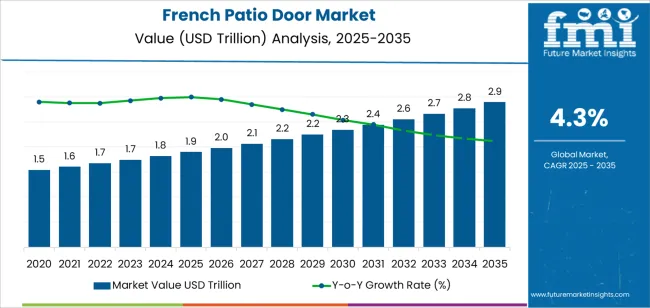

The global French patio door market is projected to reach USD 2.9 trillion by 2035, recording an absolute increase of USD 998.0 billion over the forecast period. The market is valued at USD 1.9 trillion in 2025 and is set to rise at a CAGR of 4.3% during the assessment period. The overall market size is expected to grow by nearly 1.5 times during the same period, supported by increasing demand for aesthetic architectural solutions in residential and commercial construction worldwide, driving demand for efficient indoor-outdoor transition systems, and increasing investments in home renovation and energy-efficient building projects globally. High installation costs compared to standard door systems and complex weatherproofing requirements may pose challenges to market expansion.

The market expansion between 2025 and 2035 reflects fundamental shifts in architectural design preferences and building renovation trends across residential properties and commercial establishments. French patio door manufacturers are developing integrated systems that combine energy-efficient glazing technologies, advanced locking mechanisms, and customizable frame materials that enable property owners to optimize natural light access and outdoor space connectivity. The transition from traditional sliding doors and single-panel entries to French patio configurations addresses homeowner and developer challenges related to aesthetic appeal, ventilation flexibility, and property value enhancement in markets where indoor-outdoor living concepts have become essential design features.

Technology advancement in low-emissivity glass coatings, multi-point locking systems, and thermally broken frame assemblies creates opportunities for enhanced energy performance and security improvements. French patio door providers are incorporating impact-resistant glazing options for hurricane-prone regions, sound-dampening interlayers for urban installations, and powder-coated finishes that resist environmental degradation across diverse climate conditions. The market benefits from residential remodeling trends in mature housing markets where homeowners invest in premium door systems to improve living space functionality and curb appeal. Distribution channels through building material retailers, window and door specialists, and contractor networks expand deployment across new construction projects and retrofit applications serving residential and commercial property segments.

Between 2025 and 2030, the French patio door market is projected to expand from USD 1.9 trillion to USD 2.4 trillion, resulting in a value increase of USD 446.7 billion, which represents 44.8% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for home improvement solutions and architectural enhancement products, product innovation in energy-efficient glazing systems and integrated shading solutions, as well as expanding adoption across residential renovation projects and upscale commercial developments. Companies are establishing competitive positions through investment in advanced manufacturing technologies, customization capabilities, and strategic market expansion across single-family homes, multi-unit residential buildings, and hospitality property applications.

From 2030 to 2035, the market is forecast to grow from USD 2.4 trillion to USD 2.9 trillion, adding another USD 551.3 billion, which constitutes 55.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized door systems, including ultra-slim profile designs and panoramic glass configurations tailored for luxury residential and commercial requirements, strategic collaborations between door manufacturers and architectural design firms, and an enhanced focus on sustainability credentials and smart home integration capabilities. The growing emphasis on biophilic design principles and seamless indoor-outdoor connectivity will drive demand for advanced, high-performance French patio door solutions across diverse architectural applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.9 trillion |

| Market Forecast Value (2035) | USD 2.9 trillion |

| Forecast CAGR (2025-2035) | 4.3% |

The French patio door market grows by enabling property owners to achieve superior natural light penetration and architectural elegance while creating functional transitions between interior living spaces and outdoor areas. Homeowners and commercial property developers face mounting pressure to maximize space utilization and aesthetic appeal, with French patio door installations typically providing 30-50% more natural light compared to standard entry systems, making these architectural elements essential for modern building design and renovation projects. The residential real estate market's emphasis on premium finishes and lifestyle amenities creates demand for elegant door solutions that enhance property valuation and buyer appeal through visual impact and functional versatility.

Consumer preference for open-concept living and the growing popularity of outdoor entertainment spaces drive adoption in residential construction, home remodeling, and hospitality applications, where seamless indoor-outdoor flow has a direct impact on property desirability and user experience quality. The global expansion of the home improvement industry and increasing disposable income for residential upgrades accelerates French patio door demand as homeowners invest in premium building products that deliver both aesthetic and functional benefits. However, higher price points compared to standard patio door alternatives and specialized installation requirements necessitating skilled contractors may limit adoption rates among budget-conscious homeowners and builders focused on construction cost minimization.

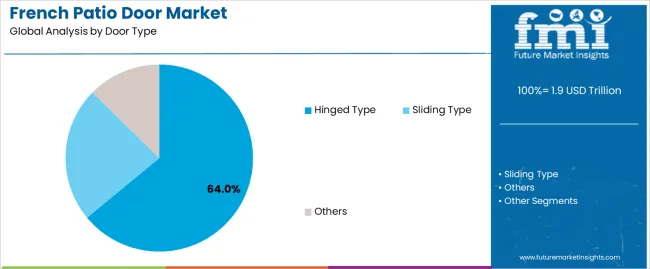

The market is segmented by door type, application, and region. By door type, the market is divided into hinged type, sliding type, and others. Based on application, the market is categorized into commercial and residential. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The hinged type segment represents the dominant force in the French patio door market, capturing approximately 64% of total market share in 2025. This advanced category encompasses configurations featuring traditional swing-out mechanisms, double-door symmetrical arrangements, and multi-panel accordion systems, delivering comprehensive access capabilities with enhanced architectural authenticity properties. The hinged type segment's market leadership stems from its exceptional aesthetic appeal reflecting classic French door design heritage, functional versatility enabling full-width opening for furniture movement and outdoor access, and compatibility with traditional and contemporary architectural styles that prioritize visual elegance.

The sliding type segment maintains a 28.0% market share, serving property owners who require space-efficient solutions through parallel panel operation, minimal floor clearance requirements, and smooth gliding mechanisms. The others segment accounts for 8.0% market share, featuring bi-fold configurations, pivot designs, and specialty installation formats for unique architectural applications.

Key advantages driving the hinged type segment include authentic French door aesthetic maintaining design tradition with divided light patterns and symmetrical panel arrangements, superior ventilation control enabling partial or full opening configurations to regulate airflow and access requirements, traditional craftsmanship appeal supporting premium positioning in luxury residential and heritage property restoration markets, enhanced security capabilities through multi-point locking systems integrated across hinged door assemblies.

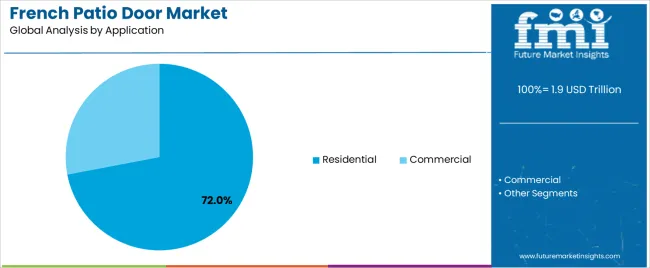

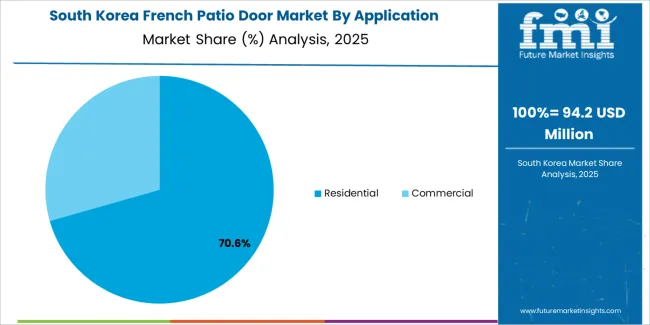

Residential applications dominate the French patio door market with approximately 72% market share in 2025, reflecting the substantial demand for aesthetic door solutions in single-family homes, townhouses, and condominiums where homeowners prioritize living space enhancement and outdoor connectivity. The residential segment's market leadership is reinforced by strong remodeling activity in mature housing markets, new home construction trends emphasizing indoor-outdoor living concepts, and homeowner willingness to invest in premium architectural products that improve property value and lifestyle quality.

The commercial segment represents 28.0% market share through installations in hospitality venues, restaurants, retail establishments, and office buildings where French patio doors serve both functional and brand positioning purposes. This segment benefits from commercial property developers seeking distinctive architectural features that enhance customer experience and property differentiation in competitive real estate markets.

Key market dynamics supporting application preferences include residential renovation spending focusing on kitchen and living area upgrades where French patio doors replace standard sliding glass units, new home construction incorporating French doors as standard features in master suites and primary living spaces for luxury positioning, commercial hospitality properties utilizing French patio doors to create elegant transitions between dining areas and outdoor terraces, retail and restaurant establishments leveraging French door installations for storefront appeal and seasonal indoor-outdoor space flexibility.

The market is driven by three concrete demand factors tied to property value enhancement and lifestyle preferences. First, home renovation spending accelerates French patio door adoption, with residential remodeling expenditures growing 5-7% annually in major markets worldwide, creating sustained demand for premium door systems that modernize aging housing stock and improve functional living space. Second, indoor-outdoor living trends drive architectural design evolution, with 60-70% of new upscale homes incorporating French patio door systems in primary living areas, reflecting consumer preference for natural light maximization and seamless outdoor access. Third, property value appreciation motivates homeowner investment in architectural upgrades, with French patio door installations delivering 70-85% return on investment through enhanced curb appeal and buyer desirability during property sales.

Market restraints include high product costs affecting adoption rates, with quality French patio door systems priced 40-80% above standard patio door alternatives, posing barriers for middle-market homeowners and value-oriented builders managing construction budget constraints. Installation complexity creates additional challenges, as French patio doors require precise fitting, proper weatherproofing, and structural header reinforcement, necessitating skilled contractor expertise and increasing total project costs beyond material expenses. Maintenance requirements and weatherproofing concerns impact long-term ownership satisfaction, particularly in harsh climate regions where hinged door systems face greater exposure to wind-driven rain and temperature fluctuations compared to sliding configurations that offer tighter weather seals.

Key trends indicate growing adoption of energy-efficient glazing technologies, with low-emissivity glass and argon-filled insulated units becoming standard specifications as building codes tighten thermal performance requirements and homeowners seek reduced heating and cooling costs. Material innovation trends toward fiberglass and composite frame construction offering superior durability and thermal performance compared to traditional wood or vinyl alternatives, integrated smart lock systems enabling remote access control and security monitoring through smartphone connectivity, and customization options including decorative glass patterns and hardware finishes that enable personalized architectural expression are driving product evolution. However, the market thesis could face disruption if large-format sliding door systems with ultra-slim sightlines gain aesthetic preference among architects and homeowners, reducing French patio door's traditional design advantage, or if economic downturns significantly curtail discretionary home improvement spending in major residential markets.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

| USA | 4.1% |

| UK | 3.7% |

| Japan | 3.2% |

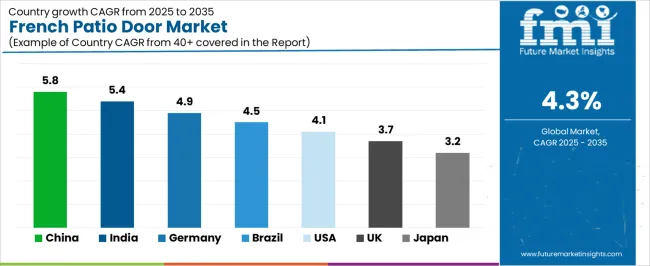

The French patio door market is gaining momentum worldwide, with China taking the lead thanks to aggressive residential construction activity and growing middle-class housing demand. Close behind, India benefits from urbanization acceleration and expanding premium residential segment, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where architectural tradition and renovation market maturity strengthen its role in European premium building products.

The USA demonstrates steady growth through established remodeling industry and new construction recovery, signaling continued investment in residential property enhancement. Meanwhile, the UK stands out for its heritage property renovation focus and conservatory addition trends, while Brazil and Japan continue to record consistent progress driven by urban housing development and property upgrade cycles. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

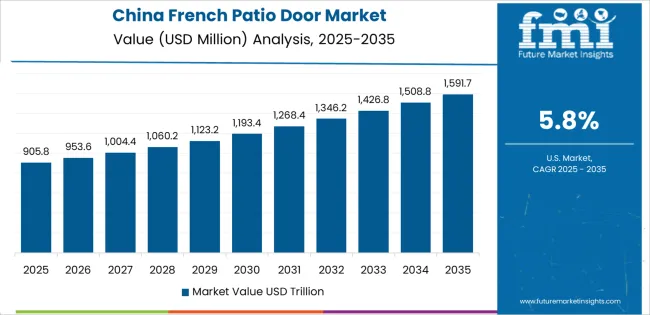

China demonstrates the strongest growth potential in the French patio door market with a CAGR of 5.8% through 2035. The country's leadership position stems from comprehensive residential construction expansion, intensive middle-class housing demand growth, and aggressive property development initiatives driving adoption of premium building products. Growth is concentrated in major urban centers, including Beijing, Shanghai, Guangzhou, and Shenzhen, where residential developers are incorporating French patio door systems in upscale apartment complexes and villa projects targeting affluent buyers.

Distribution channels through building material retailers, door and window specialty stores, and property developer supply networks expand deployment across new construction projects and luxury residential renovations. The country's urbanization policies provide support for residential construction activity, including infrastructure development and property market investment flows.

Key market factors include rapid middle-class expansion creating demand for Western-style architectural features and premium residential finishes in urban housing markets, real estate development concentration in tier-one and tier-two cities with comprehensive construction supply chains supporting premium product availability, increasing consumer preference for natural light and aesthetic door solutions influenced by exposure to international design trends, technology adoption featuring energy-efficient glazing systems and modern frame materials adapted for local climate conditions and construction practices.

In major metropolitan areas, planned urban developments, and premium residential zones, the adoption of French patio door systems is accelerating across luxury apartment projects, independent villas, and upscale commercial properties, driven by affluent consumer preferences and developer positioning strategies. The market demonstrates strong growth momentum with a CAGR of 5.4% through 2035, linked to comprehensive urbanization progression and increasing focus on residential quality enhancement.

Indian developers are implementing French patio door installations in premium property segments to differentiate offerings and command price premiums in competitive real estate markets. The country's Smart Cities Mission creates demand for modern building products, while increasing emphasis on architectural aesthetics drives adoption of elegant door systems that enhance property appeal.

Leading real estate development regions, including Mumbai, Delhi NCR, Bengaluru, and Pune, driving French patio door adoption across luxury residential projects. Growing affluent consumer segment enabling premium building product expenditure with rising disposable income supporting property upgrade investments. International architectural influence trends accelerating adoption of Western design elements and premium door systems in upscale developments. Market development through organized retail channels and specialty door showrooms expanding product accessibility for homeowners and contractors.

Mature construction sector in Germany demonstrates sophisticated implementation of French patio door systems, with documented installations showing 25-35% energy cost reduction through high-performance glazing integration in residential renovation projects. The country's residential property infrastructure in major regions, including Bavaria, North Rhine-Westphalia, Baden-Württemberg, and Lower Saxony, showcases integration of premium door technologies with existing building stock, leveraging expertise in energy-efficient construction and architectural preservation standards.

German homeowners emphasize quality engineering and thermal performance, creating demand for certified door systems that support stringent energy regulations and long-term durability requirements. The market maintains steady growth through focus on heritage property renovation and new construction quality standards, with a CAGR of 4.9% through 2035.

Key development areas include energy efficiency compliance with passive house standards and building energy regulations requiring advanced thermal performance in door assemblies, technical certification infrastructure ensuring product quality through independent testing and performance verification with documented U-values below 1.0 W/m²K, strategic partnerships between door manufacturers and architectural firms enabling customized solutions for heritage building renovations and contemporary designs, integration of triple-glazing systems and comprehensive weatherproofing technologies for extreme climate resilience in northern regions.

The Brazilian market demonstrates growing French patio door adoption based on urban residential development and increasing middle-class housing investment driving demand for aesthetic building products. The country shows solid potential with a CAGR of 4.5% through 2035, driven by residential construction recovery and property upgrade trends across major urban regions, including São Paulo, Rio de Janeiro, Brasília, and major state capitals. Brazilian homeowners are adopting French patio door systems to enhance property value and improve indoor-outdoor living functionality in tropical climate conditions. Technology deployment channels through construction material retailers, specialized door distributors, and residential contractor networks expand coverage across new construction and renovation projects.

Leading market segments include upscale condominium developments implementing French patio doors for balcony access and living area enhancement in multi-story residential buildings, single-family home construction incorporating premium door systems for backyard and pool area connectivity supporting outdoor lifestyle preferences, technology adaptation featuring tropical climate specifications including corrosion-resistant materials and ventilation optimization for humid conditions, strategic positioning in luxury property segment where French patio doors signal quality construction and architectural sophistication to prospective buyers.

The USA market demonstrates established French patio door adoption based on mature remodeling industry and comprehensive distribution infrastructure serving residential construction and renovation segments. The country shows solid potential with a CAGR of 4.1% through 2035, driven by steady home improvement spending and new construction activity in major residential markets, including California, Texas, Florida, and Northeast metropolitan regions.

American homeowners are implementing French patio door systems in kitchen renovations, master bedroom upgrades, and family room expansions that emphasize outdoor living space connectivity. Technology deployment channels through national home improvement retailers, regional building material suppliers, and specialized door and window dealers expand deployment across diverse housing stock and climate zones.

Key market characteristics include remodeling industry maturity supporting consistent demand for replacement door systems in aging housing stock with average home age exceeding 40 years, new construction incorporation of French patio doors as standard features in move-up and luxury home segments targeting buyer preferences for premium finishes, technology advancement featuring impact-resistant glazing for hurricane zones and energy-efficient specifications meeting ENERGY STAR certification requirements, strategic partnerships between manufacturers and national retail chains ensuring broad product availability and consumer accessibility through established distribution networks.

In major residential markets and conservation areas, homeowners are implementing French patio door systems that comply with planning regulations and heritage preservation requirements, with documented installations achieving 30-40% thermal performance improvement while maintaining architectural character in period properties. The market shows steady growth potential with a CAGR of 3.7% through 2035, linked to established renovation culture, conservatory addition trends, and emphasis on property value maintenance through quality improvements. British homeowners are adopting French patio doors that balance traditional aesthetics with modern performance specifications to meet building regulations and preservation guidelines.

Market development factors include heritage property renovation requirements necessitating sympathetic door replacements that maintain architectural authenticity while improving energy performance, conservatory and extension projects incorporating French patio doors for elegant transitions between existing structures and new additions supporting expanded living space, planning permission considerations driving demand for door systems that satisfy conservation area requirements and listed building regulations, emphasis on security features and weather resistance specifications suitable for British climate conditions with wind-driven rain protection and draft prevention.

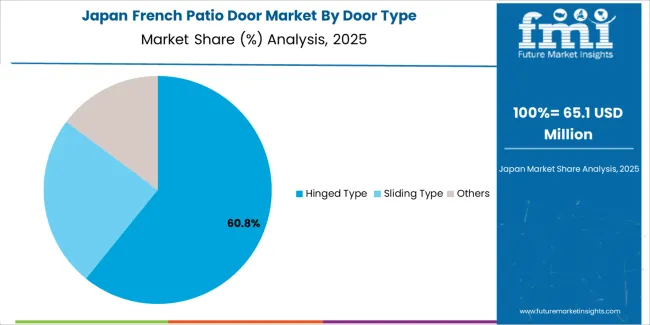

French patio door market in Japan demonstrates mature implementation focused on space-efficient designs and integration with earthquake-resistant construction standards serving dense urban residential environments. The country maintains steady growth momentum with a CAGR of 3.2% through 2035, driven by residential replacement cycles and incremental new construction in major metropolitan regions including Tokyo, Osaka, Nagoya, and Fukuoka areas. Major residential developments showcase deployment of compact French patio door configurations that maximize natural light while accommodating space constraints in urban housing units.

Key market characteristics include earthquake resistance requirements driving engineering specifications for door assemblies that maintain structural integrity during seismic events, space optimization designs featuring compact door profiles and efficient operation mechanisms suitable for limited floor areas in urban apartments, technology integration by domestic manufacturers incorporating advanced weatherproofing systems and thermal performance specifications adapted for humid subtropical climate conditions, emphasis on precision manufacturing and quality control supporting long-term operational reliability in residential applications with documented 20-25 year service life expectations.

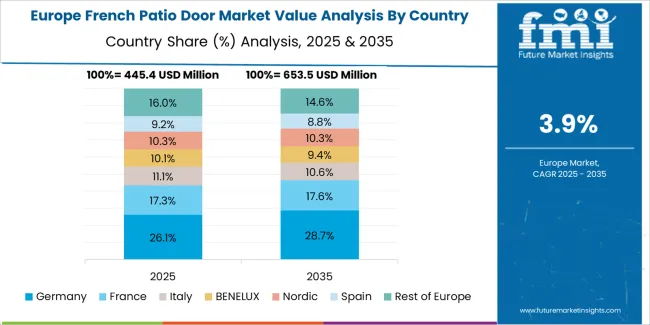

The French patio door market in Europe is projected to grow from USD 690.1 billion in 2025 to USD 1,023.9 billion by 2035, registering a CAGR of 4.0% over the forecast period. Germany is expected to maintain its leadership position with a 29.3% market share in 2025, declining slightly to 28.7% by 2035, supported by its extensive residential renovation infrastructure and major construction centers, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg regions.

France follows with a 21.4% share in 2025, projected to reach 21.8% by 2035, driven by comprehensive heritage property restoration programs and residential construction activity. The United Kingdom holds a 18.7% share in 2025, expected to reach 18.9% by 2035 through conservatory addition trends and property upgrade investments. Italy commands a 12.6% share in both 2025 and 2035, backed by architectural tradition and villa construction.

Spain accounts for 8.9% in 2025, rising to 9.1% by 2035 on coastal property development growth. The Netherlands maintains 4.2% in 2025, reaching 4.3% by 2035 on urban residential renewal. The Rest of Europe region is anticipated to hold 4.9% in 2025, expanding to 5.1% by 2035, attributed to increasing French patio door adoption in Nordic countries and emerging Central and Eastern European residential construction markets.

The Japanese French patio door market demonstrates a mature and design-conscious landscape, characterized by sophisticated integration of compact door systems and space-efficient configurations with existing residential infrastructure across urban apartments, suburban homes, and luxury properties. Japan's emphasis on natural light optimization and architectural refinement drives demand for premium door systems that support minimalist design philosophies while delivering superior thermal performance and operational reliability in residential applications.

The market benefits from established relationships between domestic door manufacturers and construction companies, creating service ecosystems that prioritize earthquake resistance compliance and precision installation standards. Residential developments in Tokyo, Osaka, Nagoya, and other major metropolitan areas showcase advanced French patio door implementations where systems achieve seamless integration with interior design concepts through customized frame finishes and hardware selections.

The South Korean French patio door market is characterized by growing international brand presence, with companies maintaining significant positions through comprehensive product portfolios and design services capabilities for upscale residential and commercial applications. The market demonstrates increasing emphasis on European-style architectural elements and premium building products, as Korean property developers increasingly demand authentic French patio door systems that integrate with luxury residential projects and boutique commercial developments deployed across major urban centers.

Regional door manufacturers are gaining market share through strategic partnerships with international suppliers, offering specialized services including custom sizing support and local building code compliance assistance for residential construction applications. The competitive landscape shows increasing collaboration between global door manufacturers and Korean architectural design firms, creating hybrid service models that combine international product quality with local market knowledge and construction practice expertise.

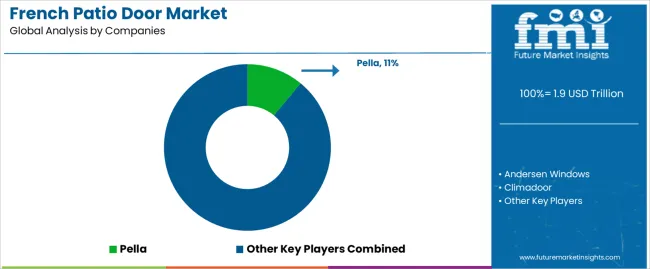

The French patio door market features approximately 20-25 meaningful players with moderate fragmentation, where the top three companies control roughly 24-30% of global market share through established manufacturing capabilities and comprehensive distribution networks. Competition centers on design authenticity, energy performance specifications, and customization capabilities rather than price competition alone. Pella leads with approximately 11.0% market share through its comprehensive residential door and window portfolio.

Market leaders include Pella, Andersen Windows, and Climadoor, which maintain competitive advantages through proven product engineering, extensive dealer networks, and deep expertise in residential construction and remodeling markets across multiple geographic regions, creating brand recognition advantages with homeowners and contractor communities. These companies leverage research and development capabilities in energy-efficient glazing systems and ongoing architectural design support relationships to defend market positions while expanding into luxury residential and commercial property applications.

Challengers encompass Lux Doors and Arcat, which compete through specialized French door designs and regional market presence in key residential construction territories. Product specialists, including Ply Gem, Anlin, ProVia, LaContina, and JELD-WEN, focus on specific door configurations or regional markets, offering differentiated capabilities in custom sizing, specialized glazing options, and distinctive hardware collections.

Regional players and emerging door manufacturers create competitive pressure through cost-competitive product offerings and local service advantages, particularly in high-growth markets where domestic manufacturers including Simpson Doors, Milgard Windows, Simonton, Premium, Therma-Tru, and ENCRAFT provide localized distribution support and competitive pricing structures adapted to regional market conditions. Market dynamics favor companies that combine authentic French door design aesthetics with comprehensive energy performance specifications that address building code requirements and homeowner efficiency expectations throughout residential construction and renovation cycles.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 trillion |

| Door Type | Hinged Type, Sliding Type, Others |

| Application | Commercial, Residential |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Pella, Andersen Windows, Climadoor, Lux Doors, Arcat, Ply Gem, Anlin, ProVia, LaContina, JELD-WEN, Simpson Doors, Milgard Windows, Simonton, Premium, Therma-Tru, ENCRAFT |

| Additional Attributes | Dollar sales by door type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with door manufacturers and distribution networks, product specifications and performance characteristics, integration with residential construction and remodeling projects, innovations in energy-efficient glazing technologies and frame materials, and development of customization options with enhanced aesthetic flexibility and smart home integration capabilities. |

The global french patio door market is estimated to be valued at USD 1.9 trillion in 2025.

The market size for the french patio door market is projected to reach USD 2.9 trillion by 2035.

The french patio door market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in french patio door market are hinged type , sliding type and others.

In terms of application, residential segment to command 72.0% share in the french patio door market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

French Square Bottle Market Size and Share Forecast Outlook 2025 to 2035

French Fries Cutter Market Size and Share Forecast Outlook 2025 to 2035

French Doors Market Size and Share Forecast Outlook 2025 to 2035

Patio Umbrella Market Growth – Trends, Size & Forecast 2025 to 2035

Patio Furniture Market Analysis - Trends & Growth Forecast 2025 to 2035

Opioid-Induced Constipation (OIC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Doors Market Size and Share Forecast Outlook 2025 to 2035

Door Hardware Market

Door Controller Systems Market

Indoor Rotary High Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Indoor Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Indoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Indoor Air Quality Monitor Market Size and Share Forecast Outlook 2025 to 2035

Indoor Location Market Size and Share Forecast Outlook 2025 to 2035

Indoor Space Heater Market Size and Share Forecast Outlook 2025 to 2035

Indoor Farming Market Analysis - Size, Share, and Forecast 2025 to 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

A Detailed Global Analysis of Brand Share for the Indoor Farming Market

Outdoor Boundary Vacuum Load Switch Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA