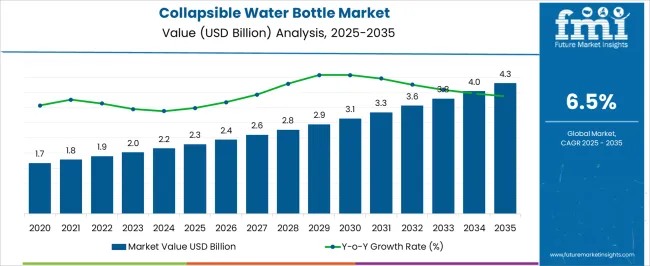

The Collapsible Water Bottle Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Collapsible Water Bottle Market Estimated Value in (2025 E) | USD 2.3 billion |

| Collapsible Water Bottle Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The collapsible water bottle market is gaining momentum as urban consumers, travelers, and fitness enthusiasts increasingly seek hydration solutions that align with convenience and environmental consciousness. The market is being driven by shifting preferences toward space-saving, lightweight drinkware that minimizes plastic waste and supports a mobile lifestyle. Brands are prioritizing materials that balance durability with compressibility, enabling bottles to collapse into compact forms without compromising on functionality.

The rise of outdoor recreation, wellness routines, and on-the-go consumption habits has further elevated demand for portable hydration formats. In parallel, growing regulatory and consumer pressure to eliminate single-use plastics is prompting companies to innovate around reusable, foldable designs with BPA-free certification and extended lifecycle value.

As the market evolves, product development is increasingly centered on customization, leak-proof engineering, and ease of cleaning. These factors are paving the way for continued growth, with collapsible water bottles expected to penetrate new retail categories and geographic regions.

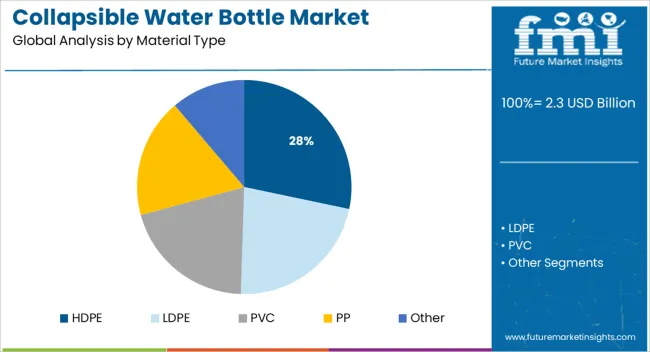

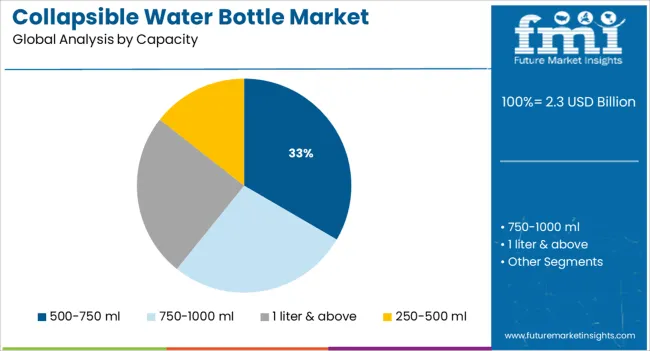

The market is segmented by Material Type and Capacity and region. By Material Type, the market is divided into HDPE, LDPE, PVC, PP, and Other. In terms of Capacity, the market is classified into 500-750 ml, 750-1000 ml, 1 liter & above, and 250-500 ml. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The HDPE material segment is expected to account for 28.3% of total market revenue in 2025, positioning it as the leading material type. This is attributed to HDPE’s high strength-to-weight ratio, flexibility, and food-grade safety certification which make it ideal for collapsible applications.

Its ability to withstand repeated folding and compressing without structural degradation has positioned it as a preferred choice for reusable bottles. Manufacturers have favored HDPE for its affordability and ease of molding, allowing for mass production of customizable and ergonomic designs.

Additionally, HDPE is recyclable and complies with sustainability mandates, aligning well with eco-conscious consumer behavior. Its resistance to impact, chemicals, and UV exposure further extends product lifespan, contributing to its strong presence in both outdoor and general lifestyle product lines.

The 500 to 750 ml capacity range is projected to hold a dominant 33.4% share of the market in 2025, reflecting strong consumer preference for mid-range hydration formats. This volume is considered ideal for daily use, offering a practical balance between portability and sufficient water capacity without adding weight or bulk.

It has gained favor among commuters, students, athletes, and travelers who prioritize convenience and packability in personal hydration gear. The segment’s strength is also supported by its compatibility with standard cup holders, backpack pockets, and gym pouches.

Brands have focused on this capacity range to maximize market appeal and minimize production complexity while offering variety in colors, caps, and designs. As reusable bottles continue to replace disposable alternatives, this segment is expected to maintain its leadership through alignment with lifestyle functionality and user ergonomics.

Bottled water manufacturers are introducing new packaging solutions with medical benefits and convenience, resulting in a few product releases in the collapsible water bottled water market.

It is predicted that demand for collapsible water bottles will rise significantly among athletes and office workers because they are lighter and more convenient than their industry rivals. Collapsible water bottles, on the other hand, have yet to gain much-needed popularity because they are not as durable as stainless or plastic water bottles.

Substantial improvements in the lifestyle and convenience of emerging economies have triggered the collapsible water bottle market's growth potential. Furthermore, the increase in per capita disposable income of emerging countries around the world has been defined as one of the key drivers of the dynamic growth of the collapsible water bottle market.

Some collapsible water bottles' flexibility makes them unsuitable for washing and drinking. Collapsible water bottles are still in the early stages of development, so they are more expensive than stainless water bottles.

The government's strict regulations regarding the hazardous effects of plastic use are impeding the growth of the collapsible water bottle market. These components are expected to aid in the development of the collapsible water bottled water market in the short run.

North America is a significant market due to its vast population, high household income, and the presence of numerous collapsible water bottle brands. North America is the second-largest region, accounting for nearly 16% share of the collapsible water bottle market in 2025.

Due to the obvious massive and ever-increasing demands from the millennial population seeking more sustainable alternatives, the North American region could be the largest collapsible water bottle market.

North America is expected to grow at a steady CAGR during the forecast period due to an increase in the number of people participating in various outdoor activities, which drives product demand as a sustainable alternative to single-use plastic bottles.

This trend can be attributed to consumers' elevated levels of awareness about the negative effects of using packed mineral water bottles for outdoor activities. According to the Outdoor Foundation's Outdoor Participation Report, approximately 150 million Americans participate in outdoor activities annually, with a participation rate of 48 percent.

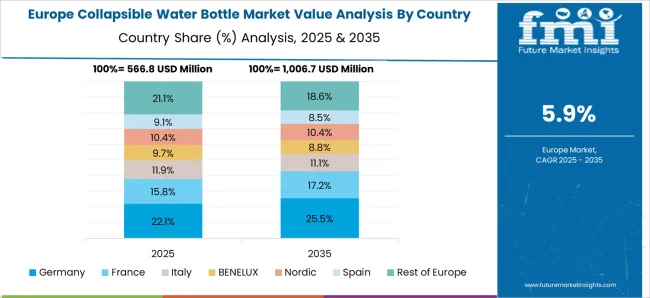

In 2025, Europe is set to acquire nearly 22% of the global collapsible water bottle market share, and is projected to maintain the governing growth throughout the forecast period, states Future Market Insights.

Germany had the highest revenue share in 2024 and is assumed to remain at the top throughout the forecast period. Substantial improvements in the luxury and accessibility of advanced markets have prompted the collapsible water bottle market's growth potential in Europe.

The collapsible water bottle market in Europe is expected to grow faster than average, with Germany, France, Italy, and the United Kingdom leading the way in terms of demand for collapsible water bottles. Collapsible water bottles are becoming increasingly prevalent in the region's workplaces, colleges, schools, and homes.

Because of the convenience it generates, e-commerce is instantly becoming the most popular distribution channel. Customers purchase these bottles through online portals since Europe has a diverse product offering. The market is exploring new aspects of product development with a fine blend of technological innovation and customization.

The increasing number of start-ups in the collapsible water bottle market has improved product quality and pushed global sales. Besides, to gain a competitive edge, new start-ups are working on novel developments and launching new products such as:

Some key players in the collapsible water bottle market are Vapur, Inc., Hydrapak LLC, inov-8, Salomon SAS, Ultimate Direction, Inc., Lingxu International Trade Co., Ltd., Qimei Packaging Co., Ltd., T&T Plastic Hardware (Zhuhai) Co., Ltd., 4MO Plastic Co., Ltd. (Zhuhai), Reshine Imp. & Exp. Co., Ltd., etc. Key developments in the collapsible water bottle market are as follows:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.5% from 2025 to 2035 |

| Market Value in 2025 | USD 2.3 billion |

| Market Value in 2035 | USD 4.3 billion |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material Type, Capacity, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Vapur Inc.; Hydrapak LLC; inov-8; Salomon SAS; Ultimate Direction Inc.; Lingxu International Trade Co. Ltd.; Qimei Packaging Co., Ltd.; T&T Plastic Hardware (Zhuhai) Co., Ltd.; 4MO Plastic Co. Ltd. (Zhuhai); Reshine Imp. & Exp. Co. Ltd. etc. |

| Customization | Available Upon Request |

The global collapsible water bottle market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the collapsible water bottle market is projected to reach USD 4.3 billion by 2035.

The collapsible water bottle market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in collapsible water bottle market are hdpe, ldpe, pvc, pp and other.

In terms of capacity, 500-750 ml segment to command 33.4% share in the collapsible water bottle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share Analysis for Collapsible Water Bottle Companies

Collapsible Rigid Containers Market Size and Share Forecast Outlook 2025 to 2035

Collapsible Metal Tubes Market Size and Share Forecast Outlook 2025 to 2035

Collapsible Gates Market Size and Share Forecast Outlook 2025 to 2035

Collapsible Fuel Tank Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Collapsible Wardrobe Market Size and Share Forecast Outlook 2025 to 2035

Collapsible Sleeve Containers Market Growth-Forecast 2025 to 2035

Competitive Landscape of Collapsible Rigid Containers Providers

Collapsible Jerry Can Market Growth - Size & Forecast 2024 to 2034

Collapsible Food Packaging Containers Market

Collapsible Aluminium Tube Market

Foldable And Collapsible Pallets Market Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA