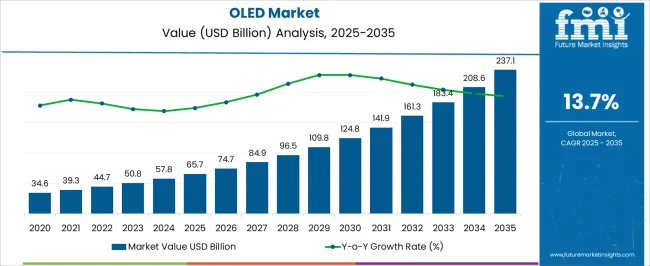

The OLED market is estimated to be valued at USD 65.7 billion in 2025 and is projected to reach USD 237.1 billion by 2035, registering a compound annual growth rate (CAGR) of 13.7% over the forecast period. This translates to a substantial compound annual growth rate (CAGR) of 13.7%, reflecting increasing adoption across diverse applications. OLED technology offers advantages such as superior display quality, flexibility, energy efficiency, and thinner form factors, making it attractive for smartphones, televisions, wearable devices, automotive displays, and lighting solutions.

The growth trajectory is driven by the expanding consumer electronics sector, rising demand for high-resolution and energy-efficient displays, and advancements in OLED materials and production processes. Additionally, increasing investments by major electronics manufacturers and technological innovations, such as foldable and rollable displays, are accelerating market penetration. The automotive and lighting segments are emerging as key growth drivers, as manufacturers integrate OLED panels for dashboard displays, interior lighting, and signage solutions.

Challenges such as high production costs and shorter lifespan compared to conventional LEDs may slow adoption in certain applications, but continuous improvements in manufacturing efficiency and material longevity are mitigating these concerns.

| Metric | Value |

|---|---|

| OLED Market Estimated Value in (2025 E) | USD 65.7 billion |

| OLED Market Forecast Value in (2035 F) | USD 237.1 billion |

| Forecast CAGR (2025 to 2035) | 13.7% |

The OLED market is experiencing robust expansion due to its critical role in next-generation display and lighting technologies. The current growth trajectory is being supported by increasing demand for high-resolution, energy-efficient, and flexible display solutions across various end-use sectors. Technological advancements in panel fabrication, reduction in manufacturing costs, and rising preference for thinner and lighter devices have positioned OLED as a preferred display technology.

The future outlook remains promising with ongoing innovations in foldable screens, transparent displays, and wearable applications. Consumer preference for enhanced visual experiences and manufacturers’ strategic investments in OLED production capacities are further paving the path for accelerated adoption.

The market is also benefiting from environmental considerations, as OLED panels consume less energy and do not require backlighting As product life cycles shorten and design differentiation becomes critical, OLED technology is expected to maintain its leadership by offering superior performance and design flexibility across multiple industries.

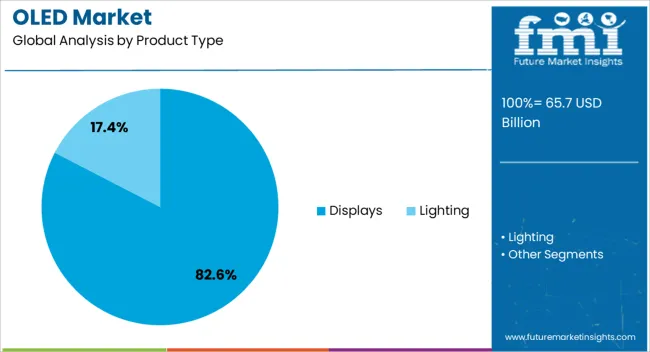

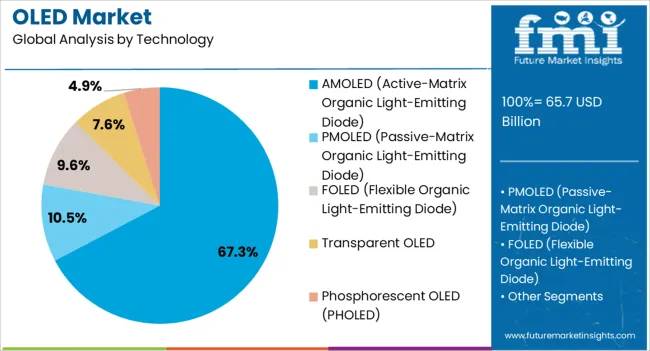

The OLED market is segmented by product type, technology, end use industry, and geographic regions. By product type, the OLED market is divided into Displays and Lighting. In terms of technology, the OLED market is classified into AMOLED (Active-Matrix Organic Light-Emitting Diode), PMOLED (Passive-Matrix Organic Light-Emitting Diode), FOLED (Flexible Organic Light-Emitting Diode), Transparent OLED, and Phosphorescent OLED (PHOLED).

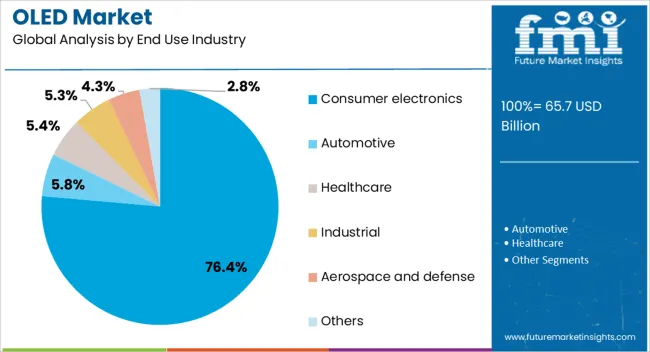

Based on end use industry, the OLED market is segmented into Consumer electronics, Automotive, Healthcare, Industrial, Aerospace and defense, and Others. Regionally, the OLED industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The displays product type segment is projected to account for 82.6% of the OLED market revenue in 2025, making it the dominant segment. This leadership is being driven by the widespread application of OLED displays in smartphones, televisions, tablets, and laptops, where high image contrast, deep blacks, and fast response times are key performance criteria.

The ability of OLED displays to deliver vibrant visuals and support advanced form factors such as curved, foldable, and rollable screens has significantly contributed to their mass adoption. Product differentiation among electronics manufacturers has further supported the segment’s expansion as OLED displays enable sleek designs and immersive viewing experiences.

The reduction in production costs over time and the scalability of OLED panel manufacturing have enhanced their accessibility across mid-range and premium product categories. As display technologies continue to evolve toward flexible and ultra-thin formats, the displays segment is expected to remain the cornerstone of OLED market growth.

The AMOLED technology segment is expected to represent 67.3% of the OLED market revenue in 2025, securing its position as the most prominent technological approach. The rise of AMOLED is being attributed to its superior display quality, faster refresh rates, and lower power consumption compared to traditional display technologies. This segment has gained traction due to its successful integration into high-volume consumer products such as smartphones and smartwatches, where battery life and visual performance are critical.

AMOLED panels allow individual pixel control, enabling higher contrast ratios and improved energy efficiency. The continued investment in flexible AMOLED manufacturing has supported the expansion of its use into foldable and wearable devices.

As consumer electronics brands prioritize premium screen experiences, AMOLED technology is being widely adopted due to its adaptability and advanced performance characteristics. The consistent push toward innovation in portable and wearable form factors is expected to sustain the segment’s market leadership in the coming years.

The consumer electronics end use industry is anticipated to account for 76.4% of the OLED market revenue in 2025, marking it as the leading application area. This dominance is being driven by the rising global consumption of devices such as smartphones, televisions, wearable electronics, and laptops that increasingly utilize OLED technology for superior visual output.

OLED’s lightweight construction, slim profile, and enhanced picture quality have aligned well with consumer demand for high-performance yet portable devices. Continuous product innovations and fast refresh cycles in the electronics sector have accelerated OLED adoption, especially among premium product lines.

The market has also been influenced by growing digital lifestyles and the integration of OLED displays in smartwatches, fitness bands, and augmented reality headsets. As consumer preferences evolve toward personalized, immersive, and energy-efficient technologies, the consumer electronics segment is expected to remain the primary revenue generator for OLED manufacturers, supported by volume demand and rapid technological advancement.

The OLED market is driven by strong demand in consumer electronics and automotive applications, with growth fueled by the need for superior display quality. Cost reduction and production scalability are key challenges but present opportunities for broader market adoption.

The OLED market is experiencing strong growth, driven by the increasing demand for high-quality displays in consumer electronics, particularly smartphones, televisions, and wearable devices. OLED’s superior color accuracy, faster refresh rates, and energy efficiency make it a preferred choice for premium devices. As consumers seek better viewing experiences with vibrant colors and deep contrasts, manufacturers are shifting to OLED technology. The demand is expected to rise with the growing adoption of OLED in the television and smartphone sectors, where consumers prioritize visual quality. This trend is pushing companies to innovate and integrate OLED displays in a wide range of consumer gadgets, further increasing market share.

The adoption of OLED technology in the automotive sector is increasing, driven by the growing need for advanced infotainment systems and digital dashboards. OLED offers clear visibility, flexibility, and improved design options, which are appealing to automakers looking for high-quality display solutions. As more car manufacturers incorporate OLED displays for instrument clusters and center consoles, the demand for OLED technology in the automotive sector is expected to rise. This shift towards OLED displays in vehicles aligns with the trend for high-tech, user-centric experiences, especially in premium and luxury vehicles. The automotive industry is seen as a key growth area for OLED technology in the coming years.

A significant challenge for the OLED market is the high cost of production, which limits its widespread adoption. However, advancements in production processes are expected to drive cost reductions. Manufacturers are focusing on scaling up OLED production, making it more affordable while maintaining the high-quality standards required by the industry. The introduction of new fabrication techniques, such as solution-based and inkjet printing technologies, is reducing production costs and improving yield. As the technology becomes more accessible and cost-efficient, it is anticipated to be used in a wider range of applications, from low-end smartphones to consumer-grade TVs, thereby expanding its market penetration.

The OLED market is highly competitive, with key players such as Samsung, LG, and BOE vying for dominance. These companies are leveraging their technological capabilities, extensive production networks, and strong brand reputations to capture market share. Samsung is a leader in the smartphone OLED display segment, while LG is driving OLED adoption in televisions. New entrants are also increasing competition by focusing on cost-effective production and differentiation in display performance. To maintain a competitive edge, manufacturers are emphasizing product innovation, strategic partnerships, and enhanced consumer experiences. This competitive landscape continues to push forward the development of OLED technology.

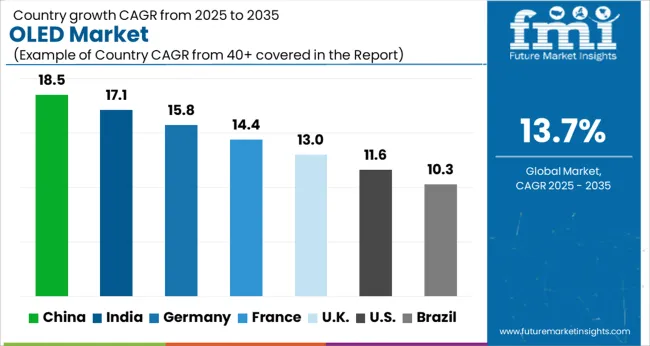

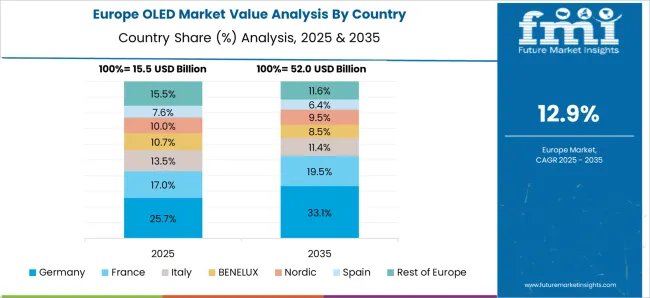

The OLED market is projected to expand globally at a CAGR of 13.7% from 2025 to 2035, driven by increasing demand for high-quality, energy-efficient display technologies in smartphones, televisions, and the automotive sector. China leads with a CAGR of 18.5%, supported by its dominant position in display manufacturing, strong consumer demand for OLED smartphones and televisions, and government investments in display technologies. India follows with 17.1%, driven by expanding smartphone penetration, the rising adoption of OLED in consumer electronics, and government initiatives boosting local manufacturing. France records 14.4%, supported by the growing adoption of OLED in television displays and wearable devices, while the UK grows at 13.0%, fueled by strong consumer demand for OLED TVs and smartphones. The USA shows 11.6%, with steady demand from the automotive and consumer electronics markets. This performance profile highlights China and India as the primary growth drivers, with Europe and North America continuing to be key markets for high-performance OLED applications in premium consumer electronics and automotive industries.

China is projected to achieve a CAGR of 18.5% for the OLED market from 2025 to 2035, surpassing the global CAGR of 13.7%. The earlier growth phase between 2020 and 2024 saw a CAGR of 16.2%, supported by the country’s leadership in OLED panel production and the increasing adoption of OLED technology in smartphones and televisions. The faster growth moving into 2025–2035 is driven by expanding consumer demand for high-resolution displays, improvements in OLED production efficiency, and continued government support for display technology innovation. The development of flexible and foldable OLED screens also supports further market growth, particularly in smartphones and wearables. China’s strength in manufacturing and its vast consumer market make it a key player in the OLED industry.

India is forecasted to grow at a CAGR of 17.1% for the OLED market from 2025 to 2035, higher than the global average of 13.7%. The CAGR for 2020–2024 is estimated to be around 14.6%, driven by the rising adoption of OLED displays in smartphones and the growth of the television market. The increase in demand is influenced by a growing middle class, greater disposable incomes, and an increasing preference for high-quality display devices. As India continues to push for digitalization and smart home adoption, the demand for OLED technology is expected to expand, especially in consumer electronics. The growth in local manufacturing capabilities and partnerships with global suppliers will help India maintain competitive pricing and enhance market penetration.

The OLED market in France is projected to grow at a CAGR of 14.4% from 2025 to 2035, higher than the global CAGR of 13.7%. From 2020 to 2024, the market grew at a CAGR of 12.5%, driven by consumer demand for high-quality television screens and growing adoption in automotive applications. The growth acceleration in the 2025–2035 period will be fueled by technological advancements in OLED production, leading to improved cost-efficiency and broader adoption across various sectors. OLED displays are increasingly being integrated into automotive dashboard and infotainment systems, contributing to the demand. As the demand for energy-efficient displays grows across multiple industries, France is expected to see steady growth in OLED adoption.

The UK OLED market is forecast to experience a CAGR of 13.0% from 2025 to 2035, compared to 9.5% between 2020 and 2024. The earlier phase saw modest growth driven by steady demand from the consumer electronics market, especially OLED TVs and smartphones. The increase in growth between 2025 and 2035 can be attributed to the ongoing demand for high-quality displays in automotive systems, particularly in luxury vehicles, and increasing adoption in home entertainment systems. The UK has seen a rise in consumer preference for OLED over traditional LCD due to superior image quality. Enhanced affordability and the expansion of flexible OLED technologies will continue to drive market growth.

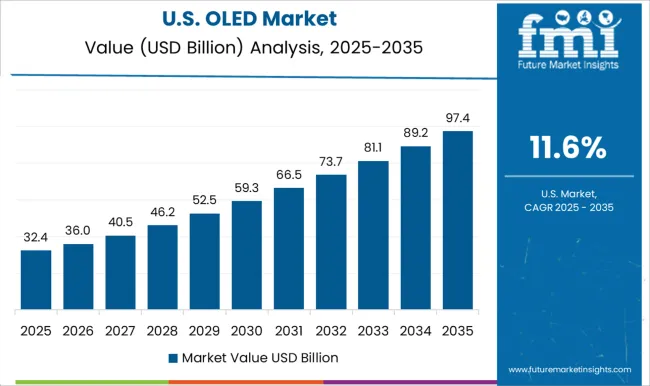

The USA OLED market is projected to grow at a CAGR of 11.6% from 2025 to 2035, slightly below the global average of 13.7%. Between 2020 and 2024, the USA market grew at a CAGR of 9.9%, with growth driven by the continued dominance of OLED technology in premium smartphones, televisions, and wearables. Moving into 2025, the market is expected to expand further with the increasing adoption of OLED technology in automotive applications, such as in-dash displays and head-up displays. As OLED displays become more affordable and accessible, their adoption in consumer electronics, particularly in mid-range smartphones and smart TVs, is expected to drive further market penetration.

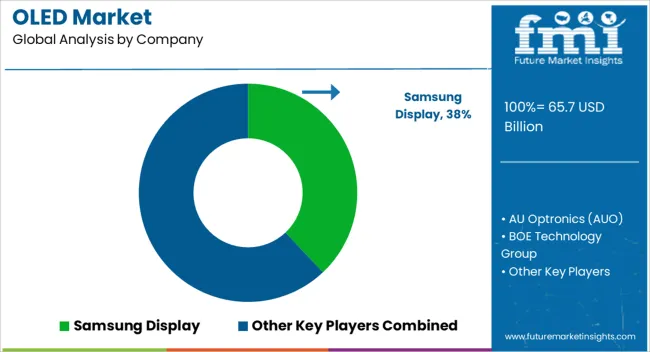

The OLED market is shaped by a combination of leading global display manufacturers and specialized display technology providers. Samsung Display maintains a dominant position in the market, leveraging its advanced OLED production capabilities and strong market presence in smartphones, televisions, and wearable devices. AU Optronics (AUO) focuses on large-screen OLED displays for televisions and is expanding its footprint in the automotive and digital signage sectors. BOE Technology Group, as a key player in the Chinese market, continues to invest heavily in OLED technology for smartphones, televisions, and smart devices, reinforcing its global competitiveness. CSOT (China Star Optoelectronics Technology) focuses on high-resolution OLED panels for smartphones and has been expanding into automotive displays, driving its market share growth. Japan Display Inc. (JDI) is working to capitalize on OLED technology in mobile and automotive sectors, especially after its restructuring efforts, positioning itself as a key player in the competitive landscape.

The OLED market is shaped by a combination of leading global display manufacturers and specialized display technology providers. Samsung Display maintains a dominant position in the market, leveraging its advanced OLED production capabilities and strong market presence in smartphones, televisions, and wearable devices. AU Optronics (AUO) focuses on large-screen OLED displays for televisions and is expanding its footprint in the automotive and digital signage sectors. BOE Technology Group, as a key player in the Chinese market, continues to invest heavily in OLED technology for smartphones, televisions, and smart devices, reinforcing its global competitiveness. CSOT (China Star Optoelectronics Technology) focuses on high-resolution OLED panels for smartphones and has been expanding into automotive displays, driving its market share growth. Japan Display Inc. (JDI) is working to capitalize on OLED technology in mobile and automotive sectors, especially after its restructuring efforts, positioning itself as a key player in the competitive landscape.

LG Display holds a significant share in OLED TV panel production, serving a growing demand for premium, high-quality television displays, particularly in the consumer electronics sector. Visionox continues to grow in the Chinese market, focusing on flexible OLED technology for smartphones and other portable devices, expanding its presence in global markets. These players shape the competitive dynamics of the OLED market by focusing on high-quality production, technological advancements in flexible and foldable displays, and strategic partnerships with device manufacturers. They prioritize expanding their production capacity and enhancing display performance to meet the rising demand for OLED technology in consumer electronics, automotive applications, and digital signage.

| Item | Value |

|---|---|

| Quantitative Units | USD 65.7 Billion |

| Product Type | Displays and Lighting |

| Technology | AMOLED (Active-Matrix Organic Light-Emitting Diode), PMOLED (Passive-Matrix Organic Light-Emitting Diode), FOLED (Flexible Organic Light-Emitting Diode), Transparent OLED, and Phosphorescent OLED (PHOLED) |

| End Use Industry | Consumer electronics, Automotive, Healthcare, Industrial, Aerospace and defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung Display, AU Optronics (AUO), BOE Technology Group, CSOT (China Star Optoelectronics Technology), Japan Display Inc. (JDI), LG Display, and Visionox |

| Additional Attributes | Dollar sales trends across regions, market share by application (smartphones, TVs, automotive, etc.), and growth projections for each segment. |

The global OLED market is estimated to be valued at USD 65.7 billion in 2025.

The market size for the OLED market is projected to reach USD 237.1 billion by 2035.

The OLED market is expected to grow at a 13.7% CAGR between 2025 and 2035.

The key product types in OLED market are displays, smartphones, tablets, televisions, monitors, wearables (smartwatches, fitness trackers), automotive displays (dashboard, infotainment systems), virtual reality (vr) / augmented reality (ar) devices, lighting, commercial lighting, automotive lighting (interior, exterior), architectural lighting, residential lighting, industrial lighting and aviation and marine lighting.

In terms of technology, amOLED (active-matrix organic light-emitting diode) segment to command 67.3% share in the OLED market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

OLED Display Market Size and Share Forecast Outlook 2025 to 2035

OLED-on-Silicon (OLEDoS) Market Size and Share Forecast Outlook 2025 to 2035

OLED Lightening Panels Market

MicroLED Photoluminescence Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Uncooled Thermal Imaging Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air-Cooled Cube Ice Machines Market – Efficient Cooling & Industry Trends 2025-2035

Self Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Cube Ice Machines Market - Growth Forecast & Industry Demand 2025 to 2035

LED and OLED lighting Products and Display Market – Growth & Forecast 2034

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

V Type Air Cooled Condenser Market Size and Share Forecast Outlook 2025 to 2035

Gas Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Africa LED & OLED Market Report – Growth & Forecast 2016-2026

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA