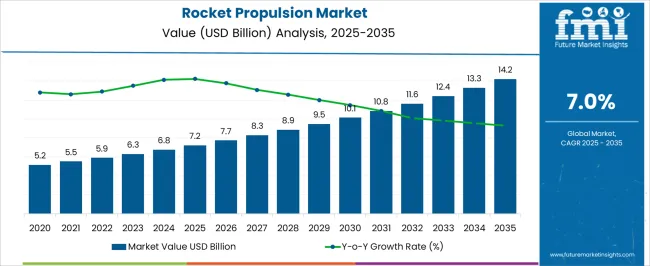

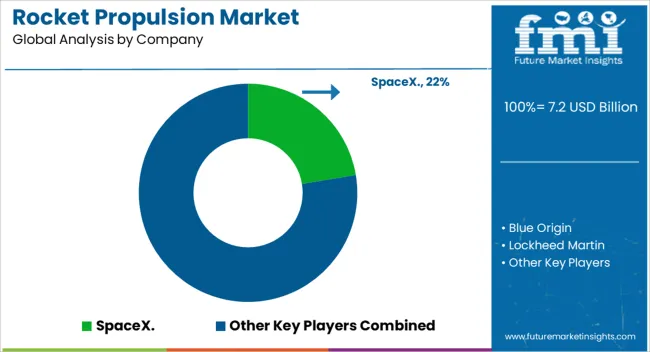

The rocket propulsion market is estimated to be valued at USD 7.2 billion in 2025 and is projected to reach USD 14.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

From 2025 to 2030, the market is expected to move from USD 7.2 billion to USD 10.1 billion, highlighting steady year-on-year gains. This growth block is being driven by the increasing launch frequency of satellites, rising government spending on defense programs, and growing commercial interest in space exploration. Demand for both liquid and solid propulsion systems is strengthening, with hybrid and reusable models gaining attention as stakeholders focus on efficiency, reliability, and performance. The progression underscores how the industry is transitioning toward wider commercial participation while maintaining strong defense-related demand.

Between 2030 and 2035, the market is projected to expand further from USD 10.1 billion to USD 14.2 billion, indicating a smooth yet accelerating trajectory. This second half of growth reflects continued emphasis on heavy-lift capabilities, expanding private investments in launch services, and the development of propulsion systems optimized for deep-space missions. The year-on-year increases from USD 10.8 billion in 2031 to USD 13.3 billion in 2034 highlight strong momentum in both government and commercial projects. The predictable shape of the curve indicates sustained growth opportunities, with competition centered around advancements in cost efficiency and payload capacity. As stakeholders continue to invest heavily in both national space programs and private space ventures, the rocket propulsion market is positioned to remain on a strong long-term expansion path.

| Metric | Value |

|---|---|

| Rocket Propulsion Market Estimated Value in (2025 E) | USD 7.2 billion |

| Rocket Propulsion Market Forecast Value in (2035 F) | USD 14.2 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The rocket propulsion market secures a critical position across several larger aerospace and defense domains, with its share shaped by reliance on advanced engines for both commercial and military applications. Within the aerospace propulsion systems market, rocket propulsion accounts for about 18%, reflecting its importance alongside jet engines and turbofans. In the space launch services market, its share is significantly higher at nearly 40%, since propulsion systems represent the most crucial technology enabling orbital and suborbital launches. Within the defense and military missile systems market, rocket propulsion contributes around 25%, as solid and liquid propulsion technologies are central to guided missile capabilities.

In the aerospace and defense equipment market, the share of rocket propulsion stands close to 10%, given that the broader market also encompasses avionics, airframes, and surveillance systems. Finally, within the satellite deployment and space exploration market, rocket propulsion represents about 30%, highlighting its indispensable role in enabling satellite constellations, deep-space missions, and interplanetary exploration. Collectively, these percentages illustrate that rocket propulsion maintains its strongest relevance in launch services and space exploration, where no alternative exists for achieving orbital access. Its sizable share in defense missile systems further reinforces its strategic role, while more moderate contributions in wider aerospace markets reflect the diversity of competing technologies. This distribution underlines rocket propulsion’s critical but specialized position, balancing niche influence in large markets with dominance in space-driven segments.

The rocket propulsion market is gaining strong momentum, fueled by surging satellite deployment, space tourism advancements, and increasing government-private collaborations in space exploration. Growth is also being propelled by heightened investments in reusable launch vehicles and advanced propulsion systems.

As commercial space companies expand their launch portfolios, the demand for efficient, scalable, and cost-optimized propulsion solutions is intensifying. Geopolitical interests in space-based defense infrastructure and remote sensing further support the sector’s expansion.

Technological strides in liquid and hybrid fuel systems, as well as miniaturized propulsion for CubeSats, continue to reshape market boundaries.

The rocket propulsion market is segmented by type, fuel type, orbit type, vehicle type, end-use, and geographic regions. By type, rocket propulsion market is divided into rocket engines and rocket motors. In terms of fuel type, rocket propulsion market is classified into liquid fuel, solid fuel, and hybrid fuel. Based on orbit type, rocket propulsion market is segmented into low Earth orbit, medium Earth orbit, geostationary Earth orbit, and beyond geosynchronous Earth orbit. By vehicle type, rocket propulsion market is segmented into unmanned and manned. By end-use, rocket propulsion market is segmented into defense & civil and commercial. Regionally, the rocket propulsion industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

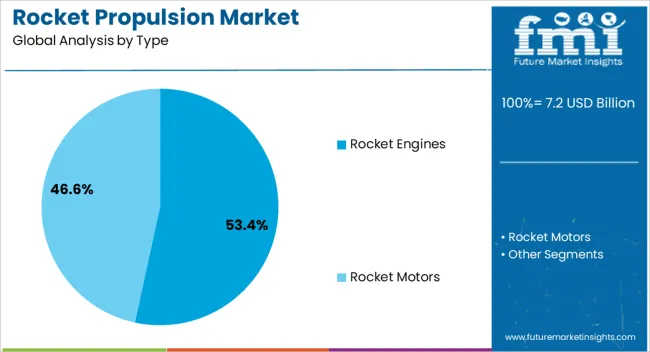

Rocket engines are anticipated to lead the market with a 53.40% share in 2025, driven by their essential role in nearly all orbital and suborbital launches. Their proven efficiency, high thrust-to-weight ratios, and adaptability across various mission profiles position them as the propulsion system of choice. Continuous R&D in nozzle design, reusability, and thrust vector control enhances performance across both governmental and commercial missions. Rocket engines are also benefiting from scalable configurations suitable for multi-stage launches, deep space missions, and reusable launch platforms.

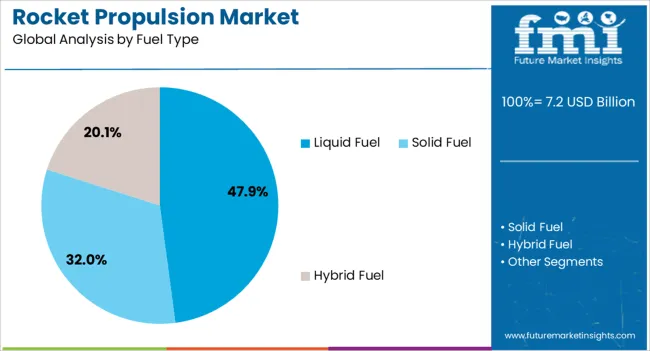

Liquid fuel-based systems are projected to dominate with 47.90% of the market share by 2025, owing to their superior controllability, higher energy density, and suitability for deep-space missions. Liquid propulsion enables throttling, restart capability, and precise orbital maneuvering, making it ideal for mission-critical applications. Innovations in cryogenic technology and green propellants are improving the safety and efficiency of these systems. Liquid fuel engines also play a central role in reusable launch vehicle programs, contributing to long-term cost reductions and higher launch cadence.

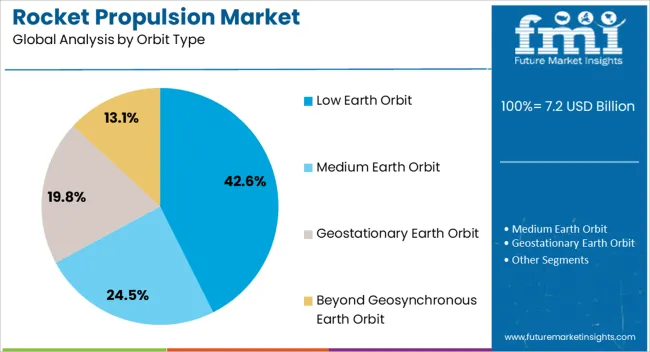

Low Earth Orbit (LEO) is expected to capture 42.60% of the market in 2025, making it the leading orbit type in rocket propulsion demand. LEO’s accessibility, shorter orbital periods, and suitability for Earth observation, broadband internet, and IoT satellite constellations are driving launch frequency. Commercial players are aggressively expanding their LEO satellite fleets, intensifying the need for reliable, quick-turnaround propulsion systems. Additionally, government-funded missions targeting surveillance, climate monitoring, and space debris mitigation frequently rely on LEO launches. The segment’s dominance is also reinforced by favorable economics and operational agility.

The rocket propulsion market is advancing as demand rises from satellite launches, defense programs, and space exploration initiatives. Opportunities are strengthening through private space ventures, commercial tourism, and emerging national space agencies, while trends emphasize reusability and fuel innovations. High costs, technical risks, and strict safety standards remain critical challenges. In my opinion, long-term competitiveness will favor companies that deliver efficient, reusable, and cost-optimized propulsion systems, ensuring they remain central to the expansion of global aerospace, defense, and commercial space operations.

Demand for rocket propulsion systems has been driven by the increasing number of satellite launches, deep-space missions, and defense-related programs. Governments and private companies are investing in reliable propulsion technologies to ensure payload efficiency and mission success. Reusable launch systems are also influencing demand for advanced engines with higher durability and precision. In my opinion, demand will continue to rise as both commercial and governmental entities accelerate space exploration, communications infrastructure, and defense preparedness, making rocket propulsion a cornerstone of the global aerospace industry.

Opportunities are expanding with the entry of private companies offering commercial launch services. Lower launch costs and growing interest in space tourism, lunar missions, and asteroid mining are creating new business models for propulsion system providers. Emerging economies are investing in indigenous space programs, further expanding opportunities for local manufacturers and international collaborations. I believe companies that focus on scalable propulsion designs and partnerships with private space ventures will secure long-term opportunities, as commercial demand broadens the scope of applications beyond traditional government missions.

Trends in the rocket propulsion market highlight the shift toward reusability and innovations in propellants. Companies are focusing on engines that can withstand multiple launches, reducing overall mission costs. Propellant advancements such as cryogenic fuels, hybrid systems, and environmentally safer alternatives are gaining prominence. In my opinion, these trends indicate that propulsion is not just about raw thrust but also efficiency, cost-effectiveness, and adaptability, reflecting a broader evolution of aerospace engineering toward meeting both performance goals and commercial viability in launch services.

Challenges include extremely high development costs, technical complexity, and stringent safety requirements. The financial risks associated with propulsion system failures remain significant, deterring smaller entrants from competing effectively. Supply chain disruptions for critical materials and geopolitical tensions add further challenges to program continuity. In my assessment, only organizations with strong funding, proven technical expertise, and vertically integrated capabilities will succeed in overcoming these hurdles, while others may face long delays, cancellations, or inability to scale in the fiercely competitive propulsion market.

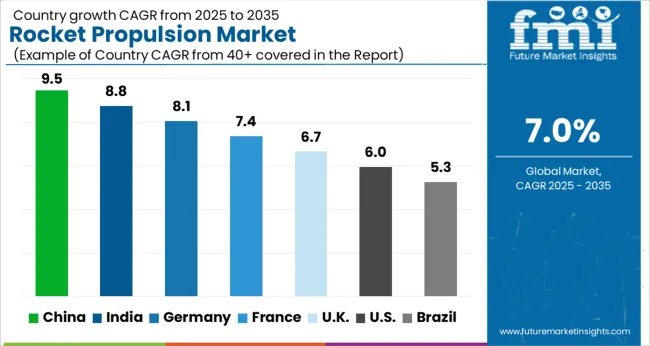

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

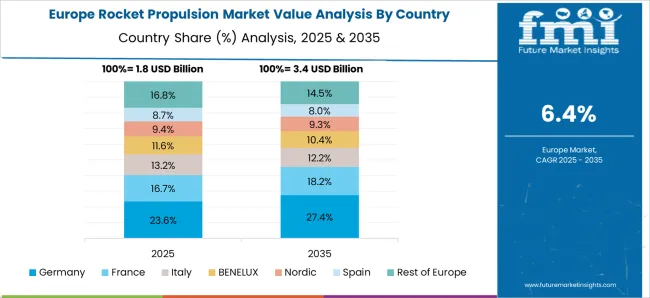

The global rocket propulsion market is projected to grow at a CAGR of 7% from 2025 to 2035. China leads with a growth rate of 9.5%, followed by India at 8.8%, and Germany at 8.1%. The United Kingdom records a growth rate of 6.7%, while the United States shows the slowest growth at 6%. Growth is supported by rising satellite launches, expanding space exploration programs, and increased investments in defense and commercial space applications. Emerging economies such as China and India are advancing rapidly due to government funding and private sector innovation, while mature markets like the USA, UK, and Germany emphasize reusable propulsion systems, high-thrust engines, and integration with commercial satellite operators. This report includes insights on 40+ countries; the top markets are shown here for reference.

The rocket propulsion market in China is projected to grow at a CAGR of 9.5%. China’s ambitious space programs, led by the China National Space Administration (CNSA), are a primary driver of growth. Frequent satellite launches, lunar exploration missions, and the development of reusable launch systems are fueling demand for advanced propulsion technologies. Rising private sector involvement and government-backed investments are expanding domestic capabilities. China is also focusing on high-thrust liquid engines and solid-propellant systems to support both defense and commercial applications, positioning itself as a global leader in rocket propulsion.

The rocket propulsion market in India is expected to grow at a CAGR of 8.8%. The Indian Space Research Organisation (ISRO) is expanding its launch capabilities, with missions for Earth observation, communications, and interplanetary exploration driving demand. Indigenous development of cryogenic engines and reusable launch vehicle programs is strengthening local expertise. Private sector companies, supported by favorable government policies, are contributing to propulsion system innovation. India’s growing role in commercial satellite launches and cost-effective launch services further enhances market opportunities.

The rocket propulsion market in Germany is projected to grow at a CAGR of 8.1%. Germany plays a critical role in European space programs under the European Space Agency (ESA). Investments in reusable propulsion systems, cryogenic engines, and green propellants are fueling innovation. Germany’s aerospace industry is focusing on collaboration with European partners to develop advanced launch systems and support commercial satellite operations. Demand is also supported by growing defense applications and the need for cost-efficient propulsion technologies.

The rocket propulsion market in the UK is projected to grow at a CAGR of 6.7%. Growth is supported by government initiatives to build domestic launch capabilities and partnerships with private aerospace firms. The UK Space Agency is focusing on satellite launch services, with particular emphasis on small-satellite propulsion solutions. Development of spaceports in Scotland and Wales is boosting opportunities for launch providers. Increasing interest in green propellants and reusable propulsion systems is shaping the market, positioning the UK as an emerging hub for specialized propulsion technologies.

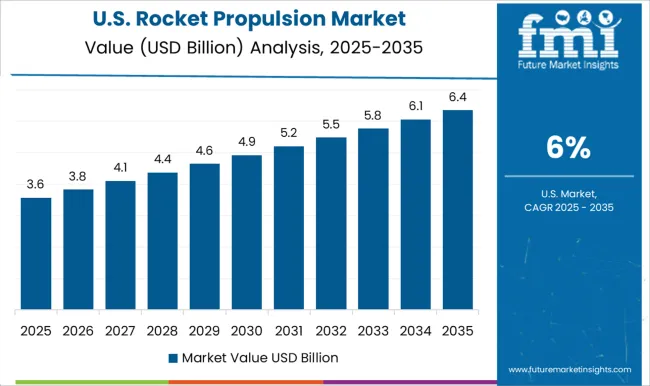

The rocket propulsion market in the USA is projected to grow at a CAGR of 6%. Despite slower growth compared to emerging markets, the USA remains a global leader in rocket propulsion technologies. NASA, SpaceX, Blue Origin, and other players are advancing reusable launch systems and high-performance engines. Defense applications, including missile propulsion and hypersonic technologies, also contribute significantly to demand. Federal investments and private sector innovation ensure continuous progress in propulsion efficiency, cost reduction, and advanced materials. The USA market’s focus on both commercial and defense applications secures its long-term global leadership.

Competition in rocket propulsion has intensified as private pioneers and aerospace giants pursue efficiency, reusability, and power scalability. SpaceX and Blue Origin have set benchmarks with reusable engine architectures, propelling demand for lower launch costs and rapid turnaround. SpaceX’s Raptor engines highlight methane-fueled efficiency for Starship, while Blue Origin promotes BE-4 propulsion for both orbital and suborbital applications. Boeing and Lockheed Martin, through the United Launch Alliance, integrate propulsion into legacy systems with proven reliability, appealing to government and defense launches. Airbus Defence and Space emphasizes European collaboration with Ariane programs, ensuring independence in access to orbit. In Asia, Korea Aerospace Industries and Hanwha Aerospace push indigenous propulsion platforms, aimed at advancing self-reliance and boosting regional presence in both commercial and defense launches. Each player’s positioning reflects a balance between innovation-driven disruption and heritage-backed credibility. Strategies focus on material breakthroughs, digital simulation, and reusability economics.

SpaceX invests in mass manufacturing of methane engines and thermal shielding for high-cycle performance, while Blue Origin advances cryogenic propellant handling for heavy-lift missions. Lockheed Martin and Boeing leverage deep defense ties, highlighting mission assurance and multi-launch reliability as competitive pillars. Airbus drives cross-European supply chain cooperation, spreading risk and maximizing research capability. Korean and Korean Hanwha Aerospace emphasize state funding support, working toward competitive pricing and export potential. Product brochures showcase thrust ratings, reusability cycles, propellant efficiency, and payload lift capabilities, often reinforced with visual schematics of combustion chambers and turbopump assemblies. Messages stress performance advantages, safety margins, and lifecycle cost reduction. By blending engineering precision with mission-oriented storytelling, these brochures act as both technical specifications and persuasive marketing instruments, shaping operator confidence and attracting governments, satellite firms, and space exploration programs seeking propulsion solutions that balance cost, innovation, and reliability.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.2 billion |

| Type | Rocket Engines and Rocket Motors |

| Fuel Type | Liquid Fuel, Solid Fuel, and Hybrid Fuel |

| Orbit Type | Low Earth Orbit, Medium Earth Orbit, Geostationary Earth Orbit, and Beyond Geosynchronous Earth Orbit |

| Vehicle Type | Unmanned and Manned |

| End-Use | Defense & Civil and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SpaceX., Blue Origin, Lockheed Martin, Airbus Defence and Space, Korea Aerospace Industries., Hanwha Aerospace, and The Boeing Company |

| Additional Attributes | Dollar sales by propulsion type (liquid, solid, hybrid, electric), Dollar sales by application (launch vehicles, missiles, spacecraft), Trends in reusable launch systems and miniaturized satellites, Use in defense programs and commercial space exploration, Growth in private aerospace investments, Regional development hubs across North America, Europe, and Asia-Pacific. |

The global rocket propulsion market is estimated to be valued at USD 7.2 billion in 2025.

The market size for the rocket propulsion market is projected to reach USD 14.2 billion by 2035.

The rocket propulsion market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in rocket propulsion market are rocket engines and rocket motors.

In terms of fuel type, liquid fuel segment to command 47.9% share in the rocket propulsion market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rocket Wrench Market Size and Share Forecast Outlook 2025 to 2035

Rockets and Missiles Market Size and Share Forecast Outlook 2025 to 2035

Rocket Propellant Chemicals Market

Automotive Chain Sprockets Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Chain Sprocket Market Analysis - Size, Share, and Forecast 2025 to 2035

Two Wheeler Chain Sprocket Kit Market

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Systems Market

Market Share Breakdown of Electrified Aircraft Propulsion Manufacturers

Electrified Aircraft Propulsion Market Analysis by Power Distribution and Power Conversion application through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA