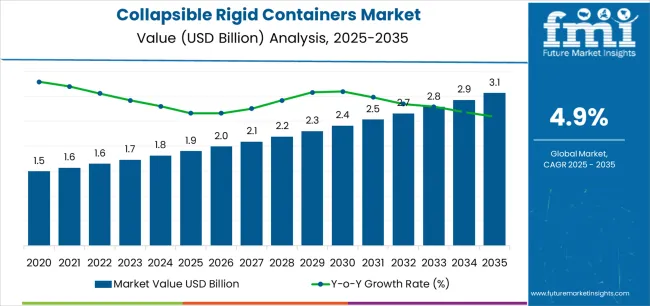

The global collapsible rigid containers market is valued at USD 1.9 billion in 2025 and is set to reach USD 3.0 billion by 2035, growing at a CAGR of 4.9%. The market stands at the forefront of a transformative decade that promises to redefine returnable packaging infrastructure and supply chain optimization excellence across automotive logistics, pharmaceutical distribution, chemical transport, and food supply sectors. The market's journey from USD 1.9 billion in 2025 to USD 3.0 billion by 2035 represents substantial growth, demonstrating the accelerating adoption of reusable bulk containers and sophisticated collapsible storage systems across closed-loop supply chains, warehouse optimization, transportation efficiency, and reverse logistics applications.

The first half of the decade (2025-2030) will witness the market climbing from USD 1.9 billion to approximately USD 2.6 billion, adding USD 0.7 billion in value, which constitutes 64% of the total forecast growth period. This phase will be characterized by the rapid adoption of advanced folding mechanisms, driven by increasing demand for storage space optimization and enhanced return logistics efficiency requirements worldwide. Superior durability capabilities and hygienic design features will become standard expectations rather than premium options.

The latter half (2030-2035) will witness growth from USD 2.6 billion to USD 3.0 billion, representing an addition of USD 0.4 billion or 36% of the decade's expansion. This period will be defined by mass market penetration of IoT-enabled tracking systems, integration with comprehensive supply chain visibility platforms, and seamless compatibility with existing material handling infrastructure. The market trajectory signals fundamental shifts in how manufacturers and logistics providers approach returnable packaging solutions, with participants positioned to benefit from demand across multiple industrial segments.

The collapsible rigid containers market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its circular economy adoption phase, expanding from USD 1.9 billion to USD 2.6 billion with steady annual increments averaging 6.5% growth. This period showcases the transition from single-use corrugated packaging to durable returnable containers with enhanced space efficiency and integrated tracking features becoming mainstream requirements.

The 2025-2030 phase adds USD 0.7 billion to market value, representing 64% of total decade expansion. Market maturation factors include standardization of folding dimensions, declining costs for high-impact polymer production, and increasing supply chain manager awareness of container pooling benefits reaching 71-76% effectiveness in automotive parts distribution applications. Competitive landscape evolution during this period features established pooling operators like Brambles and Schoeller Allibert expanding their container portfolios while new entrants focus on specialized pharmaceutical-grade solutions and enhanced hygiene technology.

From 2030 to 2035, market dynamics shift toward advanced digitalization and multi-industry deployment, with growth moderating from USD 2.6 billion to USD 3.0 billion, adding USD 0.4 billion or 36% of total expansion. This phase transition logic centers on smart container ecosystems, integration with blockchain traceability platforms, and deployment across diverse supply chain scenarios, becoming standard rather than specialized packaging formats. The competitive environment matures with focus shifting from basic collapsibility to comprehensive lifecycle management and compatibility with automated warehouse systems.

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.9 billion |

| Market Forecast (2035) | USD 3.0 billion |

| Growth Rate | 4.90% CAGR |

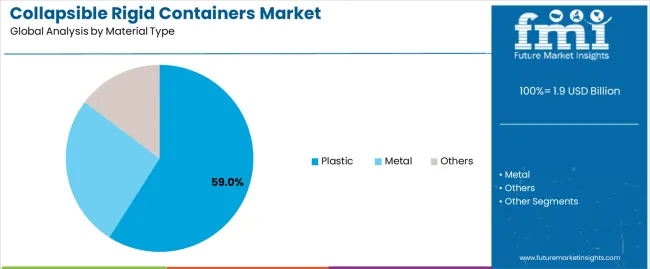

| Leading Material Type | Plastic |

| Primary Product Type | Crates |

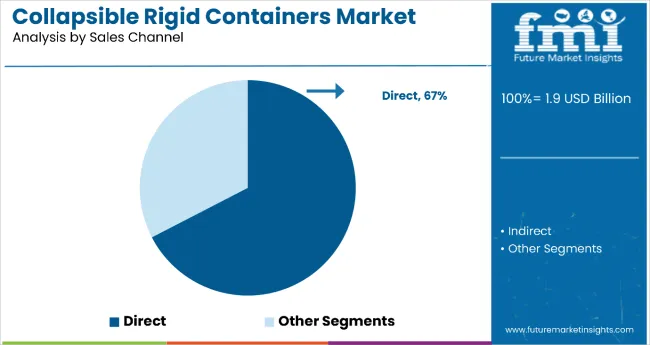

| Leading Sales Channel | Direct |

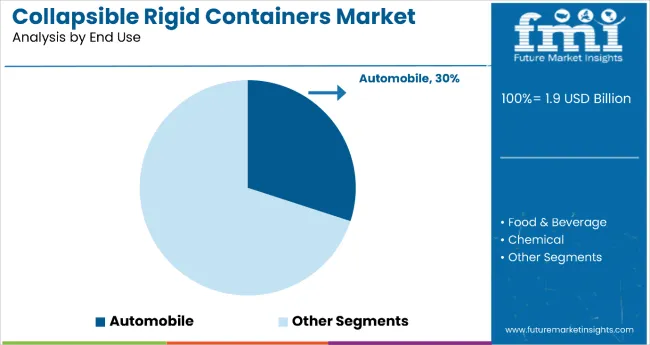

| Primary End-Use | Automobile |

The market demonstrates strong fundamentals with plastic containers capturing a dominant share through superior durability and lightweight handling capabilities. Crate configurations drive primary demand, supported by increasing just-in-time manufacturing requirements and component protection solutions. Geographic expansion remains concentrated in Asia Pacific markets with rapidly expanding automotive production, while developed regions show steady adoption rates driven by circular economy mandates and rising reverse logistics activity.

Market expansion rests on three fundamental shifts driving adoption across manufacturing and logistics sectors. Circular economy mandates create compelling advantages through returnable container systems that provide comprehensive waste reduction with enhanced cost efficiency, enabling manufacturers to optimize packaging expenditure and meet regulatory requirements while justifying pooling infrastructure investments over disposable corrugated alternatives. Automotive production optimization accelerates worldwide as just-in-time manufacturing drives precision logistics that delivers component protection across complex supply networks, enabling damage prevention that aligns with quality expectations and maximizes assembly line efficiency. E-commerce growth drives adoption from retailers requiring efficient distribution solutions that maximize warehouse space utilization while maintaining product protection during omnichannel fulfillment and reverse logistics operations.

The growth faces headwinds from initial investment barriers that differ across pooling model adoption regarding capital requirements and network establishment, potentially limiting market penetration in small-scale operations with limited financial resources. Container return rate challenges also persist regarding loss prevention and tracking accuracy that may increase operational costs in open-loop systems with multiple trading partners.

The collapsible rigid containers market represents a compelling intersection of circular economy principles, logistics optimization, and supply chain efficiency. With robust growth projected from USD 1.9 billion in 2025 to USD 3.0 billion by 2035 at a 4.90% CAGR, this market is driven by increasing automotive production trends, pharmaceutical cold chain requirements, and commercial demand for returnable packaging formats.

The market's expansion reflects a fundamental shift in how manufacturers and logistics providers approach packaging infrastructure. Strong growth opportunities exist across diverse applications, from automotive tier suppliers requiring parts protection to pharmaceutical distributors demanding temperature-controlled transport. Geographic expansion is particularly pronounced in Asia-Pacific markets, led by China (6.615% CAGR) and India (6.125% CAGR), while established markets in North America and Europe drive innovation and specialized container development.

The dominance of plastic materials and automobile applications underscores the importance of proven durability and supply chain integration in driving adoption. Return rate optimization and asset tracking remain key challenges, creating opportunities for companies that can deliver reliable performance while maintaining pooling efficiency.

Primary Classification: The market segments by material type into plastic, metal, and others categories, representing the evolution from wooden crates to advanced polymer-based systems for comprehensive returnable packaging operations.

Secondary Breakdown: Product type segmentation divides the market into crates, foldable IBCs, pallet boxes, and jerry cans sectors, reflecting distinct requirements for capacity, handling methods, and application specificity.

Tertiary Classification: Sales channel analysis covers direct and indirect distribution methods, demonstrating procurement pattern variations across different customer segments and relationship structures.

Quaternary Breakdown: End-use segmentation encompasses automobile, pharmaceutical, chemical, agriculture, food & beverage, shipping & logistics, and other manufacturing sectors, highlighting industry-specific container requirements.

Regional Classification: Geographic distribution covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with Asia Pacific markets leading adoption while developed economies show steady growth patterns driven by logistics infrastructure modernization programs.

The segmentation structure reveals technology progression from basic collapsible designs toward engineered load-bearing structures with enhanced space efficiency and integrated identification capabilities, while application diversity spans from automotive component transport to pharmaceutical temperature-controlled logistics requiring comprehensive validation solutions and regulatory compliance systems.

Plastic segment is estimated to account for 59% of the collapsible rigid containers market share in 2025. The segment's leading position stems from its fundamental role as a critical component in lightweight packaging applications and its extensive use across multiple automotive, food, and industrial sectors. Plastic's dominance is attributed to its superior weight-to-strength ratio, including excellent impact resistance, chemical inertness, and design flexibility that make it indispensable for high-rotation pooling and multi-trip logistics operations.

Market Position: Plastic container systems command the leading position in the collapsible rigid containers market through advanced polymer processing technologies, including comprehensive injection molding capabilities, structural ribbing optimization, and reliable hinge mechanisms that enable logistics providers to deploy containers across diverse transportation applications.

Value Drivers: The segment benefits from material cost-effectiveness that provides attractive total cost of ownership without compromising durability performance. Excellent corrosion resistance enables deployment in food-grade applications, chemical transport, and outdoor storage scenarios where moisture exposure and chemical contact represent critical environmental requirements.

Competitive Advantages: Plastic systems differentiate through outstanding design versatility, proven hygiene characteristics, and compatibility with automated handling equipment that enhance operational efficiency while maintaining economical lifecycle profiles suitable for diverse pooling applications.

Key market characteristics:

Crates segment is projected to hold 42.8% of the collapsible rigid containers market share in 2025. The segment's strong market position is driven by the versatile application suitability and widespread adoption across automotive parts handling, where crates serve as both protective packaging and material handling units. The manufacturing industry's preference for standardized container formats supports the segment's prominent position.

Market Context: Crate applications represent the foundation of the market due to optimal balance between load capacity, handling convenience, and space efficiency that extends operational versatility while maintaining cost-effective pricing structures.

Appeal Factors: Supply chain managers prioritize stackability when loaded, nestability when empty, and compatibility with standard pallet dimensions that enable efficient transportation and warehouse storage workflows. The segment benefits from established automotive industry standards and logistics infrastructure designed around crate-based systems.

Growth Drivers: Automotive tier supplier networks incorporate collapsible crates as standard packaging for component shipments. At the same time, e-commerce fulfillment centers are increasing adoption of crate systems that optimize storage density and enable rapid order picking operations.

Market Challenges: Specialized container requirements and unique dimensional needs may drive certain applications toward custom pallet boxes or bulk container alternatives.

Product type dynamics include:

Direct sales channel is projected to hold approximately 58% of the collapsible rigid containers market share in 2025. The segment's market leadership is driven by the pooling service model prevalence and long-term rental arrangements, where container providers serve as both equipment suppliers and logistics partners. The industry's preference for asset-light operations supports the segment's dominant position.

Market Context: Direct sales applications dominate the market due to widespread adoption of container pooling services and optimal balance between capital efficiency, fleet management expertise, and quality assurance that extends operational value while maintaining predictable cost structures.

Appeal Factors: Manufacturing organizations prioritize turnkey solutions, comprehensive asset tracking, and service level guarantees that enable coordinated deployment without internal fleet management burdens. The segment benefits from substantial logistics outsourcing trends and industry preferences that emphasize core competency focus over packaging asset ownership.

Growth Drivers: Pooling service expansion incorporates technology-enabled tracking and automated billing systems. At the same time, circular economy pressures are increasing demand for managed returnable packaging programs that ensure consistent container quality and reliable availability.

Market Challenges: Large-volume users with established logistics networks may prefer direct ownership to maintain control and reduce long-term costs.

Sales channel dynamics include:

Automobile segment is projected to hold 34% of the collapsible rigid containers market share in 2025. The segment's market leadership is driven by the extensive use of collapsible containers in parts distribution, just-in-time delivery, aftermarket logistics, and component protection, where containers serve as both damage prevention systems and supply chain efficiency enablers. The automotive industry's consistent investment in logistics optimization supports the segment's dominant position.

Market Context: Automobile manufacturing applications dominate the market due to widespread adoption of sequenced part delivery and increasing focus on lean manufacturing, inventory reduction, and packaging standardization that extend production value while maintaining quality protection standards.

Appeal Factors: Automotive OEMs and tier suppliers prioritize container durability, dimensional consistency, and integration with automated guided vehicle (AGV) systems that enable coordinated deployment across global supply networks. The segment benefits from substantial electric vehicle production growth and industry standards that emphasize returnable packaging for environmental compliance.

Growth Drivers: Global automotive production expansion incorporates collapsible containers as essential infrastructure for parts logistics. At the same time, electric vehicle manufacturing is increasing demand for specialized containers that comply with battery component protection requirements and enhance supply chain visibility.

Market Challenges: Production volume fluctuations and regional manufacturing shifts may impact container utilization rates and pooling network optimization.

Application dynamics include:

Growth Accelerators: Logistics cost optimization drives primary adoption as collapsible containers provide exceptional space efficiency that enables transportation cost reduction through maximized return load density, supporting operational profitability and competitive positioning that require efficient backhaul utilization. Environmental legislation accelerates market growth as extended producer responsibility mandates packaging waste minimization that maintains circular material flows during distribution while enhancing corporate objectives through documented recycling rates and material reuse metrics. Supply chain digitalization increases worldwide, creating demand for track-and-trace enabled containers that complement visibility platforms and provide competitive advantages in inventory accuracy.

Growth Inhibitors: Asset investment requirements differ across pooling model implementation regarding initial capital and network infrastructure, which may limit market adoption and accessibility in emerging markets with underdeveloped reverse logistics capabilities. Container standardization challenges persist regarding dimensional compatibility and industry-specific requirements that may increase complexity in multi-sector pooling operations with diverse customer specifications. Market competition from corrugated packaging and intermediate bulk containers creates substitution concerns between different packaging formats and existing supply chain preferences.

Market Evolution Patterns: Adoption accelerates in automotive and pharmaceutical sectors where container protection justifies pooling investments, with geographic concentration in Asia Pacific transitioning toward network expansion in manufacturing regions driven by automotive production growth and pharmaceutical distribution modernization. Technology development focuses on enhanced RFID integration, improved folding mechanism durability, and compatibility with automated storage and retrieval systems that optimize asset tracking and handling efficiency. The market could face disruption if alternative packaging innovations or single-use material improvements significantly challenge returnable container advantages in total cost of ownership comparisons.

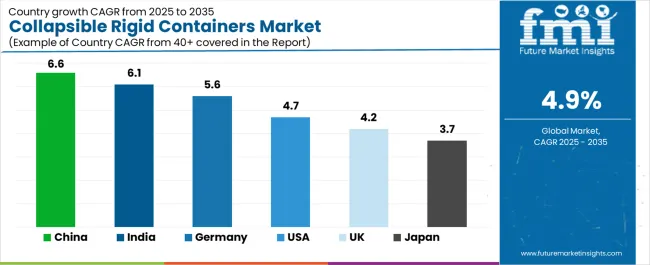

The collapsible rigid containers market shows varied regional dynamics. Growth Leaders include China (6.6% CAGR) and India (6.1% CAGR), supported by booming logistics, e-commerce, and industrial packaging sectors, where collapsible rigid containers are increasingly adopted for cost-efficient storage and return logistics. Steady Performers encompass Germany (5.6% CAGR) and the USA (4.7% CAGR), benefiting from established packaging industries, eco-friendly initiatives, and automation in warehouse management systems. Emerging Markets include the UK (4.8% CAGR) and Japan (3.9% CAGR), where adoption is driven by niche applications in retail distribution, automotive supply chains, and space-efficient storage solutions.

| Country | CAGR (2025–2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| USA | 4.7% |

| UK | 4.2% |

| Japan | 3.7% |

Asia-Pacific leads global growth, anchored by China and India, where expanding logistics networks, e-commerce growth, and manufacturing supply chains drive robust adoption of collapsible rigid containers. Europe maintains stable momentum, with Germany pushing growth through its advanced automotive and industrial packaging industries, while the UK sees consistent but modest uptake. North America shows measured growth led by the USA, where eco-friendly practices, warehouse automation, and returnable packaging programs fuel demand across retail and industrial sectors.

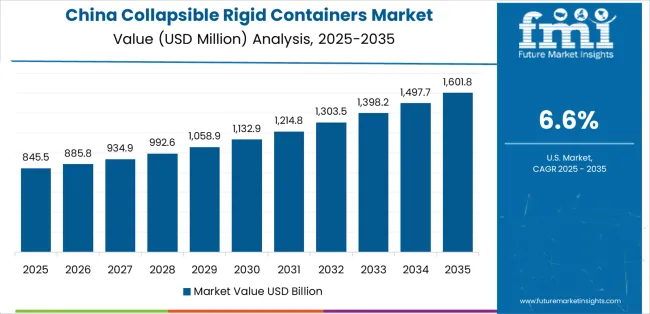

In Shanghai, Shenzhen/Guangzhou, and Tianjin, 3PLs, e-commerce fulfillment networks, and automotive suppliers are standardizing on collapsible rigid containers to cut cube, lower reverse-logistics costs, and meet environmental goals. The market is projected to grow at 6.6% CAGR through 2035, propelled by nationwide warehouse expansion, automation in mega-fulfillment centers, and OEM-led returnable packaging programs across automotive and electronics value chains. Local producers offer competitive, durable designs with quick lead times, while integrators bundle containers with RFID/IoT tracking and pooling services to boost fleet utilization.

Market Intelligence Brief:

In New Delhi, Mumbai, and Bangalore, industrial distributors, logistics providers, and e-commerce operators are adopting collapsible rigid containers to improve warehouse efficiency and return logistics. The market is set for 6.1% CAGR through 2035, supported by fast-growing e-commerce, retail and FMCG supply chains, and government-backed logistics infrastructure development. Adoption concentrates in automotive, retail distribution, and FMCG where space savings and reusability deliver measurable cost reductions.

Market Intelligence Brief:

Across Bavaria, Baden-Württemberg, and North Rhine-Westphalia, automotive, industrial machinery, and grocery distribution networks deploy collapsible rigid containers as part of closed-loop, pooled RTP programs. With 5.6% CAGR, growth is driven by automation, enviromental regulations, and precision handling needs in Tier-1/Tier-2 supplier parks. German buyers favor heavy-duty, RFID-ready designs compatible with AS/RS and AGV systems.

Market Intelligence Brief:

In the Midwest, Texas, and California corridors, big-box retail, food & beverage distributors, and industrials adopt collapsible rigid containers to streamline high-velocity DCs and reduce freight backhauls. The market grows at 4.7% CAGR, supported by warehouse automation, ESG commitments, and retailer mandates for standardized returnable packaging. Integrations with WMS and vision-guided equipment enable faster turns and lower damage rates.

Market Intelligence Brief:

In the Midlands and South East, grocery chains, automotive, and omni-channel retailers use collapsible rigid containers to save space in constrained DC footprints and trim reverse-logistics costs. With 4.8% CAGR, uptake is steady, shaped by environmental goals and network redesigns post-Brexit that favor standardized reusable systems and regional pooling.

Market Intelligence Brief:

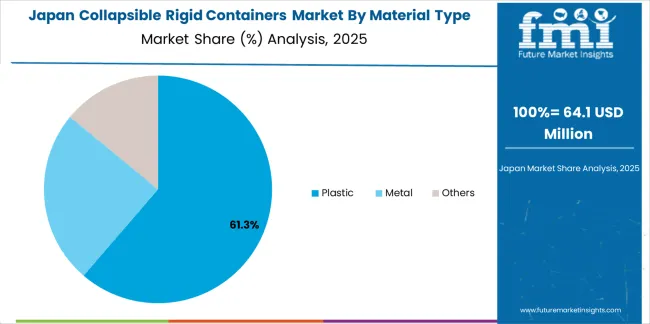

In Tokyo, Osaka, and Nagoya, automotive keiretsu, electronics, and convenience-store logistics adopt collapsible rigid containers to support just-in-time flows and backroom space constraints. The market advances at 3.9% CAGR, with buyers prioritizing precision, durability, and quiet operation in dense, automated facilities. Lifecycle services—cleaning, inspection, and refurbishment are important differentiators.

Market Intelligence Brief:

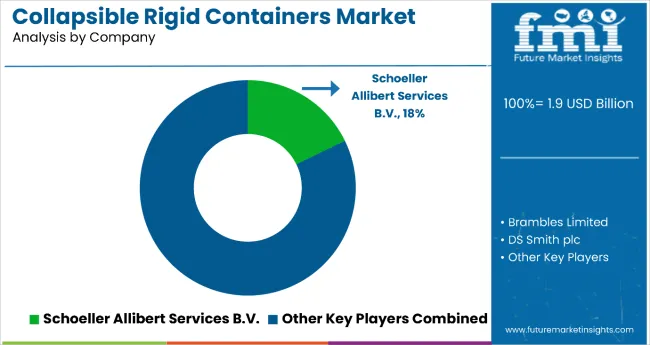

The collapsible rigid containers market operates with moderate concentration, featuring approximately 50-70 participants, where leading companies control roughly 47-55% of the global market share through established pooling networks and comprehensive service capabilities. Competition emphasizes fleet management expertise, geographic coverage, and customer service rather than price-based rivalry.

Market leaders encompass Brambles Limited, Supreme Industries Limited, and Schoeller Allibert Services B.V., which maintain competitive advantages through extensive pooling infrastructure, global service networks, and comprehensive asset tracking capabilities that create customer loyalty and support supply chain requirements. These companies leverage decades of returnable packaging experience and ongoing technology investments to develop advanced collapsible container systems with exceptional durability and tracking features.

Specialty challengers include DS Smith plc, SSI Schäfer AG, and Georg Utz Holding AG, which compete through specialized application focus and efficient regional operations that appeal to manufacturers seeking customized packaging solutions and flexible pooling arrangements. These companies differentiate through technical expertise emphasis and specialized industry application focus.

Market dynamics favor participants that combine reliable container quality with advanced pooling services, including asset tracking, maintenance programs, and logistics optimization support. Competitive pressure intensifies as packaging companies expand into pooling services. At the same time, logistics providers challenge established players through integrated supply chain solutions and multi-product container offerings targeting comprehensive packaging outsourcing opportunities.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 billion |

| Material Type | Plastic, Metal, Others |

| Product Type | Crates, Foldable IBCs, Pallet Boxes, Jerry Cans |

| Sales Channel | Direct, Indirect |

| End-Use | Automobile, Pharmaceutical, Chemical, Agriculture, Food & Beverage, Shipping & Logistics, Other Manufacturing |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, Germany, USA, Japan, UK, India, and 33+ additional countries |

| Key Companies Profiled | Brambles Limited, Supreme Industries Limited, Schoeller Allibert Services B.V., DS Smith plc, SSI Schäfer AG |

| Additional Attributes | Dollar sales by material type and end-use categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with pooling service providers and container manufacturers, customer preferences for durability and space efficiency, integration with supply chain management systems and reverse logistics networks, innovations in RFID tracking technology and material engineering, and development of specialized container solutions with enhanced collapsibility capabilities and automated handling features |

The global collapsible rigid containers market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the collapsible rigid containers market is projected to reach USD 3.1 billion by 2035.

The collapsible rigid containers market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in collapsible rigid containers market are plastic , metal and others.

In terms of product type, crates segment to command 42.8% share in the collapsible rigid containers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Landscape of Collapsible Rigid Containers Providers

Collapsible Metal Tubes Market Size and Share Forecast Outlook 2025 to 2035

Collapsible Gates Market Size and Share Forecast Outlook 2025 to 2035

Collapsible Water Bottle Market Size and Share Forecast Outlook 2025 to 2035

Collapsible Fuel Tank Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Collapsible Wardrobe Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Collapsible Water Bottle Companies

Collapsible Jerry Can Market Growth - Size & Forecast 2024 to 2034

Collapsible Aluminium Tube Market

Collapsible Sleeve Containers Market Growth-Forecast 2025 to 2035

Collapsible Food Packaging Containers Market

Foldable And Collapsible Pallets Market Size and Share Forecast Outlook 2025 to 2035

Rigid Sleeve Boxes Market Size and Share Forecast Outlook 2025 to 2035

Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Rigid-Flex PCB Market Size and Share Forecast Outlook 2025 to 2035

Rigid Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Rigid Food Packaging Market Size, Share & Forecast 2025 to 2035

Rigid Industrial Packaging Market Size, Share & Forecast 2025 to 2035

Competitive Overview of Rigid IBC Market Share

Rigid Tray Market from 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA