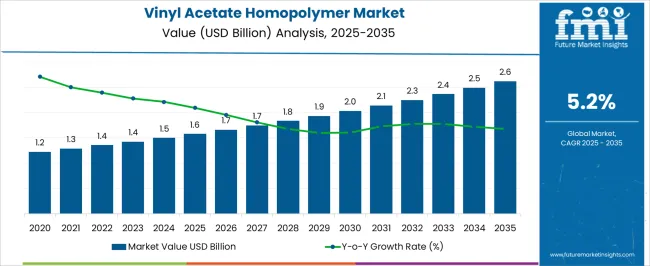

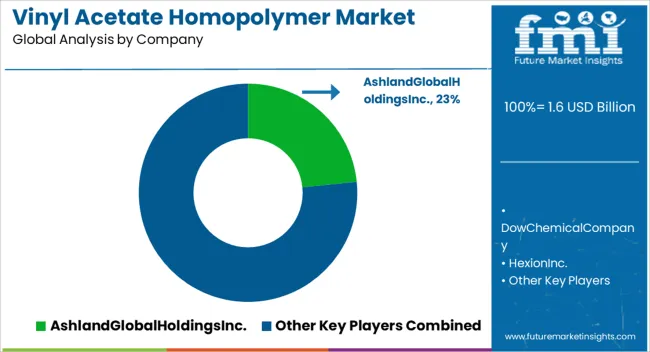

The vinyl acetate homopolymer market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

Demand is supported by the construction industry’s increasing preference for durable, flexible, and water-resistant materials, along with growing use in paper and packaging sectors. Between 2030 and 2034, the market advances from USD 1.7 billion to USD 2.3 billion, contributing an incremental gain of USD 0.6 billion. This stage is propelled by technological developments in emulsion polymerization, which enhance product performance in diverse end uses such as nonwoven fabrics, wood adhesives, and waterborne coatings. Growing emphasis on low-VOC formulations and eco-friendly polymers also supports adoption in regulated markets.

From 2035 to 2040, the market climbs from USD 2.4 billion to USD 2.6 billion, maintaining steady demand across industries while reflecting maturity in key applications. Replacement demand, coupled with expansions in emerging economies’ packaging and textile sectors, ensures stable momentum. Overall, the vinyl acetate homopolymer market demonstrates consistent growth, underpinned by industrial diversification, material performance benefits, and rising penetration across both traditional and modern applications.

The global vinyl acetate homopolymer market demonstrates steady expansion driven by adhesive manufacturing demands, textile processing applications, and coating formulations that require water-based polymeric binders with specific viscosity and film-forming characteristics. Industrial manufacturers utilize vinyl acetate homopolymers in hot-melt adhesive formulations where thermal stability and rapid setting properties enable high-speed packaging operations across food processing, consumer goods, and pharmaceutical industries. The polymer's compatibility with various plasticizers and tackifiers allows adhesive formulators to customize performance characteristics for specific bonding applications while maintaining cost-effectiveness compared to alternative synthetic polymer systems.

Paper and packaging industries represent significant consumption segments where vinyl acetate homopolymers function as coating binders that improve printability, surface smoothness, and moisture resistance in specialized paper grades. Converting facilities specify these polymers for release liner applications where controlled adhesion properties enable easy removal without substrate damage during label manufacturing processes. Corrugated box manufacturers incorporate vinyl acetate homopolymer-based adhesives in laminating operations that bond different paper layers while maintaining structural integrity during shipping and storage conditions involving moisture exposure and temperature fluctuations.

Textile manufacturing operations utilize vinyl acetate homopolymers as finishing agents that impart wrinkle resistance, dimensional stability, and improved hand feel to fabrics processed for apparel and home textile applications. Fabric treatment facilities apply these polymers through padding, coating, and impregnation processes that require precise concentration control and uniform distribution across textile substrates. Quality control departments monitor polymer application levels to achieve desired fabric properties while avoiding excessive stiffness or reduced breathability that could compromise end-user acceptance and garment performance characteristics.

| Metric | Value |

|---|---|

| Vinyl Acetate Homopolymer Market Estimated Value in (2025 E) | USD 1.6 billion |

| Vinyl Acetate Homopolymer Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The vinyl acetate homopolymer market is experiencing steady expansion, supported by its wide-ranging industrial applicability and adaptability in diverse formulations. Growth is being driven by the increasing demand for eco-friendly and cost-effective adhesive solutions, particularly in packaging, woodworking, and construction applications. The product’s chemical properties, including excellent film-forming ability, flexibility, and water resistance, have made it highly desirable in both interior and exterior applications.

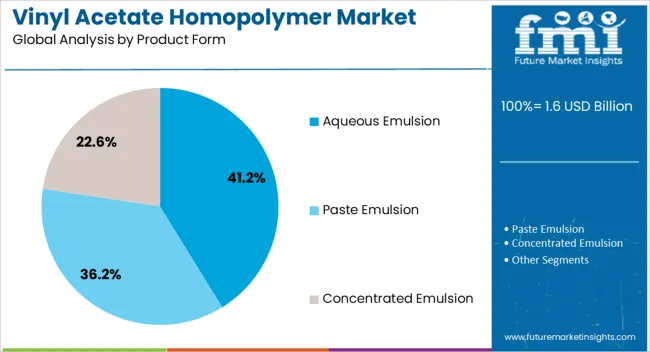

Ongoing infrastructure development projects in emerging markets, coupled with the renovation trend in developed economies, have further fueled its consumption. The aqueous emulsion form of vinyl acetate homopolymer is gaining traction due to its low VOC content and ease of handling, aligning with environmental compliance standards.

The market is also benefitting from technological improvements in polymerization processes, which have enhanced product consistency and performance Over the coming years, the convergence of sustainability regulations, application versatility, and manufacturing efficiency is expected to maintain the upward trajectory of vinyl acetate homopolymer adoption in key industrial segments.

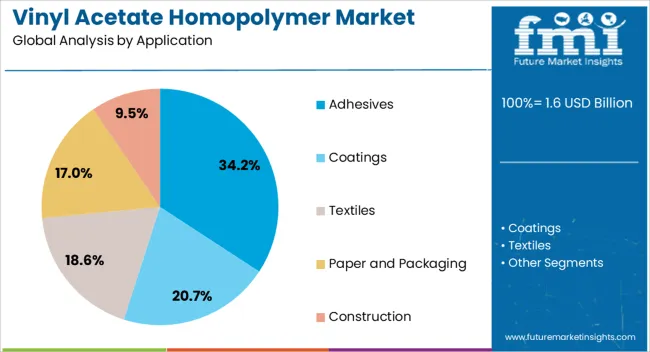

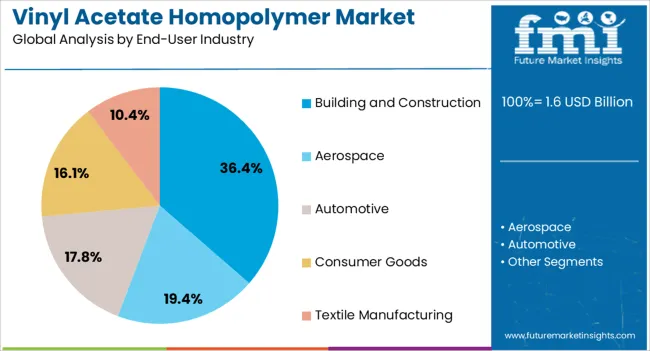

The vinyl acetate homopolymer market is segmented by application, end-user industry, product form, type of polymerization, functionality, and geographic regions. By application, vinyl acetate homopolymer market is divided into Adhesives, Coatings, Textiles, Paper and Packaging, and Construction. In terms of end-user industry, vinyl acetate homopolymer market is classified into Building and Construction, Aerospace, Automotive, Consumer Goods, and Textile Manufacturing. Based on product form, vinyl acetate homopolymer market is segmented into Aqueous Emulsion, Paste Emulsion, and Concentrated Emulsion. By type of polymerization, vinyl acetate homopolymer market is segmented into Batch Polymerization and Continuous Polymerization. By functionality, vinyl acetate homopolymer market is segmented into Binding Agents, Film Formers, Thickeners, and Surfactants. Regionally, the vinyl acetate homopolymer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The adhesives segment is anticipated to represent 34.2% of the vinyl acetate homopolymer market revenue share in 2025, underscoring its leadership in application areas. Growth in this segment has been driven by the strong bonding capabilities, flexibility, and water resistance offered by vinyl acetate homopolymers, which are critical for applications in woodworking, packaging, textiles, and laminates.

Demand has been reinforced by the transition toward environmentally friendly adhesive formulations with low VOC emissions, which align with global regulatory requirements. The ability to modify adhesive properties through formulation adjustments has enabled tailored performance for diverse substrates and conditions.

Enhanced durability and resistance to moisture have expanded the usage of these adhesives in outdoor and high-humidity environments Additionally, the scalability of aqueous polymer dispersions in adhesive manufacturing has improved production efficiency and reduced costs, further solidifying this segment’s position in the market.

The building and construction segment is expected to account for 36.4% of the vinyl acetate homopolymer market revenue share in 2025, emerging as the leading end-use industry. This dominance is attributed to the increasing use of vinyl acetate homopolymers in construction adhesives, sealants, coatings, and joint compounds due to their strong adhesion, flexibility, and weather resistance.

The ongoing wave of infrastructure development in emerging markets and the sustained renovation activity in mature economies have significantly boosted demand. Water-based formulations, particularly aqueous emulsions, have gained prominence in the sector for their low environmental impact and compliance with green building standards.

Furthermore, the product’s ability to perform effectively across diverse climatic conditions has supported its adoption in both residential and commercial projects Strategic investments in construction technologies and a growing focus on sustainable building materials are expected to reinforce the role of vinyl acetate homopolymers in this segment.

The aqueous emulsion segment is projected to hold 41.2% of the vinyl acetate homopolymer market revenue share in 2025, making it the leading product form. This growth is being driven by the segment’s favorable environmental profile, characterized by low VOC content and compliance with stringent emission regulations. The ease of formulation, handling, and application has made aqueous emulsions a preferred choice across adhesives, coatings, and construction materials.

The water-based nature of these emulsions allows safer manufacturing and application processes while reducing flammability risks. Advancements in polymerization technology have further enhanced film strength, flexibility, and durability, making aqueous emulsions suitable for both indoor and outdoor applications.

The ability to customize performance characteristics through additive integration has expanded their use across specialized industrial and commercial products As sustainability targets intensify globally, aqueous emulsions are expected to remain at the forefront of product innovation in the vinyl acetate homopolymer market.

Vinyl acetate homopolymer demand is fueled by adhesives and packaging, paints and coatings, textile binders, and competitive industry developments. Its adaptability secures growth across multiple downstream sectors.

Vinyl acetate homopolymer demand has been significantly influenced by its strong presence in the adhesives and packaging sector. These polymers provide excellent adhesion, film-forming capability, and compatibility with water-based systems, making them ideal for woodworking, labeling, paper converting, and carton sealing. Packaging manufacturers increasingly rely on these polymers due to their ability to deliver cost efficiency while meeting performance requirements for bonding strength and durability. Growth in e-commerce and food-grade packaging has created consistent opportunities for adoption, where fast-setting adhesives and non-toxic formulations are required. This expanding role has positioned vinyl acetate homopolymer as a central adhesive component across paper-based and industrial packaging solutions, sustaining its long-term relevance.

The paints and coatings sector has become a key growth driver for vinyl acetate homopolymer, given its ability to enhance adhesion, gloss, and durability in both architectural and industrial coatings. These polymers are used in water-based emulsion paints, delivering stable dispersion and long-lasting film properties. With construction and remodeling activities gaining traction worldwide, demand for coatings that ensure surface protection and extended life cycles has increased. Vinyl acetate homopolymers are particularly valued for offering flexibility, resistance to alkali, and improved washability, making them suitable for interior and exterior applications. This dynamic highlights the importance of these polymers in enabling reliable, cost-effective, and high-performance coating systems across diverse industrial sectors.

Vinyl acetate homopolymer has steadily expanded into textiles and nonwoven applications, where it is used as a binder to improve softness, resilience, and wash resistance of fabrics. In nonwoven production, these polymers provide essential strength and dimensional stability while allowing flexibility in design. Demand is driven by apparel finishing, upholstery, and technical textiles, as well as hygiene products where nonwoven binders are critical. Textile manufacturers prefer vinyl acetate homopolymers for their balance of performance and affordability, ensuring reliable finishing solutions without compromising fabric quality. As consumer preferences shift toward higher-quality textiles and functional fabrics, these polymers are becoming indispensable in enhancing material performance across global textile supply chains.

The vinyl acetate homopolymer market is shaped by competition among global chemical producers, with strategies focused on product quality, cost efficiency, and supply chain expansion. Companies are investing in advanced emulsion technologies, eco-compliant grades, and region-specific formulations to strengthen their positions. Mergers, capacity expansions, and partnerships with adhesive, coating, and textile manufacturers are common tactics to secure long-term growth. Regional producers often compete on price and cater to smaller markets, while larger players emphasize R&D to deliver high-performance variants. This dynamic interplay of competition and innovation ensures continuous improvements in product availability and application diversity, reinforcing vinyl acetate homopolymer’s central role across industries.

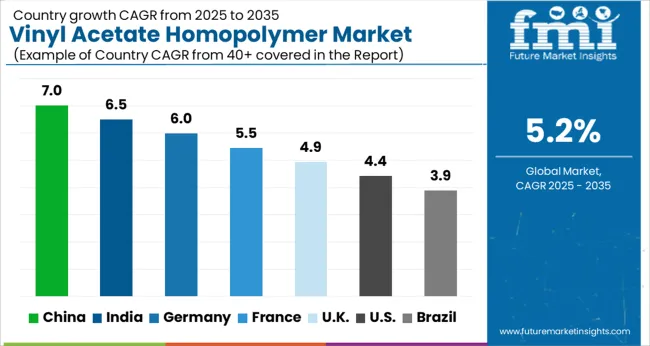

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The vinyl acetate homopolymer market is projected to expand at a global CAGR of 5.2% from 2025 to 2035, supported by its rising demand in adhesives, coatings, textiles, and construction chemicals. China leads with a CAGR of 7.0%, driven by its dominant role in packaging, paper converting, and large-scale construction projects that require water-based adhesive solutions. India follows at 6.5%, supported by growth in textiles, woodworking adhesives, and expanding infrastructure investments. France achieves 5.5%, benefiting from its strong position in specialty coatings and premium textile finishing. The United Kingdom posts 4.9% growth, shaped by demand in nonwovens, industrial coatings, and adhesives for packaging. The United States records 4.4%, reflecting steady consumption in industrial adhesives and paints, though slightly below global averages due to its mature market structure. This analysis spans more than 40 countries, with these markets serving as essential benchmarks for application-specific growth strategies, competitive positioning, and material innovations in the global vinyl acetate homopolymer industry.

China is projected to expand at a CAGR of 7.0% during 2025–2035, well above the global 5.2% path. Momentum is expected from high output of water-based adhesives for packaging, paper converting, and woodworking, with converters preferring fast-setting and humidity-tolerant grades. Architectural coatings and construction admixtures continue to widen usage where film-forming and adhesion are prioritized. Textile and nonwoven binders add steady volumes as finishing houses pursue consistent handle and wash resistance. Domestic producers have scaled reactor capacity and improved emulsifier systems to stabilize viscosity across long runs, which improves plant efficiency for end users. China remains the most influential swing market for price discovery, application trials, and rapid SKU turnover across adhesives, coatings, and binders.

India is expected to post a CAGR of 6.5% during 2025–2035, ahead of the global average. The driver set includes expanding parquet and furniture manufacturing that favors water-based bonding, rising corrugated packaging volumes from e-commerce, and greater adoption of emulsion paints in tier-two cities. Textile clusters prefer consistent binder quality for interlinings and nonwovens, which sustains recurring orders. Local producers and tollers have improved access to feedstocks and dispersion additives, lowering landed cost for regional buyers. Procurement teams view VAc homopolymers as a cost-effective alternative to higher-price polymers in mid-performance jobs. India is positioned to deepen penetration in adhesives while growing share in coatings and construction modifiers.

France is projected to grow at a 5.5% CAGR during 2025–2035, just above the global baseline. Specialty coatings for interior refurbishments and premium woodcare contribute meaningful volumes where clarity, flexibility, and block resistance are required. Packaging converters favor low-odor emulsions for food-adjacent use cases, while label and tape markets request balanced tack and peel performance. Technical textiles tied to automotive interiors and filtration use tailored binder packages that protect drape and porosity. Distributors report stable call-offs from renovation programs and private-label paint ranges. With consistent demand across DIY chains and professional contractors, France will keep a clear role in higher value emulsions that prize finish, color stability, and workable open time.

The United Kingdom is expected to register a 4.9% CAGR during 2025–2035, slightly below the global 5.2% mark yet stronger than the recent trend. For 2020–2024, CAGR is estimated near 4.3%, shaped by subdued refurbishments and cautious capex at converters. The pace lifts to 4.9% for 2025–2035 as housing repairs improve paint consumption, private label ranges expand shelf space for water-based emulsions, and packaging converters upgrade to faster-set adhesive lines. A separate note on the shift in growth: earlier gains were constrained by weak project pipelines, while the forward period benefits from retail renovations, carton consolidation, and tighter spec preferences for low-VOC formulations that VAc homopolymers serve effectively.

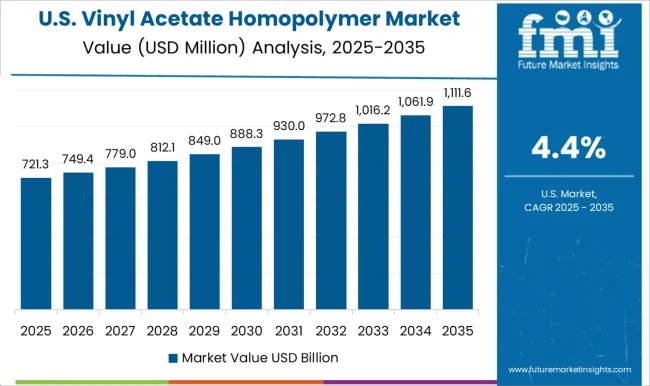

The United States is set to post a 4.4% CAGR during 2025–2035, below global pace yet supported by stable demand in industrial adhesives, construction sealants, and architectural coatings. Packaging converters emphasize line speed and bond reliability for e-commerce and food cartons, which favors homopolymer systems with controlled viscosity build and quick set. DIY and pro paint channels consume consistent volumes as remodel activity stabilizes, while nonwoven and hygiene applications maintain baseline pull. Import flows and regional capacity influence pricing cadence, with buyers prioritizing predictable rheology and film integrity. The market remains value focused, with mix improvements rather than large unit surges expected to drive contribution.

The vinyl acetate homopolymer market is defined by global chemical leaders and regional manufacturers focused on delivering high-performance polymers for adhesives, coatings, textiles, and construction applications. The Dow Chemical Company leads with a broad portfolio of vinyl acetate-based emulsions, offering advanced binders for paints, coatings, and pressure-sensitive adhesives that provide superior film formation and adhesion. Celanese Corporation maintains a strong global position as a key producer of vinyl acetate monomer and derivatives, ensuring supply reliability and material consistency for downstream homopolymer applications.

Wacker Chemie AG specializes in dispersion technologies and high-purity vinyl acetate homopolymers that improve flexibility, bonding strength, and water resistance across coatings, textile finishes, and construction adhesives. Hexion Inc. focuses on industrial and construction-grade polymers, emphasizing cost-effective, durable solutions with enhanced mechanical stability. Ashland Inc. provides specialty water-based adhesive polymers tailored for packaging, paper converting, and woodworking sectors.

BASF SE contributes through innovations in polymer chemistry, developing eco-friendly formulations and customized grades for diverse end uses. Dairen Chemical Corporation is a major Asian producer, offering competitively priced vinyl acetate polymers and monomers with large-scale capacity and export reach. Henkel AG & Co. KGaA applies its adhesive expertise to develop application-specific homopolymer blends for industrial bonding and coatings. Sumitomo Chemical Co., Ltd. focuses on performance materials for high-end coatings and textiles, while Pexi Chem Private Limited serves regional markets with cost-efficient emulsions for construction and packaging.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Application | Adhesives, Coatings, Textiles, Paper and Packaging, and Construction |

| End-User Industry | Building and Construction, Aerospace, Automotive, Consumer Goods, and Textile Manufacturing |

| Product Form | Aqueous Emulsion, Paste Emulsion, and Concentrated Emulsion |

| Type of Polymerization | Batch Polymerization and Continuous Polymerization |

| Functionality | Binding Agents, Film Formers, Thickeners, and Surfactants |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Dow Chemical Company; Celanese Corporation; Wacker Chemie AG; Hexion Inc.; Ashland Inc.; BASF SE; Dairen Chemical Corporation; Henkel AG & Co. KGaA; Sumitomo Chemical Co., Ltd.; and Pexi Chem Private Limited. |

| Additional Attributes | Dollar sales, share, CAGR, regional demand trends, adoption in adhesives and coatings, pricing benchmarks, raw material volatility, competitive landscape, construction and textile applications, supply chain risks. |

The global vinyl acetate homopolymer market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the vinyl acetate homopolymer market is projected to reach USD 2.6 billion by 2035.

The vinyl acetate homopolymer market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in vinyl acetate homopolymer market are adhesives, coatings, textiles, paper and packaging and construction.

In terms of end-user industry, building and construction segment to command 36.4% share in the vinyl acetate homopolymer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vinyl Sliding Window Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Frame Casement Window Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Windows and Doors Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Ester Market Size and Share Forecast Outlook 2025 to 2035

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Acetate Salt Market Size and Share Forecast Outlook 2025 to 2035

Acetate Cloth Tape Market Size and Share Forecast Outlook 2025 to 2035

Homopolymer Acrylic Filter Bags Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Electrical Tapes Market Size, Share & Forecast 2025 to 2035

Vinyl Flooring Market Growth - Trends & Forecast 2025 to 2035

Vinyl Extrusion Equipment Market Insights - Growth & Forecast 2025 to 2035

Market Positioning & Share in the Vinyl Cyclohexane Industry

Vinyl Films Market

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Polyvinyl Chloride (PVC) Packaging Film Market Forecast and Outlook 2025 to 2035

Polyvinyl Butyral PVB Market Size and Share Forecast Outlook 2025 to 2035

Polyvinyl Alcohol (PVA) Films Market Size and Share Forecast Outlook 2025 to 2035

Polyvinylidene Fluoride (PVDF) Market Growth - Trends & Forecast 2025 to 2035

Polyvinyl Chloride Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA