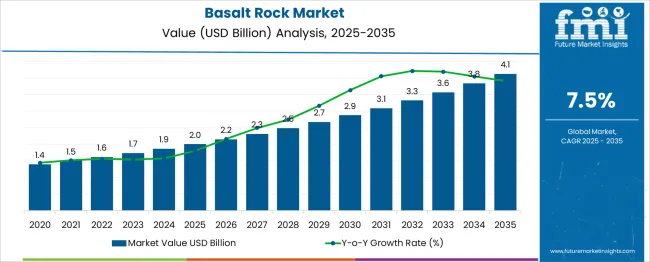

The global basalt rock market is projected to grow from USD 2 billion in 2025 to approximately USD 4.1 billion by 2035, recording an absolute increase of USD 2.122 billion over the forecast period. This translates into a total growth of 106.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.5% between 2025 and 2035. The overall market size is expected to grow by nearly 2.06X during the same period, supported by increasing demand for sustainable construction materials, rising adoption of basalt fiber in composite applications, and growing infrastructure development projects worldwide. The market's expansion is further driven by the material's superior properties including high temperature resistance, chemical stability, and environmental sustainability compared to traditional alternatives.

Between 2025 and 2030, the basalt rock market is projected to expand from USD 2.0 billion to USD 2.87 billion, resulting in a value increase of USD 0.87 billion, which represents 41.0% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating adoption of basalt-based materials in green building initiatives, increasing replacement of traditional reinforcement materials with basalt fiber composites, and expanding applications in automotive light weighting solutions. Construction companies and infrastructure developers are increasingly recognizing basalt's superior durability and environmental credentials, driving demand for basalt aggregates and tiles in major construction projects across developing economies.

| Metric | Value |

| Estimated Value in (2025E) | USD 2 billion |

| Forecast Value in (2035F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

From 2030 to 2035, the market is forecast to grow from USD 2.87 billion to USD 4.1 billion, adding another USD 1.2 billion, which constitutes 59% of the overall ten-year expansion. This period is expected to be characterized by widespread commercialization of basalt fiber in aerospace applications, integration of basalt-based materials in renewable energy infrastructure, and development of advanced basalt composite technologies. The growing emphasis on circular economy principles and carbon-neutral construction materials will accelerate adoption of basalt products as sustainable alternatives to carbon fiber and glass fiber reinforcements, particularly in high-performance applications requiring superior mechanical properties and environmental resistance.

Between 2020 and 2025, the basalt rock market experienced steady expansion, driven by increasing awareness of basalt's unique properties and growing demand for sustainable construction materials. The market developed as manufacturers recognized basalt's potential as a cost-effective alternative to carbon fiber in various applications, while maintaining comparable performance characteristics. Government initiatives promoting green building standards and sustainable infrastructure development began emphasizing the importance of environmentally friendly materials, positioning basalt rock products as preferred solutions for modern construction and manufacturing challenges.

Market expansion is being supported by the increasing global focus on sustainable construction materials and the corresponding demand for environmentally friendly alternatives to traditional building products. Construction companies and infrastructure developers are increasingly adopting basalt-based materials due to their superior durability, resistance to chemical corrosion, and excellent thermal properties. Basalt rock's natural abundance and minimal processing requirements make it an attractive option for large-scale infrastructure projects seeking to reduce environmental impact while maintaining structural integrity and performance standards.

The growing emphasis on lightweight materials in automotive and aerospace industries is driving demand for basalt fiber composites as alternatives to traditional glass and carbon fiber reinforcements. Basalt fiber offers an optimal balance of mechanical properties, cost-effectiveness, and sustainability that appeals to manufacturers seeking to reduce vehicle weight and improve fuel efficiency. The material's excellent fatigue resistance and vibration damping characteristics make it particularly suitable for automotive components, while its non-conductive properties and radar transparency create opportunities in telecommunications and defense applications.

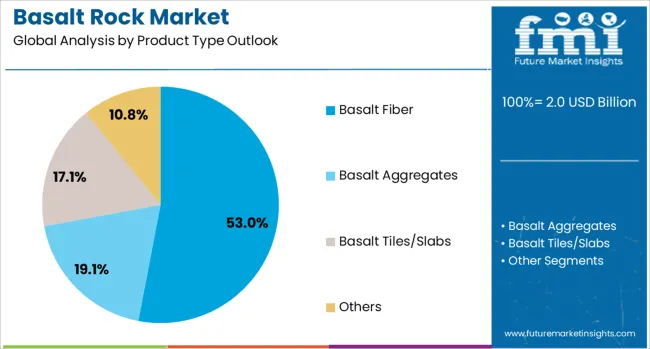

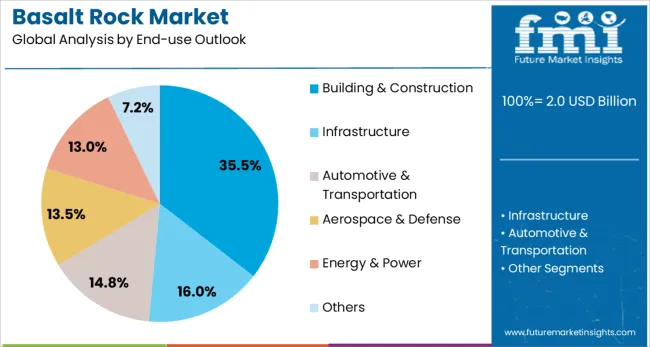

The market is segmented by product type, end-use industry, and region. By product type, the market is divided into basalt fiber, basalt aggregates, basalt tiles/slabs, and others. Based on end-use industry, the market is categorized into building & construction, infrastructure, automotive & transportation, aerospace & defense, energy & power, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The basalt fiber segment is projected to account for 53% of the basalt rock market in 2025, establishing its position as the highest value-added product category. This dominance reflects the growing recognition of basalt fiber as a sustainable and cost-effective alternative to glass and carbon fibers in composite applications. Manufacturers across automotive, construction, and wind energy sectors are increasingly adopting basalt fiber for its excellent mechanical properties, including high tensile strength, superior chemical resistance, and outstanding thermal stability that performs well in extreme temperature conditions.

The segment benefits from continuous technological improvements in fiber production processes, resulting in more consistent quality and expanded application possibilities. Advanced continuous basalt fiber manufacturing techniques have enabled production of high-performance materials suitable for demanding applications in aerospace and defense industries. With growing emphasis on sustainable materials and circular economy principles, basalt fiber's natural origin and recyclability provide significant advantages over synthetic alternatives, positioning it as a preferred reinforcement material for next-generation composite applications across multiple industries.

Building & construction applications are projected to represent 35.5% of basalt rock market demand in 2025, underscoring the material's fundamental role in modern construction practices. The segment's prominence is driven by increasing adoption of basalt-based materials in concrete reinforcement, structural applications, and architectural elements. Basalt aggregates provide superior durability and weather resistance compared to traditional materials, while basalt fiber reinforcements offer excellent tensile strength and corrosion resistance in concrete structures, extending service life and reducing maintenance requirements.

Green building certifications and sustainable construction standards are accelerating adoption of basalt materials as environmentally friendly alternatives to traditional construction products. The material's natural thermal and acoustic insulation properties make it particularly valuable for energy-efficient building designs. Additionally, basalt tiles and slabs are gaining popularity in architectural applications due to their aesthetic appeal, durability, and low maintenance requirements. As construction industries worldwide prioritize sustainability and long-term performance, basalt rock products are becoming integral components of modern building systems.

The basalt rock market is advancing rapidly due to increasing demand for sustainable construction materials and growing adoption of lightweight composites in various industries. However, the market faces challenges including limited production capacity for high-quality basalt fiber, lack of standardized specifications, and competition from established materials like glass and carbon fibers. Innovation in processing technologies and expanding application development continue to influence market growth patterns and competitive dynamics.

Continuous improvements in basalt fiber manufacturing technologies are enhancing product quality and reducing production costs. Advanced melting techniques and precision control systems enable production of consistent, high-performance fibers suitable for demanding applications. Manufacturers are developing specialized coatings and surface treatments that improve fiber-matrix adhesion in composite applications, expanding the material's utility across different resin systems and manufacturing processes.

Rapid urbanization and infrastructure development in Asia Pacific and Middle East regions are creating substantial demand for basalt rock products. Government investments in transportation infrastructure, including highways, bridges, and railways, require durable construction materials that can withstand harsh environmental conditions. Basalt aggregates and reinforcement materials offer cost-effective solutions for these large-scale projects while meeting performance requirements for structural integrity and longevity.

| Country | CAGR (2025-2035) |

| China | 10.1% |

| India | 9.3% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

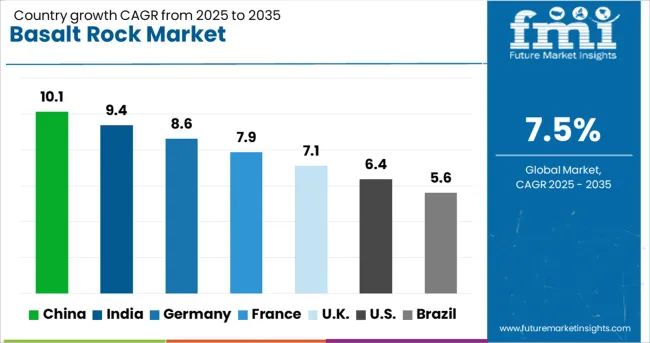

The basalt rock market is experiencing varied growth rates globally, with China leading at a 10.1% CAGR through 2035, driven by massive infrastructure development projects, rapid industrialization, and government support for green building materials. India follows at 9.3%, supported by expanding construction sector, infrastructure modernization initiatives, and growing adoption of advanced composite materials. Germany shows strong growth at 8.6%, emphasizing technological innovation and sustainable manufacturing practices. France records 7.9%, focusing on green construction and infrastructure renovation. The UK demonstrates 7.1% growth, prioritizing sustainable building materials and circular economy principles. The USA shows steady expansion at 6.4%, driven by infrastructure renewal programs and composite applications development. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from basalt rock products in China is projected to exhibit strong growth with a CAGR of 10.1% through 2035, driven by massive infrastructure development initiatives including the Belt and Road Initiative and domestic urbanization programs. The country's expanding high-speed rail network, bridge construction projects, and green building initiatives are creating unprecedented demand for basalt-based construction materials. Chinese manufacturers are rapidly scaling production capacity for basalt fiber and developing advanced processing technologies to meet growing domestic and export demand.

Revenue from basalt rock products in India is expanding at a CAGR of 9.3%, supported by rapid urbanization, infrastructure development programs, and growing construction activities. The country's Smart Cities Mission and highway development projects are driving demand for durable construction materials that can withstand diverse climatic conditions. Indian manufacturers are establishing production facilities for basalt fiber and processed basalt products to serve both domestic and regional markets.

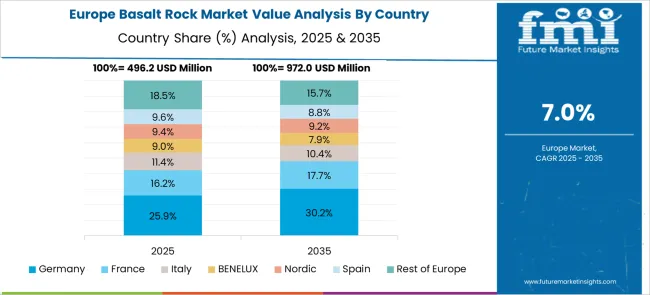

The basalt rock market in Europe demonstrates strong development across major economies with Germany showing robust presence through its advanced manufacturing capabilities and focus on sustainable construction materials, supported by stringent environmental regulations driving adoption of basalt-based products in infrastructure and automotive applications. The country's well-established composites industry and research institutions are pioneering innovative basalt fiber applications, particularly in lightweight automotive components and wind energy systems, leveraging the material's excellent mechanical properties and environmental benefits.

France represents a significant market driven by its emphasis on green building standards and infrastructure modernization programs, with construction companies increasingly specifying basalt materials for their durability and sustainability credentials in major public works projects. The UK exhibits considerable growth through government initiatives promoting sustainable construction and circular economy principles, with basalt products gaining traction in both new construction and infrastructure rehabilitation projects. Italy and Spain show expanding adoption in architectural applications, particularly basalt tiles and decorative elements that combine aesthetic appeal with superior weather resistance. Nordic countries contribute through their focus on energy-efficient building materials and harsh climate durability requirements, while Eastern European nations display growing potential driven by infrastructure development needs and increasing awareness of basalt's cost-performance advantages across construction and industrial applications.

Demand for basalt rock products in Germany is projected to grow at a CAGR of 8.6%, supported by the country's leadership in composite materials technology and sustainable manufacturing practices. German manufacturers are developing advanced basalt fiber applications for automotive light weighting, wind energy components, and high-performance industrial applications. The country's strong research infrastructure and collaboration between industry and academia are driving innovation in basalt material processing and application development.

Revenue from basalt rock products in France is projected to grow at a CAGR of 7.9% through 2035, driven by national commitments to sustainable construction and carbon reduction targets. French construction companies are increasingly adopting basalt-based materials for their superior durability and environmental credentials in both new construction and renovation projects. The country's emphasis on heritage preservation and infrastructure modernization creates unique opportunities for basalt applications.

Revenue from basalt rock products in the UK is projected to grow at a CAGR of 7.1% through 2035, supported by government initiatives promoting sustainable construction and infrastructure resilience. British companies are adopting basalt materials for their durability and low maintenance requirements in challenging weather conditions. The market benefits from strong focus on life-cycle cost analysis and sustainable procurement policies in public sector projects.

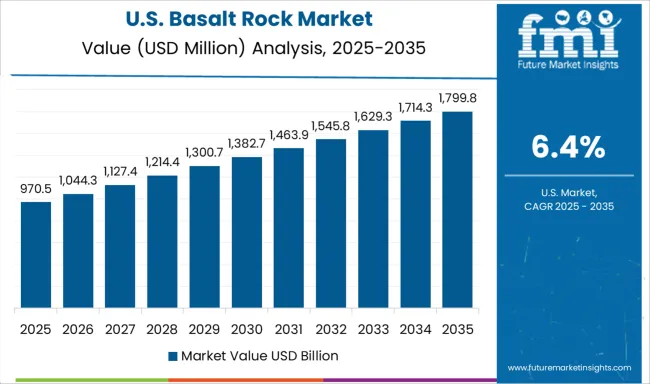

Demand for basalt rock products in the USA is projected to grow at a CAGR of 6.4%, supported by federal infrastructure investment programs and growing adoption of advanced composite materials. American manufacturers are developing specialized basalt fiber applications for aerospace, defense, and energy sectors, leveraging the material's unique properties for high-performance applications. The market benefits from established composites industry infrastructure and technical expertise.

Revenue from basalt rock products in Brazil is projected to grow at a CAGR of 5.6% through 2035, supported by the country's abundant basalt reserves and growing construction sector. Brazilian companies are developing domestic production capacity for basalt aggregates and exploring opportunities in basalt fiber manufacturing. The market benefits from increasing awareness of sustainable construction materials and growing infrastructure investment in urban areas.

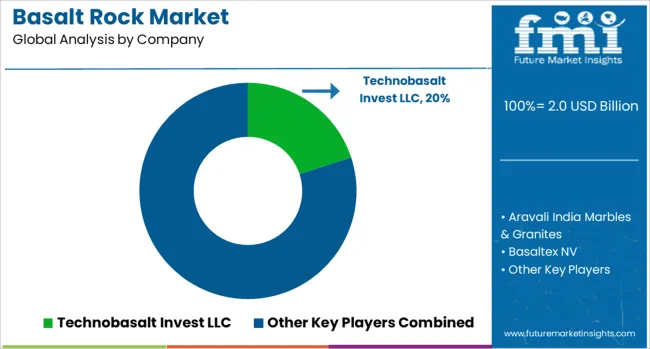

The basalt rock market is characterized by competition among specialized fiber manufacturers, aggregate producers, and integrated material companies. Companies are investing in production capacity expansion, technology development, quality certification, and market education to establish strong positions in this evolving market. Product innovation, cost optimization, and application development are central to building competitive advantages and market share.

Technobasalt Invest LLC leads with approximately 20% market share in specialized basalt fiber production, offering high-performance continuous basalt fiber for composite applications with focus on aerospace and automotive sectors. Aravali India Marbles & Granites provides comprehensive basalt stone products including tiles, slabs, and architectural elements for construction markets. Basaltex NV, Belgium-based, specializes in basalt fiber textiles and reinforcement materials with emphasis on technical textiles and composite applications. Basalt Fiber Tech focuses on innovative basalt fiber products and custom solutions for industrial applications.

Deutsche Basalt Faser GmbH, Germany, provides high-quality basalt fiber products with emphasis on consistent quality and technical support for European manufacturers. Galen Ltd offers basalt fiber reinforcement materials and composite solutions for construction and infrastructure applications. Jumeisheng and Kamenny Vek operate in Asian markets, providing basalt fiber and processed basalt products for regional construction and manufacturing industries. Mafic SA specializes in basalt fiber production with patented technology for consistent fiber quality. Mudanjiang Basalt Fiber Co. Ltd and Shanxi Basalt Fiber Technology Co., Ltd. represent China's growing presence in basalt fiber manufacturing, serving both domestic and international markets with competitive pricing and expanding production capacity.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.0 billion |

| Product Type | Basalt Fiber, Basalt Aggregates, Basalt Tiles/Slabs, Others |

| End-Use Industry | Building & Construction, Infrastructure, Automotive & Transportation, Aerospace & Defense, Energy & Power, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Technobasalt Invest LLC, Aravali India Marbles & Granites, Basaltex NV, Basalt Fiber Tech, Deutsche Basalt Faser GmbH, Galen Ltd, Jumeisheng, Kamenny Vek, Mafic SA, Mudanjiang Basalt Fiber Co. Ltd, and Shanxi Basalt Fiber Technology Co., Ltd. |

| Additional Attributes | Dollar sales by fiber diameter and length specifications, regional production capacity analysis, competitive landscape assessment, buyer preferences for different basalt grades, integration with composite manufacturing processes, innovations in surface treatment technologies, sustainable sourcing practices, and circular economy applications |

The global basalt rock market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the basalt rock market is projected to reach USD 4.1 billion by 2035.

The basalt rock market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in basalt rock market are basalt fiber, basalt aggregates, basalt tiles/slabs and others.

In terms of end-use outlook, building & construction segment to command 35.5% share in the basalt rock market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Basalt Fiber Reinforced Polymer BFRP Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fibre Market Size & Forecast 2024-2034

Rock-Socketed Drilling Rig Market Size and Share Forecast Outlook 2025 to 2035

Rocket Wrench Market Size and Share Forecast Outlook 2025 to 2035

Rock Drill Shank Adaptor Market Size and Share Forecast Outlook 2025 to 2035

Rocker Switch Market Size and Share Forecast Outlook 2025 to 2035

Rocket Propulsion Market Size and Share Forecast Outlook 2025 to 2035

Rockets and Missiles Market Size and Share Forecast Outlook 2025 to 2035

Rockbreakers Market Growth - Trends & Forecast 2025 to 2035

Rock Duster Market Growth - Trends & Forecast 2025 to 2035

Rocking Bioreactors Market

Rocket Propellant Chemicals Market

Crock Meter Market

Brush Rocker Market Growth - Trends & Forecast 2025 to 2035

Laboratory Rockers and Shakers Market Size and Share Forecast Outlook 2025 to 2035

Automotive Rocker Arm Market Growth – Trends & Forecast 2025 to 2035

Automotive Chain Sprockets Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Chain Sprocket Market Analysis - Size, Share, and Forecast 2025 to 2035

Two Wheeler Chain Sprocket Kit Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA