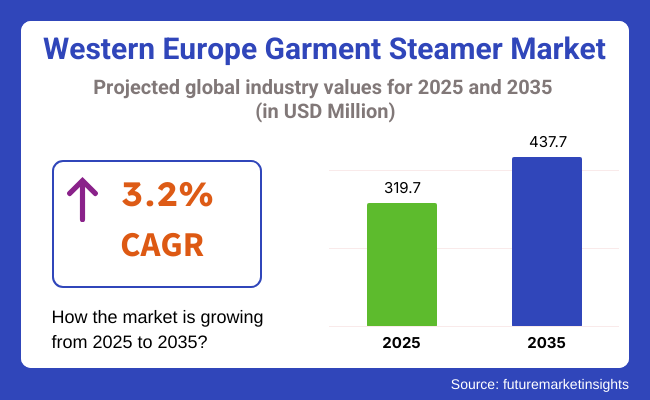

The Western Europe garment steamer market is poised to register a valuation of USD 319.7 million in 2025. The industry is slated to grow at 3.2% CAGR from 2025 to 2035, witnessing USD 437.7 million by 2035.

The market is witnessing consistent growth due to a confluence of lifestyle changes, rising urbanization, and shifting consumer preferences toward convenience-oriented home appliances. In an era where time efficiency and ease of use are highly valued, garment steamers offer a quick, hassle-free alternative to traditional irons, making them increasingly attractive to modern consumers.

With their convenience to remove wrinkles instantly without the use of an ironing board, steamers are particularly attractive to working professionals, students, and business travelers-market segments that value speed and convenience over time-consuming ironing processes.

Increasing focus on garment care and fabric protection has also made steamers a popular product. Contrary to irons, which can ruin dainty materials by direct heat contact, steamers apply mild steam, so they can be used on a greater variety of materials such as silk, wool, and synthetic. This effectiveness combined with the increased rate of garments produced using such sensitive materials has seen steamers become an increasingly popular and safe choice for daily use.

Consumers are also becoming increasingly hygiene and sanitation-conscious, and steamers provide an added benefit in this regard, as their hot-temperature steam can kill bacteria, allergens, and odors in clothing without the application of chemicals.

Another driving factor for market growth is the minimalist living and small home appliance trend, particularly in urban areas where space is at a premium. Portable and handheld garment steamers are well-suited for this demand, as they are easy to store, space-efficient, and travel-friendly.

Moreover, the growth of e-commerce websites has enhanced availability of a range of garment steamer models, brands, and price points, further increasing adoption. As Western European consumers increasingly look for efficiency, fabric care, and convenience in their home appliances, demand for garment steamers is likely to maintain its upward trend in the years to come.

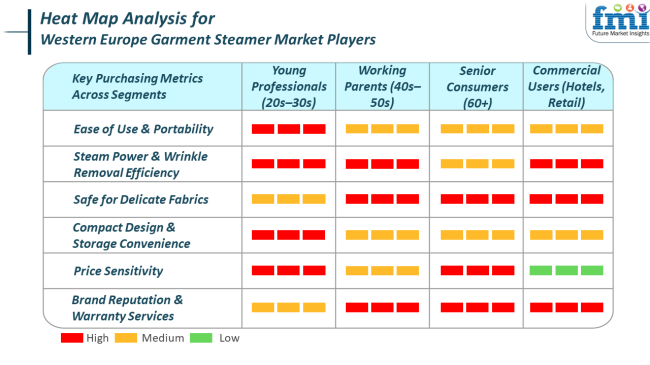

In Western Europe, the market for garment steamers is being influenced by changing consumer tastes across various end-use sectors. Individual consumers-urban residents, young professionals, and millennials-are especially inclined to prefer compact and convenient-to-use handheld steamers.

These consumers emphasize space-efficient designs, rapid use, and the convenience of managing daily wardrobe requirements without bulk or time involved in irons. Quick-heating compact steamers that can safely process a variety of fabrics are becoming necessities for individuals who reside in smaller homes or have on-the-go lifestyles.

In commercial settings like hotels, fashion stores, and dry cleaners, durability, performance, and efficiency take center stage. Companies need steamers that can last long, provide consistent steam pressure, and guarantee fabric protection. In both residential and commercial markets, auto shut-off, variable steam levels, and quick heat-up time are now minimum standards.

Sustainability and energy efficiency are also driving buying choices, and consumers are opting for environmentally friendly brands with reusable parts, BPA-free items, and reduced energy use.

Between 2020 and 2024, the Western Europe garment steamer market experienced significant change, largely stimulated by changes in lifestyle, increasing awareness regarding the care of fabric, and the impact of the pandemic. As people increasingly worked from home, demand for convenient, hassle-free garment care options that did not involve bulky ironing equipment increased.

This time also witnessed the fast pace of e-commerce, facilitating consumers to purchase a range of garment steamer models, from niche and foreign brands, more easily. The move away from fast fashion and towards sustainable, longer-term wardrobes also impacted buyers to invest in appliances that maintain garment quality.

Technological advancements around this period, including quicker heat-up times, anti-drip functionality, and more ergonomic builds, made garment steamers a mainstream household gadget instead of an niche product.

From 2025 and beyond to 2035, the market will continue to observe innovations with high focus on integrating smart technology, saving energy, and being sustainable. Shoppers will turn to steamers that can connect with smart home platforms or include technologies such as auto-fabric sensing, self-clean capabilities, and eco-modes.

With energy prices increasing and heightened sensitivity toward the environment, producers will come under scrutiny to provide low-consumption, recyclable, and refillable solutions. Further, the industry will benefit from urbanization and decreasing size of living spaces, particularly in cities, as a result of which multi-function compact appliances will be in high demand.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| During this time, garment steamers became popular among consumers at home, particularly as the pandemic made working from home the new norm and people spent more time indoors. People started spending more on home appliances that saved time and space. | Garment steamers during the coming decade will feature futuristic technologies like intelligent sensors, Bluetooth/Wi-Fi connectivity, and app-operated features. Equipment will include fabric identification systems, automatic steam adjustment, and connectivity with smart home assistants |

| Health issues during COVID-19 compelled consumers to appreciate steamers not just for wrinkle removal but also for their capacity to sanitize fabrics by eliminating germs and allergens. This was the start of steamers being considered both garment care and hygiene equipment. | As there is increasing awareness of climate change and conservation of resources, future consumers will appreciate steamers that use less electricity, have recyclable parts, and have refillable water tanks. Companies embracing environmentally friendly materials and open manufacturing will gain increased consumer trust. |

| Online shopping dominated in this stage. Convenience to compare models, read reviews, and get access to specialty brands on e-commerce helped accelerate garment steamer adoption. | Brands will increasingly establish direct relationships with consumers on their own platforms while combining physical and digital experiences. Customization is offered, live product demonstrations, and after-purchase online support will be the norm further increasing user involvement. |

| Users preferred small, travel-sized steamers that could be easily accommodated in confined spaces. Aesthetically pleasing, lightweight, and ergonomically shaped models became popular, particularly with younger urban users. | Future designs will be optimized for multifunctionality, with the integration of steaming along with deodorizing, disinfecting, and even light pressing. Small but powerful steamers will become popular in space-saving homes and on-the-move lifestyles, with high utility in reduced footprints. |

The Western Europe garment steamer market, though seeing consistent growth, is exposed to some underlying risks that may affect its long-term performance. Market saturation is one of the key issues, especially in urban regions where adoption of garment steamers has already attained very high levels.

As more homes own these products, the sales potential from new buyers can begin to slow, compelling manufacturers to depend significantly on innovation, product replacement, and upgrades to continue sales momentum. Moreover, as the newness of garment steamers wears off, consumer enthusiasm can wane unless constantly energized by technology advancements or lifestyle-based promotion.

Economic considerations also present a significant risk. Pressure of inflation, fluctuation of energy prices, and lower discretionary incomes in bad times can impact the spending by consumers on non-essential household items such as garment steamers. During adverse times, customers may switch to more affordable or conventional options like manual irons or professional laundries.

Furthermore, higher price sensitivity within mid- and low-income categories can also be an obstacle in the adoption of premium products, limiting the chances for brands targeting premium or high-feature models.

Handheld or portable garment steamers are the most common type of steamers in Western Europe, mostly because of their convenience, compact size, and flexibility with today's lifestyle. As urbanization increases and living quarters grow smaller-particularly in cities such as London, Paris, and Berlin-customers prefer appliances that save space and are easy to put away.

Handheld steamers provide a convenient, hassle-free way of daily garment care, doing away with the need for ironing boards and lengthy heat-up periods. They are especially favored by young working professionals, students, and regular flyers who appreciate time saving and convenience. The ease of operation, cost-effectiveness, and lightweight design also add to their cross-section usage among diverse income groups.

Conversely, non-portable or standing garment steamers are more prevalent in homes with greater space or in commercial and business environments, like hotels, boutiques, and dry cleaners. These steamers have greater steam output and more continuous steaming time, making them ideal for heavier material and bulk garment care.

In Western Europe, the residential/household segment is the key end-user base for garment steamers, led by evolving lifestyle trends, greater emphasis on self-grooming, and the demand for easy, home-based solutions. As more people work from home and put greater importance on appearance in virtual and face-to-face professional environments, there is high demand for fast and effective clothing care.

Portable garment steamers are especially favored by city residents who have limited space and want small, portable appliances for everyday use. These consumers appreciate the time-saving and gentleness of steamers on fabrics, as well as their ability to refresh clothing without harming sensitive fabrics. Younger consumers and millennials have also adopted garment steamers as a contemporary substitute for conventional irons, appreciating their convenience and style.

On the business side, although the segment is smaller in size, it performs a strategic and niche function in the overall market. Hospitality, fashion retail, dry cleaning operations, and theater/motion picture production depend on professional-grade garment steamers for their capacity to handle heavy quantities of clothes speedily and efficiently.

The Western European garment steamer market is vibrant and steadily expanding, driven by urban lifestyles, rising demand for convenient dressing and care, and a definite preference for compact, efficient alternatives to conventional irons. The market is led by global giants such as Philips, Electrolux, and Rowenta (Groupe SEB), who provide sturdy, high-performance products for both domestic and professional use.

Along with them, newer and niche brands such as FRIDJA LIMITED, AICOK, and Pure Enrichment are leveraging e-commerce platforms and minimalist aesthetics to attract contemporary consumers. With growing consciousness regarding sustainability, portability, and fabric safety, innovation keeps driving differentiation in product design, performance, and pricing.

Company Name & Estimated Industry Share (%)

| Company Name | Estimated Industry Share (%) |

|---|---|

| Koninklijke Philips N.V. | 14-16% |

| Electrolux AB | 10-12% |

| Groupe SEB ( Rowenta ) | 11-13% |

| Conair Corporation | 8-10% |

| BLACK+DECKER Inc. | 7-9% |

| FRIDJA LIMITED | 3-5% |

| AICOK | 3-5% |

| Pure Enrichment Company | 2-4% |

| Hamilton Beach Brands Holding Company | 2-4% |

| Amway Corporation | 2-3% |

| Company Name | Key Offerings and Activities |

|---|---|

| Koninklijke Philips N.V. | tSells handheld and upright steamers with quick heat-up times, steam-on-demand technology, and energy-saving operation. Suitable for home consumers focusing on quality and convenience. |

| Electrolux AB | tExcels in mid-to-premium steamers with Scandinavian aesthetics, steady steam flow, and long-lasting constructions. Suitable for contemporary homes and chronic users. |

| Groupe SEB ( Rowenta ) | Recognized for vertical and upright steamers that blend powerful steam output with anti- calc functionality. Popular among households and semi-professional settings. |

| Conair Corporation | Offers low-cost, compact steamers appealing to younger consumers. Focus on portability, convenience, and fabric protection in travel and home units. |

| BLACK+DECKER Inc. | Produces reliable and low-cost steamers with simple features. Attracts first-time users and price-sensitive households. |

| FRIDJA LIMITED | UK niche player selling salon-grade steamers to fashion stylists and boutiques. High-performance, sleek design, and professional-grade finish. |

| AICOK | Sells highly featured steamers online at affordable prices. Compact, fast-heating designs well-suited to everyday use in small city apartments. |

| Pure Enrichment Company | Targets health-conscious consumers with chemical-free, fabric-safe steamers. Branded for minimalist, wellness-themed designs and portable units. |

| Hamilton Beach Brands | Provides compact steamers emphasizing core performance and value. Suitable for intermittent home users and travelers. |

| Amway Corporation | Runs on a direct-selling business. Provides stable garment steamers integrated with more general home-care solutions. Resonates with dedicated, brand-trusting customers. |

Strategic Outlook

The Western European garment steamer market is expected to expand steadily with increasing demand for portable, fast-use fabric care gadgets and diminishing dependence on conventional ironing. Philips, Rowenta, and Electrolux continue to drive innovation in design, features, and intelligent integration, retaining strong positions.

At the same time, e-commerce-focused brands FRIDJA, AICOK, and Pure Enrichment are shaking up the category by targeting younger, tech-aware, and space-saving consumers. The market will tend to change with trends focusing on sustainability, energy efficiency, and beauty of function, with companies that merge performance and personalization attracting long-term allegiance.

In terms of product type, the industry is classified into handheld/portable and upright/non-portable.

Based on end use, the market is classified into household/residential and commercial.

With respect to power, the industry is divided into below 750 watt, 750-1000 watt, 1000-1500 watt, 1500-2500 watt, and 2500 watt & above.

In terms of water tank capacity, the market is categorized into below 500 ml, 500-1 litre, 1-2 litre, 2-3 litre, 3-4 litre, and 4 litre & above.

In terms of material, the industry is classified into plastic, metal, aluminium, stainless steel, cast iron, and ceramic.

Based on sales channel, the market is divided into direct and indirect.

By country, the industry is segregated into the UK, Germany, Italy, France, Spain, and the rest of Europe.

The industry is expected to reach USD 319.7 million in 2025.

The market is projected to witness USD 437.7 million by 2035.

The industry is slated to capture 3.2% CAGR during the study period.

Portable products are widely sold.

Leading companies include Koninklijke Philips N.V., Electrolux AB, AICOK, Groupe SEB, Rowenta, FRIDJA LIMITED, Conair Corporation, Pure Enrichment Company, BLACK+DECKER Inc., and Hamilton Beach Brands Holding Company.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA