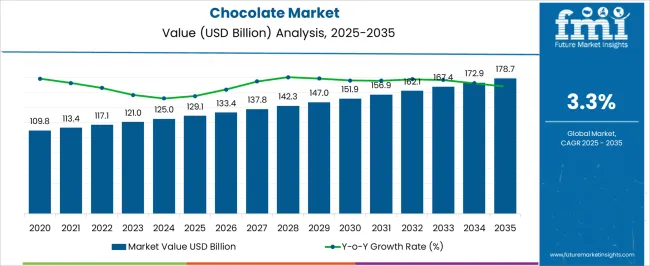

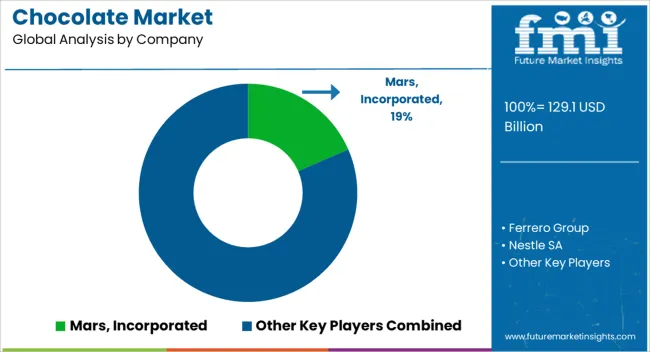

The chocolate market, estimated at USD 129.1 billion in 2025 and projected to reach USD 178.7 billion by 2035 at a CAGR of 3.3%, operates within a highly regulated environment that significantly shapes its growth trajectory and operational dynamics. Food safety regulations, labeling requirements, and ingredient restrictions imposed by authorities in major markets, including the United States, the European Union, and Asia-Pacific, influence production processes, product formulations, and packaging standards. Compliance with these regulatory frameworks necessitates investments in quality assurance, testing, and certification processes, which directly affect cost structures and pricing strategies within the market.

In addition, regulations concerning sugar content, allergen disclosures, and permissible additives have compelled manufacturers to innovate in response to evolving legal and health standards. Policies promoting sustainable sourcing and ethical cocoa production further impact procurement and supply chain decisions, imposing additional compliance costs while potentially enhancing brand reputation among consumers sensitive to ethical considerations. Trade regulations and import-export tariffs in key regions also modulate market accessibility and competitiveness, influencing regional growth patterns and revenue distribution.

The regulatory factors act both as constraints and drivers, shaping the strategic approaches of chocolate manufacturers. The relatively modest CAGR of 3.3% reflects a market that, while expanding steadily, must continuously navigate complex and evolving regulatory landscapes. Regulatory compliance thus remains a critical determinant of operational efficiency, product development, and market penetration strategies within the global market.

| Metric | Value |

|---|---|

| Chocolate Market Estimated Value in (2025 E) | USD 129.1 billion |

| Chocolate Market Forecast Value in (2035 F) | USD 178.7 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The chocolate market represents a prominent segment within the global confectionery and sweet goods industry, emphasizing flavor, indulgence, and consumer preference. Within the broader confectionery sector, it accounts for about 18%, driven by demand in retail, foodservice, and premium gift segments. In the dark, milk, and white chocolate category, its share is approximately 12.5%, reflecting consumer interest in diverse taste profiles and functional benefits. Across the packaged snacks and bakery ingredients market, it contributes around 9.8%, supporting inclusion in desserts, coatings, and ready-to-eat products.

Within the premium and artisanal chocolate segment, it represents 6.4%, highlighting demand for quality, unique flavors, and ethical sourcing. In the overall sweet and snack foods ecosystem, the market contributes about 15%, emphasizing convenience, brand loyalty, and sensory appeal. Recent developments in the chocolate market have focused on product innovation, health-oriented offerings, and ethical sourcing. Groundbreaking trends include the rise of sugar-reduced, high-cocoa, and functional chocolates enriched with probiotics, vitamins, or plant-based ingredients.

Key players are collaborating with cocoa suppliers, flavor innovators, and packaging specialists to introduce premium and limited-edition varieties. Adoption of bean-to-bar processes, clean label ingredients, and sustainable packaging is gaining traction to meet consumer expectations. The digital marketing, e-commerce distribution, and personalized gifting solutions are reshaping sales channels. These advancements demonstrate how innovation, health focus, and sustainability are defining the market.

The chocolate market is witnessing steady global expansion, supported by sustained consumer demand and evolving product innovations. Current market dynamics are shaped by premiumization trends, with manufacturers focusing on high-quality ingredients, unique flavors, and healthier formulations to cater to changing dietary preferences. Urbanization, rising disposable incomes, and the influence of Western confectionery culture in emerging economies are driving consumption growth across diverse demographics.

The competitive landscape is characterized by frequent product launches and strong brand positioning strategies, enhancing market visibility and consumer loyalty. Packaging innovations, supply chain efficiencies, and strategic retail partnerships have further reinforced the market's ability to adapt to shifting consumer behaviors.

In the long term, the industry is expected to benefit from technological advancements in production, sustainable sourcing practices, and increasing penetration into rural and underdeveloped markets. With demand fueled by both indulgence and gifting traditions, the chocolate market is poised for consistent growth, supported by its cultural relevance and adaptability to global consumption trends.

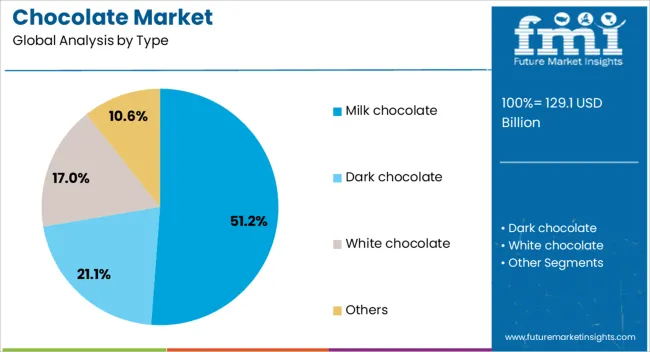

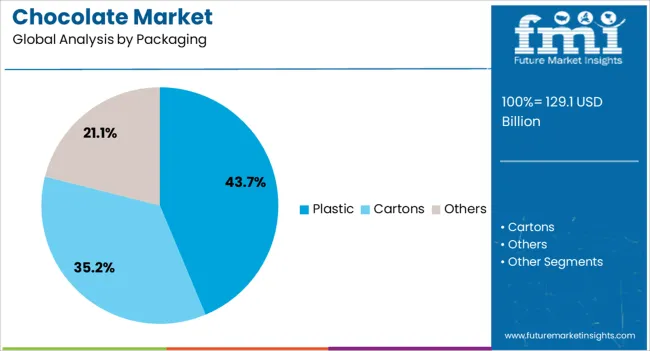

The chocolate market is segmented by type, packaging, distribution channel, and geographic regions. By type, chocolate market is divided into milk chocolate, dark chocolate, white chocolate, and others. In terms of packaging, chocolate market is classified into plastic, cartons, and others. Based on distribution channel, chocolate market is segmented into supermarkets and hypermarkets, convenience stores, specialty chocolate stores, online retail (e-commerce), and others. Regionally, the chocolate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The milk chocolate segment dominates the chocolate market, accounting for approximately 51.2% of the total share. This leadership position is maintained through widespread consumer preference for its creamy texture, balanced sweetness, and approachable flavor profile. Growth in this segment is reinforced by its strong presence across all major retail formats and its versatility in applications ranging from standalone bars to confectionery inclusions.

Milk chocolate benefits from high brand recognition and established manufacturing processes that enable cost-effective mass production without compromising quality. Seasonal demand spikes, particularly during festive and gifting occasions, have also sustained its prominence.

Marketing campaigns emphasizing nostalgia, indulgence, and emotional connection have further cemented its position in both mature and emerging markets. The combination of sensory appeal, broad demographic acceptance, and adaptability to flavor innovations ensures that the milk chocolate segment will continue to lead the market through the forecast period.

The plastic packaging segment holds the leading share in the chocolate market’s packaging category, contributing approximately 43.7% to the overall market. This dominance is attributed to its durability, lightweight nature, and cost efficiency, which make it an ideal choice for mass distribution. Plastic packaging offers strong barrier properties that protect chocolate products from moisture, oxygen, and physical damage, ensuring extended shelf life and product integrity.

Additionally, its flexibility allows for diverse shapes and sizes, enabling brands to differentiate themselves visually while meeting functional requirements. The segment's growth has also been supported by advancements in recyclable and biodegradable plastic materials, aligning with increasing sustainability goals.

Its compatibility with automated packaging systems facilitates high-speed production, further enhancing operational efficiency. Given its practicality, versatility, and alignment with evolving eco-friendly innovations, plastic packaging is expected to maintain its leading position in the market during the coming years.

The supermarkets and hypermarkets segment leads the chocolate market’s distribution channel category, capturing approximately 48.9% of the market share. This dominance stems from the wide product assortments, attractive in-store displays, and promotional activities that such retail formats offer. High consumer footfall in these outlets ensures consistent exposure and impulse purchasing opportunities, particularly for confectionery products like chocolate.

The segment benefits from competitive pricing strategies, bundle offers, and seasonal discounts that stimulate higher purchase volumes. Additionally, the ability to physically inspect products before purchase enhances consumer trust and satisfaction.

Strategic shelf placement and point-of-sale marketing further reinforce product visibility and brand recall. With supermarkets and hypermarkets expanding in both urban and semi-urban areas, along with the integration of modern retail technologies such as self-checkout systems, this distribution channel is expected to sustain its leading role in chocolate sales over the forecast horizon.

The market has witnessed significant expansion due to increasing global consumption, rising preference for premium and functional products, and growth in organized retail and e-commerce channels. Chocolates are consumed across age groups and socio-economic segments for indulgence, gifting, and health-oriented purposes. The market is influenced by product innovation, including dark, sugar-free, organic, and fortified chocolates that cater to changing consumer lifestyles and dietary trends. Sustainable sourcing of cocoa and ethical practices have become central to brand positioning. Regional variations in taste, texture, and ingredient preferences continue to drive product diversification.

Premium and functional chocolates have been significant drivers in the chocolate market due to evolving consumer preferences toward high-quality and health-oriented products. Dark chocolate with high cocoa content, sugar-free variants, and chocolates fortified with vitamins, minerals, or probiotics are increasingly favored by health-conscious consumers. Seasonal and festive gifting has also amplified demand for luxury packaging and artisanal chocolates. Retailers and e-commerce platforms have expanded their offerings, providing product customization and subscription services. Sustainability trends, including ethically sourced cocoa and eco-friendly packaging, have further influenced purchasing decisions. Marketing campaigns highlighting health benefits, indulgence, and exclusivity have reinforced consumer perception of value. Collectively, these factors have strengthened the adoption of premium and functional chocolates, ensuring sustained growth across mature and emerging markets globally.

Cocoa production and processing efficiency have had a direct impact on chocolate market growth. Investments in mechanized processing, fermentation, and quality control have enhanced flavor consistency, yield, and product stability. The integration of traceability systems and digital monitoring in supply chains ensures authenticity, minimizes adulteration risks, and strengthens sustainability initiatives. Emerging markets have witnessed increased sourcing of locally grown cocoa and partnerships with cooperatives, which enhance supply chain resilience. Efficient logistics, cold chain management, and improved warehousing practices have enabled timely delivery of raw materials and finished products, reducing wastage and cost pressures. These operational improvements have not only enhanced product quality but have also supported market expansion by facilitating timely access to chocolate products for retailers and consumers worldwide.

The proliferation of e-commerce platforms and modern retail formats has significantly amplified chocolate market penetration. Online platforms provide direct-to-consumer sales, enabling access to premium, seasonal, and niche chocolate offerings beyond local markets. Supermarkets, hypermarkets, and specialty stores offer broader product assortments and promotional activities, driving impulse purchases and repeat consumption. Personalized and customizable chocolate offerings, including gift packs, subscription boxes, and limited editions, have leveraged digital marketing campaigns to target diverse consumer segments. Retail analytics, demand forecasting, and consumer insights have facilitated inventory optimization and promotional effectiveness. This integration of digital and physical retail channels has strengthened the chocolate market by enhancing visibility, accessibility, and convenience, thus encouraging higher consumption across regions and demographics.

Sustainability and ethical sourcing have emerged as influential factors shaping chocolate consumption and market dynamics. Consumers are increasingly conscious of the environmental and social impact of cocoa production, prompting brands to adopt certified cocoa, fair trade practices, and eco-friendly packaging. Programs for reforestation, child labor prevention, and farmer support have enhanced corporate responsibility and brand credibility. Transparent labeling and communication of sustainability efforts have strengthened consumer trust and loyalty. The investments in renewable energy, waste reduction, and sustainable supply chain management have reduced operational impact and enhanced long-term viability. The alignment of product offerings with sustainability values has not only mitigated regulatory risks but also provided differentiation, enabling brands to capture premium segments and influence purchasing behavior positively in global markets.

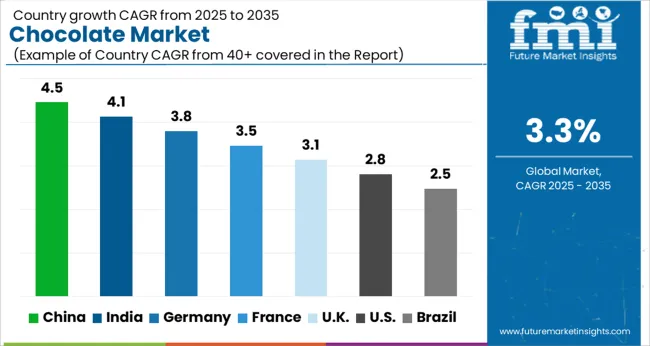

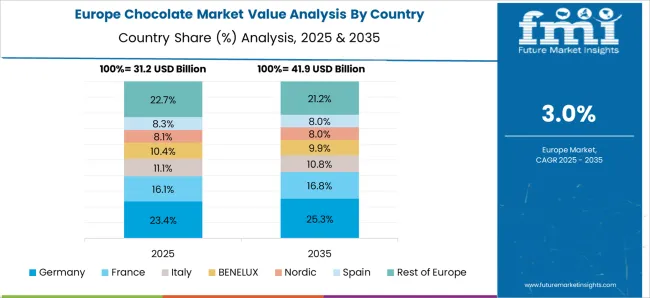

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

The market is projected to grow at a CAGR of 3.8% from 2025 to 2035, driven by rising demand for e-bikes and advanced gear systems. China leads with 5.1%, fueled by large-scale bicycle manufacturing and supportive urban mobility programs. India follows at 4.8%, benefiting from increased adoption of e-bikes and expanding cycling infrastructure. Germany records 4.4%, underpinned by engineering expertise and high-quality drivetrain innovations. The UK holds 3.6%, supported by recreational cycling trends and commuter demand. The USA registers 3.2%, where focus on efficiency and lightweight systems influences growth. The market is shaped by technological integration, performance optimization, and sustainable mobility initiatives. This report includes insights on 40+ countries; the top markets are shown here for reference.

China recorded a 4.5% CAGR, driven by increasing demand for premium and artisanal chocolate, growth in modern retail, and rising gifting culture. Domestic and international brands invested in innovative flavors, attractive packaging, and limited edition seasonal releases to capture consumer interest. Retail expansion in supermarkets, convenience stores, and online channels facilitated wider availability, while e commerce platforms promoted subscription and gift box offerings. Local taste preferences encouraged the launch of chocolate with unique fillings, nuts, and fruit blends. Competitive strategies included collaborations with global chocolatiers, experiential tasting events, and targeted digital campaigns. Brand loyalty was enhanced through promotional bundles, loyalty programs, and festive limited editions to appeal to both young and affluent consumers.

India demonstrated a 4.1% CAGR, supported by growing retail penetration, urban lifestyle trends, and festive gifting occasions. Manufacturers invested in milk chocolate, nut variants, and small format packs suitable for impulse buying. E commerce growth facilitated wider product availability and promotional campaigns targeting young consumers. Local companies collaborated with international brands to launch co branded products and seasonal assortments. Marketing strategies emphasized festive campaigns, social media engagement, and product sampling to enhance trial. Premiumization trends encouraged the introduction of single origin chocolates and imported assortments in niche retail outlets. Competitive advantage was secured through distribution network expansion, flavor differentiation, and affordability while maintaining perceived quality.

Germany advanced at a 3.8% CAGR, shaped by mature consumer preferences for high quality and premium chocolates. Artisanal and organic chocolate segments gained traction, driven by health conscious consumers and sustainable sourcing trends. Manufacturers invested in innovative packaging, single origin products, and seasonal assortments to sustain differentiation. Retail channels including supermarkets, convenience stores, and specialty chocolatiers were optimized for visibility and availability. Competitive strategies focused on product innovation, ethical sourcing, and certification compliance. Collaborations with international brands and premium local chocolatiers allowed companies to expand offerings. Brand loyalty was reinforced through experiential promotions, tasting events, and strategic retail partnerships targeting both everyday consumption and gifting occasions.

The United Kingdom progressed at a 3.1% CAGR, driven by demand for premium, organic, and ethically sourced chocolates. Retailers expanded space for gifting assortments, seasonal products, and single origin selections. E commerce and subscription box models enhanced consumer accessibility and discovery of niche brands. Marketing strategies focused on social media engagement, influencer collaborations, and festive limited editions to increase brand awareness. Consumer focus on health and quality led to growth in low sugar and dark chocolate variants. Competitive differentiation relied on innovation in flavor, packaging, and sustainability credentials, while partnerships with chocolatiers and ethical sourcing initiatives strengthened brand positioning across mainstream and specialty retail channels.

The United States expanded at a 2.8% CAGR, influenced by high demand for premium, artisanal, and functional chocolates. Consumers sought unique flavor combinations, small format indulgences, and seasonal gift assortments. Retail and e commerce channels facilitated broad product accessibility, while subscription services increased discovery of niche brands. Health conscious trends encouraged low sugar, organic, and dark chocolate variants. Manufacturers invested in innovative packaging, co-branded collaborations, and experiential campaigns to differentiate in a highly competitive market. Sustainability initiatives, including ethically sourced cocoa, gained prominence in marketing strategies. Brand loyalty was reinforced through sampling, festive campaigns, and loyalty programs targeting premium and specialty consumer segments.

The market is dominated by a combination of global leaders and specialty confectioners. Mars, Incorporated, Nestle SA, Ferrero Group, and Mondelz International have focused on high volume production, strong brand recognition, and global distribution networks. Their strategies emphasize flavor consistency, innovation in product formats, and efficient supply chains. The Hershey Company and Meiji Holdings Co., Ltd. have targeted regional and premium segments, highlighting taste profiles and local ingredient sourcing.

Barry Callebaut AG has concentrated on B2B offerings, supplying couverture chocolate and specialty formulations to manufacturers worldwide. Specialty and artisan players such as Arcor SAIC, Chocoladefabriken Lindt & Sprüngli AG, and The Australian Carob Co. have differentiated through product craftsmanship and ingredient quality. Product brochures highlight single origin chocolates, high cocoa content, and unique fillings. Emphasis is placed on ethical sourcing, bean-to-bar transparency, and innovative packaging designs. Large companies present product ranges that appeal to mass markets while maintaining consistent texture, shelf life, and brand familiarity. Smaller players focus on premium storytelling, gourmet experiences, and niche flavors that appeal to connoisseurs.

Competition has shifted beyond price, centering on product experience and brand perception. Mars and Nestle showcase multi-layered flavor innovations, while Ferrero highlights indulgent textures. Lindt emphasizes artisanal quality and heritage, and Barry Callebaut positions technical versatility for industrial clients. Brochures communicate sensory appeal, sustainable sourcing, and premium aesthetics. Across the sector, packaging and product literature are used strategically to project quality, innovation, and trustworthiness, shaping consumer preferences in a highly competitive chocolate landscape.

| Items | Values |

|---|---|

| Quantitative Units | USD 129.1 billion |

| Type | Milk chocolate, Dark chocolate, White chocolate, and Others |

| Packaging | Plastic, Cartons, and Others |

| Distribution Channel | Supermarkets and Hypermarkets, Convenience stores, Specialty chocolate stores, Online retail (e-commerce), and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mars, Incorporated, Ferrero Group, Nestle SA, Mondelz International, Inc., The Hershey Company, Meiji Holdings Co., Ltd., Barry Callebaut AG, Arcor SAIC, Chocoladefabriken Lindt & Sprüngli AG, and The Australian Carob Co. |

| Additional Attributes | Dollar sales by chocolate type and application, demand dynamics across retail, confectionery, and gourmet segments, regional trends in premium and sustainable chocolate adoption, innovation in flavor profiles, formulation, and packaging, environmental impact of cocoa sourcing and production, and emerging use cases in functional foods, bean-to-bar products, and artisanal confectionery. |

The global chocolate market is estimated to be valued at USD 129.1 billion in 2025.

The market size for the chocolate market is projected to reach USD 178.7 billion by 2035.

The chocolate market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in chocolate market are milk chocolate, dark chocolate, white chocolate and others.

In terms of packaging, plastic segment to command 43.7% share in the chocolate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chocolate Powdered Drinks Market Forecast and Outlook 2025 to 2035

Chocolate Bar Packaging Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Flavoring Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Couverture Market Size, Growth, and Forecast for 2025 to 2035

Chocolate Processing Equipment Market Size, Growth, and Forecast 2025 to 2035

Chocolate Wrapping Films Market from 2025 to 2035

Chocolate Flavors Market Analysis by Product Type, and Application Through 2035

Chocolate Confectionery Market Analysis by Product, Type, Distribution Channel, and Region Through 2035

Chocolate Inclusions and Decorations Market Analysis by Type, End Use, and Region Through 2035

Industry Share Analysis for Chocolate Bar Packaging Companies

Chocolate Syrup Market

Non-Chocolate Candy Market

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compound Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sugarless Chocolate Market

Industrial Chocolate Market Analysis by Product, Application, Type, and Region through 2035

Analysis and Growth Projections for Low-calorie Chocolate Business

Sugar-Free White Chocolate Market Trends - Demand & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA