This report forecast global Air Cooled Cube Ice Machines market with various aspects including import, export, consumption, and revenue. And the most popular ones are producing through the energy-efficient, low-maintenance, and more economical than water-cooled versions of these machines. The increasing trend towards cold drinks, along with a growing consumer preference for sanitary production of ice, is driving market growth.

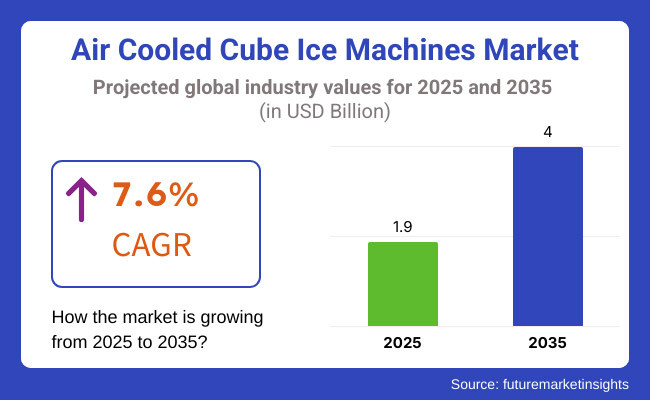

The Air Cooled Cube Ice Machines Market is anticipated to expand at a rate of 7.6% during the projection period, reaching a value of approximately USD 4.0 Billion in 2035. Smart monitoring and the usage of eco-friendly refrigerants are also driving the adoption of air cooled cube ice machines in diverse industries.

Due to a large network of quick-service restaurants, bars, and hotels needing reliable ice production, North America leads the market. Rigid health regulations increase the need for self-cleaning ice machines to offer to cleanliness and purity. Moreover, the process of manufacturing eco-friendly, high-performance ice machines has been encouraged in the USA and Canada due to the growing focus for energy efficient appliances.

Air cooled cube ice machines also see steady demand, mainly in hospitality and healthcare across Europe. Similarly, the proliferation of gourmet ice in fine dining establishments and upscale cocktail lounges is driving market growth. Strict EU regulations governing environmentally safe refrigerants drive manufacturers toward energy-efficient technologies. Moreover, the local focus on sustainability incentivizes companies to invest in environmentally friendly ice-making solutions.

The market in Asia-Pacific is anticipated to grow the most rapidly, owing to urbanization, increases in disposable income, and an increase in the food service industry. There is strong demand from fast-food chains, convenience stores and hospitals in countries such as China, Japan and India. The rising tourism industry has significantly contributed to the growth of the ice machine market, coupled with the technological advancements and local manufacturing abilities makes it even more accessible and affordable.

Challenges

High Costs and Logistical Complexities

Air Cooled Cube Ice Machines Market has been facing pressure from high-cost and detailed logistics as well as varied regulation across the different regions. Manufacturers face the need to comply with industry standards for safety, energy usage, and complexity of distribution, all of which can add friction to market penetration.

Maintenance and Operational Challenges

Air cooled cube ice machines with the specialized equipment, regular maintenance and periodic replacement of individual components are required for optimal operation. Maintenance costs are growing, as are risks associated with downtime, making it difficult for businesses that rely on unbroken ice production such as the food service and healthcare sectors.

Opportunities

Growth in Food & Beverage and Healthcare Industries

There are major opportunities for the market due to the growing demand for ice from the food & beverage and healthcare industries. The production of ice is indispensable to restaurants, hotels, bars, and hospitals, propelling the adoption of high-capacity and efficient ice-making machines.

Increase in Energy-Efficient and Smart Ice Machines

The continued focus on energy efficiency and intelligent automation is driving the development of sustainable and smart ice machines. Investments in energy efficient, self-cleaning, IoT enabled ice makers will galvanize companies in the market.

This growth was largely driven by the hospitality, healthcare, and food service sectors, where reliable ice production is essential, leading to high sales for air-cooled cube ice machines. One significant shift was seen in the adoption of innovative ice making solutions as consumer preferences shifted toward fresh, high quality ice. High-capacity ice machines were popular in North America, Europe, and Asia-Pacific markets.

Nonetheless, market growth is inhibited due to high energy intake, maintenance costs, and supply chain disruptions. Companies responded by launching new energy efficient models, intelligent ice monitoring systems, and better refrigerants.

The market will navigate through this forward towards innovations during 2025 to 2035 with development of IoT based ice machine monitoring systems, advanced cooling technologies & AI based maintenance alerts. In future, there will be self-cleaning mechanisms, antimicrobial ice storage, and energy-efficient refrigeration system in place.

Moreover, the recent movement toward the automation of commercial kitchens and hospitals will steer future market dynamics. The future of the Air-Cooled Cube Ice Machines Market is supported by companies that are focusing on smart, sustainable, and high-efficiency ice-making solutions.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Fulfilling food safety standards and energy efficiency regulations |

| Industrial Growth | Trends in the hospitality, healthcare food service solutions. |

| Industry Adoption | Growing needs for high-yield, energy-efficient ice machines |

| Supply Chain and Sourcing | Over-reliance on traditional refrigeration systems and conventional cooling technologies |

| Market Competition | Established commercial ice machine manufacturers are also present |

| Market Growth Drivers | Demand for stable ice supply, cost-cutting measures, and operational efficiency |

| Sustainability and Energy Efficiency | Targeted Categorical on Energy-efficient Refrigeration and Water-efficient Ice Making |

| Integration of Digital Planning | Underuse of smart diagnostics and remote monitoring |

| Advancements in Ice Making Technology | Traditional ice creation and refrigeration practices |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined global regulations, AI-assisted compliance monitoring, and enhanced refrigerant standards |

| Industrial Growth | Expansion into smart commercial kitchens, cloud-based ice production monitoring, and automated ice distribution |

| Industry Adoption | Rise of IoT-enabled monitoring, AI-driven predictive maintenance, and self-regulating ice machines |

| Supply Chain and Sourcing | Shift toward eco-friendly refrigerants, advanced insulation materials, and localized production |

| Market Competition | Growth of innovative startups, AI-powered ice monitoring solutions, and automation-driven ice production systems |

| Market Growth Drivers | Increased investment in smart ice makers, antimicrobial storage solutions, and cloud-based ice inventory management |

| Sustainability and Energy Efficiency | Large-scale implementation of eco-friendly refrigerants, smart defrosting systems, and sustainable ice production |

| Integration of Digital Planning | Expansion of real-time performance analytics, AI-based ice machine optimization, and predictive maintenance tools |

| Advancements in Ice Making Technology | Evolution of self-cleaning ice makers, AI-driven cooling efficiency, and antimicrobial ice storage solutions |

The USA Air-Cooled Cube Ice Machine Market is also expected to witness a growth trend with the expanding food service industry, increasing demand for energy-efficient ice-making solution, and stringent hygiene regulations. Further, rising need for superior quality ice among a growing number of hotels, restaurants and health care institutions would facilitate market growth.

Additionally, the product adoption in several segments is being driven by technological breakthroughs and automation of ice machines. Additionally, there is a rising inclination towards minimizing water and energy consumption, which is another factor prompting companies to adopt advanced ice-making technologies.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 7.8% |

UK market is growing steadily due to the increasing demand for high-quality ice machines across hospitality & healthcare services. Ease of hygiene and efficiency regulations prompt restaurants, bar and catering operations to use air-cooled cube ice machines. Additionally, increasing focus towards sustainable refrigeration and energy-efficient equipment is also supporting the growth of the market.

Advancement in ice machine technologies, such as self-cleaning, and antimicrobial technologies are also driving the growth of product in the global market. Chances are that government initiatives supporting energy-saving appliances will speed up the adoption rate in the commercial and industrial applications.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.4% |

The growth of customized solutions in air-cooled cube ice machines is due to the rising energy-efficient furnishings across the European Union, which is driving the hospitality segment. To comply with stringent EU regulations on energy consumption and eco-friendliness, companies now adopt green solutions in ice-making.

This heavy growth, coupled with the increasing number of fast food restaurants, coffee shops, and convenience stores, are the main aspects driving the market growth. Also, the new technologies like smart ice machine that you monitor your ice machine remotely and predictive maintenance gaining ground in commercial are responsible for the increasing deployment.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.5% |

The market for air-cooled cube ice machines in South Korea is estimated to develop steadily due to the thriving food & beverage segment, increasing demand for a hygienic solution for ice, and expanding adoption of smart kitchen appliances within the country.

Furthermore, their growing ubiquity at convenience stores and quick-service restaurants is also driving this market's growth. In addition, smart ice machines with IoT-enabled real-time monitoring and maintenance alerts help enhance operational efficiency. The need for energy-saving and space-saving ice machines from small business and cafes in experiencing growth in the market as well.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.7% |

The air-cooled cube ice machine market is experiencing steady growth globally, driven by the increasing demand for energy-efficient and hygienic ice-making solutions across the food service, healthcare, and hospitality industries. The adoption of smart, self-cleaning, and IoT-enabled ice machines is a key trend shaping market developments.

| Region | CAGR (2025 to 2035) |

|---|---|

| Global | 7.6% |

By type, the Global Air-Cooled Cube Ice Machine Market has been sub-segmented as follows: Based on type, the Global Air-Cooled Cube Ice Machine Market has been sub-segmented into: Drop Type, Half Cube Type and Full Cube Type, where the Floor-Standing Machine segment accounted for the largest revenue share in 2018, which can be attributed to augmented production of solid cubes of ice with freezer units, rendering it suitable for high demand settings like hospitality outlets.

These machines are used frequently in hotels, restaurants, hospitals and other large food service establishments where ice is constantly needed. As True Ice machines are capable of producing copious amounts of ice in a very short amount of time, they are often used in commercial settings.

With the advancement of technology, floor-standing machines now have automatic cleaning systems, energy-efficient cooling systems, intelligent monitoring functions, and more, making them more efficient than ever! They also mean reduced maintenance and operational costs while also promising the same ice quality.

And you’ll find features like antimicrobial protection, advanced filtration systems and AI-powered predictive maintenance on some contemporary floor-standing ice machines, all of which boost their reliability and standards of hygiene. They can also be integrated into IoT based monitoring platforms - meaning they can be remotely operated and remotely troubleshot- making them efficient for large scale operations.

As the hospitality, health care and foodservice industries continue to boom, so too will likely the need for high-capacity ice-making solutions. New models are designed with the latest low-water consumption technology, eco-friendly refrigerants and a reduced carbon footprint due to the rising energy efficiency and sustainability focus for businesses, making the floor-standing machine segment a major force within the market..

Self-Contained Unit segment is showing significant increase owing to their limited size, easy installation, and increasing inclination toward space-efficient smart cooking appliances in commercial kitchens. Ice maker with storage: These machines are dual-purpose in that they perform both ice-making and storage functions in just one unit, making them more compact than other types of ice makers, which is useful for small restaurants, cafés, bars, hotels, and convenience stores often short on space.

Due to the fact that they can generate fresh ice without needing added storage implements, they are an incredibly convenient and an affordable solution for establishments with average ice production requirements.

The steadily growing inclination toward modular and space-saving kitchen apparatus is another influential factor inducing the demand for these self-contained appliances. Newer units also feature advancements in noise reduction technology, water-saving technology, and eco-friendly refrigerants. The newer models have advanced air filtration systems inbuilt, self-cleaning mechanisms, and digital temperature controlling features, making them highly operationally efficient and requiring very little maintenance.

Rising concerns for energy conservation and environmental impact have stimulated growing demand for self-contained ice machines that incorporate smart energy management features, low energy compressors and less water consumption technology. With strict environmental regulations to meet, many manufacturers are now putting natural refrigerants including R290 into the limelight to maximize the overall performance of the machine.

In addition, there has been a growing demand for self-contained units at a slower rate from small and medium-sized foodservice units, which will drive the growth of the market significantly. The growth of the hospitality sector, particularly in urban and tourist areas, is also driving adoption. With businesses looking for reliable and space-saving solutions for making ice, continuous innovations around machine durability, hygiene control, and automation will significantly determine the future development of this market.

Demand in food service, hospitality, healthcare and retail is propelling the growth of the global air-cooled cube ice machine market. Some of the important factors that are believed to drive the growth of the market are progress in energy-efficient cooling technologies, increasing uptake of commercial ice machines, and growing worries about hygienic ice production. Furthermore, the sustainability trend and increasing demand for smart, automated ice-making solutions push manufacturers to develop innovative, affordable, eco-friendly systems.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Hoshizaki Corporation | 20-25% |

| Manitowoc Ice (Welbilt Inc.) | 15-20% |

| Scotsman Ice Systems | 12-16% |

| Ice-O-Matic | 8-12% |

| Follett LLC | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Hoshizaki Corporation | High-capacity air-cooled cube ice machines, energy-efficient designs, and advanced ice sanitation systems. |

| Manitowoc Ice (Welbilt Inc.) | Commercial-grade ice makers, space-saving modular designs, and smart diagnostic features. |

| Scotsman Ice Systems | High-efficiency ice production systems, self-monitoring features, and customizable ice cube options. |

| Ice-O-Matic | Durable ice machines with built-in antimicrobial protection and eco-friendly refrigerant solutions. |

| Follett LLC | Innovative ice dispensing systems, compact ice machines for healthcare and food service applications. |

Key Market Insights

Hoshizaki Corporation (20-25%)

Hoshizaki's air-cooled cube ice machine market share is driven by energy-efficient, hygienic, high-capacity ice production.

Manitowoc Ice (Welbilt Inc.) (15-20%)

Manitowoc Ice boasts of space-saving commercial ice machines with smart technology and designed for efficiency and durability.

Scotsman Ice Systems (12-16%)

Scotsman is a manufacturer of commercial innovative ice production systems with self-monitoring features for enhanced up-time and maintenance.

Ice-O-Matic (8-12%)

Ice-O-Matic manufactures durable ice machines featuring antimicrobial protection and eco-friendly refrigerants.

Follett LLC (5-9%)

Follett specializes in compact and innovative ice dispensing systems for the food service and health care industries.

Other Key Players (30-40% Combined)

The market is witnessing continuous advancements in ice machine technology, with contributions from various manufacturers and technology providers, including:

The overall market size for Air Cooled Cube Ice Machines market was USD 1.9 Billion in 2025.

The Air Cooled Cube Ice Machines market is expected to reach USD 4.0 Billion in 2035.

The demand for the Air Cooled Cube Ice Machines market will be driven by the dominance of floor-standing machines, which offer high-capacity ice production for commercial use. Additionally, self-contained units are gaining traction due to their compact design and versatility, making them ideal for restaurants, hotels, and convenience stores. The shift toward energy-efficient and eco-friendly cooling solutions will further boost market growth.

The top 5 countries which drives the development of Air Cooled Cube Ice Machines market are USA, European Union, Japan, South Korea and UK.

Self-Contained Units Gain Traction Due to Compact Design and Versatility demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 44: South Asia Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 46: South Asia Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 48: South Asia Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 49: South Asia Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 50: South Asia Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 57: East Asia Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 58: East Asia Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 59: East Asia Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 60: East Asia Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 64: Oceania Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 66: Oceania Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 68: Oceania Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 70: Oceania Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: MEA Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 74: MEA Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 75: MEA Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 76: MEA Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 77: MEA Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 78: MEA Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 79: MEA Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 80: MEA Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Installation, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Installation, 2023 to 2033

Figure 27: Global Market Attractiveness by Equipment Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Component Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Installation, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Installation, 2023 to 2033

Figure 57: North America Market Attractiveness by Equipment Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Component Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Installation, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Installation, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Equipment Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Component Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Installation, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Installation, 2023 to 2033

Figure 117: Europe Market Attractiveness by Equipment Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Component Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Installation, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 131: South Asia Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 132: South Asia Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 133: South Asia Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 134: South Asia Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 135: South Asia Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 136: South Asia Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 137: South Asia Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 138: South Asia Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 139: South Asia Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 143: South Asia Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 144: South Asia Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 145: South Asia Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 146: South Asia Market Attractiveness by Installation, 2023 to 2033

Figure 147: South Asia Market Attractiveness by Equipment Type, 2023 to 2033

Figure 148: South Asia Market Attractiveness by Component Type, 2023 to 2033

Figure 149: South Asia Market Attractiveness by Distribution channel, 2023 to 2033

Figure 150: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Installation, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 161: East Asia Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 162: East Asia Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 163: East Asia Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 164: East Asia Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 165: East Asia Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 169: East Asia Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 173: East Asia Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 174: East Asia Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 175: East Asia Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Installation, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Equipment Type, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Component Type, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Distribution channel, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Installation, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 191: Oceania Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 195: Oceania Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 199: Oceania Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 203: Oceania Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Installation, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Equipment Type, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Component Type, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Distribution channel, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Installation, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 221: MEA Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 222: MEA Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 223: MEA Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 224: MEA Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 225: MEA Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 226: MEA Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 227: MEA Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 228: MEA Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 229: MEA Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 233: MEA Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 236: MEA Market Attractiveness by Installation, 2023 to 2033

Figure 237: MEA Market Attractiveness by Equipment Type, 2023 to 2033

Figure 238: MEA Market Attractiveness by Component Type, 2023 to 2033

Figure 239: MEA Market Attractiveness by Distribution channel, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA