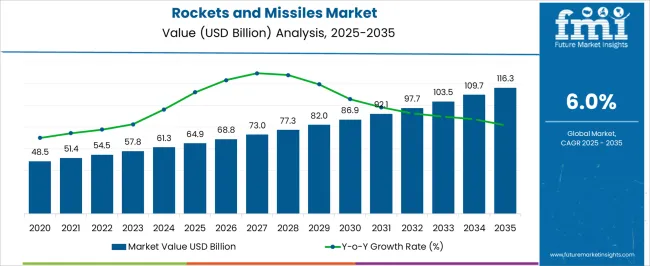

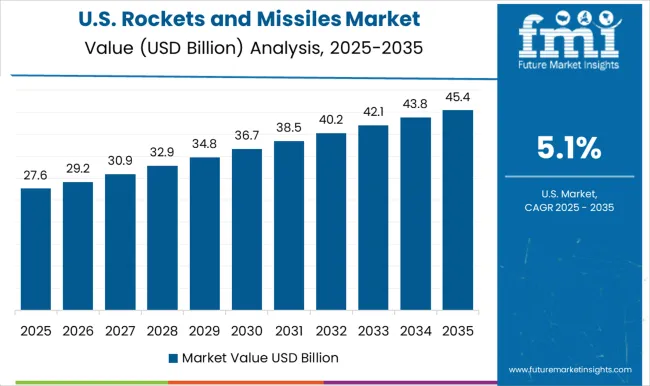

The Rockets and Missiles Market is estimated to be valued at USD 64.9 billion in 2025 and is projected to reach USD 116.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. During the initial phase from 2024 to 2029, the market rises from USD 48.5 billion to USD 64.9 billion, with year-on-year milestones including USD 51.4 billion in 2025, USD 54.5 billion in 2026, USD 57.8 billion in 2027, USD 61.3 billion in 2028, and USD 64.9 billion in 2029. This period reflects heightened defense budgets, regional security tensions, and modernization of armed forces with advanced missile systems offering precision targeting and extended ranges.

From 2030 to 2034, the market climbs from USD 68.8 billion to USD 97.7 billion, with critical steps such as USD 73.0 billion in 2030, USD 77.3 billion in 2031, USD 82.0 billion in 2032, USD 86.9 billion in 2033, and USD 92.1 billion in 2034. Growth in this stage is shaped by greater adoption of hypersonic weapons, integration of AI-enabled guidance systems, and the emergence of multi-domain warfare strategies. The final forecast stage from 2035 to 2039 continues the upward path, expanding from USD 103.5 billion in 2035 to USD 116.3 billion in 2039, supported by continued investment in space militarization, countermeasure technologies, and global defense collaborations.

Strategic priorities among leading nations emphasize indigenous production capabilities, supply chain resilience, and interoperability in joint operations. While challenges such as escalating production costs, export restrictions, and international treaties impose limitations, the overall trajectory demonstrates a strong and sustained rise, positioning rockets and missiles as one of the most critical segments in future defense expenditure worldwide.

| Metric | Value |

|---|---|

| Rockets and Missiles Market Estimated Value in (2025 E) | USD 64.9 billion |

| Rockets and Missiles Market Forecast Value in (2035 F) | USD 116.3 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The rockets and missiles market is expanding steadily due to rising defense budgets, evolving threat landscapes, and the advancement of precision-guided munitions across global military forces. Nations are focusing on modernizing their offensive and defensive capabilities to address both conventional and asymmetric warfare challenges.

The adoption of next generation missile technologies, including smart propulsion systems and advanced guidance mechanisms, is supporting this trend. Strategic collaborations between defense contractors and government agencies are facilitating innovation in range, payload, and deployment versatility.

Additionally, regional tensions and border security concerns are prompting accelerated procurement of tactical and strategic missile systems. The future market outlook remains strong, driven by continued geopolitical instability, technological breakthroughs, and integration of rockets and missiles into multi domain operations including space and cyber warfare environments.

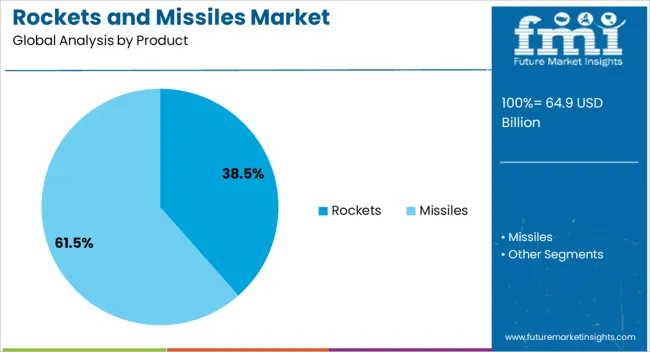

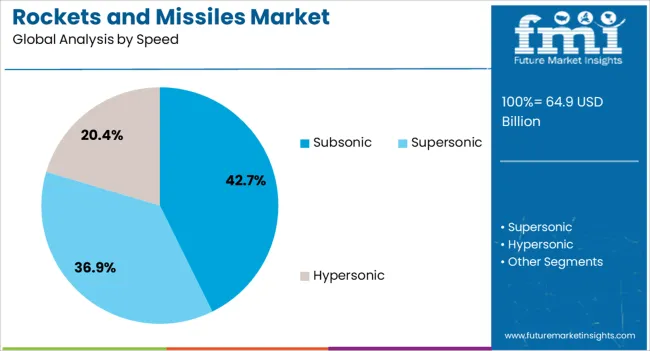

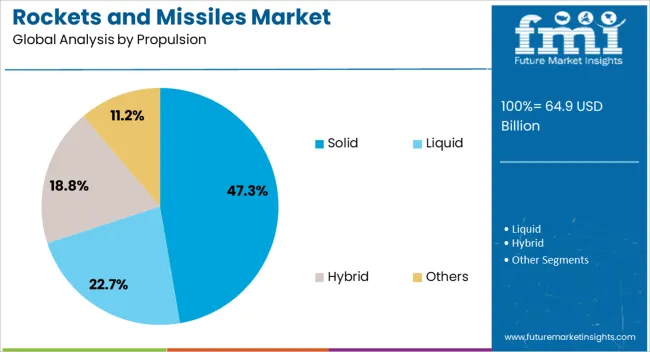

The rockets and missiles market is segmented by product, speed, propulsion, launch mode, and geographic regions. By product, the rockets and missiles market is divided into Rockets and Missiles. In terms of speed, the rockets and missiles market is classified into Subsonic, Supersonic, and Hypersonic. Based on propulsion, the rockets and missiles market is segmented into Solid, Liquid, Hybrid, and Others.

By launch mode, the rockets and missiles market is segmented into Surface-to-surface, Surface-to-air, Air-to-air, Air-to-surface, and Subsurface-to-surface. Regionally, the rockets and missiles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rockets segment is anticipated to hold 38.50% of the total market share by 2025 within the product category, positioning it as a leading contributor. This dominance is attributed to their cost-effectiveness, simpler design, and wide applicability across short-range combat operations and training exercises.

Unlike guided missiles, rockets do not rely on onboard guidance systems, which reduces production costs and enables mass deployment. Their use in artillery and close air support roles has been crucial for ground force effectiveness.

Moreover, defense programs focused on enhancing rapid response capabilities and ammunition stockpiles continue to support the procurement of advanced rocket systems, thereby reinforcing their stronghold within the product segment.

The subsonic segment is projected to account for 42.70% of the market by 2025 under the speed category. This is due to their high adaptability across tactical operations, stealth advantages, and cost efficiency.

Subsonic rockets and missiles are preferred for missions requiring lower radar detectability and precision at medium ranges. Their compatibility with various launch platforms including land, sea, and air based systems increases their operational value.

Furthermore, advancements in low observable technologies and terrain hugging flight capabilities are enhancing the effectiveness of subsonic systems in complex combat environments. As global military strategies prioritize flexibility and mission diversity, the subsonic segment remains a key pillar of growth.

The solid propulsion segment is expected to represent 47.30% of total market revenue by 2025 within the propulsion category, establishing it as the dominant choice. This prominence is supported by the simplicity of design, longer shelf life, and quick launch readiness offered by solid propulsion systems.

These systems require less maintenance and are well-suited for rapid deployment scenarios where reaction time is critical. Their usage in both tactical and strategic weapons has made them a staple in missile development programs.

Additionally, continuous improvements in composite propellant formulations and manufacturing processes are enhancing performance, reliability and range. These benefits have ensured solid propulsion’s leadership in propulsion technology across global defense applications.

The rockets and missiles market is driven by defense demand, strategic partnerships, innovation in missile systems, and private sector investments. These dynamics are shaping the future of defense and aerospace markets.

The rockets and missiles market is propelled by increasing defense budgets across various countries. Rising geopolitical tensions and the need for advanced defense capabilities have further intensified the demand for missile systems. Nations are prioritizing missile defense technologies and precision-guided systems to enhance security measures. The ongoing focus on military modernization and advanced weaponry technologies plays a significant role in pushing the market forward. Demand for missile defense systems to protect against air, missile, and drone threats remains strong, especially in regions with higher security concerns. These factors combine to create a robust growth forecast for the market.

Key industry players in the rockets and missiles sector are forming strategic partnerships to strengthen their market position. Collaboration between defense contractors and governments enables the development of tailored missile systems and integrated defense solutions. Joint ventures also promote advanced research and development efforts, resulting in cost-effective and technologically superior systems. Furthermore, these partnerships provide an opportunity to expand into new geographic markets, including emerging defense markets in the Middle East and Asia-Pacific regions. Government contracts continue to play a significant role in driving revenues and expanding the reach of major defense manufacturers.

Continued investment in enhancing missile guidance and targeting systems is helping boost market growth. Modern missile systems now incorporate sophisticated tracking technologies and multi-target capabilities, increasing their effectiveness in combat situations. Research into hypersonic missiles is also gaining momentum, offering long-range, high-speed capabilities that traditional missile systems cannot match. The defense sector is increasingly adopting advanced propulsion technologies, improving missile performance and reducing operational costs. As a result, the demand for next-generation missile systems is expected to rise, with a focus on efficiency, reliability, and precision in critical missions.

Private companies are now playing a larger role in the rockets and missiles market, driving innovation and increasing competition. The expansion of private space companies into the missile launch and defense sectors is transforming market dynamics. These companies are introducing cost-effective alternatives to traditional missile systems and developing reusable rocket technology, which significantly reduces launch costs. Additionally, the growing role of private-sector manufacturers in space exploration projects has led to advancements in commercial rocket systems. As the demand for space missions and satellite launches increases, private companies are well-positioned to capitalize on this expanding market.

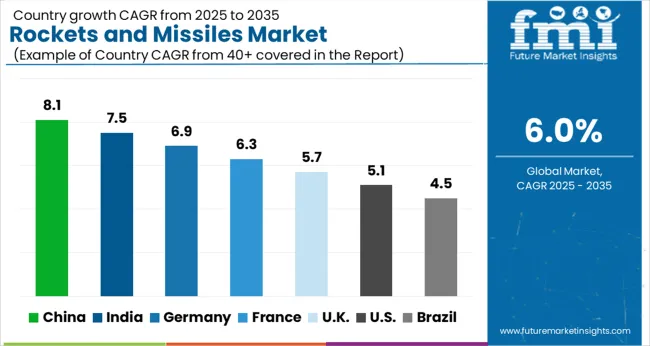

| Countries | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The rockets and missiles market is projected to grow globally at a CAGR of 6.0% from 2025 to 2035, with China leading the way at 8.1%. This growth is primarily driven by ongoing investments in defense technologies and military advancements. India follows with a 7.5% CAGR, supported by a focus on modernizing its defense systems. France posts a 6.3% CAGR, driven by strategic military collaborations and national defense priorities. The UK contributes a 5.7% growth, while the USA maintains a 5.1% CAGR, shaped by rising investments in missile defense systems and advanced weaponry.

The CAGR for the United Kingdom's rockets and missiles market was approximately 4.9% during 2020–2024 and is projected to rise to 5.7% for the 2025–2035 period. The shift in growth rate is driven by increased defense investments, particularly in missile defense and advanced weapon systems. During 2020–2024, growth was moderate as the focus was on strengthening existing defense capabilities. From 2025 onward, the market is expected to accelerate due to technological advancements in missile systems and the UK's expanding partnerships within NATO. These factors will lead to a significant boost in defense capabilities and missile market growth.

China's rockets and missiles market achieved a CAGR of 8.1% during 2020–2024 and is expected to rise even further in the 2025–2035 period. The high growth rate during this period is attributed to China's increased investment in missile technologies, space exploration, and national defense. During 2020–2024, the market was fueled by the development of advanced missile systems and greater military spending. From 2025 onward, the focus on hypersonic missiles, missile defense systems, and space defense technologies will continue to drive growth, solidifying China as a leading global player in the missile market.

India’s rockets and missiles market is projected to grow at a CAGR of 7.5% during 2020–2024, driven by increased defense expenditure and a strategic focus on missile defense systems. The initial period saw moderate growth as India worked on enhancing both domestic production and defense imports. During 2020–2024, India emphasized its focus on developing advanced indigenous missile systems and integrating them into the national defense strategy. From 2025–2035, continued investment in missile technology and space exploration will lead to significant growth in the market, driven by regional security concerns and military modernization.

France's rockets and missiles market saw a CAGR of 6.3% during 2020–2024, driven by strategic defense contracts and collaborations with the European Union. France focused on advancing its missile defense capabilities and investing in space defense technologies. The market saw significant growth as the country prioritized the development of multi-role and hypersonic missile systems. From 2025 onward, France's missile market is expected to continue expanding, driven by increased defense spending, technological development in missile systems, and the nation's growing geopolitical influence.

The USA rockets and missiles market, with a CAGR of 5.1% during 2020–2024, is poised for significant growth in the 2025–2035 period. The market was relatively slower in the initial period as focus shifted towards upgrading existing missile systems and enhancing defense infrastructure. From 2025 onward, advancements in autonomous missile technologies, radar systems, and expanding military collaborations will result in a more robust growth trajectory. The USA remains a leader in missile defense systems, contributing to global market leadership in missile technology development.

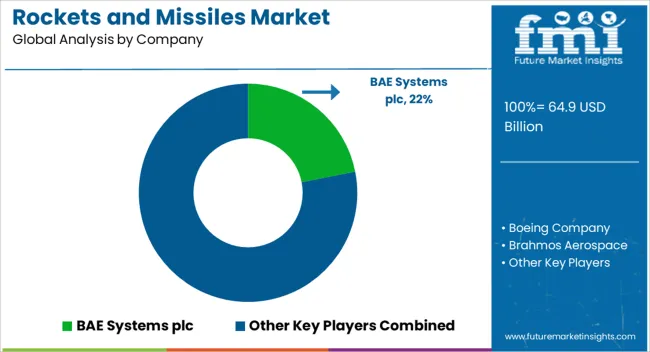

The rockets and missiles market is highly competitive, with numerous global defense contractors leading the charge in missile technology and aerospace innovations. BAE Systems plc stands as a key player, with strong capabilities in advanced defense technologies and precision-guided systems. Boeing Company remains a major competitor, offering cutting-edge missile defense solutions, including hypersonic and air defense systems. Brahmos Aerospace is known for its high-performance missile systems, particularly the Brahmos cruise missile, which has set benchmarks in missile technology.

China Aerospace Science and Industry Corporation (CASIC) continues to strengthen its position through the development of missile systems and space exploration technologies. Denel Dynamics, Irkut Corporation, and Kongsberg Gruppen ASA are key contributors with advanced air defense systems, missiles, and space exploration capabilities. Lockheed Martin Corporation and Raytheon Technologies Corporation are global leaders in missile defense technologies, known for their ongoing innovations in advanced missile systems and radar-guided solutions. Rheinmetall AG and Roketsan A.S. excel in missile technology and defense systems, with a focus on expanding their military offerings globally.

Saab AB, Safran S.A., and Thales Group continue to lead the market with cutting-edge advancements in missile guidance, defense electronics, and surveillance systems. Ongoing advancements heavily influence the competitive positioning in the rockets and missiles market in defense technology, global collaborations, and the ability to cater to diverse national security requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 64.9 Billion |

| Product | Rockets and Missiles |

| Speed | Subsonic, Supersonic, and Hypersonic |

| Propulsion | Solid, Liquid, Hybrid, and Others |

| Launch Mode | Surface-to-surface, Surface-to-air, Air-to-air, Air-to-surface, and Subsurface-to-surface |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BAE Systems plc, Boeing Company, Brahmos Aerospace, China Aerospace Science and Industry Corporation (CASIC), Denel Dynamics, Irkut Corporation, Kongsberg Gruppen ASA, Lockheed Martin Corporation, Raytheon Technologies Corporation, Rheinmetall AG, Roketsan A.S., Saab AB, Safran S.A., and Thales Group |

| Additional Attributes | Dollar sales projections, market share across regions, and competitive landscape analysis, they would be interested in understanding the strategies of key players, demand drivers such as increasing defense budgets and geopolitical tensions, and the regulatory landscape affecting market entry. |

The global rockets and missiles market is estimated to be valued at USD 64.9 billion in 2025.

The market size for the rockets and missiles market is projected to reach USD 116.3 billion by 2035.

The rockets and missiles market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in rockets and missiles market are rockets, _guided, _unguided, missiles, _cruise missiles, _ballistic missiles, _anti-tank missiles and _others.

In terms of speed, subsonic segment to command 42.7% share in the rockets and missiles market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Chain Sprockets Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Dandruff Control Shampoos Market Size and Share Forecast Outlook 2025 to 2035

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA