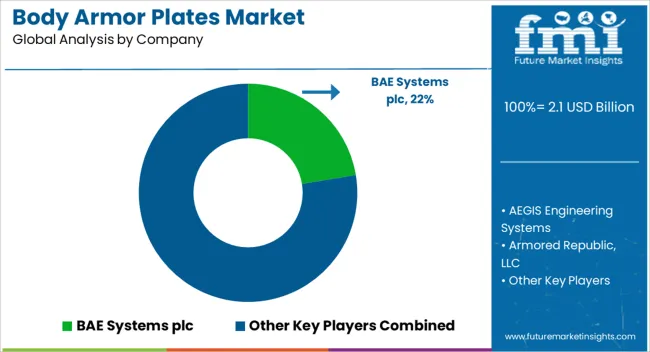

The body armor plates market is projected to grow from USD 2.1 billion in 2025 to USD 3.4 billion by 2035, reflecting a CAGR of 5.0%. During the early adoption phase of 2020–2024, the market expanded from USD 1.6 billion to USD 2.1 billion as armor solutions were tested and deployed by military and law enforcement agencies. Pilot programs were conducted to evaluate impact resistance, weight optimization, and operational comfort.

By 2025, steady adoption will likely be achieved, and broader deployment will be encouraged through procurement planning, performance validation, and operational readiness exercises, allowing market confidence to be strengthened among institutional users. From 2025 to 2035, the market is expected to transition through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market will likely reach USD 2.5 billion, driven by increased procurement across armed forces, paramilitary units, and private security sectors. During the consolidation phase, growth will likely moderate toward USD 3.4 billion by 2035 as leading manufacturers strengthen their positions and smaller suppliers are phased out. The 5.0% CAGR indicates steady expansion, and body armor plates are expected to be established as a standard solution for personal protection, operational efficiency, and tactical readiness across multiple defense and security segments.

| Metric | Value |

|---|---|

| Body Armor Plates Market Estimated Value in (2025 E) | USD 2.1 billion |

| Body Armor Plates Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The body armor plates market is influenced by several parent markets, each contributing to its growth. The defense and military sector is estimated to drive approximately 35%, as armor plates are deployed for personnel protection in combat and tactical operations. Law enforcement and public safety agencies are considered responsible for 20%, as police and security units adopt plates for riot control, patrols, and special operations. The private security services sector is assessed to account for 10%, as armored protection is applied in executive protection, transport, and security operations. Tactical gear and personal protective equipment manufacturing contributes around 8%, as helmets, vests, and complementary equipment are integrated. The aerospace and defense equipment market is evaluated at 7%, as specialized armor is incorporated into vehicles and aircraft. Research and development services are estimated at 6%, as impact testing, material enhancement, and product validation are conducted. Maintenance, retrofitting, and calibration services account for 5%, as operational performance is ensured. Finally, government and regulatory agencies are estimated at 9%, as standards, certifications, and compliance measures are implemented to govern armor plate deployment.

The Body Armor Plates market is witnessing steady expansion driven by increasing demand for personal protection and tactical gear across defense and security sectors. Growth is being supported by rising global investments in military modernization programs, heightened awareness of personnel safety, and evolving threats that require advanced ballistic protection.

The current market environment is shaped by the adoption of lightweight, high-strength materials that offer improved mobility without compromising safety. Advances in material science and production processes have allowed manufacturers to develop plates that are both ergonomically optimized and capable of withstanding higher caliber threats.

In addition, defense agencies and law enforcement organizations are increasingly focusing on equipment standardization and long-term durability, enabling predictable performance in diverse operational environments As governments continue to prioritize soldier and officer safety, and private security needs grow, the market outlook remains positive, offering opportunities for innovation in next-generation body armor plates with enhanced protective capabilities and reduced weight.

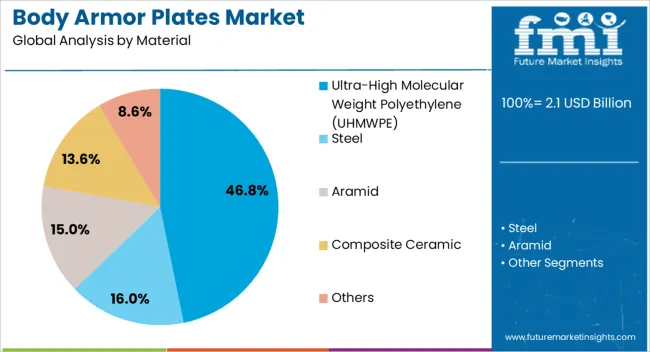

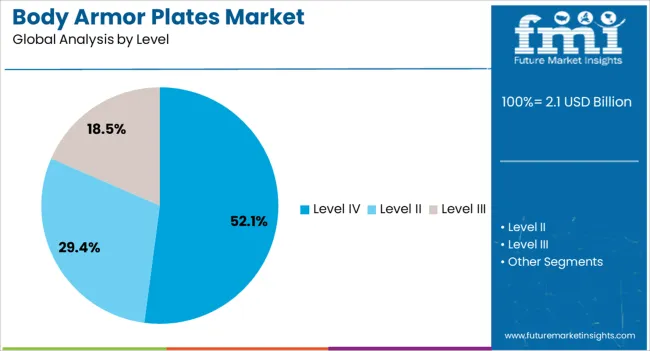

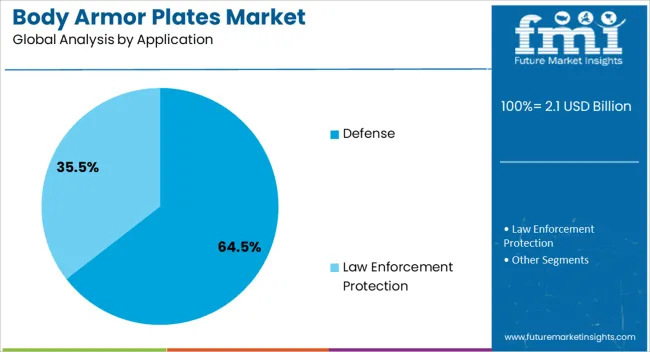

The body armor plates market is segmented by material, level, application, and geographic regions. By material, body armor plates market is divided into Ultra-High Molecular Weight Polyethylene (UHMWPE), Steel, Aramid, Composite Ceramic, and Others. In terms of level, body armor plates market is classified into Level IV, Level II, and Level III. Based on application, body armor plates market is segmented into Defense and Law Enforcement Protection. Regionally, the body armor plates industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Ultra-High Molecular Weight Polyethylene (UHMWPE) material segment is projected to hold 46.8% of the Body Armor Plates market revenue share in 2025, making it the leading material. This position is being attributed to its exceptional strength-to-weight ratio, which provides high ballistic protection while maintaining mobility for personnel in tactical and combat situations. The widespread adoption has been facilitated by the material’s corrosion resistance, longevity, and compatibility with modern plate designs.

Growth has also been influenced by defense agencies’ preference for lighter armor systems that reduce fatigue and improve operational efficiency. UHMWPE plates can be integrated into modular body armor solutions and upgraded via design improvements without full replacement, enhancing cost efficiency.

Furthermore, the ability to maintain structural integrity under multiple impact scenarios has increased confidence among end users, further driving adoption The continued focus on mobility, comfort, and performance ensures UHMWPE will remain a preferred material in the body armor plates market.

The Level IV protection segment is anticipated to capture 52.1% of total revenue in 2025, establishing it as the leading protection level. This segment’s growth is being driven by the rising need for armor capable of stopping armor-piercing rounds and high-caliber threats. Level IV plates provide the highest ballistic protection in the market, making them essential for defense forces and high-risk security personnel.

Adoption has been reinforced by stricter safety protocols, growing security concerns, and the increasing use of tactical operations that involve high-threat scenarios. The scalability and modularity of Level IV systems allow for integration with vests, carriers, and other protective equipment, offering enhanced versatility.

In addition, the durability and reliability of Level IV plates under extreme conditions have encouraged widespread procurement and deployment in both defense and specialized commercial applications With continuous investment in advanced materials and manufacturing processes, the Level IV segment is expected to maintain market leadership while supporting operational readiness and personnel safety.

The Defense end-use industry segment is projected to hold 64.5% of the Body Armor Plates market revenue in 2025, making it the dominant sector. This leadership has been driven by heightened global military modernization programs, increased troop deployment in high-risk areas, and greater focus on force protection. Defense forces are increasingly procuring body armor plates that combine high-level ballistic protection with reduced weight to enhance soldier mobility and endurance during extended missions.

The demand has also been influenced by a preference for standardized and easily upgradeable armor solutions, which provide long-term cost efficiency and operational flexibility. Enhanced materials and plate designs allow for improved survivability while minimizing fatigue, which is critical in tactical scenarios.

The ongoing focus on soldier safety, compliance with international ballistic standards, and adoption of next-generation armor systems is sustaining the growth of the defense segment As global geopolitical tensions persist, the defense sector is expected to continue driving revenue growth in the body armor plates market.

The body armor plates market is expanding due to rising global defense spending, law enforcement modernization, and increased focus on personnel protection. North America and Europe lead with advanced ceramic, polyethylene, and composite plates designed for military and tactical applications, emphasizing lightweight protection and multi-threat resistance. Asia-Pacific shows strong growth driven by security modernization, border protection, and regional conflicts. Manufacturers differentiate through material innovation, weight reduction, ballistic performance, and multi-threat coverage. Regional regulations, procurement budgets, and operational requirements shape adoption, deployment strategies, and competitive positioning worldwide.

Adoption of body armor plates depends heavily on material composition and ballistic resistance. North America and Europe prioritize high-performance ceramic, ultra-high-molecular-weight polyethylene (UHMWPE), and composite plates that provide multi-threat protection while minimizing weight for tactical operations. Asia-Pacific markets increasingly adopt affordable ceramic and steel solutions balancing protection with cost for law enforcement and border security. Differences in ballistic performance and material choice affect survivability, mobility, and long-term operational effectiveness. Leading suppliers invest in advanced ceramics, hybrid composites, and modular design innovations, while regional manufacturers focus on practical, cost-efficient alternatives. Material and performance contrasts shape adoption, personnel safety, and market competitiveness across global body armor plate applications.

Lightweight and ergonomically designed armor plates are crucial for adoption, particularly in dynamic combat and law enforcement scenarios. North America and Europe prioritize thin, modular plates integrated with carrier systems to optimize mobility and reduce fatigue during prolonged missions. Asia-Pacific markets focus on practical lightweight solutions that provide adequate protection while maintaining affordability. Differences in weight and ergonomics affect user comfort, tactical efficiency, and operational readiness. Leading suppliers develop advanced layered composites, ergonomic cuts, and modular carriers for premium adoption, while regional manufacturers provide simplified designs prioritizing durability. Weight and ergonomic contrasts drive adoption, usability, and competitive differentiation in global body armor plate markets.

Compliance with international ballistic standards and local safety regulations strongly influences market adoption. North America and Europe enforce rigorous standards such as NIJ, HOSDB, and military certifications, ensuring consistent protection against specified threat levels. Asia-Pacific regulations vary; some advanced regions adopt international standards, while emerging markets implement local ballistic and quality guidelines. Differences in certification and regulatory rigor affect procurement approval, liability management, and operational safety. Suppliers providing certified, tested armor plates gain higher adoption and credibility, while regional producers focus on cost-effective compliance with domestic regulations. Certification and regulatory contrasts shape adoption, market trust, and competitive positioning in global body armor plate markets.

Armor plate adoption is also driven by adaptability to operational environments and emerging threat types. North America and Europe design plates to withstand ballistic, fragmentation, and stab threats in diverse environments from urban operations to battlefield conditions. Asia-Pacific markets adopt plates suited to local threat profiles, climatic conditions, and mobility requirements. Differences in adaptability and threat coverage affect mission readiness, user confidence, and procurement decisions. Leading suppliers develop modular plates with interchangeable layers and environmental resistance, while regional manufacturers provide robust, single-purpose solutions. Operational adaptability contrasts shape adoption, tactical effectiveness, and market competitiveness across global body armor plate segments.

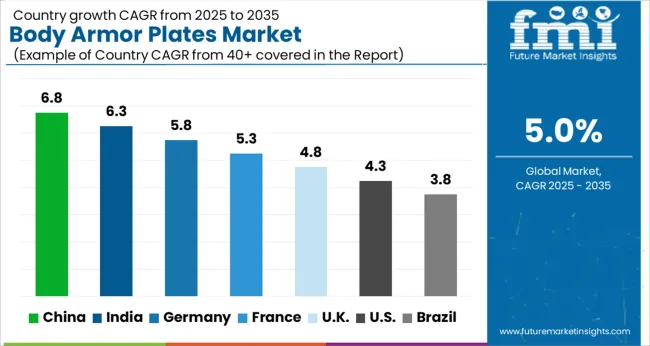

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

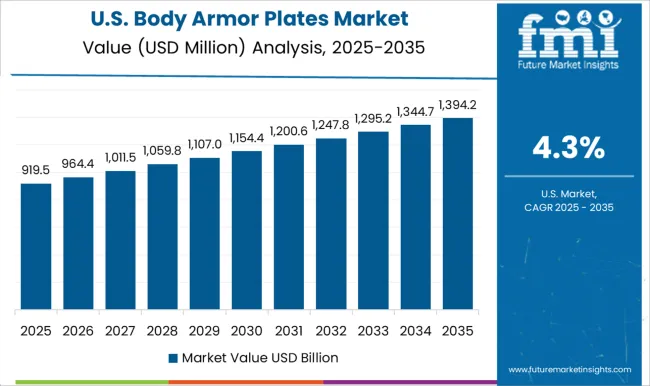

| USA | 4.3% |

| Brazil | 3.8% |

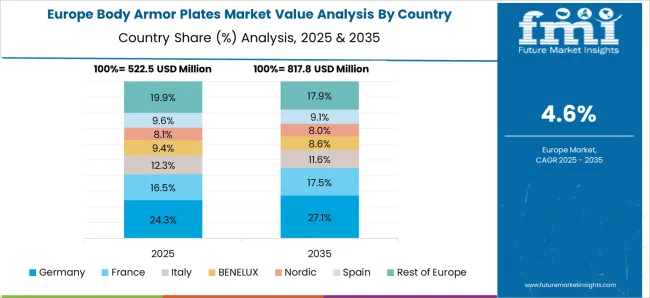

The global body armor plates market is projected to grow at a 5.0% CAGR through 2035, driven by demand in military, law enforcement, and private security applications. Among BRICS nations, China recorded 6.8% growth as large-scale production and deployment facilities were commissioned and compliance with defense and safety standards was enforced, while India at 6.3% growth saw expansion of manufacturing units to meet rising regional security demand. In the OECD region, Germany at 5.8% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 4.8% relied on moderate-scale operations for defense and law enforcement applications. The USA, expanding at 4.3%, remained a mature market with steady demand across military and security segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The body armor plates market in China is being driven at a CAGR of 6.8% due to rising demand from law enforcement, military, and private security sectors. Advanced materials such as ceramic, polyethylene, and composite plates are being adopted to improve ballistic protection and reduce weight. Manufacturers are being encouraged to produce durable, lightweight, and cost-efficient armor solutions. Distribution through defense contractors, authorized suppliers, and specialized retail channels is being maintained. Research and development in multi-threat protection, impact resistance, and ergonomic designs is being conducted. Rising security concerns, increasing protective requirements for personnel, and government procurement programs are being considered key factors driving the market growth in China.

The body armor plates market in India is being expanded at a CAGR of 6.3% with increasing procurement of body armor plates for police, paramilitary, and defense forces. Materials such as ceramic, polyethylene, and composite plates are being adopted to enhance protection and comfort. Manufacturers are being focused on producing cost-effective, lightweight, and high-quality solutions. Distribution through authorized defense contractors and security suppliers is being ensured. Awareness programs and training sessions for personnel are being conducted to promote proper usage. Rising security challenges, modernization of protective equipment, and government defense procurement policies are being considered major growth drivers in India.

Body armor plates market in germany is being driven at a CAGR of 5.8% due to demand from military, law enforcement, and private security services. Advanced composite, ceramic, and polyethylene plates are being adopted to improve ballistic protection and wearer comfort. Manufacturers are being encouraged to provide high quality, durable, and lightweight solutions. Distribution through specialized security suppliers, defense contractors, and authorized dealers is being maintained. Research and development in impact resistance, multi-threat protection, and ergonomics is being conducted. Germany’s focus on personnel safety and strict protective standards are being considered major factors supporting market growth.

The United Kingdom body armor plates market is being expanded at a CAGR of 4.8% with adoption of advanced body armor plates for defense, law enforcement, and security personnel. Materials such as ceramic and composite plates are being adopted to enhance protection and reduce weight. Manufacturers are being focused on delivering cost-efficient, lightweight, and high performance armor. Distribution through authorized suppliers, security contractors, and defense procurement channels is being ensured. Training programs and awareness campaigns are being conducted to ensure proper usage. Rising security concerns, modernization of protective equipment, and government procurement policies are being considered key drivers for market growth in the United Kingdom.

The United States body armor plates market is being driven at a CAGR of 4.3% due to growing demand from military, law enforcement, and private security sectors. Advanced body armor plates, including ceramic, composite, and polyethylene materials, are being adopted to provide improved protection while minimizing weight. Manufacturers are being encouraged to supply durable, high-quality, and ergonomically designed solutions. Distribution through authorized defense contractors, security suppliers, and specialized retail channels is being maintained. Research and development in multi-threat protection, impact resistance, and enhanced ergonomics is being conducted. Rising security needs, modernization of protective equipment, and government procurement programs are being considered key factors supporting market growth in the United States.

The body armor plates market is being driven by increasing demand from military, law enforcement, and private security sectors, as safety and protection requirements continue to rise globally. Technological advancements in materials such as ultra-high-molecular-weight polyethylene (UHMWPE), ceramic composites, and advanced metals are enhancing the protective capabilities of armor plates while reducing weight for improved mobility. The market is also witnessing growth due to geopolitical tensions, rising urban crime rates, and the adoption of enhanced personal protective equipment (PPE) standards. Key companies leading this market include BAE Systems plc, AEGIS Engineering Systems, Armored Republic, LLC, Ballistic Body Armour Pty., Bluewater Defense Inc., Ceradyne Inc. (a subsidiary of 3M), and Craig International Ballistics Pty. Ltd. These organizations are investing heavily in research and development to create lighter, stronger, and more flexible armor solutions capable of protecting against a variety of ballistic threats. BAE Systems is recognized for its cutting-edge military-grade body armor plates used in defense applications, combining ceramics and advanced polymer technologies. AEGIS Engineering Systems specializes in customizable armor solutions for both personnel and vehicle protection, focusing on modular and multi-threat protection designs. Armored Republic, LLC and Bluewater Defense Inc. are innovators in high-performance ballistic plates designed for tactical operations, emergency responders, and private security personnel. Ballistic Body Armour Pty. and Craig International Ballistics Pty. Ltd. provide a combination of standard and bespoke protective solutions to address varying levels of ballistic resistance. Ceradyne Inc., under 3M, continues to advance ceramic-based armor plates that offer superior multi-hit resistance while maintaining reduced weight for enhanced operational efficiency. The market is expanding due to increased defense budgets, heightened awareness of personal safety, and the integration of body armor with wearable technology. Emerging trends include the development of multi-layered armor systems, enhanced ergonomics, and environmental resistance for extreme conditions. Additionally, public-private partnerships and government contracts are creating opportunities for market growth, particularly in North America, Europe, and Asia-Pacific regions. As threats continue to evolve, leading players are expected to focus on innovation, cost-efficient production, and global distribution networks to meet the growing demand for advanced body armor plates. Continuous material innovation and compliance with stringent safety standards will be pivotal in maintaining competitive advantages in this market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Material | Ultra-High Molecular Weight Polyethylene (UHMWPE), Steel, Aramid, Composite Ceramic, and Others |

| Level | Level IV, Level II, and Level III |

| Application | Defense and Law Enforcement Protection |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BAE Systems plc, AEGIS Engineering Systems, Armored Republic, LLC, Ballistic Body Armour Pty., Bluewater Defense Inc., Ceradyne Inc. (Subsidiary of 3M), and Craig International Ballistics Pty. Ltd. |

| Additional Attributes | Dollar sales vary by plate type, including ceramic, polyethylene, and composite plates; by application, such as military, law enforcement, and personal protection; by end-use, spanning defense forces, police agencies, and private security; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising security concerns, modernization of protective gear, and demand for lightweight, high-performance armor solutions. |

The global body armor plates market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the body armor plates market is projected to reach USD 3.4 billion by 2035.

The body armor plates market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in body armor plates market are ultra-high molecular weight polyethylene (uhmwpe), steel, aramid, composite ceramic and others.

In terms of level, level iv segment to command 52.1% share in the body armor plates market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Body Armor Market Analysis - Size, Share & Forecast 2025 to 2035

Body Composition Monitor and Scale Market Size and Share Forecast Outlook 2025 to 2035

Body Tape Market Size and Share Forecast Outlook 2025 to 2035

Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Body Blurring Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Body Contouring Market Size and Share Forecast Outlook 2025 to 2035

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

Body-Worn Temperature Sensors Market Analysis by Type, Application, and Region through 2025 to 2035

Body Fat Measurement Market Analysis - Trends, Growth & Forecast 2025 to 2035

Body Slimming Devices Market Analysis by Product, End-User and Region through 2035

Leading Providers & Market Share in Body Augmentation Fillers

Body Firming Creams Market Growth & Forecast 2025-2035

Body Luminizer Market Trends & Forecast 2025 to 2035

Body Scrub Market Growth & Forecast 2025 to 2035

Body Dryer Market

Armored Vehicle Market

Plates Market

Body In White Market

Antibody Market Size and Share Forecast Outlook 2025 to 2035

CCW Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA