The anti-seize compounds market is valued at USD 201 million in 2025 and is expected to reach USD 298 million by 2035, registering a CAGR of 4%. This growth is driven by increasing demand from heavy industries, automotive maintenance, and energy sectors, where these compounds prevent corrosion and seizure of mechanical components under extreme conditions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 201 million |

| Industry Value (2035F) | USD 298 million |

| CAGR (2025 to 2035) | 4% |

Anti-seize compounds are essential for preventing galling, corrosion, and seizing in bolted assemblies, valves, and bearings exposed to high temperatures, pressure, and corrosive environments. The American Petroleum Institute (API) mandates their use in offshore drilling equipment, citing a 40% reduction in maintenance downtime when properly applied.

In the automotive sector, these compounds are critical for engine components, brake systems, and exhaust manifolds. The transition to electric vehicles has created demand for specialized formulations that protect battery housing fasteners from galvanic corrosion.

The chemical processing industry relies on nickel- and copper-based anti-seize compounds for reactors and pipelines handling caustic substances. Recent advancements include ceramic-reinforced formulations that withstand temperatures exceeding 1,600°C

The anti-seize compounds market demonstrates clear segmentation across product types and end-use industries, each with distinct growth trajectories. Metallic formulations continue to dominate the market, holding approximately 72% share in 2025, with copper-based variants leading this category at 35% of total demand.

These copper formulations find extensive application in automotive exhaust systems and marine environments where their exceptional thermal conductivity and corrosion resistance properties prove invaluable. The marine sector particularly benefits from copper-based compounds' ability to withstand saltwater exposure while maintaining consistent performance across temperature fluctuations common in offshore operations.

Nickel-based anti-seize compounds account for 28% of the metallic segment, primarily serving chemical processing plants and petrochemical facilities. Their superior resistance to acidic and chloride-rich environments makes them indispensable for reactor flanges, pump assemblies, and pipeline connections in aggressive chemical environments. Recent innovations in nickel compound formulations have focused on enhancing their load-bearing capabilities, with several manufacturers developing reinforced versions capable of withstanding pressures exceeding 10,000 psi in ultra-deepwater drilling applications.

Aluminum and graphite-based formulations represent the remaining metallic segment share, finding particular utility in high-temperature industrial applications. Graphite-based compounds have seen growing adoption in energy infrastructure projects due to their unique self-lubricating properties, which prevent particle buildup in constantly moving assemblies.

These compounds demonstrate exceptional performance in power plant turbine assemblies and heavy machinery where traditional lubricants would degrade under extreme operating conditions.

The non-metallic segment, while smaller at 28% market share, is growing at a more rapid 7.1% CAGR through 2035. This growth stems from increasing demand across several specialized applications where metallic compounds prove unsuitable. Aerospace applications constitute a major driver for metal-free formulations, as conductive metallic particles could potentially interfere with sensitive avionics systems.

Food processing equipment represents another key growth area, with manufacturers developing NSF-certified formulations that meet stringent hygiene requirements while providing equivalent protection to their metallic counterparts.

Within end-use industries, the oil and gas sector maintains its position as the largest consumer, accounting for 38% of total demand in 2025. This sector primarily utilizes aluminum- and graphite-based compounds for drilling rig components, pipeline connections, and refinery equipment. The automotive aftermarket follows with 25% share, where copper-based formulations predominate for exhaust system maintenance and brake component applications.

Power generation applications account for 18% of demand, with specialized formulations developed for turbine maintenance and nuclear facility applications where extreme temperature and radiation resistance are paramount.

The anti-seize compounds market is experiencing significant transformation driven by multiple converging factors across industrial sectors. Growth in energy infrastructure development stands out as a primary market driver, with substantial investments in both traditional and renewable energy projects creating sustained demand.

Offshore drilling activities in regions like the North Sea and Gulf of Mexico continue to require specialized formulations that meet stringent API standards, while simultaneously, the rapid expansion of LNG infrastructure is generating need for cryogenic-grade compounds capable of performing in extreme low-temperature environments. These energy sector requirements are pushing manufacturers to develop increasingly sophisticated products that can withstand harsh operating conditions while maintaining long-term reliability.

Industrial automation trends represent another powerful market driver, as the proliferation of robotic assembly lines creates new application areas for anti-seize technologies. Modern manufacturing facilities utilizing high-cycle fastening systems increasingly rely on advanced compounds to prevent particulate buildup and ensure consistent performance across thousands of operational cycles.

This automation-driven demand is particularly evident in automotive production lines and electronics manufacturing, where precision fastening systems require specialized formulations that won't interfere with sensitive components or processes. The transition toward Industry 4.0 standards is further amplifying this effect, as connected factories seek integrated lubrication solutions that align with predictive maintenance protocols.

Material science advancements are reshaping the competitive landscape through continuous product innovation. Recent developments in nano-ceramic additives have enabled formulations that perform reliably in extreme-pressure environments previously considered beyond the capabilities of traditional anti-seize compounds.

Simultaneously, growing environmental concerns have spurred development of bio-based lubricant carriers that meet evolving regulatory standards, particularly in marine applications where EPA VGP regulations dictate stringent requirements. These technological improvements are expanding the potential applications for anti-seize compounds while simultaneously raising performance expectations across industries.

Challenge: Metal Compatibility and Regulatory Compliance Issues

The anti-seize compounds market is challenged by limitations regarding compatibility with dissimilar metals and stringent environmental guidelines. Some formulations, especially the ones with heavy metals (copper, lead, nickel), may corrode under high-temperature or electrochemical conditions, which can be particularly detrimental in aerospace and marine vessels.

More stringent VOC and hazardous substance regulations are driving reformulations, increasing production costs, and restricting the use of traditional high-performance variants. Moreover, throughout the operation, users need to balance their torque control with the efficiency of sealing, which makes uniformity across different industries a challenge. This makes product selection and application that much more of a challenge to make sure that performance is reliable in both static assemblies as well as in assemblies exposed to high vibration.

Opportunity: High-Performance Alloys and Sustainable Maintenance Demands

The increasing use of high-performance metals in automotive, energy, and heavy machinery sectors is aiding the growth of the market despite the threats imposed by regulation. Anti-seize is used where threaded assemblies are exposed to extreme temperature, pressure, and corrosive environments.

There is an increasing demand for non-metallic, nickel-free, and food-grade variants, especially during clean energy, food processing, or pharmaceutical equipment maintenance. As predictive maintenance, sustainability and longer service intervals are increasing becoming standards within industry, existing anti-seize technologies with lower environmental impact and a more extensive temperature range are increasingly gaining traction for OEM and aftermarket applications globally.

The United States anti seize compounds market is poised to grow at a considerable rate, driven by heavy machinery, oil & gas, and automotive maintenance demand. Anti-seize products are widely used in industrial operations as reliability and minimized downtime become priorities and threads need to be protected from corrosion and high-temperature service.

USA manufacturers are innovating with high-performance formulations for even better metal compatibility and chemical resistance, and targeting sectors with very harsh environments. It has particularly high demand in both power generation, as well as petrochemical installations where long term joint integrity is required.

| Country | CAGR (2025 to 2035) |

|---|---|

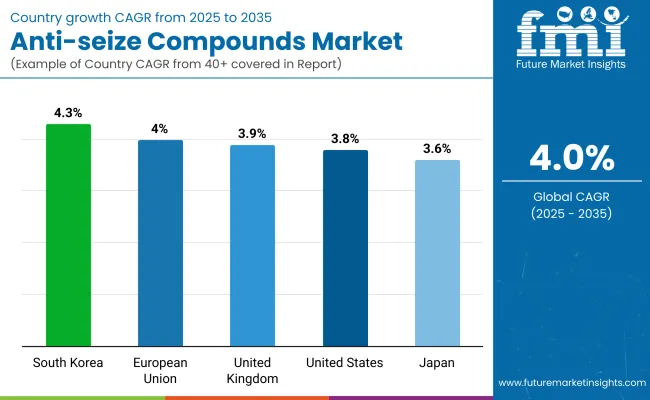

| USA | 3.8% |

In the United Kingdom, the growth of the anti-seize compounds market is moderate due to industrial sectors improving maintenance procedures to facilitate long-term preservation of assets. Shipbuilding, transport infrastructure, and maintenance of renewable energy are broadening the applications of anti-seize pastes based upon copper-derived and nickel-derived composites.

With many of their local regulatory frameworks for manufacturers and distributors now in place, UK-providers are already offering RoHS-compliant and more environmentally safer alternatives to traditional heavy-metal formulas that are already in line with customer sustainability ambitions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

Anti-seize compounds have a considerable market in the European Union due to the presence of well-established manufacturer industries, such as automotive manufacturing, railway, and heavy machinery. Germany, France, Italy, these are countries that export high performance to prevent galling, seizing and corrosion under thermal stress and load-bearing conditions.

Regulatory issues in particular EU states about health and environmental safety have led to a trend to low-toxicity, non-metallic anti-seize formulations. In more specialty applications like turbine assemblies and flange systems, European suppliers are also touting long-service life and ease of removal.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.0% |

Japan is witnessing a steady growth in the market for anti-seize compounds owing to the robust automotive and electronics manufacturing industries in the region. They are widely used in precision assemblies, threaded fasteners, and thermal interfaces to prevent corrosion, and improve removability in anti-seize formulations.

Japanese manufacturers are emphasizing compact-packaging solutions for controlled application in assembly line and aftermarket services. Demand is also growing for shipbuilding and public infrastructure, where weather-resistant and saltwater-resistant compounds are needed.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

The South Korean anti-seize compounds market is becoming lucrative with the increase of industrial production and vehicle manufacture. Applications expand in high-pressure pipelines, marine engine maintenance, and aerospace systems for durable, temperature stable formulations.

South Korean manufacturers are announcing nano improvement components that are said to show better thermal conductance and electrochemical corrosion resistance than conventional types. This means also overcoming challenges related to the country's highly developed logistics and maintenance culture responsible for broad adoption across OEM and aftermarket parts and services.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The anti-seize compounds market features a mix of global chemical giants and specialty manufacturers, with the top five players controlling 45% of revenue.

Companies

The overall market size for the anti-seize compounds market was USD 201.9 million in 2025.

The anti-seize compounds market is expected to reach USD 298.9 million in 2035.

The increasing demand for high-performance lubricants in extreme environments, rising application in corrosion and seizure prevention, and growing use of nickel-based grades in oil exploration applications fuel the anti-seize compounds market during the forecast period.

The top 5 countries driving the development of the anti-seize compounds market are the USA, UK, European Union, Japan, and South Korea.

Nickel-based grades and oil exploration applications lead market growth to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compounds Market Size and Share Forecast Outlook 2025 to 2035

Wire Compounds and Cable Compounds Market Growth - Trends & Forecast 2025 to 2035

Flavor Compounds Market Size and Share Forecast Outlook 2025 to 2035

Purging Compounds Market

Platinum Compounds Market Size and Share Forecast Outlook 2025 to 2035

Bioactive Compounds In Coffee Market

Bulk Molding Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Flavoring Compounds Market Size and Share Forecast Outlook 2025 to 2035

Quaternary Ammonium Compounds Market

Fluorescent Skincare Compounds Market Size and Share Forecast Outlook 2025 to 2035

Wire Insulation & Jacketing Compounds Market

Heterocyclic and Fluoro Organic Compounds Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA