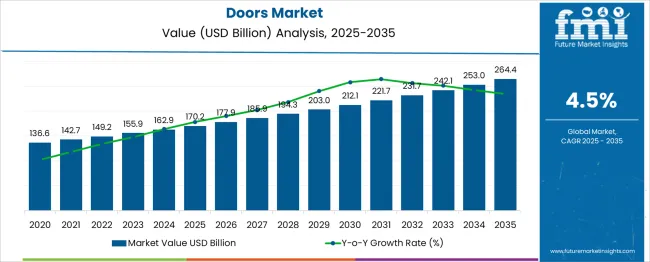

The Doors Market is estimated to be valued at USD 170.2 billion in 2025 and is projected to reach USD 264.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. Annual increments remain stable, reflecting consistent procurement across residential, commercial, and institutional segments. From 2025 to 2026, the market adds USD 7.7 billion, marking a 4.5% YoY increase.

By 2028, yearly gains expand slightly to USD 8.4 billion, indicating resilient infrastructure demand. Growth between 2029 and 2031 remains near 4.5%, with absolute additions between USD 9.1–9.6 billion per annum. These uniform YoY contributions reflect minimal external disturbance and high forecast visibility. In the second half of the forecast period, from 2032 to 2035, absolute annual increases range from USD 9.6 billion to USD 11.4 billion, signaling slightly larger nominal expansions without altering the overall YoY growth rhythm.

Despite economic cyclicality in related construction materials, the doors segment avoids material deviation. Steady replacement cycles in urban housing and code-compliant retrofits in non-residential units drive this regulated linearity. The absence of sharp YoY contractions or spikes confirms sustained sectoral maturity, allowing reliable planning and minimal inventory disruption across supply tiers.

| Metric | Value |

|---|---|

| Doors Market Estimated Value in (2025 E) | USD 170.2 billion |

| Doors Market Forecast Value in (2035 F) | USD 264.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The doors market is witnessing robust expansion, driven by rapid urbanization, rising investments in residential and commercial infrastructure, and consumer demand for energy-efficient and aesthetically pleasing entry systems. The growing popularity of smart homes and the integration of advanced locking technologies have further fueled innovation in design and material choices.

Moreover, evolving building codes and sustainability mandates are encouraging the adoption of eco-friendly materials and thermally efficient door systems. As construction activity surges globally, especially in emerging economies, manufacturers are responding with product offerings tailored for both high-end architectural specifications and cost-effective mass housing solutions.

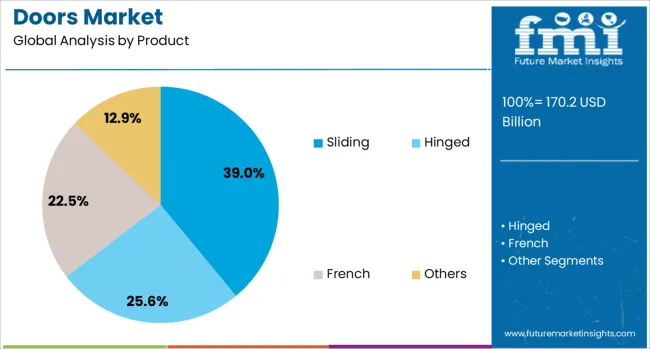

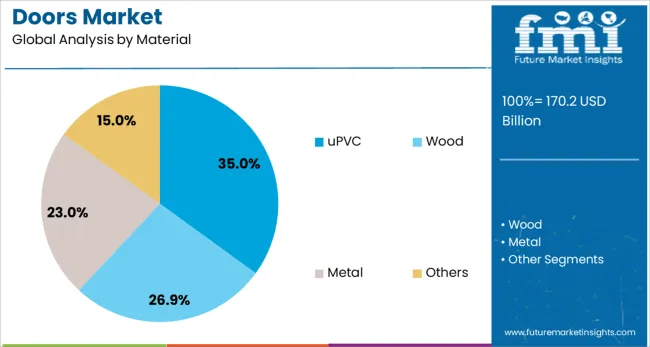

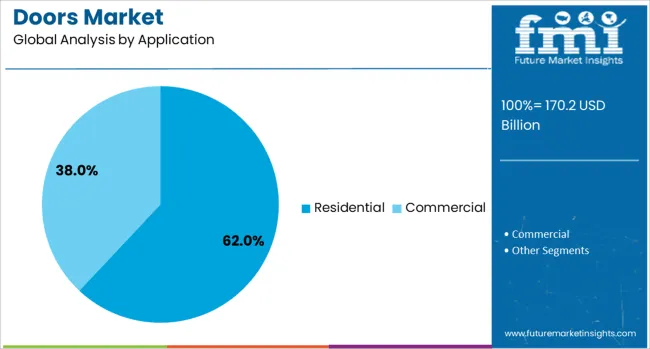

The doors market is segmented by product, material, application, and geographic regions. The product segment is divided into Sliding, Hinged, French, and others. In terms of material, the doors market is classified into uPVC, Wood, Metal, and others. Based on the application, the doors market is segmented into Residential and Commercial. Regionally, the doors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Sliding doors are projected to dominate the doors market by 2025, accounting for 39.00% of total market share. Their rising popularity stems from their space-saving functionality, modern aesthetic appeal, and ease of operation in both residential and commercial buildings.

As open-plan architecture gains traction, sliding systems offer seamless indoor-outdoor transitions and improved natural lighting, making them highly desirable for patios, balconies, and partitioned interiors.

Innovations in frame design and track systems are also enhancing durability and thermal performance, further increasing adoption in energy-conscious construction.

uPVC is expected to lead the material category with a 35.00% share of the market in 2025. Its dominance is driven by the material’s superior insulation properties, low maintenance requirements, and resistance to corrosion, termites, and weathering.

Widely used in energy-efficient building envelopes, uPVC doors contribute to reducing heating and cooling costs, aligning with sustainability trends.

The material’s versatility in color, finish, and design supports broad architectural applicability, while its recyclability makes it an increasingly favored option in green construction projects.

The residential sector is forecast to command 62.00% of the doors market share in 2025, making it the largest application segment. Rising global housing demand, renovation activity, and preference for customized, secure, and energy-efficient entry solutions are fueling this growth.

Homeowners are increasingly investing in modern door styles that enhance curb appeal and interior aesthetics.

Moreover, government-backed housing programs and smart home penetration are supporting higher sales volumes, particularly for pre-fabricated and insulated door systems in both new builds and retrofit applications.

Demand for doors with enhanced energy efficiency, aesthetic design, and smart integration is rising. Renovations and upgrades in aging structures amplify the replacement cycle. Wide adoption of insulated, high-security, and automated doors reflects evolving consumer priorities and modern building standards that favor durability, style, and compliance with energy regulations.

Urbanization and infrastructure expansion are underpinning demand for various door types, including hinged, sliding, and specialty designs. Residential upgrades are often instigated by energy savings needs or style overhauls, while commercial construction—ranging from offices to hospitality venues—requires high-performance doors in terms of safety and functionality. Renovation activity accounts for a significant portion of volume alongside new builds. Demand is shaped by aesthetic trends, as minimalist and customizable profiles find favor among architects and homeowners. Many projects specify doors that combine thermal insulation with acoustic control to meet building codes and occupant comfort.

Material innovation is reshaping the industry landscape. Solid wood retains preference in premium segments for its craftsmanship and durability, while metal and composite doors are favored for commercial and exterior applications. Increasing adoption of insulated core and energy-efficient doors supports sustainability objectives. Smart access technologies—such as biometric locks, remote control operation, and integration with home automation systems—have gained traction in new installations. This intersection of material performance and digital convenience now influences segment preference, with security, energy codes, and user experience guiding specification and procurement decisions.

Procurement and distribution of doors are being challenged by material cost fluctuations and transportation complexity. Raw materials like hardwood, aluminum, and engineered composites are subject to price volatility, sometimes resulting in longer lead times. Large-format or heavy doors often require specialized logistics, increasing overhead in remote or fragmented markets. Navigating varying global standards for fire classification, acoustic ratings, and energy code compliance can further complicate cross-border supply and adoption. For small contractors and retrofit segments, these factors increase project risk and may delay order fulfillment or installation.

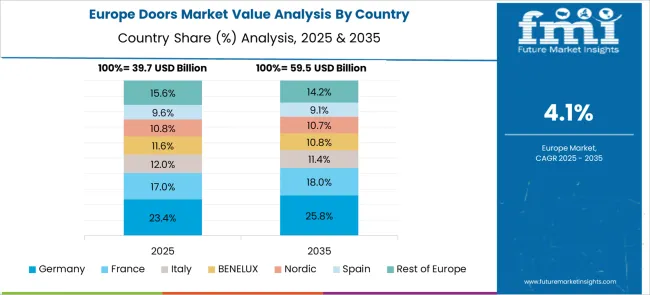

Growth trajectories in the doors market differ across regions. Asia-Pacific leads global volume, propelled by urban development and residential construction. North America and Europe demonstrate stable demand driven by renovation cycles and energy compliance. Growth is accelerating in emerging regions of Latin America, Middle East, and Africa, supported by new infrastructure spending and housing needs. Segment-wise, glass-front retail and hospitality corridors favor display and panoramic doors, while compact urban formats and multi-family housing drive demand for space-saving sliding and automatic variants. Sustainable certifications and modular construction approaches are boosting adoption of insulated and adaptable door systems.

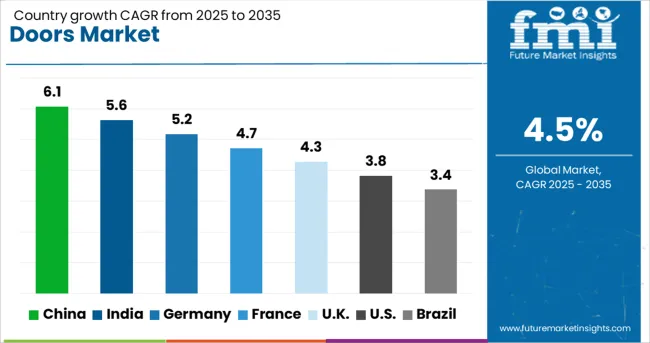

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global doors market is estimated to expand at a CAGR of 4.5% between 2025 and 2035. Demand is being led by China, India, and Germany, with the United Kingdom and United States trailing behind. China, growing at 6.1%, remains ahead of global growth by 35%. India, at 5.6%, also exceeds the global mean due to high public housing demand. Germany’s 5.2% CAGR is supported by policy-driven energy compliance. The UK, growing at 4.3%, falls marginally below the global average, while the US, at 3.8%, is lagging due to lower housing starts. OECD regulations are shaping building material compliance across Europe and North America, while ASEAN partnerships are impacting supply chains in China and India. Distinct preferences, regulatory contexts, and import exposure are driving unique adoption cycles across each country.

China’s doors market is projected to grow at a CAGR of 6.1% from 2025 to 2035, 35% above the global average. Expansion has been driven by industrial development, dense urban projects, and mid-rise residential upgrades across second-tier cities. Government-backed housing developments and public infrastructure efforts are supporting multi-material product diversification. Polymer doors and steel-core frames have replaced traditional hardwoods in compliance with urban fire safety laws. ASEAN imports are contributing to rising smart-lock installations and component supplies. Local manufacturers are scaling production for aluminium-based and insulated variants for institutional orders.

India’s doors market is forecast to register a CAGR of 5.6%, surpassing the global average by 24%. Rural electrification programs, urban expansion, and public institution construction have raised the demand for modular and fire-rated doors. Public procurement for hospitals, schools, and housing has favoured steel, fibreglass, and engineered timber variants. Installation frequency has risen in Tier 2 and Tier 3 cities due to affordable housing schemes under state and central government programs. ASEAN countries remain preferred sources for hardware and hinges, especially in volume contracts. Domestic SMEs are increasing share in laminated and moisture-resistant segments.

Germany’s doors market is expected to grow at a CAGR of 5.2%, about 16% above the global mean. Growth is being driven by EU energy-efficiency mandates and targeted subsidies for thermally efficient building materials. Retrofitting demand is increasing across apartment blocks, public-sector buildings, and high-traffic commercial locations. As an OECD member, Germany enforces high compliance standards, encouraging triple-seal frames, recycled aluminium cores, and smart-lock compatibility. EU alignment supports cross-border exports, while internal manufacturers are scaling composite production. Demand is shifting toward certified suppliers that meet passive building codes.

The UK’s doors market is projected to rise at a CAGR of 4.3%, slightly below the global rate. Market momentum is being maintained by safety retrofits, limited public infrastructure upgrades, and the growth of DIY housing components. Composite doors, fire-rated systems, and timber-alternative models are gaining traction in both commercial and residential segments. Import realignment post-Brexit has shifted sourcing from EU nations to ASEAN economies. Public-private partnerships are ordering modular fire doors for social housing retrofits. As part of the OECD, the UK is enforcing strict building material audits, impacting product lifecycles and installation cycles.

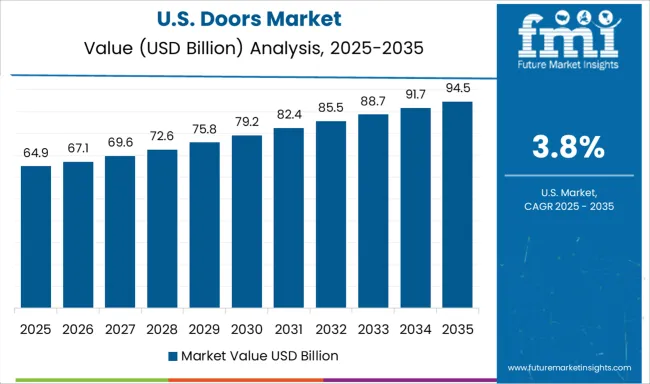

The US doors market is expected to expand at a CAGR of 3.8%, which is 16% below the global trend. Reduced new housing permits, mature urban infrastructure, and longer replacement intervals are holding back volume growth. Retrofit activity is focused on climate-rated and security-enhanced doors in hurricane-prone and suburban zones. As an OECD member, the US enforces strict building codes, limiting market penetration for imported composite doors. Cross-border sourcing under the USMCA agreement continues to dominate door-related components, leaving minimal exposure to ASEAN materials. Growth is being maintained via institutional procurement and private residential upgrades.

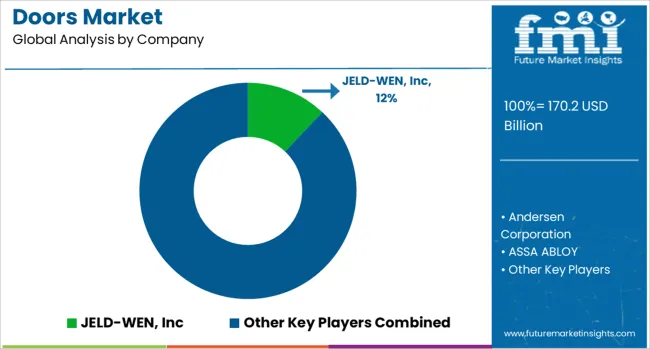

ASSA ABLOY leads the commercial segment with a wide portfolio of entrance automation, security doors, and access systems. The company focuses on mergers and acquisitions to strengthen its geographic footprint and has integrated smart locking solutions into its product lines.

Masonite International Corporation emphasizes R&D in molded panel and wood doors for residential use, with distribution networks across North America and Europe. Pella Corporation has been expanding its fiberglass and vinyl door collections, leveraging energy-saving designs that meet stringent building codes in the US. JELD-WEN, Inc. and Andersen Corporation are known for their large-scale operations, offering patio, storm, and custom doors with heavy investments in manufacturing automation. Marvin Windows & Doors targets the luxury market, providing handcrafted door systems with high customization options.

Lixil Group Corporation and YKK Corporation dominate in Asia and maintain extensive supply chains for aluminum and steel doors used in large infrastructure projects. Companies such as Deceuninck and Weru Group serve the European residential renovation segment, offering uPVC-based solutions with durability features. Emerging players like Jarida Group and Vinylguard are focusing on expanding regional footprints through dealer partnerships and cost-effective composite materials, aiming to compete with established brands in both retrofit and new construction segments.

New product lines such as smart patio doors and low-carbon entry systems were introduced in the USA and the EU. Major players expanded through acquisitions of specialty door manufacturers in North America. In Japan, collaboration on low-emission door technologies gained pace, while South Korea focused on digital access innovations. These developments reflected targeted growth, product modernization, and decarbonization across key developed markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 170.2 Billion |

| Product | Sliding, Hinged, French, and Others |

| Material | uPVC, Wood, Metal, and Others |

| Application | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | JELD-WEN, Inc, Andersen Corporation, ASSA ABLOY, ATIS Group, Atrium Corporation, Century Doors, Deceuninck, Entrematic Group AB, Jarida Group, Lixil Group Corporation, Marvin Windows & Doors, Masco Corporation, Masonite International Corporation, MI Windows and Doors LLC, Neuffer Windows + Doors GmbH, Pella Corporation, SGM Windows, Vinylguard Window & Door Systems Ltd., Weru Group, and YKK Corporation |

| Additional Attributes | Dollar sales by product mechanism and end-use application, demand dynamics in new construction and aftermarket renovation, regional dominance in Asia-Pacific, innovation in energy-efficient insulated doors and smart-access systems, environmental impact of material sustainability and thermal performance, and emerging use cases in modular architecture, retrofit upgrades, and automated commercial entries. |

The global doors market is estimated to be valued at USD 170.2 billion in 2025.

The market size for the doors market is projected to reach USD 264.4 billion by 2035.

The doors market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in doors market are sliding, hinged, french and others.

In terms of material, upvc segment to command 35.0% share in the doors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

French Doors Market Size and Share Forecast Outlook 2025 to 2035

Dog Gates, Doors, & Pens Market Analysis - Trends, Growth & Forecast 2025 to 2035

Competitive Overview of Dog Gates, Doors and Pens Companies

Locomotive Doors Market Growth – Trends & Forecast 2024 to 2034

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Yacht Shell Doors Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Windows and Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Airplane And Helicopter Hangar Doors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA