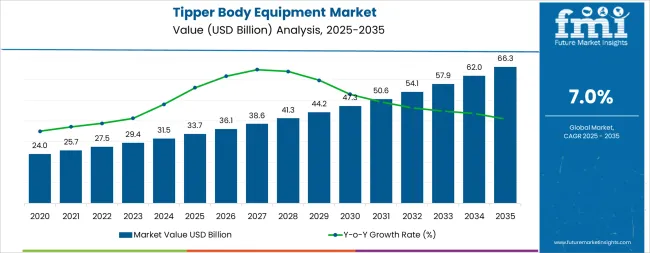

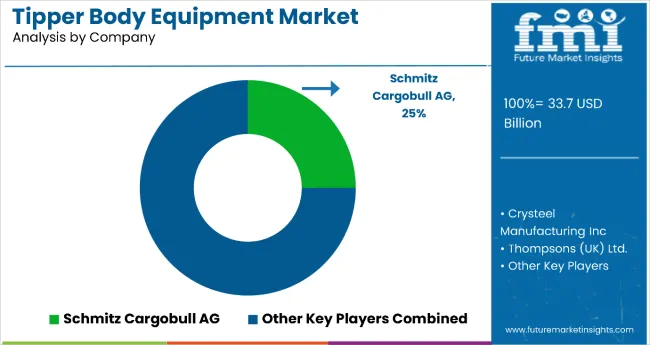

The global tipper body equipment market is valued at USD 33.7 billion in 2025 and is slated to reach USD 66.3 billion by 2035, recording an absolute increase of USD 32.6 billion over the forecast period. This translates into a total growth of 96.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.0% between 2025 and 2035. The overall market size is expected to grow by nearly 2.0X during the same period, supported by increasing construction activities, growing mining operations, and rising demand for efficient material handling equipment across diverse industrial applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 33.7 billion |

| Forecast Value in (2035F) | USD 66.3 billion |

| Forecast CAGR (2025 to 2035) | 7% |

From 2030 to 2035, the market is forecast to grow from USD 47.2 billion to USD 66.3 billion, adding another USD 19.1 billion, which constitutes 58.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of electric and hybrid tipper vehicles, the integration of IoT and automation technologies, and the development of advanced lightweight aluminum frame solutions. The growing adoption of smart fleet management systems and predictive maintenance technologies will drive demand for tipper body equipment with enhanced operational efficiency and reduced environmental impact.

Between 2020 and 2025, the tipper body equipment market experienced robust growth, driven by increasing construction industry demand for material handling solutions and growing recognition of tipper equipment as essential infrastructure for mining operations and waste management applications. The market developed as equipment manufacturers recognized the potential for tipper body systems to enhance operational efficiency while reducing transportation costs and improving job site productivity. Technological advancement in hydraulic systems and frame materials began emphasizing the critical importance of maintaining payload capacity and operational reliability in commercial vehicle applications.

Market expansion is being supported by the increasing global construction activity and the corresponding need for efficient material handling equipment that can maintain operational reliability and payload capacity while supporting diverse hauling applications across various industrial sectors. Modern construction and mining companies are increasingly focused on implementing equipment solutions that can reduce transportation time, minimize operational costs, and provide consistent performance in material handling operations. Tipper body equipment's proven ability to deliver enhanced hauling efficiency, reliable unloading capabilities, and versatile operational applications make them essential equipment for contemporary construction and industrial material transport solutions.

The growing emphasis on infrastructure development and industrial expansion is driving demand for tipper body equipment that can support large-scale construction projects, reduce material handling costs, and enable efficient transportation of bulk materials across varying terrain conditions. Commercial operators' preference for equipment that combines durability with operational efficiency and cost-effectiveness is creating opportunities for innovative tipper body implementations. The rising influence of automation technologies and smart vehicle systems is also contributing to increased adoption of tipper body equipment that can provide advanced operational control without compromising reliability or payload performance.

The tipper body equipment market is poised for robust growth and transformation. As construction and mining companies across both developed and emerging markets seek material handling equipment that is efficient, reliable, durable, and cost-effective, tipper body systems are gaining prominence not just as transportation solutions but as strategic equipment for construction efficiency, mining productivity, waste management optimization, and infrastructure development.

Rising infrastructure investment and industrial expansion in South Asia & Pacific, East Asia, North America amplify demand, while manufacturers are picking up on innovations in hydraulic technologies and material improvements.

Pathways like aluminum frame adoption, automation integration, and electric vehicle compatibility promise strong margin uplift, especially in mature markets. Geographic expansion and localization will capture volume, particularly where construction activity is intensifying or mining operations require modernization. Regulatory pressures around emission reduction, safety standards, payload optimization, and operational efficiency give structural support.

The market is segmented by tipping type, load carrying capacity, mechanism, frame material, end use, and region. By tipping type, the market is divided into roll-off tipper body, 3-way tipper body, and rear tipper body. By load carrying capacity, it covers below 15 tons, 15 to 30 tons, and 30 tons & above. By mechanism, it is segmented into hydraulic and pneumatic. By frame material, it covers steel and aluminum. By end use, it includes mining, construction, waste management, marine services, and others. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

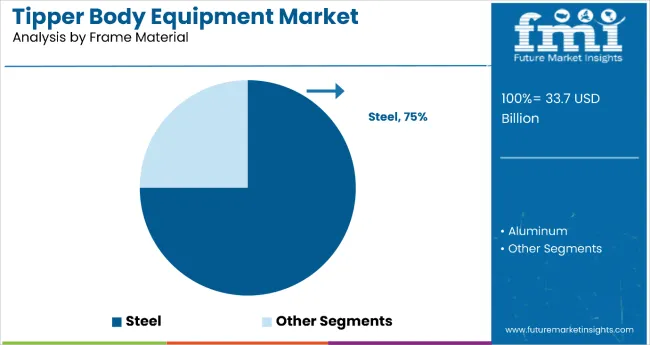

The steel segment is projected to account for 75% of the tipper body equipment market in 2025, reaffirming its position as the leading frame material category. Equipment manufacturers increasingly utilize steel frames for their superior strength-to-weight ratio, exceptional durability, and cost-effectiveness in heavy-duty hauling applications across construction, mining, and industrial transport operations. Steel frame technology's advanced metallurgical capabilities and consistent structural performance directly address the industrial requirements for reliable load-bearing capacity and operational longevity in demanding working environments.

This frame material segment forms the foundation of modern tipper body operations, as it represents the material with the greatest structural integrity and established performance record across multiple applications and operational scenarios. Manufacturer investments in enhanced steel processing technologies and corrosion protection systems continue to strengthen adoption among equipment operators. With companies prioritizing payload capacity and equipment durability, steel frames align with both operational efficiency objectives and cost management requirements, making them the central component of comprehensive tipper body equipment strategies.

Construction is projected to represent 48% of tipper body equipment demand in 2025, underscoring its critical role as the primary industrial application of tipper equipment for material transportation and job site operations. Construction companies prefer tipper body equipment for their efficiency, reliability, and ability to handle diverse materials while supporting project timelines and operational productivity. Positioned as essential equipment for modern construction operations, tipper bodies offer both operational advantages and cost benefits.

The segment is supported by continuous innovation in construction project development and the growing availability of specialized tipper configurations that enable efficient material handling with enhanced operational flexibility. Additionally, construction companies are investing in fleet optimization to support large-scale material transportation and project execution. As infrastructure development becomes more prevalent and construction efficiency requirements increase, construction applications will continue to dominate the end-use market while supporting advanced equipment utilization and project management strategies.

The tipper body equipment market is advancing rapidly due to increasing construction industry demand for material handling solutions and growing adoption of advanced hydraulic systems that provide enhanced operational efficiency and payload optimization across diverse industrial applications. However, the market faces challenges, including high initial investment costs, stringent environmental regulations compliance, and the need for specialized maintenance expertise. Innovation in automation technologies and lightweight material development continues to influence equipment design and market expansion patterns.

The growing expansion of infrastructure projects and mining operations is enabling equipment manufacturers to develop tipper body systems that provide superior material handling capabilities, enhanced operational efficiency, and reliable performance in demanding working conditions. Advanced tipper body systems provide improved payload capacity while allowing more effective material transportation and consistent operational delivery across various applications and job site requirements. Manufacturers are increasingly recognizing the competitive advantages of specialized tipper body capabilities for construction efficiency and mining productivity positioning.

Modern tipper body manufacturers are incorporating IoT connectivity and automated hydraulic control systems to enhance operational efficiency, optimize load management, and ensure consistent performance delivery to equipment operators. These technologies improve operational reliability while enabling new applications, including fleet management integration and predictive maintenance solutions. Advanced technology integration also allows manufacturers to support premium equipment positioning and operational optimization beyond traditional material handling equipment supply.

| Country | CAGR (2025-2035) |

|---|---|

| India | 7.8% |

| China | 7.5% |

| USA | 7.2% |

| United Kingdom | 6.8% |

| Australia | 8.2% |

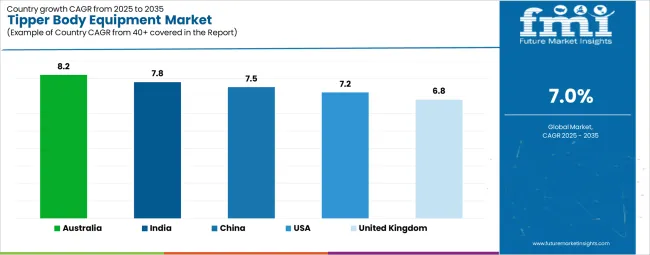

The tipper body equipment market is experiencing strong growth globally, with India leading at a 7.8% CAGR through 2035, driven by the expanding infrastructure development, growing construction activities, and significant investment in industrial equipment modernization. China follows at 7.5%, supported by large-scale urbanization projects, extensive mining operations, and growing demand for advanced material handling equipment. USA shows growth at 7.2%, emphasizing construction sector expansion and equipment technology advancement. European Union records 7.1%, focusing on industrial efficiency and environmental compliance. United Kingdom demonstrates 6.8% growth, supported by infrastructure renewal and construction sector modernization.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from tipper body equipment in India is projected to exhibit exceptional growth with a CAGR of 7.8% through 2035, driven by expanding infrastructure development programs and rapidly growing construction activities supported by government smart city initiatives. The country's ambitious industrial expansion targets and increasing investment in mining operations are creating substantial demand for advanced tipper body equipment solutions. Major construction companies and mining operators are establishing comprehensive equipment fleets to serve both domestic infrastructure projects and industrial development requirements.

Revenue from tipper body equipment in China is expanding at a CAGR of 7.5%, supported by the country's extensive urbanization programs, large-scale construction projects, and increasing mining activities for industrial raw materials. The country's comprehensive infrastructure strategy and growing industrial equipment demand are driving sophisticated tipper body capabilities. State enterprises and construction companies are establishing extensive equipment operations to address the growing demand for efficient material handling and construction support.

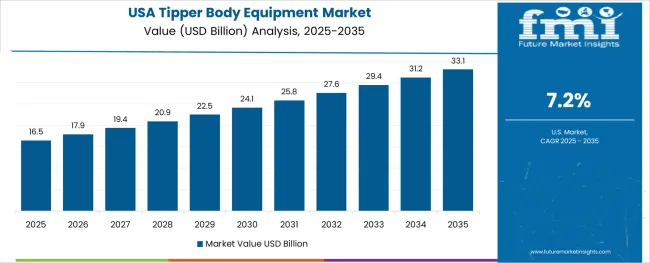

Revenue from tipper body equipment in the USA is expanding at a CAGR of 7.2%, supported by the country's robust construction industry, strong emphasis on equipment innovation, and extensive infrastructure maintenance requirements among commercial operators. The nation's mature construction sector and increasing adoption of advanced material handling equipment are driving sophisticated tipper body capabilities throughout the equipment market. Leading manufacturers and construction companies are investing extensively in equipment modernization and technology integration to serve both domestic construction needs and export markets.

Revenue from tipper body equipment in Australia is projected to exhibit strong growth with a CAGR of 8.2% through 2035, driven by expanding infrastructure development projects and increasing construction and mining activities supported by both urban and regional investment programs. The country’s rising demand for efficient bulk-material transport solutions is creating substantial demand for advanced tipper body equipment designs that offer higher payload, durability, and improved material handling performance. Major mining operators, construction firms, and road development contractors are scaling up their fleets and investing in specialized tipper bodies optimized for local terrain and regulatory standards.

Revenue from tipper body equipment in the United Kingdom is expanding at a CAGR of 6.8%, supported by the country's focus on infrastructure renewal, construction sector modernization, and strategic investment in industrial equipment upgrades. The UK's established construction industry and emphasis on operational efficiency are driving demand for specialized tipper body technologies focusing on performance optimization and environmental compliance. Construction companies are investing in comprehensive equipment programs to serve both domestic infrastructure projects and specialized industrial applications.

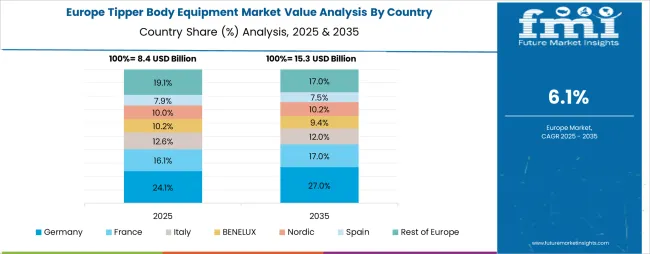

The tipper body equipment market in Europe is projected to grow from USD 8.4 billion in 2025 to USD 16.5 billion by 2035, registering a CAGR of 7.0% over the forecast period. Germany is expected to maintain its leadership position with a 28.0% market share in 2025, increasing to 29.0% by 2035, supported by its strong construction industry, advanced manufacturing capabilities, and comprehensive industrial equipment networks serving major European markets.

France follows with a 18.0% share in 2025, projected to reach 18.5% by 2035, driven by robust infrastructure development projects, construction sector expansion, and established equipment manufacturing capabilities, combined with strong government investment in industrial modernization. United Kingdom holds a 16.0% share in 2025, expected to maintain 16.0% by 2035, supported by construction sector activity and infrastructure renewal requirements but facing challenges from economic uncertainties and equipment import considerations. Italy commands a 14.0% share in 2025, projected to reach 14.2% by 2035, while Spain accounts for 12.0% in 2025, expected to reach 12.1% by 2035.

Netherlands maintains a 4.0% share in 2025, growing to 4.1% by 2035. The Rest of Europe region, including Nordic countries, Eastern European markets, Belgium, Switzerland, Austria, and other European countries, is anticipated to gain momentum, expanding its collective share from 8.0% to 6.1% by 2035, attributed to increasing construction activity across Nordic countries and growing industrial equipment modernization across various European markets implementing infrastructure development programs.

The tipper body equipment market is characterized by competition among established equipment manufacturers, specialized hydraulic system providers, and integrated commercial vehicle companies. Companies are investing in advanced hydraulic technology research, frame material optimization, operational efficiency enhancement, and comprehensive product portfolios to deliver reliable, durable, and cost-effective tipper body equipment solutions. Innovation in automation technologies, lightweight materials, and smart fleet integration capabilities is central to strengthening market position and competitive advantage.

Hyva Global leads the market with a strong market share, offering comprehensive hydraulic tipping solutions with a focus on construction and industrial transport applications. Meiller Kipper provides specialized tipper body capabilities with an emphasis on high-strength materials and robust hydraulic technology. Schmitz Cargobull delivers innovative lightweight tipper solutions with a focus on fuel efficiency and payload optimization. Crysteel Manufacturing specializes in customizable tipper body systems for demanding applications. Thompsons Group focuses on heavy-duty steel tipper bodies and impact-resistant designs. Marrel SAS offers advanced hydraulic hook-lift systems with superior load-bearing capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 33.7 billion |

| Tipping Type | Roll-off Tipper Body, 3-Way Tipper Body, Rear Tipper Body |

| Load Carrying Capacity | Below 15 tons, 15 to 30 tons, 30 tons & above |

| Mechanism | Hydraulic, Pneumatic |

| Frame Material | Steel, Aluminum |

| End Use | Mining, Construction, Waste Management, Marine Services, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia and 40+ countries |

| Key Companies Profiled | Hyva Global, Meiller Kipper, Schmitz Cargobull, Crysteel Manufacturing, Thompsons Group, and Marrel SAS |

| Additional Attributes | Equipment sales by type and application category, regional demand trends, competitive landscape, technological advancements in hydraulic systems, frame material innovation, automation development, and operational efficiency optimization |

The global tipper body equipment market is estimated to be valued at USD 33.7 billion in 2025.

The market size for the tipper body equipment market is projected to reach USD 66.3 billion by 2035.

The tipper body equipment market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in tipper body equipment market are steel and aluminum.

In terms of end use, mining segment to command 0.0% share in the tipper body equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tipper Pads Market

Body Armor Plates Market Size and Share Forecast Outlook 2025 to 2035

Body Composition Monitor and Scale Market Size and Share Forecast Outlook 2025 to 2035

Body Tape Market Size and Share Forecast Outlook 2025 to 2035

Body Blurring Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Body Contouring Market Size and Share Forecast Outlook 2025 to 2035

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

Body Armor Market Analysis - Size, Share & Forecast 2025 to 2035

Body-Worn Temperature Sensors Market Analysis by Type, Application, and Region through 2025 to 2035

Body Fat Measurement Market Analysis - Trends, Growth & Forecast 2025 to 2035

Body Slimming Devices Market Analysis by Product, End-User and Region through 2035

Leading Providers & Market Share in Body Augmentation Fillers

Body Firming Creams Market Growth & Forecast 2025-2035

Body Luminizer Market Trends & Forecast 2025 to 2035

Body Scrub Market Growth & Forecast 2025 to 2035

Body Dryer Market

Body In White Market

Antibody Market Size and Share Forecast Outlook 2025 to 2035

Antibody Specificity Testing Market Size and Share Forecast Outlook 2025 to 2035

Antibody Therapy Market Insights - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA