controls, and regulatory compliance requirements. The market remains competitive with ongoing innovations aimed at enhancing product performance and environmental compatibility, positioning leading manufacturers for long-term growth.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Application | Architectural glazing, Acoustic protection, Lamination, Binders, Coatings, and Others |

| End Use | Building & construction, Transportation, Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eastman Chemical Company, Chang Chun Petrochemicals, DuLite, DuPont, Huakai Plastic (Chongqing) Co., Kingboard Chemical Holdings, Kuraray, SEKISUI CHEMICAL, Tiantai Kanglai Industrial, and Zhejiang Pulijin Plastic |

| Additional Attributes | Dollar sales by grade type and end-use application, demand dynamics across automotive safety glass, architectural laminated glass, and photovoltaic panels, regional trends in production and consumption across Asia-Pacific, Europe, and North America, innovation in high-performance formulations, enhanced adhesion properties, and UV resistance, environmental impact of raw material sourcing, manufacturing emissions, and recycling challenges, and emerging use cases in smart windows, impact-resistant glazing, and energy-efficient building materials. |

The global polyvinyl butyral PVB market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the polyvinyl butyral PVB market is projected to reach USD 8.1 billion by 2035.

The polyvinyl butyral PVB market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in polyvinyl butyral PVB market are architectural glazing, acoustic protection, lamination, binders, coatings and others.

In terms of end use, building & construction segment to command 47.0% share in the polyvinyl butyral PVB market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyvinyl Butyral Market Growth – Trends & Forecast 2024-2034

Polyvinyl Chloride (PVC) Packaging Film Market Forecast and Outlook 2025 to 2035

Polyvinyl Alcohol (PVA) Films Market Size and Share Forecast Outlook 2025 to 2035

Polyvinylidene Fluoride (PVDF) Market Growth - Trends & Forecast 2025 to 2035

Butyraldehyde Market Growth – Trends & Forecast 2024-2034

Polyvinyl Chloride Market Growth – Trends & Forecast 2024-2034

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Calendered Polyvinyl Chloride Flexible Films Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA