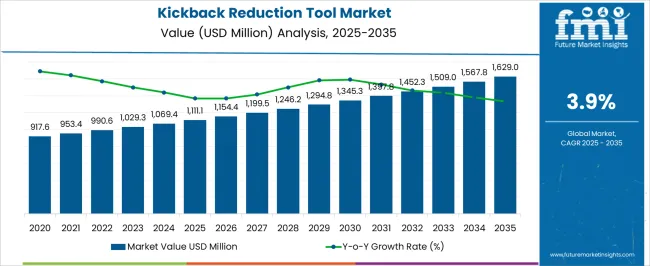

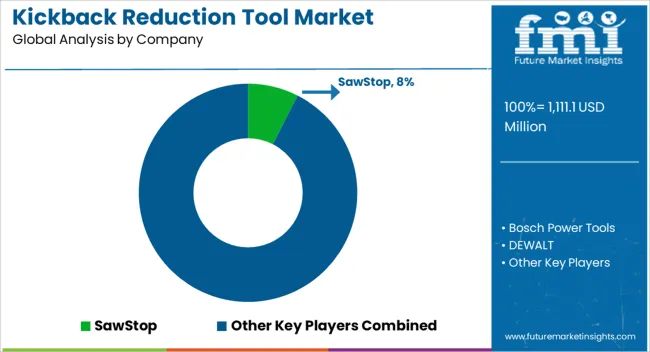

The global kickback reduction tool market is expected to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.6 billion by 2035. This reflects an absolute increase of USD 500 million, equivalent to a growth of 45.5% over the forecast period. The expansion is forecast to occur at a CAGR of 3.9%, with the market size estimated to grow by nearly 1.45X by the end of the decade.

The market is growing due to rising emphasis on workplace safety, stricter regulations, and increasing awareness of accident prevention in industries such as woodworking, metalworking, and construction. Kickback is a leading cause of tool-related injuries, and demand is rising for technologies that minimize risks while maintaining productivity. Manufacturers are integrating advanced safety mechanisms, sensors, and ergonomic designs into power tools to enhance user protection. Growing DIY culture, combined with professional demand for reliable and safer equipment, is also fueling adoption. Additionally, insurance and compliance requirements encourage businesses to invest in safer tools, driving consistent market expansion.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.1 billion |

| Industry Value (2035F) | USD 1.6 billion |

| CAGR (2025 to 2035) | 3.9% |

From 2020 to 2025, the market rose from USD 960.3 million to USD 1.1 billion, propelled by heightened awareness of workshop safety standards, implementation of stricter occupational safety regulations, and increasing adoption of advanced safety technologies in power tools. Manufacturers prioritized flesh-sensing brake systems and electronic kickback control mechanisms to reduce workplace accidents, ensure compliance with safety regulations, and meet growing demand from safety-conscious professionals.

Between 2025 and 2030, the market is projected to expand from USD 1.1 billion to nearly USD 1.3 billion, adding USD 130 million. Growth in this first phase will be supported by increased adoption of safety technologies across professional woodworking environments, rising regulatory focus on workplace injury prevention, and the integration of advanced flesh-sensing brake systems in power tools. Industrial woodshops and professional contractors are emerging as major demand drivers, ensuring compliance with safety standards while maintaining productivity levels.

From 2030 to 2035, the market is expected to grow from USD 1.3 billion to USD 1.6 billion, a further increase of USD 300 million. This second phase will be shaped by the broader adoption of electronic kickback control systems, enhanced safety guard technologies, and deeper penetration in DIY and educational segments. Hardware upgrades will emphasize integration with existing tool platforms, while software enhancements will focus on real-time monitoring and predictive safety protocols for comprehensive workshop protection.

Professional woodworking and construction industries are under increasing pressure to reduce workplace injuries while maintaining operational efficiency. Kickback reduction tools offer proven safety benefits and liability protection, making them essential for contractors and industrial facilities. Demand for table-saw safety systems and circular saw anti-kickback devices is expected to accelerate adoption across professional workshops in the USA, Germany, Japan, and other developed markets.

Safety authorities and insurance providers are increasingly mandating advanced kickback protection in professional environments. The integration of flesh-sensing brake technology and electronic kickback control systems ensures compliance with evolving workplace safety standards. By 2025, professional contractors already represent 45% of market demand, with steady expansion forecast as safety regulations become more stringent across global markets.

Manufacturers are developing more affordable and user-friendly kickback reduction technologies that integrate seamlessly with existing tool platforms. Advanced guard systems and riving knife assemblies are becoming standard features rather than optional add-ons, driving broader market penetration across both professional and DIY segments.

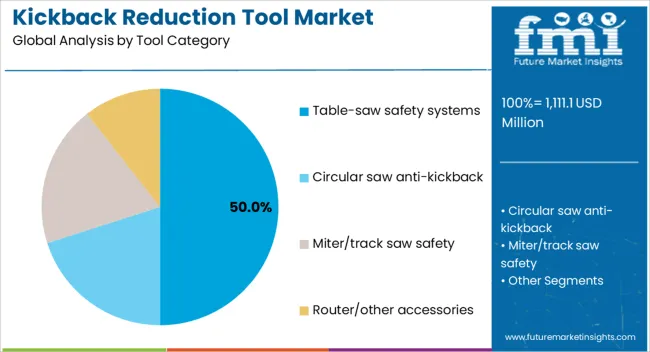

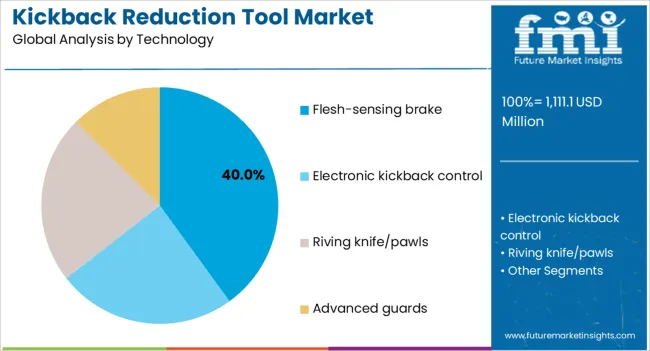

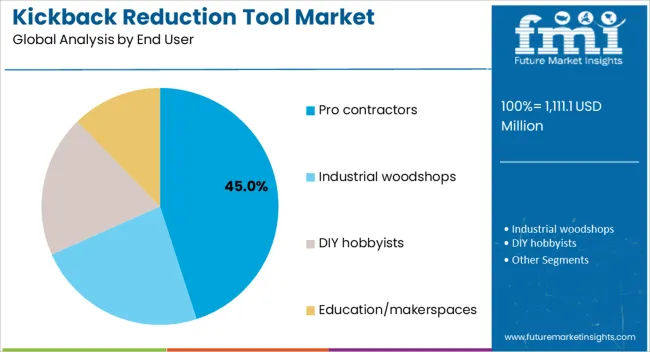

The market is segmented by tool category, technology, end user, channel, and region. By tool category, the market is divided into table-saw safety systems, circular saw anti-kickback, miter/track saw safety, and router/other accessories. Based on technology, the market is categorized into flesh-sensing brake, electronic kickback control, riving knife/pawls, and advanced guards. In terms of end user, the market is segmented into pro contractors, industrial woodshops, diy hobbyists, and education/makerspaces. By channel, the market is classified into pro dealer, big-box retail, and online/direct. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Table-saw safety systems are projected to hold the largest share at 50% in 2025, as workshops, contractors, and educational facilities adopt advanced protection for one of the most hazardous power tools. Flesh-sensing brake technology and electronic monitoring systems make these tools critical for meeting safety compliance and reducing injury liability. Circular saw anti-kickback and miter/track saw safety each contribute 20%, strengthening demand through integration into portable and stationary cutting applications. Router and other accessories form secondary demand pools at 10%, where kickback reduction supports precision work and operator protection.

Flesh-sensing brake systems account for 40% of technology demand in 2025, driven by their proven effectiveness in preventing severe injuries and their growing integration into professional-grade tools. Electronic kickback control systems retain 25% share through deployment in mid-range equipment and upgrade installations. Riving knife and pawl systems maintain 20% relevance in traditional woodworking applications, while advanced guard technologies contribute 15% through specialized safety enhancement projects.

Professional contractors contribute 45% of market demand in 2025, expanding steadily with safety mandate compliance and liability reduction priorities. Industrial woodshops account for 30% of deployments, with growing emphasis on worker protection and productivity maintenance. DIY hobbyists represent 15% of demand through increasing safety awareness and tool upgrade cycles. Educational institutions and makerspaces form 10% of the market through teaching safety protocols and demonstrating best practices.

The kickback reduction tool market is driven by rising safety regulations, growing adoption of advanced woodworking tools, and increasing demand from professional contractors seeking efficiency and accident prevention. However, high costs of advanced safety systems and limited awareness among small-scale users restrain wider adoption. Key trends include integration of smart sensing technologies, user-friendly retrofitting solutions, and partnerships between manufacturers and safety regulators to promote standardized safety features across global woodworking applications.

The kickback reduction tool market is witnessing a strong shift toward the integration of smart safety technologies, particularly IoT-enabled systems, predictive analytics, and real-time monitoring. These advancements allow tools to deliver proactive alerts that warn users of unsafe conditions before kickback occurs. Additionally, connectivity features enable manufacturers and end-users to track tool usage, optimize maintenance schedules, and extend equipment life. This smart integration not only enhances safety standards but also improves overall efficiency and minimizes costly operational downtime.

Kickback reduction technology, once concentrated primarily in table saws, is increasingly being deployed across a wider range of power tools. Manufacturers are now incorporating these systems into portable circular saws, miter saws, and specialty cutting equipment used in both professional and DIY markets. This expansion reflects a growing recognition that kickback risks extend across multiple tool categories, not just stationary equipment. By broadening applications, the industry is meeting diverse user needs while reinforcing a safety-first approach in construction and woodworking.

Another key trend shaping the market is the growing focus on retrofit and aftermarket solutions. Instead of only targeting new tool sales, manufacturers are designing kickback reduction systems that can be seamlessly integrated into existing tool fleets. This strategy addresses the vast installed base of older equipment, which often lacks modern safety features. For budget-conscious businesses and individual users, retrofit solutions provide a cost-effective path to improved safety without replacing entire tool sets, thereby expanding market adoption significantly.

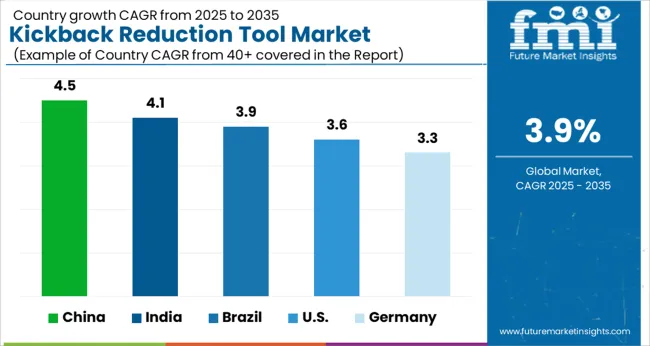

| Country | CAGR |

| China | 4.5% |

| India | 4.1% |

| Brazil | 3.9% |

| USA | 3.7% |

| Germany | 3.3% |

Demand for kickback reduction tool in China leads with a 4.5% CAGR from 2025 to 2035, supported by expanding manufacturing capacity and increasing workplace safety regulations. Large-scale furniture production facilities and construction workshops are adopting table-saw safety systems and electronic kickback control technologies to meet export quality standards and reduce worker injury rates.

Sales of kickback reduction tool in India are projected to grow at 4.1% CAGR, driven by rapid industrialization and growing awareness of workplace safety standards. Furniture manufacturing hubs and carpentry workshops are increasingly adopting flesh-sensing brake systems and advanced guard technologies to comply with emerging safety regulations.

Revenue from kickback reduction tool in Brazil maintains 3.9% CAGR growth through expansion of construction activity and implementation of stricter safety protocols. Professional contractors and industrial woodshops are adopting circular saw anti-kickback systems and table-saw safety technologies to meet insurance requirements and reduce liability exposure.

The USA kickback reduction tool market expands at 3.7% CAGR, anchored by technology innovation and strong professional market penetration. SawStop and other domestic manufacturers lead development of flesh-sensing brake systems, while DEWALT and Milwaukee Tool integrate electronic kickback control into contractor-grade equipment for widespread professional adoption.

Demand for kickback reduction tool in Germany grows at 3.3% CAGR through engineering leadership and rigorous safety standard implementation. Bosch Power Tools and Festool advance riving knife technology and advanced guard systems while maintaining focus on precision and reliability for professional applications.

The kickback reduction tool market is increasingly technology-driven, with manufacturers focusing on advanced safety systems integration and user-friendly operation. Companies are investing in flesh-sensing brake technology, electronic monitoring systems, and retrofit compatibility to deliver reliable, precise, and safe solutions for professional and consumer users. Strategic innovation, product differentiation, and global distribution remain central to strengthening market presence and portfolios.

SawStop, USA-based, leads with patented flesh-sensing brake systems and advanced safety integration for table saws. DEWALT, also USA, offers kickback-reduction tools with electronic monitoring and enhanced ergonomic features for professional users. Bosch Power Tools, Germany, provides advanced safety and monitoring solutions with precision engineering and global availability. Festool, Germany, emphasizes professional-grade performance, integrated safety features, and modular system compatibility.

Milwaukee Tool, USA, focuses on innovation, durable design, and professional workflow integration. Makita, Japan, delivers ergonomic and high-performance tools with safety and user-friendly operation. RIDGID, USA, provides reliable kickback-reduction solutions for professional workshops. Metabo HPT, Japan, emphasizes precision and safety in corded and cordless tools. Skil, USA, offers accessible safety-focused solutions for consumer use. Triton Tools, UK, specializes in portable, safety-integrated cutting equipment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.1 billion |

| Tool Category | Table-saw Safety Systems, Circular Saw Anti-kickback, Miter/Track Saw Safety, Router/Other Accessories |

| Technology | Flesh-sensing Brake, Electronic Kickback Control, Riving Knife/Pawls, Advanced Guards |

| End User | Pro Contractors, Industrial Woodshops, DIY Hobbyists, Education/Makerspaces |

| Channel | Pro Dealer, Big-box Retail, Online/Direct |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | SawStop, DEWALT, Bosch Power Tools, Festool, Milwaukee Tool, Makita, RIDGID, Metabo HPT, Skil, Triton Tools |

The global kickback reduction tool market is estimated to be valued at USD 1,111.1 million in 2025.

The market size for the kickback reduction tool market is projected to reach USD 1,629.0 million by 2035.

The kickback reduction tool market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in kickback reduction tool market are table-saw safety systems, circular saw anti-kickback, miter/track saw safety and router/other accessories.

In terms of technology, flesh-sensing brake segment to command 40.0% share in the kickback reduction tool market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analysis and Growth Projections for Sodium Reduction Ingredient Business

Methane Reduction Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

Pathogen Reduction Systems Market

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Salt Content Reduction Ingredients Market Size & Trends 2035

Non-Surgical Fat Reduction Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Enzymatic Acrylamide-Reduction Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Selective Catalytic Reduction Systems Market Growth – Trends & Forecast 2025 to 2035

Tool Holders Market Size and Share Forecast Outlook 2025 to 2035

Tool Box Market Size and Share Forecast Outlook 2025 to 2035

Tool Tethering Market Size and Share Forecast Outlook 2025 to 2035

Tool Steel Market Size and Share Forecast Outlook 2025 to 2035

Tool Presetter Market Trend Analysis Based on Product, Category, End-Use, and Region 2025 to 2035

Understanding Market Share Trends in the Tool Box Industry

Tool Holder Collets Market

Tool Chest Market

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

CNC Tool Storage System Market

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA