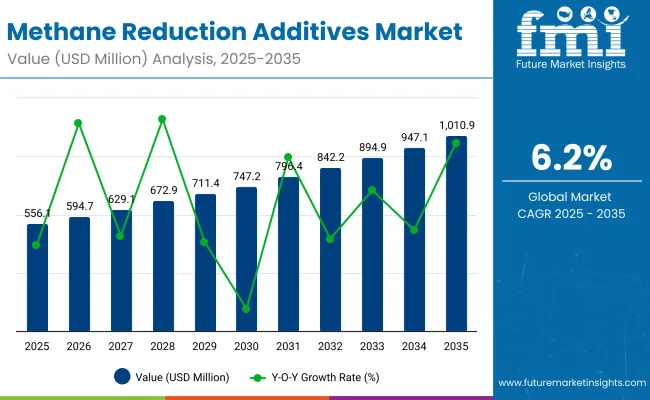

The Methane Reduction Additives Market is expected to record a valuation of USD 0.56 billion in 2025 and USD 1.01 billion in 2035, with an increase of USD 0.45 billion, which equals a growth of nearly 82% over the decade. The overall expansion represents a CAGR of 6.2% and close to a 2X increase in market size.

Methane Reduction Additives Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 0.56 billion |

| Market Forecast Value in (2035F) | USD 1.01 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 0.56 billion to USD 0.75 billion, adding USD 0.19 billion, which accounts for 42% of the total decade growth. This phase records steady adoption in dairy and beef cattle production, driven by the need to reduce enteric methane emissions and improve feed efficiency. Feed additive formats such as direct TMR inclusion dominate this phase as they cater to large-scale farm systems requiring consistent dosing.

The second half from 2030 to 2035 contributes USD 0.26 billion, equal to 58% of total growth, as the market jumps from USD 0.75 billion to USD 1.01 billion. This acceleration is powered by widespread deployment of seaweed-based solutions (particularly Asparagopsis), probiotics, and microbial-based additives, along with regulatory mandates across North America and Europe. Adoption expands into sheep, goats, and other ruminants, while global sustainability programs and carbon-credit monetization further push demand. Software-enabled monitoring platforms bundled with additive use enhance traceability, strengthening adoption among large-scale integrators.

From 2020 to 2024, the Methane Reduction Additives Market scaled up gradually as early-stage trials transitioned into commercial adoption. The market expanded from pilot volumes to nearly USD 0.50 billion by 2024, primarily driven by feed additive applications in dairy cattle. During this period, competitive dynamics were led by multinational feed additive manufacturers and emerging algae-based solution developers, who jointly commanded the majority share. Differentiation was centered on scientific validation, regulatory approvals, and proven methane reduction efficacy, while distribution relied heavily on partnerships with feed integrators and cooperatives.

By 2025, the market reaches USD 0.56 billion, marking the start of a decade of scaling. The revenue mix begins shifting toward seaweed-based and microbial-based additives, alongside synthetic compounds like 3-Nitrooxypropanol (3-NOP). Looking ahead, by 2035 the industry is expected to exceed USD 1.0 billion, with growth underpinned by carbon-credit monetization, regulatory mandates in Europe and North America, and adoption in beef cattle and small ruminants. Traditional leaders such as DSM-Firmenich and Elanco are adapting by broadening into algae and microbial solutions, while startups like Symbrosia, Blue Ocean Barns, and FutureFeed accelerate commercialization. Competitive advantage is evolving from individual additive performance to ecosystem integration, traceability platforms, and scalable supply chains that ensure consistent efficacy at global scale.

Rising global pressure to reduce greenhouse gas emissions from the livestock sector is the primary driver of the Methane Reduction Additives Market. Advances in feed science and biotechnology have enabled the development of additives such as 3-Nitrooxypropanol (3-NOP), seaweed-based compounds, and microbial cultures that directly inhibit methane formation in the rumen. These innovations improve feed conversion efficiency while simultaneously lowering methane output, offering farmers both environmental and productivity gains. Early commercial trials have validated emission reduction rates of up to 80% with seaweed additives, significantly boosting interest and investment in scalable solutions.

The introduction of regulatory mandates and incentive mechanisms, particularly in Europe and North America, is fueling adoption. Carbon-credit programs are creating financial returns for farmers and integrators who adopt methane reduction strategies, transforming these additives from a compliance tool into a revenue opportunity. In parallel, consumer demand for sustainably produced dairy and beef products is pushing food companies to secure lower-emission supply chains, reinforcing uptake across the value chain.

Growth is further supported by diverse additive platforms. While chemical inhibitors like 3-NOP dominate current usage, algae-based, plant-based, and microbial solutions are expanding application areas across dairy cattle, beef cattle, and small ruminants. The scalability of powdered and pelletized formats, along with integration through feed manufacturers and premix suppliers, ensures compatibility with existing farm operations. As the decade progresses, the strongest growth is expected from algae-based additives, propelled by advancements in aquaculture cultivation and commercialization by startups and large ingredient players.

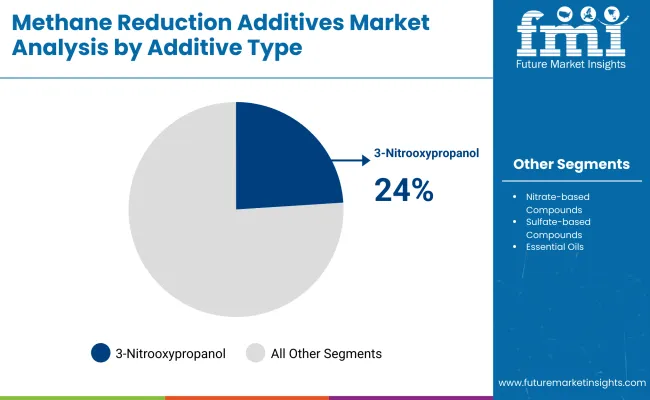

The Methane Reduction Additives Market is segmented across multiple dimensions reflecting diverse technological approaches and adoption pathways. By additive type, the market includes chemical inhibitors such as 3-Nitrooxypropanol, natural bioactives like essential oils, saponins, and tannins, seaweed-based solutions including Asparagopsis and other red and brown seaweeds, as well as probiotics, microbial strains, yeast cultures, enzymes, and other emerging additives. Sources are categorized into synthetic, plant-based, algae-based, and microbial-based platforms, with synthetic dominating early adoption while algae-based and microbial solutions are gaining traction. In terms of livestock, dairy and beef cattle lead current applications, while sheep, goats, and other ruminants are gradually adopting these solutions.

Application methods span feed inclusion in TMR systems, water-soluble additives, and pasture-based supplements such as lick blocks, ensuring flexibility for various farm operations. Functionally, the additives target methane emission inhibition, rumen microbiome modulation, and feed conversion efficiency improvement. Formulations include powders, granules or pellets, and liquids to enhance compatibility with existing feed systems. Distribution occurs through direct-to-farm sales, feed manufacturers and premix suppliers, and third-party distributors, with feed integrators playing a crucial role in scaling adoption.

Regionally, the market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with the USA, Germany, the UK, China, and India emerging as leading growth markets.

| Additive Type Segment | Market Value Share, 2025 |

|---|---|

| 3-Nitrooxypropanol (3-NOP) | 24% |

| Nitrate-based Compounds | 12% |

| Sulfate-based Compounds | 5% |

| Essential Oils | 10% |

| Saponins | 7% |

| Tannins | 8% |

| Flavonoids | 3% |

| Asparagopsis taxiformis | 9% |

| Other Red Seaweeds | 4% |

| Brown Seaweeds | 4% |

| Specific Rumen Bacteria Strains | 5% |

| Yeast Cultures | 3% |

| Enzyme-based Additives | 2% |

| Fat & Oil Supplements | 2% |

| Other Emerging Additives | 2% |

Chemical inhibitors, led by 3-Nitrooxypropanol (3-NOP), dominate the Methane Reduction Additives Market Share 24% in 2025, capturing more than half of the global market value. This leadership is driven by their scientifically validated efficacy, ability to integrate seamlessly into total mixed ration (TMR) systems, and proven consistency across large-scale dairy and beef operations. Farmers and feed integrators continue to prioritize chemical inhibitors due to their reliable methane suppression rates and compatibility with existing feeding practices.

Growth in this segment is also supported by ongoing R&D investments to refine formulations and reduce costs, making adoption more feasible in price-sensitive markets. As sustainability-linked financing and carbon-credit monetization expand, demand for proven and measurable reduction solutions further reinforces the dominance of chemical inhibitors. Although seaweed, microbial, and plant-based additives are emerging as competitive alternatives, the chemical inhibitor segment is expected to remain the backbone of methane reduction strategies throughout the forecast period, providing the industry with a scalable and effective pathway to lower emissions.

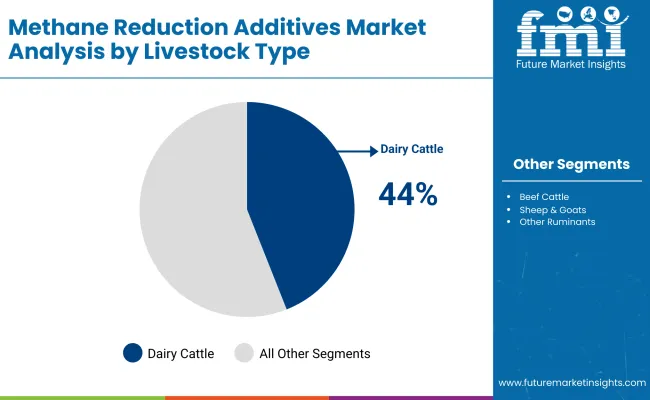

| Livestock Type | 2025 Share |

|---|---|

| Dairy Cattle | 44% |

| Beef Cattle | 33% |

| Sheep & Goats | 15% |

| Other Ruminants | 8% |

The dairy cattle segment is forecasted to hold 44% of the Methane Reduction Additives Market share in 2025, led by its application in large-scale milk production systems where enteric methane emissions are highest. Adoption is driven by the dual benefits of lowering greenhouse gas output while improving feed efficiency and overall herd productivity. Dairy operations, particularly in regions such as North America and Europe, are under increasing regulatory and consumer pressure to reduce emissions, positioning additives as an essential part of sustainability strategies.

The segment’s leadership is reinforced by consistent feed delivery through TMR systems, which ensures accurate dosing and reliable performance of additives like chemical inhibitors and algae-based supplements. In addition, partnerships between dairy cooperatives, feed manufacturers, and sustainability certification programs are accelerating uptake across both developed and emerging markets. While beef cattle and small ruminants are projected to expand adoption over the decade, dairy cattle will remain the primary driver of volume demand due to their higher methane output intensity and established integration of feed additives into daily farm operations.

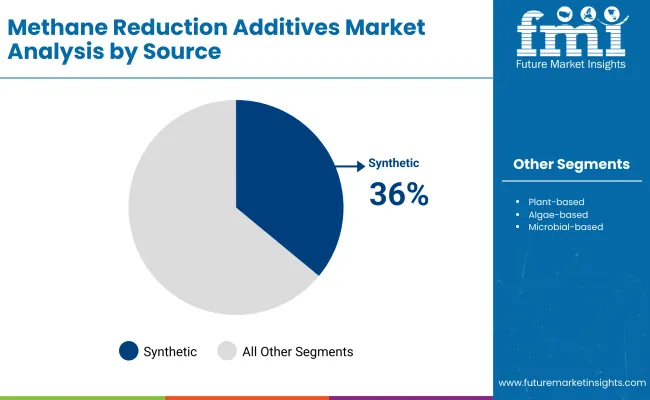

| Source Segment | 2025 Share |

|---|---|

| Synthetic | 36% |

| Plant-based | 27% |

| Algae-based | 21% |

| Microbial-based | 16% |

The synthetic source segment is forecasted to hold 36% of the Methane Reduction Additives Market share in 2025, making it the largest contributor, followed by plant-based at 27%, algae-based at 21%, and microbial-based at 16%. Synthetic additives, particularly chemical inhibitors such as 3-Nitrooxypropanol (3-NOP), lead adoption due to their strong scientific validation, clear regulatory pathways, and proven ability to consistently reduce methane emissions in dairy and beef cattle. Their scalability and integration into existing feed systems make them highly attractive for commercial farms seeking measurable and immediate results.

The dominance of synthetic solutions is also supported by large-scale production capacity and distribution networks, which ensure reliable supply across major markets such as North America and Europe. At the same time, governments and industry players are prioritizing synthetic additives for early rollout under sustainability and carbon-credit frameworks because of their validated reduction potential.

Precision-Driven Sustainability Adoption and Industry Integration

The Methane Reduction Additives Market is expanding as livestock producers, feed companies, and policymakers prioritize sustainability and emission reduction. Additives such as 3-Nitrooxypropanol (3-NOP), seaweed-based compounds, and microbial solutions have demonstrated proven reductions in enteric methane emissions, making them central to climate strategies. Adoption is particularly strong in dairy and beef cattle production, where methane intensity is highest.

Integration into feed manufacturer supply chains and carbon-credit programs is streamlining adoption and creating new revenue opportunities for farmers. In addition, global food and beverage companies are partnering with suppliers to secure low-carbon dairy and meat for environmentally conscious consumers. As regulators set stricter emission targets, methane reduction additives are positioned as a scalable and science-backed pathway to meet compliance while improving herd productivity.

Cost Barriers and Supply Constraints

Despite clear benefits, adoption is limited by cost challenges and supply scalability. Many methane reduction additives, particularly seaweed-based and microbial formulations, remain expensive to produce at commercial volumes. Farmers in cost-sensitive regions find it difficult to adopt without subsidies or carbon-credit incentives. In addition, feed manufacturers face logistical and formulation challenges in ensuring consistent dosing, stability, and palatability across livestock systems.

Limited infrastructure for large-scale seaweed cultivation and fermentation-based production also constrains supply. Moreover, regulatory approval processes vary widely across regions, creating delays in commercialization and adoption. For smaller farms, the added complexity of incorporating these additives into existing routines poses further barriers, slowing widespread uptake.

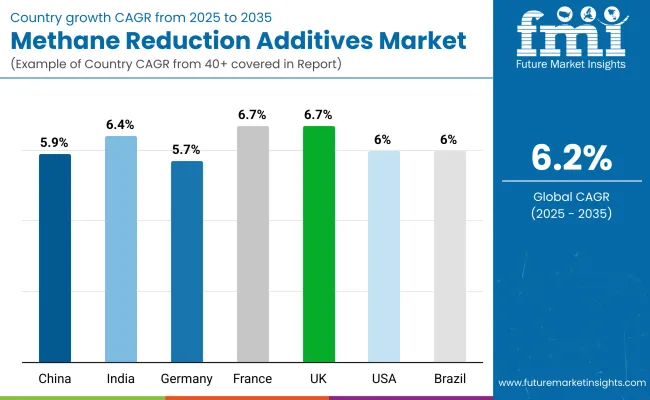

| Countries | CAGR |

|---|---|

| China | 5.90% |

| India | 6.48% |

| Germany | 5.71% |

| France | 6.79% |

| UK | 6.78% |

| USA | 5.36% |

| Brazil | 6.01% |

The global Methane Reduction Additives Market shows a pronounced regional disparity in adoption speed, strongly influenced by livestock intensity, sustainability regulations, and carbon-credit integration. Asia-Pacific emerges as the fastest-growing region, anchored by China at 5.9% CAGR and India at 6.5% CAGR. This acceleration is driven by the scale of dairy and beef production systems, rising investments in sustainable agriculture, and government-backed mandates to curb agricultural emissions. China’s regulatory framework promoting green livestock practices further accelerates adoption, while India’s trajectory reflects rapid integration of additives in its expanding dairy sector, supported by feed manufacturers and international sustainability programs.

Europe maintains a strong growth profile, led by Germany at 5.7%, France at 6.8%, and the UK at 6.8% CAGR, supported by stringent EU climate targets, methane reduction policies, and sustainability certification requirements in livestock supply chains. High penetration of cooperative dairy structures and government funding for climate-smart agriculture keep Europe ahead of North America, particularly in the early rollout of algae-based and microbial additives. North America shows moderate expansion, with the USA at 5.4% CAGR, reflecting maturity in feed systems and slower regulatory pressure compared to Europe.

Growth here is more market-driven, supported by carbon-credit monetization and partnerships between innovators and dairy cooperatives. Adoption is increasingly tied to sustainability branding in beef and dairy exports rather than regulatory compliance. Latin America, anchored by Brazil at 6.0% CAGR, benefits from its vast ruminant population and growing demand for low-carbon beef and dairy exports. Government-backed climate commitments and partnerships with global food companies are reinforcing adoption, positioning the region as a rising growth hub by 2035.

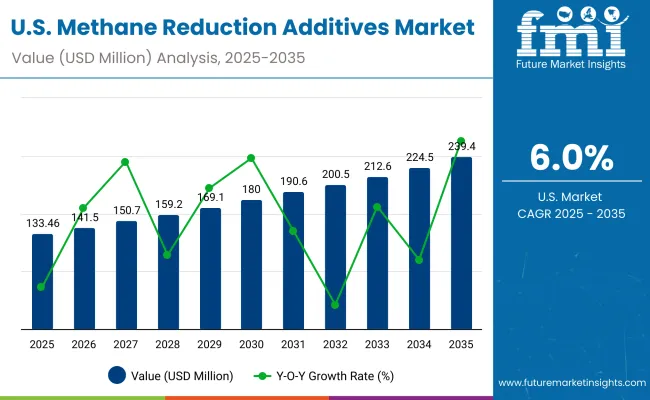

| Year | USA Methane Reduction Additives Market (USD Million) |

|---|---|

| )2025 | 133.46 |

| 2026 | 141.5 |

| 2027 | 150.7 |

| 2028 | 159.2 |

| 2029 | 169.1 |

| 2030 | 180.0 |

| 2031 | 190.6 |

| 2032 | 200.5 |

| 2033 | 212.6 |

| 2034 | 224.5 |

| 2035 | 239.4 |

The Methane Reduction Additives Market in the United States is projected to grow at a CAGR of 5.4%, supported by adoption in dairy cooperatives and beef supply chains. Early uptake is driven by carbon-credit monetization programs and partnerships between additive developers and large-scale feed manufacturers. Regulatory pressure is lighter compared to Europe, but market-driven sustainability initiatives by food and beverage companies are accelerating trials and adoption. Dairy producers are adopting chemical inhibitors such as 3-NOP for consistent methane suppression, while startups are piloting seaweed-based additives in beef operations. Cloud-based traceability platforms are also being integrated to validate emission reductions for buyers and regulators.

The Methane Reduction Additives Market in the United Kingdom is expected to grow at a CAGR of 6.8%, backed by strong regulatory alignment with EU climate goals and sustainability certifications. Government-backed innovation programs and grants are incentivizing additive trials across dairy and beef herds. The country’s dairy sector has been an early adopter of synthetic inhibitors and is now expanding into algae-based platforms, supported by collaborations between startups and academic institutions. Retailers and food companies are also beginning to demand methane disclosure from suppliers, pushing producers to integrate additives into their supply chains.

India is witnessing rapid growth in the Methane Reduction Additives Market, projected at a CAGR of 6.5% through 2035. Growth is fueled by the expansion of the country’s massive dairy sector and increasing collaborations with multinational feed suppliers. Pilot programs supported by international sustainability funds are helping small and medium farms test algae- and microbial-based additives. Educational institutions and veterinary extension programs are introducing farmers to the productivity and environmental benefits of feed interventions. Cost sensitivity remains a restraint, but falling prices and carbon-credit access are gradually improving affordability.

The Methane Reduction Additives Market in China is expected to grow at a CAGR of 5.9%, among the highest globally. Momentum is driven by government-backed climate action plans, rapid modernization of dairy farms, and investments in seaweed cultivation. The dairy and beef sectors are integrating synthetic additives as part of sustainability reporting, while regional governments are piloting algae-based supplements to align with emission-reduction targets. Local startups are collaborating with global innovators to scale production and lower costs, creating opportunities for mass adoption.

| Countries | 2025 |

|---|---|

| UK | 19.74% |

| Germany | 21.22% |

| Italy | 10.77% |

| France | 13.84% |

| Spain | 11.22% |

| BNELUX | 6.27% |

| Nordic | 5.22% |

| Rest of Europe | 12% |

| Countries | 2035 |

|---|---|

| UK | 19.36% |

| Germany | 21.61% |

| Italy | 9.72% |

| France | 12.83% |

| Spain | 10.44% |

| BNELUX | 5.39% |

| Nordic | 5.32% |

| Rest of Europe | 15% |

The Methane Reduction Additives Market in Germany is projected to grow at a CAGR of 5.7%, supported by the country’s strong commitment to climate goals and precision in agricultural practices. Dairy cooperatives and beef producers are integrating additives such as 3-Nitrooxypropanol (3-NOP) into feed systems to comply with EU methane reduction mandates. Pilot programs using seaweed-based additives are expanding, backed by government research grants and partnerships with academic institutions. Sustainability certifications tied to livestock exports are also reinforcing adoption, particularly in the premium dairy segment. Germany’s role as a leader in agricultural technology ensures early integration of additives with digital farm management and traceability systems, aligning with EU climate reporting standards.

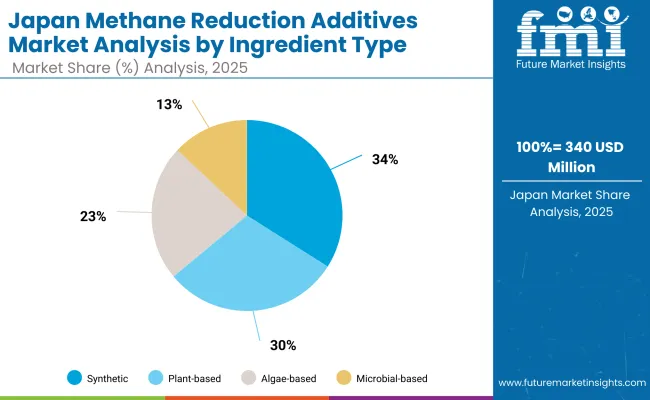

| Source Segment | 2025 Share |

|---|---|

| Synthetic | 34% |

| Plant-based | 30% |

| Algae-based | 23% |

| Microbial-based | 13% |

The Methane Reduction Additives Market in Japan is projected at USD 0.34 billion in 2025, with a balanced source mix that highlights the country’s focus on sustainable agriculture. Synthetic additives contribute 34% of the market, while plant-based holds 30%, algae-based 23%, and microbial-based 13%. This distribution reflects Japan’s dual approach: leveraging proven synthetic solutions for immediate methane reduction while rapidly expanding investment into natural platforms to align with consumer preferences and environmental goals.

Japan’s dairy and beef sectors are under increasing sustainability scrutiny, with government-backed initiatives encouraging the adoption of low-carbon practices. The growing role of algae-based additives, particularly Asparagopsis, is supported by academic collaborations and innovation programs aimed at scaling aquaculture production. Similarly, plant-based solutions such as saponins and tannins are being integrated into premium livestock feed as part of clean-label strategies.

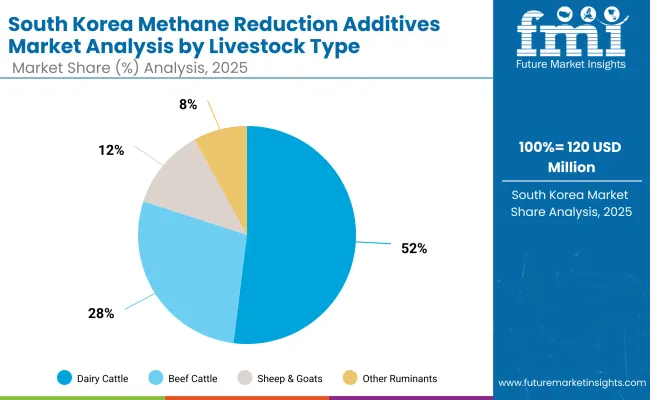

| Livestock Type Segment | 2025 Share |

|---|---|

| Dairy Cattle | 52% |

| Beef Cattle | 28% |

| Sheep & Goats | 12% |

| Other Ruminants | 8% |

The Methane Reduction Additives Market in South Korea is valued at USD 0.12 billion in 2025, with the dairy cattle segment leading at 52%, followed by beef cattle at 28%, sheep & goats at 12%, and other ruminants at 8%. The dominance of dairy reflects the country’s strong focus on improving milk productivity and aligning with sustainability commitments in the livestock sector. Government incentives for emission reduction and industry-led initiatives to enhance feed efficiency are driving rapid adoption of additives, particularly synthetic inhibitors and microbial-based solutions.

This leadership is reinforced by South Korea’s highly industrialized farming systems, where precision feeding practices and cooperative structures make integration of additives easier compared to fragmented markets. Dairy producers are increasingly adopting traceability tools and carbon reporting frameworks, creating opportunities for additive suppliers to bundle solutions with sustainability verification. While beef and small ruminants remain secondary segments, their share is expected to expand as awareness grows and carbon markets reward broader adoption.

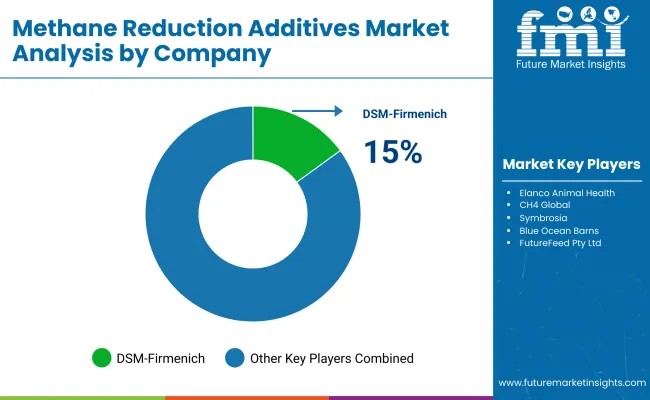

The Methane Reduction Additives Market is moderately fragmented, with established global feed and animal health leaders competing alongside innovative startups and regional specialists. Global leaders such as DSM-Firmenich and Elanco Animal Health hold significant market share, driven by their established portfolios in animal nutrition and early commercialization of methane inhibitors like 3-NOP. Their strategies emphasize scaling synthetic solutions, securing regulatory approvals, and expanding partnerships with feed manufacturers and dairy cooperatives to accelerate adoption.

Emerging mid-sized players including CH4 Global, Symbrosia, Blue Ocean Barns, FutureFeed Pty Ltd, Volta Greentech, and Sea Forest Pty Ltd are spearheading algae-based solutions, particularly Asparagopsis-based feed additives, which have demonstrated high methane reduction potential. These firms are building aquaculture capacity, partnering with dairy and beef producers, and leveraging sustainability programs to expand pilot trials into commercial-scale production.

Specialized providers such as Mootral and Agolin SA focus on plant-based and microbial solutions, catering to regions where natural and clean-label feed additives are in high demand. Their strength lies in targeted R&D, agility in product innovation, and alignment with consumer-driven sustainability preferences.

Competitive differentiation is shifting from the additive’s methane reduction efficacy alone toward ecosystem strength including supply chain scalability, carbon-credit integration, and traceability platforms. Companies that can deliver not just a product but a complete sustainability package spanning verified emission reductions, digital monitoring, and certification support are best positioned to secure long-term leadership.

Key Developments in the Methane Reduction Additives Market

| Item | Value |

|---|---|

| Quantitative Units | USD 0.56 Billion |

| Additive Type | Chemical Inhibitors (3-NOP, Nitrate & Sulfate Compounds), Seaweed & Algal Additives (Asparagopsis, Red & Brown Seaweeds), Probiotics, Specific Rumen Bacteria, Yeast Cultures, Enzyme-based, Fat & Oils, Others |

| Source | Synthetic, Plant-based, Algae-based, Microbial-based |

| Livestock Type | Dairy Cattle, Beef Cattle, Sheep & Goats, Other Ruminants |

| Application Method | Feed Additive (TMR Inclusion), Water-soluble Additive, Pasture-based Supplements (Lick Blocks) |

| Functionality | Methane Emission Inhibition, Rumen Microbiome Modulation, Feed Conversion Efficiency Improvement |

| Form | Powder, Granules/Pellets, Liquid |

| Sales Channel | Direct to Farms (B2B), Through Feed Manufacturers & Premix Suppliers, Distributors & Agents |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | DSM- Firmenich, Elanco Animal Health, CH4 Global, Symbrosia, Blue Ocean Barns, FutureFeed Pty Ltd, Volta Greentech, Mootral, Sea Forest Pty Ltd, Agolin SA, Others |

| Additional Attributes | Dollar sales by additive type, source, and livestock type; adoption trends in dairy and beef systems; rising demand for algae-based and microbial platforms; carbon-credit monetization; regulatory influences; innovation in aquaculture & fermentation |

The global Methane Reduction Additives Market is estimated to be valued at USD 0.56 billion in 2025.

The market size is projected to reach USD 1.01 billion by 2035.

The market is expected to grow at a CAGR of 6.2% during 2025-2035.

Key additive types include chemical inhibitors, seaweed & algal additives, probiotics, microbial strains, yeast cultures, enzyme-based solutions, and plant-based bioactives.

In 2025, dairy cattle are expected to contribute the largest share at 52%, reflecting high adoption in large-scale milk production systems.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Methane Sulfonic Acid Market Growth - Trends & Forecast 2025 to 2035

Biomethane Market Size and Share Forecast Outlook 2025 to 2035

Nitromethane Market Size and Share Forecast Outlook 2025 to 2035

Chloromethane Market Forecast and Outlook 2025 to 2035

Steam Methane Reforming Blue Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Biogas To Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Coal Bed Methane Market Size and Share Forecast Outlook 2025 to 2035

Diindolylmethane Market Trends - Form & Nature Analysis

Chlorinated Methane Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Sodium Reduction Ingredient Business

Kickback Reduction Tool Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

Pathogen Reduction Systems Market

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Salt Content Reduction Ingredients Market Size & Trends 2035

Non-Surgical Fat Reduction Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Enzymatic Acrylamide-Reduction Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Selective Catalytic Reduction Systems Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA