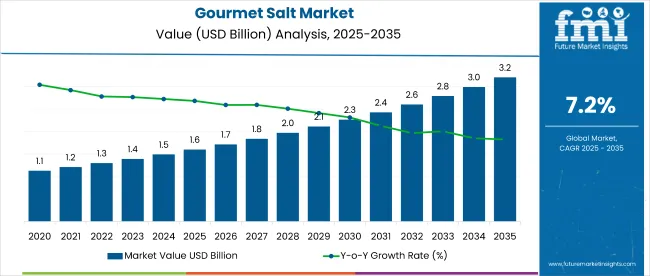

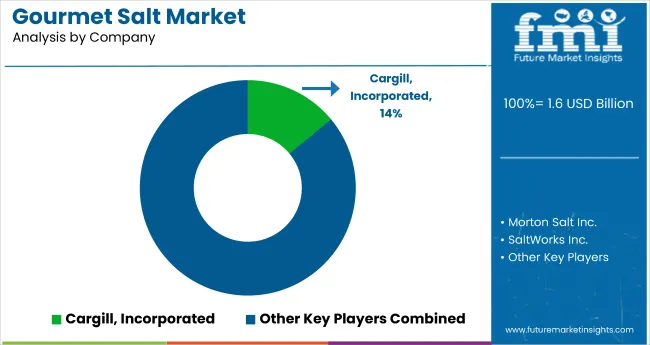

The global gourmet salt market is projected to grow from USD 1.6 billion in 2025 to USD 3.2 billion by 2035, registering a CAGR of 7.2%. This growth is driven by rising consumer demand for premium, natural, and minimally processed food ingredients.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.6 billion |

| Industry Value (2035F) | USD 3.2 billion |

| CAGR (2025 to 2035) | 7.2% |

Increasing awareness about the mineral-rich composition and health benefits of gourmet salts, such as Himalayan pink salt, fleur de sel, and sea salt, is encouraging their adoption in everyday cooking as well as gourmet cuisine.

The market holds 60% share within the global specialty salt market, highlighting its dominance in high-end salt varieties. It accounts for nearly 45% of the premium food ingredients market due to rising demand for natural and minimally processed products. In the natural food additives segment, gourmet salt contributes around 25%, driven by its preservative and flavor-enhancing properties. It holds about 5% share in the overall food flavor enhancer market and 18% in the natural food preservatives segment. However, in the broader food and beverage ingredients market, its share remains modest at below 0.1%.

Government regulations impacting the market emphasize product purity, origin labeling, and additive content. In the United States, the Food and Drug Administration (FDA) regulates food-grade salt under CFR Title 21, ensuring it is free from harmful contaminants. The European Union enforces Regulation (EC) No 1169/2011 for food information and labeling, while Codex Alimentarius standards provide global guidelines for salt quality and iodization. These regulations support the increasing demand for unrefined and additive-free gourmet salts, encouraging producers to invest in quality sourcing, certification, and transparent labeling practices.

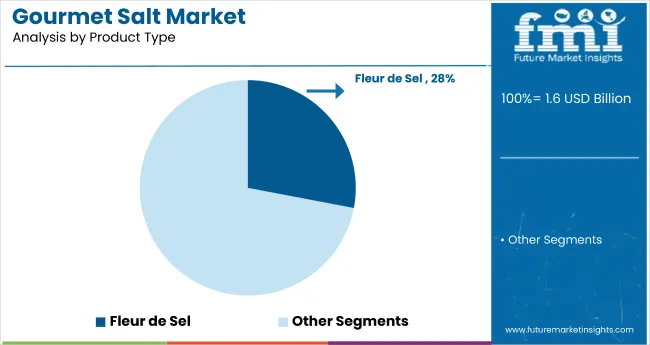

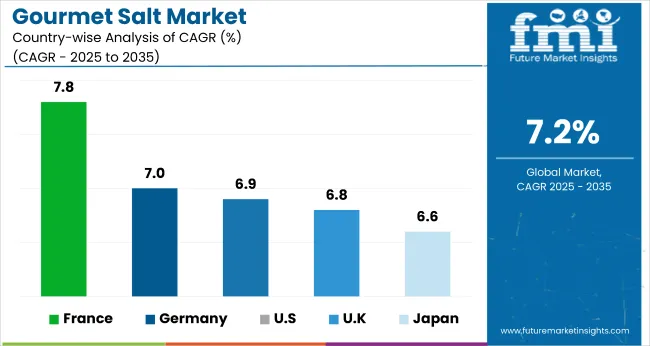

France is projected to be the fastest-growing market, expected to expand at a CAGR of 7.8% from 2025 to 2035. Fleur de Sel will lead the product type segment with a 28% share, while supermarkets and hypermarkets will dominate the distribution channel segment with a 40% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 6.9% and 7.0%, respectively. The UK and Japan are projected to expand at CAGRs of 6.8% and 6.6%, respectively.

The global market is segmented by product type, application, distribution channel, and region. By product type, the market includes coarse salt, flake salt, fleur de sel, Indian black salt, Italian sea salt, selgris sea salt, smoked sea salt, and others (bamboo salt, truffle salt, Hawaiian red salt, and Persian blue salt).

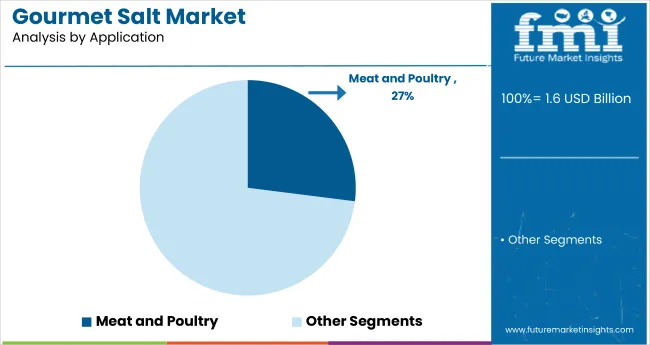

Based on application, the market is segmented into bakery and confectionery, meat and poultry, seafood, sauces and savory, desserts and frozen food, and others (snacks, ready-to-eat meals, beverages, and dairy products).

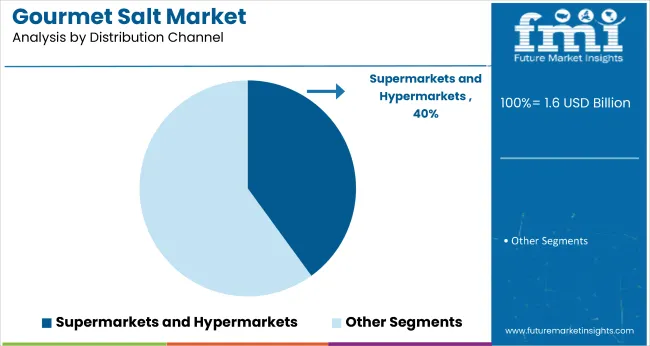

In terms of distribution channel, the market is classified into B2B (direct sales), B2C (indirect sales), store-based retailing, supermarket/hypermarket, convenience stores, groceries, specialty stores, other retailing formats, and online retailing. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Japan, and the Middle East and Africa.

Fleur de Sel is projected to dominate the product type segment with a 28% market share in 2025. Known for its delicate texture and high mineral content, this salt is hand-harvested and used in gourmet dishes and premium culinary applications.

Meat and poultry applications are projected to hold a 27% market share in 2025. Gourmet salts are widely used in this segment for their ability to enhance flavor and serve as natural preservatives, making them ideal for curing, seasoning, and improving the shelf life of processed and artisan meat products.

Supermarkets and hypermarkets are expected to lead the distribution channel segment with a 40% market share in 2025. Their wide consumer reach, organized shelf displays, and diverse product offerings make them the preferred retail format for purchasing gourmet salts, especially among health-conscious and premium product-seeking customers.

The global gourmet salt market is experiencing steady growth, driven by increasing consumer demand for premium, natural, and minimally processed food ingredients. Gourmet salts enhance flavor, visual appeal, and nutritional value, making them a preferred choice in culinary applications and premium food production.

Recent Trends in the Gourmet Salt Market

Challenges in the Gourmet Salt Market

France leads the market among key OECD countries, driven by traditional culinary usage and strong demand for artisanal salts like fleur de sel. Germany and Japan maintain consistent momentum due to EU clean-label mandates and Japan’s alignment with premium culinary trends and functional food innovation.

The European Green Deal continues to support sustainable food production in Germany and France. In contrast, developed economies such as the USA (6.9% CAGR), UK (6.8% CAGR), and France (7.8% CAGR) are expected to growat a steady 0.91-0.96x of the global growth rate.

France shows the strongest growth in the market, supported by deep-rooted culinary traditions and rising demand for premium salts like fleur de sel. Germany follows, with demand fueled by bakery, dairy, and charcuterie applications under strict EU clean-label guidelines. The USA market is expanding steadily, driven by consumer interest in natural and non-GMO salt varieties used in grilling and health foods.

The UK shows stable progress, supported by increased use in bakery and frozen meals despite sourcing challenges. Japan records the slowest growth among these countries, though demand remains resilient due to preferences for mineral-rich salts in traditional cuisine.

The report covers in-depth analysis of 40+ countries, five top-performing OECD countries are highlighted below.

The Japan gourmet salt market revenue is growing at a CAGR of 6.6% from 2025 to 2035. Growth is driven by consumer preference for authentic and mineral-rich salt varieties in traditional and fusion cuisines. As a high-income OECD market, Japan prioritizes clean-label and premium ingredients across food and beverage segments. While mass-market salt consumption is stable, demand for packaged Himalayan, smoked, and flavored salts is increasing across retail and foodservice channels.

The sales of gourmet salt in Germany are expected to expandat 7.0% CAGR during the forecast period, close to the global average and heavily regulation led. EU sustainability goals and clean-label compliance are boosting premium salt usage in bakery, cheese, and cured meat applications. Germany emphasizes origin labeling, natural ingredients, and organic certification in gourmet salts. The market aligns closely with European culinary trends and consumer transparency expectations.

The French gourmet salt market is projected to grow at a 7.8% CAGR during the forecast period, outpacing the global average. Growth is driven by traditional usage in culinary dishes and rising demand for high-end food experiences. French cuisine relies on fleur de sel and sea salt for authenticity, and domestic production of specialty salts supports the local market. The segment benefits from government support for artisanal producers and EU promotion of regional food identity.

The USA gourmet salt market is projected to grow at 6.9% CAGR from 2025 to 2035, translating to 0.96x the global rate. Demand is fueled by rising consumer interest in natural and unrefined ingredients, especially in premium retail, health food, and restaurant sectors. Himalayan salt, smoked salt, and infused salt blends are gaining popularity in meat rubs, snack seasoning, and sauces. Clean-label trends and non-GMO preferences continue to shape product development and packaging.

The UK gourmet salt revenue is projected to grow at a CAGR of 6.8% from 2025 to 2035, slightly below the global average at 0.94 times the global pace. Growth is supported by consumer focus on health, origin traceability, and reduced sodium options. Post-Brexit import adjustments have affected sourcing, but local distribution networks remain strong. Increasing demand for sea salt and flavored salts across bakery and frozen meals sustains volume growth.

The global market is moderately fragmented, with key players such as Cargill, Incorporated, SaltWorks Inc., Amagansett Sea Salt Co., Murray River, and Morton Salt Inc. leading the industry. These companies offer a diverse range of premium salts tailored for culinary excellence, health-conscious consumers, and artisanal applications. Cargill, Incorporated focuses on large-scale natural salt production with sustainability in mind, while SaltWorks Inc. specializes in handcrafted, flavored, and mineral-rich gourmet salts.

Amagansett Sea Salt Co. and Alaska Pure Sea Salt Co. are known for small-batch, solar-evaporated sea salts, catering to niche gourmet markets. Morton Salt Inc. and Maldon Crystal Salt Company Limited maintain strong retail distribution networks and offer widely recognized gourmet salt brands. Other notable players such as Saltopia Artisan Infused Sea Salts, SüdwestdeutscheSalzwerke AG, SeaSalt Superstore LLC, The Savory Pantry, and The Meadow (Bitterman and Sons, Inc.) contribute by offering unique infusions, region-specific salts, and premium culinary-grade salt varieties.

Recent Gourmet Salt Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 3.2 billion |

| CAGR (2025 to 2035) | 7.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Product Types Analyzed | Coarse Salt, Flake Salt, Fleur de Sel, Indian Black Salt, Italian Sea Salt, Sel Gris Sea Salt, Smoked Sea Salt, others (bamboo salt, truffle salt, Hawaiian red salt, and Persian blue salt) |

| Applications Analyzed | Bakery & Confectionery, Meat & Poultry, Seafood, Sauces & Savory, Desserts & Frozen Food, others (snacks, ready-to-eat meals, beverages, and dairy products) . |

| Distribution Channels Analyzed | B2B (Direct Sales), B2C (Indirect Sales), Store-based Retailing, Supermarket/Hypermarket, Convenience Stores, Groceries, Specialty Stores, Other Retailing Formats, Online Retailing |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market | Cargill, Incorporated, SaltWorks Inc., Amagansett Sea Salt Co., Murray River, Morton Salt Inc., Alaska Pure Sea Salt Co., Maldon Crystal Salt Company Limited, Saltopia Artisan Infused Sea Salts, Südwestdeutsche Salzwerke AG, SeaSalt Superstore LLC, The Savory Pantry, Evolution Salt Co., INFOSA, Salty Wahine Gourmet Hawaiian Sea Salts LLC, The Meadow (Bitterman and Sons, Inc.) |

| Additional Attributes | Dollar sales by salt type, share by distribution channel, regional consumption trends, clean-label influence, artisanal product launches, competitive benchmarking |

The global gourmet salt market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the gourmet salt market is projected to reach USD 3.2 billion by 2035.

The gourmet salt market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in gourmet salt market are coarse salt, flake salt, fleur de sel, indian black salt, italian sea salt, sel griss sea salt, smoked sea salt and others.

In terms of application, bakery & confectionery segment to command 41.7% share in the gourmet salt market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gourmet Salts Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Salt Content Reduction Ingredients Market Size & Trends 2035

Salt Meter Market

Salt Hydrate Market

Basalt Rock Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fiber Reinforced Polymer BFRP Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fibre Market Size & Forecast 2024-2034

Sea Salt Market Analysis – Size, Share & Forecast 2024 to 2034

Soap Salts Market Size and Share Forecast Outlook 2025 to 2035

Bath Salts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Lemon Salt Market Trends - Citrus-Infused Seasoning Demand 2025 to 2035

Cobalt Salt for Tires Market Size and Share Forecast Outlook 2025 to 2035

Cesium Salts Market Size and Share Forecast Outlook 2025 to 2035

Smoked Salt Market Trends - Growth, Demand & Forecast 2025 to 2035

Ginger Salt Market Trends – Flavor Innovation & Industry Demand 2025 to 2035

Analyzing Celtic Salt Market Share & Industry Leaders

Pretzel Salt Market Size and Share Forecast Outlook 2025 to 2035

Acetate Salt Market Size and Share Forecast Outlook 2025 to 2035

Vanilla Salt Market Insights - Sweet & Savory Fusion Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA