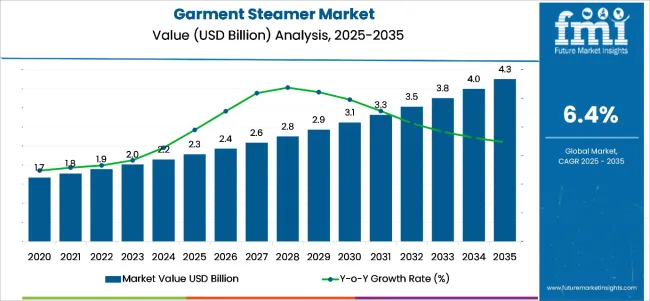

The garment steamer industry is expected to expand from USD 2.3 billion in 2025 to USD 4.3 billion by 2035, growing at a CAGR of 6.4%.This growth is fueled by a shift in consumer preference toward convenient, fabric-friendly alternatives to traditional irons. Increasing awareness of hygiene and fabric care, especially post-COVID, has driven adoption across households and commercial sectors such as hospitality and fashion retail.

Manufacturers are aligning with energy-efficiency norms and safety regulations set by agencies such as the USA Consumer Product Safety Commission and the European Committee for Electrotechnical Standardization. Key players are also leveraging online retail platforms and digital marketing strategies to reach younger demographics and urban consumers in regions like Asia Pacific and North America.

Industry leaders are emphasizing product innovation and sustainability. Hotel chains like Marriott and Hyatt have partnered with steamer brands to supply guest rooms, citing operational efficiency and garment safety. E-commerce giants such as Amazon have observed a 30% year-over-year growth in portable steamer sales.

With evolving consumer expectations, traceability and performance tracking are gaining traction. In 2024, Conair introduced QR-enabled warranty and usage tracking for select steamers, improving post-sale service and customer retention. The Home Appliance Standards Committee commended such innovations, citing their alignment with circular economy principles.

Compact handheld steamers are projected to comprise nearly 50% of total sales by 2035 due to urban living trends. The hospitality and garment care industries are expected to generate nearly 40% of global demand. As consumers seek ease of use, lower energy consumption, and enhanced garment protection, Products are becoming an essential component of modern fabric care routines.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.3 billion |

| Industry Value (2035F) | USD 4.3 billion |

| CAGR (2025 to 2035) | 6.40% |

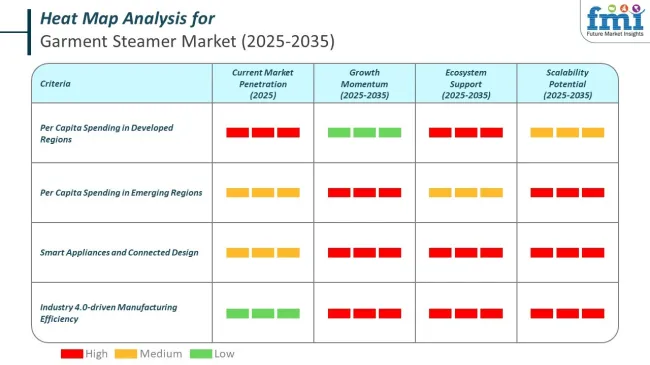

Per capita spending on garment steamers varies sharply across different global regions, reflecting disparities in income levels, lifestyle demands, and household appliance adoption. While aggregate consumption is highest in populous markets, individual spending per person remains elevated in developed economies due to higher purchasing power and preference for convenience-focused solutions.

The garment steamer market is rapidly adopting Industry 4.0 technologies such as IoT, AI, smart sensors, and cloud-based systems to revolutionize product design and production processes. These advancements enable connected appliances, improved manufacturing efficiency, and enhanced consumer experiences. IoT-enabled garment steamers now offer app-based connectivity, automatic steam calibration, and energy-saving modes.

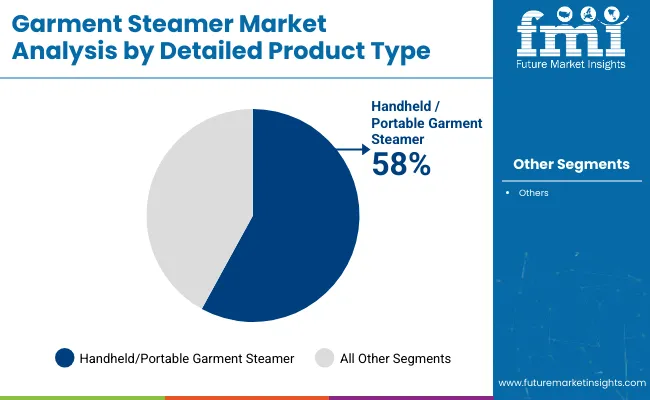

The industry has been comprehensively segmented to include detailed analysis by product type, sales channel, and region. By product type, the industry is categorized intohandheld/portable garment steamer and upright/non-portable garment steamer.

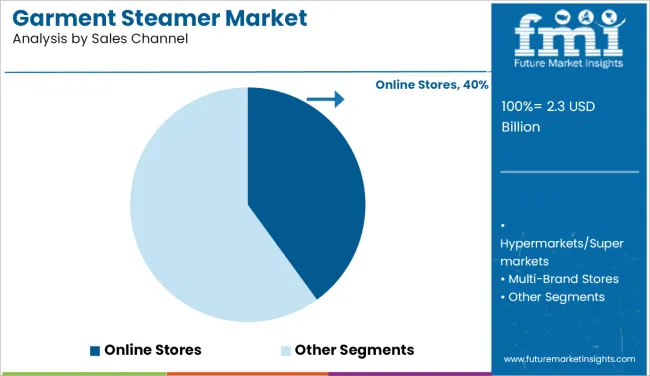

The sales channel analysis coversdirect sales, hypermarkets/supermarkets, multi-brand stores, exclusive stores, independent stores, online stores, and other sales channels. Regional analysis spansNorth America, Latin America, Europe, South Asia, East Asia, Oceania, and theMiddle East & Africa, with data examined across the historical period of 2020 to 2024 and forecasted from 2025 to 2035.

On the basis of product type, the handheld/portable segment accounts for 58% share.Handheld and portable garment steamers are widely sold because they offer a quick, convenient, and efficient way to remove wrinkles from clothes without the need for an ironing board.

Their compact and lightweight design makes them ideal for home use, travel, or small living spaces. Consumers appreciate their ease of use, fast heat-up time, and ability to freshen fabrics, sanitize garments, and reduce odors.

These steamers are also gentle on delicate materials like silk and chiffon, making them a versatile option for a variety of clothing types. As busy lifestyles demand faster and simpler solutions for garment care, the popularity of handheld garment steamers continues to grow among users looking for practicality and portability.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Handheld/Portable Garment Steamer | 5.80% |

| Upright/Non-Portable Garment Steamer | 5.10% |

Garment steamers are widely sold through online stores because of the convenience, variety, and competitive pricing e-commerce platforms offer.

Consumers can easily compare features, read reviews, and choose from a wide range of brands and models without visiting physical stores. Online retailers often provide detailed product descriptions, usage videos, and customer ratings, helping buyers make informed decisions.

Additionally, online shopping allows for doorstep delivery, easy returns, and frequent discounts or bundle offers, making it more attractive. As garment steamers are lightweight and compact, they are easy to ship, further encouraging online sales.

With growing demand for convenient garment care solutions and the popularity of e-commerce, online stores have become a preferred channel for purchasing garment steamers. By sales channels, the online stores segment accounts for 40% share.

| Sales Channel | CAGR (2025 to 2035) |

|---|---|

| Online Stores | 4.50% |

| Hypermarkets/Supermarkets | 5.40% |

| Multi-Brand Stores | 5.20% |

| Exclusive Stores | 4.80% |

| Independent Stores | 3.90% |

| Other Sales Channels | 3.50% |

The United States will continue to be the largest market, with a projected value of USD 800 million by 2035, up from USD 550 million in 2025. This reflects a stable CAGR of 3.8%, driven by demand from dual-income households and young professionals. The domestic regulatory landscape, led by the USA Consumer Product Safety Commission (CPSC) and the Department of Energy (DOE), mandates strict adherence to safety and energy efficiency norms.

Premium consumer expectations around technology integration have prompted manufacturers to focus on auto-cleaning systems, dual heat zones, and smart steam optimization. While in-store purchases through retailers like Target and Macy’s remain relevant, nearly 60% of sales in 2035 are expected via e-commerce. As Products increasingly compete with wrinkle-resistant clothing and high-end irons, brands must position themselves on convenience, safety, and design differentiation.

USA consumers increasingly demand appliances that blend utility with aesthetic appeal. This has led to a surge in sleek, lightweight, and multipurpose steamer designs that align with minimalist interior styles. Additionally, there's a growing segment of consumers looking for travel steamers that meet TSA standards and operate on dual-voltage, catering to business travelers and frequent flyers.

Sustainability is also becoming a strong purchase driver, with brands promoting low-energy usage and BPA-free water tanks. The integration of smart technology, such as app-enabled controls and usage tracking, is gradually entering the premium segment, particularly among tech-savvy younger consumers.

The USA industry remains attractive not only due to its purchasing power but also its trendsetting role in product innovation. Manufacturers seeking to capture or grow the garment steamer industry share must prioritize certifications, warranty-backed reliability, and seamless omnichannel experiences.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

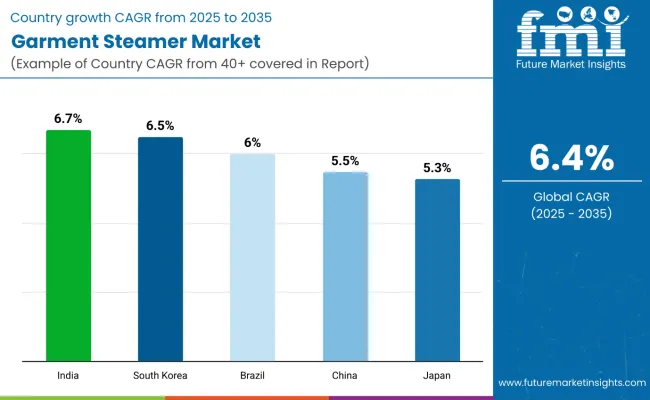

China's industry is on an aggressive upward trajectory, expected to reach USD 750 million in 2035 from USD 400 million in 2025, delivering a CAGR of 5.5%. This expansion is powered by rapid urbanization, rising middle-class disposable income, and lifestyle shifts toward compact, functional home appliances. Regulatory oversight from the State Administration for Industry Regulation (SAMR) is tightening around electrical safety and emissions standards, prompting local brands to invest in R&D and quality control.

E-commerce plays a dominant role, with platforms like JD.com and Taobao driving nearly 70% of unit sales. The younger demographic prefers portable and quick-use solutions, prompting strong growth in handheld segment variants. Competitive pricing and local manufacturing advantages enable Chinese players to scale rapidly while maintaining margins.

In recent years, Chinese consumers have shown increasing interest in multi-functionality and smart features. Devices that combine steaming with disinfecting or fabric deodorizing are gaining ground. Domestic manufacturers are also leveraging AI and app-based interfaces to deliver a seamless user experience.

Seasonal shopping festivals like Singles’ Day significantly impact industry dynamics, creating concentrated surges in sales volumes. Moreover, influencer-led live-stream shopping is reshaping how consumers discover and evaluate Products in real-time.

Despite being a price-sensitive industry, the growing sophistication of Chinese consumers is allowing mid-to-premium tier brands to gain traction. Going forward, success will hinge on balancing affordability, innovation, and speed-to-market execution.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.5% |

India represents one of the fastest-growing industries globally, with the industry projected to grow from USD 150 million in 2025 to USD 300 million by 2035, registering a CAGR of 6.7%. This surge is driven by a young and increasingly urbanized population, growing fashion consciousness, and rising disposable incomes among middle-class consumers. The need for convenient, affordable, and space-efficient alternatives to traditional irons is leading to the adoption of compact steamers, especially in Tier 1 and Tier 2 cities.

The regulatory landscape, under the Bureau of Indian Standards (BIS), is evolving to enforce stricter compliance for small electronic appliances. Domestic brands such as Havells, Usha, and Bajaj are actively innovating to produce lightweight and energy-efficient steamers suited for the Indian industry, which faces unique challenges like inconsistent voltage and high humidity.

E-commerce platforms such as Amazon India, Flipkart, and Reliance Digital dominate distribution due to their reach and affordability. Seasonal sales during festivals like Diwali and Big Billion Days contribute significantly to unit growth. Offline retail channels, including Croma and Vijay Sales, play a strong supporting role in metros.

Consumers are highly value-driven, preferring multifunctional devices that offer both vertical and horizontal steaming. Travel steamers and handheld units are increasingly preferred over upright variants due to portability and ease of use. Going forward, bundling steamers with other personal care electronics and increasing digital education on garment care will play pivotal roles in expanding the addressable industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.7% |

Japan's garment steamer industry is forecast to grow from USD 100 million in 2025 to USD 180 million by 2035, reflecting a steady CAGR of 5.3%. The Japanese industry values aesthetics, precision, and compact design-traits that perfectly align with premium Product offerings. A culture of meticulous clothing care and limited living space makes handheld steamers highly popular.

Regulatory oversight by the Ministry of Economy, Trade, and Industry (METI) ensures all appliances meet high standards for safety, energy efficiency, and quiet operation. Japanese brands such as Panasonic and Iris Ohyama dominate the industry, emphasizing product reliability, sleek design, and antimicrobial steam technology. These features are essential in a hygiene-conscious, aging society where consumers demand both safety and usability.

Department stores like Bic Camera and Yodobashi Camera still play a role, but there is an accelerating shift toward digital commerce platforms such as Rakuten and Amazon Japan. High consumer loyalty and preference for Japanese-made products provide local manufacturers with a competitive edge against global brands.

Increasing overlap between beauty routines and garment care is opening up new product marketing angles. Innovations around allergen-free steaming and wrinkle-removal technology that caters to delicate fabrics are likely to see higher uptake among female consumers and elderly households.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

Germany's industry is anticipated to expand from USD 80 million in 2025 to USD 130 million in 2035, registering a CAGR of 5.0%. The German consumer is quality-focused, demanding highly efficient, long-lasting, and eco-certified home appliances. Garment steamers are steadily replacing irons in households that prioritize wrinkle-free, ready-to-wear clothing with minimal effort.

The country’s regulations, governed by BAuA and the German Energy Agency, emphasize safety, energy conservation, and recyclability. German brands and premium European manufacturers like Tefal, Braun, and Miele are incorporating sensor technology, automatic shutoff features, and EU-certified eco-materials into their product lines.

Retail activity remains strong through both traditional electronics chains like MediaMarkt and Saturn and online channels like Amazon.de. German consumers rely heavily on verified reviews, energy certifications, and comparative value ratings when choosing appliances.

Handheld steamers dominate over upright variants due to their suitability for modern apartments and their integration with smart home ecosystems. Sustainability, noise reduction, and compact form factor will remain decisive features as Germany continues its shift toward minimal-waste, low-energy households.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.0% |

The United Kingdom's industry is forecasted to grow from USD 70 million in 2025 to USD 110 million by 2035, at a CAGR of 4.7%. The industry reflects moderate but steady expansion driven by the rising demand for convenience in fabric care among working professionals and urban households. The growth is concentrated in major metropolitan areas such as London, Manchester, and Birmingham, where garment care is linked to formal workplace dress codes and fast fashion consumption.

The UK’s regulatory regime, overseen by the Office for Product Safety and Standards (OPSS), enforces clear labelling and safety compliance for all imported and domestic electrical appliances. The UK’s post-Brexit standards have also emphasized energy efficiency and recyclability in consumer products. British consumers are highly attuned to sustainability, with a growing preference for low-energy steamers and biodegradable packaging.

Retail distribution is dominated by omnichannel players such as John Lewis, Argos, and Amazon UK, with mobile-friendly digital interfaces and next-day delivery boosting the online share. Seasonal sales like Black Friday and Boxing Day generate large purchase spikes. Customers prioritize steamers that are lightweight, versatile, and quick-heating, particularly those with accessories for delicate fabrics and upholstery.

The industry is increasingly favoring smart integration, and premium products are being marketed not just as appliances, but as components of a broader home care ecosystem. Manufacturers offering warranties, eco-labels, and digital guides for use and maintenance are likely to capture a larger share.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

France’s industry is expected to grow from USD 60 million in 2025 to USD 100 million in 2035, registering a CAGR of 5.2%. The market is driven by an image-conscious population, especially in urban centers such as Paris, Lyon, and Marseille, where wardrobe care is closely tied to fashion aesthetics and lifestyle branding.

The French regulatory ecosystem, managed by DGCCRF and ANSES, ensures that consumer appliances meet strict safety and emission standards. Energy ratings and fragrance-free options are gaining popularity as consumers become more sensitive to indoor air quality and environmental impacts.

Steamers that double as disinfecting tools or allow the use of essential oils for aromatherapy are carving out a niche appeal. Carrefour and FNAC-Darty remain strong in offline channels, while online platforms like Amazon France, Cdiscount, and Monoprix Digital are seeing surges in direct-to-door orders, particularly for multifunctional handheld variants.

The French consumer’s expectations of elegance and performance are creating demand for premium European brands like Calor and Rowenta. Promotional tie-ins with fashion houses, beauty brands, and influencers are helping elevate Products as must-have personal lifestyle devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 5.2% |

Brazil's industry is set to rise from USD 50 million in 2025 to USD 90 million in 2035, reflecting a CAGR of 6.0%. Brazil’s growing middle class and the shift towards urban apartment living are key enablers for this trend. Brazilian consumers are embracing steamers as low-maintenance alternatives to traditional ironing, particularly as affordability improves.

Regulatory bodies like INMETRO enforce compliance for appliance safety, voltage protection, and manufacturing origin. Regional disparities in infrastructure mean demand is largely focused in the Southeast-particularly São Paulo, Rio de Janeiro, and Belo Horizonte-where electrification, income levels, and lifestyle aspirations are highest.

Handheld models dominate the Brazilian market due to their low cost and ease of use. Online retail giants such as Magazine Luiza, Mercado Livre, and Americanas have built strong distribution channels supported by in-app financing and cash-on-delivery options. Local manufacturing by emerging Brazilian brands is also growing, helping to buffer against currency volatility and import duties.

Increasing interest in garment care among young professionals and students is helping to widen the industry base. Marketing steamers for their dual utility-both for grooming and sanitizing-is expected to become a powerful positioning lever.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 6.0% |

South Korea’s garment steamer industry is projected to grow from USD 45 million in 2025 to USD 85 million in 2035, achieving a CAGR of 6.5%. The country’s highly trend-sensitive and technologically advanced population is increasingly turning to Products as part of holistic grooming and daily wardrobe management.

The Korean Agency for Technology and Standards (KATS) mandates advanced safety and electromagnetic compliance for domestic and imported appliances. Consumers expect flawless performance, low noise, compact design, and high aesthetic appeal, often favoring pastel-toned or metallic finishes.

Retail is led by omnichannel players such as Lotte, E-Mart, and Coupang. Mobile app shopping and influencer-driven sales are particularly strong among 20- to 40-year-old consumers. Homegrown giants like LG and Coway lead innovation with features like IoT-enabled steaming schedules, AI-assisted fabric recognition, and integration into smart wardrobes.

As Korean consumers seek devices that combine health, hygiene, and design, garment steamers that offer anti-bacterial properties, dehumidification, and scent control are commanding premium prices. The industry is increasingly viewed not just as an appliance sector, but as part of a broader lifestyle-tech industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

Australia's industry is anticipated to increase from USD 40 million in 2025 to USD 70 million by 2035, marking a CAGR of 5.5%. Demand is shaped by urban consumer preferences for compact, low-maintenance, and energy-efficient devices. Rising utility costs and eco-consciousness further reinforce this trend.

The Australian Competition and Consumer Commission (ACCC) enforces mandatory safety and environmental compliance for all household electrical appliances. Products with recyclable packaging, low wattage, and multiple steaming modes are preferred by the urban population concentrated in Sydney, Melbourne, and Brisbane.

Harvey Norman and The Good Guys continue to anchor physical retail, while Amazon Australia, Kogan, and Catch dominate digital sales. Consumers rely heavily on reviews, YouTube demonstrations, and influencer endorsements to finalize purchasing decisions.

Australian consumers often choose portable and travel-friendly steamers that also sanitize upholstery and baby garments. As flexible work arrangements become permanent, steamers that support quick grooming before video calls or outings are becoming a household staple.

| Country | CAGR (2025 to 2035) |

|---|---|

| Australia | 5.5% |

| Company Name | Estimated Global Market Share (2025) |

|---|---|

| Philips Domestic Appliances | 13-15% |

| Rowenta ( Groupe SEB) | 10-12% |

| Panasonic Corporation | 7-8% |

The global industry is characterized by a moderately fragmented competitive landscape, with a mix of multinational giants and regional specialists. The industry leaders are employing differentiated strategies to strengthen brand positioning, improve product innovation, and expand distribution channels.

Philips Domestic Appliances, known for its deep product innovation and health-centric branding, has focused on ergonomically designed handheld steamers with energy-efficient technology. The company emphasizes smart temperature control, quick heat-up functionality, and dual-voltage adaptability-features tailored for both home and travel use.

Jiffy Steamer Company, LLC, one of the oldest steamer brands, continues to dominate the professional segment, particularly among fashion retailers, dry cleaners, and event-based garment services. It leverages industrial-grade build quality, durable heating components, and a reputation for longevity.

Conair Corporation and its sub-brand SteamFast (Vornado Air, LLC) target the middle-income household and travel segment, offering compact, affordable models. Conair is also increasing its focus on smart home integration, positioning its steamers alongside personal grooming products.

Rowenta (Groupe SEB) is leveraging Groupe SEB's European design heritage and eco-efficiency leadership to attract premium consumers. Its steamers feature auto shut-off, anti-calc systems, and multi-steam head options. The brand is actively promoting EU-compliant sustainability credentials.

Panasonic Corporation is focusing on ultra-quiet operation and compactness, particularly in the Japanese and Southeast Asian industries. Panasonic steamers often include antimicrobial coating and garment sanitization as USPs.

PurSteam and SALAV focus on affordability and accessibility in mass-market retail and e-commerce. SALAV, part of Shenzhen Salav Household Products Co., Ltd., is expanding globally through volume-based pricing and frequent SKU updates.

Midea GroupandHaier Group Corporation, large appliance conglomerates from China, are integrating garment steamers within larger smart home ecosystems. They focus on multifunctionality, modular design, and in-app connectivity.

Industry share is broadly distributed, with Philips, Rowenta, and Panasonic collectively estimated to hold approximately 30-35% of global value share. Regional players like Jiffy (in North America) and SALAV (in East Asia) maintain strong local positions.

Trade associations such as the Home Appliance Manufacturers Trade Association (HAMTA) indicate that innovation around garment sanitization, energy efficiency, and user convenience will continue to shape competitive dynamics through 2035.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.3billion |

| Projected Market Size (2035) | USD 4.3billion |

| CAGR (2025 to 2035) | 6.40% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Detailed Product Type | Handheld/Portable Garment Steamer and Upright/ Non-Portable Garment Steamer |

| By Sales Channel | Direct Sales, Hypermarkets/Supermarkets, Multi-Brand Stores, Exclusive Stores, Independent Stores, Online Stores, and Other Sales Channels |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA |

| Countries Covered | United States, China, India, Japan , Germany , United Kingdom, France, Brazil, South Korea, Australia |

| Key Players | Philips Domestic Appliances, Jiffy Steamer Company, LLC, Conair Corporation, Rowenta ( Groupe SEB), Panasonic Corporation, SteamFast (Vornado Air, LLC), PurSteam World’s Best Steamers, SALAV (Shenzhen Salav Household Products Co., Ltd.), Midea Group, Haier Group Corporation |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The garment steamer industry is segmented into handheld/portable garment steamer and upright/ non-portable garment steamer.

The industry is divided into direct sales, hypermarkets/supermarkets, multi-brand stores, exclusive stores, independent stores, online stores, and other sales channels.

The industry spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

The industry is poised to reach USD 2.29 billion in 2025.

The industry is slated to register USD 4.26 billion by 2035.

The hypermarkets/supermarkets are widely preferred.

India, slated to grow at 6.7% CAGR during the study period, is poised for the fastest growth.

Key companies include Philips Domestic Appliances, Jiffy Steamer Company, LLC, Conair Corporation, Rowenta (Groupe SEB), Panasonic Corporation, SteamFast (Vornado Air, LLC), PurSteam World’s Best Steamers, SALAV (Shenzhen Salav Household Products Co., Ltd.), Midea Group, and Haier Group Corporation.

Table 1: Global Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast, By End Use, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast, By End Use, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast, By Power, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast, By Power, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast, By Water Tank Capacity, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast, By Water Tank Capacity, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast, By Material, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast, By Material, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 13: Global Market Value (US$ Million) Forecast, By Region, 2018 to 2033

Table 14: Global Market Volume (Units) Forecast, By Region, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast, By End Use, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast, By End Use, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast, By Power, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast, By Power, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast, By Water Tank Capacity, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast, By Water Tank Capacity, 2018 to 2033

Table 25: North America Market Value (US$ Million) Forecast, By Material, 2018 to 2033

Table 26: North America Market Volume (Units) Forecast, By Material, 2018 to 2033

Table 27: North America Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 28: North America Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast, By End Use, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast, By End Use, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast, By Power, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast, By Power, 2018 to 2033

Table 37: Latin America Market Value (US$ Million) Forecast, By Water Tank Capacity, 2018 to 2033

Table 38: Latin America Market Volume (Units) Forecast, By Water Tank Capacity, 2018 to 2033

Table 39: Latin America Market Value (US$ Million) Forecast, By Material, 2018 to 2033

Table 40: Latin America Market Volume (Units) Forecast, By Material, 2018 to 2033

Table 41: Latin America Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 42: Latin America Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 44: Europe Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 46: Europe Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast, By End Use, 2018 to 2033

Table 48: Europe Market Volume (Units) Forecast, By End Use, 2018 to 2033

Table 49: Europe Market Value (US$ Million) Forecast, By Power, 2018 to 2033

Table 50: Europe Market Volume (Units) Forecast, By Power, 2018 to 2033

Table 51: Europe Market Value (US$ Million) Forecast, By Water Tank Capacity, 2018 to 2033

Table 52: Europe Market Volume (Units) Forecast, By Water Tank Capacity, 2018 to 2033

Table 53: Europe Market Value (US$ Million) Forecast, By Material, 2018 to 2033

Table 54: Europe Market Volume (Units) Forecast, By Material, 2018 to 2033

Table 55: Europe Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 56: Europe Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 57: East Asia Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 58: East Asia Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 59: East Asia Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 60: East Asia Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast, By End Use, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast, By End Use, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast, By Power, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast, By Power, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast, By Water Tank Capacity, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast, By Water Tank Capacity, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast, By Material, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast, By Material, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 71: South Asia Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 72: South Asia Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 73: South Asia Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 74: South Asia Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 75: South Asia Market Value (US$ Million) Forecast, By End Use, 2018 to 2033

Table 76: South Asia Market Volume (Units) Forecast, By End Use, 2018 to 2033

Table 77: South Asia Market Value (US$ Million) Forecast, By Power, 2018 to 2033

Table 78: South Asia Market Volume (Units) Forecast, By Power, 2018 to 2033

Table 79: South Asia Market Value (US$ Million) Forecast, By Water Tank Capacity, 2018 to 2033

Table 80: South Asia Market Volume (Units) Forecast, By Water Tank Capacity, 2018 to 2033

Table 81: South Asia Market Value (US$ Million) Forecast, By Material, 2018 to 2033

Table 82: South Asia Market Volume (Units) Forecast, By Material, 2018 to 2033

Table 83: South Asia Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 84: South Asia Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 85: Oceania Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 86: Oceania Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 87: Oceania Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 88: Oceania Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 89: Oceania Market Value (US$ Million) Forecast, By End Use, 2018 to 2033

Table 90: Oceania Market Volume (Units) Forecast, By End Use, 2018 to 2033

Table 91: Oceania Market Value (US$ Million) Forecast, By Power, 2018 to 2033

Table 92: Oceania Market Volume (Units) Forecast, By Power, 2018 to 2033

Table 93: Oceania Market Value (US$ Million) Forecast, By Water Tank Capacity, 2018 to 2033

Table 94: Oceania Market Volume (Units) Forecast, By Water Tank Capacity, 2018 to 2033

Table 95: Oceania Market Value (US$ Million) Forecast, By Material, 2018 to 2033

Table 96: Oceania Market Volume (Units) Forecast, By Material, 2018 to 2033

Table 97: Oceania Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 98: Oceania Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 99: MEA Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 100: MEA Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 101: MEA Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 102: MEA Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 103: MEA Market Value (US$ Million) Forecast, By End Use, 2018 to 2033

Table 104: MEA Market Volume (Units) Forecast, By End Use, 2018 to 2033

Table 105: MEA Market Value (US$ Million) Forecast, By Power, 2018 to 2033

Table 106: MEA Market Volume (Units) Forecast, By Power, 2018 to 2033

Table 107: MEA Market Value (US$ Million) Forecast, By Water Tank Capacity, 2018 to 2033

Table 108: MEA Market Volume (Units) Forecast, By Water Tank Capacity, 2018 to 2033

Table 109: MEA Market Value (US$ Million) Forecast, By Material, 2018 to 2033

Table 110: MEA Market Volume (Units) Forecast, By Material, 2018 to 2033

Table 111: MEA Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 112: MEA Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Figure 01: Global Market Value (US$ Million) and Volume (Units) Analysis, 2018 to 2033

Figure 02: Global Market Value (US$ Million) and Volume (Units) Forecast 2023 to 2033

Figure 03: Global Market Value (US$ Million) and Volume (Units) , 2018 to 2033

Figure 04: Global Market Absolute $ Opportunity (US$ Million) 2023 to 2033

Figure 05: Global Market Value (US$ Million) and Volume (Units) Forecast 2023 to 2033

Figure 06: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 07: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 08: Global Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 09: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections, By End Use, 2023 to 2033

Figure 13: Global Market Attractiveness by End Use, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Power, 2018 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections, By Power, 2023 to 2033

Figure 17: Global Market Attractiveness by Power, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Water Tank Capacity, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Water Tank Capacity, 2018 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections, By Water Tank Capacity, 2023 to 2033

Figure 21: Global Market Attractiveness by Water Tank Capacity, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections, By Material, 2023 to 2033

Figure 25: Global Market Attractiveness by Material, 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 27: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 31: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 32: Global Market Y-o-Y Growth (%) Projections, By Region, 2023 to 2033

Figure 33: Global Market Attractiveness by Region, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 37: North America Market Attractiveness by Country, 2023 to 2033

Figure 38: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 39: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 41: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 42: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections, By End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by End Use, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 47: North America Market Volume (Units) Analysis by Power, 2018 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections, By Power, 2023 to 2033

Figure 49: North America Market Attractiveness by Power, 2023 to 2033

Figure 50: North America Market Value (US$ Million) Analysis by Water Tank Capacity, 2018 to 2033

Figure 51: North America Market Volume (Units) Analysis by Water Tank Capacity, 2018 to 2033

Figure 52: North America Market Y-o-Y Growth (%) Projections, By Water Tank Capacity, 2023 to 2033

Figure 53: North America Market Attractiveness by Water Tank Capacity, 2023 to 2033

Figure 54: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 55: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 56: North America Market Y-o-Y Growth (%) Projections, By Material, 2023 to 2033

Figure 57: North America Market Attractiveness by Material, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 59: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections, By End Use, 2023 to 2033

Figure 61: North America Market Attractiveness by End Use, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 63: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 65: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections, By End Use, 2023 to 2033

Figure 73: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Power, 2018 to 2033

Figure 76: Latin America Market Y-o-Y Growth (%) Projections, By Power, 2023 to 2033

Figure 77: Latin America Market Attractiveness by Power, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Water Tank Capacity, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Water Tank Capacity, 2018 to 2033

Figure 80: Latin America Market Y-o-Y Growth (%) Projections, By Water Tank Capacity, 2023 to 2033

Figure 81: Latin America Market Attractiveness by Water Tank Capacity, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections, By Material, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 86: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 87: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 88: Latin America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 91: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 93: Europe Market Attractiveness by Country, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 95: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 96: Europe Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 97: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 98: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 99: Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 100: Europe Market Y-o-Y Growth (%) Projections, By End Use, 2023 to 2033

Figure 101: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 102: Europe Market Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 103: Europe Market Volume (Units) Analysis by Power, 2018 to 2033

Figure 104: Europe Market Y-o-Y Growth (%) Projections, By Power, 2023 to 2033

Figure 105: Europe Market Attractiveness by Power, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Water Tank Capacity, 2018 to 2033

Figure 107: Europe Market Volume (Units) Analysis by Water Tank Capacity, 2018 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections, By Water Tank Capacity, 2023 to 2033

Figure 109: Europe Market Attractiveness by Water Tank Capacity, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 111: Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 112: Europe Market Y-o-Y Growth (%) Projections, By Material, 2023 to 2033

Figure 113: Europe Market Attractiveness by Material, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 115: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 116: Europe Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 117: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 118: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 119: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 120: East Asia Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 121: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 123: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 124: East Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 127: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 128: East Asia Market Y-o-Y Growth (%) Projections, By End Use, 2023 to 2033

Figure 129: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 131: East Asia Market Volume (Units) Analysis by Power, 2018 to 2033

Figure 132: East Asia Market Y-o-Y Growth (%) Projections, By Power, 2023 to 2033

Figure 133: East Asia Market Attractiveness by Power, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Water Tank Capacity, 2018 to 2033

Figure 135: East Asia Market Volume (Units) Analysis by Water Tank Capacity, 2018 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections, By Water Tank Capacity, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Water Tank Capacity, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 139: East Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 140: East Asia Market Y-o-Y Growth (%) Projections, By Material, 2023 to 2033

Figure 141: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: East Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 145: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 146: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 147: South Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 148: South Asia Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 149: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 150: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 151: South Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 152: South Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 153: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 155: South Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 156: South Asia Market Y-o-Y Growth (%) Projections, By End Use, 2023 to 2033

Figure 157: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 158: South Asia Market Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 159: South Asia Market Volume (Units) Analysis by Power, 2018 to 2033

Figure 160: South Asia Market Y-o-Y Growth (%) Projections, By Power, 2023 to 2033

Figure 161: South Asia Market Attractiveness by Power, 2023 to 2033

Figure 162: South Asia Market Value (US$ Million) Analysis by Water Tank Capacity, 2018 to 2033

Figure 163: South Asia Market Volume (Units) Analysis by Water Tank Capacity, 2018 to 2033

Figure 164: South Asia Market Y-o-Y Growth (%) Projections, By Water Tank Capacity, 2023 to 2033

Figure 165: South Asia Market Attractiveness by Water Tank Capacity, 2023 to 2033

Figure 166: South Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 167: South Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 168: South Asia Market Y-o-Y Growth (%) Projections, By Material, 2023 to 2033

Figure 169: South Asia Market Attractiveness by Material, 2023 to 2033

Figure 170: South Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 171: South Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 172: South Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 173: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 174: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 175: Oceania Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 176: Oceania Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 177: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 178: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 179: Oceania Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 180: Oceania Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 181: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 183: Oceania Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 184: Oceania Market Y-o-Y Growth (%) Projections, By End Use, 2023 to 2033

Figure 185: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 187: Oceania Market Volume (Units) Analysis by Power, 2018 to 2033

Figure 188: Oceania Market Y-o-Y Growth (%) Projections, By Power, 2023 to 2033

Figure 189: Oceania Market Attractiveness by Power, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Water Tank Capacity, 2018 to 2033

Figure 191: Oceania Market Volume (Units) Analysis by Water Tank Capacity, 2018 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections, By Water Tank Capacity, 2023 to 2033

Figure 193: Oceania Market Attractiveness by Water Tank Capacity, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 195: Oceania Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 196: Oceania Market Y-o-Y Growth (%) Projections, By Material, 2023 to 2033

Figure 197: Oceania Market Attractiveness by Material, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 199: Oceania Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 200: Oceania Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 201: Oceania Market Attractiveness by Sales Channel, 2023 to 2033

Figure 202: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 203: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 204: MEA Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 205: MEA Market Attractiveness by Country, 2023 to 2033

Figure 206: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 207: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 208: MEA Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 209: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 210: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 211: MEA Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 212: MEA Market Y-o-Y Growth (%) Projections, By End Use, 2023 to 2033

Figure 213: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) Analysis by Power, 2018 to 2033

Figure 215: MEA Market Volume (Units) Analysis by Power, 2018 to 2033

Figure 216: MEA Market Y-o-Y Growth (%) Projections, By Power, 2023 to 2033

Figure 217: MEA Market Attractiveness by Power, 2023 to 2033

Figure 218: MEA Market Value (US$ Million) Analysis by Water Tank Capacity, 2018 to 2033

Figure 219: MEA Market Volume (Units) Analysis by Water Tank Capacity, 2018 to 2033

Figure 220: MEA Market Y-o-Y Growth (%) Projections, By Water Tank Capacity, 2023 to 2033

Figure 221: MEA Market Attractiveness by Water Tank Capacity, 2023 to 2033

Figure 222: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 223: MEA Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 224: MEA Market Y-o-Y Growth (%) Projections, By Material, 2023 to 2033

Figure 225: MEA Market Attractiveness by Material, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 227: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 228: MEA Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 229: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaluating Garment Steamer Market Share & Provider Insights

Japan Garment Steamer Market Analysis - Size, Share & Trends 2025 to 2035

Korea Garment Steamer Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Garment Steamer Market Analysis - Size, Share & Trends 2025 to 2035

Garment Interlining Market Size and Share Forecast Outlook 2025 to 2035

Garment Packing Machine Market Trends & Forecast 2024-2034

Direct to Garment Printing Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Direct to Garment Printing Market Share & Provider Insights

Intelligent Garment Hanging Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

Compression Garments and Stockings Market Analysis - Size, Share, and Forecast 2025 to 2035

Abdominal Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

Face Steamer Market Size and Share Forecast Outlook 2025 to 2035

Facial Steamer Market - Trends, Growth & Forecast 2025 to 2035

Commercial Steamer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA