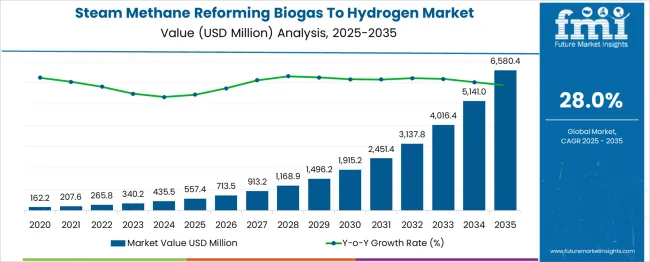

The Steam Methane Reforming Biogas To Hydrogen Market is estimated to be valued at USD 557.4 million in 2025 and is projected to reach USD 6580.4 million by 2035, registering a compound annual growth rate (CAGR) of 28.0% over the forecast period. This growth corresponds to a multiplying factor of approximately 11.8x over the forecast period. The annual absolute increases accelerate sharply, beginning with USD 156.1 million growth between 2025 and 2026 and reaching USD 1,439.4 million between 2034 and 2035.

This pattern confirms a strong acceleration phase throughout the period. From 2025 to 2030, annual increments rise from USD 156.1 million to USD 383.3 million, indicating steady acceleration supported by expanding industrial hydrogen applications and decarbonization mandates. The second half, from 2030 to 2035, shows further acceleration with annual increases growing from USD 456.2 million to USD 1,439.4 million.

The market demonstrates no visible signs of deceleration or plateauing, reflecting rapid adoption of cleaner hydrogen production technologies. The consistent year-on-year increase in both value and growth rate suggests the market is in an expansion phase driven by technological advancements, scaling production capacity, and supportive policies. The acceleration is expected to maintain momentum, reinforcing long-term market development with no indication of slowing over the forecast horizon.

The steam methane reforming (SMR) biogas to hydrogen market is experiencing significant growth, driven by the increasing demand for clean energy solutions and advancements in renewable hydrogen production technologies. Leading companies in this sector include Air Products and Chemicals, Inc., Linde Plc, Technip Energies N.V., and FuelCell Energy, among others.

These industry leaders are focusing on enhancing the efficiency of SMR processes, integrating carbon capture and storage (CCS) technologies, and developing scalable solutions to meet the rising need for hydrogen across various applications, including power generation, transportation, and industrial processes. The market is projected to continue its upward trajectory, supported by supportive government policies and investments in sustainable energy infrastructure.

| Metric | Value |

|---|---|

| Steam Methane Reforming Biogas To Hydrogen Market Estimated Value in (2025 E) | USD 557.4 million |

| Steam Methane Reforming Biogas To Hydrogen Market Forecast Value in (2035 F) | USD 6580.4 million |

| Forecast CAGR (2025 to 2035) | 28.0% |

The Steam Methane Reforming Biogas to Hydrogen market is gaining significant traction as global focus intensifies on low-emission hydrogen production and circular energy solutions. This market is being shaped by the convergence of renewable energy policies, biogas valorization initiatives, and growing demand for green hydrogen across industrial and energy applications.

Strategic efforts to decarbonize power systems and reduce reliance on fossil fuels have positioned biogas as a viable feedstock, especially when integrated with steam methane reforming processes that offer scalable hydrogen output. Investments in regional hydrogen hubs, government-backed pilot projects, and public-private partnerships are also contributing to the commercialization of biogas-based hydrogen technologies.

Furthermore, regulatory alignment on carbon reduction targets and the integration of renewable gas into energy grids are expanding the addressable market. As energy systems transition towards sustainability, the use of biogas as an input for hydrogen production through mature and adaptable reforming processes is expected to play a critical role in shaping a resilient and low-carbon energy infrastructure..

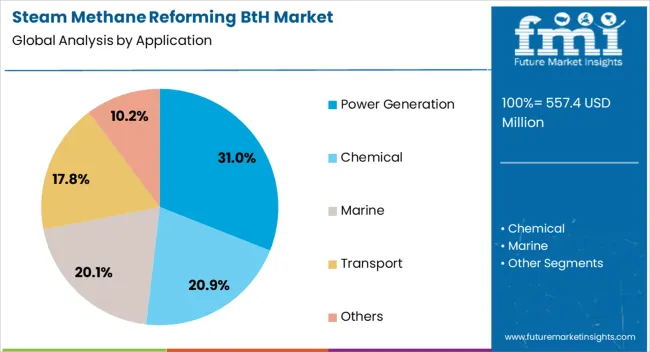

The steam methane reforming biogas to hydrogen market is segmented by application and geographic regions. The application of the steam methane reforming biogas to the hydrogen market is divided into Power Generation, Chemical, Marine, Transport, and Others. Regionally, the steam methane reforming biogas to hydrogen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The power generation application segment is anticipated to account for 31% of the Steam Methane Reforming Biogas to Hydrogen market revenue share in 2025, making it the leading application segment. This leadership has been supported by the increased adoption of hydrogen-enriched gas in combined heat and power systems, gas turbines, and fuel cells for distributed energy applications.

The reliability and scalability of steam methane reforming have allowed biogas to be converted into hydrogen efficiently, supporting continuous power generation without dependence on variable renewable inputs. Power producers have favored this segment for its ability to reduce greenhouse gas emissions while utilizing existing energy infrastructure with minor modifications.

Additionally, the compatibility of biogas-derived hydrogen with hydrogen-ready turbines and the growing implementation of decentralized energy networks have elevated its utility in sustainable electricity generation. With mounting pressure to decarbonize grid operations and ensure energy security, power generation has emerged as a primary driver for deploying biogas-to-hydrogen pathways, reinforcing its prominence within the overall market..

Growth is driven by advancements in biogas production technologies, including improved anaerobic digestion processes, biogas purification techniques, and gas storage solutions. The implementation of carbon pricing mechanisms to reduce greenhouse gas emissions is also influencing the adoption of low-carbon intensity methods for hydrogen production. The simplicity and low-cost nature of SMR technology make it accessible for small-scale applications, particularly in rural areas, thereby influencing business dynamics and expanding market reach.

Advancements in biogas production technologies have propelled the adoption of SMR for hydrogen production. Enhanced anaerobic digestion processes have increased biogas yields, while improved purification techniques have elevated methane concentrations, making the feedstock more suitable for SMR. The integration of gas storage solutions has facilitated the stabilization of hydrogen supply, addressing intermittency issues associated with renewable energy sources. These technological improvements have reduced operational costs and increased the efficiency of hydrogen production, making SMR a more attractive option for biogas-to-hydrogen conversion. As a result, the market for SMR biogas-to-hydrogen systems is experiencing significant growth, with increased investments and installations worldwide.

The variability in biogas composition poses a significant challenge to the SMR biogas-to-hydrogen market. Fluctuations in methane content can affect the efficiency and stability of the reforming process, leading to inconsistent hydrogen production. Additionally, the infrastructure required for biogas collection, purification, and storage can be costly and complex, especially in regions lacking existing facilities. These factors can deter potential investors and slow the adoption of SMR technology for hydrogen production. Addressing these challenges requires technological innovations to stabilize feedstock quality and reduce infrastructure costs, which are essential for the widespread implementation of SMR biogas-to-hydrogen systems.

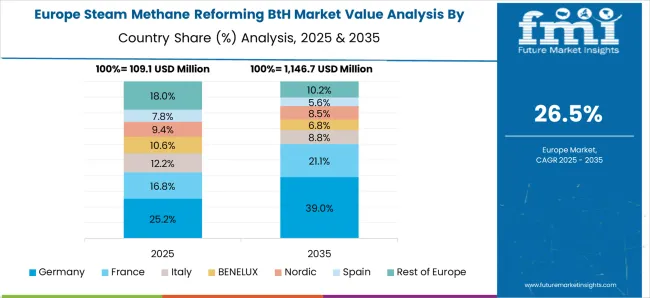

Retrofitting existing biogas plants presents a significant opportunity for expanding SMR biogas-to-hydrogen production. In regions like Germany, approximately 9,500 existing biogas plants could utilize steam reforming to produce around 58 terawatt-hours or 1.7 million tonnes of hydrogen annually. This approach leverages existing infrastructure, reducing the need for new facilities and associated capital expenditures. Retrofitting allows for a more rapid deployment of hydrogen production capabilities, supporting the transition to a hydrogen economy. This opportunity is particularly relevant in areas with established biogas production but limited hydrogen infrastructure, offering a cost-effective pathway to sustainable hydrogen generation.

The integration of SMR biogas-to-hydrogen systems with renewable energy sources is a growing trend. Utilizing excess renewable electricity for biogas upgrading and hydrogen production can enhance the overall sustainability and efficiency of the process. Policy support, including subsidies and incentives for renewable hydrogen projects, is also driving market growth. Governments worldwide are implementing regulations and providing financial backing to promote clean energy solutions. These supportive policies are encouraging investments in SMR biogas-to-hydrogen technologies, fostering innovation, and accelerating the adoption of hydrogen as a clean fuel alternative. The combination of technological integration and favorable policies is shaping the future of the hydrogen production landscape.

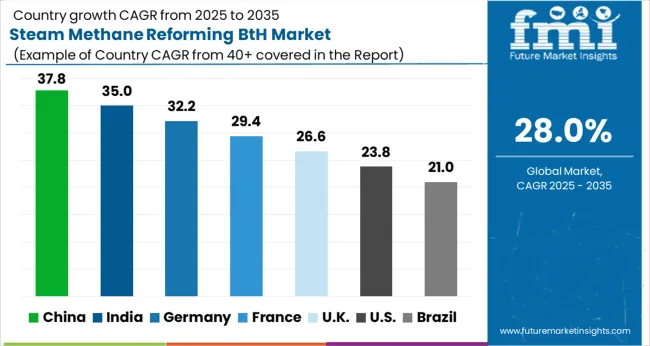

| Country | CAGR |

|---|---|

| China | 37.8% |

| India | 35.0% |

| Germany | 32.2% |

| France | 29.4% |

| UK | 26.6% |

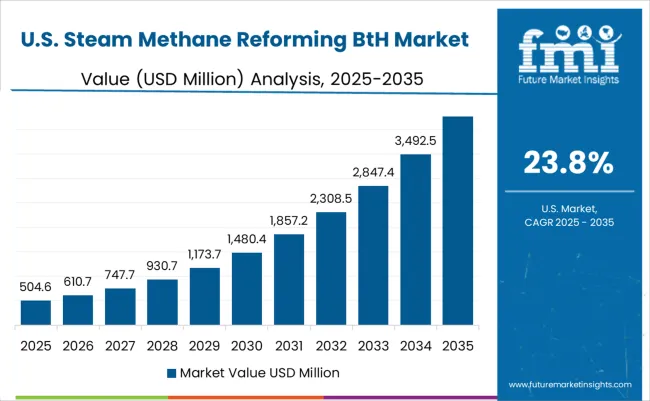

| USA | 23.8% |

| Brazil | 21.0% |

The Steam Methane Reforming Biogas to Hydrogen Market is expected to grow at a global CAGR of 28% over the forecast period. China leads with a value of USD 37.8 million, reflecting significant investments in hydrogen infrastructure and clean energy policies. India follows closely at USD 35.0 million, driven by expanding renewable energy initiatives and biogas utilization.

Germany records USD 32.2 million, supported by strong government incentives for green hydrogen production. The UK and the USA report USD 26.6 million and USD 23.8 million respectively, benefiting from ongoing energy transition efforts. This report includes a detailed assessment of over 40 countries, with the top five markets highlighted to provide strategic insights into regional growth dynamics.

China’s market for steam methane reforming biogas to hydrogen is projected to expand at a CAGR of 37.8% from 2025 to 2035. The country’s industrial hydrogen demand has accelerated adoption of biogas feedstock reforming processes to reduce carbon intensity. Large-scale reformer installations are supported by government policies aimed at decarbonizing steel and chemical manufacturing sectors.

Integration with renewable biogas sources from agricultural waste is increasing across eastern provinces. Investments in advanced catalysts and high-temperature reforming reactors are fostering efficiency gains. Capacity expansions in major hydrogen production hubs are expected to accommodate growing fuel cell vehicle fleets and industrial hydrogen supply chains. Partnerships between energy firms and technology providers are driving faster commercialization of biogas-based hydrogen production.

India’s steam methane reforming biogas to hydrogen market is expected to grow at a CAGR of 35.0% during 2025 to 2035. Biomethane derived from agricultural residues is being prioritized to supplement conventional natural gas reforming. Pilot projects integrating biogas feedstock into existing steam methane reformers are increasing across key industrial clusters.

Government incentives are promoting localized biogas production facilities to enhance hydrogen supply security. Research into low-cost catalysts and modular reforming units has been advanced by public-private partnerships. The demand from the fertilizer and refining sectors is anticipated to expand rapidly, given the need for cleaner hydrogen sources. Efforts to develop green hydrogen corridors are driving infrastructure investments that favor biogas reforming technologies.

Germany’s market for steam methane reforming biogas to hydrogen is forecasted to expand at a CAGR of 32.2% through 2035. Industrial decarbonization efforts are driving investments in biogas reforming reactors to replace grey hydrogen production. Biogas derived from organic waste is increasingly integrated with steam methane reforming plants within chemical manufacturing clusters.

The transition is supported by stringent emissions regulations and hydrogen demand from the transport sector. Advanced catalyst development and process optimization have improved the energy efficiency of biogas reforming units. Regional infrastructure projects are underway to facilitate hydrogen transport and storage linked to biogas reforming facilities. Public funding programs have accelerated the demonstration and scale-up of biogas-to-hydrogen technologies.

The UK market for steam methane reforming biogas to hydrogen is estimated to grow at a CAGR of 26.6% by 2035. The integration of biogas into steam methane reforming is driven by commitments to reduce carbon emissions across industrial and power generation sectors. Biogas sourcing from anaerobic digestion of organic waste is increasingly used as an alternative feedstock to natural gas.

Key pilot projects are underway focusing on coupling reforming reactors with renewable biogas supplies. The hydrogen supply for fuel cell applications is expected to incorporate a growing share of biogas reforming output. Policy frameworks supporting low-carbon hydrogen production are stimulating investments in advanced reforming technologies. The market is gradually shifting toward decentralized hydrogen production models leveraging local biogas sources.

The steam methane reforming biogas to hydrogen market in the USA is projected to grow at a CAGR of 23.8% through 2035. The shift towards cleaner hydrogen production includes biogas reforming as a critical component of decarbonization strategies. Biogas from landfill and agricultural sources is increasingly utilized as an alternative to fossil natural gas in hydrogen reforming.

Technology advancements in catalyst stability and reactor design have improved biogas reforming process economics. Investments in hydrogen hubs across the Midwest and California emphasize integration with biogas feedstocks. Industrial demand from refining and chemical production sectors continues to increase the deployment of biogas steam methane reformers. Federal funding programs are accelerating technology adoption and pilot project execution.

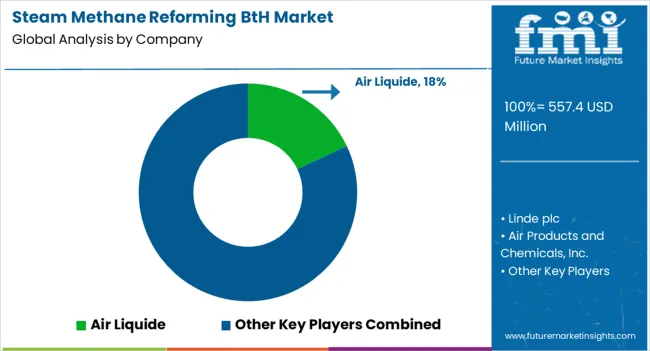

The steam methane reforming (SMR) biogas to hydrogen market is driven by companies specializing in hydrogen production technologies that convert biogas into clean hydrogen for industrial and energy applications. Air Liquide provides integrated SMR solutions with expertise in gas processing, offering modular plants designed to optimize biogas feedstock conversion while maintaining operational efficiency.

Linde plc delivers advanced reforming systems incorporating proprietary catalyst technologies, enhancing hydrogen yield from biogas and integrating carbon capture to reduce emissions. Air Products and Chemicals, Inc. develops scalable SMR units with tailored process controls targeting the renewable hydrogen segment, supporting various industrial sectors.

Praxair Technology, Inc. focuses on delivering equipment and engineering services that optimize biogas reforming processes, increasing hydrogen purity and system reliability. Haldor Topsoe supplies catalysts and process technologies improving conversion efficiency and lifespan of reformers in biogas-to-hydrogen setups.

HyGear (Xebec Adsorption Inc.) provides modular, on-site SMR units emphasizing decentralized hydrogen production using biogas as a feedstock. Competition centers on system integration capabilities, catalyst durability, feedstock flexibility, and minimizing CO2 emissions during hydrogen generation, with increasing interest in smaller-scale, localized production units for industrial clients.

Air Liquide, Linde plc, and Air Products expanded project portfolios focusing on low-carbon hydrogen production. Haldor Topsoe and Praxair Technology advanced catalyst and reformer technologies to optimize biogas conversion. HyGear (Xebec Adsorption Inc.) developed modular, scalable systems for distributed hydrogen generation. Market growth was supported by rising demand for clean fuel in transportation, power, and industrial sectors, alongside increasing regulatory emphasis on carbon reduction.

| Item | Value |

|---|---|

| Quantitative Units | USD 557.4 Million |

| Application | Power Generation, Chemical, Marine, Transport, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Linde plc, Air Products and Chemicals, Inc., Praxair Technology, Inc., Haldor Topsoe, and HyGear (Xebec Adsorption Inc.) |

| Additional Attributes | Dollar sales by technology (steam methane reforming, partial oxidation, auto-thermal reforming) and application (power generation, transportation, industrial feedstock), demand driven by renewable energy adoption and decarbonization goals, regional trends led by Asia-Pacific with North America catching up, innovation in modular reformers, carbon capture integration, and biogas feedstock optimization. |

The global steam methane reforming biogas to hydrogen market is estimated to be valued at USD 557.4 million in 2025.

The market size for the steam methane reforming biogas to hydrogen market is projected to reach USD 6,580.4 million by 2035.

The steam methane reforming biogas to hydrogen market is expected to grow at a 28.0% CAGR between 2025 and 2035.

The key product types in steam methane reforming biogas to hydrogen market are power generation, chemical, marine, transport and others.

In terms of , segment to command 0.0% share in the steam methane reforming biogas to hydrogen market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steam Trap Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Turbine Market Size and Share Forecast Outlook 2025 to 2035

Steam Sterilizer Bags Market Size and Share Forecast Outlook 2025 to 2035

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Steam Safety Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Trap Market Size, Growth, and Forecast 2025 to 2035

Steam Tables & Food Wells Market – Hot Food Service Solutions 2025 to 2035

Steam Flow Meter Market

Steam Operated Condensate Pump Market

Steam And Water Analysis System Market

Steam Humidifiers Market

Steam Turbine For Power Generation Market

Steam Autoclaves Market Size and Share Forecast Outlook 2023 to 2033

Steam Jet Ejector Market

Steam Trap Monitor Market

Steam Chemical Indicator Market

Steam Methane Reforming Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Blue Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA