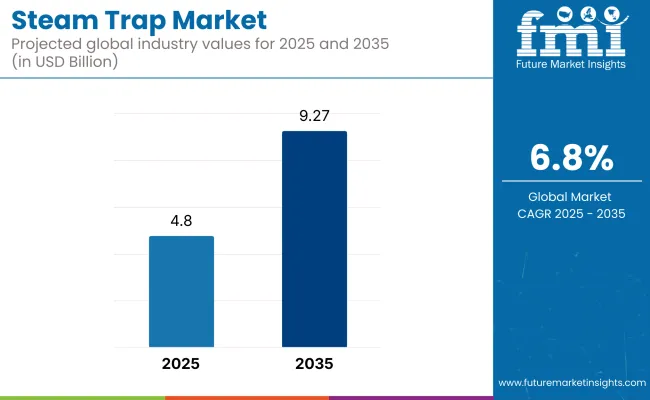

The global steam trap market is projected to grow from USD 4.8 billion in 2025 to USD 9.27 billion by 2035, expanding at a CAGR of 6.8%. Growth is predominantly driven by the rising demand for automation in energy-intensive sectors such as oil & gas and power generation.

Countries like the United States, India, and China are spearheading adoption due to their investments in energy optimization technologies and regulatory compliance. Thermodynamic steam traps remain the most widely used product type, while steel dominates material preference due to durability and corrosion resistance.

Key growth drivers include stricter energy efficiency mandates, the rising importance of predictive maintenance, and the shift toward smart, IoT-enabled steam traps. Industries are under increasing pressure to reduce energy waste and meet emissions targets, resulting in high demand for intelligent steam traps in applications such as pipeline tracing, process heating, and condensate removal. However, cost sensitivity in developing markets like India and China continues to influence the adoption of mechanical over automated traps.

Looking ahead, the industry is expected to evolve rapidly with a strong focus on sustainability, AI-integrated monitoring, and regulatory alignment. Trends such as leasing-based models, hybrid steel-alloy designs, and partnerships for localized manufacturing are expected to gain momentum.

Firms investing in R&D and predictive analytics platforms will likely achieve competitive differentiation. As the sector matures, the convergence of digitalization and regulation will define the next growth frontier for steam trap manufacturers across global markets.

Additionally, market competitiveness is intensifying as both global and regional players accelerate innovation in response to evolving end-user needs. Leading companies such as Spirax-Sarco Engineering, Emerson Electric Co., and TLV Co., Ltd. are expanding their portfolios with intelligent steam trap systems that offer real-time diagnostics and remote monitoring. The growing emphasis on lifecycle cost reduction and energy recovery is prompting manufacturers to offer service-based models and bundled solutions.

At the same time, regulatory pressures-especially in Western markets-are compelling firms to meet stringent certifications such as ASME, ISO, and EPA-compliant efficiency standards. In developing regions, where affordability remains key, suppliers are adapting by offering robust yet cost-effective mechanical solutions. This dual-track approach-premium innovation in the West and scalable reliability in the East-will continue to shape the competitive dynamics of the global steam trap market through 2035.

The steam trap market is segmented into thermodynamic, mechanical, and thermostatic types. Thermodynamic steam traps continue to dominate due to their high durability in high-pressure environments, making them ideal for refineries and power plants. However, thermostatic steam traps are emerging as the fastest-growing segment, driven by their precise temperature control and compatibility with smart automation systems.

These are increasingly preferred in pharmaceutical and food industries, where thermal accuracy and energy savings are critical. Integration with IoT and predictive maintenance features makes thermostatic traps attractive in digital transformation initiatives across industrial plants, accelerating their uptake in modern facilities.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Thermostatic Traps | 7.4% |

Among drip, process, and tracing applications, process applications are projected to grow at the fastest rate. With rising energy costs, industries are focusing on optimizing heat transfer and steam usage in critical production phases. Steam traps used in process applications help minimize energy loss, maintain pressure integrity, and enhance throughput-particularly in high-precision industries such as chemicals, pharmaceuticals, and food processing. Additionally, the transition toward high-efficiency boilers and continuous production lines is increasing the need for automated steam trap systems capable of maintaining consistent thermal performance.

| Application | CAGR (2025 to 2035) |

|---|---|

| Process Application | 7.1% |

Steel remains the material of choice in steam trap construction due to its superior durability, corrosion resistance, and ability to withstand extreme industrial conditions. Its usage is expanding further as firms look to minimize long-term maintenance costs and improve energy efficiency. While iron-based traps are still used in cost-sensitive regions, the performance limitations and susceptibility to corrosion have restricted their share. The development of hybrid steel alloys and surface treatments is helping prolong lifecycle and reduce wear, making steel steam traps a cornerstone of next-gen industrial automation systems.

| Material | CAGR (2025 to 2035) |

|---|---|

| Steel | 6.6% |

The power generation industry is projected to be the fastest-growing end-use segment for steam traps, expanding rapidly as utilities upgrade their infrastructure for better thermal efficiency and emission control. Steam traps play a vital role in ensuring turbine performance, preventing condensate backflow, and reducing fuel consumption in thermal power plants. With rising investments in grid modernization and clean energy integration, steam trap systems are being incorporated into combined heat and power (CHP) units and waste-to-energy facilities. Additionally, power sector regulations increasingly mandate efficiency upgrades, making high-performance steam traps a key compliance tool.

| End Use | CAGR (2025 to 2035) |

|---|---|

| Power Industry | 7.3% |

The steam trap sector is on a robust growth path, driven by increasing automation in oil and gas, more stringent energy efficiency regulations, and increasing industrial infrastructure investments.

Firms that adopt sophisticated, intelligent steam trap technologies will achieve a competitive advantage through improved efficiency and cost savings, while laggards face operational inefficiencies and regulatory delays. With emerging industries, manufacturing, and power generation leading demand, the sector offers a strategic opportunity for visionary investors and business leaders.

Automate Smart with Competitive Edge

To remain at the forefront in a changing industrial environment, managers need to focus investments on intelligent steam trap solutions with smart monitoring and predictive analytics. These new technologies improve efficiency, reduce energy losses, and provide effortless compliance with strict regulatory requirements.

Align with Sustainability and Regulatory Momentum

With the rigidness in global energy policies, adopting high-efficiency steam trap technologies is no longer a choice but a matter of staying competitive. Business leaders need to take proactive steps to integrate sustainability into their businesses, build regulatory alliances, and establish their companies as energy-saving pioneers.

Enhance Innovation and Strategic Industry Expansion

Future-proofing needs to have a two-pronged emphasis on R&D and international market penetration. Businesses need to expedite the production of next-generation steam traps with self-regulating technology while creating strategic partnerships to widen distribution networks in high-growth sectors.

| Priority | Immediate Action |

|---|---|

| Regulatory Disruptions & Policy Shifts | Create a regulatory intelligence function to foretell policy changes and gain early compliance benefits. |

| Supply Chain Volatility & Strategic Sourcing | Enter into long-term contracts with high-reliability vendors to counteract material shortages and price spikes. |

| Smart Technology Leadership & Market Differentiation | Accelerate rollout of AI-based steam trap analysis to improve competitive positioning and drive operational effectiveness. |

To stay competitive, top priorities should be obtaining early regulatory compliance benefits, reducing supply risk dependencies, and accelerating AI-powered steam trap innovation. CEOs should sign exclusive supplier deals to offset raw material volatility and leverage automation to achieve operational efficiencies.

Predictive analytics integration in steam trap systems will not only improve performance but also generate new revenue streams via service-based models. The strategy now moves towards bold differentiation-that which wins in regulatory flexibility, supply chain mastery, and intelligent technology adoption will set the next stage for the industry.

The United States continues to be a leading player for steam traps, fueled by the fast growth of industrial automation and regulations on energy efficiency. The oil & gas and power generation sectors lead the adoption with the use of sophisticated steam trap technologies for minimizing emissions and maximizing fuel efficiency.

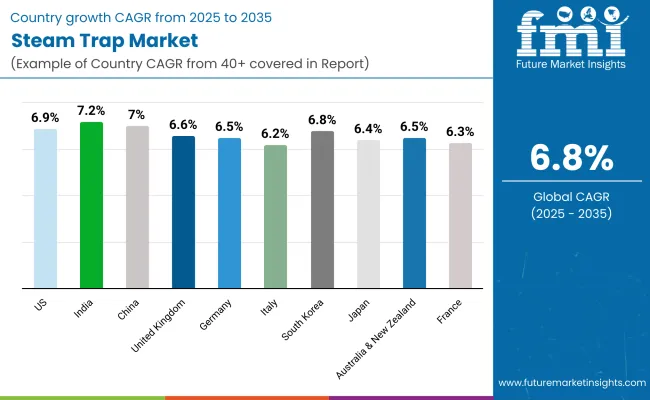

A growing focus on preventive maintenance is also promoting demand for IoT-enabled devices that ensure reliability of operations and reduce downtime. The chemical and pharmaceutical industries also account for considerable contribution, integrating high-performance steam traps to provide tight process control. FMI analysis found that the CAGR of this industry in the USA will be 6.9% from 2025 to 2035.

India's steam trap industry is set to witness strong growth, driven by fast-paced industrialization and rising investments in manufacturing and energy industries. The government's focus on Make in India and energy efficiency programs has hastened the uptake of steam management solutions in power plants, refineries, and food processing facilities.

In addition, small and medium-sized enterprises (SMEs) are now incorporating affordable steam traps to maximize operational efficiency and minimize fuel usage. The rise of smart industrial technologies, such as AI-powered steam management, is opening new avenues for manufacturers. FMI opines that the CAGR of this industry in India will be 7.2% over the forecast period.

China's industrial expansion and government-supported programs to enhance energy efficiency are driving the uptake of steam trap solutions in various industries. Heavy industry expansion, including steel, chemicals, and textiles, is pushing the demand for efficient steam management systems to enhance production efficiency. China's ambitious carbon neutrality plans are also pressuring industries towards energy-efficient steam traps that reduce heat loss and improve sustainability.

Domestic dominance in industry is also supporting demand, specifically in precision-related uses like pharmaceuticals and electronics. Spending on intelligent factories as well as on AI-based predictive maintenance solutions should support adoption levels. FMI analysis found that the CAGR of this industry in China is 7.0% from 2025 to 2035.

The United Kingdom is witnessing consistent growth in the adoption of steam traps, boosted by the government's industrial decarbonization agenda and net-zero ambitions. The manufacturing, food & beverage, and pharmaceutical industries in the country are incorporating high-performance steam traps into their operations to improve process efficiency and meet tight energy policies.

The shift towards hydrogen-based energy solutions is also impacting the industry, with steam trap technologies being fine-tuned for next-generation heating systems. As more focus is being placed on minimizing energy wastage, steam trap uptake in the UK will continue to grow steadily. FMI opines that the CAGR of this industry in the UK is 6.6% from 2025 to 2035.

Germany's manufacturing sector is extensively investing in energy-efficient steam management, spurred by rigid environmental regulations and high-level automation in the manufacturing process. Chemical and automotive sectors are among the leading users of high-performance steam traps that maintain high levels of precise temperature control and minimize energy loss.

Besides, the shift to sustainable energy resources is propelling steam trap demand for renewable energy processes, such as biomass and geothermal facilities. The nation's strong engineering talent and dedication to efficiency are inspiring innovation in the design of steam traps. FMI analysis found that the CAGR of this industry in Germany is 6.5% from 2025 to 2035.

South Korea's steam trap industry is propelled by industrial automation technology and the growing need for intelligent steam management solutions. Its semiconductor and electronics industries, which are among the top contributors to the economy, are incorporating precision steam traps to maximize thermal efficiency in manufacturing processes.

The petrochemical industry is another prime driver, with expansions of refineries requiring top-performing steam traps. Besides, the nation's emphasis on sustainability and renewable energy is also influencing companies to invest in steam traps that reduce wastage of energy. FMI opines that the CAGR of this industry in South Korea is 6.8% from 2025 to 2035.

The industry of steam traps in Japan is transforming with robust emphasis on sustainability, efficiency, and automation. The nation's manufacturing sector has been at the forefront of taking up automated steam traps with remote monitoring to facilitate greater energy optimization. Urban areas are pushing for energy-efficient solutions for steam management through the spread of district heating networks.

Further, the food & beverage industry is investing in smart steam traps to meet hygiene and safety standards. Japan's mission to become carbon neutral is also compelling industries to adopt smart steam trap technologies. FMI analysis found that the CAGR of this industry in Japan is 6.4% from 2025 to 2035.

France's steam trap industry is on the rise with industries focusing on energy conservation and regulatory adherence. The nation's chemical, pharmaceutical, and power generation industries are propelling the demand for energy-efficient steam traps that reduce energy losses. Increasing green industrial policies are forcing companies to adopt automated steam traps in conjunction with real-time monitoring systems.

Moreover, the growing use of renewable energy solutions such as biomass and waste-to-energy facilities is opening up opportunities for steam trap manufacturers. With robust government support for eco-friendly industrial processes, steam trap usage in France will grow consistently. FMI opines that the CAGR of this industry in France is 6.3% from 2025 to 2035.

Italy's steam trap industry is growing as industries are improving their energy efficiency measures. The textile and food processing industries are significant adopters, employing steam traps to maximize production processes while saving costs. The development of smart factories is also helping to fuel the greater adoption of IoT-capable steam traps for real-time performance monitoring.

As the industrial world becomes increasingly focused on green industrial practices, manufacturers are going for the latest generation of steam trap technology with the promise of long-term cost-effectiveness. Italy's demand for energy-saving manufacturing solutions will continue to support consistent industry growth. FMI analysis found that the CAGR of this industry in Italy is 6.2% from 2025 to 2035.

Australia and New Zealand’s steam trap industry is shaped by growing investments in energy efficiency and industrial automation. The mining and power generation sectors are the primary adopters, leveraging steam traps to enhance system reliability and reduce operational costs. The expansion of district heating networks and the push for carbon-neutral energy solutions are further driving adoption.

The food & beverage industry in both countries is increasingly integrating steam traps for process efficiency and regulatory compliance. With a focus on sustainability, the demand for advanced steam trap technologies is set to grow. FMI opines that the CAGR of this industry in Australia & New Zealand is 6.5% from 2025 to 2035.

(Surveyed Q1 2025, n=500 stakeholder participants evenly distributed across manufacturers, industrial plant operators, distributors, and energy consultants in the US, Western Europe, China, Japan, South Korea, and India.)

Priorities of Major Stakeholders

Energy efficiency is the primary concern, with 79% of global stakeholders considering reduction of steam loss as "critical" for cost savings and sustainability. Use of automated steam traps for real-time monitoring of leaks is spreading fast.

Regional Variance:

Adopting Sophisticated Technologies

Trends with high variance were witnessed in the adoption of IoT-capable steam traps.

Convergent and Divergent Views of ROI:

Whereas 69% of USA stakeholders found automation "worth the investment," 35% of Japanese producers were not convinced due to integration issues with older plants.

Material Preferences

Demand for high-durability steam traps is increasing across sectors.

Consensus:

Steel: Preferred by 68% worldwide because of endurance in high-pressure conditions.

Variance:

Price Sensitivity

Purchasing behavior has been influenced by cost pressures because of increasing raw material costs.

Shared Challenges:

86% of the respondents mentioned increasing steel and manufacturing costs as a key concern.

Regional Variations:

Value Chain Pain Points

Manufacturers:

Distributors:

End-Users (Industrial Operators):

Future Investment Priorities

A prominent emphasis on technology developments appeared among stakeholders.

Alignment:

73% of worldwide manufacturers intend to make higher investments in sensor-based steam traps.

Divergence:

Regulatory Impact

Conclusion: Variance vs. Consensus

High Consensus: Energy efficiency, material resilience, and budget restrictions are across-the-board issues.

Key Variances:

Strategic Insight:

Manufacturers must prioritize automation in the West, cost savings in Asia, and hybrid solutions in sectors that are moving toward digital adoption.

| Country | Key Regulations & Mandatory Certifications |

|---|---|

| United States | Energy-saving standards by DOE and EPA make steam traps in industrial applications achieve stringent energy-saving standards. Steam traps for pressure systems must carry ASME and ANSI certifications. |

| India | The Bureau of Energy Efficiency (BEE) is promoting tougher efficiency standards for industrial steam traps in accordance with national carbon savings targets. Manufacturing approval is carried out through IS 5312 certification. |

| China | The China Energy Conservation Law mandates energy efficiency standards for industrial steam traps, with CCC (China Compulsory Certification) for imports and domestic units. |

| United Kingdom | The UK Climate Change Act and Energy Savings Opportunity Scheme (ESOS) require regular steam trap audits for large enterprises. Steam systems must comply with BS 806. |

| Germany | Efficiency of steam trap should comply with DIN EN 12952 and DIN EN 12953 in the interest of energy conservation. More stringent policies for carbon cut under the Federal Climate Protection Act are driving fresh acquisitions. |

| South Korea | Advanced steam trap technology is encouraged under the Energy Use Rationalization Act to reduce industrial emissions. KOSHA certification is necessary to ensure steam system safety compliance. |

| Japan | The Rational Use of Energy Act encourages efficient steam traps for industrial efficiency. JIS B 8231 standards control steam trap quality and performance. |

| France | The French Energy Transition Law requires steam system modernization in industrial facilities, with AFNOR certification necessary to meet national energy policy requirements. |

| Italy | Businesses need to comply with EU Ecodesign Regulations for steam traps, which reduce emissions and enhance efficiency. UNI 11584 standards control steam trap performance. |

| Australia-New Zealand | Australian National Greenhouse and Energy Reporting Act and NZ Energy Efficiency Programme mandate regular steam trap inspection. AS/NZS 3788 steam trap safety in high-pressure systems compliance is mandatory. |

The sector for steam traps is moderately fragmented, with several regional and international players vying for market share. Top companies in the industry are using competitive pricing, technology innovation, strategic alliances, and expansion into new segments to drive their positions.

Energy-efficient and intelligent steam trap solutions are of prime importance, as they meet the increasing demand for sustainable industrial processes. Joint ventures with local distributors and service providers are also prevalent, as they improve segment reach and customer support.

Recent updates have it that Emerson Electric Co. has made a move to acquire Fluxa, a life sciences software company, to support its automation offerings. The action is meant to enhance operating efficiency and move further into industrial automation.

Spirax-Sarco Engineering has also released a new series of steam traps with built-in monitoring systems to support energy efficiency and less maintenance for industrial consumers. These developments reflect the industry's focus on innovation and strategic growth to meet evolving industry demands.

Thermodynamic, Mechanical, Thermostatic

Drip Application, Process Application, Tracing Application

Steel, Iron

Oil & Gas, Power Industry, Pharmaceuticals, Food & Beverage, Pulp & Paper, General Industry, Others

North America, Latin America, Europe, Asia Pacific, MEA

Increased automation of industrial processes, more stringent energy efficiency requirements, and technological advancements in smart monitoring are spurring the installation of next-generation steam traps.

Industry leaders are using IoT integration, predictive maintenance features, and advanced materials to improve efficiency, minimize downtime, and provide long-term cost savings.

High-performance steam traps are top of mind among energy-intensive processes like oil & gas, power generation, and pharmaceuticals in order to streamline operations and satisfy regulatory requirements.

Diverse regulatory requirements, expensive maintenance, and supply chain disruptions persist as major pain points for manufacturers, driving them to innovate and optimize production.

Tighter emissions standards and energy-saving programs are driving companies to invest in intelligent steam traps, speeding up adoption and innovation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steam Trap Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Trap Monitor Market

Steam Turbine Market Size and Share Forecast Outlook 2025 to 2035

Steam Sterilizer Bags Market Size and Share Forecast Outlook 2025 to 2035

Steam Autoclaves Market Size and Share Forecast Outlook 2023 to 2033

Steam Methane Reforming Blue Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Steam Safety Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Biogas To Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Tables & Food Wells Market – Hot Food Service Solutions 2025 to 2035

Steam Chemical Indicator Market

Steam Flow Meter Market

Steam Humidifiers Market

Steam Jet Ejector Market

Steam And Water Analysis System Market

Steam Operated Condensate Pump Market

Steam Turbine For Power Generation Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA