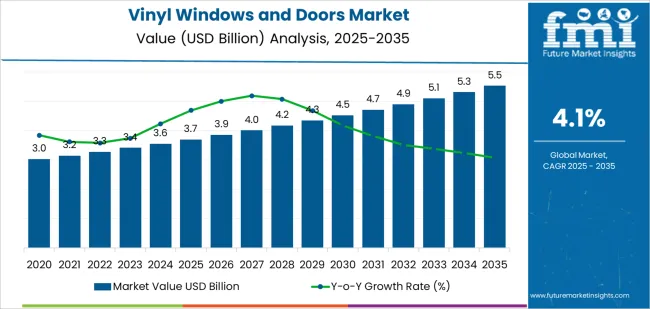

The global vinyl windows and doors market is projected to reach USD 5.5 billion by 2035, recording an absolute increase of USD 1,825.1 million over the forecast period. The market is valued at USD 3.7 billion in 2025 and is set to rise at a CAGR of 4.1% during the assessment period. The overall market size is expected to grow by nearly 1.5 times during the same period, supported by increasing demand for energy-efficient building products in residential and commercial construction, driving adoption of low-maintenance fenestration systems and expanding investments in housing development projects and building renovation programs globally. The market expansion reflects growing requirements for thermal insulation and weather resistance capabilities in modern building construction, where vinyl windows and doors deliver superior energy performance and durability compared to traditional wood and aluminum alternatives.

Construction projects across residential development, commercial buildings, and renovation applications are implementing vinyl fenestration technology to achieve lower heating and cooling costs and reduced maintenance requirements. The integration of these advanced building products with multi-chamber frame designs and low-emissivity glazing systems enables builders to meet stringent energy codes while providing homeowners with long-lasting, aesthetically appealing solutions that resist warping, rotting, and corrosion.

Construction adoption accelerates as builders and homeowners seek to optimize building energy efficiency and minimize lifecycle maintenance costs in new construction and replacement applications. The proliferation of green building standards and energy efficiency mandates creates sustained demand for vinyl fenestration products capable of achieving U-factor ratings below 0.30 and Solar Heat Gain Coefficients optimized for specific climate zones. Vinyl windows and doors with fusion-welded corners, reinforced frame profiles, and advanced weatherstripping systems offer performance advantages in residential construction, commercial buildings, and institutional facilities where energy costs represent significant operational expenses.

Renovation markets are adopting vinyl replacement windows for improved comfort and energy savings in existing structures where original fenestration products have deteriorated or fail to meet current performance expectations. However, perception challenges regarding appearance limitations compared to wood products and regional preferences for traditional materials may pose obstacles to market expansion in heritage districts and markets with strong architectural traditions favoring conventional fenestration materials.

Between 2025 and 2030, the vinyl windows and doors market is projected to expand from USD 3.7 billion to USD 4,511.7 million, resulting in a value increase of USD 821.2 million, which represents 45.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for energy-efficient building products and residential construction activity growth, product innovation in multi-chamber frame technology and advanced glazing integration, as well as expanding implementation of building energy codes and green building certification programs. Companies are establishing competitive positions through investment in extrusion technology capabilities, color and finish customization options, and strategic market expansion across residential new construction, replacement window markets, and commercial building applications.

From 2030 to 2035, the market is forecast to grow from USD 4,511.7 million to USD 5.5 billion, adding another USD 1,003.9 million, which constitutes 55.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized product configurations, including impact-resistant systems for hurricane-prone regions and sound-dampening designs tailored for urban noise reduction requirements, strategic collaborations between vinyl extrusion suppliers and window manufacturers, and an enhanced focus on sustainable manufacturing practices and recycled content integration. The growing emphasis on net-zero building standards and circular economy principles will drive demand for advanced, high-performance vinyl windows and doors solutions across diverse construction applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.7 billion |

| Market Forecast Value (2035) | USD 5.5 billion |

| Forecast CAGR (2025-2035) | 4.1% |

The vinyl windows and doors market grows by enabling builders and homeowners to achieve superior energy efficiency and maintenance-free performance while reducing lifecycle costs in residential and commercial construction. Building owners and contractors face mounting pressure to improve energy performance and reduce maintenance expenses, with vinyl fenestration systems typically providing 30-40% lower heat transfer rates over standard aluminum windows, making these advanced building products essential for code-compliant construction and energy-conscious homeowners. The residential construction industry's need for durable, low-maintenance building materials creates demand for vinyl window and door solutions that eliminate painting requirements, resist moisture damage, and maintain appearance quality across decades of service life in diverse climate conditions.

Energy code requirements promoting thermal performance standards and building efficiency mandates drive adoption in residential construction, renovation projects, and commercial building applications, where fenestration thermal performance has a direct impact on heating and cooling energy consumption. The global shift toward sustainable building practices and operational cost reduction accelerates vinyl windows and doors demand as construction projects seek fenestration solutions that deliver long-term value through reduced maintenance needs and sustained energy performance. However, aesthetic perception challenges in premium residential markets and higher upfront costs compared to basic aluminum windows may limit adoption rates among budget-conscious builders and regions with traditional preferences for wood fenestration products in architectural heritage applications.

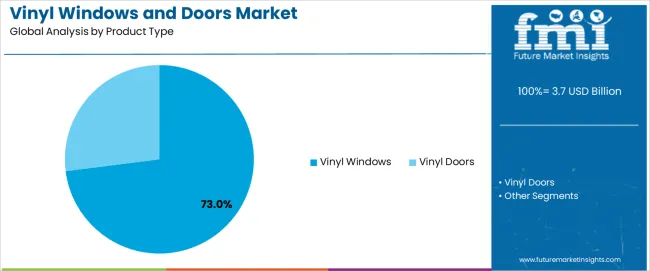

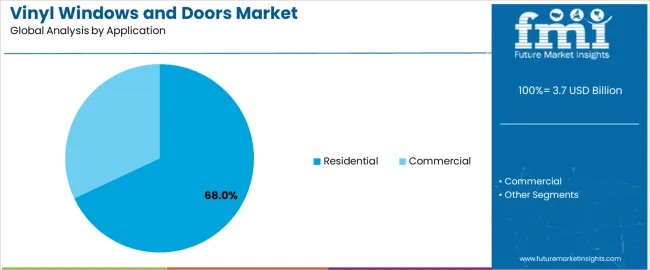

The market is segmented by product type, application, and region. By product type, the market is divided into vinyl windows and vinyl doors. Based on application, the market is categorized into residential and commercial. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The vinyl windows segment represents the dominant force in the vinyl windows and doors market, capturing approximately 73.0% of total market share in 2025. This advanced category encompasses double-hung configurations, casement designs, sliding window systems, and specialty shapes optimized for diverse architectural requirements, delivering efficient thermal insulation and superior weather resistance in residential and commercial building applications. The vinyl windows segment's market leadership stems from its extensive application versatility, proven energy performance characteristics, and compatibility with various building styles from traditional to contemporary architectural designs.

The vinyl doors segment maintains a substantial 27.0% market share, serving applications requiring durable entry systems through sliding patio door configurations, French door designs, and hinged entry door systems suitable for residential and light commercial installations where vinyl material properties provide weather resistance and thermal performance advantages.

Key advantages driving the vinyl windows segment include:

Residential applications dominate the vinyl windows and doors market with approximately 68.0% market share in 2025, reflecting the extensive adoption of vinyl fenestration products across single-family housing construction, multi-family residential development, and home renovation projects. The residential segment's market leadership is reinforced by widespread implementation in new home construction (32.0%), replacement window installations (24.0%), and remodeling projects (12.0%), which provide essential energy efficiency advantages and maintenance reduction benefits in homeowner-focused applications.

The commercial segment represents 32.0% market share through specialized applications including office building fenestration (14.0%), retail facility installations (10.0%), and institutional building projects (8.0%). Key market dynamics supporting application preferences include residential construction demanding cost-effective fenestration with proven energy performance and aesthetic appeal, commercial applications requiring standardized products with reliable delivery schedules and consistent quality specifications, growing renovation activity driven by aging housing stock and energy upgrade incentives, and increasing adoption across diverse building types seeking lifecycle cost advantages through maintenance-free fenestration products.

The market is driven by three concrete demand factors tied to energy efficiency and construction economics. First, residential construction growth creates increasing requirements for cost-effective fenestration solutions, with global housing starts exceeding 15 million units annually in major markets worldwide, requiring reliable vinyl window and door systems for energy code compliance where thermal performance requirements mandate U-factors below 0.32 in heating-dominated climates and Solar Heat Gain Coefficients under 0.25 in cooling-dominated regions. Second, replacement window market expansion and aging housing stock drive adoption of energy-efficient upgrades, with vinyl replacement windows reducing heating and cooling costs by 15-25% compared to original single-pane aluminum windows while eliminating maintenance requirements that wood windows demand through periodic painting and weather sealing. Third, building energy code intensification and green building certification programs accelerate deployment of high-performance fenestration, with vinyl windows and doors enabling ENERGY STAR certification compliance and contributing points toward LEED and NGBS green building ratings through demonstrated thermal performance and sustainable material attributes.

Market restraints include aesthetic perception challenges affecting high-end residential markets and architectural applications, particularly where wood fenestration products maintain preference for traditional appearance characteristics and where vinyl material properties limit color selection options compared to factory-finished aluminum or natural wood grain finishes. Regional climate performance limitations in extreme temperature environments pose adoption challenges in markets experiencing sustained high temperatures, as vinyl material expansion and contraction characteristics require careful engineering consideration in desert climates where surface temperatures exceed 160°F. Material recyclability awareness gaps create additional barriers in sustainability-focused markets, as vinyl fenestration recycling infrastructure remains underdeveloped compared to aluminum recycling systems despite PVC material's technical recyclability and growing industry efforts toward circular economy implementation.

Key trends indicate accelerated adoption in Asian residential construction markets, particularly China and India, where urbanization programs and middle-class housing development are expanding rapidly through government affordable housing initiatives and private residential construction investment. Technology advancement trends toward impact-resistant vinyl fenestration for hurricane and severe weather protection, integrated smart window systems with automated shading and ventilation control, and enhanced color stability formulations resisting chalking and fading are driving next-generation product development. However, the market thesis could face disruption if bio-based polymer technologies achieve breakthrough cost and performance capabilities in fenestration applications, potentially offering sustainable alternatives to petroleum-based vinyl while maintaining comparable durability and thermal performance characteristics.

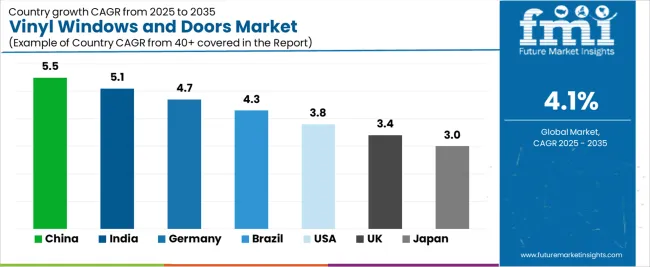

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| Brazil | 4.3% |

| U.S. | 3.8% |

| U.K. | 3.4% |

| Japan | 3.0% |

The vinyl windows and doors market is gaining momentum worldwide, with China taking the lead thanks to aggressive urbanization programs and residential construction expansion initiatives. Close behind, India benefits from growing housing development and government affordable housing programs, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding residential construction activity and building product modernization strengthen its role in South American fenestration markets.

The U.S. demonstrates robust growth through replacement window demand and residential construction recovery, signaling continued investment in energy-efficient building products. Meanwhile, Japan stands out for its quality-focused construction standards and energy efficiency emphasis, while U.K. and Germany continue to record consistent progress driven by building energy regulations and renovation market activity. Together, China and India anchor the global expansion story, while established markets build stability and product innovation into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

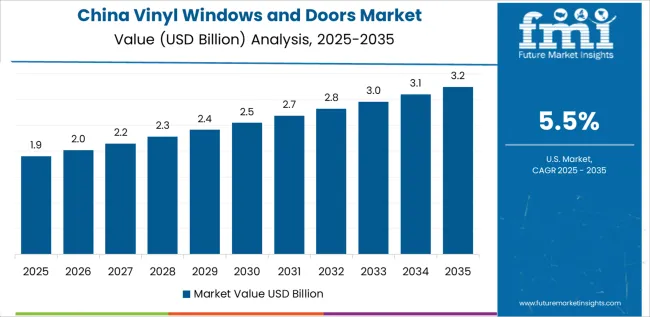

China demonstrates the strongest growth potential in the Vinyl Windows and Doors Market with a CAGR of 5.5% through 2035. The country's leadership position stems from comprehensive urbanization programs, intensive residential construction development, and aggressive affordable housing targets driving adoption of cost-effective building materials. Growth is concentrated in major development regions, including Guangdong, Jiangsu, Zhejiang, and Shandong, where residential developers, commercial builders, and renovation contractors are implementing vinyl fenestration systems for energy efficiency and construction cost optimization. Distribution channels through building material dealers, window and door distributors, and direct manufacturer relationships expand deployment across residential construction projects, commercial building developments, and renovation applications. The country's urbanization initiatives provide policy support for affordable housing construction, including standards for energy-efficient building products and quality fenestration systems.

Key market factors:

In the National Capital Region, Maharashtra, Karnataka, and Tamil Nadu development zones, the adoption of vinyl windows and doors systems is accelerating across residential construction projects, commercial building developments, and renovation applications, driven by Smart Cities initiatives and increasing focus on energy-efficient building practices. The market demonstrates strong growth momentum with a CAGR of 5.1% through 2035, linked to comprehensive housing development expansion and increasing investment in modern building materials adoption.

Indian developers and homeowners are implementing vinyl fenestration technology and energy-efficient building products to improve thermal comfort while meeting building code requirements in residential and commercial construction serving domestic urbanization needs. The country's Pradhan Mantri Awas Yojana creates sustained demand for affordable building materials, while increasing emphasis on energy efficiency drives adoption of thermal-performance fenestration that reduces operational costs.

Germany's advanced construction sector demonstrates sophisticated implementation of vinyl windows and doors systems, with documented case studies showing 35-40% energy cost reduction in residential renovation projects through high-performance fenestration replacement strategies. The country's building construction infrastructure in major development regions, including Bavaria, Baden-Württemberg, North Rhine-Westphalia, and Lower Saxony, showcases integration of energy-efficient fenestration technologies with existing building renovation practices, leveraging expertise in thermal insulation and building physics principles. German builders and homeowners emphasize energy performance standards and quality construction, creating demand for reliable vinyl fenestration solutions that support thermal efficiency commitments and stringent building code requirements. The market maintains strong growth through focus on building energy standards and renovation market activity, with a CAGR of 4.7% through 2035.

Key development areas:

The Brazilian market leads in Latin American vinyl windows and doors adoption based on expanding residential construction operations and growing building product modernization in major urban centers. The country shows solid potential with a CAGR of 4.3% through 2035, driven by housing sector investment and increasing domestic demand for modern fenestration products across residential developments, commercial buildings, and renovation projects. Brazilian developers and homeowners are adopting vinyl fenestration technology for improved building performance, particularly in middle-class housing developments requiring cost-effective energy efficiency and in coastal regions where corrosion-resistant materials provide lifecycle advantages over metal fenestration. Technology deployment channels through building material dealers, window and door distributors, and home improvement retailers expand coverage across residential construction markets.

Leading market segments:

The U.S. market leads in advanced vinyl windows and doors applications based on mature replacement window market and comprehensive residential construction activity supporting diverse fenestration requirements. The country shows solid potential with a CAGR of 3.8% through 2035, driven by aging housing stock and increasing adoption of energy-efficient building products across residential renovation, new home construction, and commercial building sectors. American homeowners and builders are implementing vinyl fenestration systems for improved energy performance, particularly in replacement window applications requiring quick installation and in new construction where cost-effective code compliance supports competitive housing prices. Technology deployment channels through home improvement retailers, contractor networks, and direct-to-consumer sales expand coverage across diverse renovation and construction applications.

Leading market segments:

The U.K. market demonstrates consistent implementation focused on residential renovation projects and new housing construction, with documented integration of vinyl windows and doors systems achieving 30-35% energy cost improvements in retrofit applications. The country maintains steady growth momentum with a CAGR of 3.4% through 2035, driven by building energy regulations and housing renovation activity levels. Major residential regions, including South East England, North West England, and Scotland, showcase deployment of energy-efficient fenestration technologies that integrate with existing housing stock renovation practices and support building regulation requirements for thermal performance.

Key market characteristics:

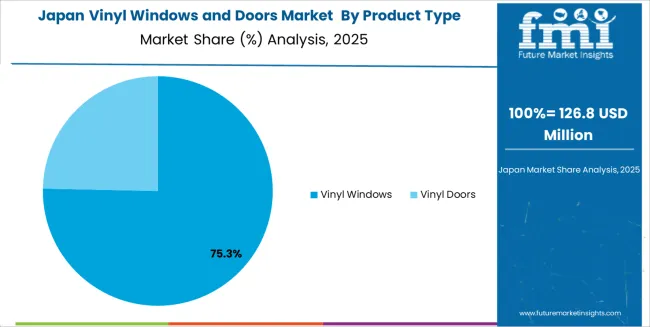

Japan's vinyl windows and doors market demonstrates sophisticated implementation focused on residential construction quality and energy efficiency optimization, with documented integration of advanced fenestration systems achieving 28-32% heating energy reduction in modern residential construction. The country maintains steady growth momentum with a CAGR of 3.0% through 2035, driven by construction quality standards and emphasis on thermal comfort principles aligned with energy conservation objectives. Major construction regions, including Tokyo, Osaka, Nagoya, and Fukuoka, showcase advanced deployment of energy-efficient fenestration technologies that integrate seamlessly with residential construction practices and comprehensive building energy standards.

Key market characteristics:

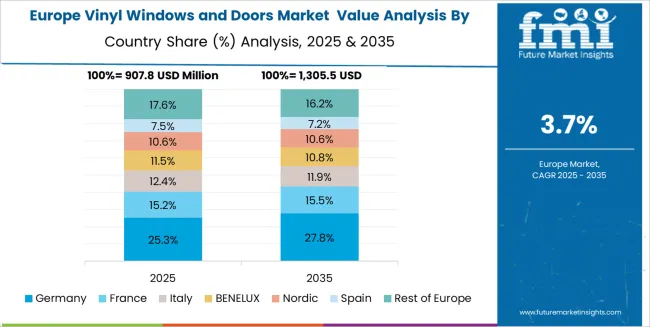

The vinyl windows and doors market in Europe is projected to grow from USD 1,355.9 million in 2025 to USD 2,106.5 million by 2035, registering a CAGR of 4.5% over the forecast period. Germany is expected to maintain its leadership position with a 29.7% market share in 2025, declining slightly to 29.3% by 2035, supported by its extensive building renovation activity and major residential construction centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia development regions.

France follows with a 19.3% share in 2025, projected to reach 19.6% by 2035, driven by comprehensive residential renovation programs and new housing construction in major urban regions. The United Kingdom holds a 17.1% share in 2025, expected to reach 17.3% by 2035 through building regulation requirements and renovation market activity. Italy commands a 12.8% share in both 2025 and 2035, backed by residential construction and building renovation operations. Spain accounts for 8.4% in 2025, rising to 8.6% by 2035 on residential construction recovery and fenestration modernization. The Rest of Europe region is anticipated to hold 12.7% in 2025, expanding to 13.4% by 2035, attributed to increasing vinyl windows and doors adoption in Nordic countries and emerging Central & Eastern European residential construction markets implementing modern building material standards.

The Japanese vinyl windows and doors market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of vinyl window systems with existing residential construction practices across single-family housing, multi-family developments, and renovation applications. Japan's emphasis on construction quality and thermal comfort optimization drives demand for energy-efficient fenestration products that support building performance commitments in residential environments.

The market benefits from strong partnerships between international fenestration providers and domestic building material distributors including major housing companies, creating comprehensive supply ecosystems that prioritize product quality and installation standards. Construction projects in Tokyo, Osaka, Nagoya, and other major urban areas showcase advanced fenestration implementations where vinyl window systems achieve thermal performance compliance through optimized frame designs and integrated glazing specifications.

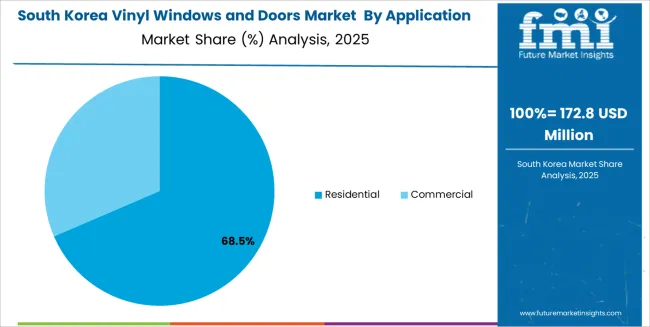

The South Korean vinyl windows and doors market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive technical support and product quality capabilities for residential construction and commercial building applications. The market demonstrates increasing emphasis on energy efficiency and building performance enhancement, as Korean developers and homeowners increasingly demand advanced fenestration solutions that integrate with domestic building construction practices and energy efficiency standards deployed across major urban development projects. Regional building material distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized products including thermal-break frame systems and application-specific glazing configurations for residential and commercial construction operations. The competitive landscape shows increasing collaboration between multinational fenestration companies and Korean building material specialists, creating hybrid distribution models that combine international product development expertise with local market knowledge and installation service capabilities.

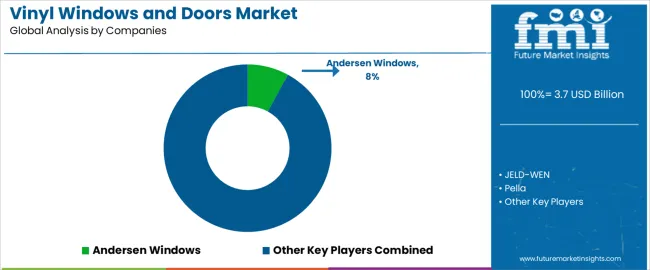

The vinyl windows and doors market features approximately 30-35 meaningful players with moderate fragmentation, where the top three companies control roughly 18-22% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on energy performance specifications, product quality consistency, and distribution channel strength rather than price competition alone. Andersen Windows leads with approximately 8.0% market share through its comprehensive fenestration solutions portfolio and North American market presence.

Market leaders include Andersen Windows, JELD-WEN, and Pella, which maintain competitive advantages through extensive distribution infrastructure, proven product quality standards, and deep expertise in fenestration engineering across multiple construction segments, creating trust and performance advantages with builders, contractors, and homeowners. These companies leverage research and development capabilities in thermal performance optimization and ongoing builder relationship programs to defend market positions while expanding into replacement window markets and commercial building applications.

Challengers encompass Milgard and Harvey Windows & Doors, which compete through regional market strength and specialized product offerings in key residential construction markets. Product specialists, including PGT, MI Windows, and Ply Gem, focus on specific market segments or geographic regions, offering differentiated capabilities in impact-resistant fenestration, volume production efficiency, and contractor-focused distribution models.

Regional players and emerging window manufacturers create competitive pressure through localized manufacturing advantages and responsive customer service capabilities, particularly in high-growth markets including China and India, where proximity to residential construction activity provides advantages in delivery responsiveness and installation support. Market dynamics favor companies that combine proven energy performance with comprehensive distribution coverage and contractor support programs that address the complete fenestration supply chain from product specification through installation and warranty service.

Vinyl windows and doors represent energy-efficient fenestration products that enable builders and homeowners to achieve 30-40% lower heat transfer rates compared to standard aluminum windows, delivering superior thermal insulation and maintenance-free performance with reduced lifecycle costs and sustained appearance quality in demanding residential and commercial construction applications. With the market projected to grow from USD 3.7 billion in 2025 to USD 5.5 billion by 2035 at a 4.1% CAGR, these advanced building products offer compelling advantages - energy efficiency, maintenance reduction, and cost-effectiveness - making them essential for residential applications (68.0% market share), commercial construction (32.0% share), and building projects seeking alternatives to wood and aluminum fenestration that compromise performance through maintenance requirements and thermal inefficiency. Scaling market adoption and technology deployment requires coordinated action across building code policy, construction industry standards, fenestration manufacturers, builder communities, and green building investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 billion |

| Product Type | Vinyl Windows, Vinyl Doors |

| Application | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | Andersen Windows, JELD-WEN, Pella, Milgard, Harvey Windows & Doors, PGT, MI Windows, Ply Gem, Sierra Pacific, VEKA, TAF, COROSI, Rosati Windows, Prime Window Systems, Oridow Industrial, Champion Windows |

| Additional Attributes | Dollar sales by product type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with fenestration manufacturers and distribution networks, manufacturing facility requirements and specifications, integration with building energy codes and green building certification programs, innovations in frame thermal technology and glazing systems, and development of specialized vinyl fenestration solutions with enhanced energy performance and durability capabilities. |

The global vinyl windows and doors market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the vinyl windows and doors market is projected to reach USD 5.5 billion by 2035.

The vinyl windows and doors market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in vinyl windows and doors market are vinyl windows and vinyl doors.

In terms of application, residential segment to command 68.0% share in the vinyl windows and doors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vinyl Ester Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Acetate Homopolymer Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Electrical Tapes Market Size, Share & Forecast 2025 to 2035

Vinyl Flooring Market Growth - Trends & Forecast 2025 to 2035

Vinyl Extrusion Equipment Market Insights - Growth & Forecast 2025 to 2035

Market Positioning & Share in the Vinyl Cyclohexane Industry

Vinyl Films Market

Polyvinyl Chloride (PVC) Packaging Film Market Forecast and Outlook 2025 to 2035

Polyvinyl Butyral PVB Market Size and Share Forecast Outlook 2025 to 2035

Polyvinyl Alcohol (PVA) Films Market Size and Share Forecast Outlook 2025 to 2035

Polyvinylidene Fluoride (PVDF) Market Growth - Trends & Forecast 2025 to 2035

Polyvinyl Chloride Market Growth – Trends & Forecast 2024-2034

Polyvinyl Butyral Market Growth – Trends & Forecast 2024-2034

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Ethylene-vinyl Alcohol Copolymer (EVOH) Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Butylene-divinyl Fraction Market Growth – Trends & Forecast 2024-2034

Mass Loaded Vinyl (MLV) Market Size and Share Forecast Outlook 2025 to 2035

Calendered Polyvinyl Chloride Flexible Films Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA