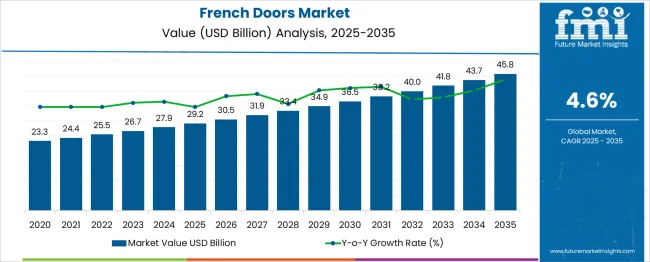

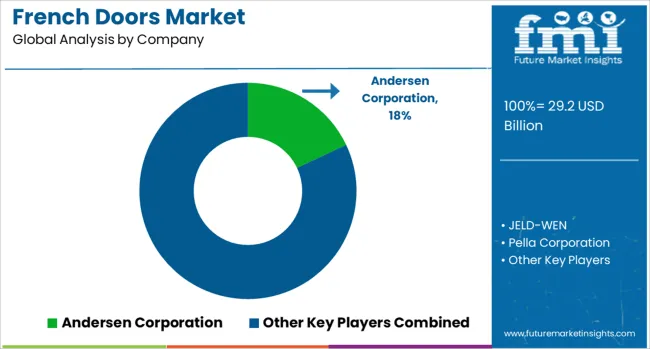

The French Doors Market is estimated to be valued at USD 29.2 billion in 2025 and is projected to reach USD 45.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. Between 2025 and 2030, the market expands steadily, reaching USD 36.5 billion. Intermediate figures include USD 30.5 billion in 2026, USD 31.9 billion in 2027, USD 33.4 billion in 2028, and USD 34.9 billion in 2029. Manufacturers offering customizable, easy-to-install, and thermally efficient French door solutions are expected to gain market share.

Demand will remain strong across residential and light commercial segments, particularly in regions emphasizing aesthetics and natural lighting. Manufacturers focusing on quality finishes, wide material options, and competitive pricing are well-positioned for growth. Conversely, firms relying on limited design ranges, inefficient supply chains, or outdated retail partnerships may lose traction. Lack of installer support or slow delivery timelines can further undermine market presence. Between 2025 and 2030, brand visibility, distributor relationships, and product innovation in terms of space efficiency and user-friendly locking mechanisms will be key to outperforming competitors. Those addressing mid-range consumer needs without compromising durability are likely to expand their share as demand trends remain stable and volume-driven.

| Metric | Value |

|---|---|

| French Doors Market Estimated Value in (2025 E) | USD 29.2 billion |

| French Doors Market Forecast Value in (2035 F) | USD 45.8 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The French doors market is a subsegment of the broader global doors market, which is part of the construction and building materials industry. This parent market is driven by increasing demand for residential construction, home renovation, and aesthetic architectural solutions. Within the overall doors market, residential doors represent the dominant segment, accounting for approximately 60% of total market demand. French doors, known for their aesthetic appeal and ability to maximize natural light, hold a niche but significant place in this segment.

French doors represent around 8–10% of the residential doors market, making their global market size an estimated USD 7–9 billion. Their popularity is strongest in North America and Europe, where architectural styles and consumer preferences support their use in both new construction and remodeling projects. However, demand is rising in Asia-Pacific, where growing urban housing and premium interiors are influencing adoption. Key players in the parent doors market Andersen Corporation, Pella Corporation, Masonite International, and Jeld-Wen have dedicated French door product lines. Competitive advantages are increasingly driven by design flexibility, energy efficiency, and material innovation, positioning French doors as a growing premium category within the residential sector.

The adoption of energy-efficient and space-optimizing solutions has played a pivotal role in driving market expansion. Additionally, the growing demand for larger openings, improved natural lighting, and seamless indoor-outdoor transitions in both residential and commercial spaces has created favorable conditions for the adoption of French doors.

Rising disposable incomes, especially in urban regions, and the increasing focus on sustainable construction practices have further contributed to the growing market presence. Demand has also been supported by advancements in frame materials, glazing technologies, and insulation features that enhance energy performance and soundproofing.

The market is expected to continue its upward trajectory as consumers prioritize modernized entryways that offer security, customization, and long-term value. Manufacturers are focusing on product differentiation and material innovation to meet changing consumer expectations and building codes..

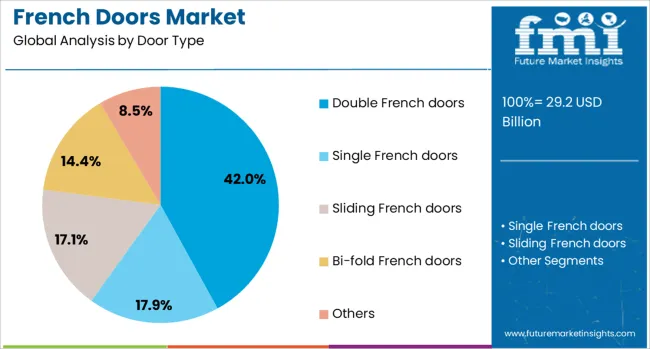

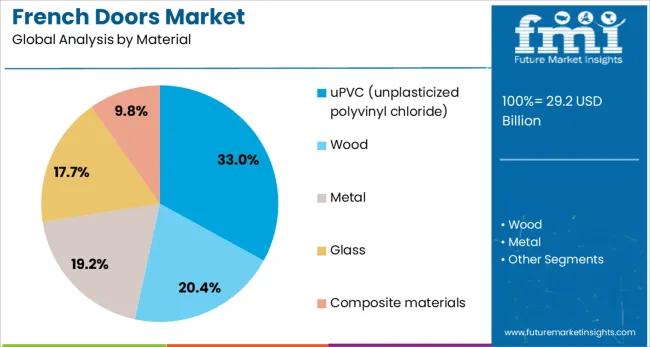

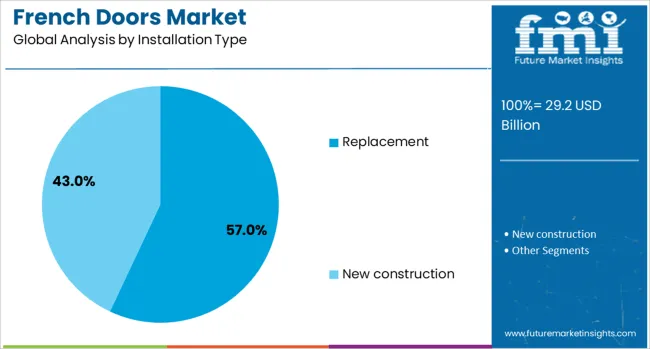

The French doors market is segmented by door type, material, installation type, end use, distribution channel, and geographic regions. By door type, the French doors market is divided into Double French doors, Single French doors, sliding French doors, Bi-fold French doors, and Others. In terms of materials, the French doors market is classified into uPVC (unplasticized polyvinyl chloride), Wood, Metal, Glass, and Composite materials. Based on the installation type, the French doors market is segmented into Replacement and New construction. The end use of the French doors market is segmented into Residential, Commercial, Offices, Hotels & restaurants, and Retail spaces. The distribution channel of the French doors market is segmented into Indirect and Direct. Regionally, the french doors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The double French doors segment is projected to hold 42% of the French doors market revenue share in 2025, establishing it as the leading door type. This dominance has been supported by strong demand for wider openings that provide an unobstructed view, improved natural light, and enhanced access between indoor and outdoor living spaces. Homeowners and architects have increasingly favored double French doors for their symmetrical design and aesthetic appeal, especially in high-end residential projects.

The flexibility offered by these doors in both traditional and contemporary settings has driven their widespread acceptance. In addition to visual appeal, advancements in thermal insulation, security features, and sealing mechanisms have made double French doors a practical and durable choice.

Their adaptability to various frame materials and finishes has enabled extensive customization, aligning with modern interior and exterior design trends. As more consumers focus on blending functionality with architectural elegance, the double French doors segment is expected to maintain its leadership in the overall market..

The uPVC material segment is anticipated to account for 33% of the French doors market revenue share in 2025, making it the most prominent material used. The growth of this segment has been driven by the material's inherent durability, thermal efficiency, and cost-effectiveness. uPVC has gained traction among both homeowners and developers due to its low maintenance, resistance to moisture, and long service life.

Unlike wood or metal, uPVC does not warp, rust, or require frequent painting, making it an attractive solution for both interior and exterior installations. Its contribution to energy efficiency, especially when combined with double or triple glazing, has aligned with global trends promoting sustainable building practices.

Moreover, the lightweight nature of uPVC has facilitated easier installation and reduced structural load, making it ideal for retrofitting projects. As awareness around eco-friendly materials and total lifecycle value continues to grow, uPVC is expected to remain a dominant choice in the material segment of the French doors market..

The replacement segment is expected to capture 57% of the French doors market revenue share in 2025, emerging as the leading installation type. This growth has been primarily attributed to the rising demand for home remodeling and energy-efficient upgrades in existing buildings. Property owners have increasingly opted to replace outdated or underperforming doors with modern French door solutions that offer improved insulation, security, and aesthetic appeal.

The ease of retrofitting French doors into pre-existing structures without major structural modifications has made the replacement process more accessible and cost-effective. Incentives and rebates supporting energy-efficient renovations have also played a key role in accelerating adoption.

Furthermore, the growing popularity of do-it-yourself installation kits and customizable options has made replacement projects more consumer-friendly. As older housing stock continues to age and sustainability becomes a critical factor in renovation decisions, the replacement installation type is anticipated to lead the market by addressing both functional and lifestyle-driven needs..

The French doors market is expanding steadily as homeowners and designers prioritize aesthetic appeal, indoor‑outdoor connectivity, and natural lighting. Renovation trends, outdoor living space integration, and performance expectations in insulation and security drive demand. Popular materials include wood, aluminum, vinyl, and fiberglass, with emphasis on low‑maintenance finishes and durable weather resistance. Designers favor French door configurations to enhance visual openness while maintaining energy efficiency through insulated glazing. The market is strongest in temperate regions and premium residential segments. Manufacturers differentiate through hardware innovation, bespoke sizing, and integrated security solutions. Modern offerings cater to smart home connectivity and multi‑panel stacking, making French doors a preferred choice in contemporary architectural layouts.

Customization and material selection heavily influence buyer decisions in the French doors market. Consumers now expect tailored dimensions, finish options, and trim styles to suit diverse architectural aesthetics. Material innovations like vinyl composites, clad wood, and thermal‑break aluminum offer improved energy performance and longevity with minimal upkeep. Manufacturers provide options such as UV-resistant coatings, fingerprint-resistant finishes, and corrosion-proof hardware to enhance durability. Bespoke sizing enables compatibility with varying wall frames and ceiling heights. Custom glass overlays, grille patterns, and integrated blinds support personalization. These capabilities allow suppliers to meet both traditional and modern home styles in retrofit and new builds. Brand offerings that combine custom sizing and premium material technology gain preference in high-end and performance-minded consumer segments seeking both form and function in door design.

Rising expectations around energy performance are influencing design trends in French doors. Modern products now integrate multi‑pane insulated glazing with argon or krypton infills and low emissivity coatings to reduce heat transfer. Frame systems include thermal breaks and insulated cores to minimize conductivity. Weather seals and weather‑strip compression help maintain tight drafts resistance. Performance testing for air infiltration, water leakage, and sound insulation influence design selection in regions prioritizing airtight building envelopes. Retrofit markets especially favor easy‑install models that improve energy performance in older home stock. As building codes increasingly mandate energy efficiency, French doors meeting or exceeding thermal benchmarks become more attractive to builders and homeowners. Customers seek assurance around reduced heating and cooling costs. Brands that deliver high-insulation door systems without compromising aesthetic transparency enhance adoption in both climate‑conscious and performance-driven markets.

Security concerns significantly shape consumer preferences in the French doors segment. Premium locking systems—such as multi‑point deadbolts and reinforced frame anchoring—are key differentiators. Heavy‑duty hinges, tamper-resistant handles, and burglary-resistant glass options enhance perceived door reliability. Manufacturers are offering hardware with anti‑lift pins and secure fit mechanisms. Glass options now include laminated or tempered safety variants for enhanced break‑resistance. Audible feedback on multi‑site locking engagement builds user confidence. Brands providing extended warranty on hardware and weather sealing reinforce value perception. Installation services that include hardware alignment and security certification attract buyers in higher-risk or premium neighborhoods. Building specifiers increasingly request compliance with local standards for forced entry ratings. Door systems combining superior security features with visual openness appeal to homeowners seeking stylish and safe living spaces.

Smart connectivity is a growing trend in premium French door offerings. Integration with home automation systems allows features such as remote locking, glass tinting, and environmental sensing. Doors now support sensors that detect open‑position status, breakage, or forced entry; alerts are routed to smartphones or home control hubs. Hardware can link to climate systems, automatically adjusting blinds or shades based on sunlight exposure. Some models offer voice‑activated lock control and proximity-based unlocking. These features are appealing in smart home ecosystems prioritizing convenience and safety. As energy management systems evolve, door-level data feeds into HVAC and lighting automation. Suppliers that offer modular and retrofit-friendly smart hardware options enhance appeal in modern home environments. Smart-enabled systems position French doors not just as architectural elements but integral components within connected residential design frameworks.

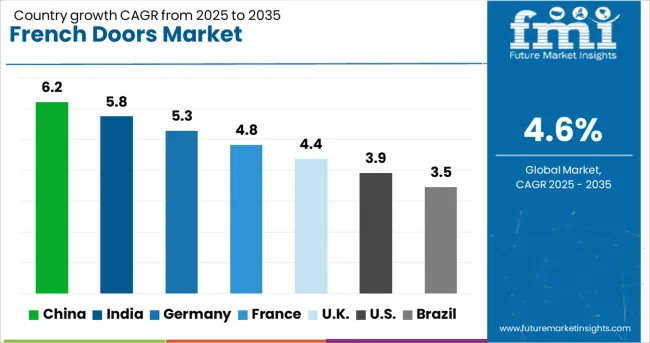

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| U.K. | 4.4% |

| U.S. | 3.9% |

| Brazil | 3.5% |

| China | 72.2% |

| India | 66.9% |

| Germany | 61.5% |

| France | 56.2% |

| U.K. | 50.8% |

| U.S. | 45.5% |

| Brazil | 40.1% |

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| U.K. | 3.7% |

| U.S. | 3.3% |

| Brazil | 2.9% |

The French Doors Market is projected to grow at a CAGR of 4.6% through 2035, driven by a rising focus on aesthetic home upgrades, energy-efficient designs, and smart home integration. China leads with a growth rate of 6.2%, spurred by rapid urban housing developments and increasing consumer preference for luxury finishes. India follows at 5.8%, supported by expanding residential construction and a growing middle-class demand for premium home décor. Germany’s 5.3% growth is tied to stringent building regulations, energy efficiency norms, and rising home renovation activity. The United Kingdom, growing at 4.4%, is witnessing greater adoption of elegant and light-maximizing door systems, particularly in suburban developments. Meanwhile, the United States, with a 3.9% growth rate, is incorporating French doors in both traditional and modern architectural styles. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China has recorded a CAGR of 6.2 percent in the French Doors Market, primarily supported by rising demand for aesthetic residential architecture and the expansion of mid-range housing projects. Urban real estate developments have shown a preference for premium finishes, driving the uptake of French doors in both vertical and low-rise constructions. Local manufacturers are scaling production capacities and offering customized glass and frame combinations to meet varied consumer preferences. These doors are being integrated into smart home designs with automated opening systems and enhanced insulation. Real estate developers and interior contractors are also collaborating with domestic brands to roll out cost-effective yet visually appealing models. Growth is concentrated in provinces like Guangdong and Jiangsu where renovation activity is also high. Price-sensitive buyers are targeted through mass-market PVC and aluminum designs, which replicate high-end finishes at lower costs.

India has achieved a CAGR of 5.8 % in the French Doors Market, fueled by rapid urban housing growth and the popularity of Western-style interiors. Developers are incorporating French doors into apartment complexes and independent houses to enhance natural lighting and ventilation. The southern and western regions of the country, including Karnataka and Maharashtra, are showing particularly strong growth. Small and mid-sized manufacturers are producing locally assembled units using imported hardware and laminated glass. These are tailored for India's climate and budget constraints. Consumer awareness of energy efficiency and dust insulation is further influencing purchasing behavior. The integration of French doors into balconies, patios, and modular kitchens has become a common design trend in urban residences.

Germany has posted a CAGR of 5.3% in the French Doors Market, largely shaped by demand in energy-efficient retrofits and new family homes. Property owners are opting for dual-glass French doors with thermal break systems to maintain indoor temperature levels and reduce heating costs. German manufacturers focus on precision assembly, low-emission frames, and durable glass panes that meet strict regional building codes. French doors are common in garden-facing lounges, balconies, and basement exits. Renovation subsidies for improving home efficiency have indirectly boosted demand for well-sealed, modern door systems. The use of wood-aluminum hybrids and fingerprint-access locks is gaining popularity in both new construction and upgrades. DIY outlets and home improvement chains are also promoting customizable French doors to tap into the renovation market.

The United Kingdom has seen a CAGR of 4.4% in the French Doors Market, driven by both modern home construction and refurbishment of older properties. French doors remain a preferred choice for garden access and kitchen extensions. Demand is centered in suburban regions of England, where homeowners favor high-light entryways and increased ventilation. Installers are promoting slimline aluminum frames and double-glazed units for better temperature regulation and noise reduction. The market is competitive, with local fabricators offering bespoke solutions at relatively shorter lead times. Home improvement retailers are pushing seasonal promotions and bundled installation services to increase volume sales. Shifts in design preference have also seen increased use of dark-colored frames and matte finishes in both modern and classic interiors.

The United States has recorded a CAGR of 3.9 percent in the French Doors Market, largely propelled by suburban residential construction and outdoor living trends. French doors are extensively used in patio, backyard, and deck access, particularly in the southern and western states. Energy-efficient glass and reinforced vinyl frames are key selling points for American consumers concerned with utility costs and storm protection. Homebuilders are specifying these doors in multi-family dwellings and upscale residential projects. Contractors are also incorporating wider and taller configurations to align with contemporary architectural styles. The use of impact-resistant glass in hurricane-prone zones like Florida is another driving factor. Direct-to-consumer brands and online platforms are broadening access with custom-size ordering and virtual visualization tools.

The French doors market continues to thrive as homeowners, designers, and commercial developers seek architectural solutions that blend aesthetic elegance with energy efficiency and space maximization. Known for their wide glass panes and classic symmetry, French doors are widely used in patios, interiors, and high-end residential builds. Market growth is being propelled by smart home integration, demand for natural lighting, and the increasing use of sustainable materials in construction. Andersen Corporation leads with its extensive French door lineup under brands like Andersen® and Renewal by Andersen®, offering both hinged and gliding configurations with superior thermal performance and design flexibility.

JELD-WEN, a major player in residential and commercial door systems, offers energy-efficient French doors in wood, fiberglass, and vinyl, catering to varying climate zones and budget segments. Pella Corporation stands out for its premium craftsmanship and customizable features, including built-in blinds and smart-lock options designed for modern homes. Masonite International Corp provides a strong interior French door portfolio, emphasizing design variety and ease of installation, especially for remodelers and DIY consumers. Marvin Windows & Doors focuses on high-end, architecturally driven French doors that emphasize durability, aesthetics, and historical authenticity. As sustainability standards, smart home functionality, and luxury living continue to influence buyer preferences, suppliers who offer customization, low-maintenance materials, and enhanced energy efficiency are best positioned to lead the evolving French doors market.

Origin launched its Soho External Door, a luxury aluminium French-door with 36 mm sightlines and 2025 energy compliance. Genius PVC Trade Frames added Deceuninck 2500/2800 systems and plans a flush-sash French-door launch in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.2 Billion |

| Door Type | Double French doors, Single French doors, Sliding French doors, Bi-fold French doors, and Others |

| Material | uPVC (unplasticized polyvinyl chloride), Wood, Metal, Glass, and Composite materials |

| Installation Type | Replacement and New construction |

| End Use | Residential, Commercial, Offices, Hotels & restaurants, and Retail spaces |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Andersen Corporation, JELD-WEN, Pella Corporation, Masonite International Corp, and Marvin Windows & Doors |

| Additional Attributes | Dollar sales by French door type include single, double, sliding, and bi-fold configurations, applied in residential, commercial, and hospitality sectors across North America, Europe, and Asia-Pacific. Demand is driven by renovation trends, aesthetic appeal, and energy-efficient housing. Innovation focuses on smart locking systems, improved insulation, and sustainable materials. Costs depend on frame material (wood, vinyl, aluminum), glazing options, and customization features. |

The global french doors market is estimated to be valued at USD 29.2 billion in 2025.

The market size for the french doors market is projected to reach USD 45.8 billion by 2035.

The french doors market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in french doors market are double french doors, single french doors, sliding french doors, bi-fold french doors and others.

In terms of material, upvc (unplasticized polyvinyl chloride) segment to command 33.0% share in the french doors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

French Patio Door Market Size and Share Forecast Outlook 2025 to 2035

French Square Bottle Market Size and Share Forecast Outlook 2025 to 2035

French Fries Cutter Market Size and Share Forecast Outlook 2025 to 2035

Doors Market Size and Share Forecast Outlook 2025 to 2035

Dog Gates, Doors, & Pens Market Analysis - Trends, Growth & Forecast 2025 to 2035

Competitive Overview of Dog Gates, Doors and Pens Companies

Locomotive Doors Market Growth – Trends & Forecast 2024 to 2034

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Yacht Shell Doors Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Windows and Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Airplane And Helicopter Hangar Doors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA